Soybean Complex Crushing & Stocks Update – Sep ’19

Executive Summary

U.S. soybean crush and stocks figures provided by USDA were recently updated with values spanning through Jul ’19. Highlights from the updated report include:

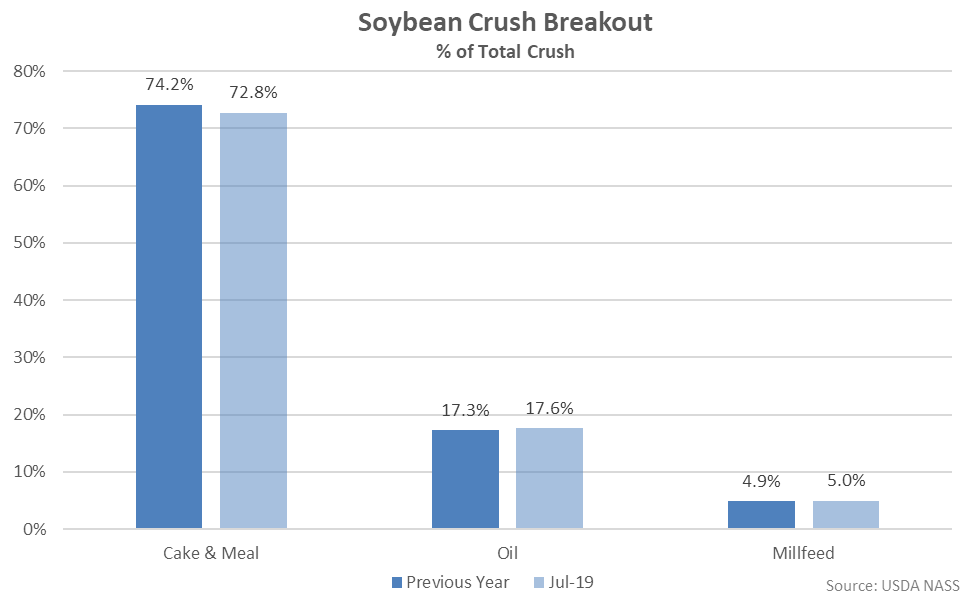

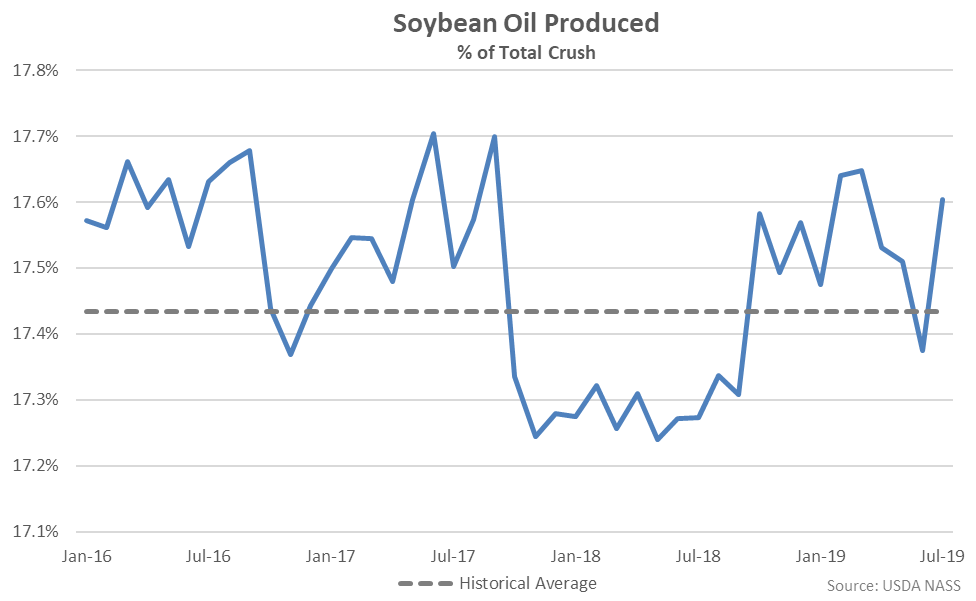

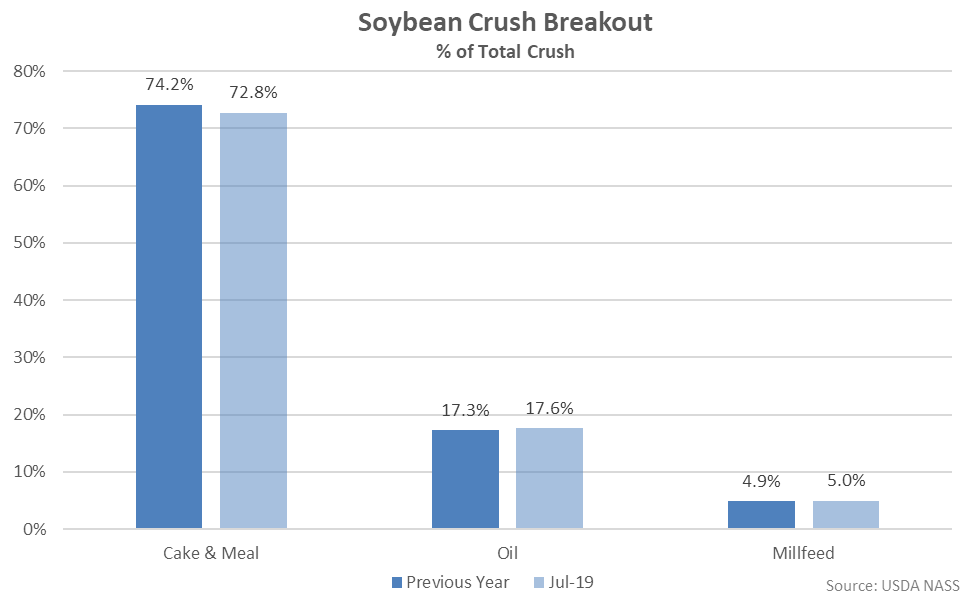

Cake & Meal accounted for 72.8% of the total soybean crush throughout Jul ’19, down slightly from the previous year, while oil accounted for 17.6% of the total soybean crush, up slightly from the previous year.

Cake & Meal accounted for 72.8% of the total soybean crush throughout Jul ’19, down slightly from the previous year, while oil accounted for 17.6% of the total soybean crush, up slightly from the previous year.

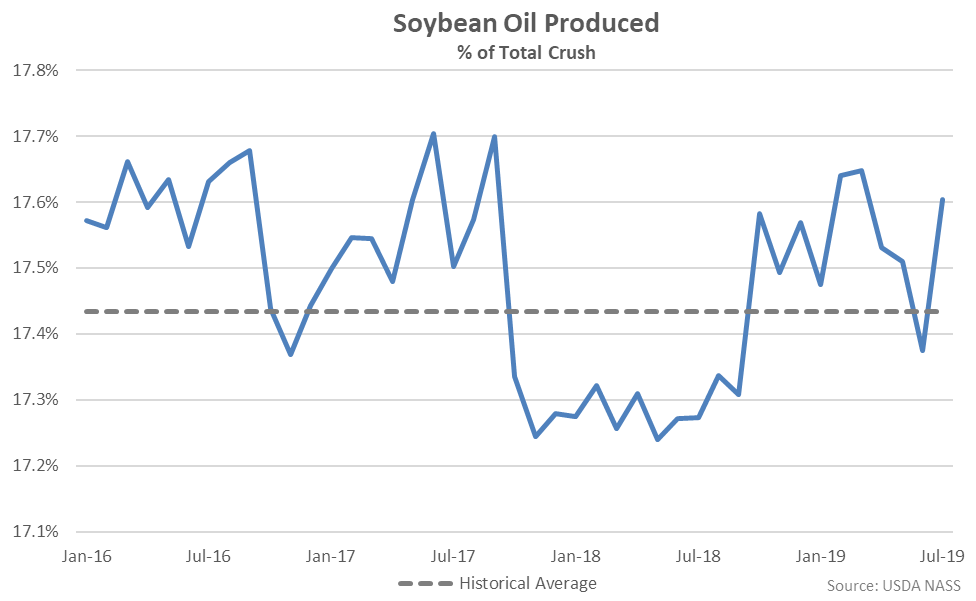

Jul ’19 soybean oil produced as a percentage of total crush rebounded to a four month high, finishing above historical average figures for the ninth time in the past ten months.

Jul ’19 soybean oil produced as a percentage of total crush rebounded to a four month high, finishing above historical average figures for the ninth time in the past ten months.

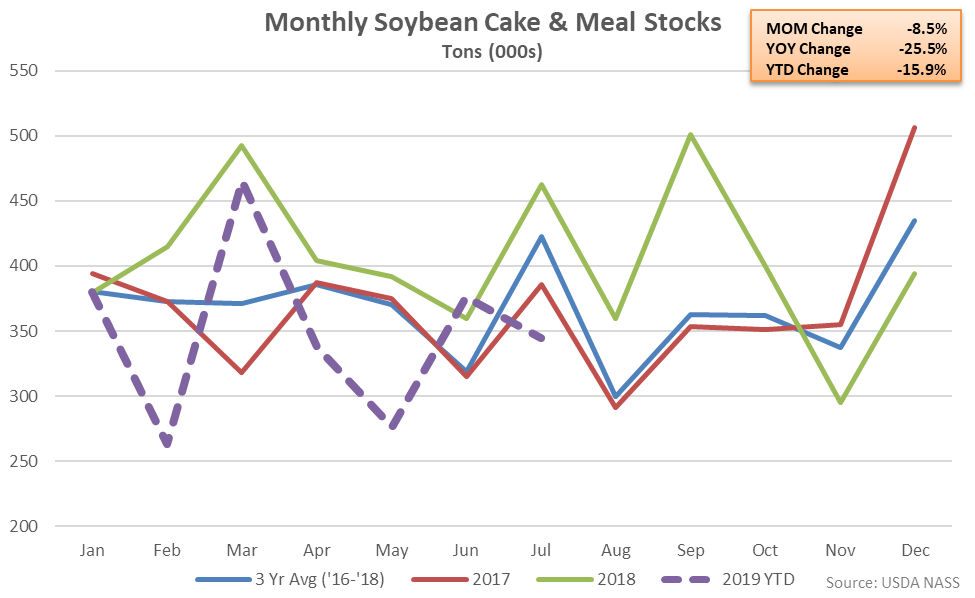

Soybean Cake & Meal Stocks – Stocks Decline 25.5% YOY, Reach a Four Year Seasonal Low Level

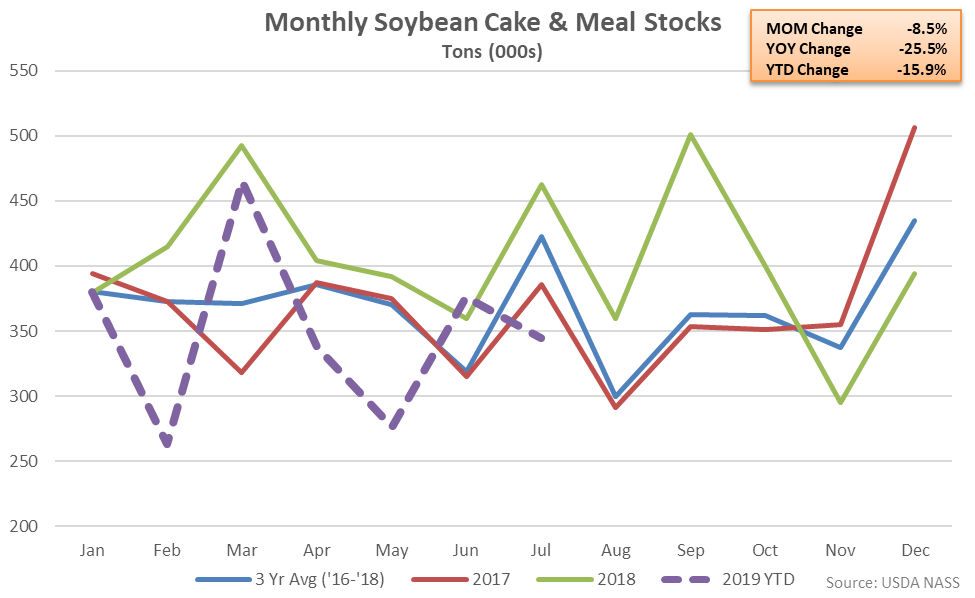

Jul ’19 U.S. soybean cake & meal stocks declined 8.5% MOM and 25.5% YOY, finishing lower on a YOY basis for the fifth time in the past six months and reaching a four year seasonal low level. The seasonal decline in soybean cake & meal stocks of 8.5% was a contraseasonal move when compared to the three year June – July seasonal average increase of 33.5%.

Soybean Cake & Meal Stocks – Stocks Decline 25.5% YOY, Reach a Four Year Seasonal Low Level

Jul ’19 U.S. soybean cake & meal stocks declined 8.5% MOM and 25.5% YOY, finishing lower on a YOY basis for the fifth time in the past six months and reaching a four year seasonal low level. The seasonal decline in soybean cake & meal stocks of 8.5% was a contraseasonal move when compared to the three year June – July seasonal average increase of 33.5%.

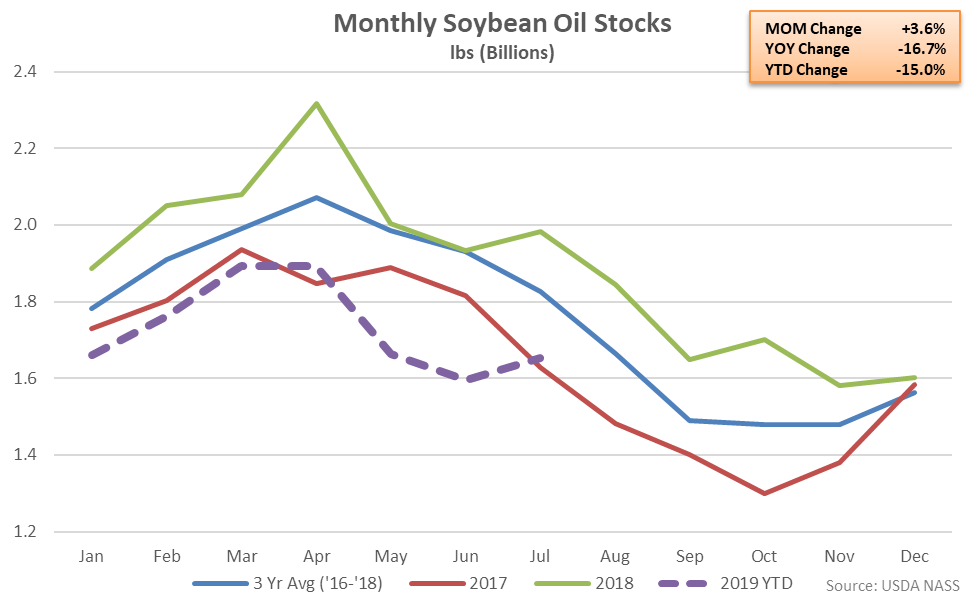

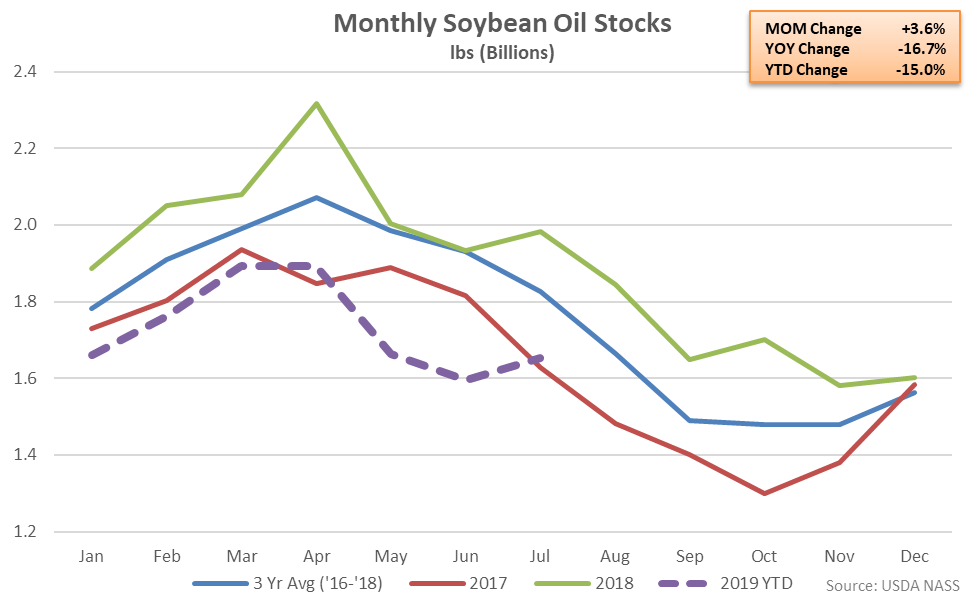

Soybean Oil Stocks – Stocks Rebound Contraseasonally but Remain Down 16.7% YOY

Jul ’19 U.S. soybean oil stocks rebounded 3.6% MOM from the seven month low experienced throughout the previous month but remained 16.7% lower on a YOY basis. The YOY decline in soybean oil stocks was the seventh experienced in a row. The seasonal increase in soybean oil stocks of 3.6% was a contraseasonal move when compared to the three year June – July seasonal average decline of 5.5%, however.

Soybean Oil Stocks – Stocks Rebound Contraseasonally but Remain Down 16.7% YOY

Jul ’19 U.S. soybean oil stocks rebounded 3.6% MOM from the seven month low experienced throughout the previous month but remained 16.7% lower on a YOY basis. The YOY decline in soybean oil stocks was the seventh experienced in a row. The seasonal increase in soybean oil stocks of 3.6% was a contraseasonal move when compared to the three year June – July seasonal average decline of 5.5%, however.

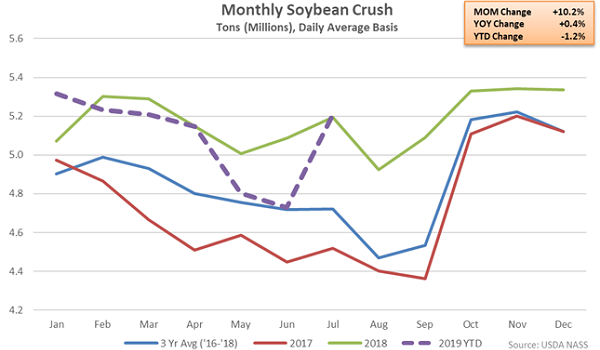

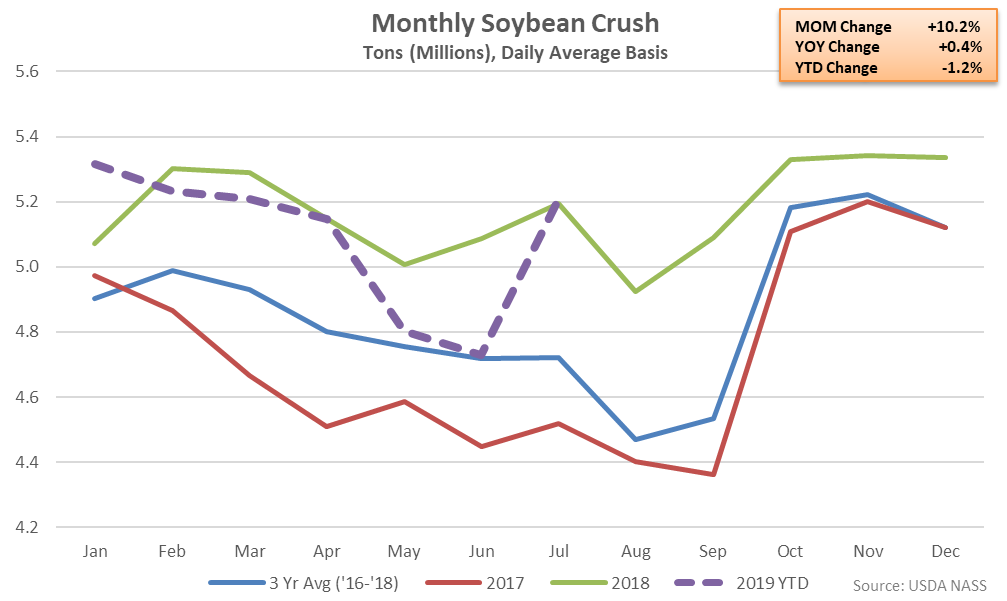

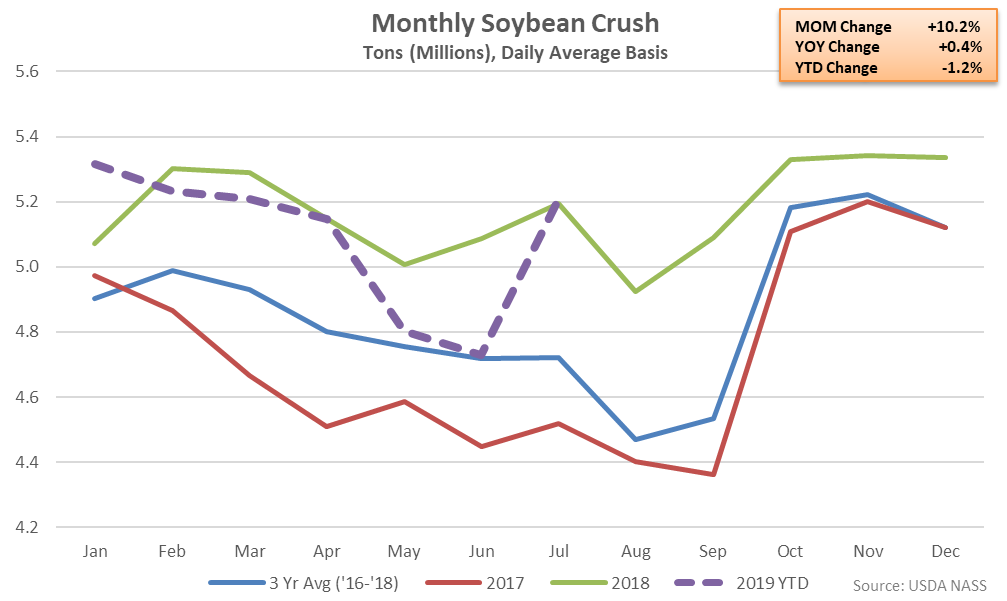

- Jul ’19 U.S. soybean crushings increased on a YOY basis for the first time in the past six months, finishing up 0.4% to a five year seasonal high level.

- Jul ’19 U.S. soybean cake & meal stocks declined 25.5% YOY, reaching a four year seasonal low level. Soybean cake & meal stocks declined contraseasonally throughout the month.

- Jul ’19 U.S. soybean oil stocks increased contraseasonally but remained 16.7% lower YOY, finishing lower on a YOY basis for the seventh consecutive month.

Cake & Meal accounted for 72.8% of the total soybean crush throughout Jul ’19, down slightly from the previous year, while oil accounted for 17.6% of the total soybean crush, up slightly from the previous year.

Cake & Meal accounted for 72.8% of the total soybean crush throughout Jul ’19, down slightly from the previous year, while oil accounted for 17.6% of the total soybean crush, up slightly from the previous year.

Jul ’19 soybean oil produced as a percentage of total crush rebounded to a four month high, finishing above historical average figures for the ninth time in the past ten months.

Jul ’19 soybean oil produced as a percentage of total crush rebounded to a four month high, finishing above historical average figures for the ninth time in the past ten months.

Soybean Cake & Meal Stocks – Stocks Decline 25.5% YOY, Reach a Four Year Seasonal Low Level

Jul ’19 U.S. soybean cake & meal stocks declined 8.5% MOM and 25.5% YOY, finishing lower on a YOY basis for the fifth time in the past six months and reaching a four year seasonal low level. The seasonal decline in soybean cake & meal stocks of 8.5% was a contraseasonal move when compared to the three year June – July seasonal average increase of 33.5%.

Soybean Cake & Meal Stocks – Stocks Decline 25.5% YOY, Reach a Four Year Seasonal Low Level

Jul ’19 U.S. soybean cake & meal stocks declined 8.5% MOM and 25.5% YOY, finishing lower on a YOY basis for the fifth time in the past six months and reaching a four year seasonal low level. The seasonal decline in soybean cake & meal stocks of 8.5% was a contraseasonal move when compared to the three year June – July seasonal average increase of 33.5%.

Soybean Oil Stocks – Stocks Rebound Contraseasonally but Remain Down 16.7% YOY

Jul ’19 U.S. soybean oil stocks rebounded 3.6% MOM from the seven month low experienced throughout the previous month but remained 16.7% lower on a YOY basis. The YOY decline in soybean oil stocks was the seventh experienced in a row. The seasonal increase in soybean oil stocks of 3.6% was a contraseasonal move when compared to the three year June – July seasonal average decline of 5.5%, however.

Soybean Oil Stocks – Stocks Rebound Contraseasonally but Remain Down 16.7% YOY

Jul ’19 U.S. soybean oil stocks rebounded 3.6% MOM from the seven month low experienced throughout the previous month but remained 16.7% lower on a YOY basis. The YOY decline in soybean oil stocks was the seventh experienced in a row. The seasonal increase in soybean oil stocks of 3.6% was a contraseasonal move when compared to the three year June – July seasonal average decline of 5.5%, however.