Grain & Oilseeds WASDE Update – Sep ’19

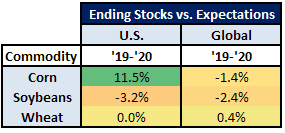

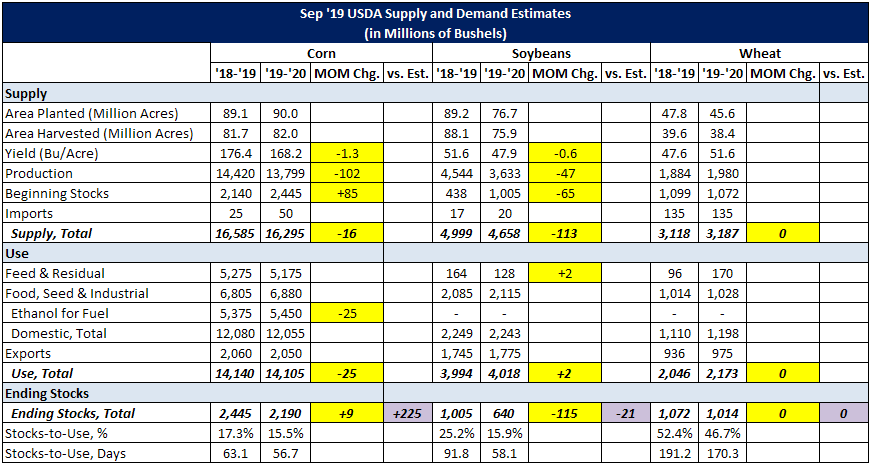

Corn – U.S. Ending Stocks Significantly Above Private Estimates, Global Stocks Below Expectations

Corn – U.S. Ending Stocks Significantly Above Private Estimates, Global Stocks Below Expectations

- ’19-’20 U.S. ending stocks of 2.190 billion bushels significantly above expectations

- ’19-’20 global ending stocks of 306.3 million MT below expectations

- ’19-’20 U.S. ending stocks of 640 million bushels below expectations

- ’19-’20 global ending stocks of 99.2 million MT below expectations

- ’19-’20 U.S. ending stocks of 1.014 billion bushels consistent with expectations

- ’19-’20 global ending stocks of 286.5 million MT slightly above expectations