New Zealand Milk Production Update – Mar ’20

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Feb ’20. Highlights from the updated report include:

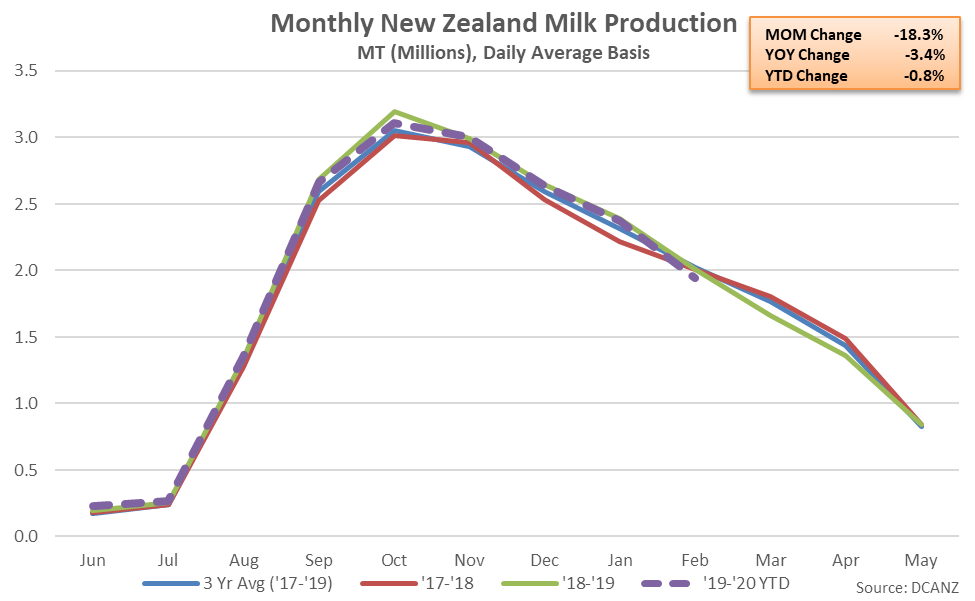

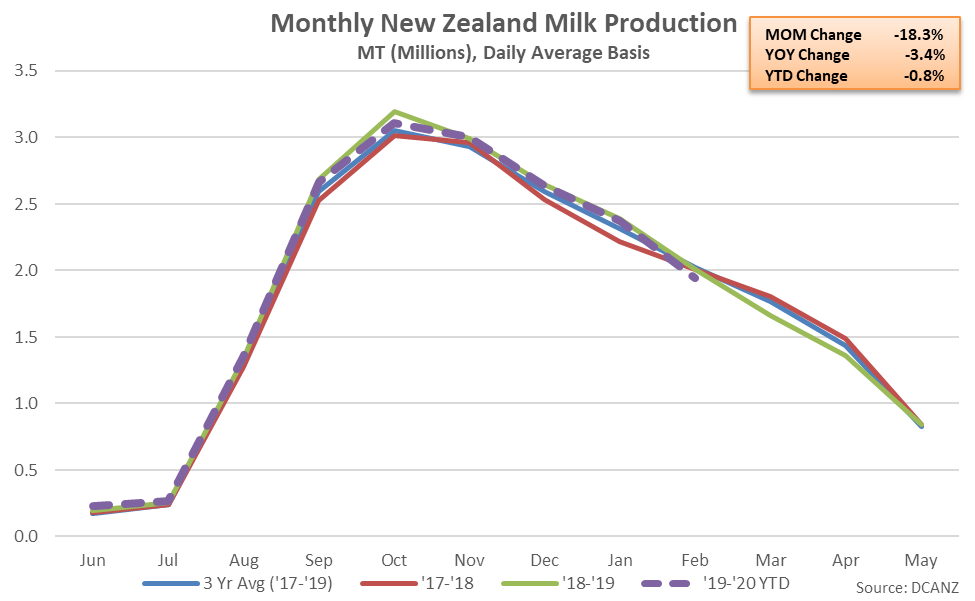

New Zealand milk production volumes typically reach a peak seasonal level throughout the month of October, prior to declining until seasonal lows are experienced throughout the months of June and July. October – February production volumes have combined to account for over 60% of the total annual New Zealand milk production volumes over the past ten years.

’19-’20 YTD New Zealand milk production volumes have declined 0.8% on a YOY basis throughout the first three quarters of the production season however production on a milk-solids basis has increased 0.3% on a YOY basis throughout the period.

New Zealand milk production volumes typically reach a peak seasonal level throughout the month of October, prior to declining until seasonal lows are experienced throughout the months of June and July. October – February production volumes have combined to account for over 60% of the total annual New Zealand milk production volumes over the past ten years.

’19-’20 YTD New Zealand milk production volumes have declined 0.8% on a YOY basis throughout the first three quarters of the production season however production on a milk-solids basis has increased 0.3% on a YOY basis throughout the period.

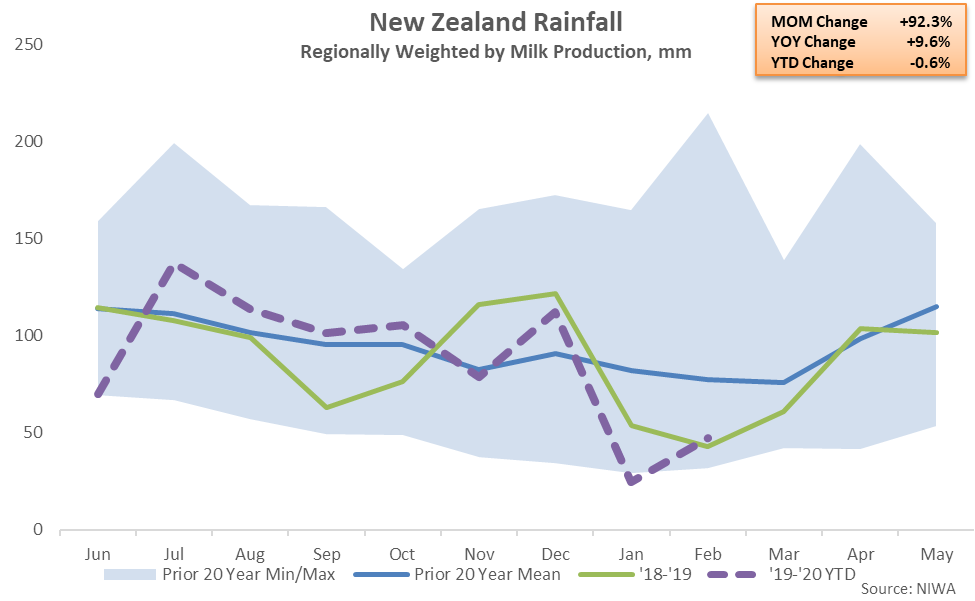

Rainfall & Soil Moisture Deficits

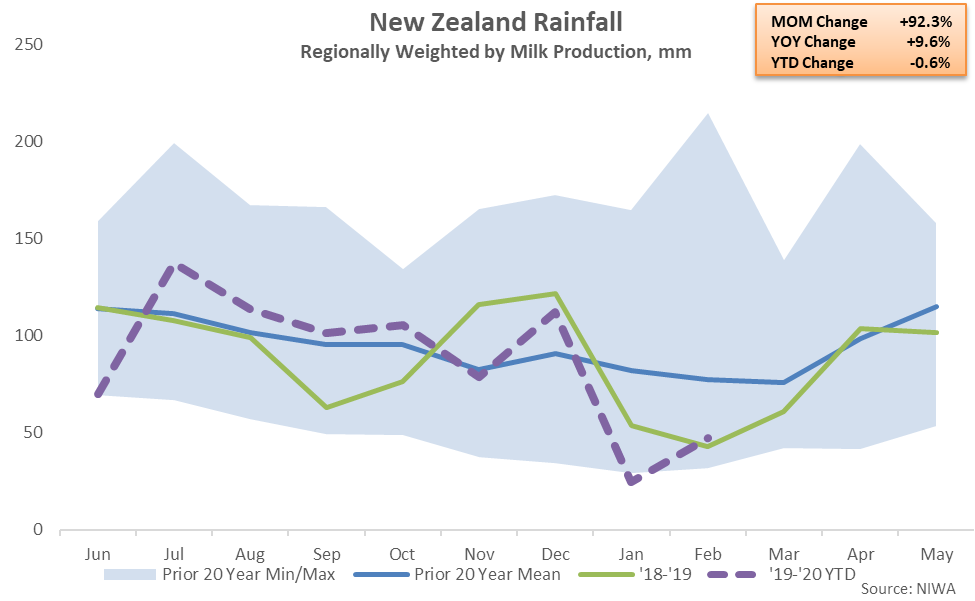

New Zealand rainfall levels rebounded from the previous month during Feb ’20 but remained at the second lowest seasonal level experienced throughout the past six years when regionally weighted by milk production. Rainfall levels finished 9.6% above the previous year but remained 39.1% below 20 year average seasonal levels for the month of February. The North Island of New Zealand has been particularly dry over recent months, remaining at a 20 year low seasonal rainfall level over each of the past two months through Feb ’20.

Rainfall & Soil Moisture Deficits

New Zealand rainfall levels rebounded from the previous month during Feb ’20 but remained at the second lowest seasonal level experienced throughout the past six years when regionally weighted by milk production. Rainfall levels finished 9.6% above the previous year but remained 39.1% below 20 year average seasonal levels for the month of February. The North Island of New Zealand has been particularly dry over recent months, remaining at a 20 year low seasonal rainfall level over each of the past two months through Feb ’20.

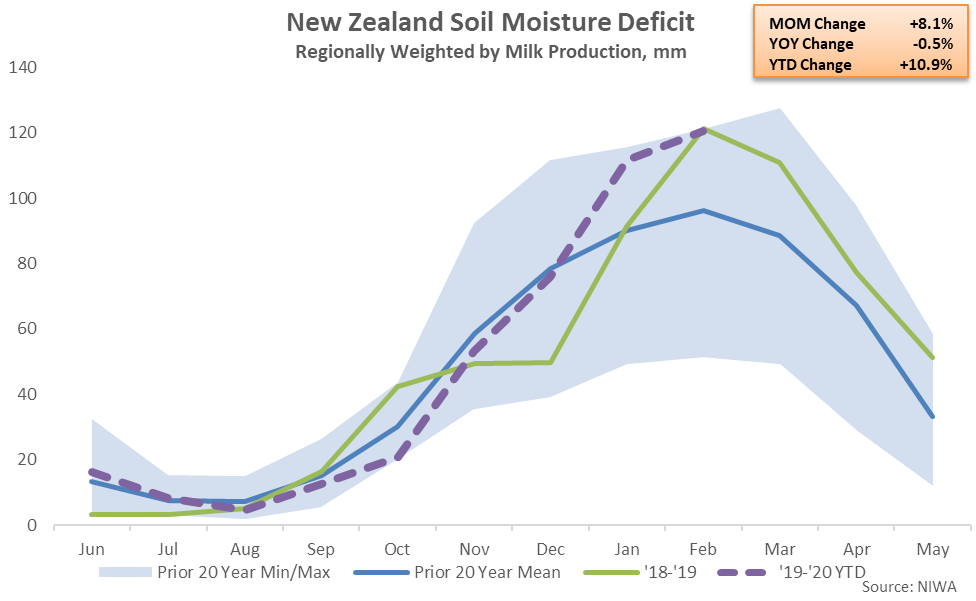

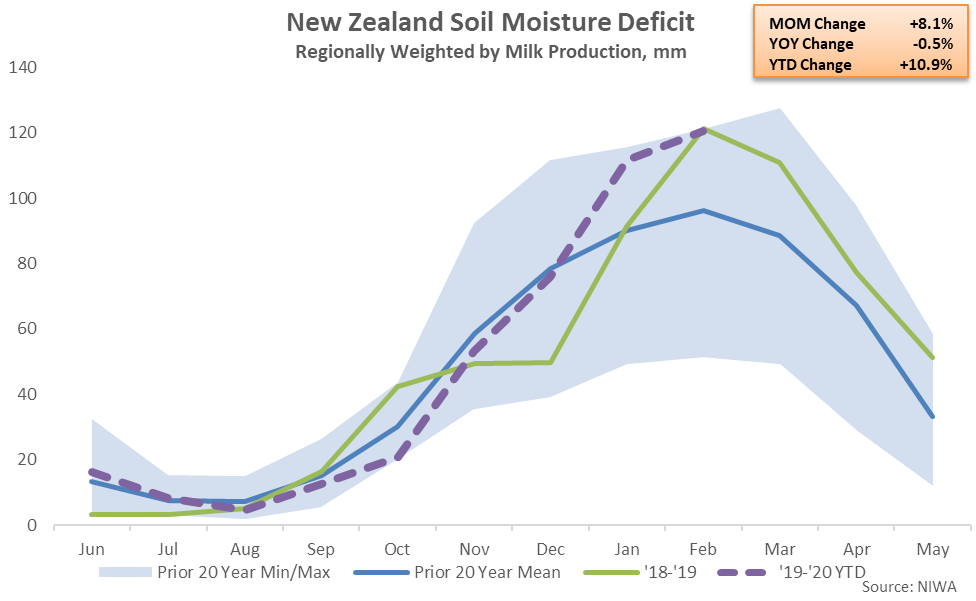

Reduced rainfall levels experienced throughout Feb ’20 have contributed to New Zealand soil moisture deficits remaining near record high seasonal levels. Feb ’20 soil moisture deficits finished 0.5% below the record high seasonal level experienced throughout the previous year but remained 25.3% above 20 year average seasonal levels for the month of February. Soil moisture deficits reached a record high seasonal level throughout the North Island of New Zealand.

Reduced rainfall levels experienced throughout Feb ’20 have contributed to New Zealand soil moisture deficits remaining near record high seasonal levels. Feb ’20 soil moisture deficits finished 0.5% below the record high seasonal level experienced throughout the previous year but remained 25.3% above 20 year average seasonal levels for the month of February. Soil moisture deficits reached a record high seasonal level throughout the North Island of New Zealand.

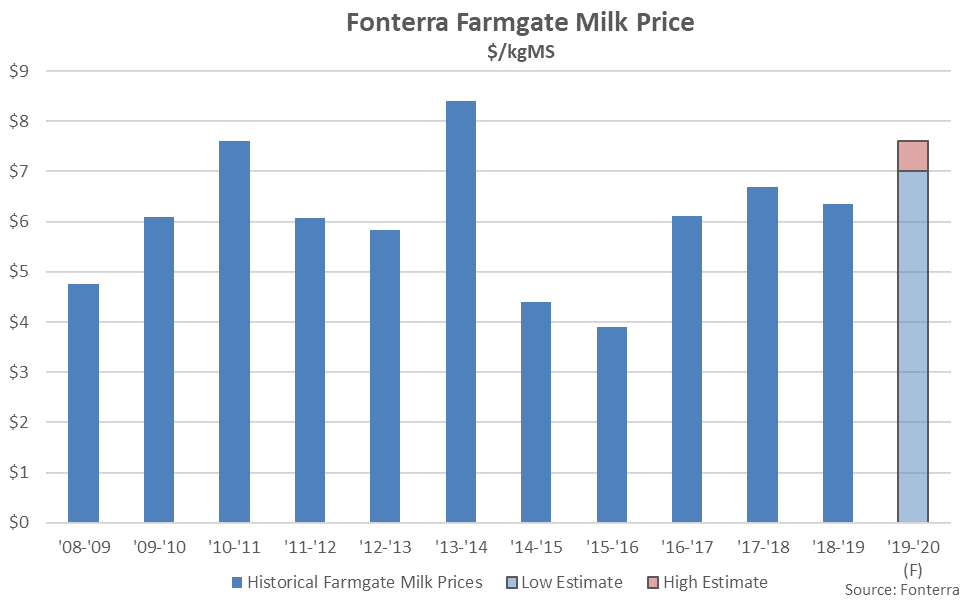

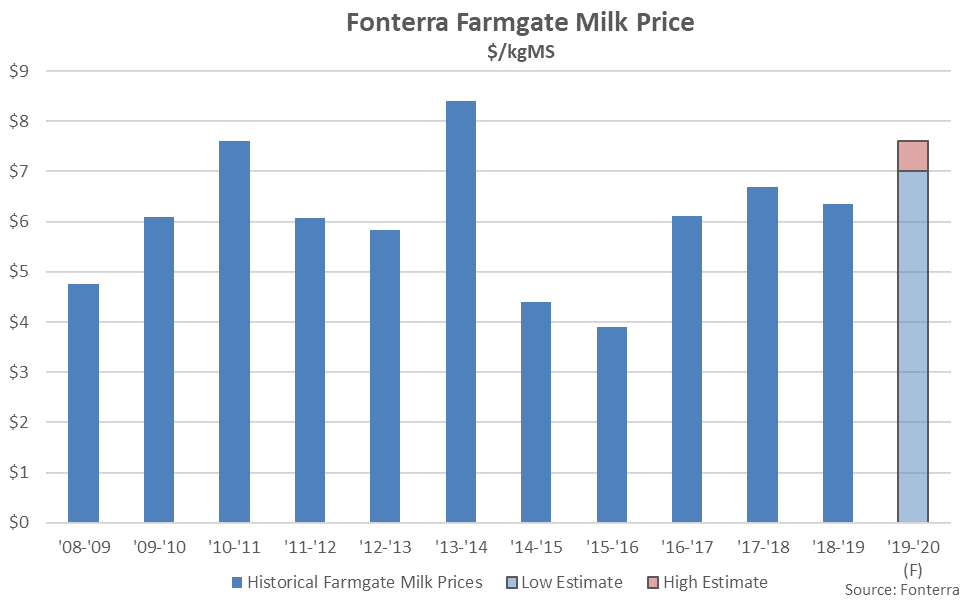

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels.

Fonterra’s current ’19-’20 farmgate milk price forecast of $7.00-$7.60/kgMS was raised by an average of $0.25/kgMS, or 3.5%, in Dec ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted recent Global Dairy Trade price appreciation and a favorable global supply and demand balance as drivers to the increase in forecasted pay prices. Fonterra reaffirmed the forecasted price in Mar ’20 but noted the outlook remains fluid as markets balance the impact of COVID-19 versus lower production output and weather challenges. Fonterra’s current ’19-’20 farmgate milk price forecast has increased by a total of $0.55/kgMS, or 8.1%, since the opening forecast in May ’19.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels.

Fonterra’s current ’19-’20 farmgate milk price forecast of $7.00-$7.60/kgMS was raised by an average of $0.25/kgMS, or 3.5%, in Dec ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted recent Global Dairy Trade price appreciation and a favorable global supply and demand balance as drivers to the increase in forecasted pay prices. Fonterra reaffirmed the forecasted price in Mar ’20 but noted the outlook remains fluid as markets balance the impact of COVID-19 versus lower production output and weather challenges. Fonterra’s current ’19-’20 farmgate milk price forecast has increased by a total of $0.55/kgMS, or 8.1%, since the opening forecast in May ’19.

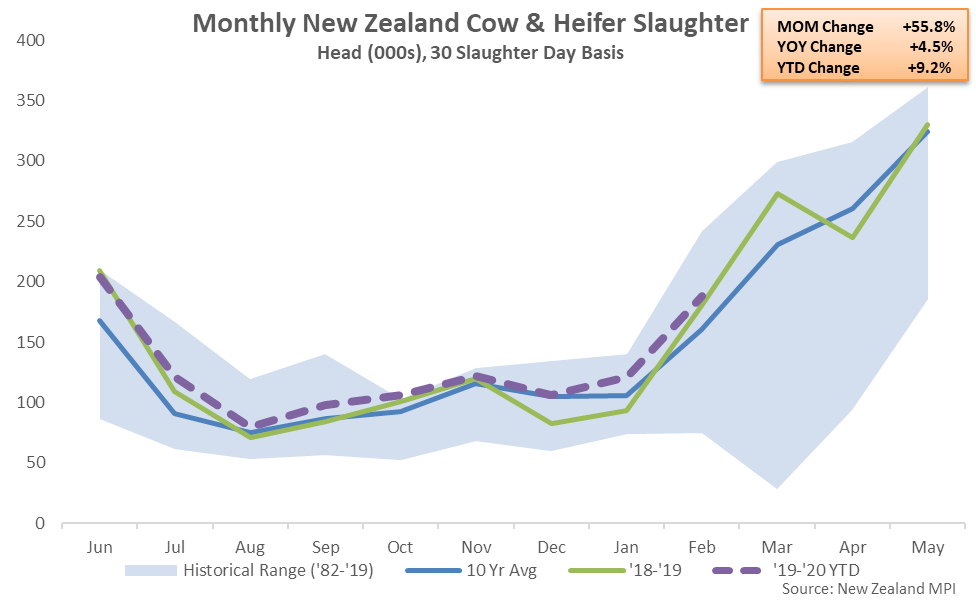

Cow & Heifer Slaughter

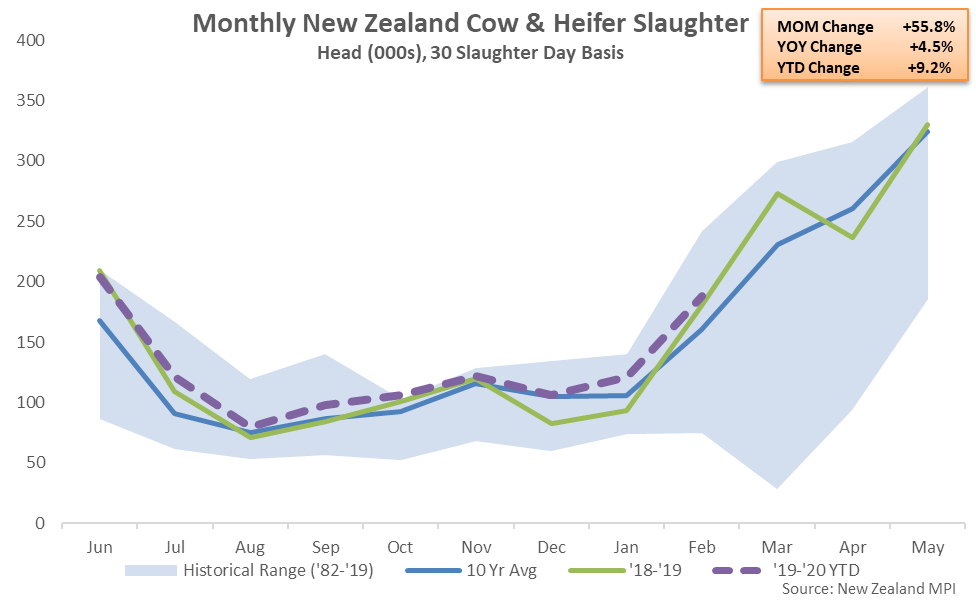

New Zealand cow & heifer slaughter rates increased 4.5% on a YOY basis during Feb ’20 when normalizing for slaughter days, finishing higher on a YOY basis for the eighth consecutive month. Feb ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the eighth consecutive month, finishing up 7.3%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 9.2% throughout the first three quarters of the production season and are on pace to reach a four year high level.

Cow & Heifer Slaughter

New Zealand cow & heifer slaughter rates increased 4.5% on a YOY basis during Feb ’20 when normalizing for slaughter days, finishing higher on a YOY basis for the eighth consecutive month. Feb ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the eighth consecutive month, finishing up 7.3%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 9.2% throughout the first three quarters of the production season and are on pace to reach a four year high level.

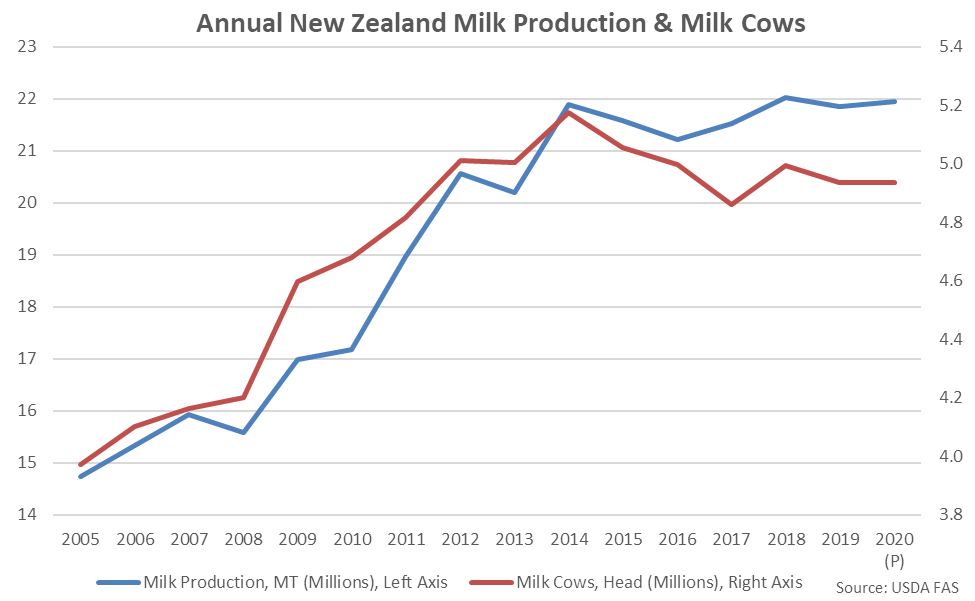

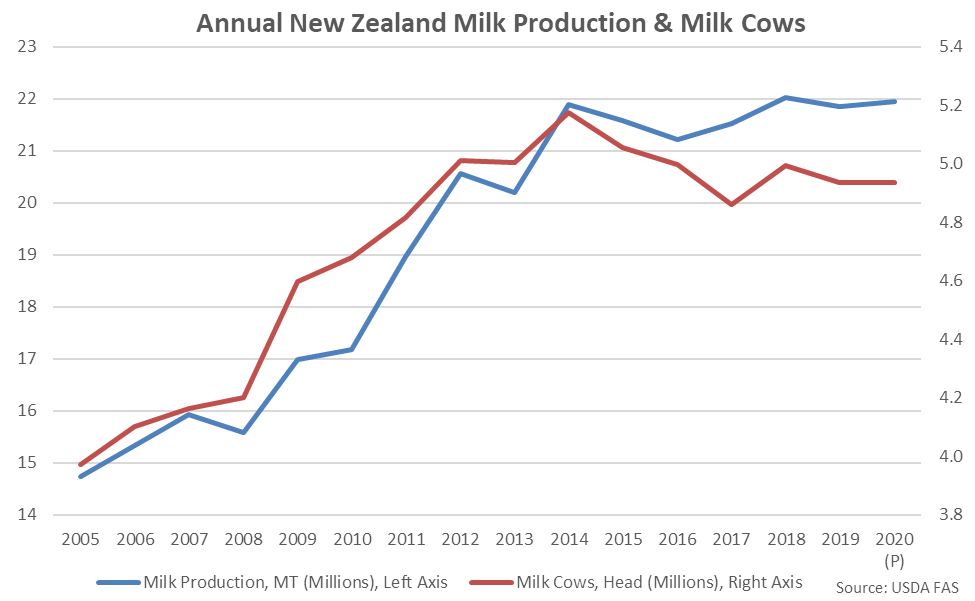

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.

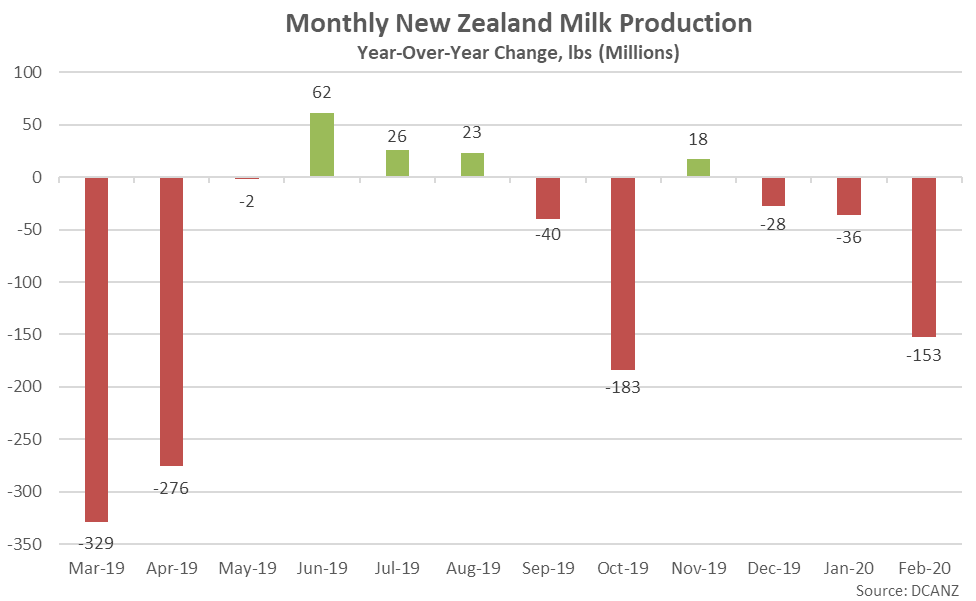

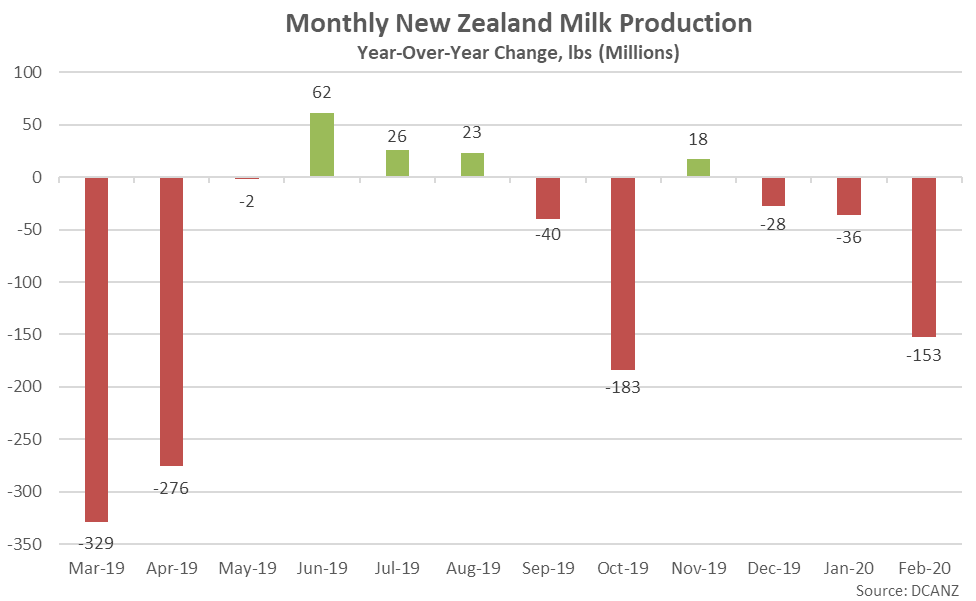

- New Zealand milk production volumes declined on a YOY basis for the fifth time in the past six months during Feb ’20, finishing down 3.4%. Production on a milk-solids basis finished lower on a YOY basis for the first time in the past four months, declining by 1.8%.

- Fonterra’s current ’19-’20 farmgate milk price forecast of $7.00-$7.60/kgMS was raised by an average of $0.25/kgMS, or 3.5%, in Dec ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra reaffirmed the price forecast in Mar ’20.

- New Zealand cow & heifer slaughter rates increased 4.5% on a YOY basis during Feb ’20 when normalizing for slaughter days, finishing higher on a YOY basis for the eighth consecutive month.

New Zealand milk production volumes typically reach a peak seasonal level throughout the month of October, prior to declining until seasonal lows are experienced throughout the months of June and July. October – February production volumes have combined to account for over 60% of the total annual New Zealand milk production volumes over the past ten years.

’19-’20 YTD New Zealand milk production volumes have declined 0.8% on a YOY basis throughout the first three quarters of the production season however production on a milk-solids basis has increased 0.3% on a YOY basis throughout the period.

New Zealand milk production volumes typically reach a peak seasonal level throughout the month of October, prior to declining until seasonal lows are experienced throughout the months of June and July. October – February production volumes have combined to account for over 60% of the total annual New Zealand milk production volumes over the past ten years.

’19-’20 YTD New Zealand milk production volumes have declined 0.8% on a YOY basis throughout the first three quarters of the production season however production on a milk-solids basis has increased 0.3% on a YOY basis throughout the period.

Rainfall & Soil Moisture Deficits

New Zealand rainfall levels rebounded from the previous month during Feb ’20 but remained at the second lowest seasonal level experienced throughout the past six years when regionally weighted by milk production. Rainfall levels finished 9.6% above the previous year but remained 39.1% below 20 year average seasonal levels for the month of February. The North Island of New Zealand has been particularly dry over recent months, remaining at a 20 year low seasonal rainfall level over each of the past two months through Feb ’20.

Rainfall & Soil Moisture Deficits

New Zealand rainfall levels rebounded from the previous month during Feb ’20 but remained at the second lowest seasonal level experienced throughout the past six years when regionally weighted by milk production. Rainfall levels finished 9.6% above the previous year but remained 39.1% below 20 year average seasonal levels for the month of February. The North Island of New Zealand has been particularly dry over recent months, remaining at a 20 year low seasonal rainfall level over each of the past two months through Feb ’20.

Reduced rainfall levels experienced throughout Feb ’20 have contributed to New Zealand soil moisture deficits remaining near record high seasonal levels. Feb ’20 soil moisture deficits finished 0.5% below the record high seasonal level experienced throughout the previous year but remained 25.3% above 20 year average seasonal levels for the month of February. Soil moisture deficits reached a record high seasonal level throughout the North Island of New Zealand.

Reduced rainfall levels experienced throughout Feb ’20 have contributed to New Zealand soil moisture deficits remaining near record high seasonal levels. Feb ’20 soil moisture deficits finished 0.5% below the record high seasonal level experienced throughout the previous year but remained 25.3% above 20 year average seasonal levels for the month of February. Soil moisture deficits reached a record high seasonal level throughout the North Island of New Zealand.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels.

Fonterra’s current ’19-’20 farmgate milk price forecast of $7.00-$7.60/kgMS was raised by an average of $0.25/kgMS, or 3.5%, in Dec ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted recent Global Dairy Trade price appreciation and a favorable global supply and demand balance as drivers to the increase in forecasted pay prices. Fonterra reaffirmed the forecasted price in Mar ’20 but noted the outlook remains fluid as markets balance the impact of COVID-19 versus lower production output and weather challenges. Fonterra’s current ’19-’20 farmgate milk price forecast has increased by a total of $0.55/kgMS, or 8.1%, since the opening forecast in May ’19.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels.

Fonterra’s current ’19-’20 farmgate milk price forecast of $7.00-$7.60/kgMS was raised by an average of $0.25/kgMS, or 3.5%, in Dec ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted recent Global Dairy Trade price appreciation and a favorable global supply and demand balance as drivers to the increase in forecasted pay prices. Fonterra reaffirmed the forecasted price in Mar ’20 but noted the outlook remains fluid as markets balance the impact of COVID-19 versus lower production output and weather challenges. Fonterra’s current ’19-’20 farmgate milk price forecast has increased by a total of $0.55/kgMS, or 8.1%, since the opening forecast in May ’19.

Cow & Heifer Slaughter

New Zealand cow & heifer slaughter rates increased 4.5% on a YOY basis during Feb ’20 when normalizing for slaughter days, finishing higher on a YOY basis for the eighth consecutive month. Feb ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the eighth consecutive month, finishing up 7.3%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 9.2% throughout the first three quarters of the production season and are on pace to reach a four year high level.

Cow & Heifer Slaughter

New Zealand cow & heifer slaughter rates increased 4.5% on a YOY basis during Feb ’20 when normalizing for slaughter days, finishing higher on a YOY basis for the eighth consecutive month. Feb ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the eighth consecutive month, finishing up 7.3%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 9.2% throughout the first three quarters of the production season and are on pace to reach a four year high level.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.