Quarterly Hog and Pig Report Summary – Sep ’19

Executive Summary

Quarterly U.S. hog and pig figures provided by USDA were recently updated with values spanning through Sep ’19. Highlights from the updated report include:

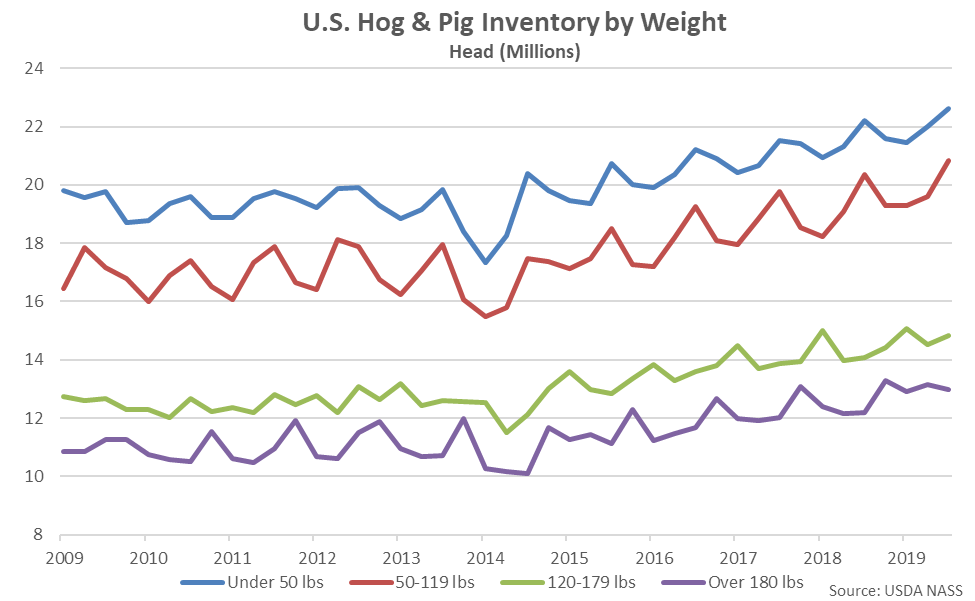

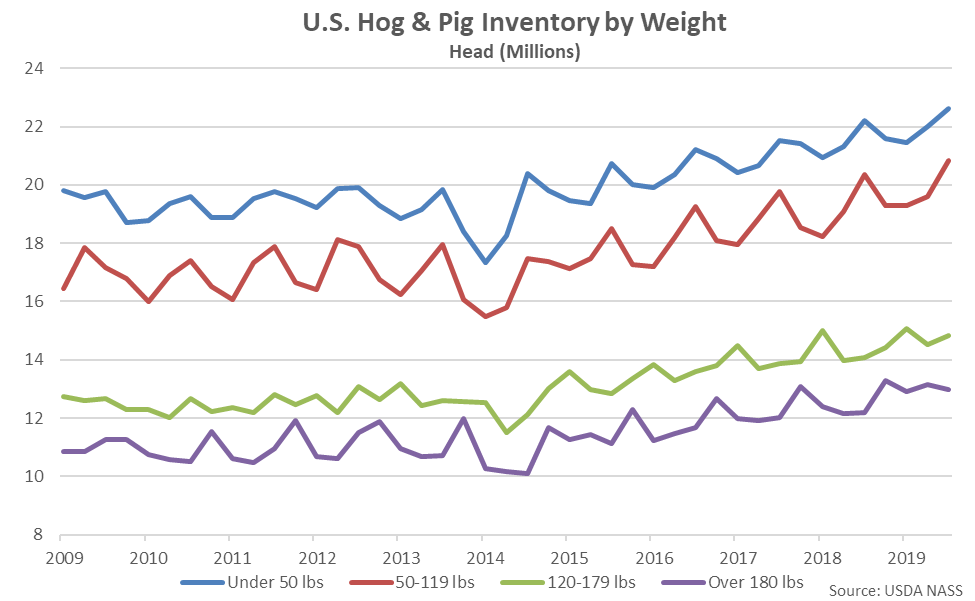

On a YOY basis, Sep ’19 hog and pig inventories weighing less than 120 pounds increased 2.5% YOY while those weighing 120 pounds or more finished 5.8% above the previous year levels. The YOY increase in inventories weighing 120 pounds or more was the second largest experienced throughout the past 16 quarters on a percentage basis.

On a YOY basis, Sep ’19 hog and pig inventories weighing less than 120 pounds increased 2.5% YOY while those weighing 120 pounds or more finished 5.8% above the previous year levels. The YOY increase in inventories weighing 120 pounds or more was the second largest experienced throughout the past 16 quarters on a percentage basis.

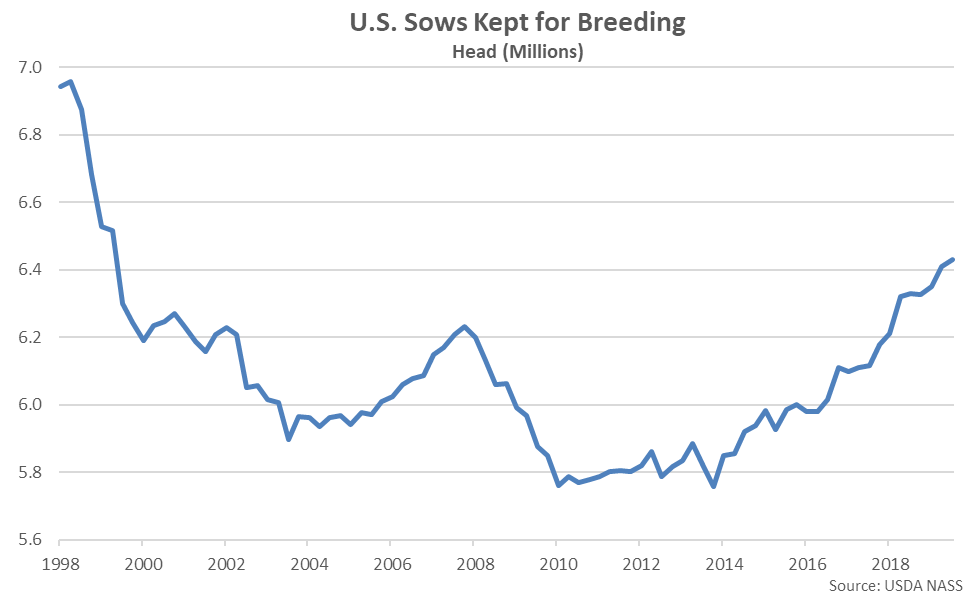

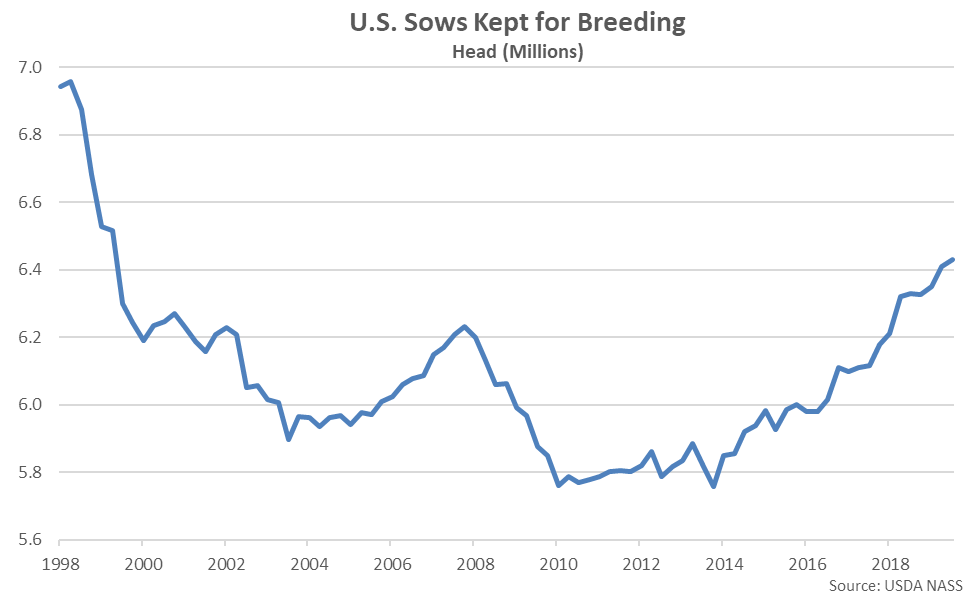

Sep ’19 sows kept for breeding increased 0.3% from the previous quarter while also remaining higher on a YOY basis, finishing up 1.6% to a 20 year high level. Sows kept for breeding have increased on a YOY basis over 21 consecutive quarters through Sep ’19. Sows kept for breeding finished 0.2% above average analyst expectations.

Sep ’19 sows kept for breeding increased 0.3% from the previous quarter while also remaining higher on a YOY basis, finishing up 1.6% to a 20 year high level. Sows kept for breeding have increased on a YOY basis over 21 consecutive quarters through Sep ’19. Sows kept for breeding finished 0.2% above average analyst expectations.

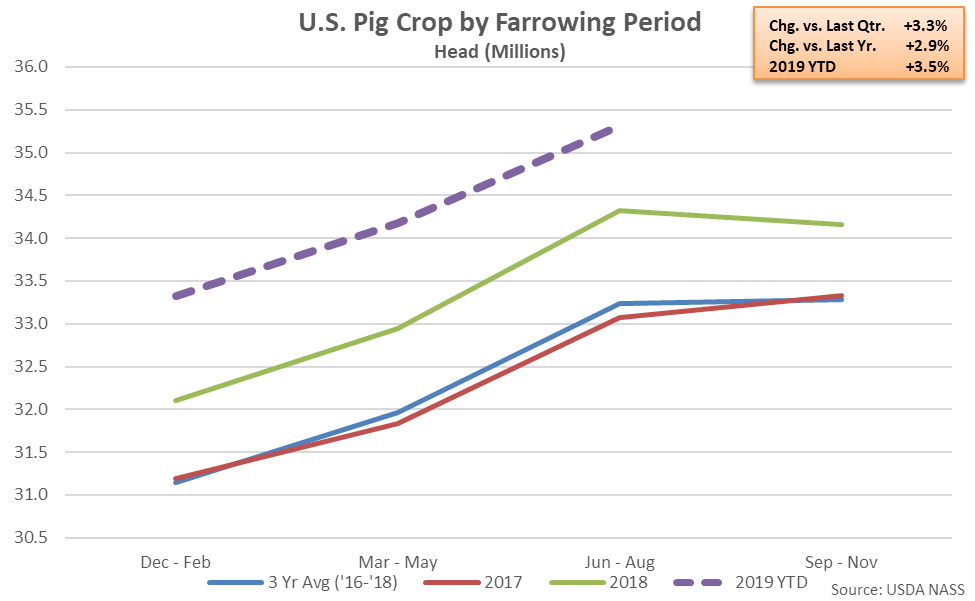

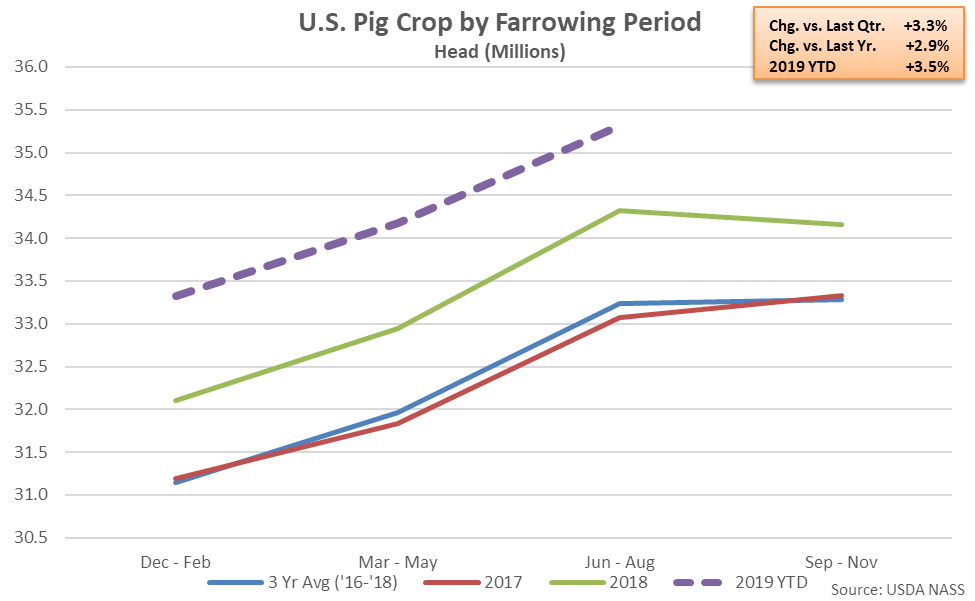

The Jun ’19 – Aug ’19 pig crop increased 3.3% from the previous quarter while remaining 2.9% higher YOY, finishing at a record high level. The 3.3% seasonal increase in the pig crop was smaller than the five year average seasonal build of 5.7%, however.

The Jun ’19 – Aug ’19 pig crop increased 3.3% from the previous quarter while remaining 2.9% higher YOY, finishing at a record high level. The 3.3% seasonal increase in the pig crop was smaller than the five year average seasonal build of 5.7%, however.

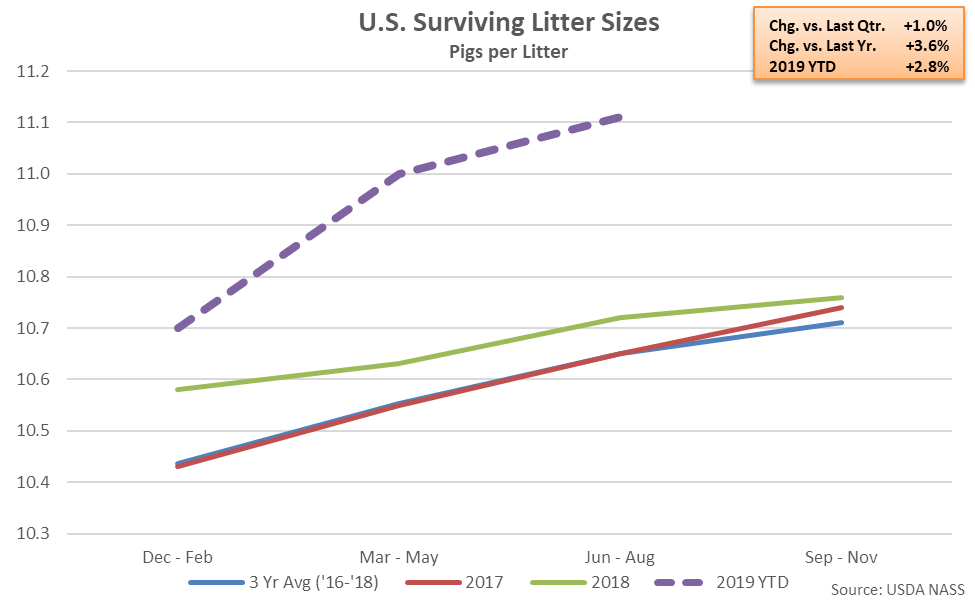

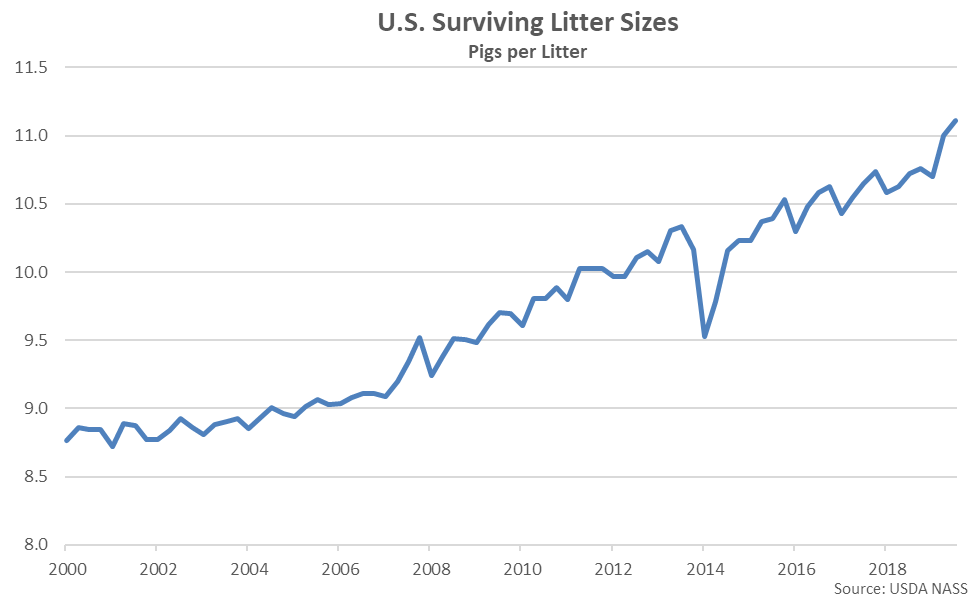

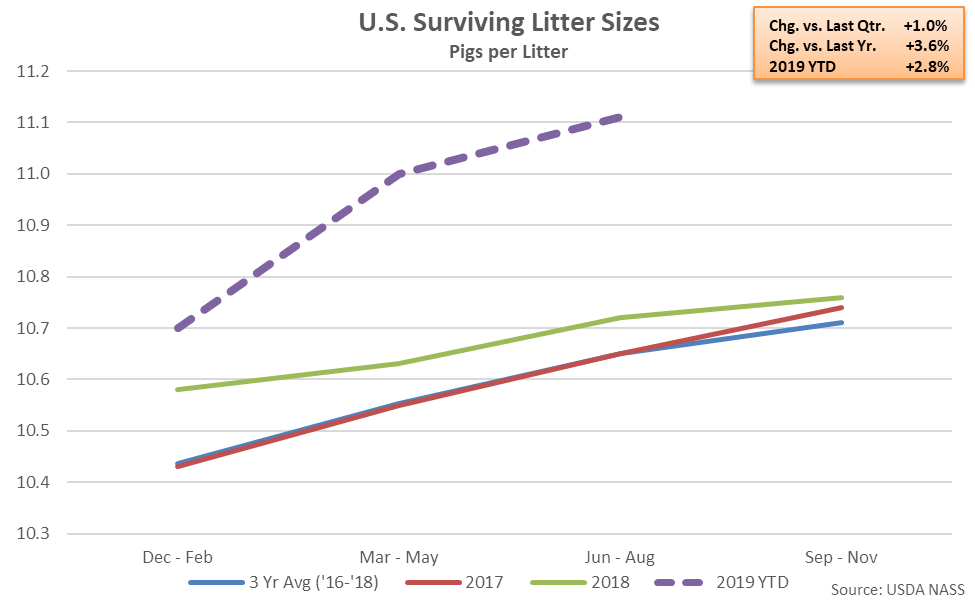

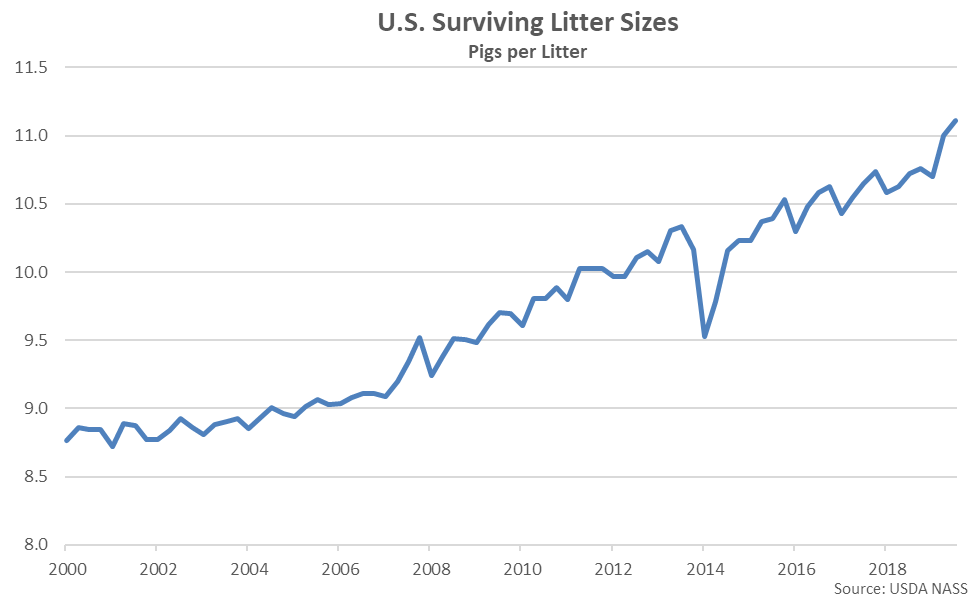

Jun ’19 – Aug ’19 surviving litter sizes increased 1.0% from the previous quarter while remaining 3.6% higher YOY, reaching a record high level. The quarterly YOY increase in surviving litter sizes was the 20th experienced in a row and the largest experienced throughout the past 17 quarters on a percentage basis. The seasonal increase in weaned pigs saved per litter of 1.0% was slightly smaller than the five year average seasonal build of 1.4%, however. Surviving litter sizes finished 1.2% above average analyst expectations.

Jun ’19 – Aug ’19 surviving litter sizes increased 1.0% from the previous quarter while remaining 3.6% higher YOY, reaching a record high level. The quarterly YOY increase in surviving litter sizes was the 20th experienced in a row and the largest experienced throughout the past 17 quarters on a percentage basis. The seasonal increase in weaned pigs saved per litter of 1.0% was slightly smaller than the five year average seasonal build of 1.4%, however. Surviving litter sizes finished 1.2% above average analyst expectations.

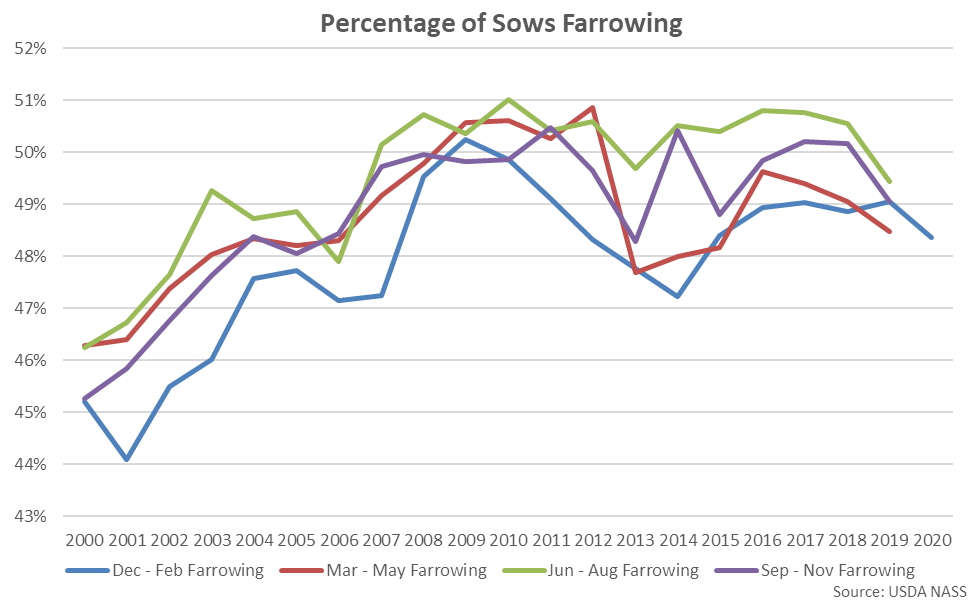

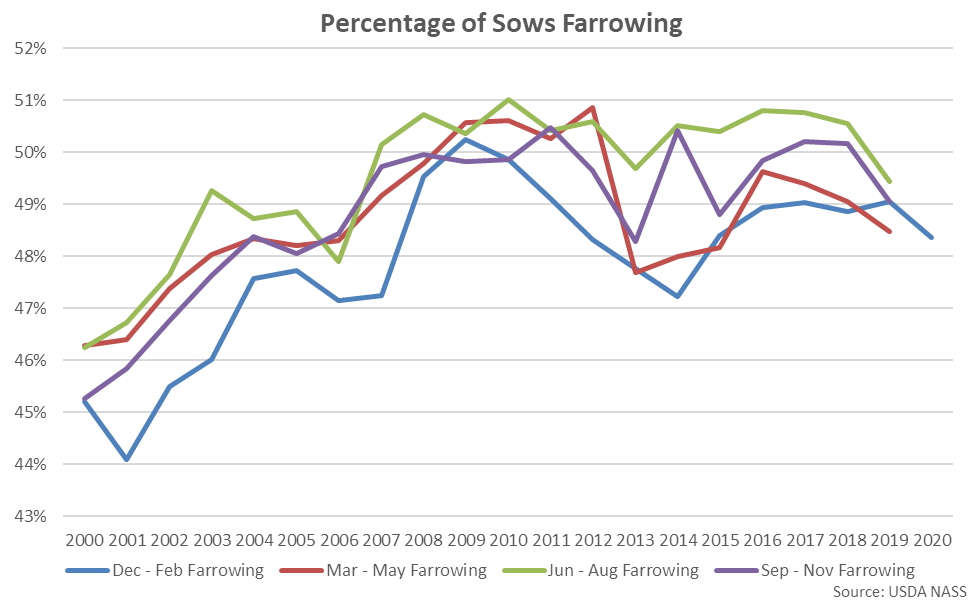

Jun ’19 – Aug ’19 farrowing rates declined 2.2% YOY while farrowing intentions are expected to decline 2.2% YOY throughout the Sep ’19 – Nov ’19 period and 1.4% throughout the Dec ’19 – Feb ’20 period. Sows farrowing during the June – August period represented 49.4% of the breeding herd.

Jun ’19 – Aug ’19 farrowing rates declined 2.2% YOY while farrowing intentions are expected to decline 2.2% YOY throughout the Sep ’19 – Nov ’19 period and 1.4% throughout the Dec ’19 – Feb ’20 period. Sows farrowing during the June – August period represented 49.4% of the breeding herd.

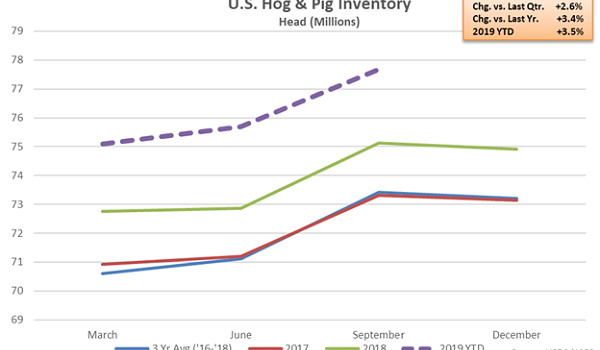

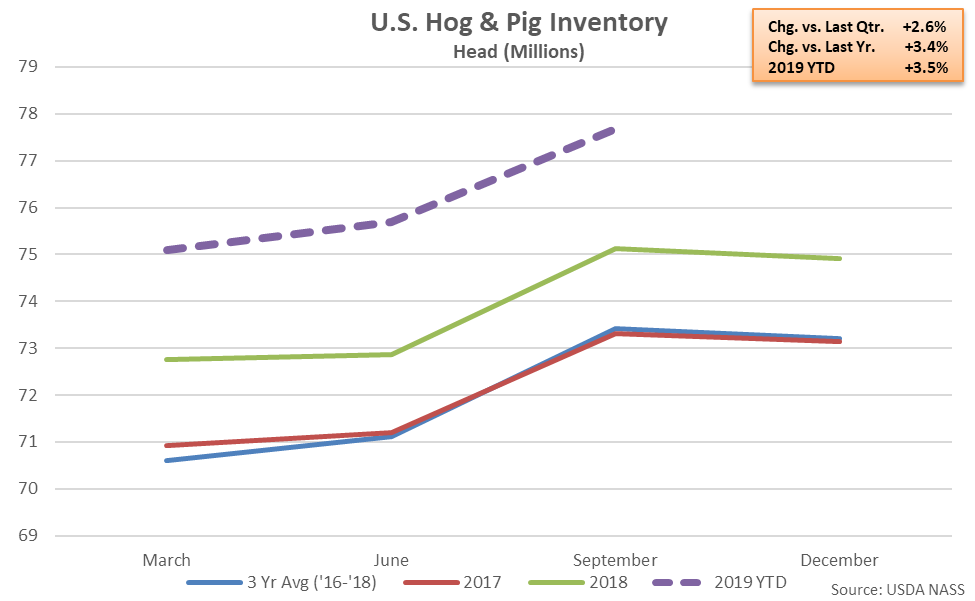

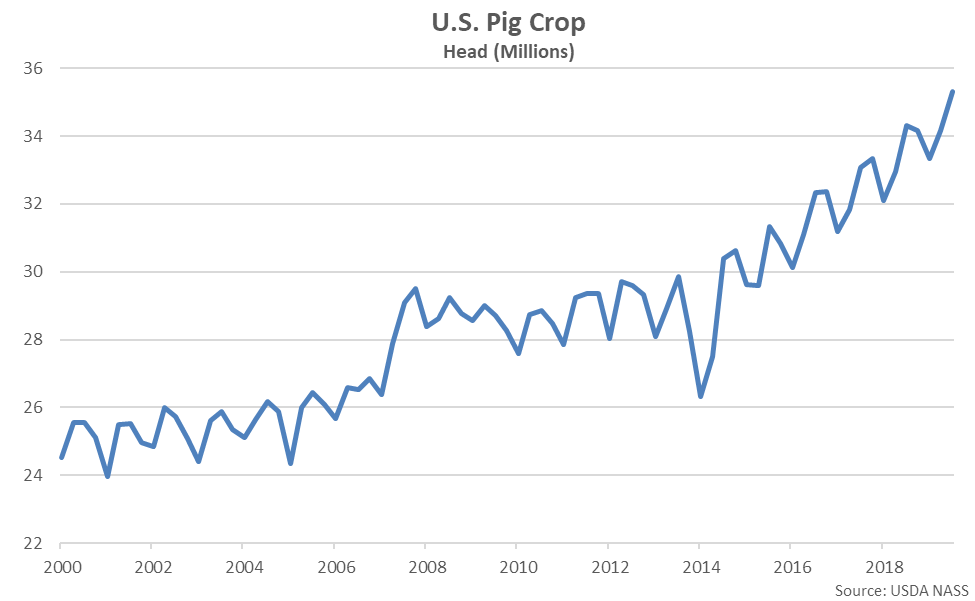

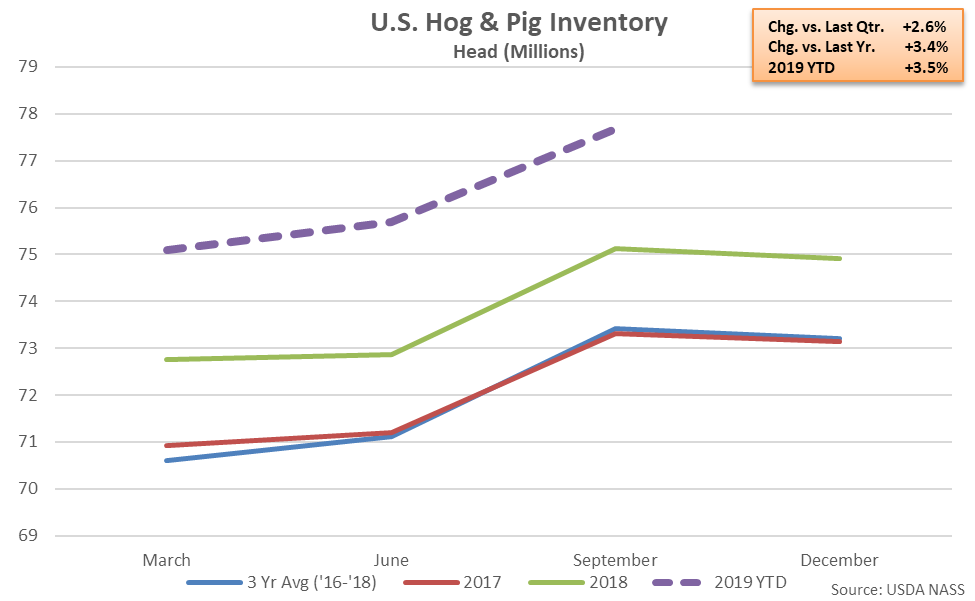

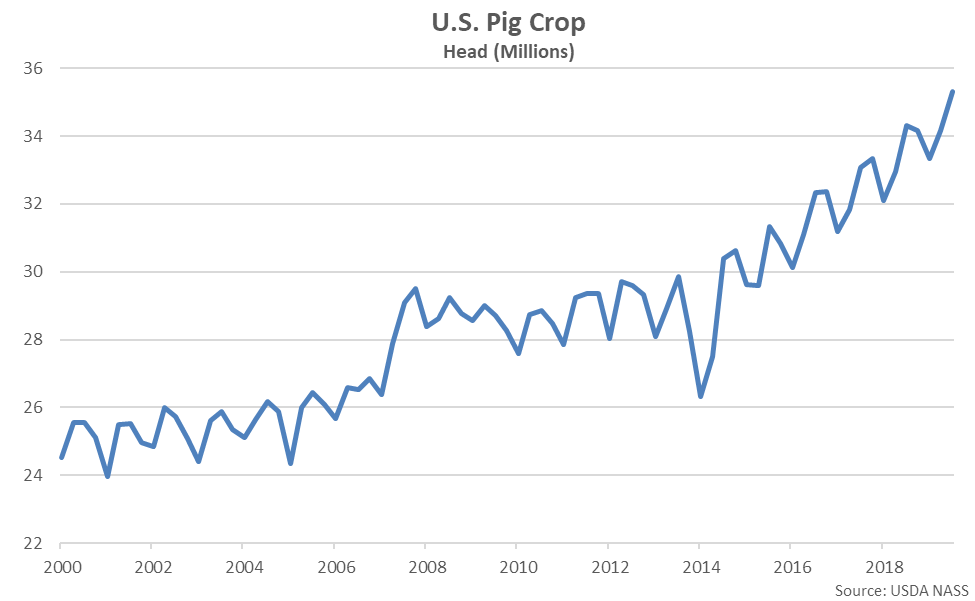

- The U.S. pig inventory remained higher on a YOY basis for the 20th consecutive quarter during Sep ’19, finishing 3.4% above the previous year and reaching a record high level. Pig inventory figures finished 0.5% above average analyst expectations.

- U.S. sows kept for breeding increased 1.6% YOY, finishing at a 20 year high level. Sows kept for breeding finished 0.2% above average analyst expectations.

- U.S. farrowing rates for the Jun ’19 – Aug ’19 period declined 2.2% YOY while farrowing intentions are expected to decline 2.2% throughout the Sep ’19 – Nov ’19 period and 1.4% throughout the Dec ’19 – Feb ’20 period.

On a YOY basis, Sep ’19 hog and pig inventories weighing less than 120 pounds increased 2.5% YOY while those weighing 120 pounds or more finished 5.8% above the previous year levels. The YOY increase in inventories weighing 120 pounds or more was the second largest experienced throughout the past 16 quarters on a percentage basis.

On a YOY basis, Sep ’19 hog and pig inventories weighing less than 120 pounds increased 2.5% YOY while those weighing 120 pounds or more finished 5.8% above the previous year levels. The YOY increase in inventories weighing 120 pounds or more was the second largest experienced throughout the past 16 quarters on a percentage basis.

Sep ’19 sows kept for breeding increased 0.3% from the previous quarter while also remaining higher on a YOY basis, finishing up 1.6% to a 20 year high level. Sows kept for breeding have increased on a YOY basis over 21 consecutive quarters through Sep ’19. Sows kept for breeding finished 0.2% above average analyst expectations.

Sep ’19 sows kept for breeding increased 0.3% from the previous quarter while also remaining higher on a YOY basis, finishing up 1.6% to a 20 year high level. Sows kept for breeding have increased on a YOY basis over 21 consecutive quarters through Sep ’19. Sows kept for breeding finished 0.2% above average analyst expectations.

The Jun ’19 – Aug ’19 pig crop increased 3.3% from the previous quarter while remaining 2.9% higher YOY, finishing at a record high level. The 3.3% seasonal increase in the pig crop was smaller than the five year average seasonal build of 5.7%, however.

The Jun ’19 – Aug ’19 pig crop increased 3.3% from the previous quarter while remaining 2.9% higher YOY, finishing at a record high level. The 3.3% seasonal increase in the pig crop was smaller than the five year average seasonal build of 5.7%, however.

Jun ’19 – Aug ’19 surviving litter sizes increased 1.0% from the previous quarter while remaining 3.6% higher YOY, reaching a record high level. The quarterly YOY increase in surviving litter sizes was the 20th experienced in a row and the largest experienced throughout the past 17 quarters on a percentage basis. The seasonal increase in weaned pigs saved per litter of 1.0% was slightly smaller than the five year average seasonal build of 1.4%, however. Surviving litter sizes finished 1.2% above average analyst expectations.

Jun ’19 – Aug ’19 surviving litter sizes increased 1.0% from the previous quarter while remaining 3.6% higher YOY, reaching a record high level. The quarterly YOY increase in surviving litter sizes was the 20th experienced in a row and the largest experienced throughout the past 17 quarters on a percentage basis. The seasonal increase in weaned pigs saved per litter of 1.0% was slightly smaller than the five year average seasonal build of 1.4%, however. Surviving litter sizes finished 1.2% above average analyst expectations.

Jun ’19 – Aug ’19 farrowing rates declined 2.2% YOY while farrowing intentions are expected to decline 2.2% YOY throughout the Sep ’19 – Nov ’19 period and 1.4% throughout the Dec ’19 – Feb ’20 period. Sows farrowing during the June – August period represented 49.4% of the breeding herd.

Jun ’19 – Aug ’19 farrowing rates declined 2.2% YOY while farrowing intentions are expected to decline 2.2% YOY throughout the Sep ’19 – Nov ’19 period and 1.4% throughout the Dec ’19 – Feb ’20 period. Sows farrowing during the June – August period represented 49.4% of the breeding herd.