U.S. Milk Production Update – Oct ’15

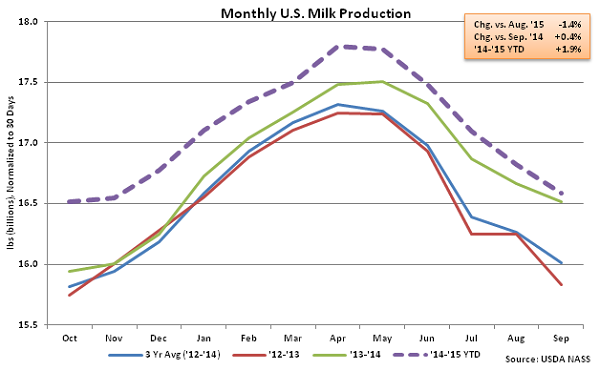

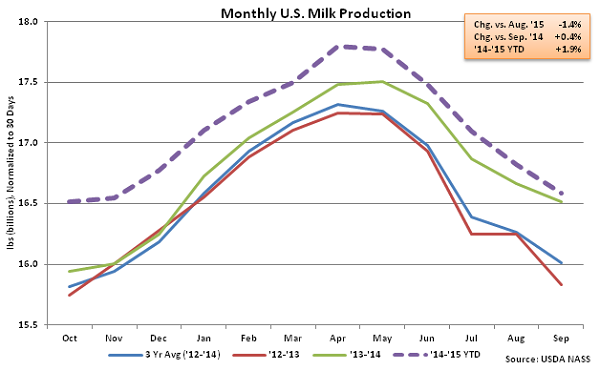

According to USDA, Sep ’15 U.S. milk production was up 0.4% YOY, at 16,587 million pounds, setting a new September production record. Production continued to decline MOM, however, contracting 1.4% on a daily average basis as production continues to seasonally decline until lows are typically reached in October. Production has declined seasonally from August – September by an average rate of 1.0% over the past ten years.

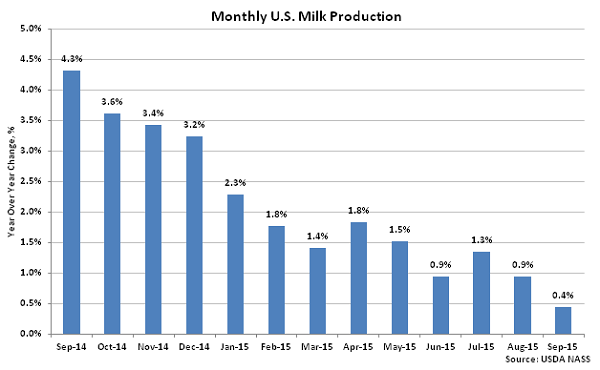

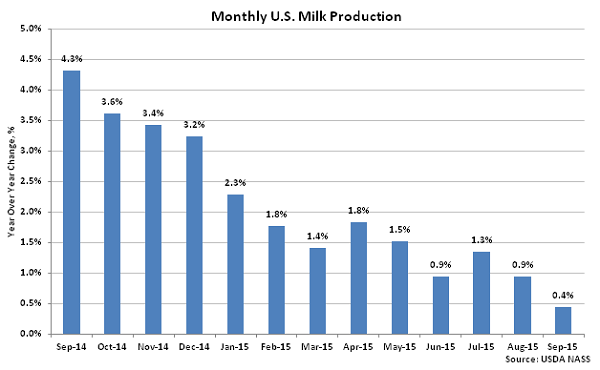

U.S. milk production remained significantly higher on a YOY basis throughout the final third of 2014, as shown below, however production growth has decelerated over the past 12 months. The Sep ’15 YOY growth rate of 0.4% was a 21 month low and significantly below the ’14-’15 annual growth rate of 1.9%.

U.S. milk production remained significantly higher on a YOY basis throughout the final third of 2014, as shown below, however production growth has decelerated over the past 12 months. The Sep ’15 YOY growth rate of 0.4% was a 21 month low and significantly below the ’14-’15 annual growth rate of 1.9%.

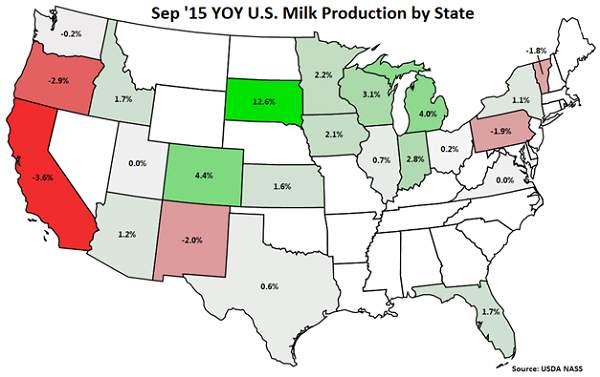

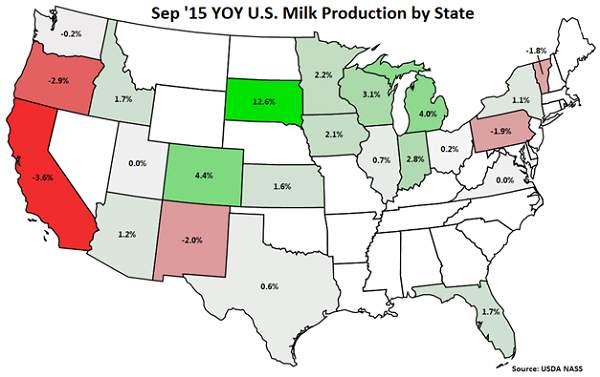

YOY production gains on a percentage basis continue to be led by South Dakota (+12.6%), followed by Colorado (+4.4%) and Wisconsin (+4.0%). California milk production declined YOY for the tenth consecutive month, finishing 3.6% lower, while production in Oregon, New Mexico, Pennsylvania, Vermont and Washington also finished lower than the prior year. California, Oregon, New Mexico, Pennsylvania, Vermont and Washington all experienced lower YOY milk per cow yields while California, Oregon and Vermont also experienced reductions in their milk cow herds.

YOY production gains on a percentage basis continue to be led by South Dakota (+12.6%), followed by Colorado (+4.4%) and Wisconsin (+4.0%). California milk production declined YOY for the tenth consecutive month, finishing 3.6% lower, while production in Oregon, New Mexico, Pennsylvania, Vermont and Washington also finished lower than the prior year. California, Oregon, New Mexico, Pennsylvania, Vermont and Washington all experienced lower YOY milk per cow yields while California, Oregon and Vermont also experienced reductions in their milk cow herds.

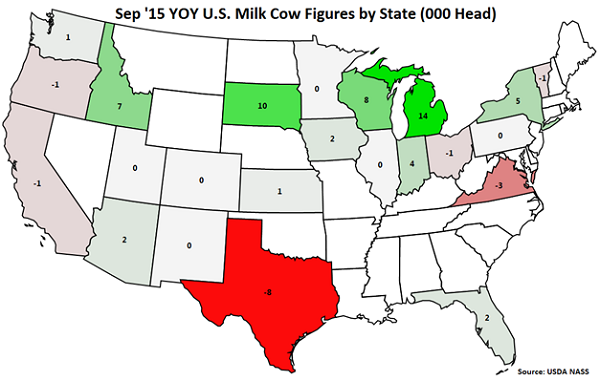

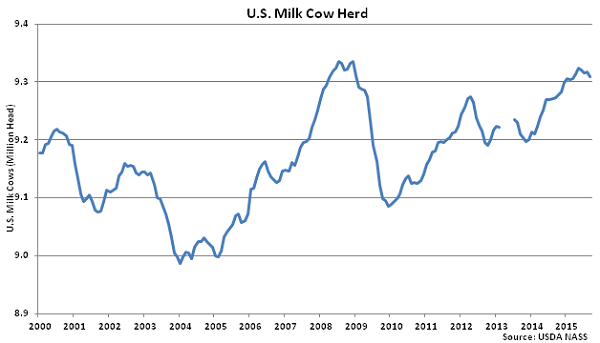

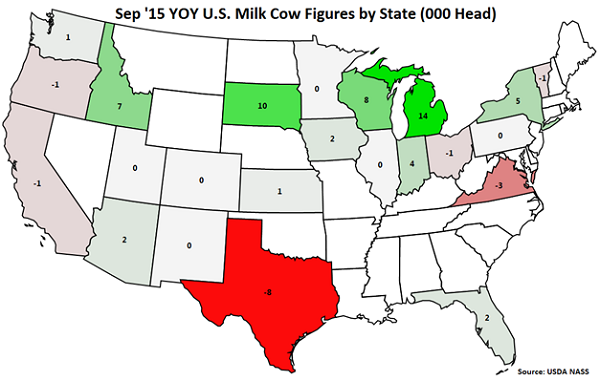

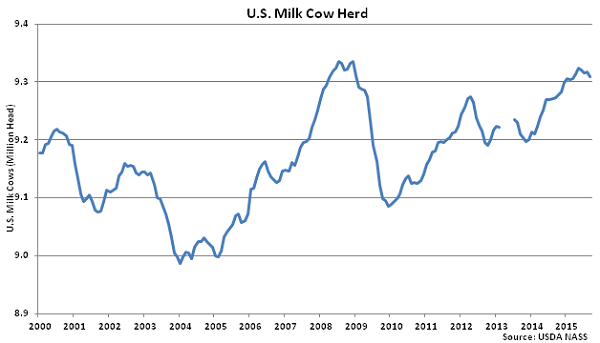

Overall, the U.S. milk cow herd declined MOM for the third time in four months during Sep ’15, finishing 5,000 head below the previous month. The total U.S. milk cow herd currently stands at 9,310,000 head, which remains 36,000 head more than September of last year.

Overall, the U.S. milk cow herd declined MOM for the third time in four months during Sep ’15, finishing 5,000 head below the previous month. The total U.S. milk cow herd currently stands at 9,310,000 head, which remains 36,000 head more than September of last year.

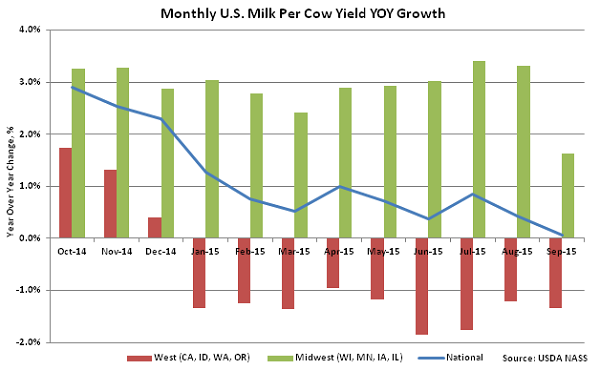

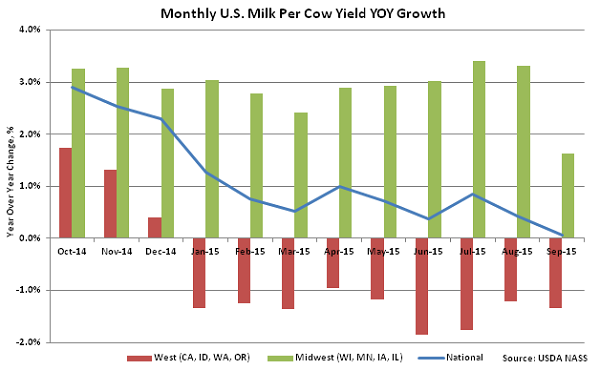

The U.S. milk per cow yield was up 0.1% YOY, increasing to 1,782 lbs, the largest on record for the month of September. Milk per cow yields continue to trend higher YOY in the Midwest while declining in the Western United States. Milk per cow yields increased by an average of 1.6% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 1.3% YOY on average within California, Idaho, Washington and Oregon.

The U.S. milk per cow yield was up 0.1% YOY, increasing to 1,782 lbs, the largest on record for the month of September. Milk per cow yields continue to trend higher YOY in the Midwest while declining in the Western United States. Milk per cow yields increased by an average of 1.6% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 1.3% YOY on average within California, Idaho, Washington and Oregon.

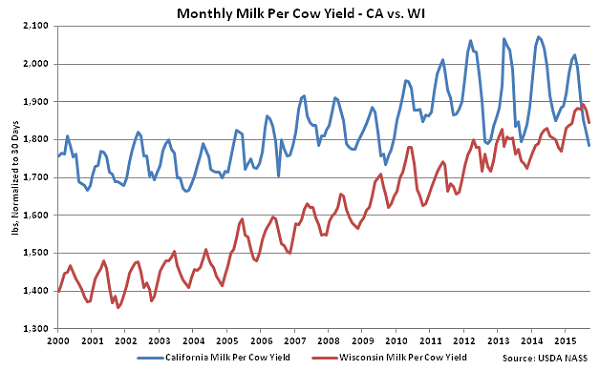

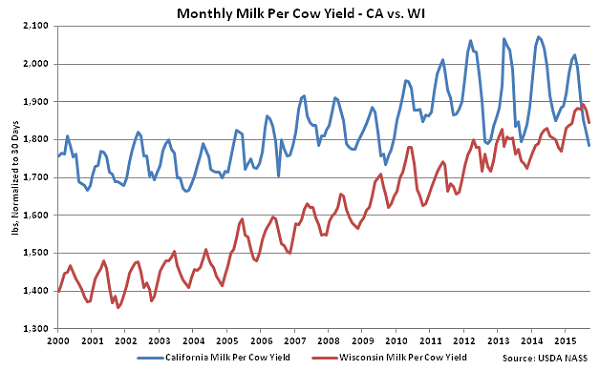

Wisconsin milk per cow yields increased to a new 63 year high relative to California milk per cow yields during Sep ’15 while finishing higher than California yields on an absolute basis for the third consecutive month.

Wisconsin milk per cow yields increased to a new 63 year high relative to California milk per cow yields during Sep ’15 while finishing higher than California yields on an absolute basis for the third consecutive month.

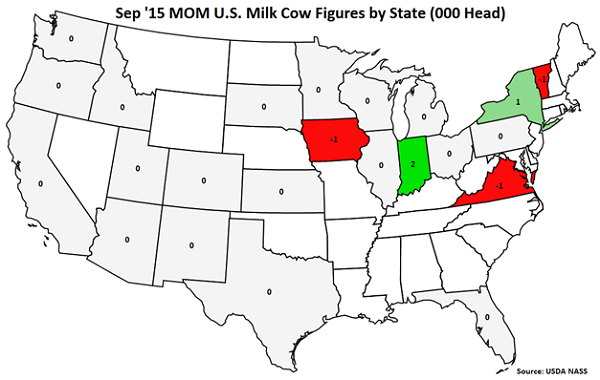

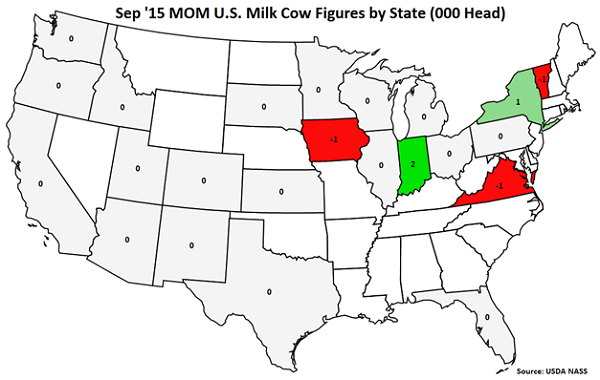

Milk cow herds declined MOM in Iowa (-1,000 head), Vermont (-1,000 head) and Virginia (-1,000 head) but increased in Indiana (+2,000 head) and New York (+1,000 head).

Milk cow herds declined MOM in Iowa (-1,000 head), Vermont (-1,000 head) and Virginia (-1,000 head) but increased in Indiana (+2,000 head) and New York (+1,000 head).

YOY increases in milk cow herds continue to be led by Michigan (+14,000 head), followed by South Dakota (+10,000 head), Wisconsin (+8,000 head) and Idaho (+7,000 head). Texas (-8,000 head), Virginia, (-3,000 head), California (-1,000 head), Oregon (-1,000 head), Ohio (-1,000 head) and Vermont (-1,000 head) experienced YOY reductions in their milk cow herds.

YOY increases in milk cow herds continue to be led by Michigan (+14,000 head), followed by South Dakota (+10,000 head), Wisconsin (+8,000 head) and Idaho (+7,000 head). Texas (-8,000 head), Virginia, (-3,000 head), California (-1,000 head), Oregon (-1,000 head), Ohio (-1,000 head) and Vermont (-1,000 head) experienced YOY reductions in their milk cow herds.

U.S. milk production remained significantly higher on a YOY basis throughout the final third of 2014, as shown below, however production growth has decelerated over the past 12 months. The Sep ’15 YOY growth rate of 0.4% was a 21 month low and significantly below the ’14-’15 annual growth rate of 1.9%.

U.S. milk production remained significantly higher on a YOY basis throughout the final third of 2014, as shown below, however production growth has decelerated over the past 12 months. The Sep ’15 YOY growth rate of 0.4% was a 21 month low and significantly below the ’14-’15 annual growth rate of 1.9%.

YOY production gains on a percentage basis continue to be led by South Dakota (+12.6%), followed by Colorado (+4.4%) and Wisconsin (+4.0%). California milk production declined YOY for the tenth consecutive month, finishing 3.6% lower, while production in Oregon, New Mexico, Pennsylvania, Vermont and Washington also finished lower than the prior year. California, Oregon, New Mexico, Pennsylvania, Vermont and Washington all experienced lower YOY milk per cow yields while California, Oregon and Vermont also experienced reductions in their milk cow herds.

YOY production gains on a percentage basis continue to be led by South Dakota (+12.6%), followed by Colorado (+4.4%) and Wisconsin (+4.0%). California milk production declined YOY for the tenth consecutive month, finishing 3.6% lower, while production in Oregon, New Mexico, Pennsylvania, Vermont and Washington also finished lower than the prior year. California, Oregon, New Mexico, Pennsylvania, Vermont and Washington all experienced lower YOY milk per cow yields while California, Oregon and Vermont also experienced reductions in their milk cow herds.

Overall, the U.S. milk cow herd declined MOM for the third time in four months during Sep ’15, finishing 5,000 head below the previous month. The total U.S. milk cow herd currently stands at 9,310,000 head, which remains 36,000 head more than September of last year.

Overall, the U.S. milk cow herd declined MOM for the third time in four months during Sep ’15, finishing 5,000 head below the previous month. The total U.S. milk cow herd currently stands at 9,310,000 head, which remains 36,000 head more than September of last year.

The U.S. milk per cow yield was up 0.1% YOY, increasing to 1,782 lbs, the largest on record for the month of September. Milk per cow yields continue to trend higher YOY in the Midwest while declining in the Western United States. Milk per cow yields increased by an average of 1.6% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 1.3% YOY on average within California, Idaho, Washington and Oregon.

The U.S. milk per cow yield was up 0.1% YOY, increasing to 1,782 lbs, the largest on record for the month of September. Milk per cow yields continue to trend higher YOY in the Midwest while declining in the Western United States. Milk per cow yields increased by an average of 1.6% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 1.3% YOY on average within California, Idaho, Washington and Oregon.

Wisconsin milk per cow yields increased to a new 63 year high relative to California milk per cow yields during Sep ’15 while finishing higher than California yields on an absolute basis for the third consecutive month.

Wisconsin milk per cow yields increased to a new 63 year high relative to California milk per cow yields during Sep ’15 while finishing higher than California yields on an absolute basis for the third consecutive month.

Milk cow herds declined MOM in Iowa (-1,000 head), Vermont (-1,000 head) and Virginia (-1,000 head) but increased in Indiana (+2,000 head) and New York (+1,000 head).

Milk cow herds declined MOM in Iowa (-1,000 head), Vermont (-1,000 head) and Virginia (-1,000 head) but increased in Indiana (+2,000 head) and New York (+1,000 head).

YOY increases in milk cow herds continue to be led by Michigan (+14,000 head), followed by South Dakota (+10,000 head), Wisconsin (+8,000 head) and Idaho (+7,000 head). Texas (-8,000 head), Virginia, (-3,000 head), California (-1,000 head), Oregon (-1,000 head), Ohio (-1,000 head) and Vermont (-1,000 head) experienced YOY reductions in their milk cow herds.

YOY increases in milk cow herds continue to be led by Michigan (+14,000 head), followed by South Dakota (+10,000 head), Wisconsin (+8,000 head) and Idaho (+7,000 head). Texas (-8,000 head), Virginia, (-3,000 head), California (-1,000 head), Oregon (-1,000 head), Ohio (-1,000 head) and Vermont (-1,000 head) experienced YOY reductions in their milk cow herds.