U.S. Dairy Cow Slaughter Update – May ’15

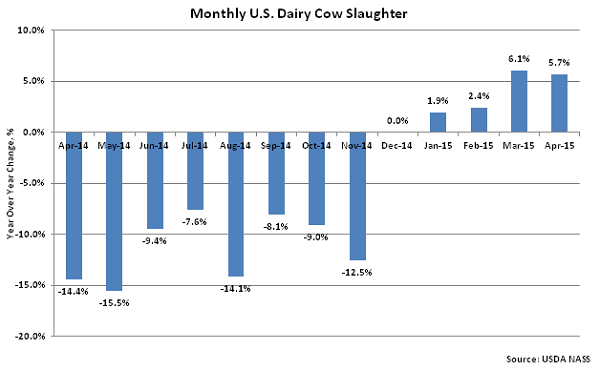

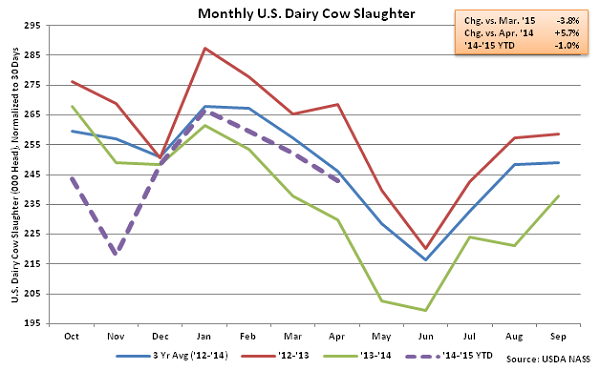

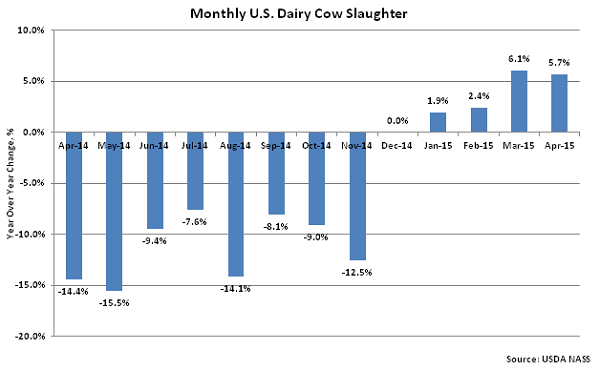

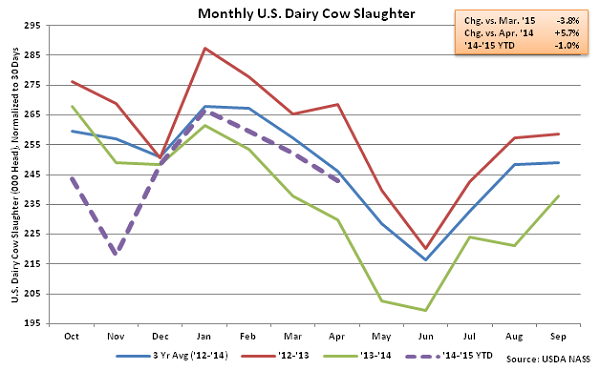

According to USDA, Apr ’15 U.S. dairy cow slaughter of 242,800 head was up 5.7% YOY but down 3.8% MOM on a daily average basis as slaughter rates continue to decline seasonally. The YOY increase in dairy cow slaughter was the second largest experienced in the past two years, trailing only the Mar ’15 YOY increase of 6.1%. The majority of the monthly YOY increase in dairy cow slaughter was experienced in Standard Federal Region 9, which consists of Arizona, California, Hawaii and Nevada, while dairy cow slaughter declined significantly in Standard Federal Region 5, which consists of Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin.

Despite the continued YOY increases in dairy cow slaughter, the number of dairy cows on farms remained at the second highest figure experienced in the past six years in Apr ‘15. The U.S. milk cow herd increased 1,000 head in Apr ’15 vs. the Mar ’15 revised figure to 9,305,000 total head, 65,000 head more than April of last year.

Despite the continued YOY increases in dairy cow slaughter, the number of dairy cows on farms remained at the second highest figure experienced in the past six years in Apr ‘15. The U.S. milk cow herd increased 1,000 head in Apr ’15 vs. the Mar ’15 revised figure to 9,305,000 total head, 65,000 head more than April of last year.

Despite the continued YOY increases in dairy cow slaughter, the number of dairy cows on farms remained at the second highest figure experienced in the past six years in Apr ‘15. The U.S. milk cow herd increased 1,000 head in Apr ’15 vs. the Mar ’15 revised figure to 9,305,000 total head, 65,000 head more than April of last year.

Despite the continued YOY increases in dairy cow slaughter, the number of dairy cows on farms remained at the second highest figure experienced in the past six years in Apr ‘15. The U.S. milk cow herd increased 1,000 head in Apr ’15 vs. the Mar ’15 revised figure to 9,305,000 total head, 65,000 head more than April of last year.