U.S. Livestock Cold Storage Update – Oct ’15

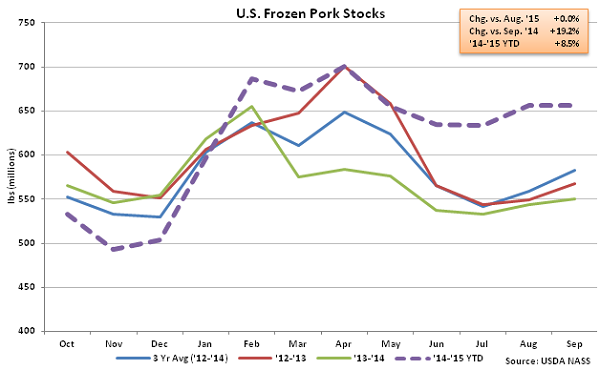

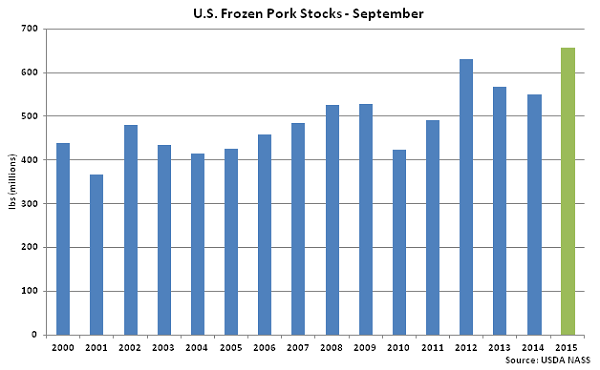

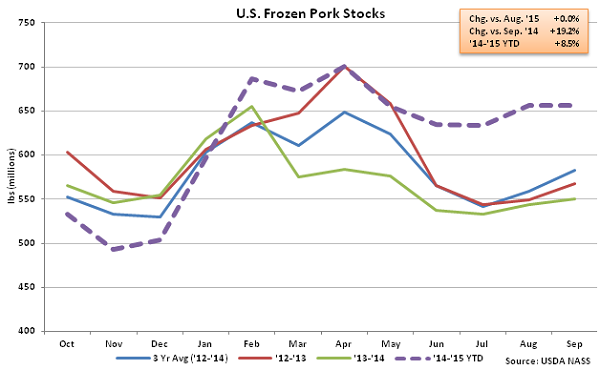

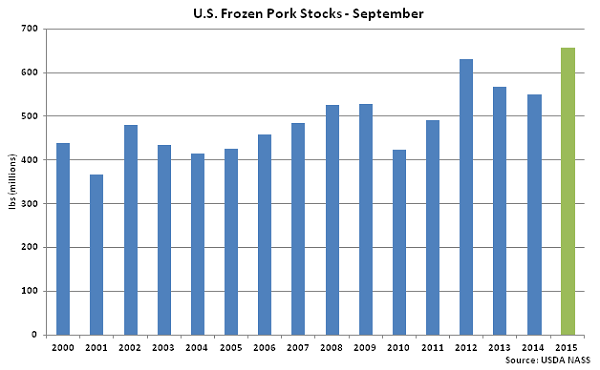

Pork – Stocks Finish at New Record High for the Month of September, up 19.2% YOY

According to USDA, Sep ’15 U.S. frozen pork stocks of 656.4 million pounds increased 3.6% MOM and 20.7% YOY, setting a new record high for the month of September. Pork stocks have increased YOY for eight month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Sep ’15 pork stocks finished 12.6% higher than the three year average September pork stocks and are at a five month high on an absolute basis.

According to USDA, Sep ’15 U.S. frozen pork stocks of 656.4 million pounds increased 3.6% MOM and 20.7% YOY, setting a new record high for the month of September. Pork stocks have increased YOY for eight month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Sep ’15 pork stocks finished 12.6% higher than the three year average September pork stocks and are at a five month high on an absolute basis.

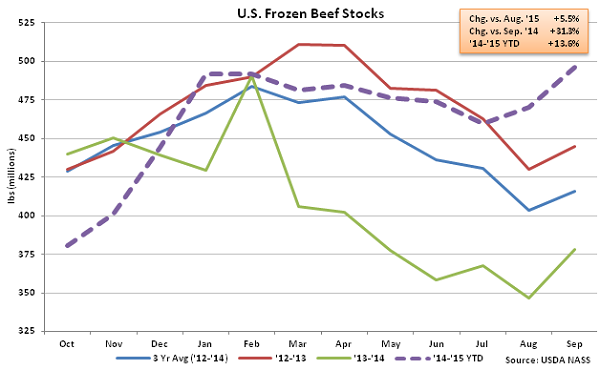

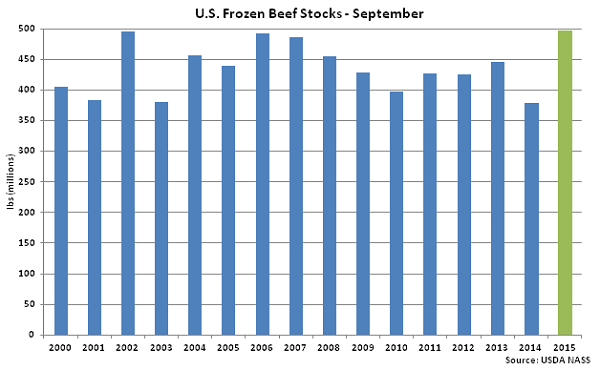

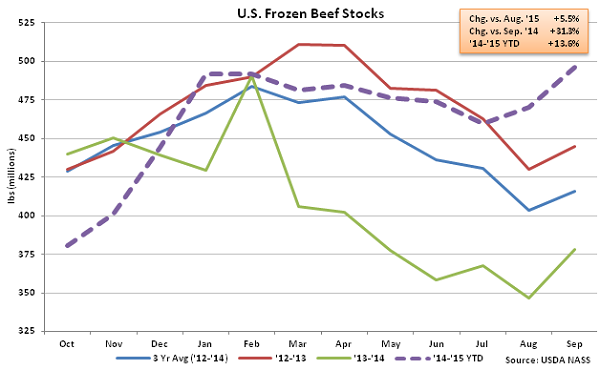

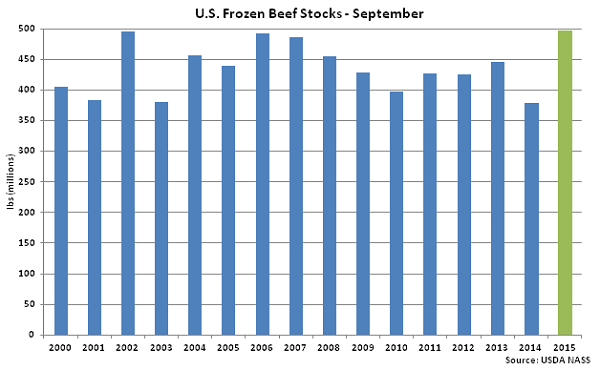

Beef – Stocks Finish at New Record High for the Month of September, up 31.3% YOY

Beef – Stocks Finish at New Record High for the Month of September, up 31.3% YOY

Sep ’15 U.S. frozen beef stocks of 496.4 million pounds increased 5.5% MOM and 31.3% YOY to a new record high for the month of September. The monthly YOY increase in beef stocks was the tenth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 25.9 million pounds, or 5.5%, was approximately twice the three year average August – September increase in beef stocks of 11.1 million pounds, or 2.8%. Sep ’15 beef stocks finished 19.3% higher than the three year average September beef stocks and are at a 29 month high on an absolute basis.

Sep ’15 U.S. frozen beef stocks of 496.4 million pounds increased 5.5% MOM and 31.3% YOY to a new record high for the month of September. The monthly YOY increase in beef stocks was the tenth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 25.9 million pounds, or 5.5%, was approximately twice the three year average August – September increase in beef stocks of 11.1 million pounds, or 2.8%. Sep ’15 beef stocks finished 19.3% higher than the three year average September beef stocks and are at a 29 month high on an absolute basis.

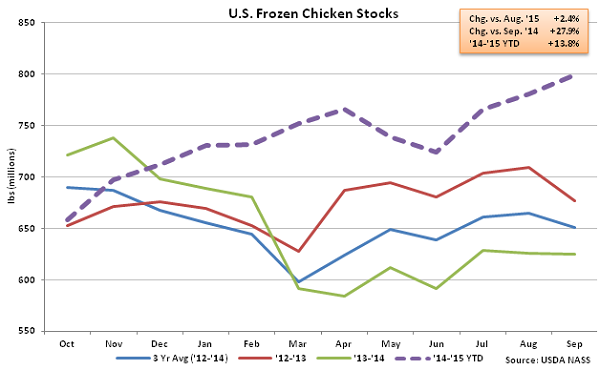

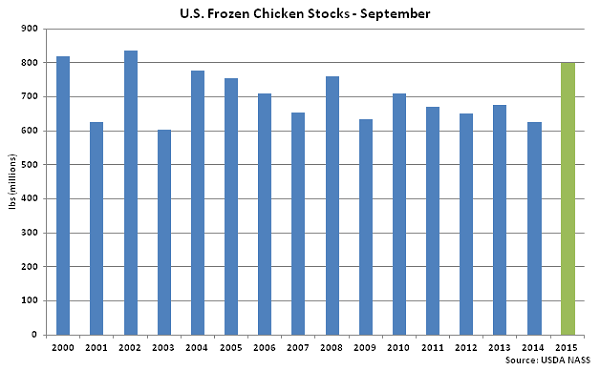

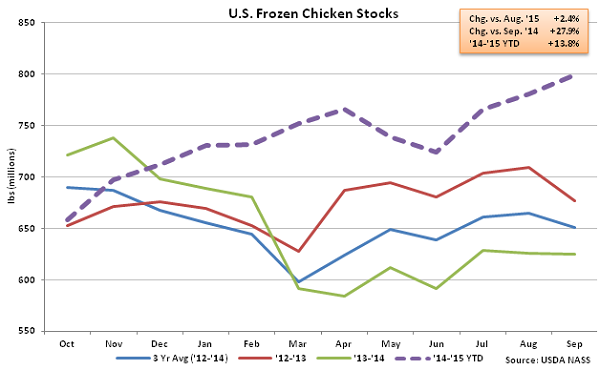

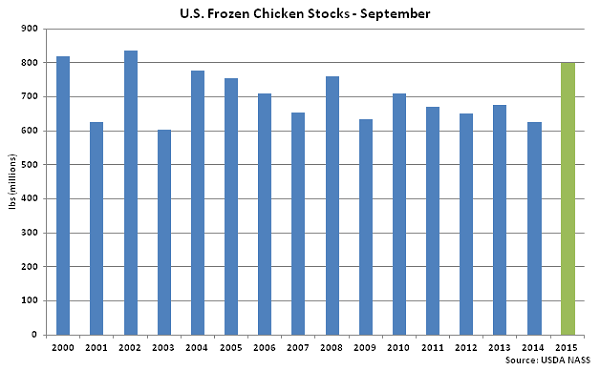

Chicken – Stocks Remain Significantly Higher on YOY Basis, Finish up 27.9%

Chicken – Stocks Remain Significantly Higher on YOY Basis, Finish up 27.9%

Sep ’15 U.S. frozen chicken stocks of 799.8 million pounds increased 2.4% MOM and 27.9% YOY to a new 13 year high for the month of September. Chicken stocks increased YOY for the tenth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the three year average August – September seasonal decline of 1.7 million pounds, or 0.3%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 8.2% YOY since the ban was announced. Sep ’15 chicken stocks finished 22.9% higher than the three year average September chicken stocks and are at a four and a half year high on an absolute basis.

Sep ’15 U.S. frozen chicken stocks of 799.8 million pounds increased 2.4% MOM and 27.9% YOY to a new 13 year high for the month of September. Chicken stocks increased YOY for the tenth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the three year average August – September seasonal decline of 1.7 million pounds, or 0.3%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 8.2% YOY since the ban was announced. Sep ’15 chicken stocks finished 22.9% higher than the three year average September chicken stocks and are at a four and a half year high on an absolute basis.

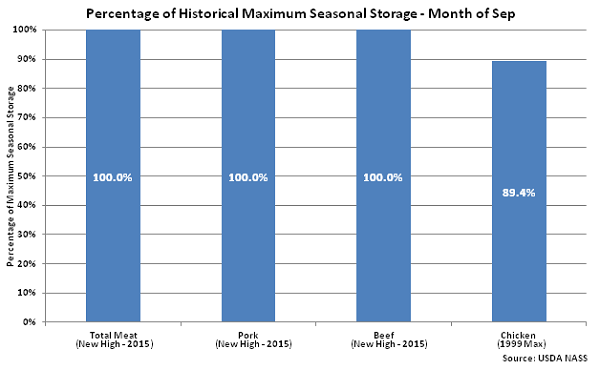

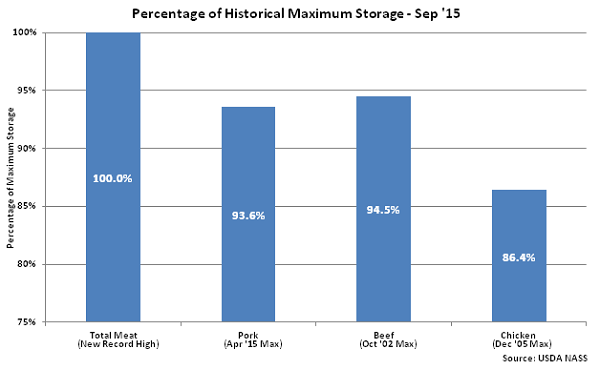

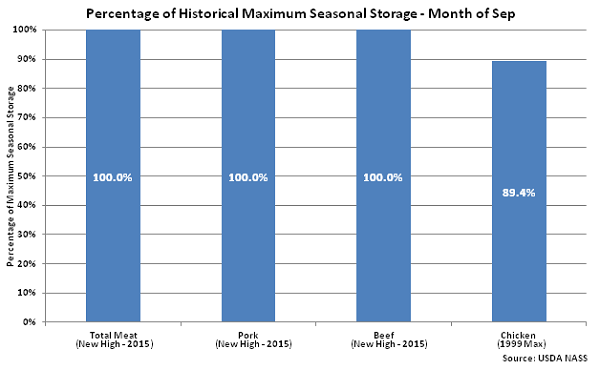

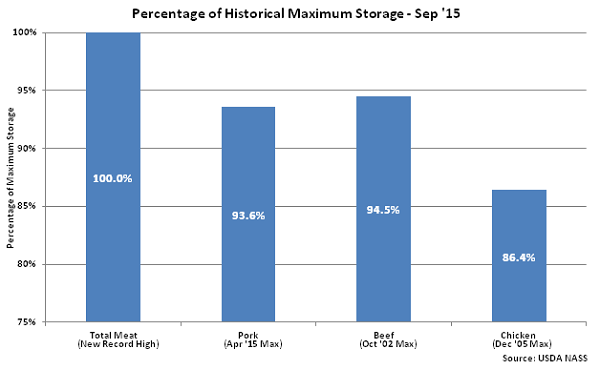

Overall, combined Sep ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Sep ’15 U.S. pork and beef stocks remained above 90% of historical maximum storage levels, while chicken stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Overall, combined Sep ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Sep ’15 U.S. pork and beef stocks remained above 90% of historical maximum storage levels, while chicken stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Individually, Sep ’15 U.S. pork and beef stocks set a new record high for the month of September, while chicken stocks finished at just under 90% of historical maximum storage levels for the month of September.

Individually, Sep ’15 U.S. pork and beef stocks set a new record high for the month of September, while chicken stocks finished at just under 90% of historical maximum storage levels for the month of September.

According to USDA, Sep ’15 U.S. frozen pork stocks of 656.4 million pounds increased 3.6% MOM and 20.7% YOY, setting a new record high for the month of September. Pork stocks have increased YOY for eight month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Sep ’15 pork stocks finished 12.6% higher than the three year average September pork stocks and are at a five month high on an absolute basis.

According to USDA, Sep ’15 U.S. frozen pork stocks of 656.4 million pounds increased 3.6% MOM and 20.7% YOY, setting a new record high for the month of September. Pork stocks have increased YOY for eight month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Sep ’15 pork stocks finished 12.6% higher than the three year average September pork stocks and are at a five month high on an absolute basis.

Beef – Stocks Finish at New Record High for the Month of September, up 31.3% YOY

Beef – Stocks Finish at New Record High for the Month of September, up 31.3% YOY

Sep ’15 U.S. frozen beef stocks of 496.4 million pounds increased 5.5% MOM and 31.3% YOY to a new record high for the month of September. The monthly YOY increase in beef stocks was the tenth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 25.9 million pounds, or 5.5%, was approximately twice the three year average August – September increase in beef stocks of 11.1 million pounds, or 2.8%. Sep ’15 beef stocks finished 19.3% higher than the three year average September beef stocks and are at a 29 month high on an absolute basis.

Sep ’15 U.S. frozen beef stocks of 496.4 million pounds increased 5.5% MOM and 31.3% YOY to a new record high for the month of September. The monthly YOY increase in beef stocks was the tenth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 25.9 million pounds, or 5.5%, was approximately twice the three year average August – September increase in beef stocks of 11.1 million pounds, or 2.8%. Sep ’15 beef stocks finished 19.3% higher than the three year average September beef stocks and are at a 29 month high on an absolute basis.

Chicken – Stocks Remain Significantly Higher on YOY Basis, Finish up 27.9%

Chicken – Stocks Remain Significantly Higher on YOY Basis, Finish up 27.9%

Sep ’15 U.S. frozen chicken stocks of 799.8 million pounds increased 2.4% MOM and 27.9% YOY to a new 13 year high for the month of September. Chicken stocks increased YOY for the tenth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the three year average August – September seasonal decline of 1.7 million pounds, or 0.3%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 8.2% YOY since the ban was announced. Sep ’15 chicken stocks finished 22.9% higher than the three year average September chicken stocks and are at a four and a half year high on an absolute basis.

Sep ’15 U.S. frozen chicken stocks of 799.8 million pounds increased 2.4% MOM and 27.9% YOY to a new 13 year high for the month of September. Chicken stocks increased YOY for the tenth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the three year average August – September seasonal decline of 1.7 million pounds, or 0.3%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 8.2% YOY since the ban was announced. Sep ’15 chicken stocks finished 22.9% higher than the three year average September chicken stocks and are at a four and a half year high on an absolute basis.

Overall, combined Sep ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Sep ’15 U.S. pork and beef stocks remained above 90% of historical maximum storage levels, while chicken stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Overall, combined Sep ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Sep ’15 U.S. pork and beef stocks remained above 90% of historical maximum storage levels, while chicken stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Individually, Sep ’15 U.S. pork and beef stocks set a new record high for the month of September, while chicken stocks finished at just under 90% of historical maximum storage levels for the month of September.

Individually, Sep ’15 U.S. pork and beef stocks set a new record high for the month of September, while chicken stocks finished at just under 90% of historical maximum storage levels for the month of September.