Weekly DOE Ethanol Update – 6/17/15

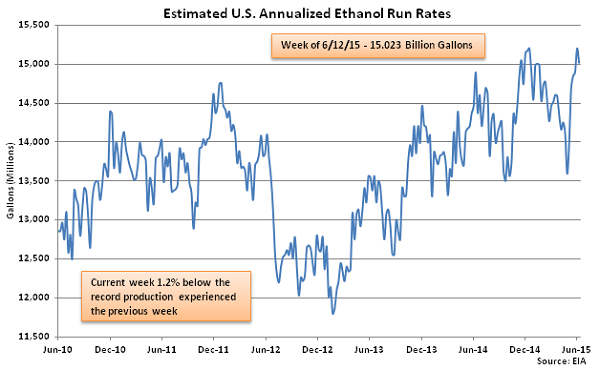

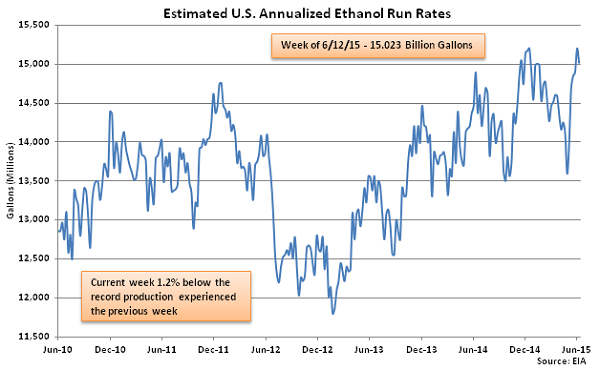

Jun 12th Ethanol Run Rates Down 1.2% From the Previous Weekly Record High

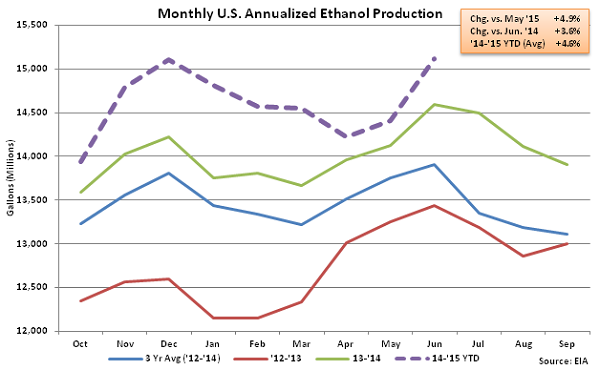

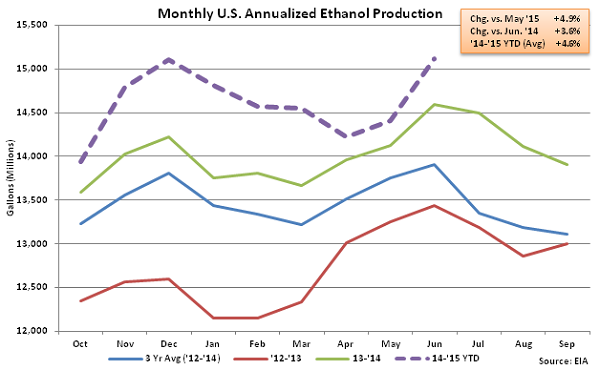

Jun ’15 Ethanol Production Remains up 4.9% MOM and 3.6% YOY Through Two Weeks

Jun ’15 Ethanol Production Remains up 4.9% MOM and 3.6% YOY Through Two Weeks

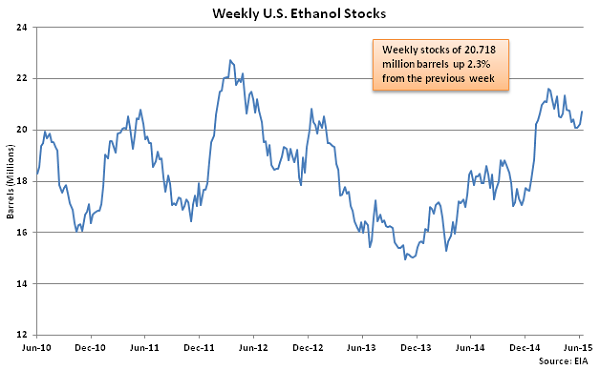

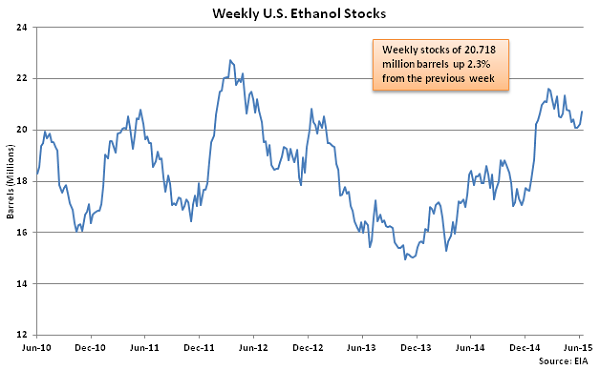

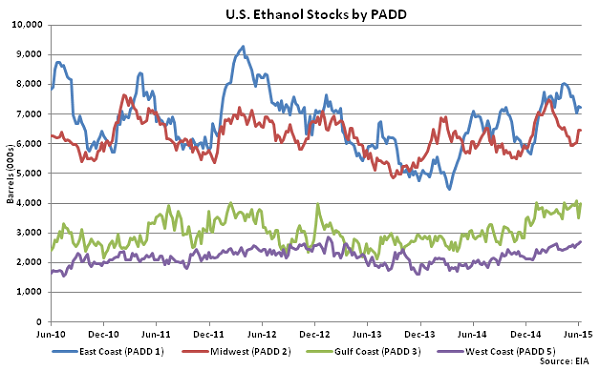

Jun 12th Ethanol Stocks up 2.3% From the Previous Week

Jun 12th Ethanol Stocks up 2.3% From the Previous Week

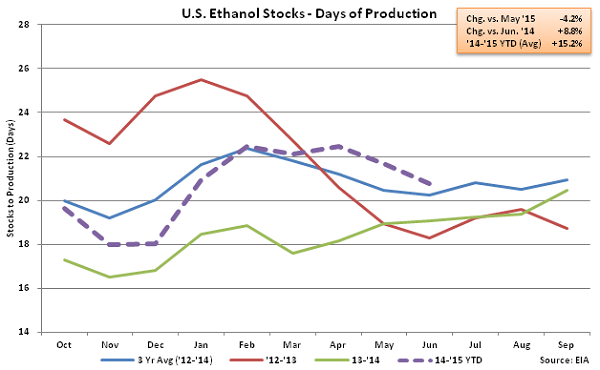

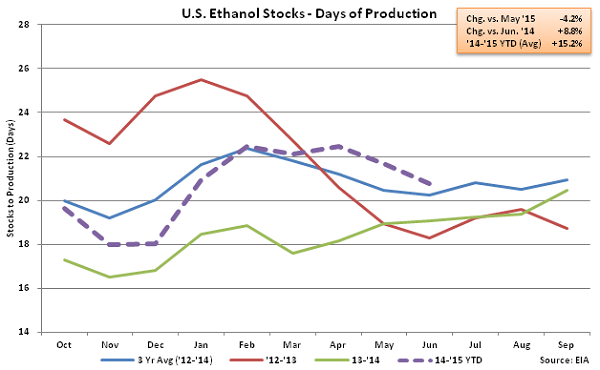

Jun ’15 Ethanol Stocks-to-Production Down 4.2% MOM but up 8.8% YOY Through Two Weeks

Jun ’15 Ethanol Stocks-to-Production Down 4.2% MOM but up 8.8% YOY Through Two Weeks

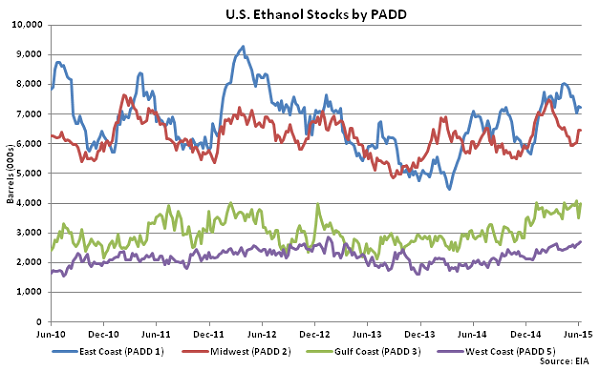

Jun 12th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jun 12th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

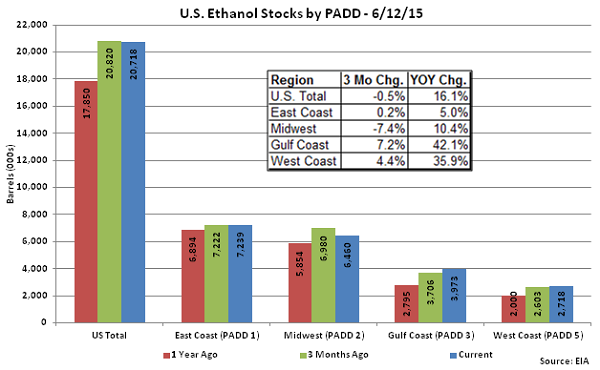

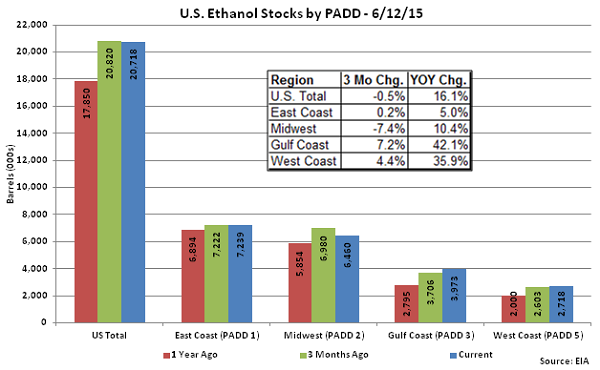

Jun 12th Total Ethanol Stocks up 16.1% YOY, Gulf Coast Stocks up 42.1% YOY

Jun 12th Total Ethanol Stocks up 16.1% YOY, Gulf Coast Stocks up 42.1% YOY

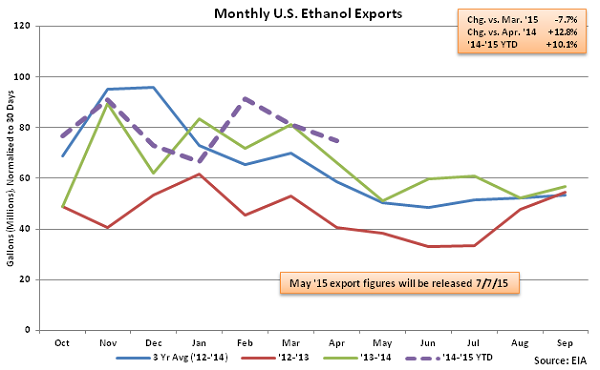

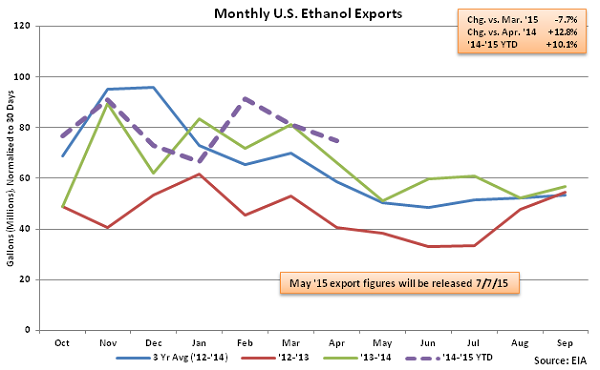

Apr ’15 Ethanol Exports Down 7.7% MOM but up 12.8% YOY

Apr ’15 Ethanol Exports Down 7.7% MOM but up 12.8% YOY

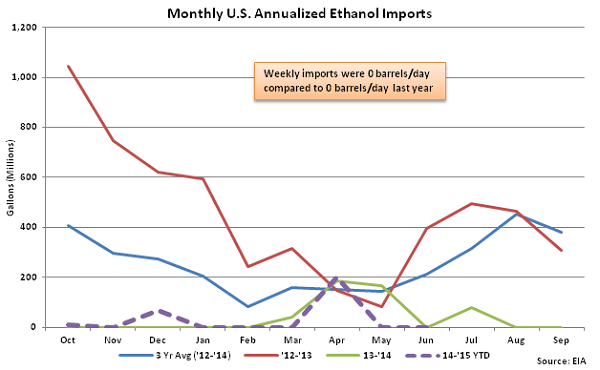

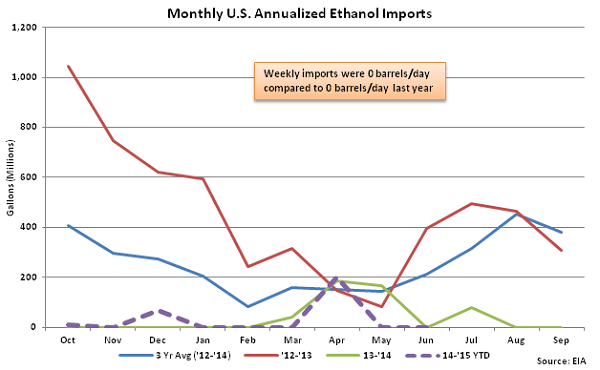

Jun ’15 Ethanol Imports Remain at Minimal Values

Jun ’15 Ethanol Imports Remain at Minimal Values

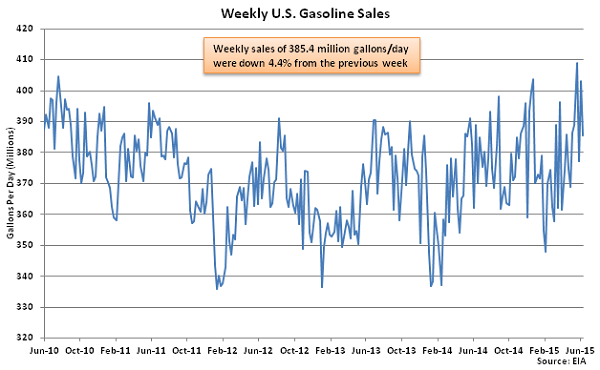

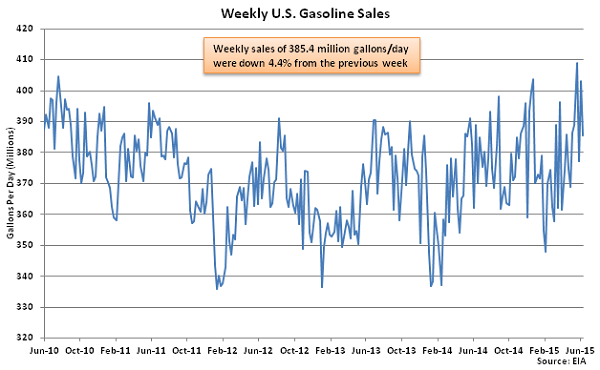

Jun 12th Gasoline Sales Down 4.4% From the Previous Week

Jun 12th Gasoline Sales Down 4.4% From the Previous Week

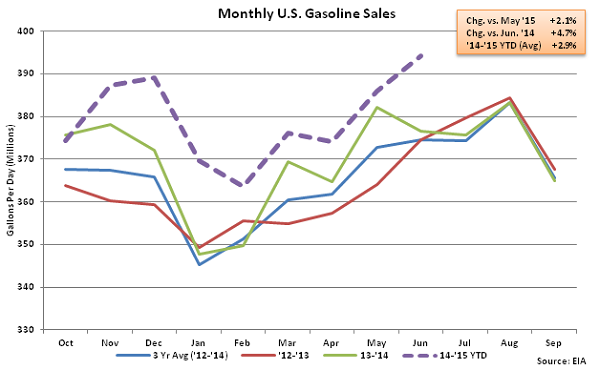

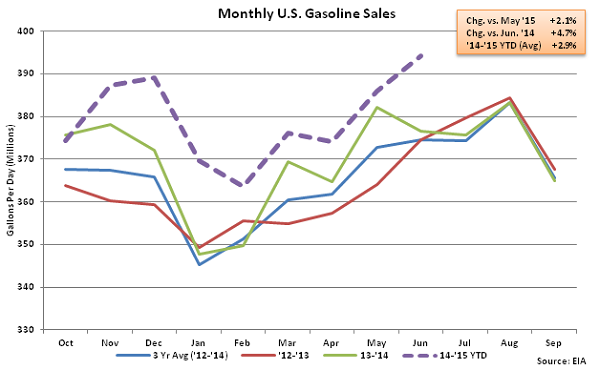

Jun ’15 Gasoline Sales Remain up 2.1% MOM and 4.7% YOY Through Two Weeks

Jun ’15 Gasoline Sales Remain up 2.1% MOM and 4.7% YOY Through Two Weeks

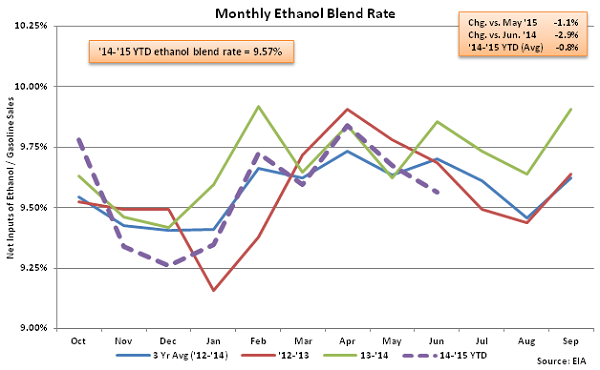

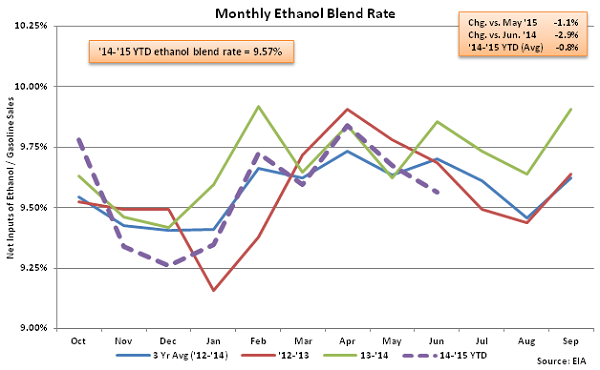

Jun ’15 Ethanol Blend Rate Down 1.1% MOM and 2.9% YOY Through Two Weeks

Jun ’15 Ethanol Blend Rate Down 1.1% MOM and 2.9% YOY Through Two Weeks

Jun ’15 Ethanol Production Remains up 4.9% MOM and 3.6% YOY Through Two Weeks

Jun ’15 Ethanol Production Remains up 4.9% MOM and 3.6% YOY Through Two Weeks

Jun 12th Ethanol Stocks up 2.3% From the Previous Week

Jun 12th Ethanol Stocks up 2.3% From the Previous Week

Jun ’15 Ethanol Stocks-to-Production Down 4.2% MOM but up 8.8% YOY Through Two Weeks

Jun ’15 Ethanol Stocks-to-Production Down 4.2% MOM but up 8.8% YOY Through Two Weeks

Jun 12th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jun 12th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jun 12th Total Ethanol Stocks up 16.1% YOY, Gulf Coast Stocks up 42.1% YOY

Jun 12th Total Ethanol Stocks up 16.1% YOY, Gulf Coast Stocks up 42.1% YOY

Apr ’15 Ethanol Exports Down 7.7% MOM but up 12.8% YOY

Apr ’15 Ethanol Exports Down 7.7% MOM but up 12.8% YOY

Jun ’15 Ethanol Imports Remain at Minimal Values

Jun ’15 Ethanol Imports Remain at Minimal Values

Jun 12th Gasoline Sales Down 4.4% From the Previous Week

Jun 12th Gasoline Sales Down 4.4% From the Previous Week

Jun ’15 Gasoline Sales Remain up 2.1% MOM and 4.7% YOY Through Two Weeks

Jun ’15 Gasoline Sales Remain up 2.1% MOM and 4.7% YOY Through Two Weeks

Jun ’15 Ethanol Blend Rate Down 1.1% MOM and 2.9% YOY Through Two Weeks

Jun ’15 Ethanol Blend Rate Down 1.1% MOM and 2.9% YOY Through Two Weeks