U.S. Dry Product Stocks Update – Jul ’15

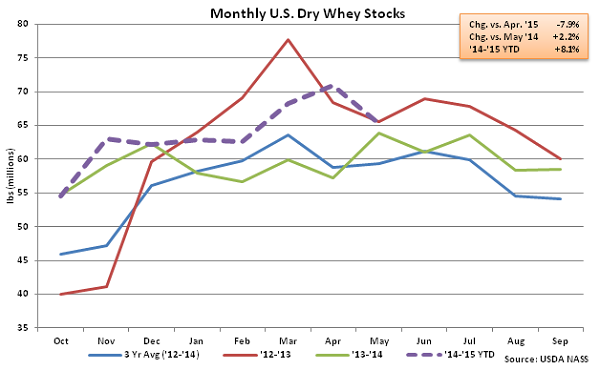

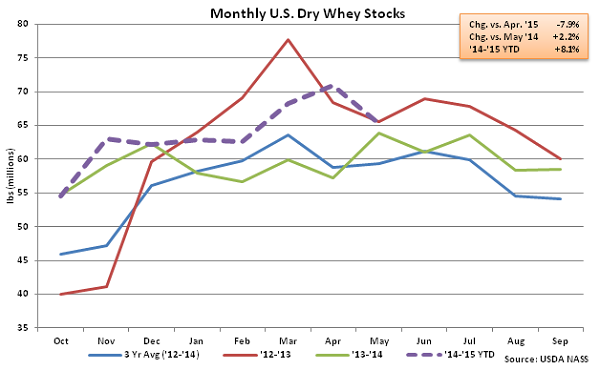

Dry Whey – Stocks Decline MOM, Remain Higher on YOY Basis for Fifth Consecutive Month

Despite the MOM increase in dry whey production, May ’15 month-end dry whey stocks declined by 7.9%, or 5.6 million lbs, MOM, suggesting demand for whey increased in May after a sustained drop in prices. Dry whey stocks did, however, finish higher on a YOY basis for the fifth consecutive month, finishing 2.2% higher than a year ago and 9.9% higher than the three year average May dry whey stocks.

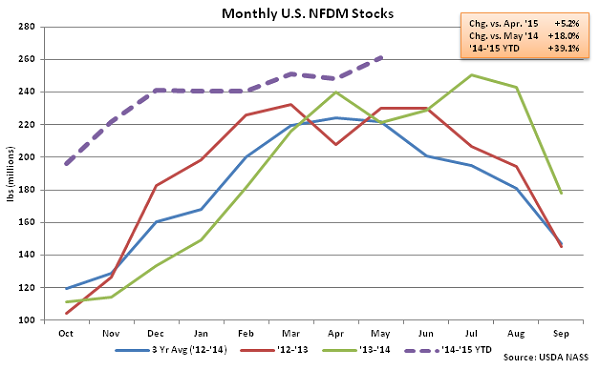

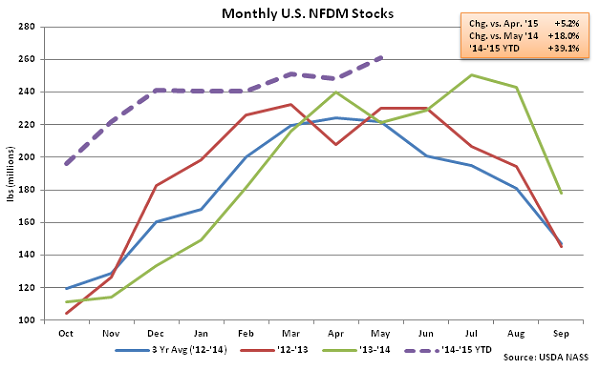

NFDM – Stocks Reach New Monthly Record High

Despite the seasonal decline in total powder production, May ’15 month-ending NFDM stocks reached a new monthly record high. May ’15 NFDM stocks increased by 5.2%, or 13.0 million lbs, MOM to a total of 261.0 million lbs while also remaining significantly higher on a YOY basis. May ’15 NFDM stocks finished 18.0% higher than a year ago and 17.5% higher than the three year average May NFDM stocks.

NFDM – Stocks Reach New Monthly Record High

Despite the seasonal decline in total powder production, May ’15 month-ending NFDM stocks reached a new monthly record high. May ’15 NFDM stocks increased by 5.2%, or 13.0 million lbs, MOM to a total of 261.0 million lbs while also remaining significantly higher on a YOY basis. May ’15 NFDM stocks finished 18.0% higher than a year ago and 17.5% higher than the three year average May NFDM stocks.

NFDM – Stocks Reach New Monthly Record High

Despite the seasonal decline in total powder production, May ’15 month-ending NFDM stocks reached a new monthly record high. May ’15 NFDM stocks increased by 5.2%, or 13.0 million lbs, MOM to a total of 261.0 million lbs while also remaining significantly higher on a YOY basis. May ’15 NFDM stocks finished 18.0% higher than a year ago and 17.5% higher than the three year average May NFDM stocks.

NFDM – Stocks Reach New Monthly Record High

Despite the seasonal decline in total powder production, May ’15 month-ending NFDM stocks reached a new monthly record high. May ’15 NFDM stocks increased by 5.2%, or 13.0 million lbs, MOM to a total of 261.0 million lbs while also remaining significantly higher on a YOY basis. May ’15 NFDM stocks finished 18.0% higher than a year ago and 17.5% higher than the three year average May NFDM stocks.