Weekly DOE Ethanol Update – 8/5/15

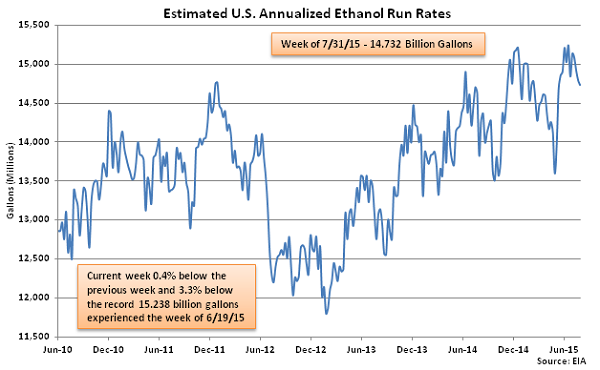

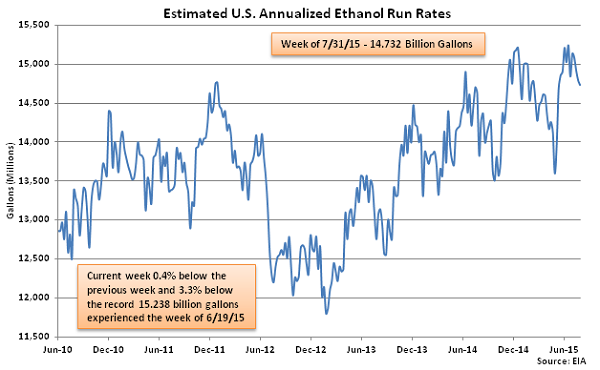

Jul 31st Ethanol Run Rates Down 0.4% From the Previous Week

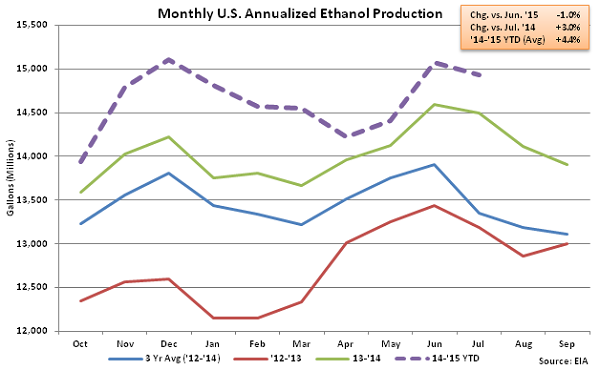

Jul ’15 Ethanol Production Finished Down 1.0% MOM but up 3.0% YOY

Jul ’15 Ethanol Production Finished Down 1.0% MOM but up 3.0% YOY

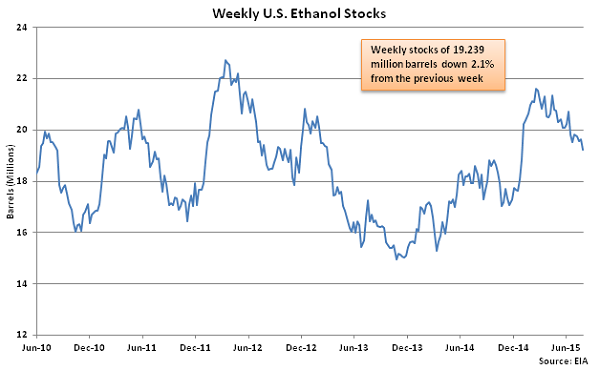

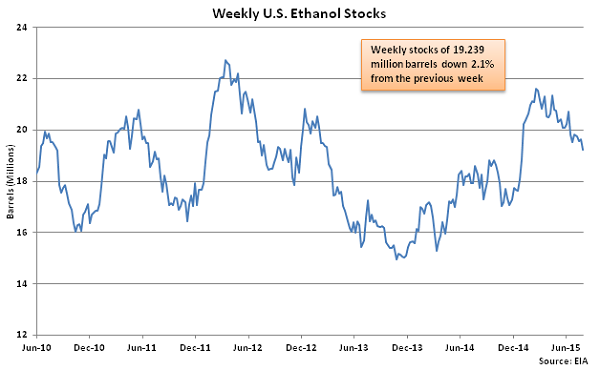

Jul 31st Ethanol Stocks Down 2.1% From the Previous Week to a New Seven Month Low

Jul 31st Ethanol Stocks Down 2.1% From the Previous Week to a New Seven Month Low

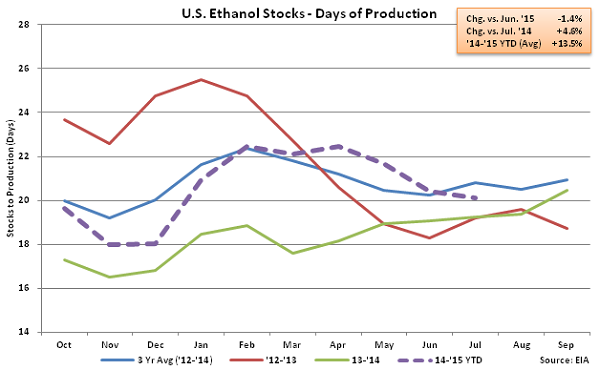

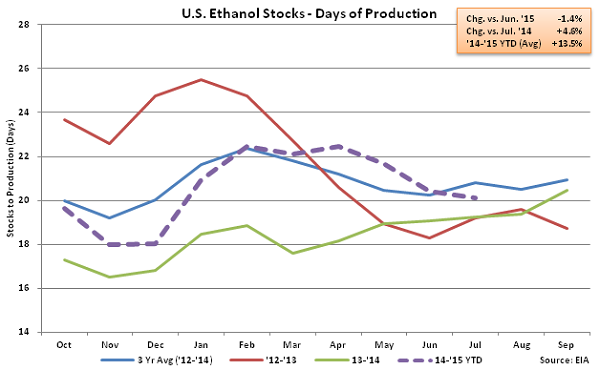

Jul ’15 Ethanol Stocks-to-Production Finished Down 1.4% MOM but up 4.6% YOY

Jul ’15 Ethanol Stocks-to-Production Finished Down 1.4% MOM but up 4.6% YOY

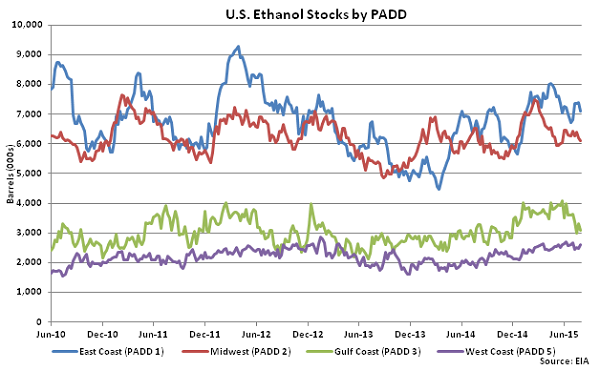

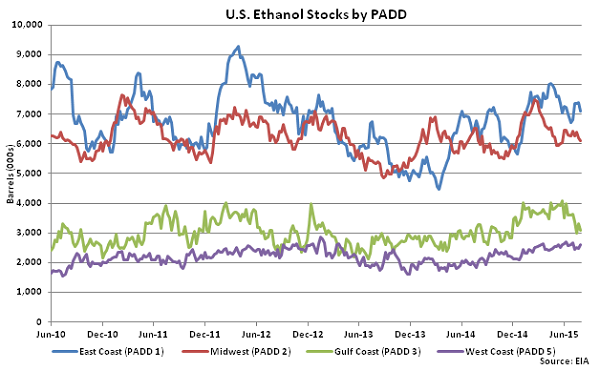

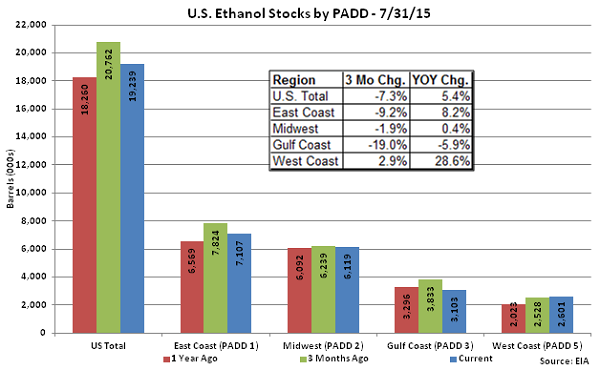

Jul 31st Weekly Decrease in Ethanol Stocks Greatest on the East Coast

Jul 31st Weekly Decrease in Ethanol Stocks Greatest on the East Coast

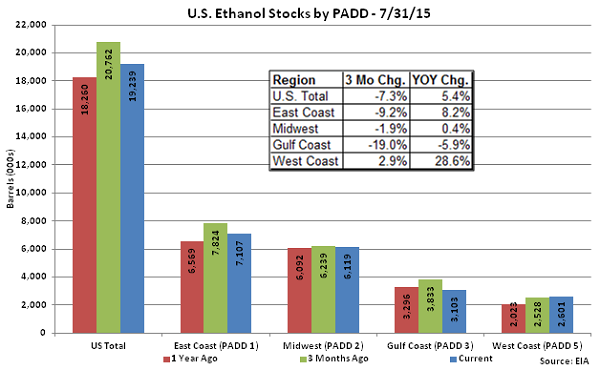

Jul 31st Total Ethanol Stocks Remain up 5.4% YOY, West Coast Stocks up 28.6% YOY

Jul 31st Total Ethanol Stocks Remain up 5.4% YOY, West Coast Stocks up 28.6% YOY

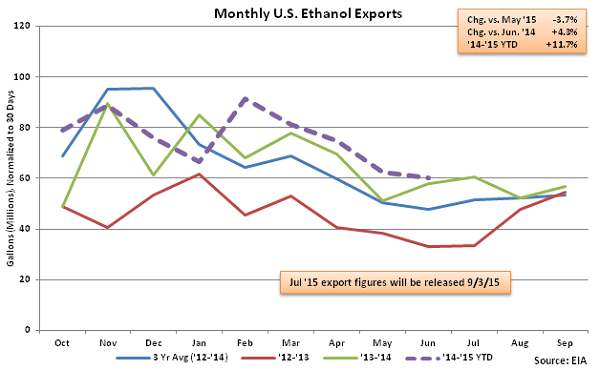

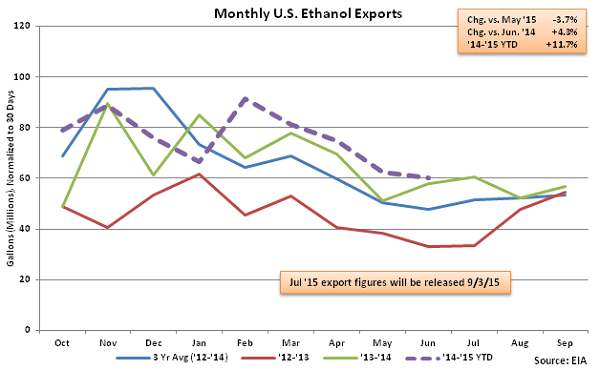

Jun ’15 Ethanol Exports Down 3.7% MOM but up 4.3% YOY

Jun ’15 Ethanol Exports Down 3.7% MOM but up 4.3% YOY

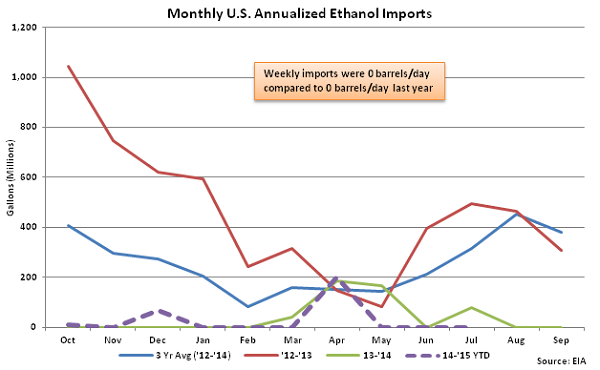

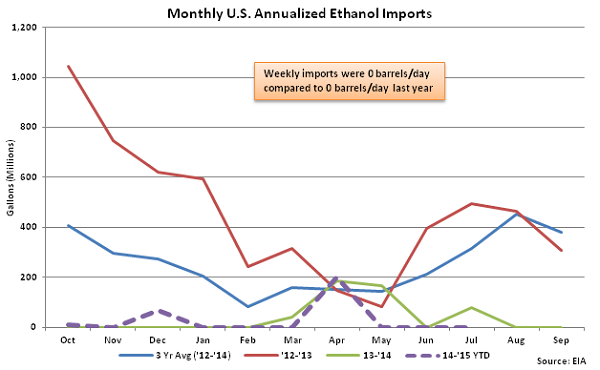

Jul ’15 Ethanol Imports Remain at Minimal Values

Jul ’15 Ethanol Imports Remain at Minimal Values

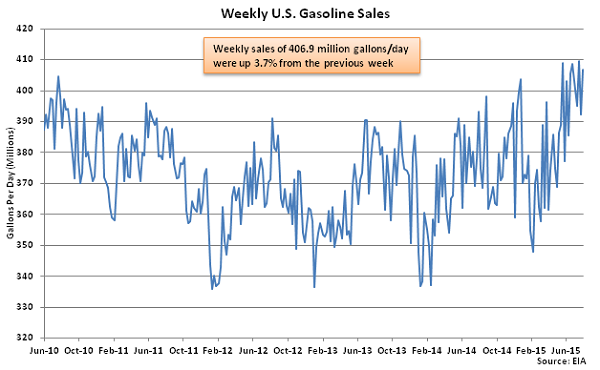

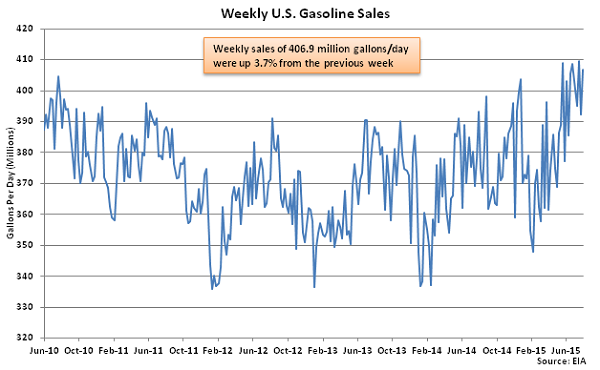

Jul 31st Gasoline Sales up 3.7% From the Previous Week

Jul 31st Gasoline Sales up 3.7% From the Previous Week

Jul ’15 Gasoline Sales Finished Flat MOM and up 6.6% YOY

Jul ’15 Gasoline Sales Finished Flat MOM and up 6.6% YOY

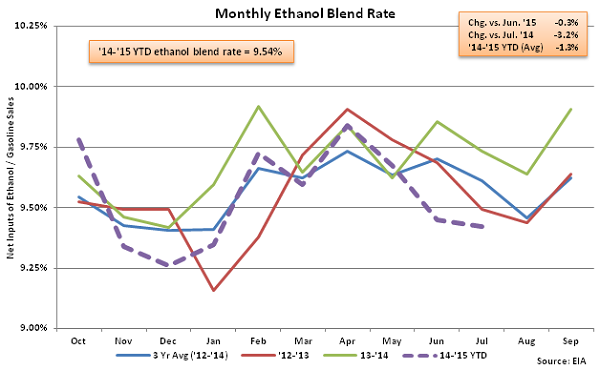

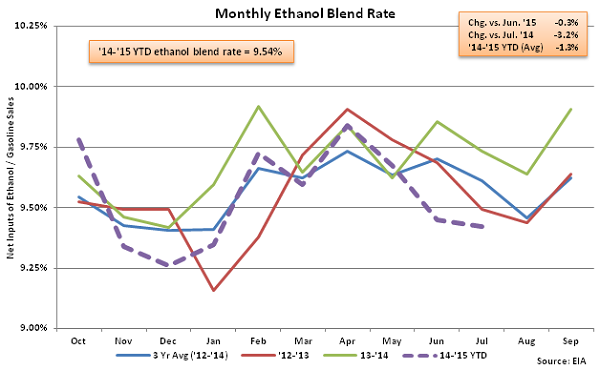

Jul ’15 Ethanol Blend Rate Finished Down 0.3% MOM and 3.2% YOY

Jul ’15 Ethanol Blend Rate Finished Down 0.3% MOM and 3.2% YOY

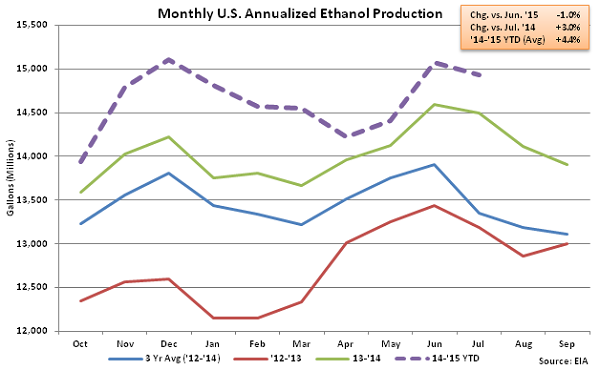

Jul ’15 Ethanol Production Finished Down 1.0% MOM but up 3.0% YOY

Jul ’15 Ethanol Production Finished Down 1.0% MOM but up 3.0% YOY

Jul 31st Ethanol Stocks Down 2.1% From the Previous Week to a New Seven Month Low

Jul 31st Ethanol Stocks Down 2.1% From the Previous Week to a New Seven Month Low

Jul ’15 Ethanol Stocks-to-Production Finished Down 1.4% MOM but up 4.6% YOY

Jul ’15 Ethanol Stocks-to-Production Finished Down 1.4% MOM but up 4.6% YOY

Jul 31st Weekly Decrease in Ethanol Stocks Greatest on the East Coast

Jul 31st Weekly Decrease in Ethanol Stocks Greatest on the East Coast

Jul 31st Total Ethanol Stocks Remain up 5.4% YOY, West Coast Stocks up 28.6% YOY

Jul 31st Total Ethanol Stocks Remain up 5.4% YOY, West Coast Stocks up 28.6% YOY

Jun ’15 Ethanol Exports Down 3.7% MOM but up 4.3% YOY

Jun ’15 Ethanol Exports Down 3.7% MOM but up 4.3% YOY

Jul ’15 Ethanol Imports Remain at Minimal Values

Jul ’15 Ethanol Imports Remain at Minimal Values

Jul 31st Gasoline Sales up 3.7% From the Previous Week

Jul 31st Gasoline Sales up 3.7% From the Previous Week

Jul ’15 Gasoline Sales Finished Flat MOM and up 6.6% YOY

Jul ’15 Gasoline Sales Finished Flat MOM and up 6.6% YOY

Jul ’15 Ethanol Blend Rate Finished Down 0.3% MOM and 3.2% YOY

Jul ’15 Ethanol Blend Rate Finished Down 0.3% MOM and 3.2% YOY