New Zealand Milk Production Update – Mar ’15

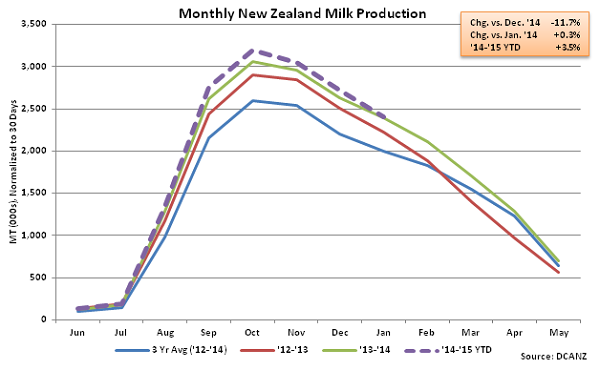

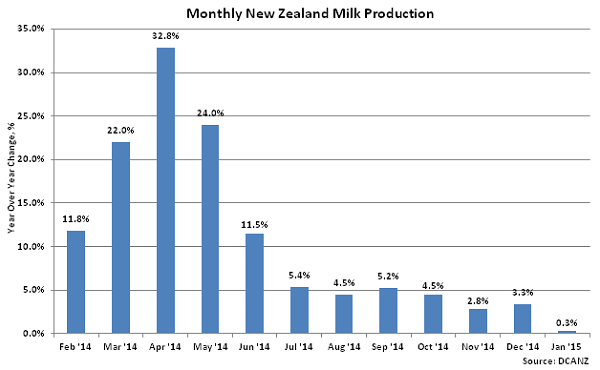

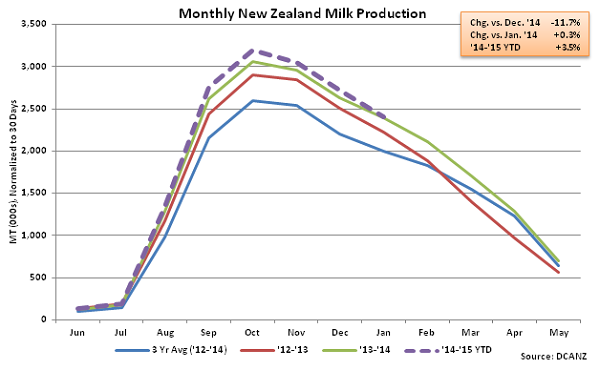

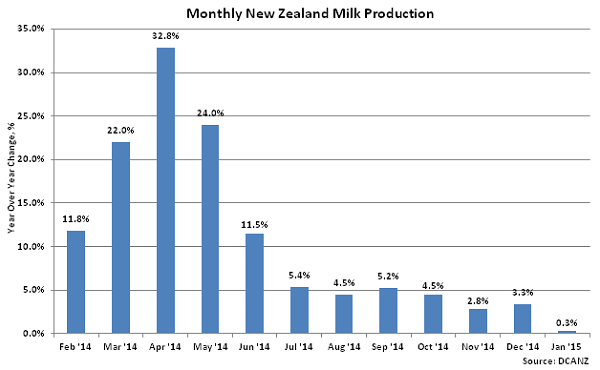

According to Dairy Companies Association of New Zealand (DCANZ), Jan ’15 New Zealand milk production continues to remain higher on a YOY basis, with Jan ’15 production finishing 0.3% higher than the previous year. Monthly production of 2.48 million MT (5.5 billion lbs) set a new record high for January, although production declined 11.7% MOM seasonally on a daily average basis. New Zealand milk production typically peaks in October and gradually declines until seasonal lows are reached in the summer months. The 11.7% December – January decline in production was larger than the five year average 9.5% decline over the same period.

New Zealand has experienced 18 consecutive months of YOY production gains, although the Jan ’15 gain was the lowest of the period. Total milk-solids collected for processing did decline on a YOY basis for the first time in 18 months, finishing 1.3% lower than the previous year. The YOY declined in milk-solids collected for processing was fairly consistent with the 2.9% YOY decline in Jan ’15 Fonterra milk collections. Jan ’15 milk-solids collected for processing remained 5.9% above the three year average January milk-solids collected while milk production remained 6.6% higher than the three year average January production. Overall, ’14-’15 YTD New Zealand milk production remains up 3.5% YOY through the first eight months of the production season.

New Zealand has experienced 18 consecutive months of YOY production gains, although the Jan ’15 gain was the lowest of the period. Total milk-solids collected for processing did decline on a YOY basis for the first time in 18 months, finishing 1.3% lower than the previous year. The YOY declined in milk-solids collected for processing was fairly consistent with the 2.9% YOY decline in Jan ’15 Fonterra milk collections. Jan ’15 milk-solids collected for processing remained 5.9% above the three year average January milk-solids collected while milk production remained 6.6% higher than the three year average January production. Overall, ’14-’15 YTD New Zealand milk production remains up 3.5% YOY through the first eight months of the production season.

Lower farmgate milk prices and the dry conditions are expected to temper future production gains. In early Dec ’14, Fonterra revised its forecasted Farmgate Milk Price for the ’14-’15 season in December from $5.30/kgMS to $4.70/kgMS, noting that falling oil prices, geopolitical uncertainty in Russia and Ukraine, and subdued demand from China has contributed to ongoing volatility and weak demand in global dairy markets. In addition, dry conditions over both islands have raised drought concerns. According to USDA AMS, conditions are more severe on the South Island where some irrigation systems are being shut down, due to low river levels. On Feb 12th, the New Zealand government officially declared the South Island as being in a state of drought. Citing the recent dry weather, Fonterra drastically cut its YOY milk production forecast in late Jan ’15 from flat to a reduction of 3.3% from this season compared to last. Accounting for Jan ’15 actual production, Feb – May ’15 production would need to decline 21.8% to match Fonterra’s projection. The Fonterra Feb ’15 Global Dairy Update noted that daily milk production across New Zealand was eight percent lower than the same period last year as a result of the dry conditions.

Lower farmgate milk prices and the dry conditions are expected to temper future production gains. In early Dec ’14, Fonterra revised its forecasted Farmgate Milk Price for the ’14-’15 season in December from $5.30/kgMS to $4.70/kgMS, noting that falling oil prices, geopolitical uncertainty in Russia and Ukraine, and subdued demand from China has contributed to ongoing volatility and weak demand in global dairy markets. In addition, dry conditions over both islands have raised drought concerns. According to USDA AMS, conditions are more severe on the South Island where some irrigation systems are being shut down, due to low river levels. On Feb 12th, the New Zealand government officially declared the South Island as being in a state of drought. Citing the recent dry weather, Fonterra drastically cut its YOY milk production forecast in late Jan ’15 from flat to a reduction of 3.3% from this season compared to last. Accounting for Jan ’15 actual production, Feb – May ’15 production would need to decline 21.8% to match Fonterra’s projection. The Fonterra Feb ’15 Global Dairy Update noted that daily milk production across New Zealand was eight percent lower than the same period last year as a result of the dry conditions.

New Zealand has experienced 18 consecutive months of YOY production gains, although the Jan ’15 gain was the lowest of the period. Total milk-solids collected for processing did decline on a YOY basis for the first time in 18 months, finishing 1.3% lower than the previous year. The YOY declined in milk-solids collected for processing was fairly consistent with the 2.9% YOY decline in Jan ’15 Fonterra milk collections. Jan ’15 milk-solids collected for processing remained 5.9% above the three year average January milk-solids collected while milk production remained 6.6% higher than the three year average January production. Overall, ’14-’15 YTD New Zealand milk production remains up 3.5% YOY through the first eight months of the production season.

New Zealand has experienced 18 consecutive months of YOY production gains, although the Jan ’15 gain was the lowest of the period. Total milk-solids collected for processing did decline on a YOY basis for the first time in 18 months, finishing 1.3% lower than the previous year. The YOY declined in milk-solids collected for processing was fairly consistent with the 2.9% YOY decline in Jan ’15 Fonterra milk collections. Jan ’15 milk-solids collected for processing remained 5.9% above the three year average January milk-solids collected while milk production remained 6.6% higher than the three year average January production. Overall, ’14-’15 YTD New Zealand milk production remains up 3.5% YOY through the first eight months of the production season.

Lower farmgate milk prices and the dry conditions are expected to temper future production gains. In early Dec ’14, Fonterra revised its forecasted Farmgate Milk Price for the ’14-’15 season in December from $5.30/kgMS to $4.70/kgMS, noting that falling oil prices, geopolitical uncertainty in Russia and Ukraine, and subdued demand from China has contributed to ongoing volatility and weak demand in global dairy markets. In addition, dry conditions over both islands have raised drought concerns. According to USDA AMS, conditions are more severe on the South Island where some irrigation systems are being shut down, due to low river levels. On Feb 12th, the New Zealand government officially declared the South Island as being in a state of drought. Citing the recent dry weather, Fonterra drastically cut its YOY milk production forecast in late Jan ’15 from flat to a reduction of 3.3% from this season compared to last. Accounting for Jan ’15 actual production, Feb – May ’15 production would need to decline 21.8% to match Fonterra’s projection. The Fonterra Feb ’15 Global Dairy Update noted that daily milk production across New Zealand was eight percent lower than the same period last year as a result of the dry conditions.

Lower farmgate milk prices and the dry conditions are expected to temper future production gains. In early Dec ’14, Fonterra revised its forecasted Farmgate Milk Price for the ’14-’15 season in December from $5.30/kgMS to $4.70/kgMS, noting that falling oil prices, geopolitical uncertainty in Russia and Ukraine, and subdued demand from China has contributed to ongoing volatility and weak demand in global dairy markets. In addition, dry conditions over both islands have raised drought concerns. According to USDA AMS, conditions are more severe on the South Island where some irrigation systems are being shut down, due to low river levels. On Feb 12th, the New Zealand government officially declared the South Island as being in a state of drought. Citing the recent dry weather, Fonterra drastically cut its YOY milk production forecast in late Jan ’15 from flat to a reduction of 3.3% from this season compared to last. Accounting for Jan ’15 actual production, Feb – May ’15 production would need to decline 21.8% to match Fonterra’s projection. The Fonterra Feb ’15 Global Dairy Update noted that daily milk production across New Zealand was eight percent lower than the same period last year as a result of the dry conditions.