Planting Progress Update – 6/6/16

According to USDA, corn planting progress finished slightly ahead of last year’s pace and five year average levels through the week ending Jun 5th while soybean planting progress also remained ahead of both last year’s pace and five year average levels. Emergence rates for both corn and soybeans have trended above previous year figures through the week ending Jun 5th while conditions have remained fairly consistent with previous year figures.

Corn:

Corn plantings as of the week ending Jun 5th were 99% complete, finishing 1% ahead of last year’s pace and 2% ahead of the five year average pace.

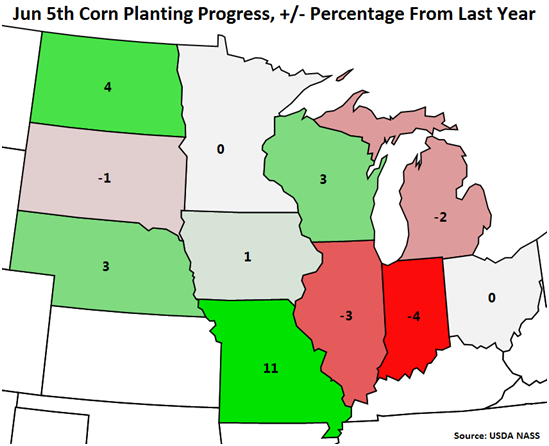

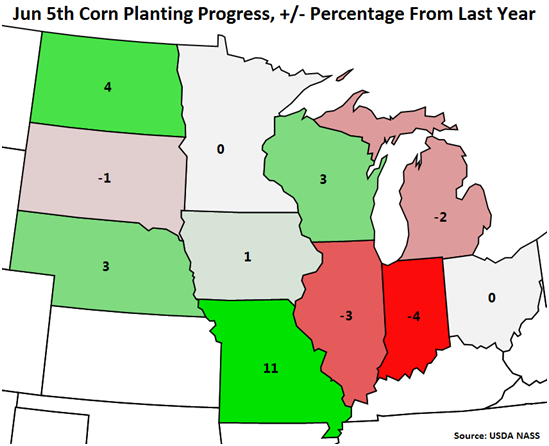

Of the major corn planting states, plantings trended above the previous year most significantly in Missouri, North Dakota, Wisconsin and Nebraska while trailing the previous year on a YOY basis most significantly in Indiana and Illinois.

Of the major corn planting states, plantings trended above the previous year most significantly in Missouri, North Dakota, Wisconsin and Nebraska while trailing the previous year on a YOY basis most significantly in Indiana and Illinois.

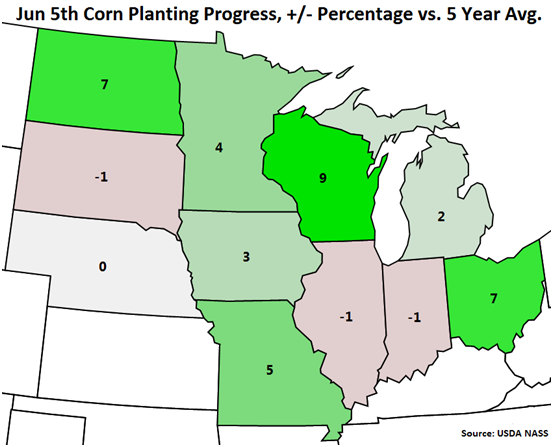

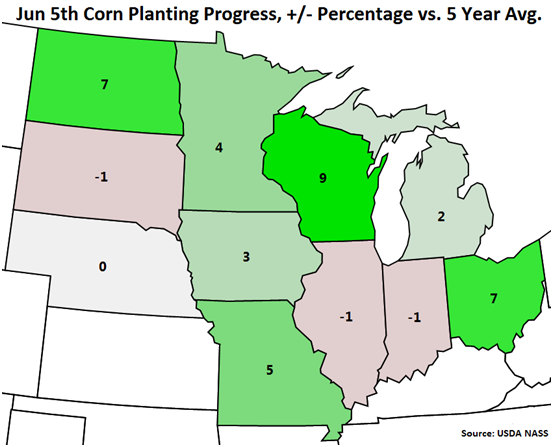

Corn plantings were most significantly higher when compared to five year average figures within Wisconsin, North Dakota and Ohio, while finishing slightly lower when compared to five year average figures within Illinois, Indiana and South Dakota.

Corn plantings were most significantly higher when compared to five year average figures within Wisconsin, North Dakota and Ohio, while finishing slightly lower when compared to five year average figures within Illinois, Indiana and South Dakota.

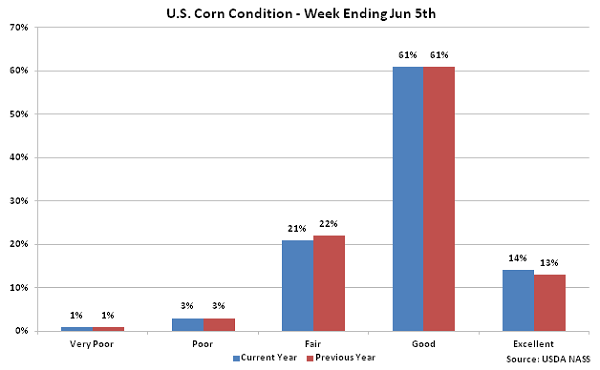

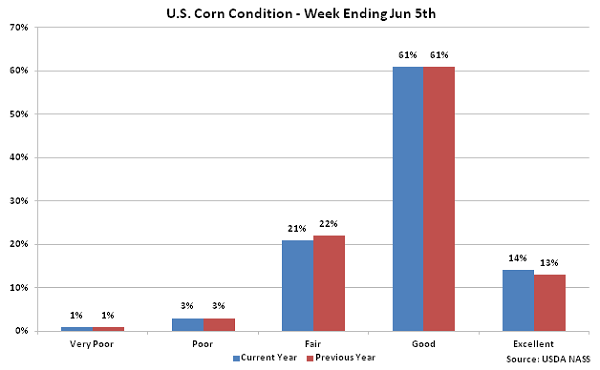

Corn emergence for the week ending Jun 5th was reported at 90% compared to an 89% emergence rate experienced last year and a five year average emergence rate of 86%. Three quarters of the corn crop was deemed good or excellent during the week ending Jun 5th, with 21% of the corn crop identified as fair. These figures were consistent with previous year figures.

Corn emergence for the week ending Jun 5th was reported at 90% compared to an 89% emergence rate experienced last year and a five year average emergence rate of 86%. Three quarters of the corn crop was deemed good or excellent during the week ending Jun 5th, with 21% of the corn crop identified as fair. These figures were consistent with previous year figures.

Soybeans:

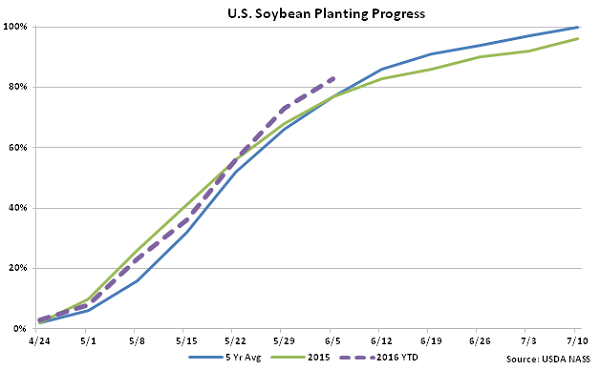

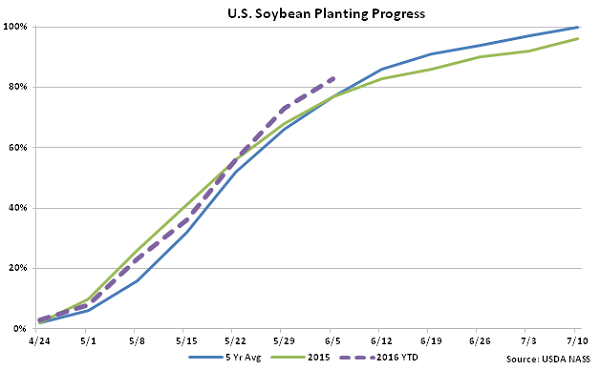

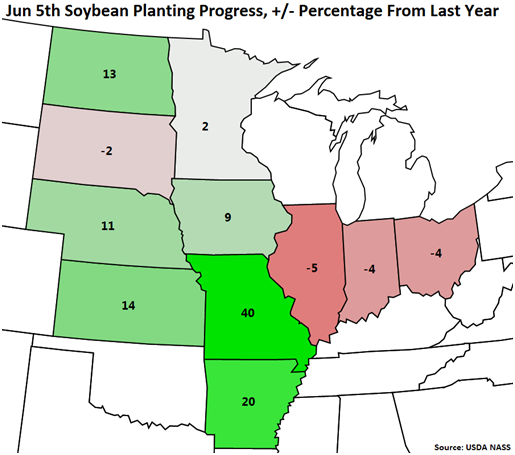

Soybean plantings as of the week ending Jun 5th were 83% complete, ahead of last year’s pace of 77% and the five year average pace of 77%.

Soybeans:

Soybean plantings as of the week ending Jun 5th were 83% complete, ahead of last year’s pace of 77% and the five year average pace of 77%.

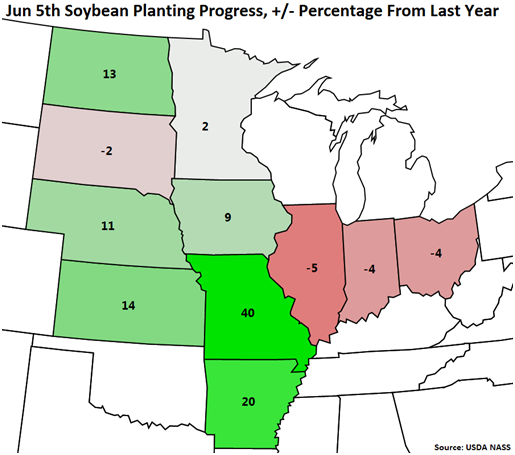

Of the major soybean planting states, plantings trended above the previous year most significantly in Missouri and Arkansas while trailing the previous year on a YOY basis most significantly in Illinois, Indiana and Ohio.

Of the major soybean planting states, plantings trended above the previous year most significantly in Missouri and Arkansas while trailing the previous year on a YOY basis most significantly in Illinois, Indiana and Ohio.

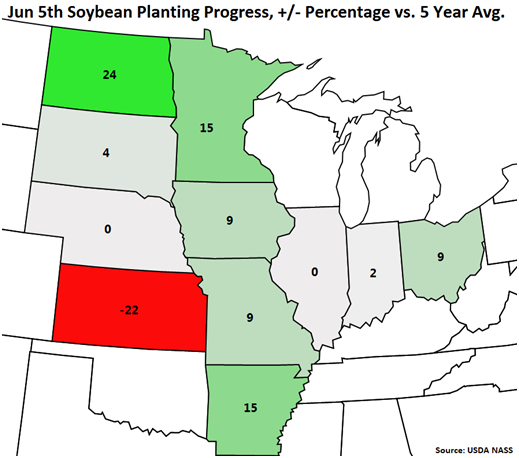

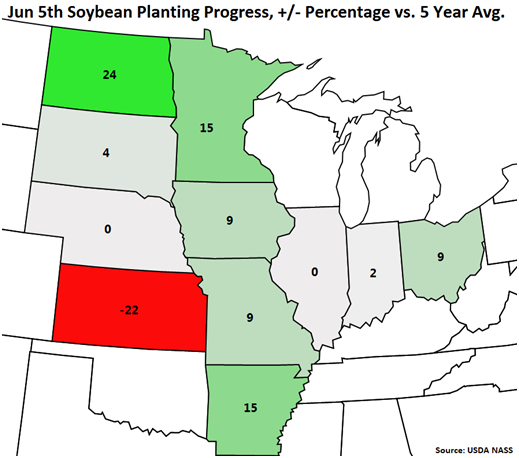

Soybean plantings were most significantly higher when compared to five year average figures within North Dakota, Minnesota and Arkansas, while finishing most significantly lower when compared to five year average figures within Kansas.

Soybean plantings were most significantly higher when compared to five year average figures within North Dakota, Minnesota and Arkansas, while finishing most significantly lower when compared to five year average figures within Kansas.

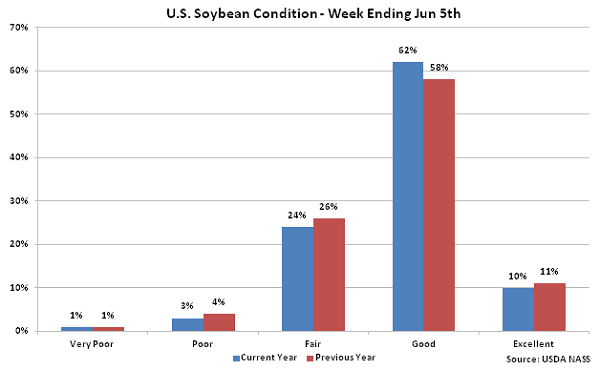

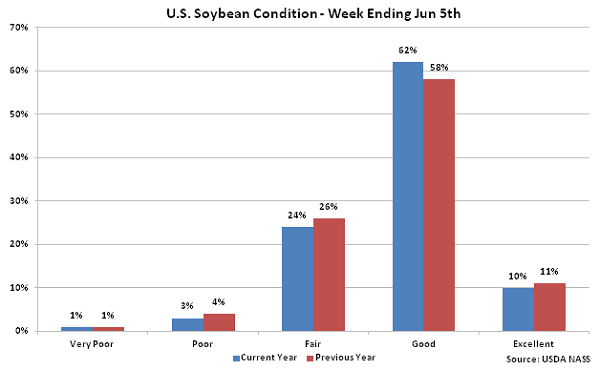

Soybean emergence for the week ending Jun 5th was reported at 65% compared to a 60% emergence rate experienced last year and a five year average emergence rate of 57%. Nearly three quarters of the soybean crop was deemed good or excellent during the week ending Jun 5th, with 24% of the soybean crop identified as fair. These figures were fairly consistent with previous year figures.

Soybean emergence for the week ending Jun 5th was reported at 65% compared to a 60% emergence rate experienced last year and a five year average emergence rate of 57%. Nearly three quarters of the soybean crop was deemed good or excellent during the week ending Jun 5th, with 24% of the soybean crop identified as fair. These figures were fairly consistent with previous year figures.

Of the major corn planting states, plantings trended above the previous year most significantly in Missouri, North Dakota, Wisconsin and Nebraska while trailing the previous year on a YOY basis most significantly in Indiana and Illinois.

Of the major corn planting states, plantings trended above the previous year most significantly in Missouri, North Dakota, Wisconsin and Nebraska while trailing the previous year on a YOY basis most significantly in Indiana and Illinois.

Corn plantings were most significantly higher when compared to five year average figures within Wisconsin, North Dakota and Ohio, while finishing slightly lower when compared to five year average figures within Illinois, Indiana and South Dakota.

Corn plantings were most significantly higher when compared to five year average figures within Wisconsin, North Dakota and Ohio, while finishing slightly lower when compared to five year average figures within Illinois, Indiana and South Dakota.

Corn emergence for the week ending Jun 5th was reported at 90% compared to an 89% emergence rate experienced last year and a five year average emergence rate of 86%. Three quarters of the corn crop was deemed good or excellent during the week ending Jun 5th, with 21% of the corn crop identified as fair. These figures were consistent with previous year figures.

Corn emergence for the week ending Jun 5th was reported at 90% compared to an 89% emergence rate experienced last year and a five year average emergence rate of 86%. Three quarters of the corn crop was deemed good or excellent during the week ending Jun 5th, with 21% of the corn crop identified as fair. These figures were consistent with previous year figures.

Soybeans:

Soybean plantings as of the week ending Jun 5th were 83% complete, ahead of last year’s pace of 77% and the five year average pace of 77%.

Soybeans:

Soybean plantings as of the week ending Jun 5th were 83% complete, ahead of last year’s pace of 77% and the five year average pace of 77%.

Of the major soybean planting states, plantings trended above the previous year most significantly in Missouri and Arkansas while trailing the previous year on a YOY basis most significantly in Illinois, Indiana and Ohio.

Of the major soybean planting states, plantings trended above the previous year most significantly in Missouri and Arkansas while trailing the previous year on a YOY basis most significantly in Illinois, Indiana and Ohio.

Soybean plantings were most significantly higher when compared to five year average figures within North Dakota, Minnesota and Arkansas, while finishing most significantly lower when compared to five year average figures within Kansas.

Soybean plantings were most significantly higher when compared to five year average figures within North Dakota, Minnesota and Arkansas, while finishing most significantly lower when compared to five year average figures within Kansas.

Soybean emergence for the week ending Jun 5th was reported at 65% compared to a 60% emergence rate experienced last year and a five year average emergence rate of 57%. Nearly three quarters of the soybean crop was deemed good or excellent during the week ending Jun 5th, with 24% of the soybean crop identified as fair. These figures were fairly consistent with previous year figures.

Soybean emergence for the week ending Jun 5th was reported at 65% compared to a 60% emergence rate experienced last year and a five year average emergence rate of 57%. Nearly three quarters of the soybean crop was deemed good or excellent during the week ending Jun 5th, with 24% of the soybean crop identified as fair. These figures were fairly consistent with previous year figures.