Biweekly U.S. Oil Rig Count Update – 6/10/15

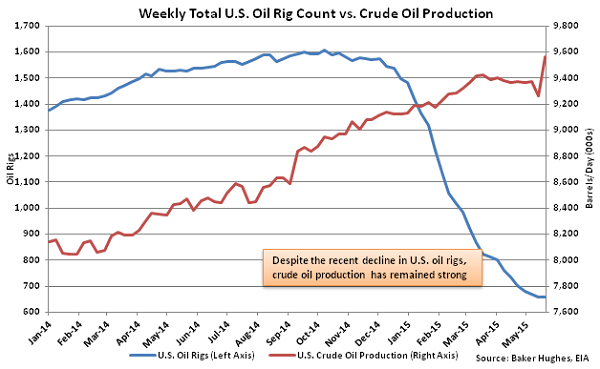

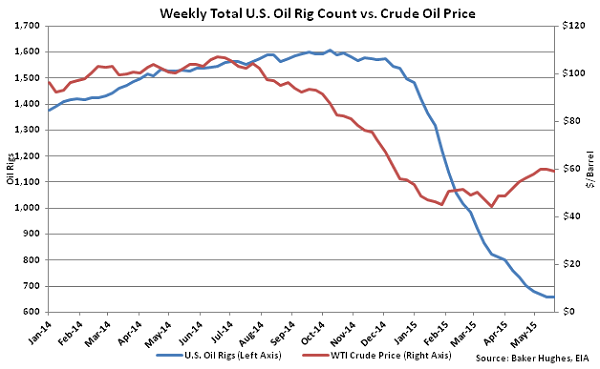

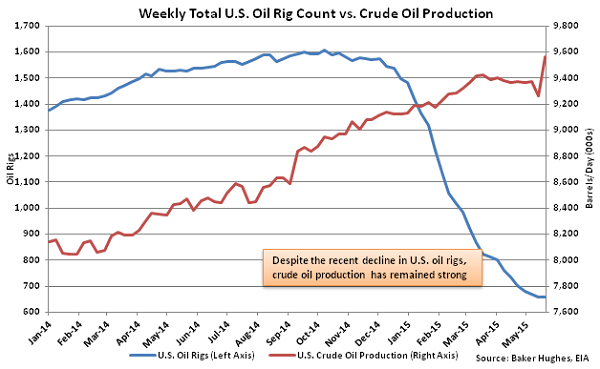

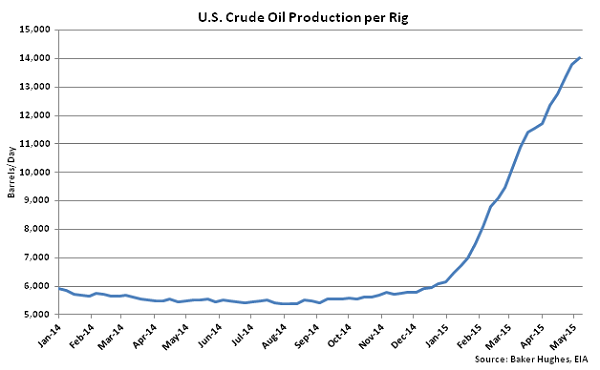

According to Baker Hughes, U.S. oil rig counts continue to decline, falling by 13 in the week ending May 29th and an additional four in the week ending June 5th to a total of 642. The weekly declines were the 25th and 26th in a row, although the rate of the declines continues to decelerate. Overall, the total U.S. oil rig count fell to a new four and a half year low on June 5th. Despite the decline in oil rigs, weekly crude oil production figures show continued growth through the first week of June, however drilling productivity estimates show declining production in coming months throughout areas accounting for 95% of recent production gains.

U.S. Oil Rig Counts Continue to Fall in Response to Depressed Crude Oil Prices

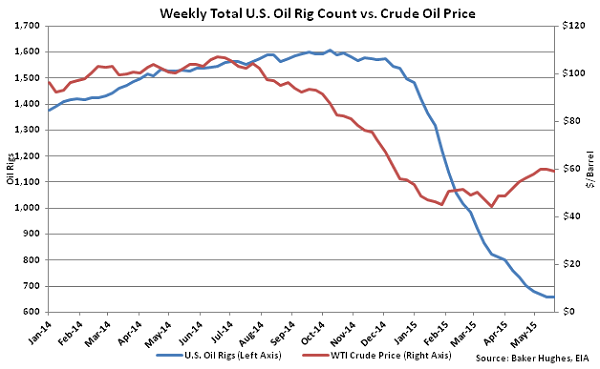

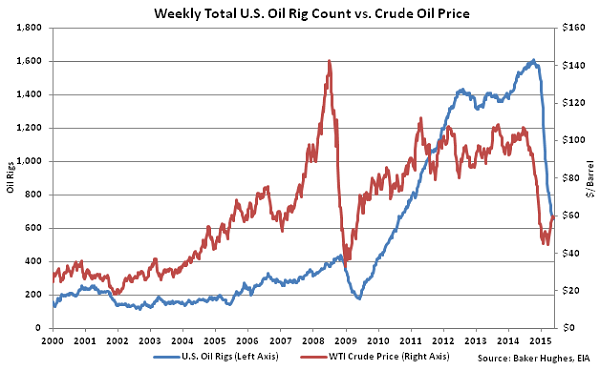

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

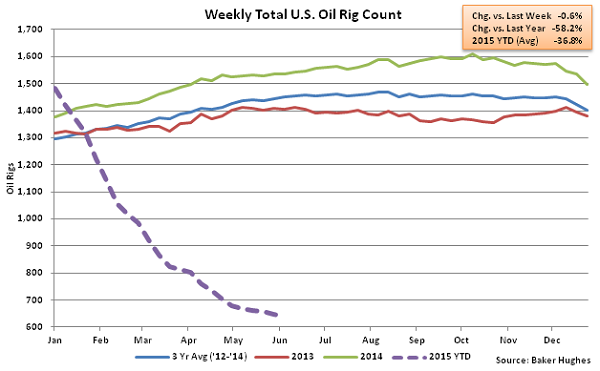

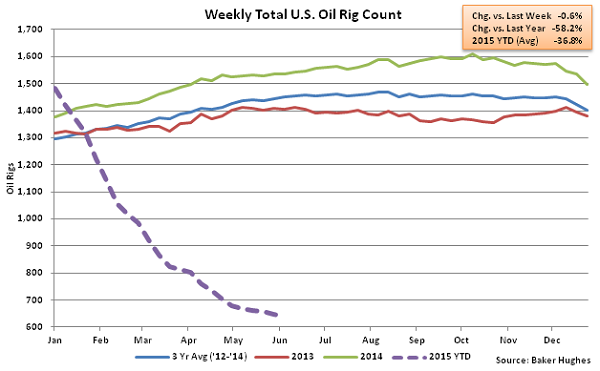

Jun 5th U.S. Oil Rigs Declined 0.6% From the Previous Week and are Down 58.2% YOY

Jun 5th U.S. Oil Rigs Declined 0.6% From the Previous Week and are Down 58.2% YOY

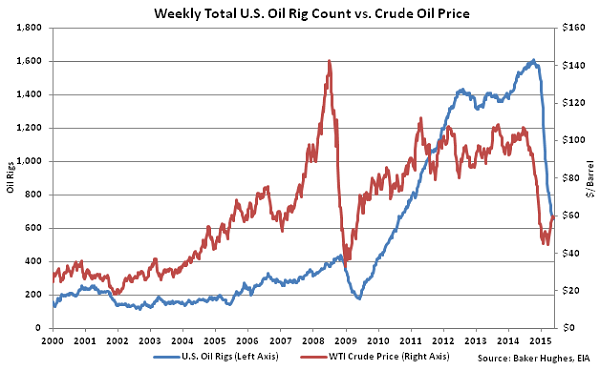

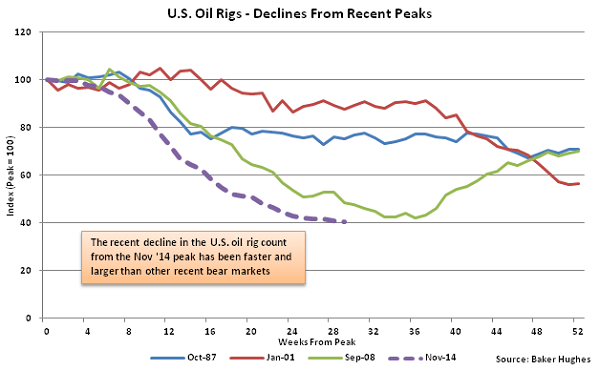

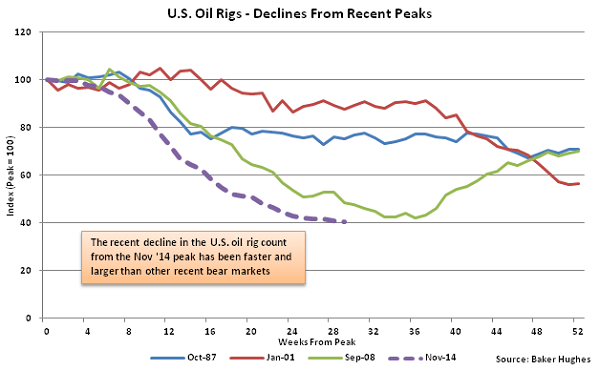

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

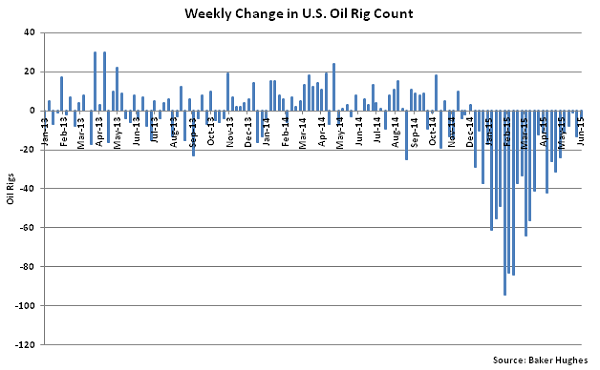

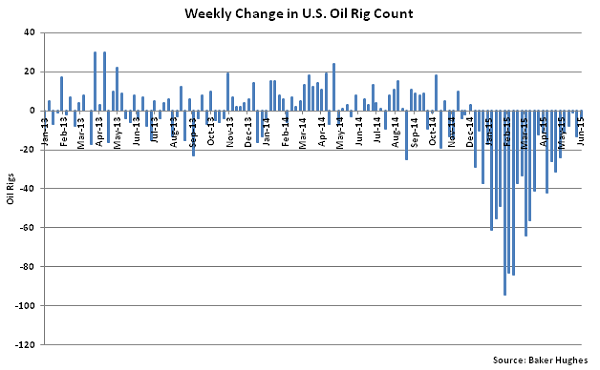

Declines in U.S. Oil Rig Counts Have Continued to Decelerate Over Recent Weeks

Declines in U.S. Oil Rig Counts Have Continued to Decelerate Over Recent Weeks

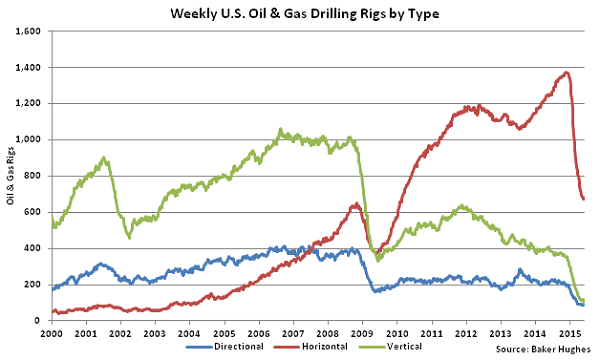

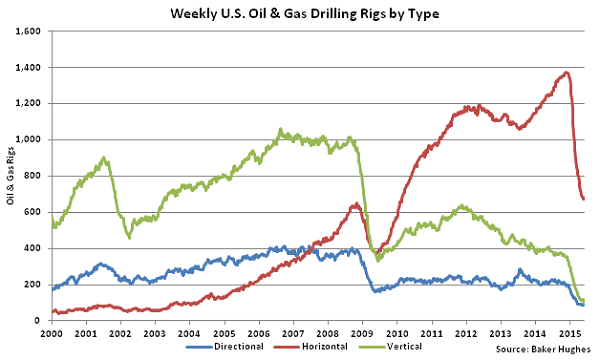

Vertical Rigs Have Recently Declined the Most on a Percentage Basis, Reaching New Lows

Vertical Rigs Have Recently Declined the Most on a Percentage Basis, Reaching New Lows

Crude Oil Production Remains Strong, up 12.9% YOY

Crude Oil Production Remains Strong, up 12.9% YOY

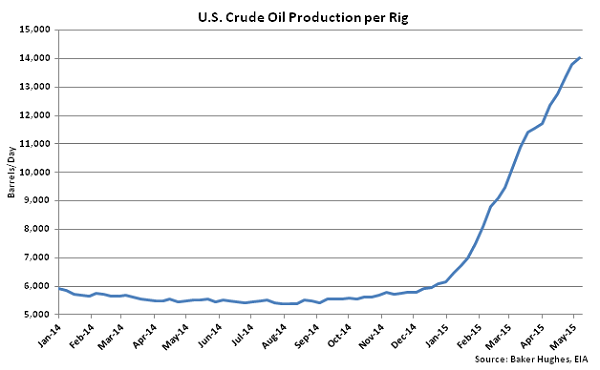

Crude Oil Production per Rig Continues to Accelerate, Reaching a New Five Year High

Crude Oil Production per Rig Continues to Accelerate, Reaching a New Five Year High

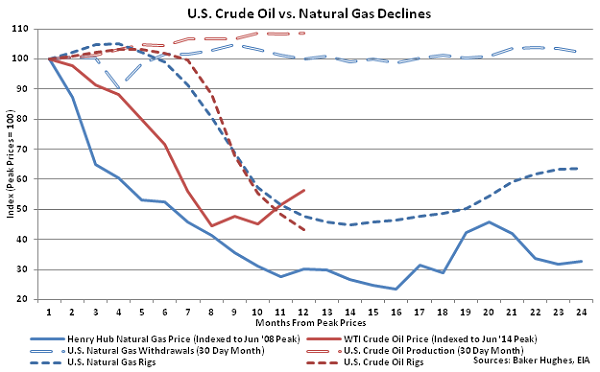

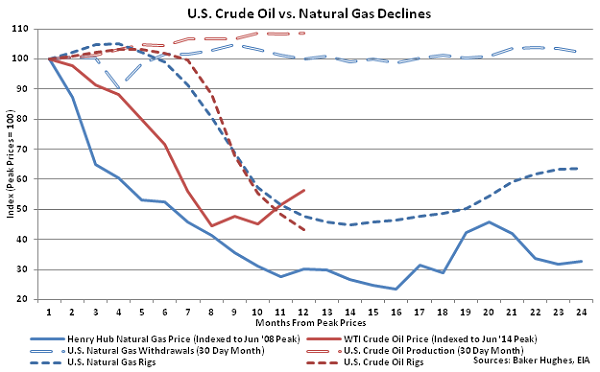

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

Jun 5th U.S. Oil Rigs Declined 0.6% From the Previous Week and are Down 58.2% YOY

Jun 5th U.S. Oil Rigs Declined 0.6% From the Previous Week and are Down 58.2% YOY

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

Declines in U.S. Oil Rig Counts Have Continued to Decelerate Over Recent Weeks

Declines in U.S. Oil Rig Counts Have Continued to Decelerate Over Recent Weeks

Vertical Rigs Have Recently Declined the Most on a Percentage Basis, Reaching New Lows

Vertical Rigs Have Recently Declined the Most on a Percentage Basis, Reaching New Lows

Crude Oil Production Remains Strong, up 12.9% YOY

Crude Oil Production Remains Strong, up 12.9% YOY

Crude Oil Production per Rig Continues to Accelerate, Reaching a New Five Year High

Crude Oil Production per Rig Continues to Accelerate, Reaching a New Five Year High

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas