U.S. DDGS Exports Update – Jan ’21

Nov ’20 U.S. DDGS Export Volumes Rebounded Slightly From the Previous Month

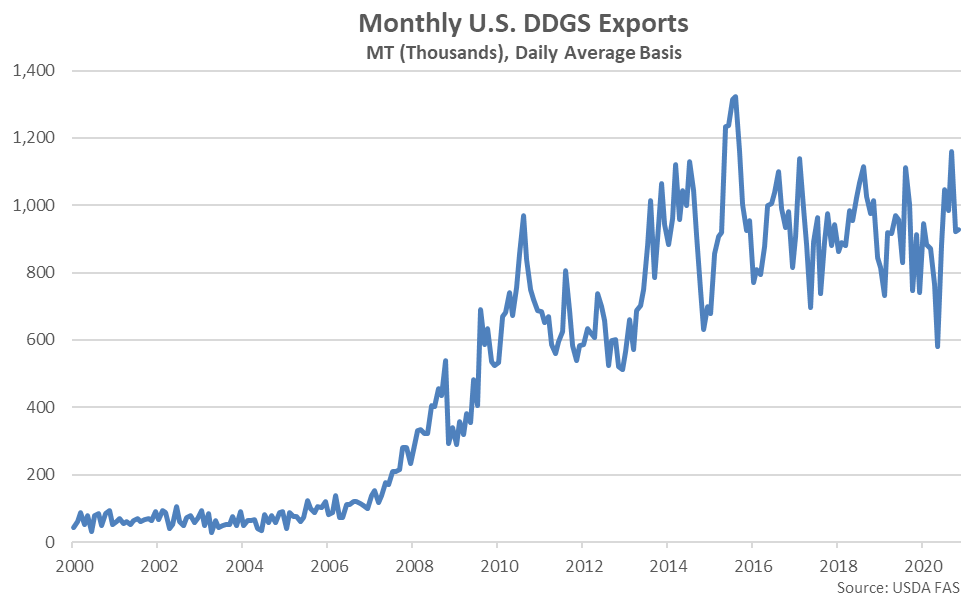

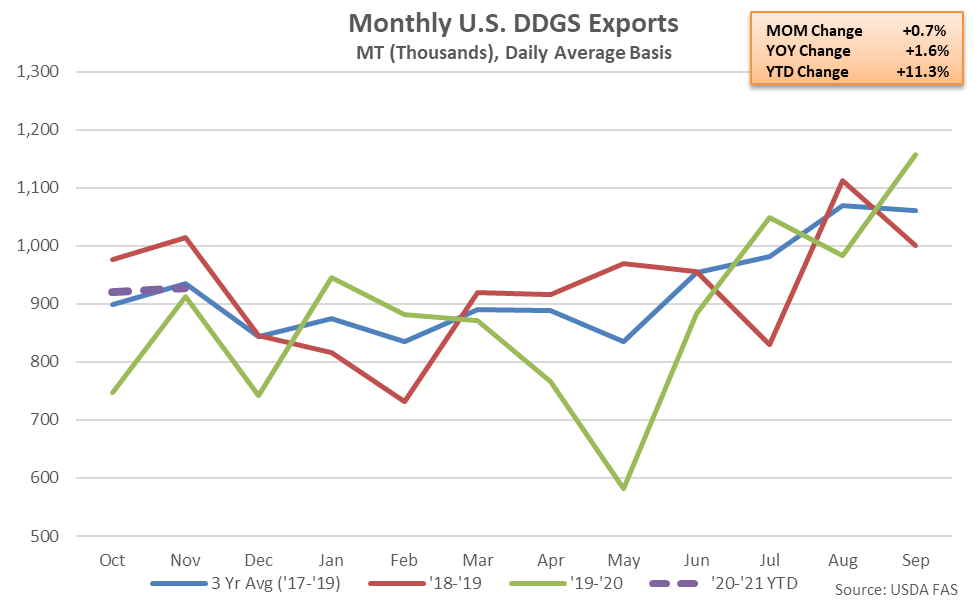

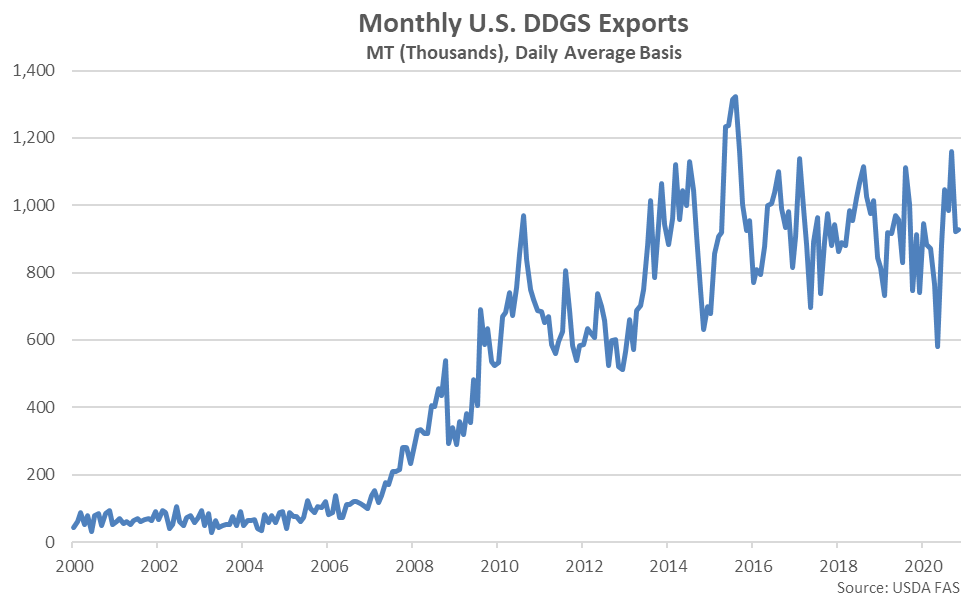

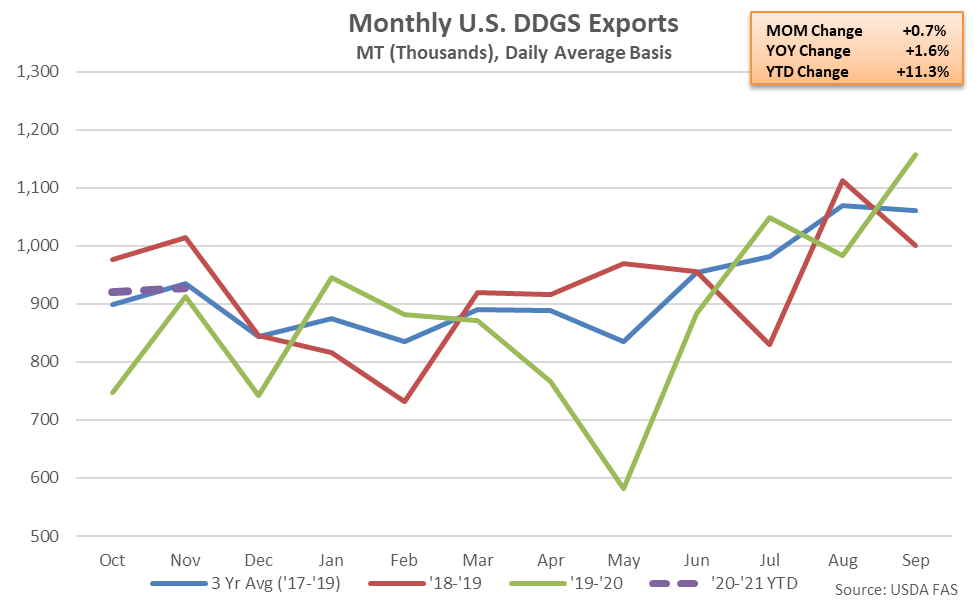

Nov ’20 U.S. DDGS Export Volumes Increased 0.7% MOM and 1.6% YOY

Nov ’20 U.S. DDGS Export Volumes Increased 0.7% MOM and 1.6% YOY

Nov ’20 U.S. DDGS Export Volumes Remained 0.8% Below Three Year Avg. Seasonal Figures

Nov ’20 U.S. DDGS Export Volumes Remained 0.8% Below Three Year Avg. Seasonal Figures

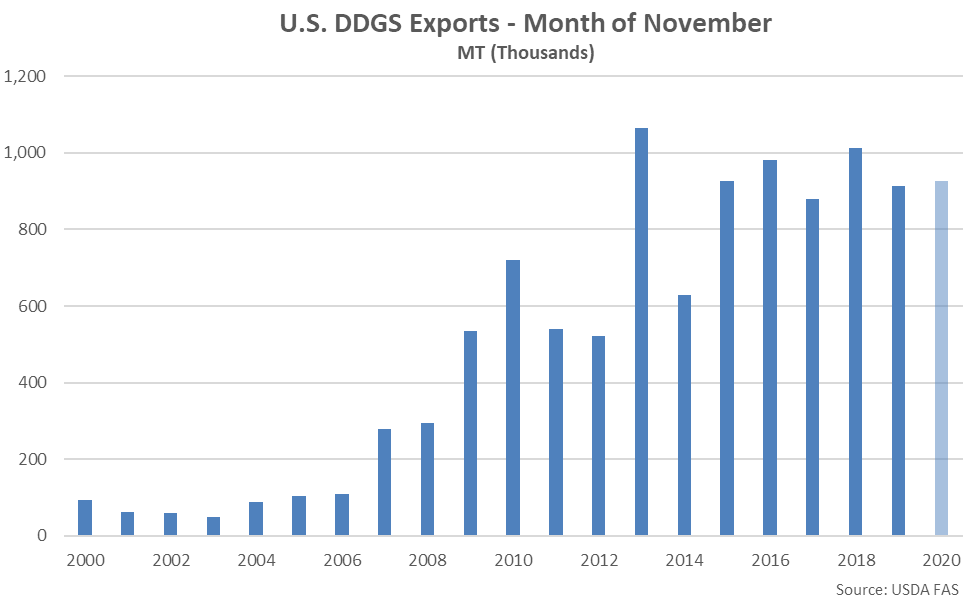

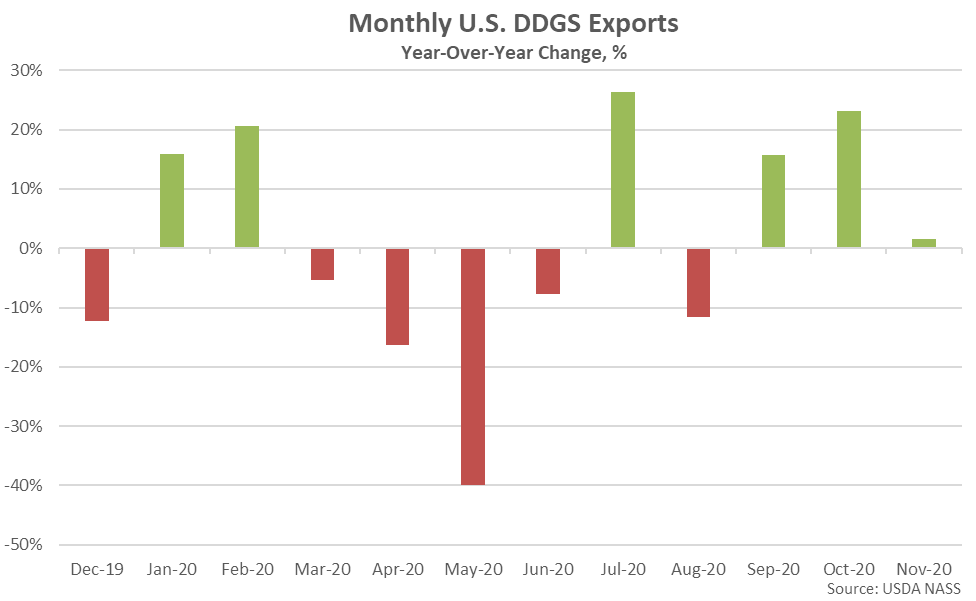

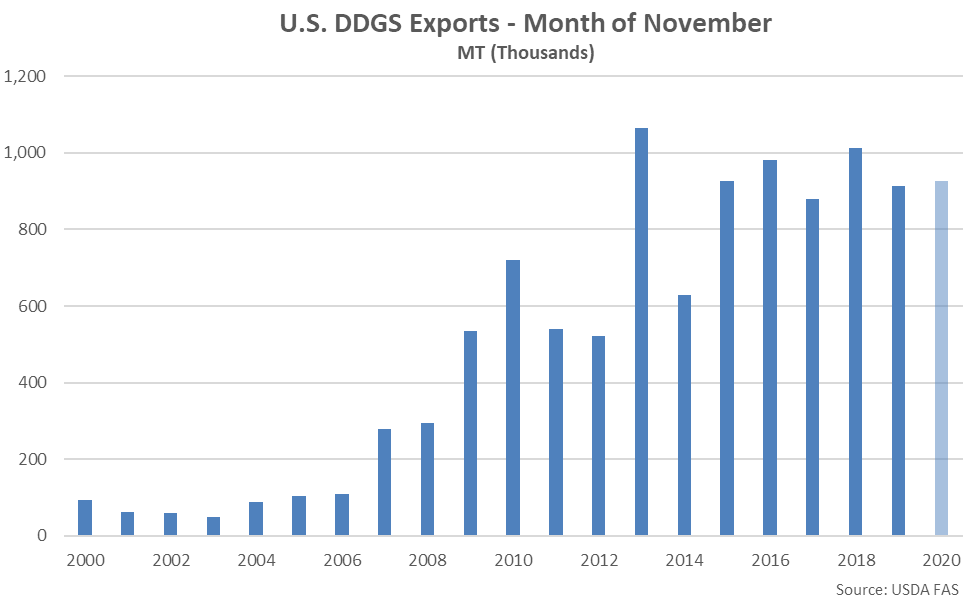

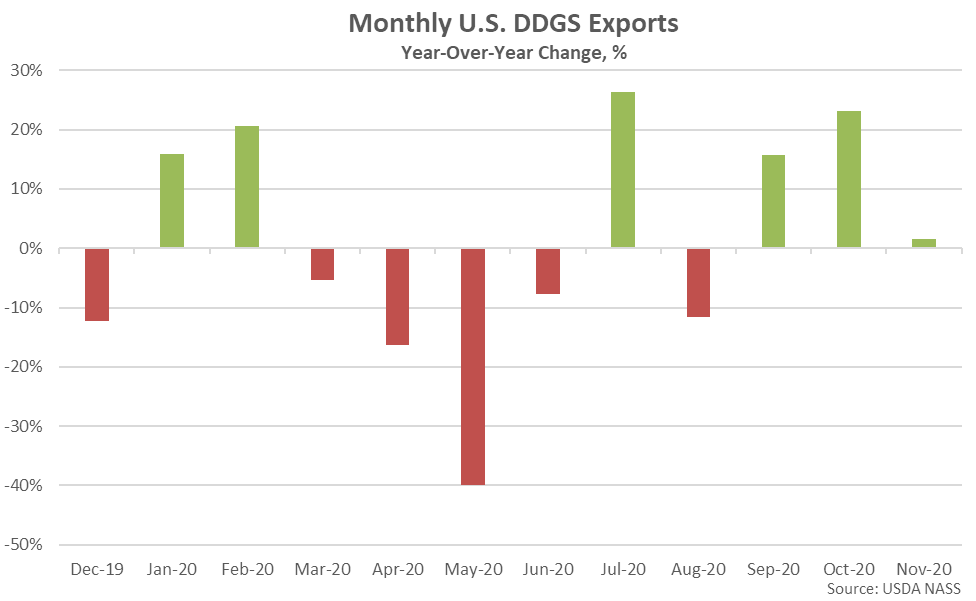

The Nov ’20 YOY Increase in U.S. DDGS Exports was the Third Experienced in a Row

The Nov ’20 YOY Increase in U.S. DDGS Exports was the Third Experienced in a Row

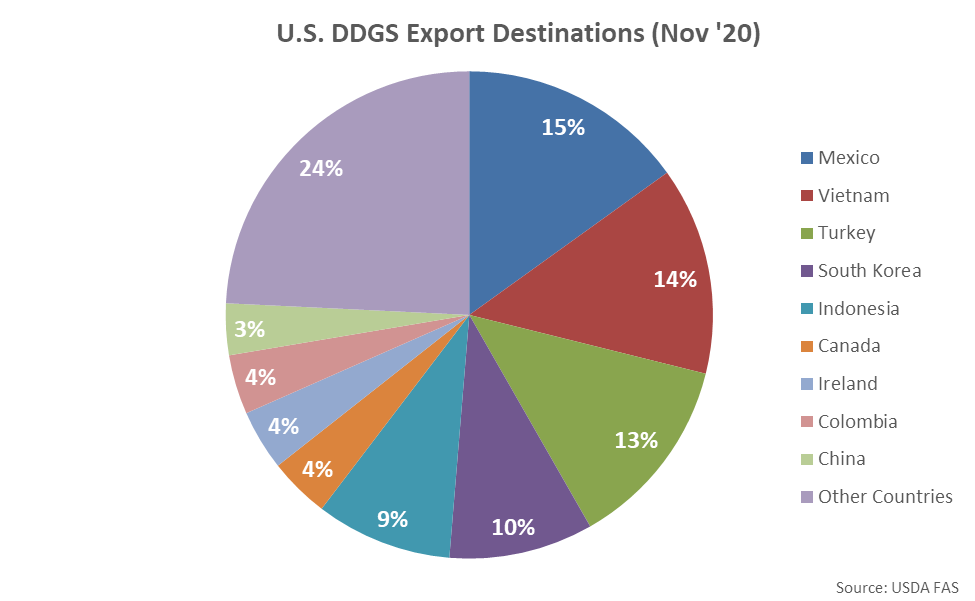

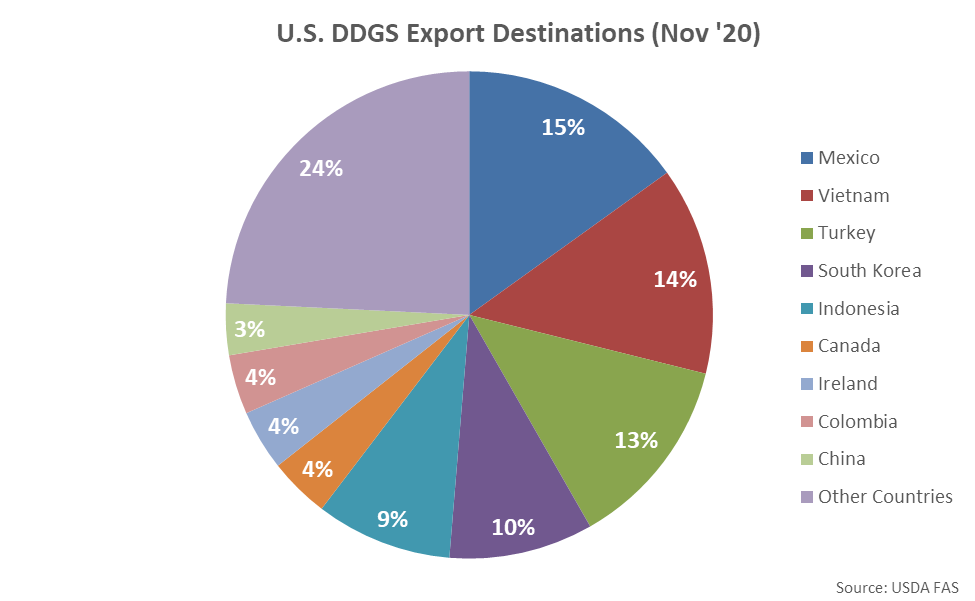

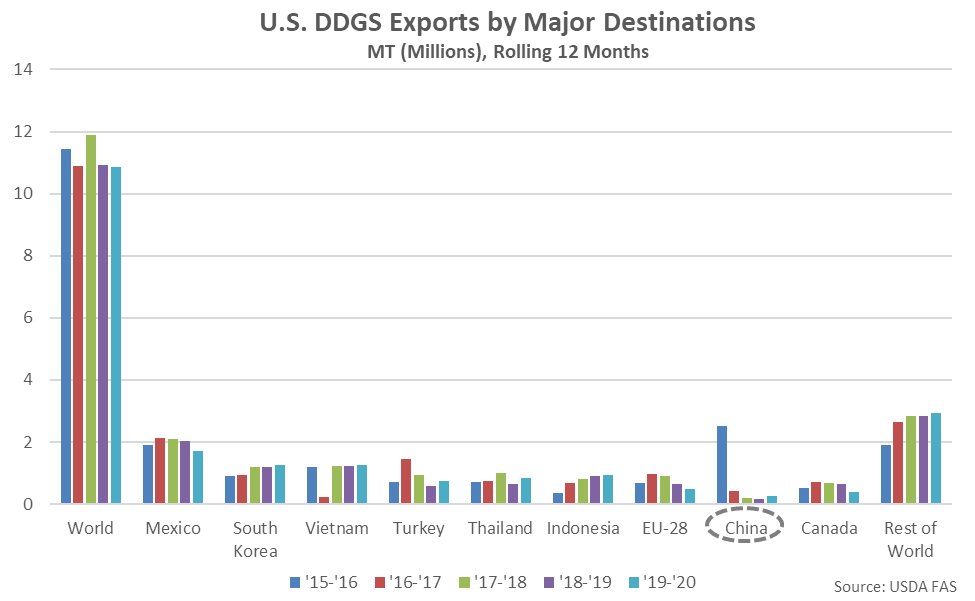

Mexico and Vietnam Were the Top Destinations for U.S. DDGS Exports During Nov ’20

Mexico and Vietnam Were the Top Destinations for U.S. DDGS Exports During Nov ’20

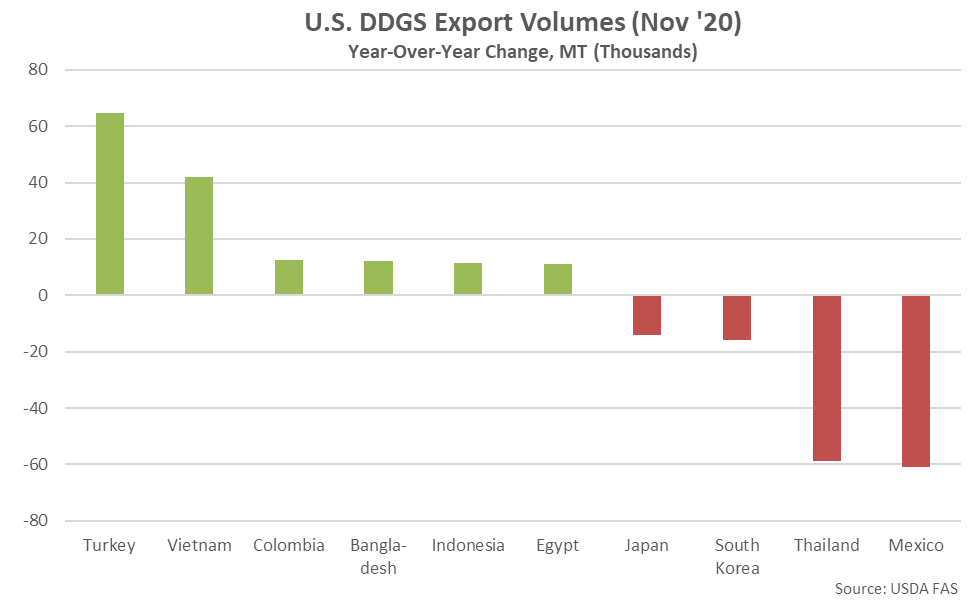

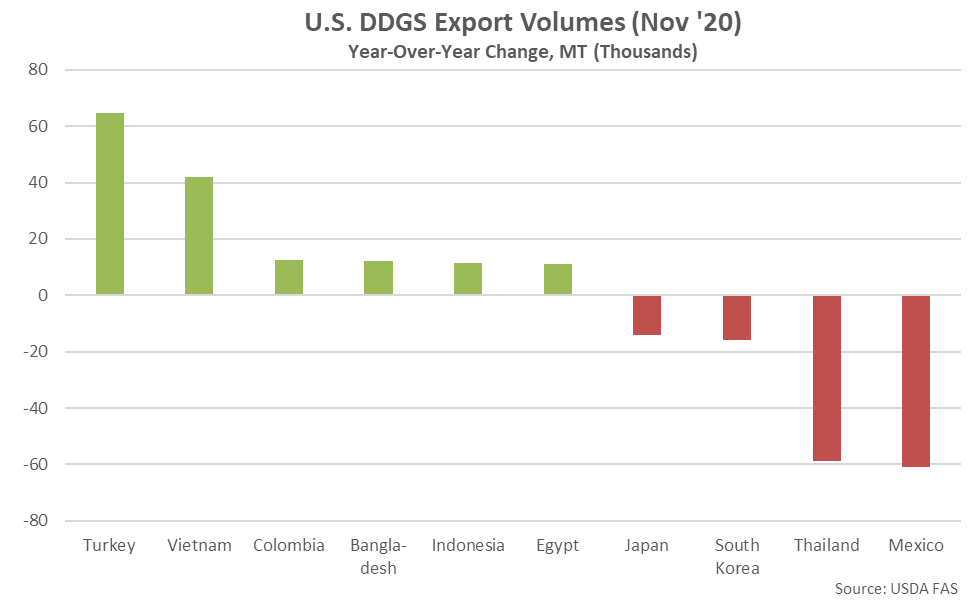

Nov ’20 U.S. DDGS Exports Destined to Turkey up, Mexico Down Most Significantly YOY

Nov ’20 U.S. DDGS Exports Destined to Turkey up, Mexico Down Most Significantly YOY

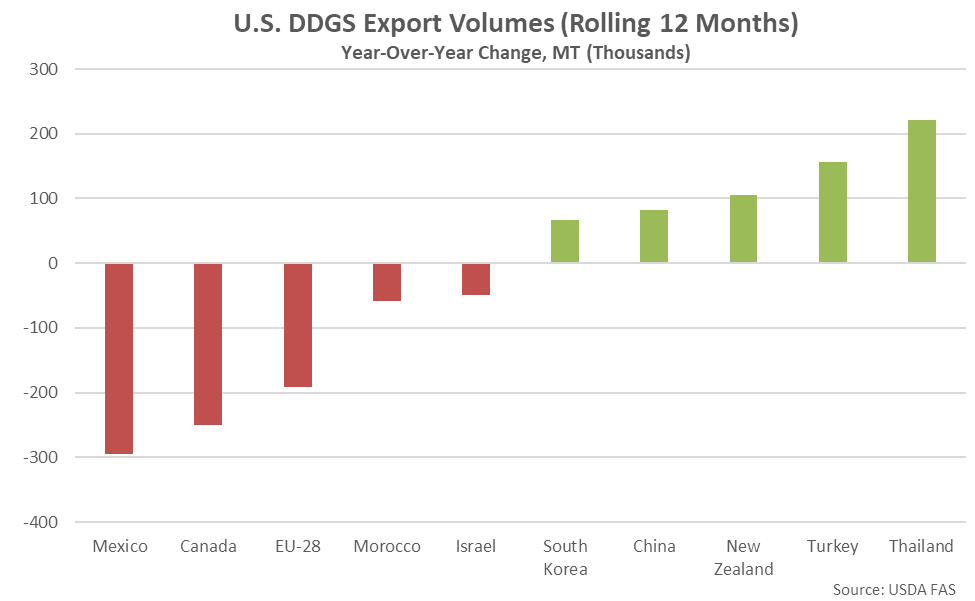

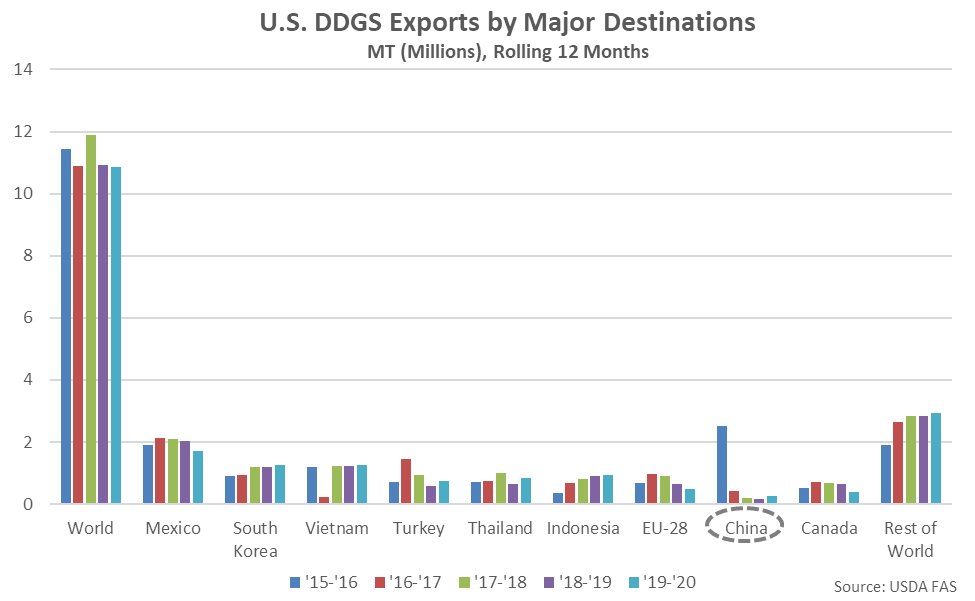

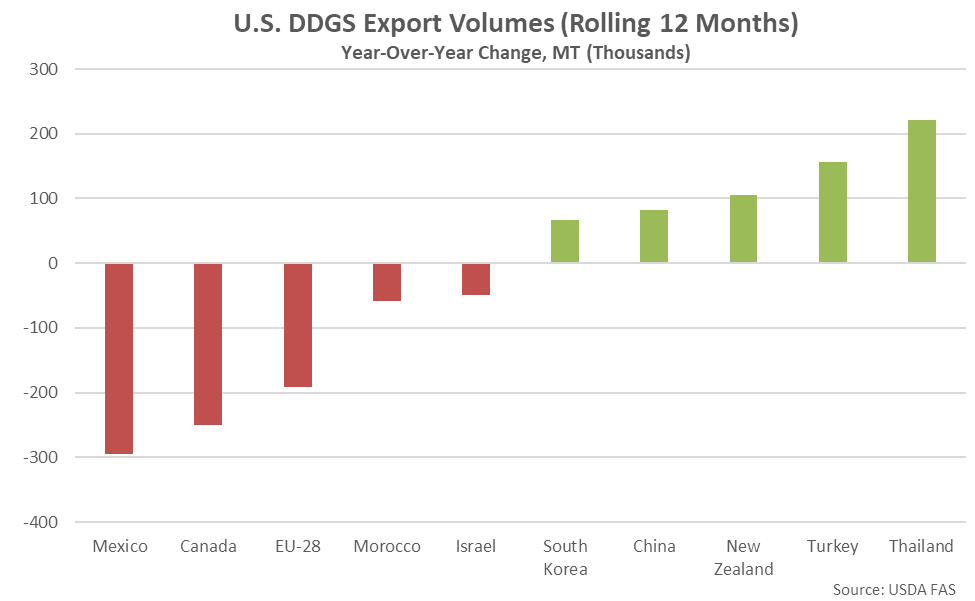

U.S. DDGS Exports Destined to Mexico Down, Thailand up, Over the Past 12 Months

U.S. DDGS Exports Destined to Mexico Down, Thailand up, Over the Past 12 Months

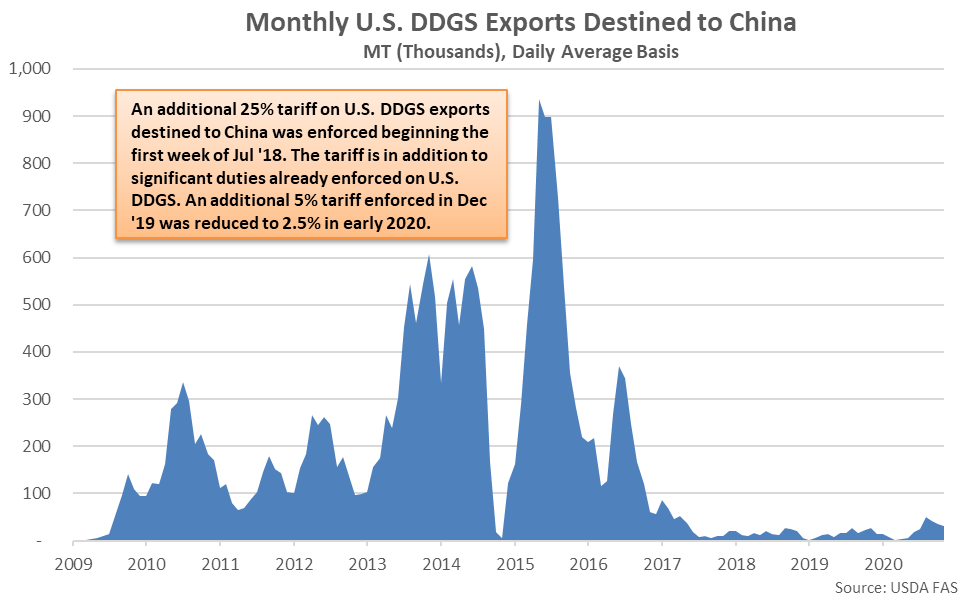

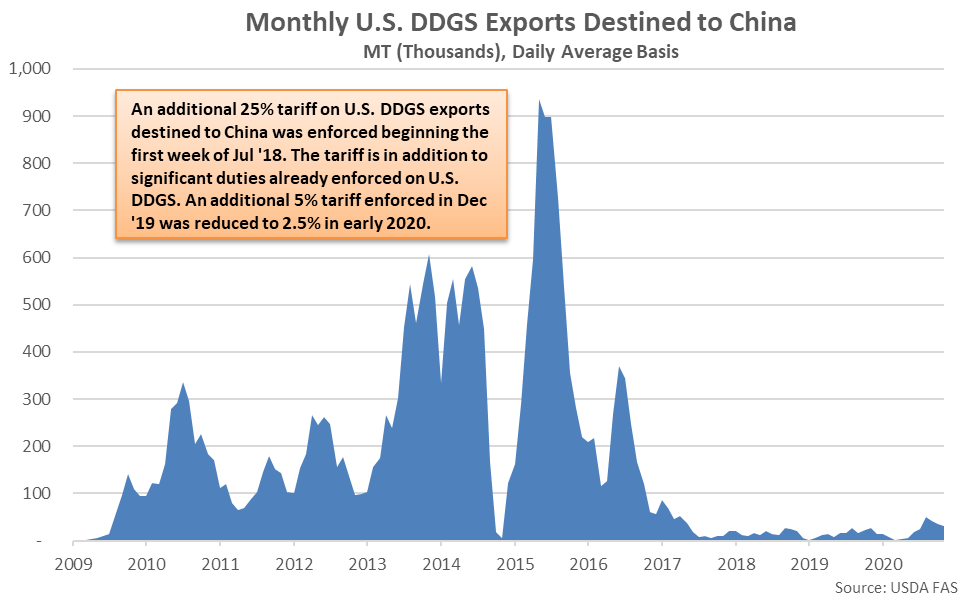

U.S. DDGS Exports Destined to China Have Declined Significantly Over Recent Years

U.S. DDGS Exports Destined to China Have Declined Significantly Over Recent Years

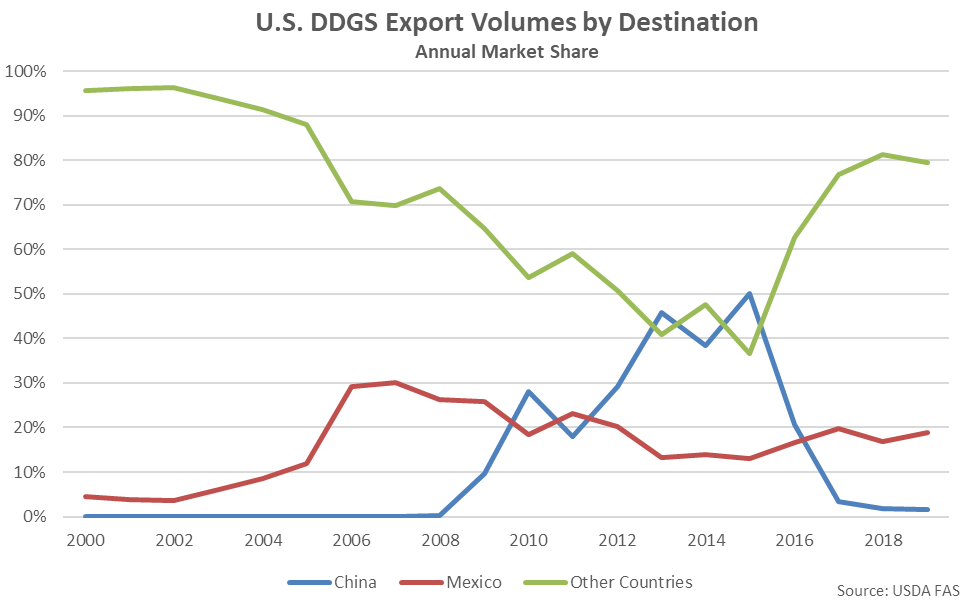

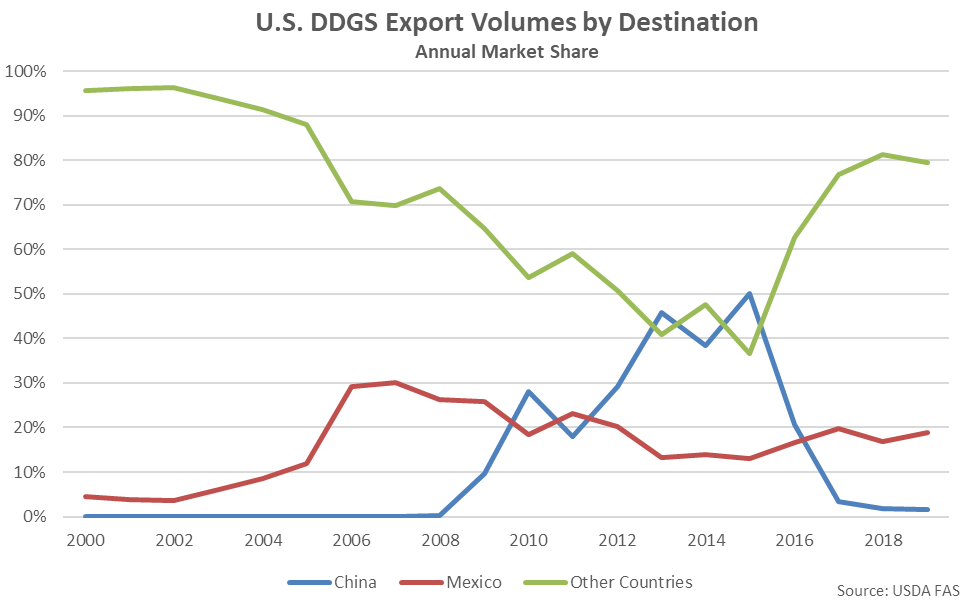

The 2019 Market Share of U.S. DDGS Exports Destined to China Declined to an 11 Year Low

The 2019 Market Share of U.S. DDGS Exports Destined to China Declined to an 11 Year Low

Nov ’20 U.S. DDGS Exports Destined to China Remained Minimal

Nov ’20 U.S. DDGS Exports Destined to China Remained Minimal

Nov ’20 U.S. DDGS Export Volumes Increased 0.7% MOM and 1.6% YOY

Nov ’20 U.S. DDGS Export Volumes Increased 0.7% MOM and 1.6% YOY

Nov ’20 U.S. DDGS Export Volumes Remained 0.8% Below Three Year Avg. Seasonal Figures

Nov ’20 U.S. DDGS Export Volumes Remained 0.8% Below Three Year Avg. Seasonal Figures

The Nov ’20 YOY Increase in U.S. DDGS Exports was the Third Experienced in a Row

The Nov ’20 YOY Increase in U.S. DDGS Exports was the Third Experienced in a Row

Mexico and Vietnam Were the Top Destinations for U.S. DDGS Exports During Nov ’20

Mexico and Vietnam Were the Top Destinations for U.S. DDGS Exports During Nov ’20

Nov ’20 U.S. DDGS Exports Destined to Turkey up, Mexico Down Most Significantly YOY

Nov ’20 U.S. DDGS Exports Destined to Turkey up, Mexico Down Most Significantly YOY

U.S. DDGS Exports Destined to Mexico Down, Thailand up, Over the Past 12 Months

U.S. DDGS Exports Destined to Mexico Down, Thailand up, Over the Past 12 Months

U.S. DDGS Exports Destined to China Have Declined Significantly Over Recent Years

U.S. DDGS Exports Destined to China Have Declined Significantly Over Recent Years

The 2019 Market Share of U.S. DDGS Exports Destined to China Declined to an 11 Year Low

The 2019 Market Share of U.S. DDGS Exports Destined to China Declined to an 11 Year Low

Nov ’20 U.S. DDGS Exports Destined to China Remained Minimal

Nov ’20 U.S. DDGS Exports Destined to China Remained Minimal