Biweekly Railroad Service Report Update – 3/26/15

The Surface Transportation Board (STB) published the 22nd and 23rd weekly service report updates for Class 1 railroads spanning data acquired from March 8th to March 21st. Overall, ethanol and grain transportation speeds were higher during the week ending March 21st while weekly held car figures were lower.

Ethanol Transportation:

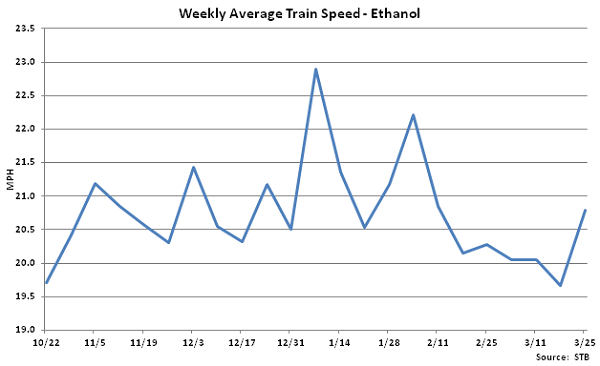

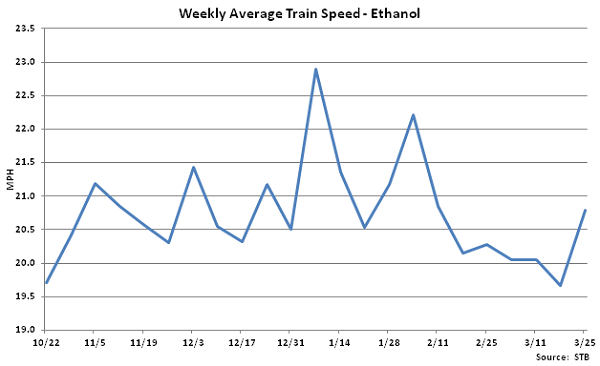

• Average train speeds for ethanol transportation declined to a 21 week low during the week ending March 14th prior to increasing to a six week high during the week ending March 21st. March 21st ethanol train speeds of 20.8 MPH were 0.3% higher than the previous 22 week average ethanol train speeds.

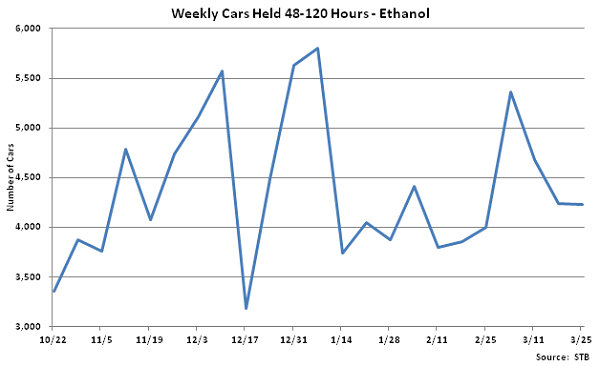

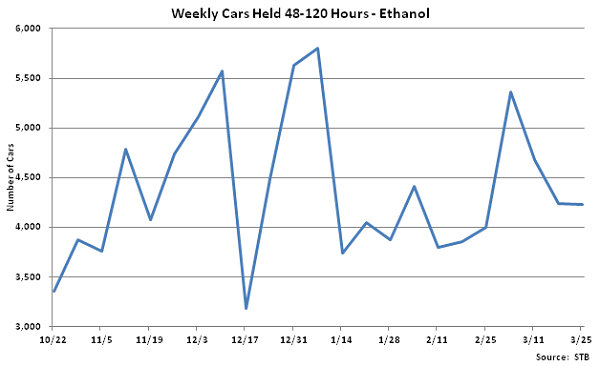

• Ethanol cars held 48-120 hours declined off of the eight week high experienced during the week ending February 28th, decreasing by a total of 9.6% over the most recent two weeks. March 21st ethanol cars held 48-120 hours were 3.4% below the previous 22 week average ethanol cars held 48-120 hours.

• Ethanol cars held 48-120 hours declined off of the eight week high experienced during the week ending February 28th, decreasing by a total of 9.6% over the most recent two weeks. March 21st ethanol cars held 48-120 hours were 3.4% below the previous 22 week average ethanol cars held 48-120 hours.

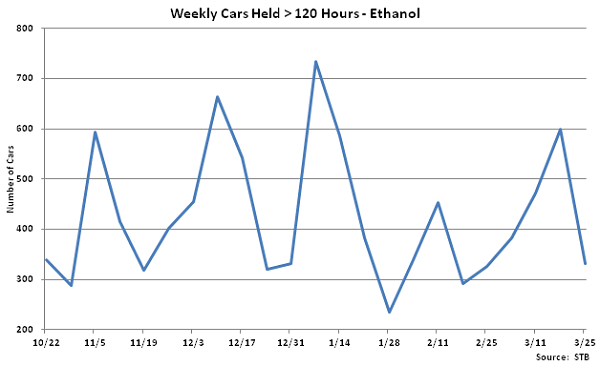

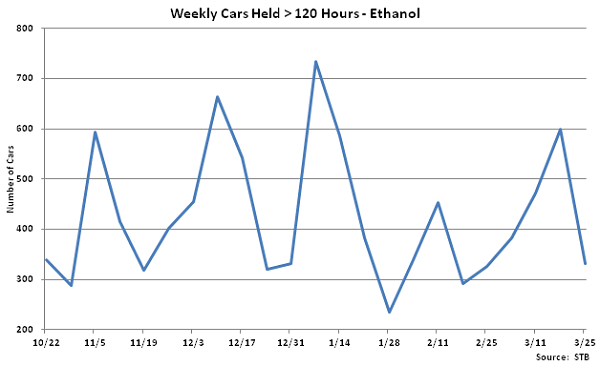

• Ethanol cars held longer than 120 hours increased to a ten week high during the week ending March 14th prior to declining to an eight week low during the week ending March 21st. March 21st ethanol cars held longer than 120 hours were 23.1% lower than the previous 22 week average ethanol cars held longer than 120 hours.

• Ethanol cars held longer than 120 hours increased to a ten week high during the week ending March 14th prior to declining to an eight week low during the week ending March 21st. March 21st ethanol cars held longer than 120 hours were 23.1% lower than the previous 22 week average ethanol cars held longer than 120 hours.

Grain Transportation:

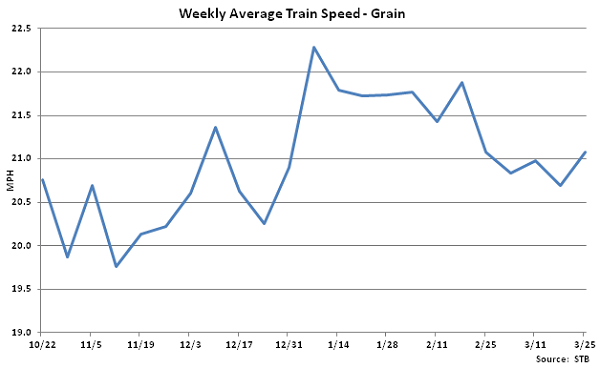

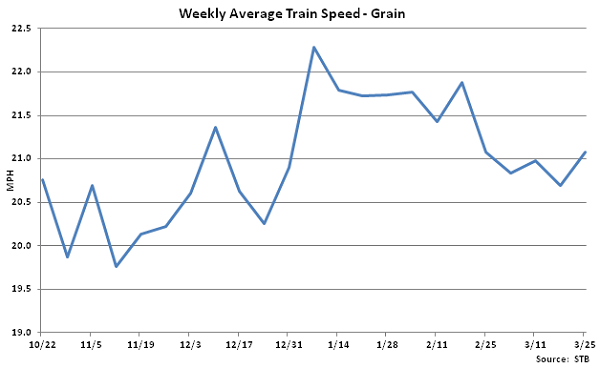

• Average train speeds for grain transportation declined to a 13 week low during the week ending March 14th prior to increasing 1.9% higher during the week ending March 21st. March 21st grain train speeds of 21.1 MPH were 0.5% higher than the previous 22 week average grain train speeds.

Grain Transportation:

• Average train speeds for grain transportation declined to a 13 week low during the week ending March 14th prior to increasing 1.9% higher during the week ending March 21st. March 21st grain train speeds of 21.1 MPH were 0.5% higher than the previous 22 week average grain train speeds.

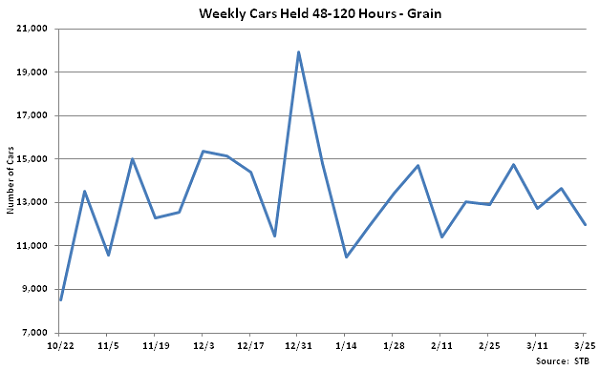

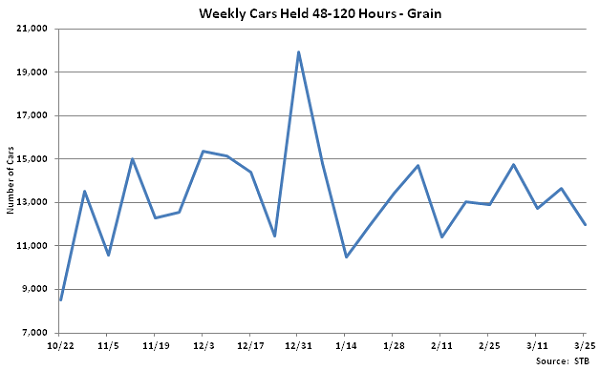

• Grain cars held 48-120 hours increased slightly during the week ending March 14th before declining to a six week low during the week ending March 21st. March 21st grain cars held 48-120 hours were 9.9% lower than the previous 22 week average grain cars held 48-120 hours.

• Grain cars held 48-120 hours increased slightly during the week ending March 14th before declining to a six week low during the week ending March 21st. March 21st grain cars held 48-120 hours were 9.9% lower than the previous 22 week average grain cars held 48-120 hours.

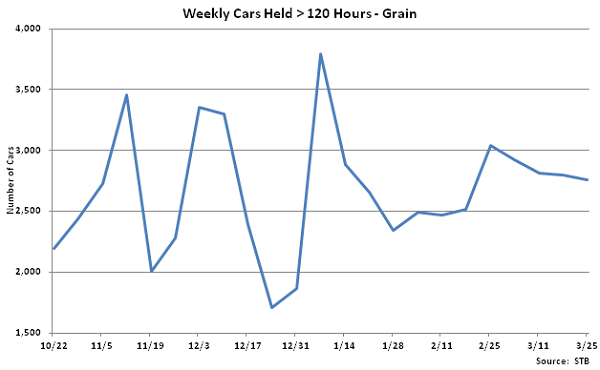

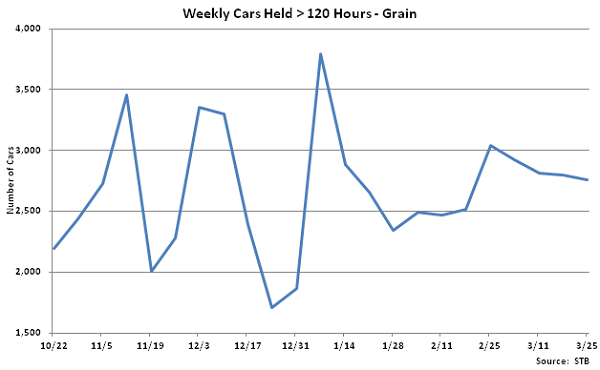

• Grain cars held longer than 120 hours declined slightly during the weeks ending March 14th and March 21st, but remain 3.7% above the previous 22 week average grain cars held longer than 120 hours.

• Grain cars held longer than 120 hours declined slightly during the weeks ending March 14th and March 21st, but remain 3.7% above the previous 22 week average grain cars held longer than 120 hours.

• Ethanol cars held 48-120 hours declined off of the eight week high experienced during the week ending February 28th, decreasing by a total of 9.6% over the most recent two weeks. March 21st ethanol cars held 48-120 hours were 3.4% below the previous 22 week average ethanol cars held 48-120 hours.

• Ethanol cars held 48-120 hours declined off of the eight week high experienced during the week ending February 28th, decreasing by a total of 9.6% over the most recent two weeks. March 21st ethanol cars held 48-120 hours were 3.4% below the previous 22 week average ethanol cars held 48-120 hours.

• Ethanol cars held longer than 120 hours increased to a ten week high during the week ending March 14th prior to declining to an eight week low during the week ending March 21st. March 21st ethanol cars held longer than 120 hours were 23.1% lower than the previous 22 week average ethanol cars held longer than 120 hours.

• Ethanol cars held longer than 120 hours increased to a ten week high during the week ending March 14th prior to declining to an eight week low during the week ending March 21st. March 21st ethanol cars held longer than 120 hours were 23.1% lower than the previous 22 week average ethanol cars held longer than 120 hours.

Grain Transportation:

• Average train speeds for grain transportation declined to a 13 week low during the week ending March 14th prior to increasing 1.9% higher during the week ending March 21st. March 21st grain train speeds of 21.1 MPH were 0.5% higher than the previous 22 week average grain train speeds.

Grain Transportation:

• Average train speeds for grain transportation declined to a 13 week low during the week ending March 14th prior to increasing 1.9% higher during the week ending March 21st. March 21st grain train speeds of 21.1 MPH were 0.5% higher than the previous 22 week average grain train speeds.

• Grain cars held 48-120 hours increased slightly during the week ending March 14th before declining to a six week low during the week ending March 21st. March 21st grain cars held 48-120 hours were 9.9% lower than the previous 22 week average grain cars held 48-120 hours.

• Grain cars held 48-120 hours increased slightly during the week ending March 14th before declining to a six week low during the week ending March 21st. March 21st grain cars held 48-120 hours were 9.9% lower than the previous 22 week average grain cars held 48-120 hours.

• Grain cars held longer than 120 hours declined slightly during the weeks ending March 14th and March 21st, but remain 3.7% above the previous 22 week average grain cars held longer than 120 hours.

• Grain cars held longer than 120 hours declined slightly during the weeks ending March 14th and March 21st, but remain 3.7% above the previous 22 week average grain cars held longer than 120 hours.