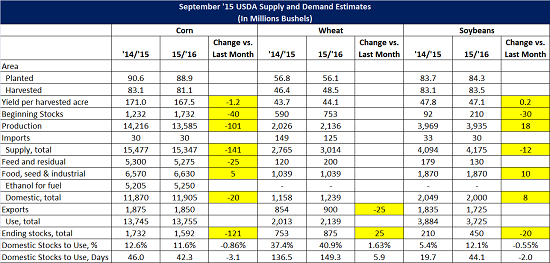

September ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o Increased exports by 25 million bushels and industrial use by 15 million leaving ending stocks 40 million lower at 1.73 billion.

’15/’16 Corn

o Yield was reduced 1.3 bushels per acre to 167.5 versus an average 167.6 private estimate.

o Feed and residual usage was reduced by 25 million.

o Ending stocks were projected at 1.59 billion bushels or 42.3 days of use and on the low end of private estimates.

’14/’15 Soybeans

o Crush was revised higher by an additional 25 million bushels and exports increased 10 million leaving ending stocks at 210 million.

’15/’16 Soybeans

o Yield was increased 0.2 bushels per acre to 47.1 and on the high end of private estimates

o Crush was increased 10 million bushels.

o Ending stocks of 450 million bushels or 44.1 days of use and were toward the higher end of private estimates.

Other Markets

o EU wheat production was sharply higher on better than expected yields pushing global ending stocks in 15/16 surging to a record 226.6 million tons (previous record was 210.4 tons in 1999)

o Global corn production was reduced by 7.5 million tons offsetting gains in small grains such as barley leaving ending stocks of coarse grains down by 2.6 million tons from prior estimates.

o Combined coarse grain and wheat projected ending stocks are estimated up 7.6 million tons from last year and above the prior 1999 record.

*Significant changes are highlighted

’14/’15 Corn

o Increased exports by 25 million bushels and industrial use by 15 million leaving ending stocks 40 million lower at 1.73 billion.

’15/’16 Corn

o Yield was reduced 1.3 bushels per acre to 167.5 versus an average 167.6 private estimate.

o Feed and residual usage was reduced by 25 million.

o Ending stocks were projected at 1.59 billion bushels or 42.3 days of use and on the low end of private estimates.

’14/’15 Soybeans

o Crush was revised higher by an additional 25 million bushels and exports increased 10 million leaving ending stocks at 210 million.

’15/’16 Soybeans

o Yield was increased 0.2 bushels per acre to 47.1 and on the high end of private estimates

o Crush was increased 10 million bushels.

o Ending stocks of 450 million bushels or 44.1 days of use and were toward the higher end of private estimates.

Other Markets

o EU wheat production was sharply higher on better than expected yields pushing global ending stocks in 15/16 surging to a record 226.6 million tons (previous record was 210.4 tons in 1999)

o Global corn production was reduced by 7.5 million tons offsetting gains in small grains such as barley leaving ending stocks of coarse grains down by 2.6 million tons from prior estimates.

o Combined coarse grain and wheat projected ending stocks are estimated up 7.6 million tons from last year and above the prior 1999 record.