EIA Drilling Productivity Report Update – Oct ’15

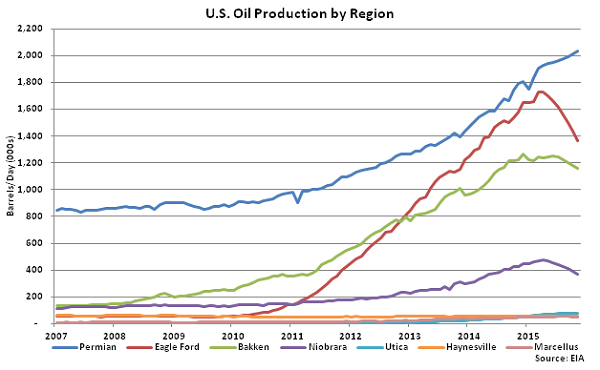

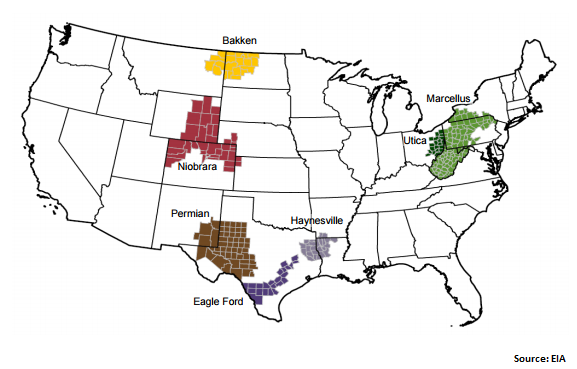

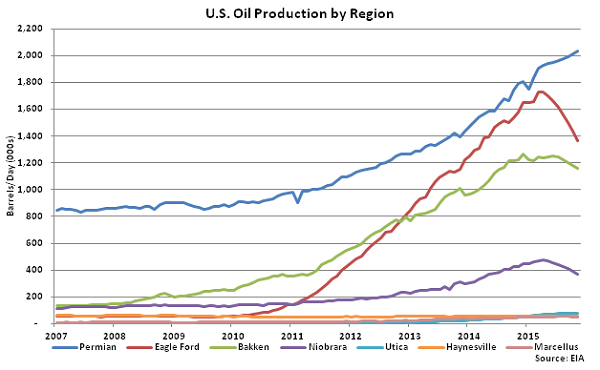

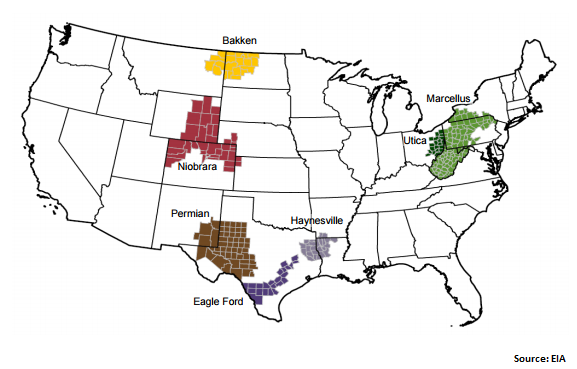

According to the EIA’s October Drilling Productivity Report, U.S. oil output is expected to continue to decline through Nov ’15. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below. The seven regions analyzed have accounted for 95% of domestic oil production growth from 2011-2013.

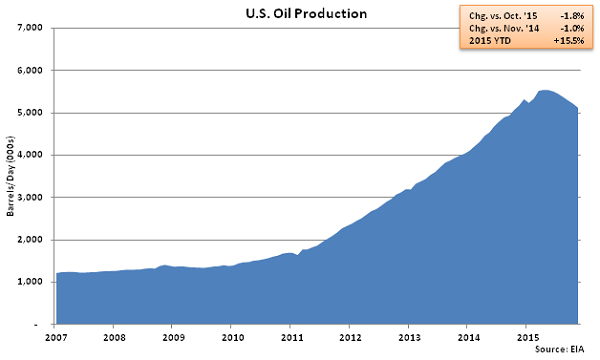

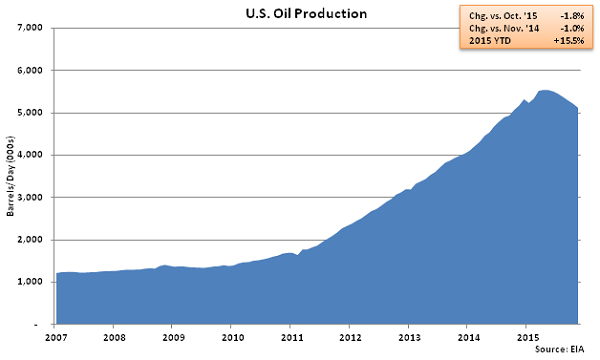

Oct ’15 shale production was revised higher by approximately 6,000 barrels per day (bpd), or 0.1%, but is expected to remain approximately 78,000 bpd, or 1.5%, below Sep ’15 production levels. Nov ’15 production is expected to decline an additional 94,000 bpd, or 1.8%, from the Oct ’15 revised production levels to 5.12 million bpd, a 13 month low.

Oct ’15 shale production was revised higher by approximately 6,000 barrels per day (bpd), or 0.1%, but is expected to remain approximately 78,000 bpd, or 1.5%, below Sep ’15 production levels. Nov ’15 production is expected to decline an additional 94,000 bpd, or 1.8%, from the Oct ’15 revised production levels to 5.12 million bpd, a 13 month low.

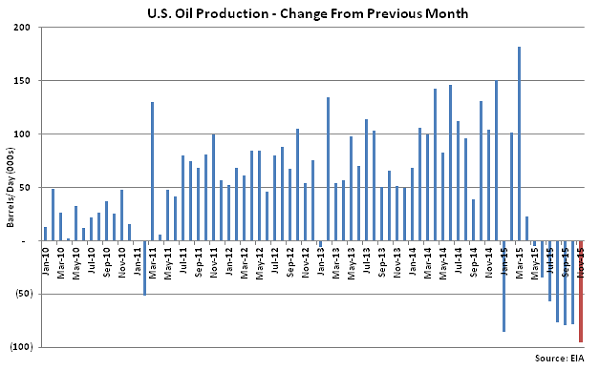

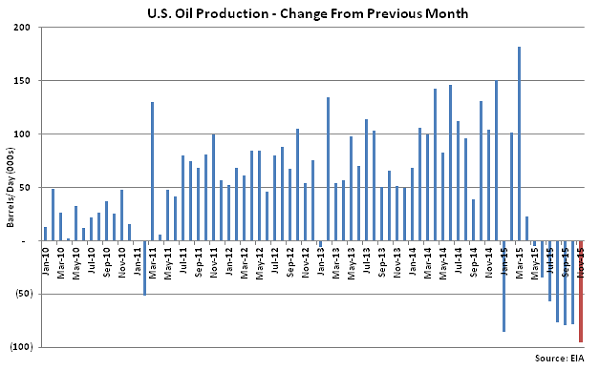

The projected MOM declines in oil production throughout 2015 have been the largest experienced since the report was originated in 2007. The Nov ’15 projected declined in oil production was the largest on record.

The projected MOM declines in oil production throughout 2015 have been the largest experienced since the report was originated in 2007. The Nov ’15 projected declined in oil production was the largest on record.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 4.9%, 2.0% and 5.2%, respectively in Nov ’15. Growth is expected to continue within the Permian and Utica regions, with projected production up 1.0% and 1.4% MOM, respectively, in Nov ’15.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 4.9%, 2.0% and 5.2%, respectively in Nov ’15. Growth is expected to continue within the Permian and Utica regions, with projected production up 1.0% and 1.4% MOM, respectively, in Nov ’15.

Oct ’15 shale production was revised higher by approximately 6,000 barrels per day (bpd), or 0.1%, but is expected to remain approximately 78,000 bpd, or 1.5%, below Sep ’15 production levels. Nov ’15 production is expected to decline an additional 94,000 bpd, or 1.8%, from the Oct ’15 revised production levels to 5.12 million bpd, a 13 month low.

Oct ’15 shale production was revised higher by approximately 6,000 barrels per day (bpd), or 0.1%, but is expected to remain approximately 78,000 bpd, or 1.5%, below Sep ’15 production levels. Nov ’15 production is expected to decline an additional 94,000 bpd, or 1.8%, from the Oct ’15 revised production levels to 5.12 million bpd, a 13 month low.

The projected MOM declines in oil production throughout 2015 have been the largest experienced since the report was originated in 2007. The Nov ’15 projected declined in oil production was the largest on record.

The projected MOM declines in oil production throughout 2015 have been the largest experienced since the report was originated in 2007. The Nov ’15 projected declined in oil production was the largest on record.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 4.9%, 2.0% and 5.2%, respectively in Nov ’15. Growth is expected to continue within the Permian and Utica regions, with projected production up 1.0% and 1.4% MOM, respectively, in Nov ’15.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 4.9%, 2.0% and 5.2%, respectively in Nov ’15. Growth is expected to continue within the Permian and Utica regions, with projected production up 1.0% and 1.4% MOM, respectively, in Nov ’15.