Crude Oil Overview – Mar ’15

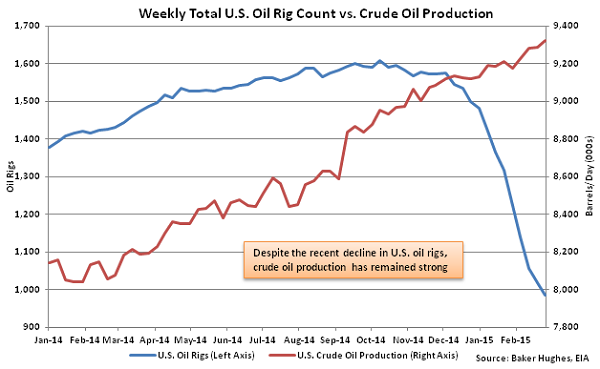

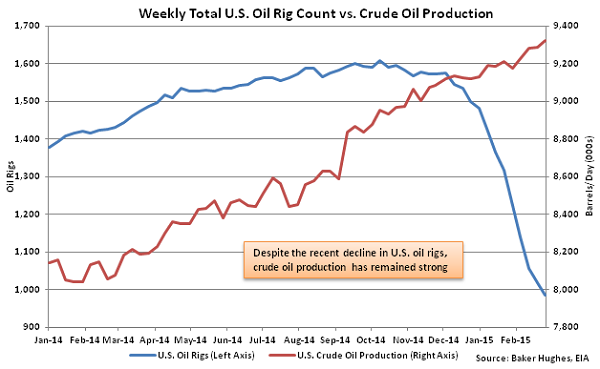

U.S. crude oil production continues to reach new highs, despite significant reductions in oil rig counts. Coupled with a slowdown in global demand, higher production has resulted in crude oil prices falling by more than half since the middle of 2014.

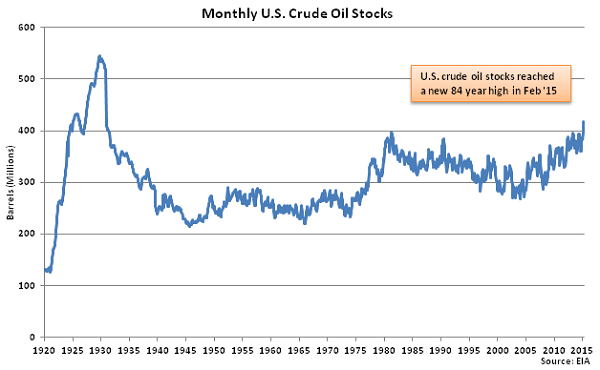

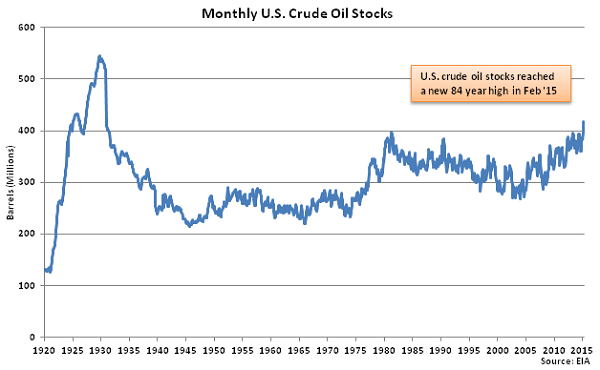

Increased supply and weak relative demand has resulted in a glut of oil stocks both domestically and internationally as global stocks reached a three and a half year high while U.S. stocks reached an 84 year high in early 2015.

Increased supply and weak relative demand has resulted in a glut of oil stocks both domestically and internationally as global stocks reached a three and a half year high while U.S. stocks reached an 84 year high in early 2015.

Crude oil prices are off of recent lows experienced in Jan ’15 but remain at approximately half of last year’s levels. Despite the reduced prices, price uncertainty for the remainder of 2015 remains high as supply continues to build and demand remains soft. Follow this link to view the complete crude oil overview analyzing recent crude oil supply and demand trends. Please let us know if you have any questions.

Crude oil prices are off of recent lows experienced in Jan ’15 but remain at approximately half of last year’s levels. Despite the reduced prices, price uncertainty for the remainder of 2015 remains high as supply continues to build and demand remains soft. Follow this link to view the complete crude oil overview analyzing recent crude oil supply and demand trends. Please let us know if you have any questions.

Increased supply and weak relative demand has resulted in a glut of oil stocks both domestically and internationally as global stocks reached a three and a half year high while U.S. stocks reached an 84 year high in early 2015.

Increased supply and weak relative demand has resulted in a glut of oil stocks both domestically and internationally as global stocks reached a three and a half year high while U.S. stocks reached an 84 year high in early 2015.

Crude oil prices are off of recent lows experienced in Jan ’15 but remain at approximately half of last year’s levels. Despite the reduced prices, price uncertainty for the remainder of 2015 remains high as supply continues to build and demand remains soft. Follow this link to view the complete crude oil overview analyzing recent crude oil supply and demand trends. Please let us know if you have any questions.

Crude oil prices are off of recent lows experienced in Jan ’15 but remain at approximately half of last year’s levels. Despite the reduced prices, price uncertainty for the remainder of 2015 remains high as supply continues to build and demand remains soft. Follow this link to view the complete crude oil overview analyzing recent crude oil supply and demand trends. Please let us know if you have any questions.