U.S. Livestock Cold Storage Update – May ’15

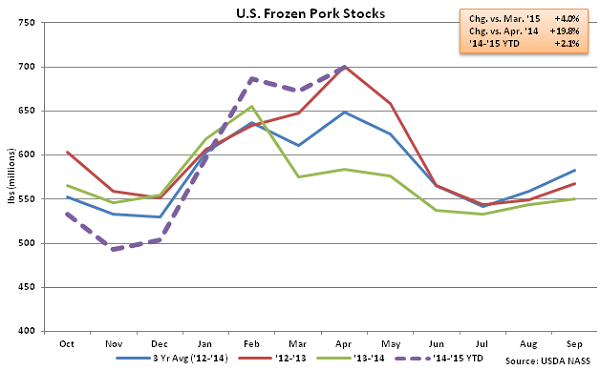

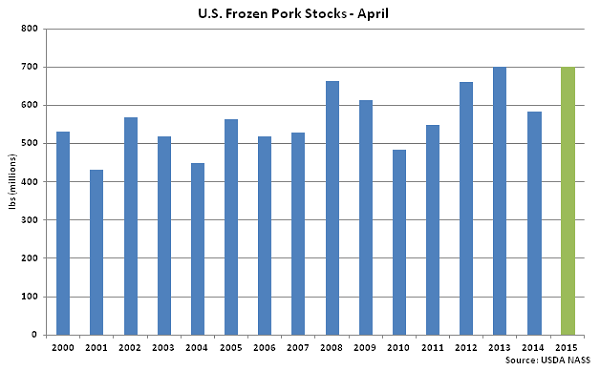

Pork – Stocks Increase 19.8% YOY to Second Largest Figure on Record

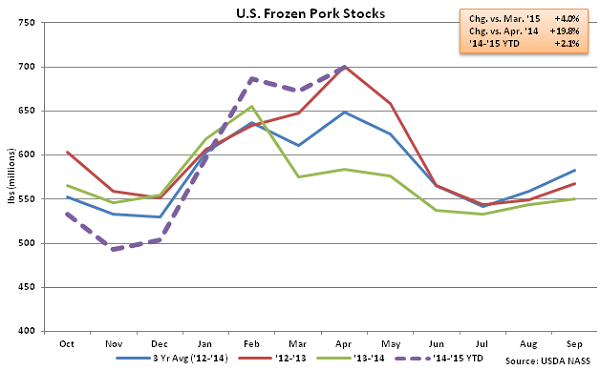

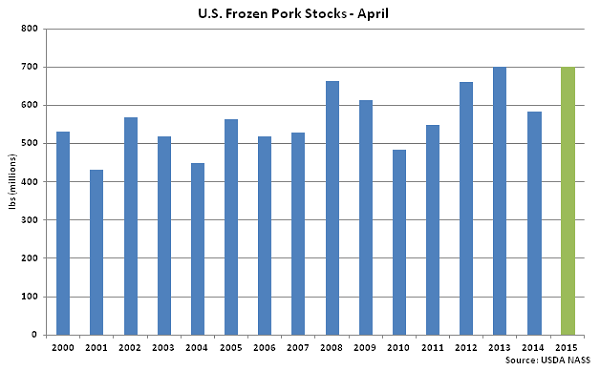

According to USDA, Apr ’15 U.S. frozen pork stocks of 699.6 million pounds increased 4.0% MOM and 19.8% YOY. Month ending stocks were the second largest monthly figure on record, trailing only the Apr ’13 ending stocks. Pork stocks increased YOY for the third month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. The YOY increase in stocks was the largest experienced in the last two and a half years on a percentage basis. The March – April increase in pork stocks of 27.2 million pounds, or 4.0%, was significantly larger than the ten year average March – April seasonal increase of 15.2 million pounds, or 2.6%. Apr ’15 pork stocks finished 7.9% higher than the three year average April pork stocks.

According to USDA, Apr ’15 U.S. frozen pork stocks of 699.6 million pounds increased 4.0% MOM and 19.8% YOY. Month ending stocks were the second largest monthly figure on record, trailing only the Apr ’13 ending stocks. Pork stocks increased YOY for the third month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. The YOY increase in stocks was the largest experienced in the last two and a half years on a percentage basis. The March – April increase in pork stocks of 27.2 million pounds, or 4.0%, was significantly larger than the ten year average March – April seasonal increase of 15.2 million pounds, or 2.6%. Apr ’15 pork stocks finished 7.9% higher than the three year average April pork stocks.

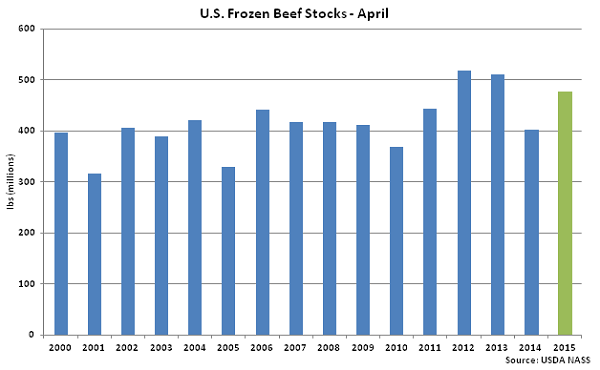

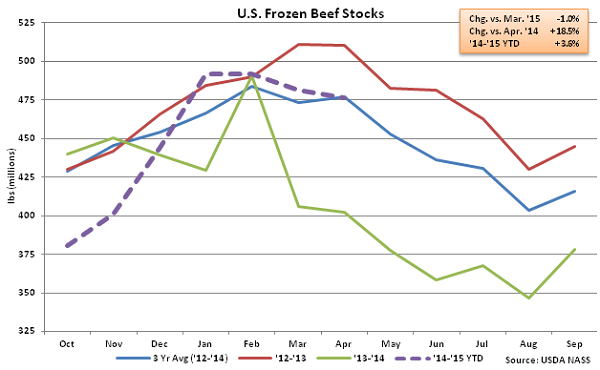

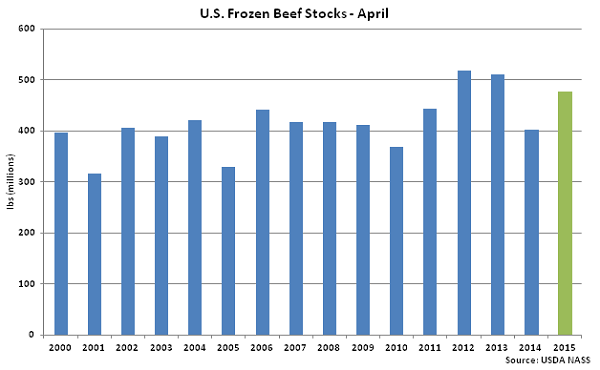

Beef – Stocks Remain Higher on YOY Basis, Finish up 18.5%

Beef – Stocks Remain Higher on YOY Basis, Finish up 18.5%

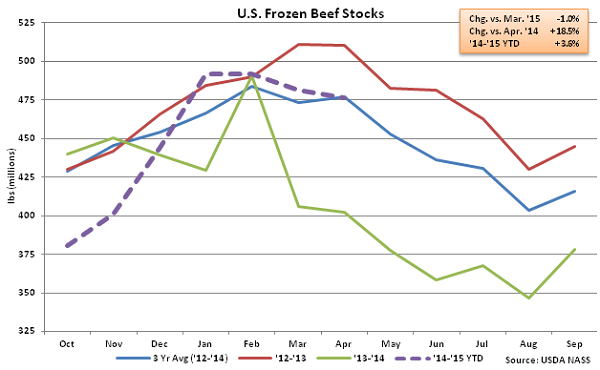

Apr ’15 U.S. frozen beef stocks of 476.7 million pounds declined 1.0% MOM but remained higher on a YOY basis, increasing 18.5%. The monthly YOY increase in beef stocks was the fifth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the second largest experienced in nearly four years on a percentage basis, trailing only the Mar ’15 YOY increase of 18.7%. The March – April decline in beef stocks of 4.8 million pounds, or 1.0% was approximately half of the ten year average March – April seasonal decline of 8.1 million pounds, or 2.1%. Apr ’15 beef stocks finished even with the three year average April beef stocks.

Apr ’15 U.S. frozen beef stocks of 476.7 million pounds declined 1.0% MOM but remained higher on a YOY basis, increasing 18.5%. The monthly YOY increase in beef stocks was the fifth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the second largest experienced in nearly four years on a percentage basis, trailing only the Mar ’15 YOY increase of 18.7%. The March – April decline in beef stocks of 4.8 million pounds, or 1.0% was approximately half of the ten year average March – April seasonal decline of 8.1 million pounds, or 2.1%. Apr ’15 beef stocks finished even with the three year average April beef stocks.

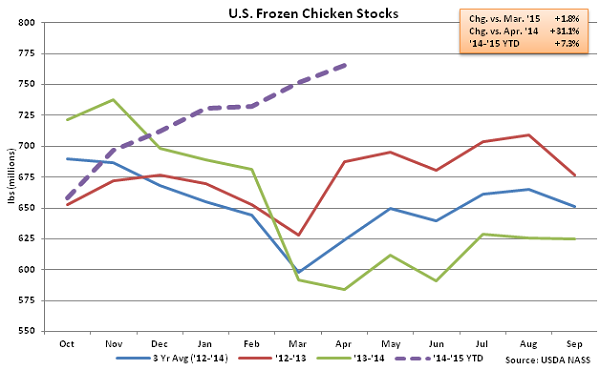

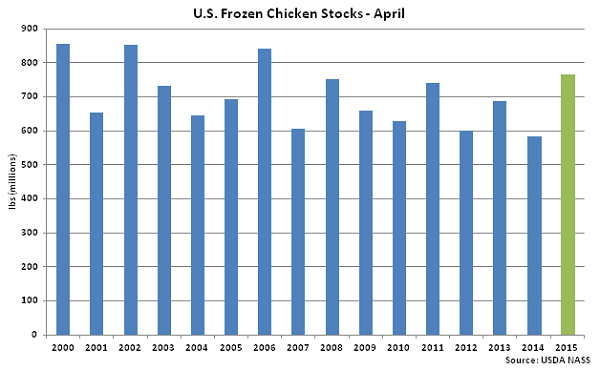

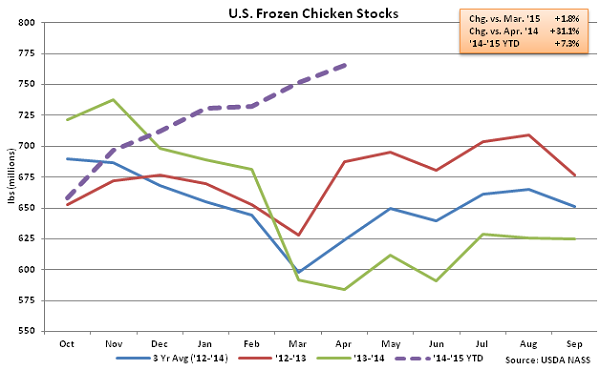

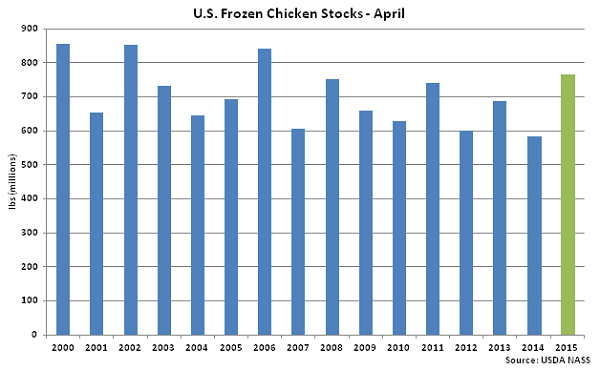

Chicken – Stocks Continue to Climb, Finish up 31.1% YOY

Chicken – Stocks Continue to Climb, Finish up 31.1% YOY

Apr ’15 U.S. frozen chicken stocks of 765.5 million pounds increased 1.8% MOM and 31.1% YOY. Chicken stocks increased YOY for the fifth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the largest experienced in the last nine years on a percentage basis. The March – April increase in chicken stocks of 13.7 million pounds, or 1.8%, was fairly consistent with the ten year average March – April increase of 14.2 million pounds, or 2.4%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined YOY for six consecutive months since the ban was announced, finishing 8.0% lower over the period. Apr ’15 chicken stocks finished 22.7% higher than the three year average April chicken stocks.

Apr ’15 U.S. frozen chicken stocks of 765.5 million pounds increased 1.8% MOM and 31.1% YOY. Chicken stocks increased YOY for the fifth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the largest experienced in the last nine years on a percentage basis. The March – April increase in chicken stocks of 13.7 million pounds, or 1.8%, was fairly consistent with the ten year average March – April increase of 14.2 million pounds, or 2.4%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined YOY for six consecutive months since the ban was announced, finishing 8.0% lower over the period. Apr ’15 chicken stocks finished 22.7% higher than the three year average April chicken stocks.

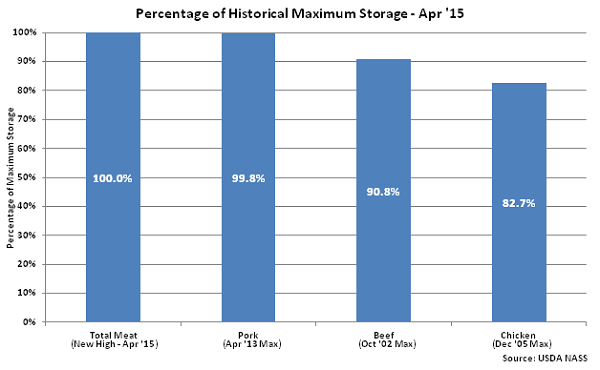

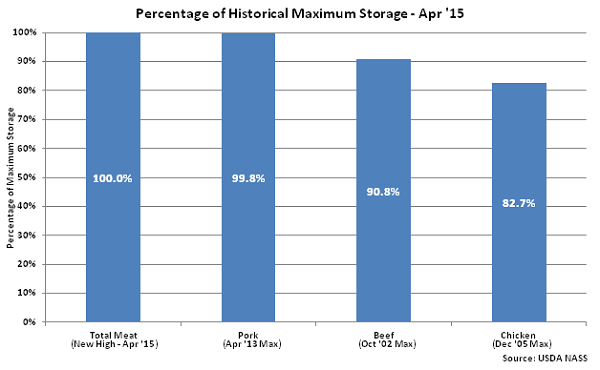

Overall, combined Apr ’15 U.S. pork, beef and chicken stocks increased to a new record high, finishing 1.4% above the previous Jan ’06 high. Individually, Apr ’15 U.S. pork and beef stocks finished at levels above 90% of historical maximum storage levels, while U.S. chicken stocks were also relatively high, finishing above 80% of historical maximum storage levels.

Overall, combined Apr ’15 U.S. pork, beef and chicken stocks increased to a new record high, finishing 1.4% above the previous Jan ’06 high. Individually, Apr ’15 U.S. pork and beef stocks finished at levels above 90% of historical maximum storage levels, while U.S. chicken stocks were also relatively high, finishing above 80% of historical maximum storage levels.

According to USDA, Apr ’15 U.S. frozen pork stocks of 699.6 million pounds increased 4.0% MOM and 19.8% YOY. Month ending stocks were the second largest monthly figure on record, trailing only the Apr ’13 ending stocks. Pork stocks increased YOY for the third month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. The YOY increase in stocks was the largest experienced in the last two and a half years on a percentage basis. The March – April increase in pork stocks of 27.2 million pounds, or 4.0%, was significantly larger than the ten year average March – April seasonal increase of 15.2 million pounds, or 2.6%. Apr ’15 pork stocks finished 7.9% higher than the three year average April pork stocks.

According to USDA, Apr ’15 U.S. frozen pork stocks of 699.6 million pounds increased 4.0% MOM and 19.8% YOY. Month ending stocks were the second largest monthly figure on record, trailing only the Apr ’13 ending stocks. Pork stocks increased YOY for the third month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. The YOY increase in stocks was the largest experienced in the last two and a half years on a percentage basis. The March – April increase in pork stocks of 27.2 million pounds, or 4.0%, was significantly larger than the ten year average March – April seasonal increase of 15.2 million pounds, or 2.6%. Apr ’15 pork stocks finished 7.9% higher than the three year average April pork stocks.

Beef – Stocks Remain Higher on YOY Basis, Finish up 18.5%

Beef – Stocks Remain Higher on YOY Basis, Finish up 18.5%

Apr ’15 U.S. frozen beef stocks of 476.7 million pounds declined 1.0% MOM but remained higher on a YOY basis, increasing 18.5%. The monthly YOY increase in beef stocks was the fifth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the second largest experienced in nearly four years on a percentage basis, trailing only the Mar ’15 YOY increase of 18.7%. The March – April decline in beef stocks of 4.8 million pounds, or 1.0% was approximately half of the ten year average March – April seasonal decline of 8.1 million pounds, or 2.1%. Apr ’15 beef stocks finished even with the three year average April beef stocks.

Apr ’15 U.S. frozen beef stocks of 476.7 million pounds declined 1.0% MOM but remained higher on a YOY basis, increasing 18.5%. The monthly YOY increase in beef stocks was the fifth in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the second largest experienced in nearly four years on a percentage basis, trailing only the Mar ’15 YOY increase of 18.7%. The March – April decline in beef stocks of 4.8 million pounds, or 1.0% was approximately half of the ten year average March – April seasonal decline of 8.1 million pounds, or 2.1%. Apr ’15 beef stocks finished even with the three year average April beef stocks.

Chicken – Stocks Continue to Climb, Finish up 31.1% YOY

Chicken – Stocks Continue to Climb, Finish up 31.1% YOY

Apr ’15 U.S. frozen chicken stocks of 765.5 million pounds increased 1.8% MOM and 31.1% YOY. Chicken stocks increased YOY for the fifth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the largest experienced in the last nine years on a percentage basis. The March – April increase in chicken stocks of 13.7 million pounds, or 1.8%, was fairly consistent with the ten year average March – April increase of 14.2 million pounds, or 2.4%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined YOY for six consecutive months since the ban was announced, finishing 8.0% lower over the period. Apr ’15 chicken stocks finished 22.7% higher than the three year average April chicken stocks.

Apr ’15 U.S. frozen chicken stocks of 765.5 million pounds increased 1.8% MOM and 31.1% YOY. Chicken stocks increased YOY for the fifth month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The YOY increase in stocks was the largest experienced in the last nine years on a percentage basis. The March – April increase in chicken stocks of 13.7 million pounds, or 1.8%, was fairly consistent with the ten year average March – April increase of 14.2 million pounds, or 2.4%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined YOY for six consecutive months since the ban was announced, finishing 8.0% lower over the period. Apr ’15 chicken stocks finished 22.7% higher than the three year average April chicken stocks.

Overall, combined Apr ’15 U.S. pork, beef and chicken stocks increased to a new record high, finishing 1.4% above the previous Jan ’06 high. Individually, Apr ’15 U.S. pork and beef stocks finished at levels above 90% of historical maximum storage levels, while U.S. chicken stocks were also relatively high, finishing above 80% of historical maximum storage levels.

Overall, combined Apr ’15 U.S. pork, beef and chicken stocks increased to a new record high, finishing 1.4% above the previous Jan ’06 high. Individually, Apr ’15 U.S. pork and beef stocks finished at levels above 90% of historical maximum storage levels, while U.S. chicken stocks were also relatively high, finishing above 80% of historical maximum storage levels.