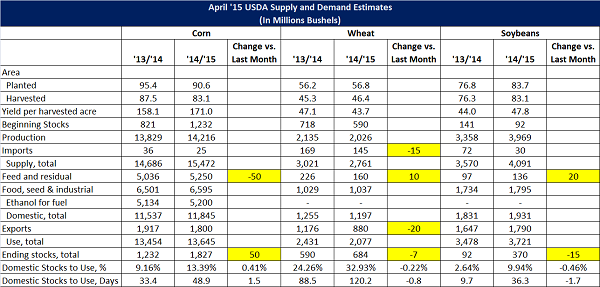

April ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’13/’14 Corn

o No significant changes.

’14/’15 Corn

o Feed and residual usage was reduced 50 million bushels based on March stocks report however last half feed and residual usage is still projected to be up 330 million bushels over last year and the highest since 09/10.

o Ending stocks were projected at 1.827 billion bushels or 48.9 days of use which was a little below private estimates.

’13/’14 Soybeans

o No significant changes.

’14/’15 Soybeans

o Residual usage was increased 20 million bushels based on March stocks report.

o Ending stocks were projected unchanged at 370 million bushels or 36.3 days of use. This was near average private estimates.

Other Markets

o Pork and beef production for 2015 are revised higher on greater numbers and weights respectively.

o Milk production is revised slightly lower for 2015 on less milk per cow primarily from dry Western state conditions.

Click below for a downloadable pdf file.

April ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’13/’14 Corn

o No significant changes.

’14/’15 Corn

o Feed and residual usage was reduced 50 million bushels based on March stocks report however last half feed and residual usage is still projected to be up 330 million bushels over last year and the highest since 09/10.

o Ending stocks were projected at 1.827 billion bushels or 48.9 days of use which was a little below private estimates.

’13/’14 Soybeans

o No significant changes.

’14/’15 Soybeans

o Residual usage was increased 20 million bushels based on March stocks report.

o Ending stocks were projected unchanged at 370 million bushels or 36.3 days of use. This was near average private estimates.

Other Markets

o Pork and beef production for 2015 are revised higher on greater numbers and weights respectively.

o Milk production is revised slightly lower for 2015 on less milk per cow primarily from dry Western state conditions.

Click below for a downloadable pdf file.

April ’15 USDA World Agriculture Supply and Demand Estimates