U.S. Dairy Cow Slaughter Update – Aug ’20

Executive Summary

U.S. dairy cow slaughter figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

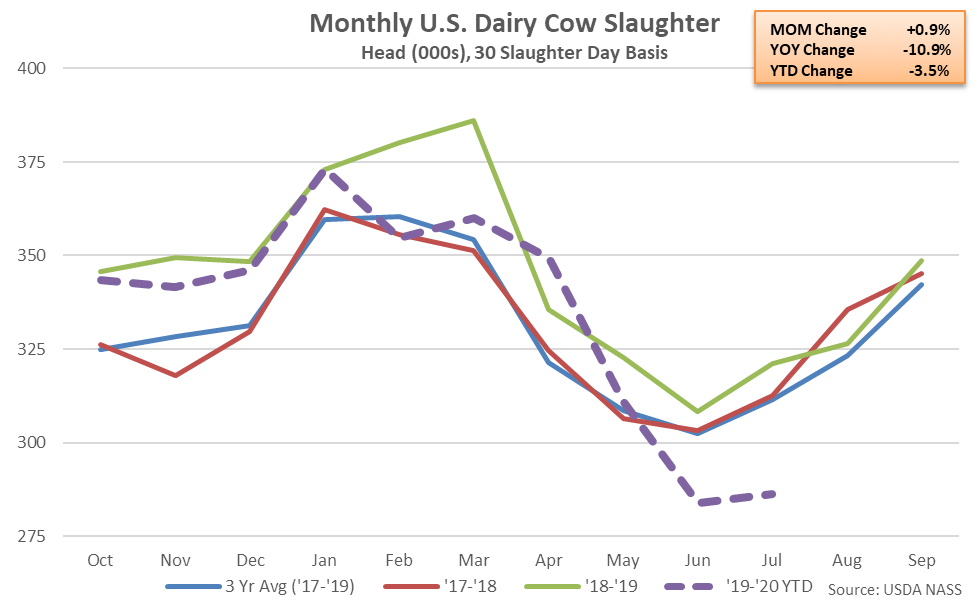

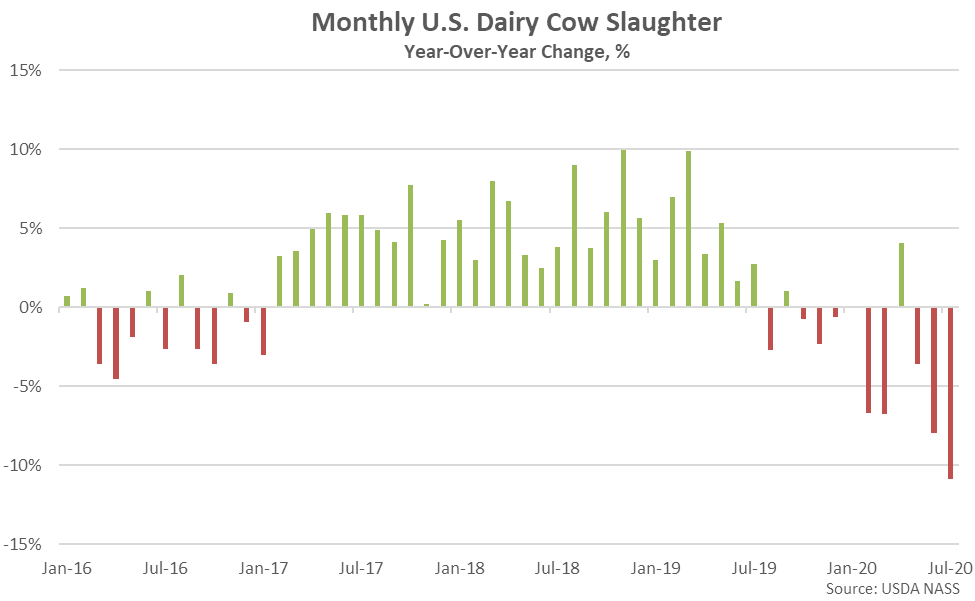

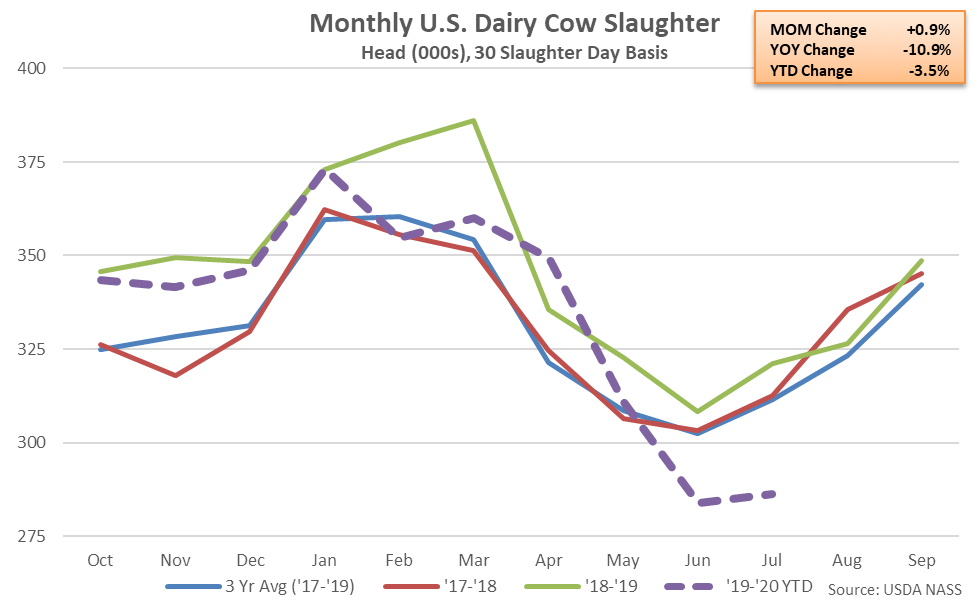

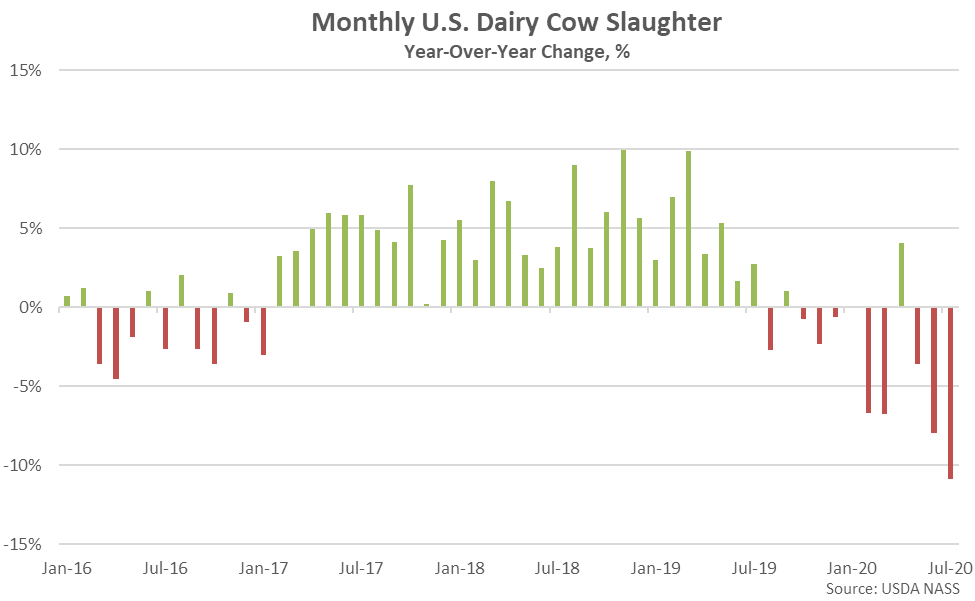

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months through Jul ’19 prior to finishing flat or lower throughout ten of the past 12 months. The Jul ’20 YOY decline in dairy cow slaughter rates was the largest experienced throughout the past five and a half years on a percentage basis.

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months through Jul ’19 prior to finishing flat or lower throughout ten of the past 12 months. The Jul ’20 YOY decline in dairy cow slaughter rates was the largest experienced throughout the past five and a half years on a percentage basis.

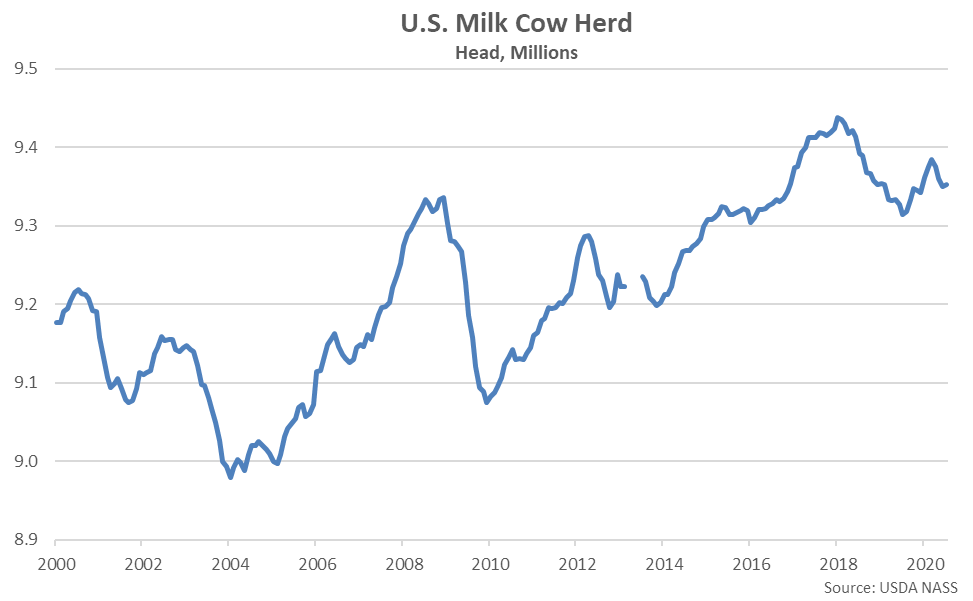

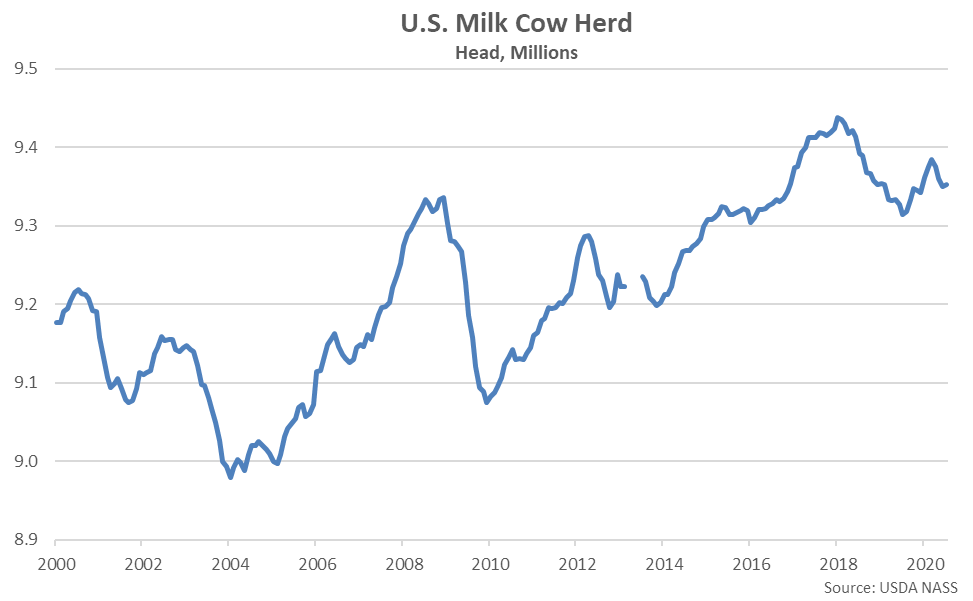

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through Jul ’20. The Jul ’20 U.S. milk cow herd rebounded 2,000 head from the six month low level experienced throughout the previous month while finishing 37,000 head above previous year levels.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through Jul ’20. The Jul ’20 U.S. milk cow herd rebounded 2,000 head from the six month low level experienced throughout the previous month while finishing 37,000 head above previous year levels.

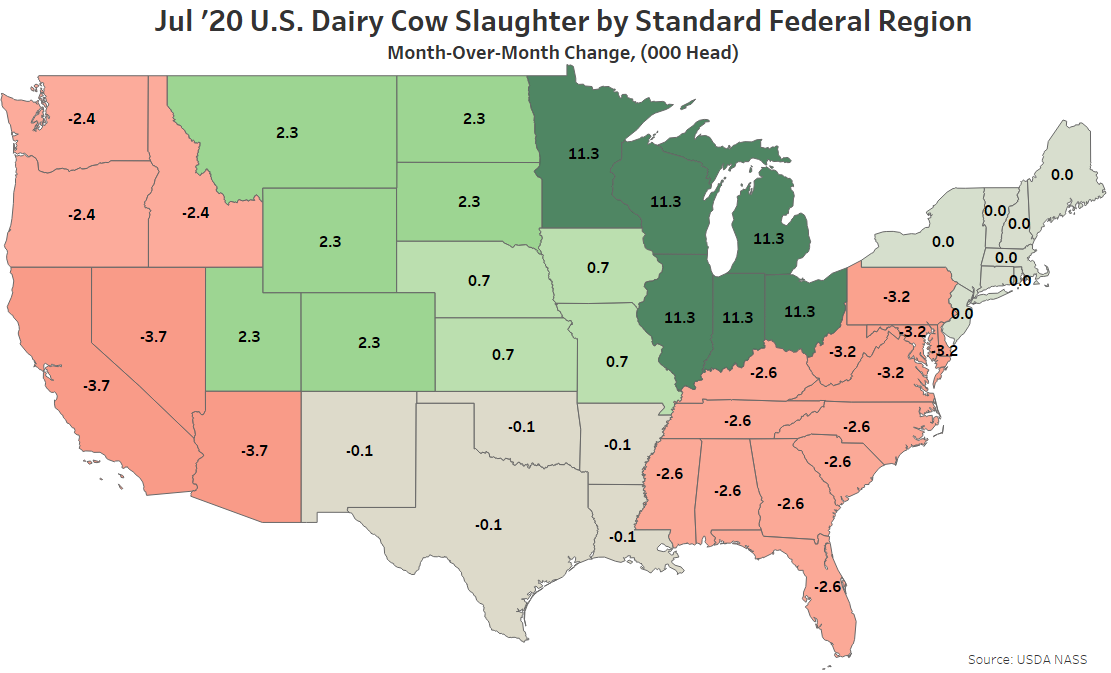

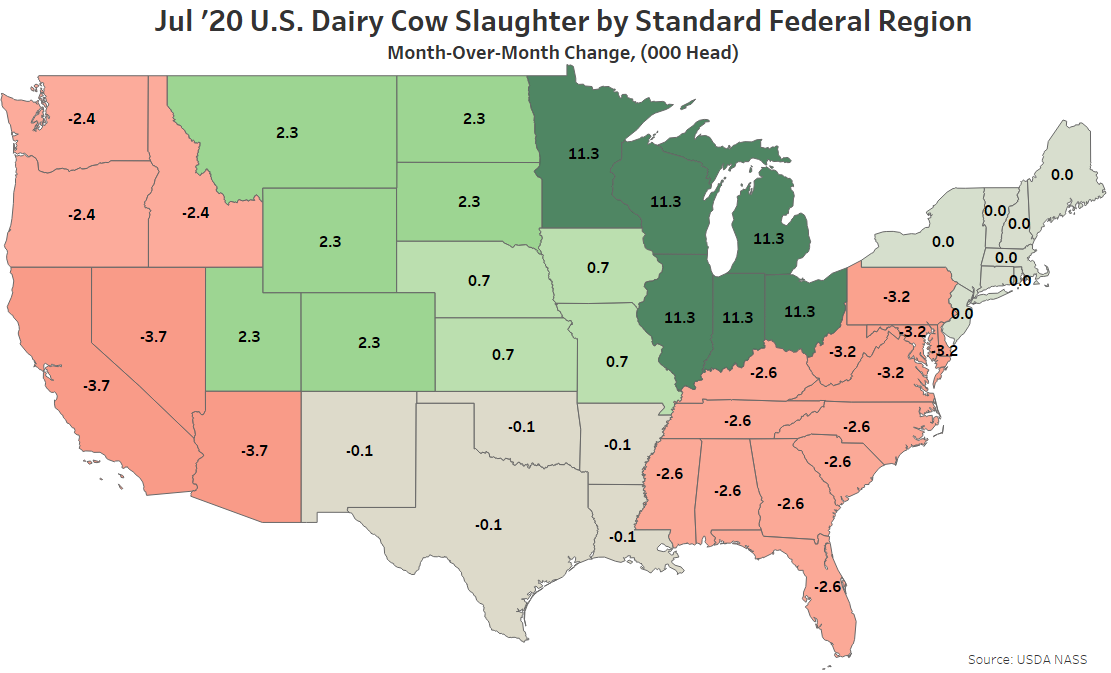

Month-over-month increases in dairy cow slaughter rates were most significant throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) declined most significantly from the previous month.

Month-over-month increases in dairy cow slaughter rates were most significant throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) declined most significantly from the previous month.

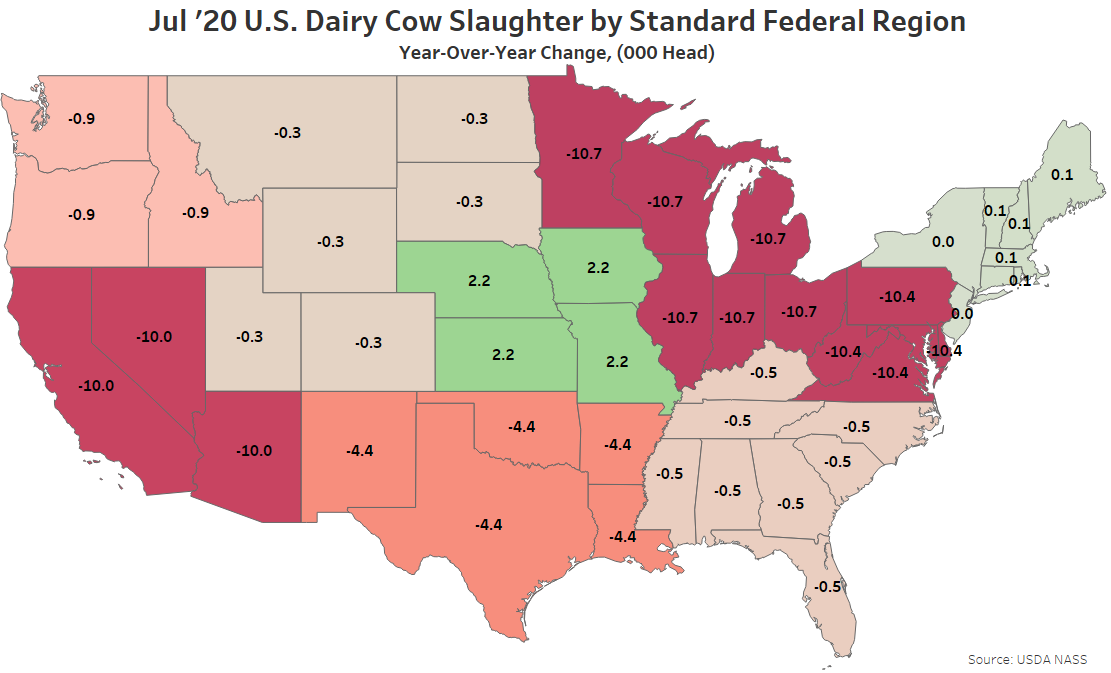

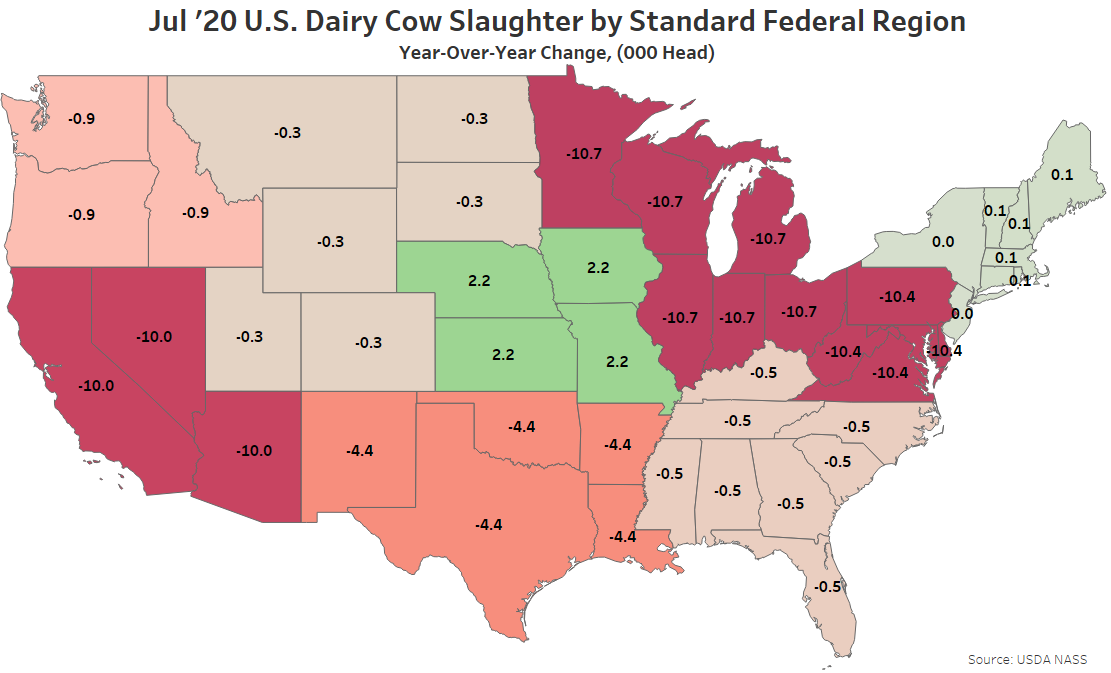

YOY declines in dairy cow slaughter continued to be led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed closely by Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) and Standard Federal Region 9 (Arizona, California, Hawaii and Nevada)

YOY declines in dairy cow slaughter continued to be led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed closely by Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) and Standard Federal Region 9 (Arizona, California, Hawaii and Nevada)

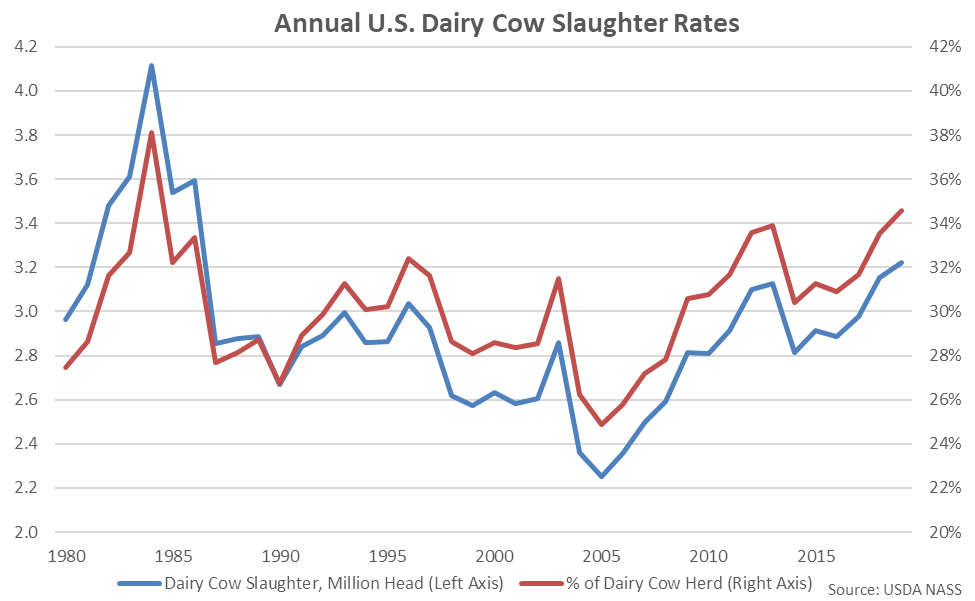

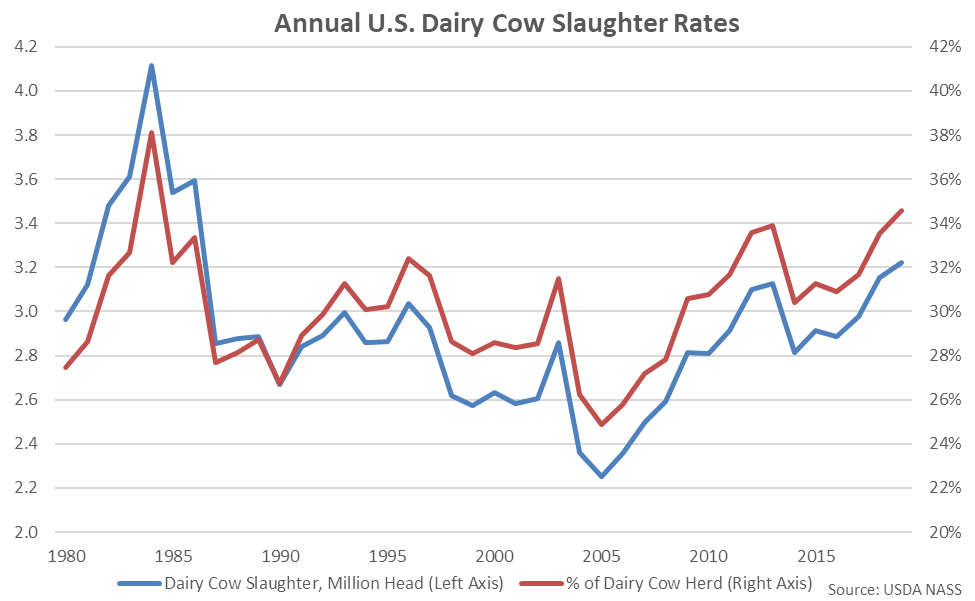

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

- Jul ’20 U.S. dairy cow slaughter rates increased seasonally from the previous month but remained 10.9% lower on a YOY basis when normalizing for slaughter days. The YOY decline in dairy cow slaughter rates was the largest experienced throughout the past five and a half years on a percentage basis.

- Month-over-month increases in dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

- YOY declines in dairy cow slaughter rates continued to be led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months through Jul ’19 prior to finishing flat or lower throughout ten of the past 12 months. The Jul ’20 YOY decline in dairy cow slaughter rates was the largest experienced throughout the past five and a half years on a percentage basis.

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months through Jul ’19 prior to finishing flat or lower throughout ten of the past 12 months. The Jul ’20 YOY decline in dairy cow slaughter rates was the largest experienced throughout the past five and a half years on a percentage basis.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through Jul ’20. The Jul ’20 U.S. milk cow herd rebounded 2,000 head from the six month low level experienced throughout the previous month while finishing 37,000 head above previous year levels.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through Jul ’20. The Jul ’20 U.S. milk cow herd rebounded 2,000 head from the six month low level experienced throughout the previous month while finishing 37,000 head above previous year levels.

Month-over-month increases in dairy cow slaughter rates were most significant throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) declined most significantly from the previous month.

Month-over-month increases in dairy cow slaughter rates were most significant throughout Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) declined most significantly from the previous month.

YOY declines in dairy cow slaughter continued to be led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed closely by Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) and Standard Federal Region 9 (Arizona, California, Hawaii and Nevada)

YOY declines in dairy cow slaughter continued to be led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed closely by Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) and Standard Federal Region 9 (Arizona, California, Hawaii and Nevada)

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.