Atten Babler Corn & Soybeans FX Indexes – Mar…

Corn FX Indices:

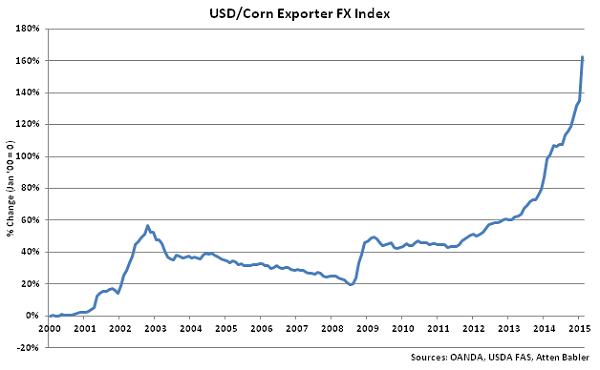

U.S. dollar (USD) strength continued within the Atten Babler Commodities Corn Foreign Exchange (FX) Indexes during Feb ’15. The USD/Corn Exporter FX Index, USD/Corn Importer FX Index and USD/Domestic Corn Importer FX Index all increased to record high values.

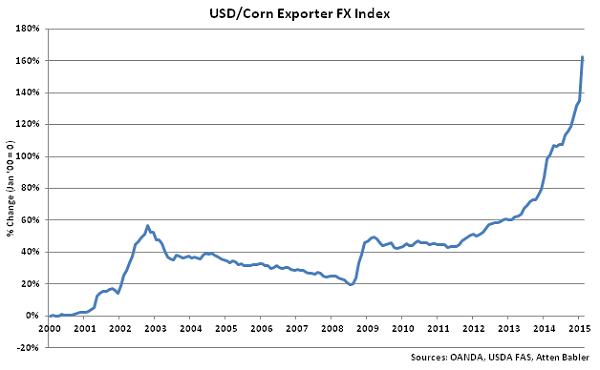

USD/Corn Exporter FX Index:

The USD/Corn Exporter FX Index increased 27.4 points in Feb ’15 to a new high value of 262.2. The USD/Corn Exporter FX Index has increased 82.7 points since the beginning of 2014 and 48.6 points throughout the past six months. A strengthening USD/Corn Exporter FX Index reduces the competitiveness of U.S. corn relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Ukrainian hryvnia has accounted for the majority of the gains since the beginning of 2014.

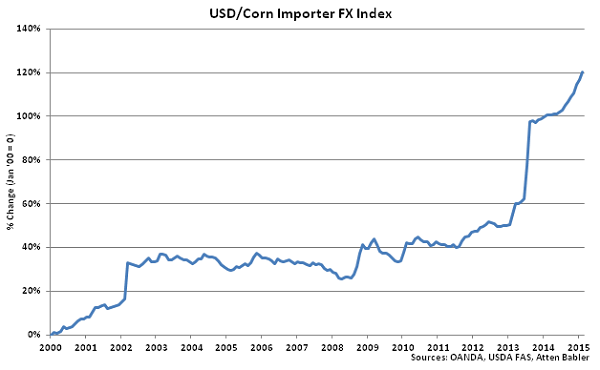

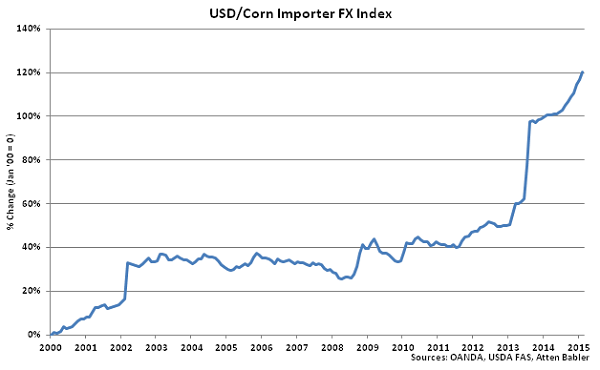

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index increased 3.3 points in Feb ’15 to a new high value of 220.1. The USD/Corn Importer FX Index has increased 21.1 points since the beginning of 2014 and 15.1 points throughout the past six months. A strengthening USD/Corn Importer FX Index results in less purchasing power for major corn importing countries, making U.S. corn more expensive to import. USD appreciation against the Iranian rial, euro and Mexican peso has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index increased 3.3 points in Feb ’15 to a new high value of 220.1. The USD/Corn Importer FX Index has increased 21.1 points since the beginning of 2014 and 15.1 points throughout the past six months. A strengthening USD/Corn Importer FX Index results in less purchasing power for major corn importing countries, making U.S. corn more expensive to import. USD appreciation against the Iranian rial, euro and Mexican peso has accounted for the majority of the gains since the beginning of 2014.

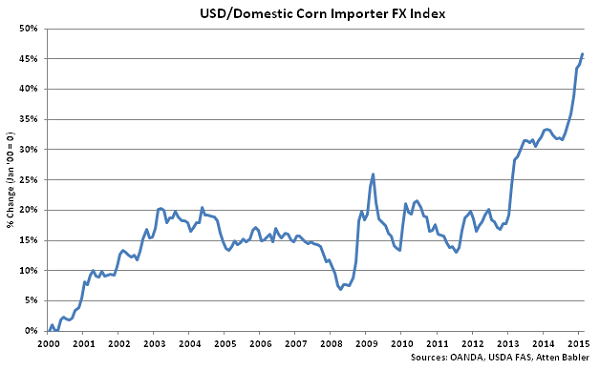

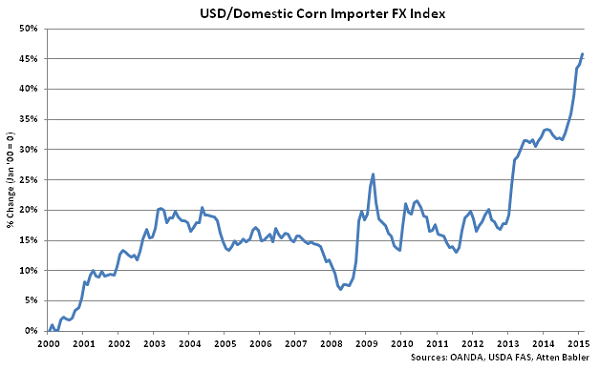

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index increased 1.7 points in Feb ’15 to a new high value of 145.8. The USD/Domestic Corn Importer FX Index has increased 13.7 points since the beginning of 2014 and 13.1 points throughout the past six months. A strengthening USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index increased 1.7 points in Feb ’15 to a new high value of 145.8. The USD/Domestic Corn Importer FX Index has increased 13.7 points since the beginning of 2014 and 13.1 points throughout the past six months. A strengthening USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

Soybeans FX Indices:

U.S. dollar (USD) strength continued within the Atten Babler Commodities Soybeans Foreign Exchange (FX) Indexes during Feb ’15. The USD/Soybeans Exporter FX Index reached a record high value while the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index reached seven and a half year and five and a half year highs, respectively.

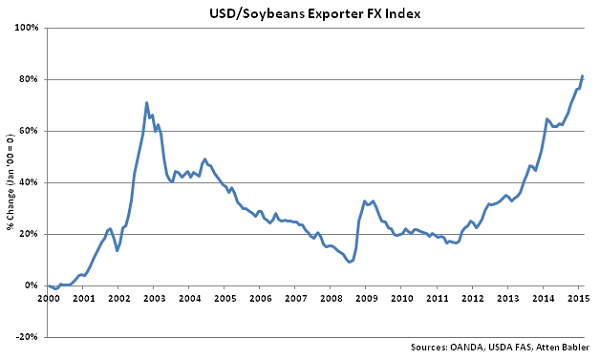

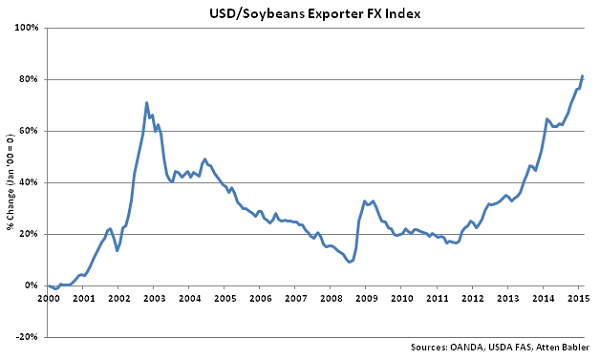

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 4.9 points in Feb ’15 to a new high value of 181.5. The USD/Soybeans Exporter FX Index has increased 29.2 points since the beginning of 2014 and 16.8 points throughout the past six months. A strengthening USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

Soybeans FX Indices:

U.S. dollar (USD) strength continued within the Atten Babler Commodities Soybeans Foreign Exchange (FX) Indexes during Feb ’15. The USD/Soybeans Exporter FX Index reached a record high value while the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index reached seven and a half year and five and a half year highs, respectively.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 4.9 points in Feb ’15 to a new high value of 181.5. The USD/Soybeans Exporter FX Index has increased 29.2 points since the beginning of 2014 and 16.8 points throughout the past six months. A strengthening USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

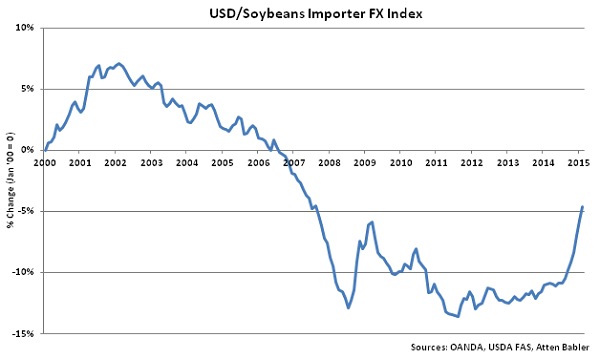

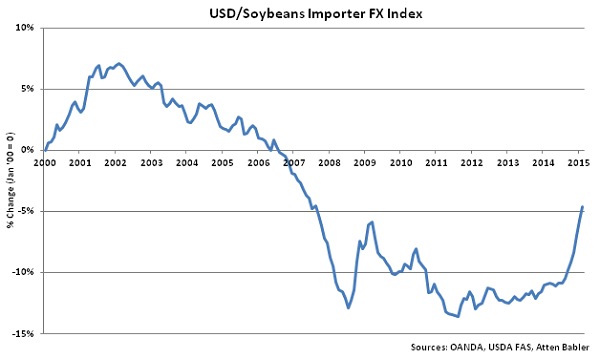

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index increased 1.1 points in Feb ’15 to a value of 95.4, a seven and a half year high. The USD/Soybeans Importer FX Index has increased 7.0 points since the beginning of 2014 and 5.9 points throughout the past six months. A strengthening USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries, making U.S. soybeans more expensive to import. USD appreciation against the Russian ruble and euro has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index increased 1.1 points in Feb ’15 to a value of 95.4, a seven and a half year high. The USD/Soybeans Importer FX Index has increased 7.0 points since the beginning of 2014 and 5.9 points throughout the past six months. A strengthening USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries, making U.S. soybeans more expensive to import. USD appreciation against the Russian ruble and euro has accounted for the majority of the gains since the beginning of 2014.

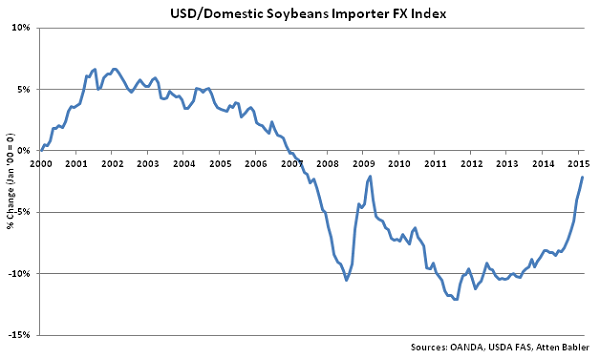

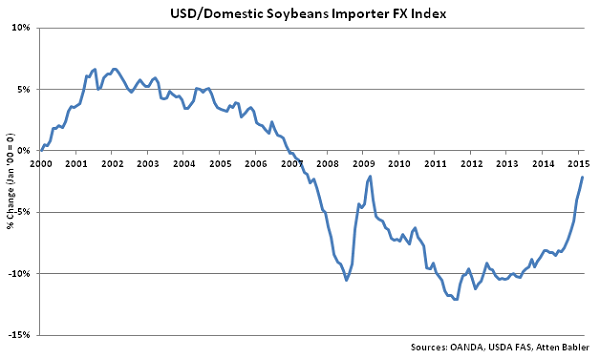

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index increased 1.0 points in Feb ’15 to a value of 97.9, a five and a half year high. The USD/Domestic Soybeans Importer FX Index has increased 6.5 points since the beginning of 2014 and 5.7 points throughout the past six months. A strengthening USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso, Russian ruble and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index increased 1.0 points in Feb ’15 to a value of 97.9, a five and a half year high. The USD/Domestic Soybeans Importer FX Index has increased 6.5 points since the beginning of 2014 and 5.7 points throughout the past six months. A strengthening USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso, Russian ruble and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index increased 3.3 points in Feb ’15 to a new high value of 220.1. The USD/Corn Importer FX Index has increased 21.1 points since the beginning of 2014 and 15.1 points throughout the past six months. A strengthening USD/Corn Importer FX Index results in less purchasing power for major corn importing countries, making U.S. corn more expensive to import. USD appreciation against the Iranian rial, euro and Mexican peso has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index increased 3.3 points in Feb ’15 to a new high value of 220.1. The USD/Corn Importer FX Index has increased 21.1 points since the beginning of 2014 and 15.1 points throughout the past six months. A strengthening USD/Corn Importer FX Index results in less purchasing power for major corn importing countries, making U.S. corn more expensive to import. USD appreciation against the Iranian rial, euro and Mexican peso has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index increased 1.7 points in Feb ’15 to a new high value of 145.8. The USD/Domestic Corn Importer FX Index has increased 13.7 points since the beginning of 2014 and 13.1 points throughout the past six months. A strengthening USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index increased 1.7 points in Feb ’15 to a new high value of 145.8. The USD/Domestic Corn Importer FX Index has increased 13.7 points since the beginning of 2014 and 13.1 points throughout the past six months. A strengthening USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

Soybeans FX Indices:

U.S. dollar (USD) strength continued within the Atten Babler Commodities Soybeans Foreign Exchange (FX) Indexes during Feb ’15. The USD/Soybeans Exporter FX Index reached a record high value while the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index reached seven and a half year and five and a half year highs, respectively.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 4.9 points in Feb ’15 to a new high value of 181.5. The USD/Soybeans Exporter FX Index has increased 29.2 points since the beginning of 2014 and 16.8 points throughout the past six months. A strengthening USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

Soybeans FX Indices:

U.S. dollar (USD) strength continued within the Atten Babler Commodities Soybeans Foreign Exchange (FX) Indexes during Feb ’15. The USD/Soybeans Exporter FX Index reached a record high value while the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index reached seven and a half year and five and a half year highs, respectively.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 4.9 points in Feb ’15 to a new high value of 181.5. The USD/Soybeans Exporter FX Index has increased 29.2 points since the beginning of 2014 and 16.8 points throughout the past six months. A strengthening USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index increased 1.1 points in Feb ’15 to a value of 95.4, a seven and a half year high. The USD/Soybeans Importer FX Index has increased 7.0 points since the beginning of 2014 and 5.9 points throughout the past six months. A strengthening USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries, making U.S. soybeans more expensive to import. USD appreciation against the Russian ruble and euro has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index increased 1.1 points in Feb ’15 to a value of 95.4, a seven and a half year high. The USD/Soybeans Importer FX Index has increased 7.0 points since the beginning of 2014 and 5.9 points throughout the past six months. A strengthening USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries, making U.S. soybeans more expensive to import. USD appreciation against the Russian ruble and euro has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index increased 1.0 points in Feb ’15 to a value of 97.9, a five and a half year high. The USD/Domestic Soybeans Importer FX Index has increased 6.5 points since the beginning of 2014 and 5.7 points throughout the past six months. A strengthening USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso, Russian ruble and Japanese yen has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index increased 1.0 points in Feb ’15 to a value of 97.9, a five and a half year high. The USD/Domestic Soybeans Importer FX Index has increased 6.5 points since the beginning of 2014 and 5.7 points throughout the past six months. A strengthening USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso, Russian ruble and Japanese yen has accounted for the majority of the gains since the beginning of 2014.