U.S. Milk Production Update – Apr ’16

Executive Summary

U.S. milk production figures provided by USDA were recently updated with values spanning through Mar ’16. Highlights from the updated report include:

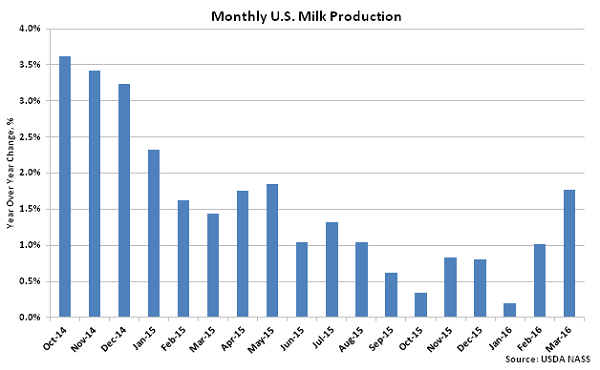

• U.S. milk production remained higher on a YOY basis for the 27th consecutive month during Mar ’16, finishing up 1.8%. The YOY growth rate was a ten month high on a percentage basis.

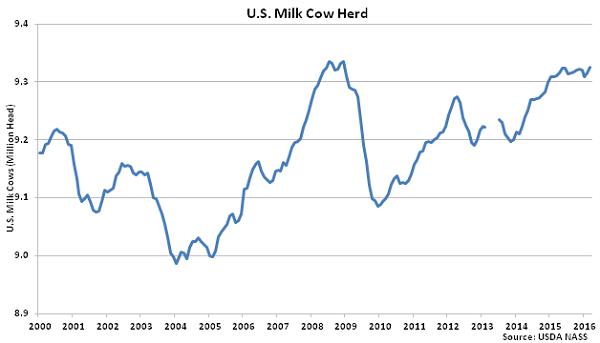

• The U.S. dairy cow herd increased by 10,000 head throughout Mar ’16, finishing at the highest figure on record experienced since Dec ’08.

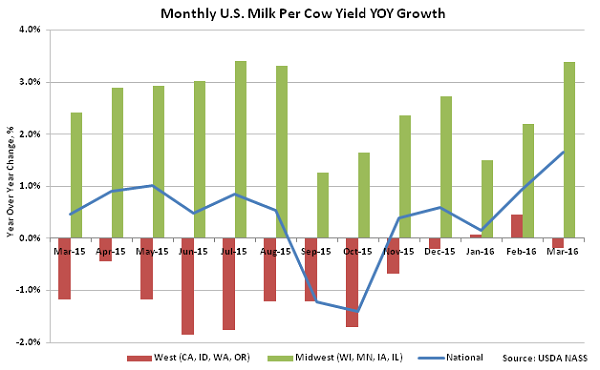

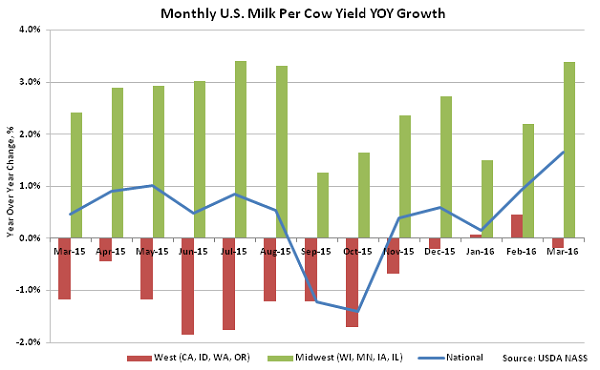

• U.S. milk per cow yields increased on a YOY basis for the fifth consecutive month during Mar ’16 as growth in Midwestern yields offset YOY declines in yields experienced throughout the Western United States.

Additional Report Details

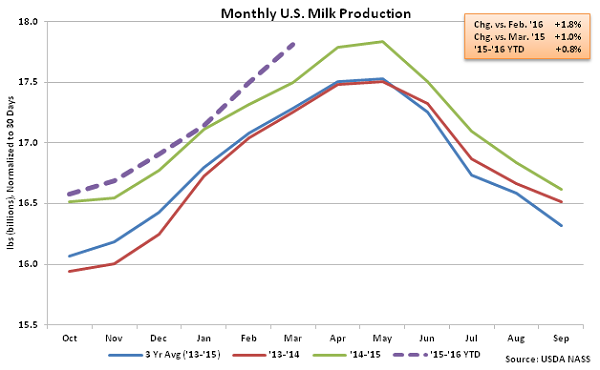

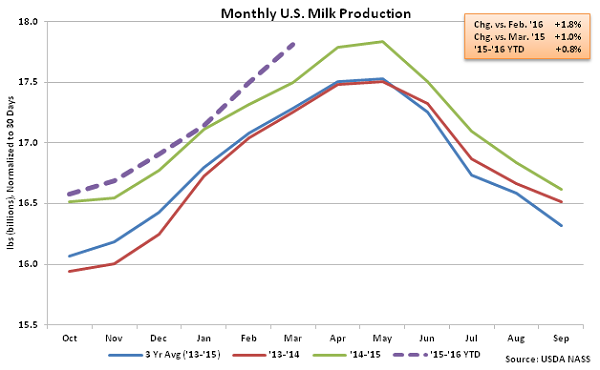

According to USDA, Mar ’16 U.S. milk production was up 1.8% YOY, at 18.4 billion pounds, setting a new March production record. U.S. milk production has increased YOY for 27 consecutive months through March. Production also increased MOM, finishing 1.8% higher on a daily average basis. The MOM increase in production was higher than the ten year average February – March seasonal increase of 1.4%.

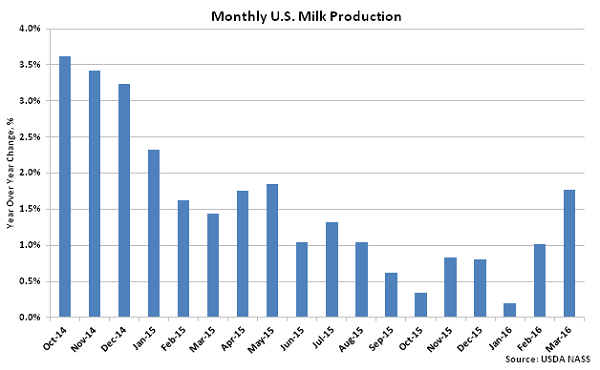

U.S. milk production remained significantly higher on a YOY basis throughout the final months of 2014, however production growth decelerated over the majority of 2015. The Mar ’16 YOY growth rate of 1.8% was the highest experienced in the past ten months but remained slightly below the ’14-’15 annual growth rate of 1.9%.

U.S. milk production remained significantly higher on a YOY basis throughout the final months of 2014, however production growth decelerated over the majority of 2015. The Mar ’16 YOY growth rate of 1.8% was the highest experienced in the past ten months but remained slightly below the ’14-’15 annual growth rate of 1.9%.

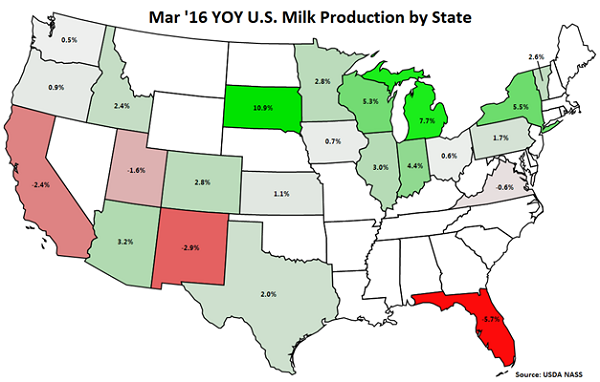

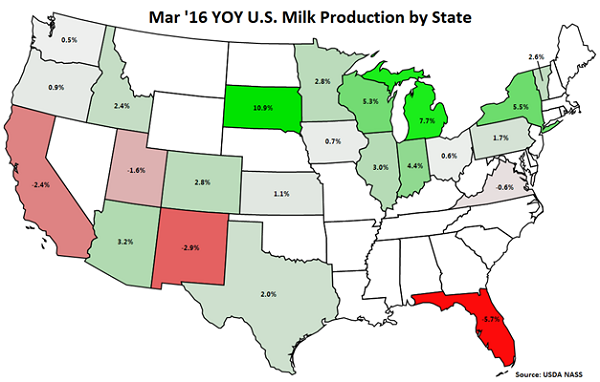

YOY production gains on a percentage basis continue to be led by South Dakota (+10.9%), followed by Michigan (+7.7%), New York (+5.5%) and Wisconsin (+5.3%). California milk production declined YOY for the 15th consecutive month, finishing 2.4% lower, while production in Florida, New Mexico, Utah and Virginia also finished below the previous year. California, Florida and Utah experienced lower YOY milk per cow yields during Mar ’16 while California, Utah and Virginia experienced YOY reductions in their milk cow herds throughout the month.

YOY production gains on a percentage basis continue to be led by South Dakota (+10.9%), followed by Michigan (+7.7%), New York (+5.5%) and Wisconsin (+5.3%). California milk production declined YOY for the 15th consecutive month, finishing 2.4% lower, while production in Florida, New Mexico, Utah and Virginia also finished below the previous year. California, Florida and Utah experienced lower YOY milk per cow yields during Mar ’16 while California, Utah and Virginia experienced YOY reductions in their milk cow herds throughout the month.

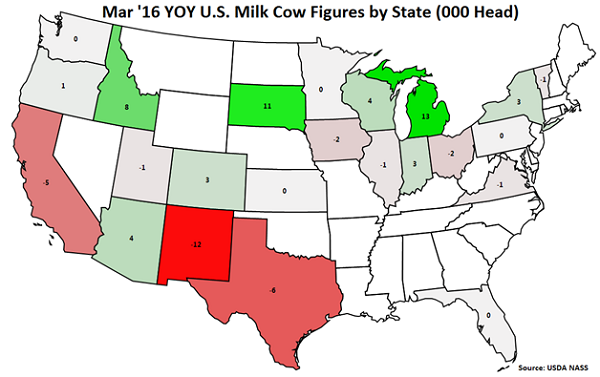

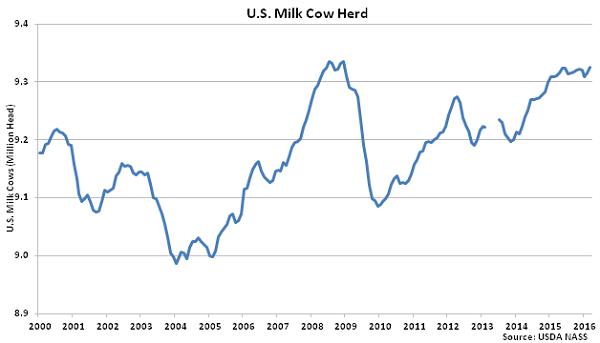

Overall, the U.S. milk cow herd increased by 10,000 head MOM during Mar ’16, reaching the highest figure on record experienced since Dec ’08. The total U.S. milk cow herd currently stands at 9,325,000 head, which is 14,000 head more than March of last year.

Overall, the U.S. milk cow herd increased by 10,000 head MOM during Mar ’16, reaching the highest figure on record experienced since Dec ’08. The total U.S. milk cow herd currently stands at 9,325,000 head, which is 14,000 head more than March of last year.

The U.S. milk per cow yield increased YOY for the fifth consecutive month, finishing 1.6% higher than the previous year. Milk per cow yields continue to trend higher YOY in the Midwest, more than offsetting declining milk per cow yields in the Western United States. Milk per cow yields increased by an average of 3.4% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 0.2% YOY on average within California, Idaho, Washington and Oregon.

The U.S. milk per cow yield increased YOY for the fifth consecutive month, finishing 1.6% higher than the previous year. Milk per cow yields continue to trend higher YOY in the Midwest, more than offsetting declining milk per cow yields in the Western United States. Milk per cow yields increased by an average of 3.4% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 0.2% YOY on average within California, Idaho, Washington and Oregon.

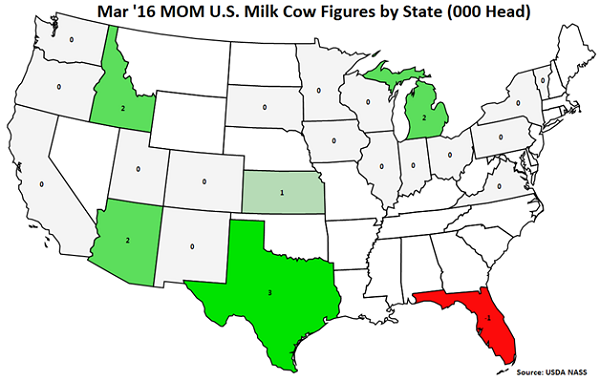

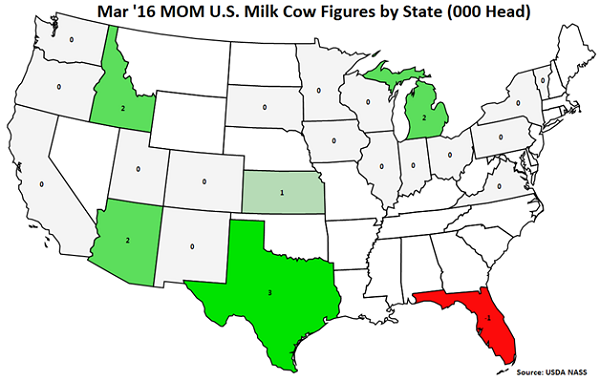

MOM increases in the milk cow herd were experienced in Texas (+3,000 head), Idaho (+2,000 head), Michigan (+2,000 head), Arizona (+2,000 head) and Kansas (+1,000 head). Florida experienced a MOM decline of 1,000 head during Mar ’16.

MOM increases in the milk cow herd were experienced in Texas (+3,000 head), Idaho (+2,000 head), Michigan (+2,000 head), Arizona (+2,000 head) and Kansas (+1,000 head). Florida experienced a MOM decline of 1,000 head during Mar ’16.

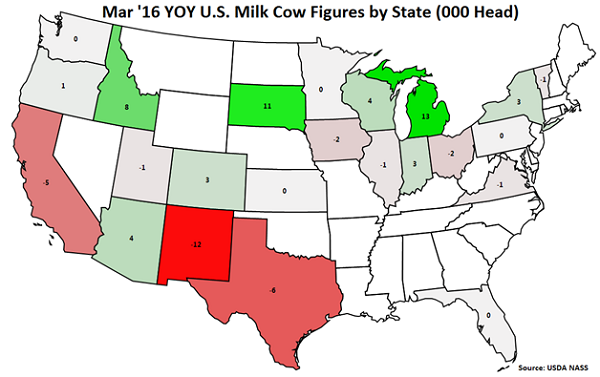

YOY increases in milk cow herds were led by Michigan (+13,000 head), followed by South Dakota (+11,000 head) and Idaho (+8,000 head). New Mexico (-12,000 head), Texas (-6,000 head) and California (-5,000 head) experienced the largest YOY reductions in their milk cow herds throughout the month.

YOY increases in milk cow herds were led by Michigan (+13,000 head), followed by South Dakota (+11,000 head) and Idaho (+8,000 head). New Mexico (-12,000 head), Texas (-6,000 head) and California (-5,000 head) experienced the largest YOY reductions in their milk cow herds throughout the month.

U.S. milk production remained significantly higher on a YOY basis throughout the final months of 2014, however production growth decelerated over the majority of 2015. The Mar ’16 YOY growth rate of 1.8% was the highest experienced in the past ten months but remained slightly below the ’14-’15 annual growth rate of 1.9%.

U.S. milk production remained significantly higher on a YOY basis throughout the final months of 2014, however production growth decelerated over the majority of 2015. The Mar ’16 YOY growth rate of 1.8% was the highest experienced in the past ten months but remained slightly below the ’14-’15 annual growth rate of 1.9%.

YOY production gains on a percentage basis continue to be led by South Dakota (+10.9%), followed by Michigan (+7.7%), New York (+5.5%) and Wisconsin (+5.3%). California milk production declined YOY for the 15th consecutive month, finishing 2.4% lower, while production in Florida, New Mexico, Utah and Virginia also finished below the previous year. California, Florida and Utah experienced lower YOY milk per cow yields during Mar ’16 while California, Utah and Virginia experienced YOY reductions in their milk cow herds throughout the month.

YOY production gains on a percentage basis continue to be led by South Dakota (+10.9%), followed by Michigan (+7.7%), New York (+5.5%) and Wisconsin (+5.3%). California milk production declined YOY for the 15th consecutive month, finishing 2.4% lower, while production in Florida, New Mexico, Utah and Virginia also finished below the previous year. California, Florida and Utah experienced lower YOY milk per cow yields during Mar ’16 while California, Utah and Virginia experienced YOY reductions in their milk cow herds throughout the month.

Overall, the U.S. milk cow herd increased by 10,000 head MOM during Mar ’16, reaching the highest figure on record experienced since Dec ’08. The total U.S. milk cow herd currently stands at 9,325,000 head, which is 14,000 head more than March of last year.

Overall, the U.S. milk cow herd increased by 10,000 head MOM during Mar ’16, reaching the highest figure on record experienced since Dec ’08. The total U.S. milk cow herd currently stands at 9,325,000 head, which is 14,000 head more than March of last year.

The U.S. milk per cow yield increased YOY for the fifth consecutive month, finishing 1.6% higher than the previous year. Milk per cow yields continue to trend higher YOY in the Midwest, more than offsetting declining milk per cow yields in the Western United States. Milk per cow yields increased by an average of 3.4% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 0.2% YOY on average within California, Idaho, Washington and Oregon.

The U.S. milk per cow yield increased YOY for the fifth consecutive month, finishing 1.6% higher than the previous year. Milk per cow yields continue to trend higher YOY in the Midwest, more than offsetting declining milk per cow yields in the Western United States. Milk per cow yields increased by an average of 3.4% YOY within Wisconsin, Minnesota, Iowa and Illinois while yields declined 0.2% YOY on average within California, Idaho, Washington and Oregon.

MOM increases in the milk cow herd were experienced in Texas (+3,000 head), Idaho (+2,000 head), Michigan (+2,000 head), Arizona (+2,000 head) and Kansas (+1,000 head). Florida experienced a MOM decline of 1,000 head during Mar ’16.

MOM increases in the milk cow herd were experienced in Texas (+3,000 head), Idaho (+2,000 head), Michigan (+2,000 head), Arizona (+2,000 head) and Kansas (+1,000 head). Florida experienced a MOM decline of 1,000 head during Mar ’16.

YOY increases in milk cow herds were led by Michigan (+13,000 head), followed by South Dakota (+11,000 head) and Idaho (+8,000 head). New Mexico (-12,000 head), Texas (-6,000 head) and California (-5,000 head) experienced the largest YOY reductions in their milk cow herds throughout the month.

YOY increases in milk cow herds were led by Michigan (+13,000 head), followed by South Dakota (+11,000 head) and Idaho (+8,000 head). New Mexico (-12,000 head), Texas (-6,000 head) and California (-5,000 head) experienced the largest YOY reductions in their milk cow herds throughout the month.