Global Dairy Trade Biannual Chart Focus Update – Oct…

Global Dairy Trade (GDT) released their biannual Chart Focus report in early October, which includes updated data through Sep ’15 on several key indicators within the GDT. Information on the distribution of sales, participating bidders and quantities sold were included within the report.

Distribution of Sales

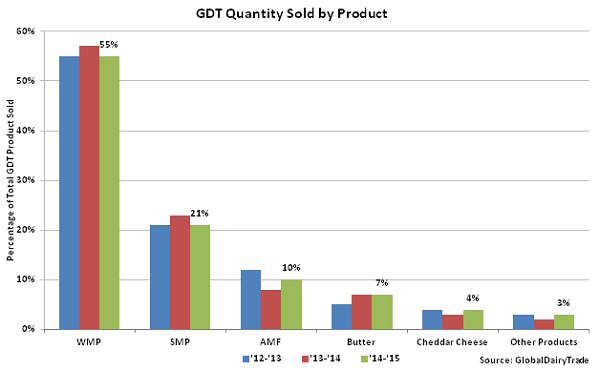

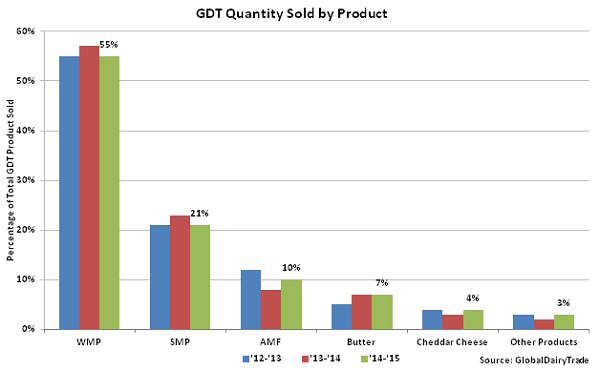

Volumes sold by product as a percentage of total product sold declined from a year ago for whole milk powder (WMP) and skim milk powder (SMP) but increased for anhydrous milkfat (AMF) and cheddar cheese. Despite the YOY decline, WMP continued to account for over half of the total GDT volume for the third consecutive year.

Product was sold from Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Murray Goulburn (Australia), Arla (Europe) and Euroserum (Europe). Molkerei Ammerland withdrew from selling products on the auction platform during Apr ’15 and Land O ‘Lakes exited the exchange in Aug ’15.

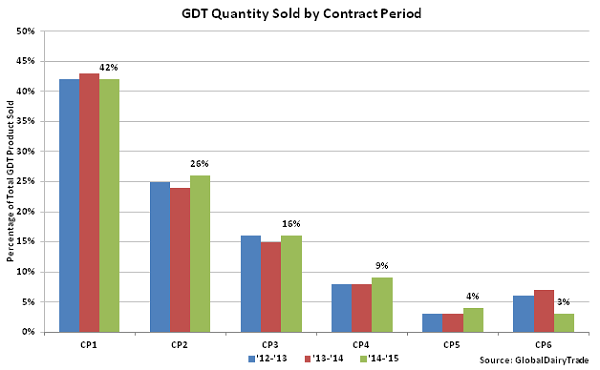

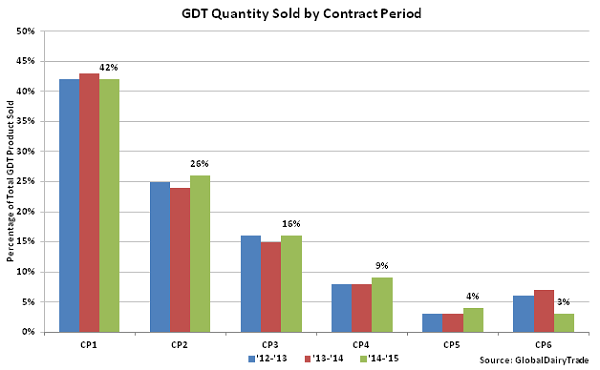

Volume sold by Contract Period (CP) was largely unchanged from the previous year, although product sold in CP6 fell by over half of last year’s product sold. Contract Periods refer to the month when product is shipped. Product sold in CP1 is shipped in the month after the trading event when it was purchased CP2 is shipped two month after, etc. Over two thirds of volumes sold have occurred within the first two Contract Periods throughout the past three years.

Product was sold from Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Murray Goulburn (Australia), Arla (Europe) and Euroserum (Europe). Molkerei Ammerland withdrew from selling products on the auction platform during Apr ’15 and Land O ‘Lakes exited the exchange in Aug ’15.

Volume sold by Contract Period (CP) was largely unchanged from the previous year, although product sold in CP6 fell by over half of last year’s product sold. Contract Periods refer to the month when product is shipped. Product sold in CP1 is shipped in the month after the trading event when it was purchased CP2 is shipped two month after, etc. Over two thirds of volumes sold have occurred within the first two Contract Periods throughout the past three years.

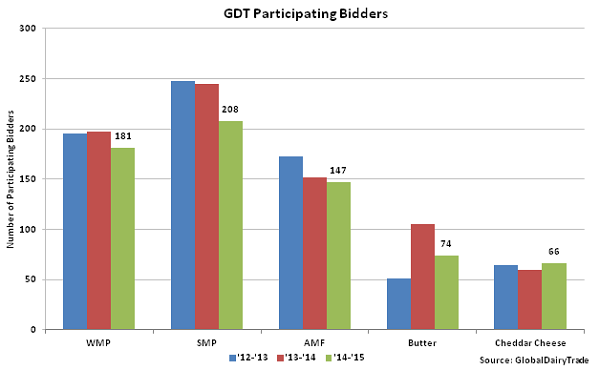

Participating Bidders

Market share of participating bidders by region increased YOY in North Asia and South East Asia & Oceania while declining YOY in the Middle East & Africa, the Americas and Europe. Bidders in North Asia and South East Asia & Oceania combined to account for over half of the total bidders, finishing up 6% from a year ago.

Participating Bidders

Market share of participating bidders by region increased YOY in North Asia and South East Asia & Oceania while declining YOY in the Middle East & Africa, the Americas and Europe. Bidders in North Asia and South East Asia & Oceania combined to account for over half of the total bidders, finishing up 6% from a year ago.

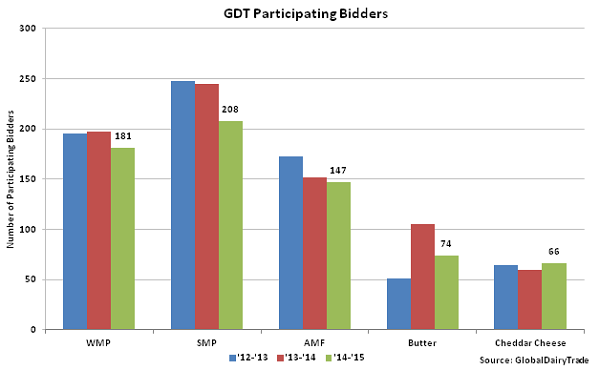

Participating bidders who actively bid on product in at least one trading event over the 12 months declined across all major products offered within the GDT with the exception of cheddar cheese. Participating bidders for SMP and butter declined the most throughout the year, followed by WMP and AMF.

Participating bidders who actively bid on product in at least one trading event over the 12 months declined across all major products offered within the GDT with the exception of cheddar cheese. Participating bidders for SMP and butter declined the most throughout the year, followed by WMP and AMF.

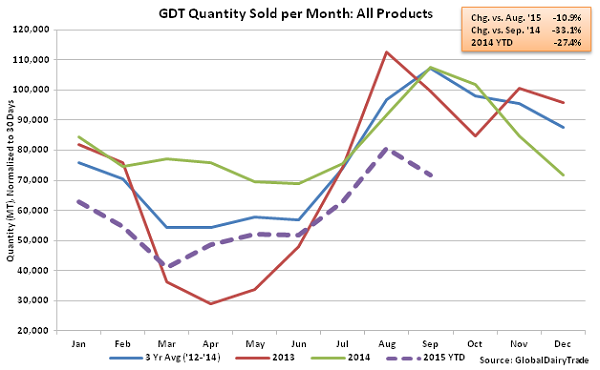

Quantities Sold

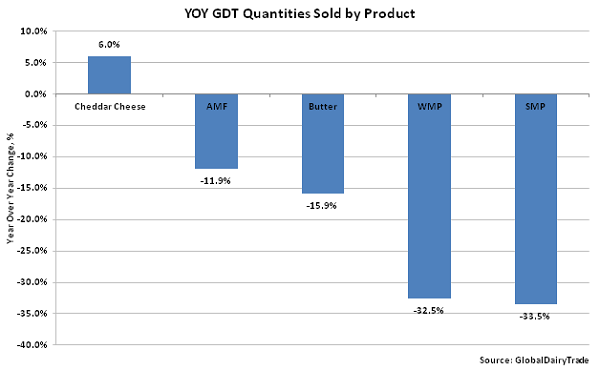

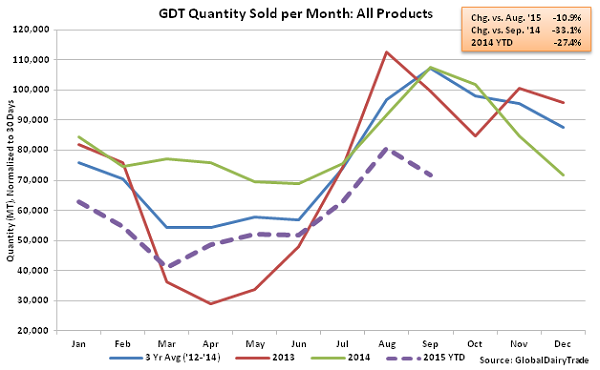

Combined quantities sold for all products within the GDT remained lower than the previous year throughout the first three quarters of 2015. Total quantities sold for all products are down 27.4% YOY through September.

Quantities Sold

Combined quantities sold for all products within the GDT remained lower than the previous year throughout the first three quarters of 2015. Total quantities sold for all products are down 27.4% YOY through September.

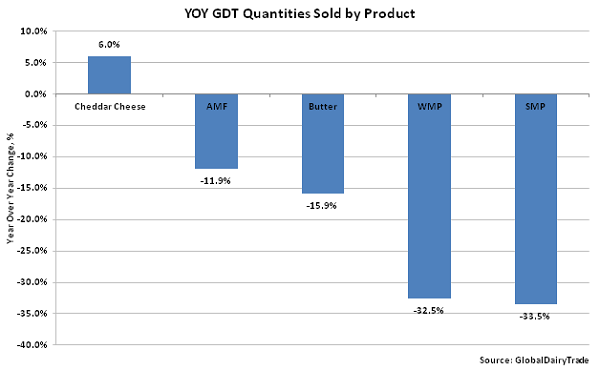

Of the major products offered within the GDT, cheddar cheese was the only product to experience an increase in quantities sold on a YOY basis throughout the first nine months of 2015. Declines in quantities sold on a YOY basis were led by SMP (-33.5%), followed by WMP (-32.5%), butter (-15.9%) and AMF (-11.9%).

Of the major products offered within the GDT, cheddar cheese was the only product to experience an increase in quantities sold on a YOY basis throughout the first nine months of 2015. Declines in quantities sold on a YOY basis were led by SMP (-33.5%), followed by WMP (-32.5%), butter (-15.9%) and AMF (-11.9%).

Product was sold from Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Murray Goulburn (Australia), Arla (Europe) and Euroserum (Europe). Molkerei Ammerland withdrew from selling products on the auction platform during Apr ’15 and Land O ‘Lakes exited the exchange in Aug ’15.

Volume sold by Contract Period (CP) was largely unchanged from the previous year, although product sold in CP6 fell by over half of last year’s product sold. Contract Periods refer to the month when product is shipped. Product sold in CP1 is shipped in the month after the trading event when it was purchased CP2 is shipped two month after, etc. Over two thirds of volumes sold have occurred within the first two Contract Periods throughout the past three years.

Product was sold from Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Murray Goulburn (Australia), Arla (Europe) and Euroserum (Europe). Molkerei Ammerland withdrew from selling products on the auction platform during Apr ’15 and Land O ‘Lakes exited the exchange in Aug ’15.

Volume sold by Contract Period (CP) was largely unchanged from the previous year, although product sold in CP6 fell by over half of last year’s product sold. Contract Periods refer to the month when product is shipped. Product sold in CP1 is shipped in the month after the trading event when it was purchased CP2 is shipped two month after, etc. Over two thirds of volumes sold have occurred within the first two Contract Periods throughout the past three years.

Participating Bidders

Market share of participating bidders by region increased YOY in North Asia and South East Asia & Oceania while declining YOY in the Middle East & Africa, the Americas and Europe. Bidders in North Asia and South East Asia & Oceania combined to account for over half of the total bidders, finishing up 6% from a year ago.

Participating Bidders

Market share of participating bidders by region increased YOY in North Asia and South East Asia & Oceania while declining YOY in the Middle East & Africa, the Americas and Europe. Bidders in North Asia and South East Asia & Oceania combined to account for over half of the total bidders, finishing up 6% from a year ago.

Participating bidders who actively bid on product in at least one trading event over the 12 months declined across all major products offered within the GDT with the exception of cheddar cheese. Participating bidders for SMP and butter declined the most throughout the year, followed by WMP and AMF.

Participating bidders who actively bid on product in at least one trading event over the 12 months declined across all major products offered within the GDT with the exception of cheddar cheese. Participating bidders for SMP and butter declined the most throughout the year, followed by WMP and AMF.

Quantities Sold

Combined quantities sold for all products within the GDT remained lower than the previous year throughout the first three quarters of 2015. Total quantities sold for all products are down 27.4% YOY through September.

Quantities Sold

Combined quantities sold for all products within the GDT remained lower than the previous year throughout the first three quarters of 2015. Total quantities sold for all products are down 27.4% YOY through September.

Of the major products offered within the GDT, cheddar cheese was the only product to experience an increase in quantities sold on a YOY basis throughout the first nine months of 2015. Declines in quantities sold on a YOY basis were led by SMP (-33.5%), followed by WMP (-32.5%), butter (-15.9%) and AMF (-11.9%).

Of the major products offered within the GDT, cheddar cheese was the only product to experience an increase in quantities sold on a YOY basis throughout the first nine months of 2015. Declines in quantities sold on a YOY basis were led by SMP (-33.5%), followed by WMP (-32.5%), butter (-15.9%) and AMF (-11.9%).