Chinese Dairy Imports Update – Feb ’15

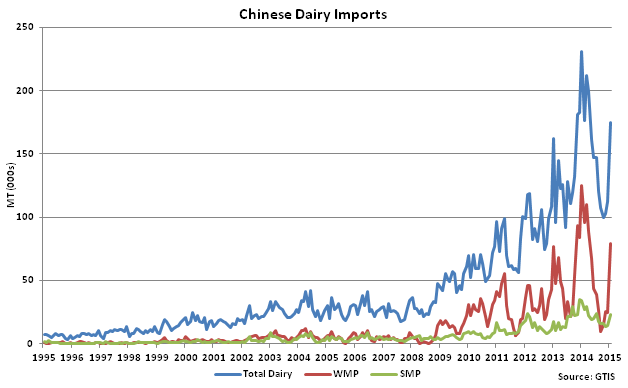

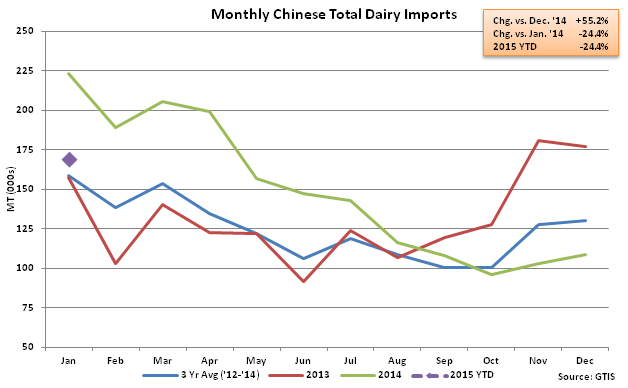

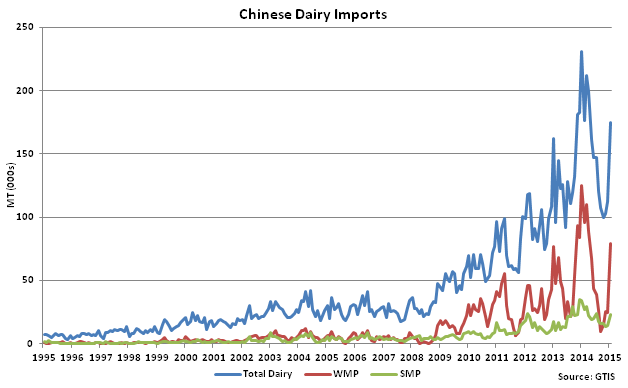

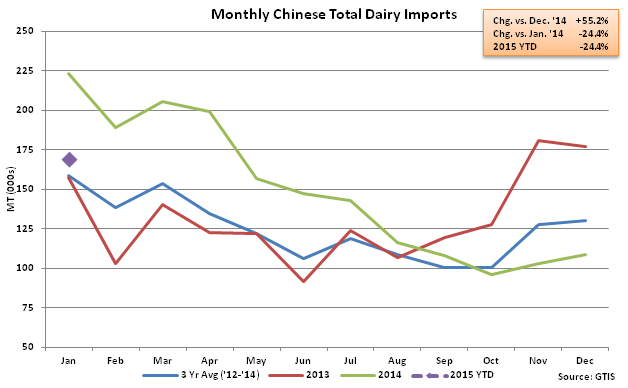

According to GTIS, total Jan ’15 Chinese dairy import volumes increased 55.2% MOM on a daily average basis but remain lower YOY, finishing the month down 24.4%. Total Chinese dairy import volumes have declined YOY for five consecutive months at an average rate of 28.1%. The Jan ’15 YOY decline of 24.4% was the smallest in four months on a percentage basis, while Jan ’15 import volumes finished above three year average volumes for the first time in three months, up 6.3% vs. Jan ’12 – Jan ’14 average volumes.

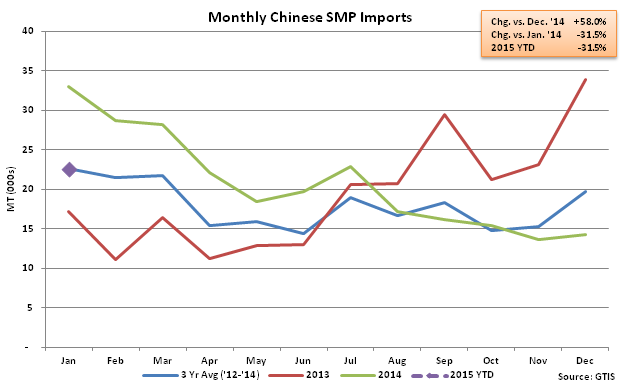

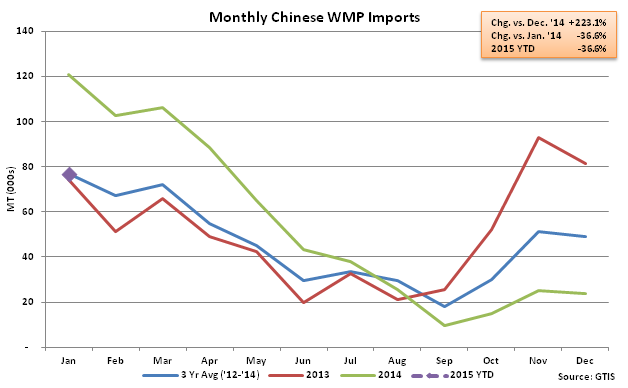

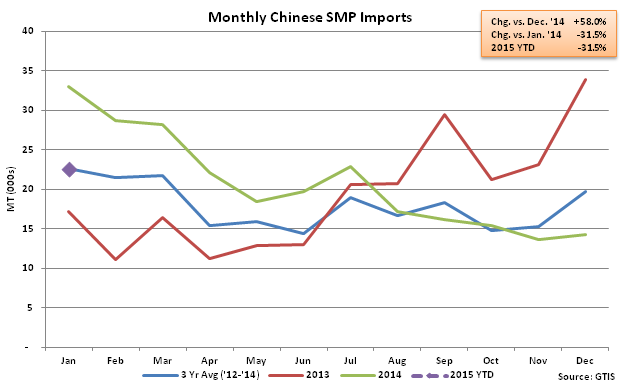

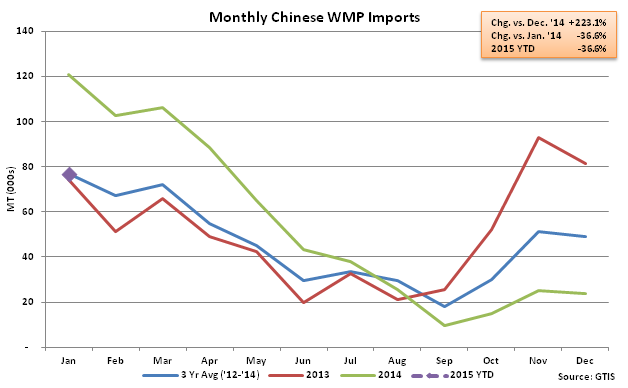

Jan ’15 Chinese milk powder imports followed the same general trend as total dairy import volumes, increasing significantly MOM but remaining lower on a YOY basis. Jan ’15 whole milk powder (WMP) imports finished up 223.1% MOM on a daily average basis but down 36.6% YOY while skim milk powder (SMP) imports finished up 58.0% MOM on a daily average basis but down 31.5% YOY. WMP and SMP import volumes remained slightly below three year average volumes, both down 0.3% vs. Jan ’12 – Jan ’14 average volumes.

The December – January MOM increases in import volumes were consistent with historical figures. Over the past ten years, WMP, SMP and total dairy average import volumes reached seasonal highs in the month of January. Seasonal increases in import volumes within the early months of the year are experienced as importers look to take advantage of the lower tariff rates that are offered as part of the New Zealand – China Free Trade Agreement.

The New Zealand – China Free Trade Agreement was entered into force in Oct ’08, allowing for a limited number of exports from New Zealand to China to receive a preferential tariff rate. For 2015, the quota allows for 133,645 MT of milk powder to enter China at the preferential tariff rate of 3.3%, rather than the base tariff rate of 10.0%. In 2014, the quota allowed for 127,309 MT of milk powder to enter China at a tariff rate of 4.2%.According to the agreement, quota volumes of milk powder increase each year by 5.0% through 2023, while tariff rates are linearly reduced on an annual basis from the base rate of 10.0% prior to the agreement to tariff free in 2019. Jan ’15 combined WMP and SMP import volumes consisted of approximately 77% of the total 2015 reduced-tariff milk powder volume quota.

Jan ’15 Total Chinese Dairy Imports Increased Seasonally to a Nine Month High

Jan ’15 Chinese Dairy Import Volumes up 55.2% MOM but Down 24.4% YOY

Jan ’15 Chinese Dairy Import Volumes up 55.2% MOM but Down 24.4% YOY

Jan ’15 Chinese WMP Import Volumes up 223.1% MOM but Down 36.6% YOY

Jan ’15 Chinese WMP Import Volumes up 223.1% MOM but Down 36.6% YOY

Jan ’15 Chinese SMP Import Volumes up 58.0% MOM but Down 31.5% YOY

Jan ’15 Chinese SMP Import Volumes up 58.0% MOM but Down 31.5% YOY

Jan ’15 Chinese Dairy Import Volumes up 55.2% MOM but Down 24.4% YOY

Jan ’15 Chinese Dairy Import Volumes up 55.2% MOM but Down 24.4% YOY

Jan ’15 Chinese WMP Import Volumes up 223.1% MOM but Down 36.6% YOY

Jan ’15 Chinese WMP Import Volumes up 223.1% MOM but Down 36.6% YOY

Jan ’15 Chinese SMP Import Volumes up 58.0% MOM but Down 31.5% YOY

Jan ’15 Chinese SMP Import Volumes up 58.0% MOM but Down 31.5% YOY