2015 U.S. Milk Production Projected Higher for First Time…

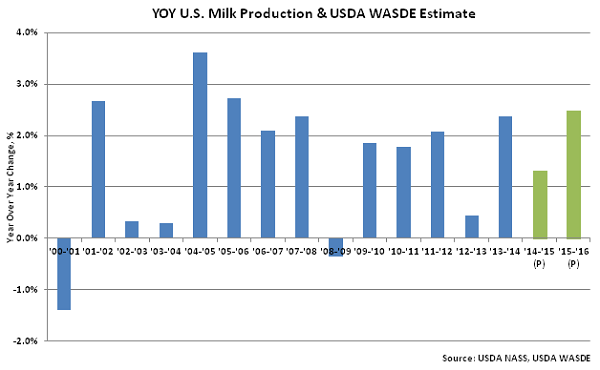

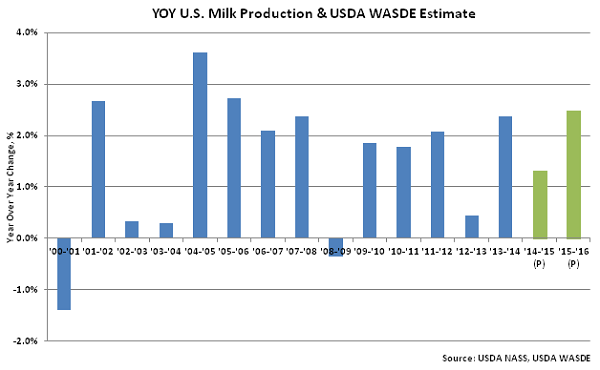

According to the June USDA World Agricultural Supply and Demand Estimate (WASDE) report, 2015 projected U.S. milk production was revised slightly higher on gains in output per cow, increasing by 0.1 billion lbs to a total of 208.7 billion lbs. The upward revision in milk production was the first experienced in the last eight months. 2015 projected production of 208.7 billion lbs equates to a 1.3% YOY increase from 2014 production of 206.0 billion lbs. The projected 1.3% YOY increase in milk production would remain less than the three year average growth rate of 1.6%.

2016 projected U.S. milk production was also revised higher on gains in output per cow, increasing by 0.3 billion lbs to a total of 213.6 billion lbs. 2016 projected milk production translates to a 2.5% increase from the 2015 projected production of 208.6 billion lbs. Milk production for 2016 is forecast higher as improved forage availability and moderate feed costs are expected to support gains in milk per cow, while cow numbers were also forecast slightly higher. The 2.5% increase in YOY milk production would be the largest experienced in ten years.

Export forecasts on a fat basis were raised for 2015 on higher cheese exports while 2015 and 2016 export forecasts on a skim-solids basis were raised on higher nonfat dry milk (NFDM) shipments. Fat basis imports were raised for 2015 and 2016 on expectations for strong demand for imported cheese.

Butter, NFDM and whey prices were forecast lower for 2015 due to relatively abundant supplies, however the 2015 cheese forecasted price was raised on strong demand. NFDM and whey prices were reduced for 2016 while the 2016 butter price range was narrowed. The 2015 Class III price estimate of $16.15-$16.55/cwt was raised by $0.10/cwt on the low end and unchanged at the high end of the forecast while the 2015 Class IV price estimate of $14.20-$14.70/cwt was lowered by $0.15-$0.25/cwt. The 2016 Class III price forecast of $16.15-$17.15/cwt was reduced by $0.05/cwt on lower whey prices, but remains 1.8% above the 2015 forecasted price. The 2016 Class IV price forecast of $15.40-$16.50/cwt was reduced by $0.20/cwt on weaker product prices, but remains 10.4% above the 2015 forecasted level.

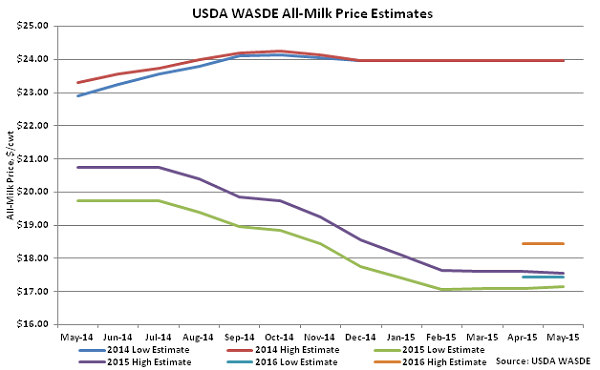

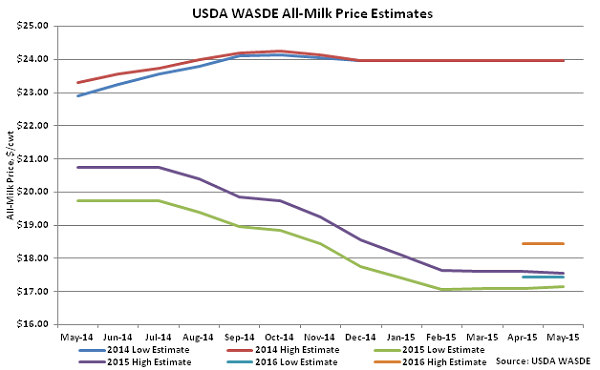

As shown in the chart below, the 2015 All-Milk price is expected to be well below previous year price levels, at a range of $17.15-$17.55/cwt, unchanged at the midpoint from last month and 27.6% below the 2014 average All-Milk price of $23.98/cwt. The 2016 All-Milk price forecast of $17.45-$18.45/cwt remains significantly below 2014 levels but 3.5% higher than 2015 forecast prices.

Export forecasts on a fat basis were raised for 2015 on higher cheese exports while 2015 and 2016 export forecasts on a skim-solids basis were raised on higher nonfat dry milk (NFDM) shipments. Fat basis imports were raised for 2015 and 2016 on expectations for strong demand for imported cheese.

Butter, NFDM and whey prices were forecast lower for 2015 due to relatively abundant supplies, however the 2015 cheese forecasted price was raised on strong demand. NFDM and whey prices were reduced for 2016 while the 2016 butter price range was narrowed. The 2015 Class III price estimate of $16.15-$16.55/cwt was raised by $0.10/cwt on the low end and unchanged at the high end of the forecast while the 2015 Class IV price estimate of $14.20-$14.70/cwt was lowered by $0.15-$0.25/cwt. The 2016 Class III price forecast of $16.15-$17.15/cwt was reduced by $0.05/cwt on lower whey prices, but remains 1.8% above the 2015 forecasted price. The 2016 Class IV price forecast of $15.40-$16.50/cwt was reduced by $0.20/cwt on weaker product prices, but remains 10.4% above the 2015 forecasted level.

As shown in the chart below, the 2015 All-Milk price is expected to be well below previous year price levels, at a range of $17.15-$17.55/cwt, unchanged at the midpoint from last month and 27.6% below the 2014 average All-Milk price of $23.98/cwt. The 2016 All-Milk price forecast of $17.45-$18.45/cwt remains significantly below 2014 levels but 3.5% higher than 2015 forecast prices.

Export forecasts on a fat basis were raised for 2015 on higher cheese exports while 2015 and 2016 export forecasts on a skim-solids basis were raised on higher nonfat dry milk (NFDM) shipments. Fat basis imports were raised for 2015 and 2016 on expectations for strong demand for imported cheese.

Butter, NFDM and whey prices were forecast lower for 2015 due to relatively abundant supplies, however the 2015 cheese forecasted price was raised on strong demand. NFDM and whey prices were reduced for 2016 while the 2016 butter price range was narrowed. The 2015 Class III price estimate of $16.15-$16.55/cwt was raised by $0.10/cwt on the low end and unchanged at the high end of the forecast while the 2015 Class IV price estimate of $14.20-$14.70/cwt was lowered by $0.15-$0.25/cwt. The 2016 Class III price forecast of $16.15-$17.15/cwt was reduced by $0.05/cwt on lower whey prices, but remains 1.8% above the 2015 forecasted price. The 2016 Class IV price forecast of $15.40-$16.50/cwt was reduced by $0.20/cwt on weaker product prices, but remains 10.4% above the 2015 forecasted level.

As shown in the chart below, the 2015 All-Milk price is expected to be well below previous year price levels, at a range of $17.15-$17.55/cwt, unchanged at the midpoint from last month and 27.6% below the 2014 average All-Milk price of $23.98/cwt. The 2016 All-Milk price forecast of $17.45-$18.45/cwt remains significantly below 2014 levels but 3.5% higher than 2015 forecast prices.

Export forecasts on a fat basis were raised for 2015 on higher cheese exports while 2015 and 2016 export forecasts on a skim-solids basis were raised on higher nonfat dry milk (NFDM) shipments. Fat basis imports were raised for 2015 and 2016 on expectations for strong demand for imported cheese.

Butter, NFDM and whey prices were forecast lower for 2015 due to relatively abundant supplies, however the 2015 cheese forecasted price was raised on strong demand. NFDM and whey prices were reduced for 2016 while the 2016 butter price range was narrowed. The 2015 Class III price estimate of $16.15-$16.55/cwt was raised by $0.10/cwt on the low end and unchanged at the high end of the forecast while the 2015 Class IV price estimate of $14.20-$14.70/cwt was lowered by $0.15-$0.25/cwt. The 2016 Class III price forecast of $16.15-$17.15/cwt was reduced by $0.05/cwt on lower whey prices, but remains 1.8% above the 2015 forecasted price. The 2016 Class IV price forecast of $15.40-$16.50/cwt was reduced by $0.20/cwt on weaker product prices, but remains 10.4% above the 2015 forecasted level.

As shown in the chart below, the 2015 All-Milk price is expected to be well below previous year price levels, at a range of $17.15-$17.55/cwt, unchanged at the midpoint from last month and 27.6% below the 2014 average All-Milk price of $23.98/cwt. The 2016 All-Milk price forecast of $17.45-$18.45/cwt remains significantly below 2014 levels but 3.5% higher than 2015 forecast prices.