Soybean Complex Crushing & Stocks Update – Oct ’19

Executive Summary

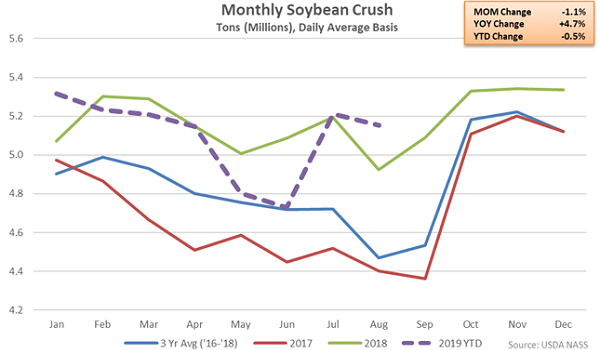

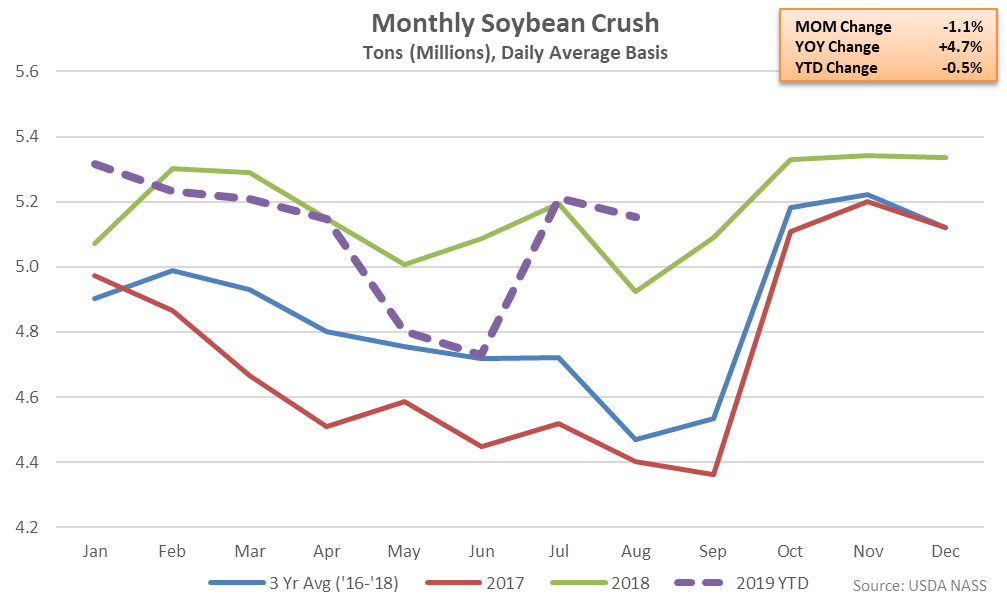

U.S. soybean crush and stocks figures provided by USDA were recently updated with values spanning through Aug ’19. Highlights from the updated report include:

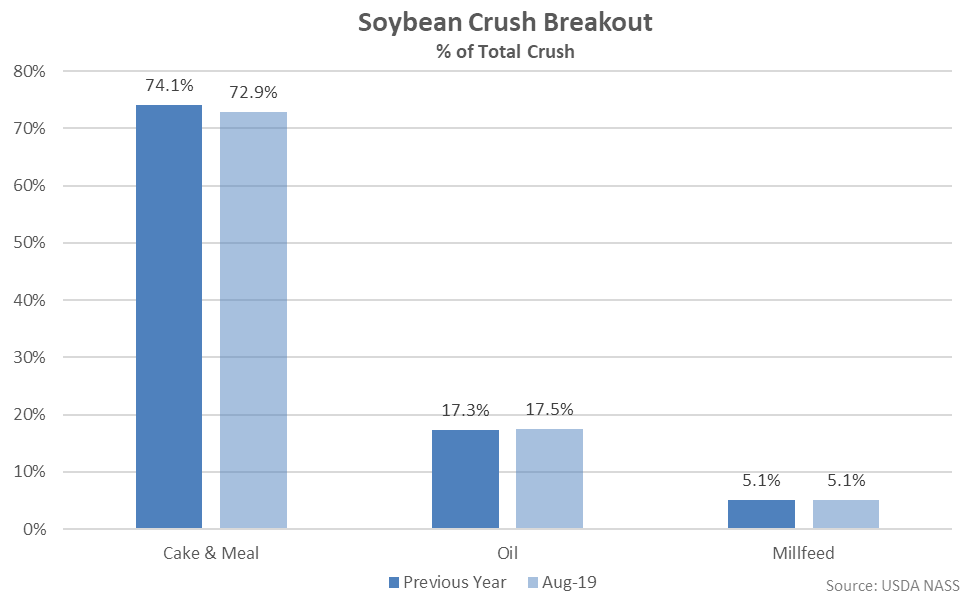

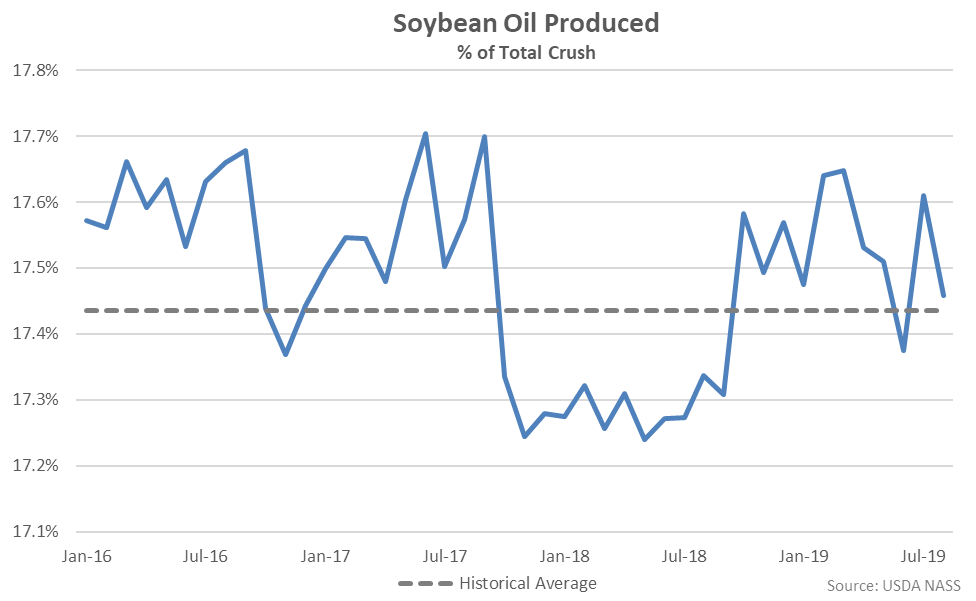

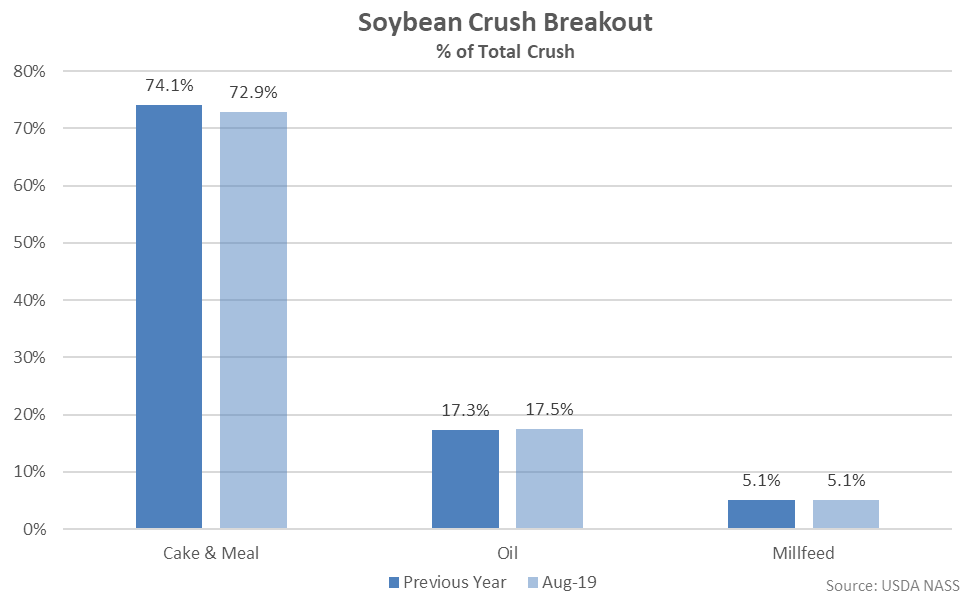

Cake & Meal accounted for 72.9% of the total soybean crush throughout Aug ’19, down slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, up slightly from the previous year.

Cake & Meal accounted for 72.9% of the total soybean crush throughout Aug ’19, down slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, up slightly from the previous year.

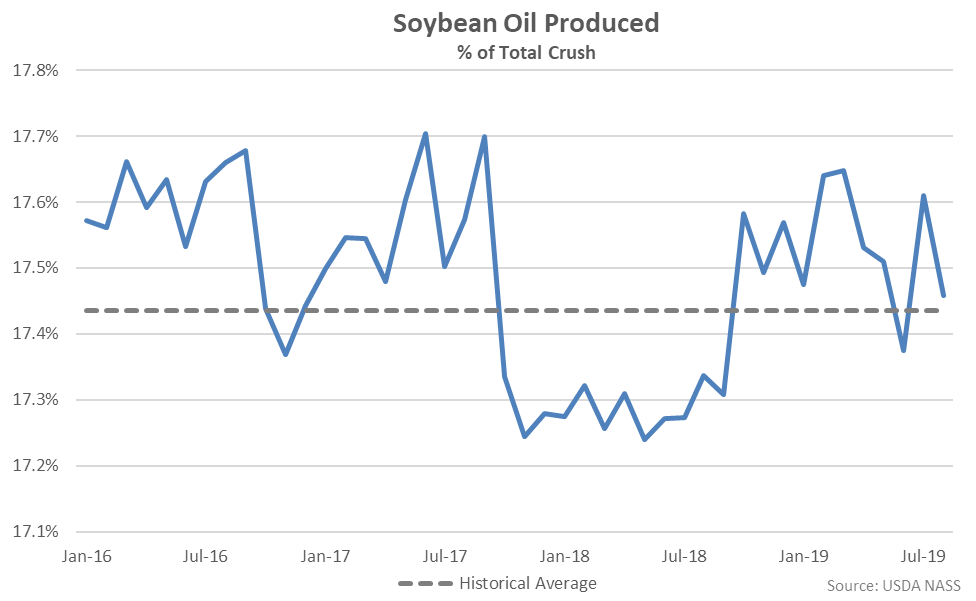

Aug ’19 soybean oil produced as a percentage of total crush declined from the previous month but remained above historical average figures for the tenth time in the past 11 months.

Aug ’19 soybean oil produced as a percentage of total crush declined from the previous month but remained above historical average figures for the tenth time in the past 11 months.

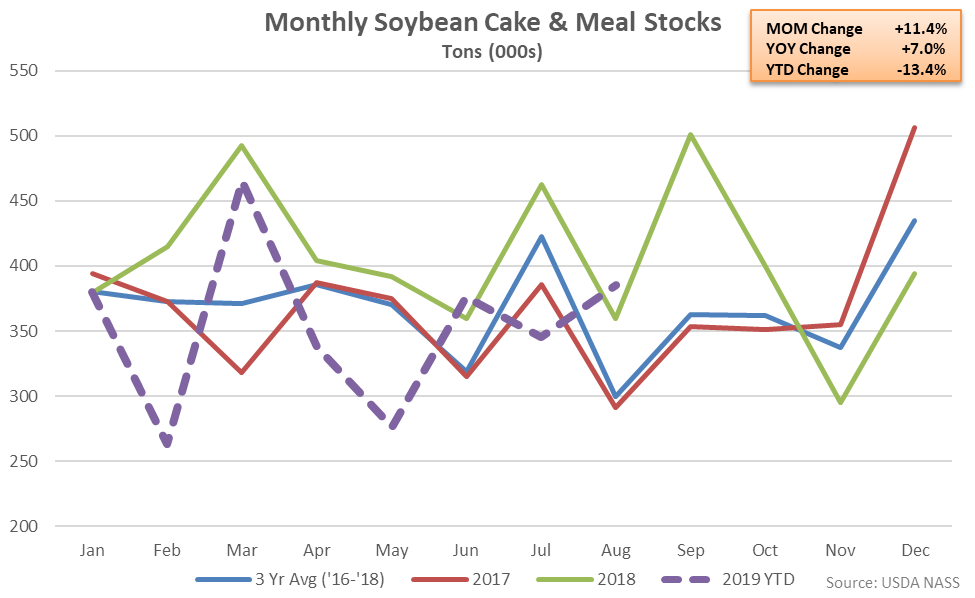

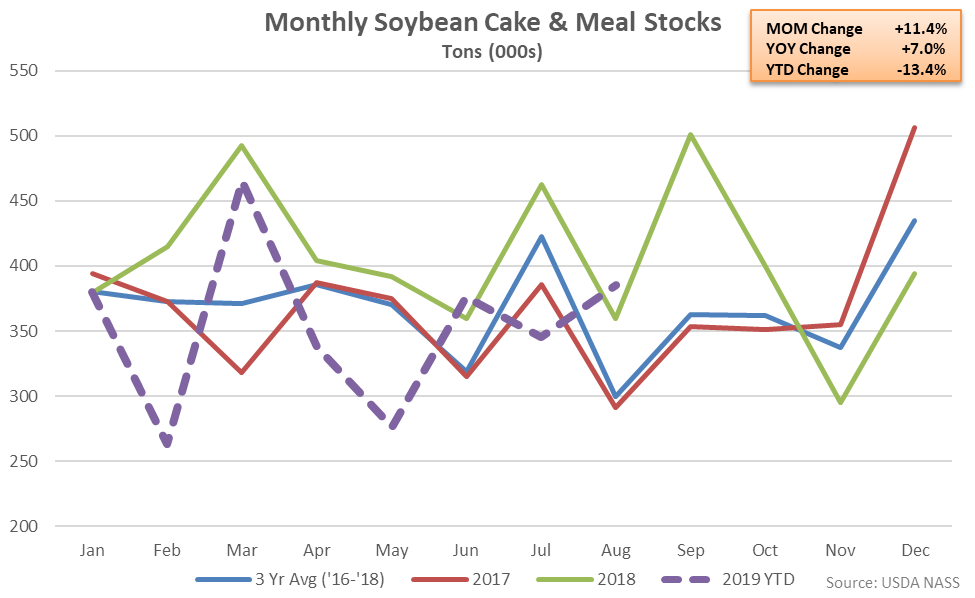

Soybean Cake & Meal Stocks – Stocks Increase 7.0% YOY, Reach a Five Year Seasonal High Level

Aug ’19 U.S. soybean cake & meal stocks increased 11.4% MOM and 7.0% YOY, finishing higher on a YOY basis for the second time in the past three months and reaching a five year seasonal high level. The seasonal increase in soybean cake & meal stocks of 11.4% was a contraseasonal move when compared to the three year July – August seasonal average decline of 29.2%.

Soybean Cake & Meal Stocks – Stocks Increase 7.0% YOY, Reach a Five Year Seasonal High Level

Aug ’19 U.S. soybean cake & meal stocks increased 11.4% MOM and 7.0% YOY, finishing higher on a YOY basis for the second time in the past three months and reaching a five year seasonal high level. The seasonal increase in soybean cake & meal stocks of 11.4% was a contraseasonal move when compared to the three year July – August seasonal average decline of 29.2%.

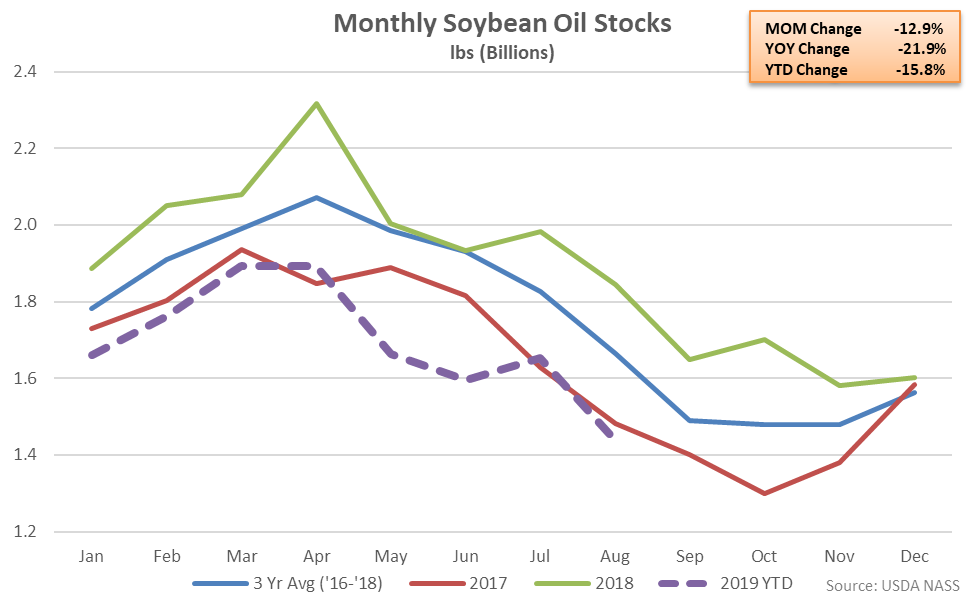

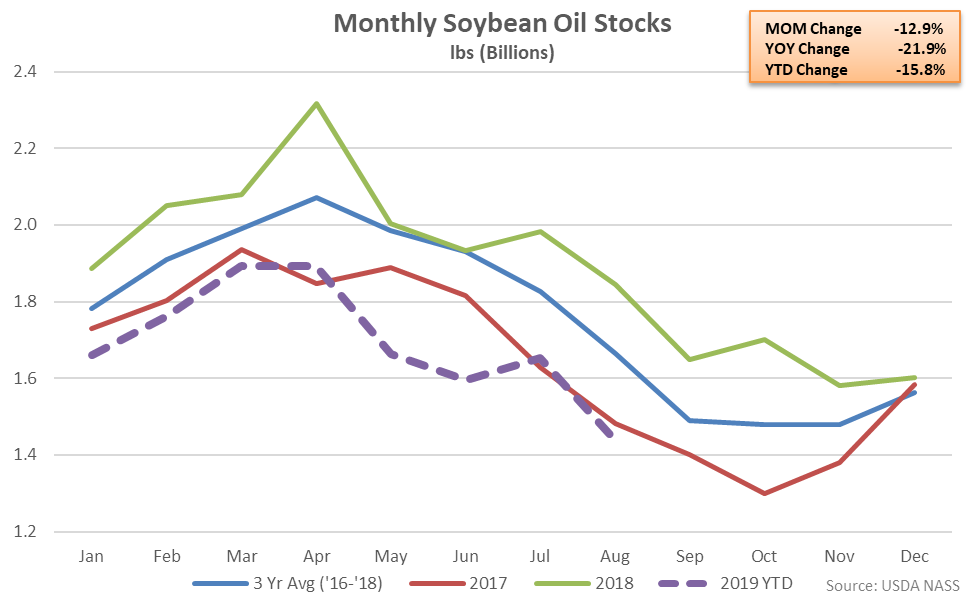

Soybean Oil Stocks – Stocks Decline to a 21 Month Low, Finish Down 21.9% YOY

Aug ’19 U.S. soybean oil stocks declined 12.9% MOM to a 21 month low level, finishing 21.9% below previous year volumes and reaching a five year seasonal low. The YOY decline in soybean oil stocks was the eighth experienced in a row and the largest experienced throughout the past four years on a percentage basis. The seasonal decline in soybean oil stocks of 12.9% was greater than the three year July – August seasonal average decline of 8.9%.

Soybean Oil Stocks – Stocks Decline to a 21 Month Low, Finish Down 21.9% YOY

Aug ’19 U.S. soybean oil stocks declined 12.9% MOM to a 21 month low level, finishing 21.9% below previous year volumes and reaching a five year seasonal low. The YOY decline in soybean oil stocks was the eighth experienced in a row and the largest experienced throughout the past four years on a percentage basis. The seasonal decline in soybean oil stocks of 12.9% was greater than the three year July – August seasonal average decline of 8.9%.

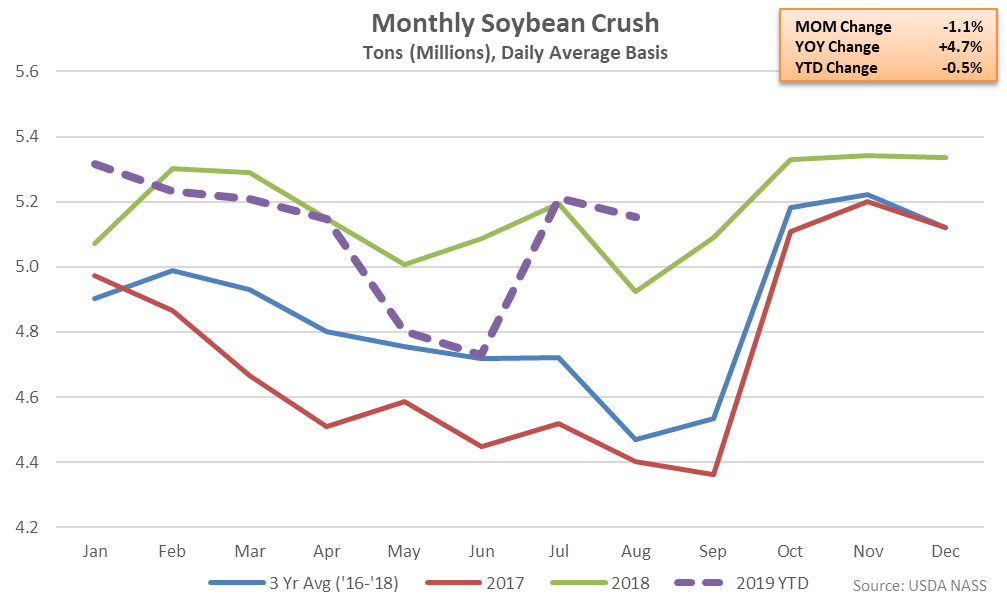

- Aug ’19 U.S. soybean crushings increased on a YOY basis for the second consecutive month, finishing up 4.7% to a five year seasonal high level.

- Aug ’19 U.S. soybean cake & meal stocks increased 7.0% YOY, reaching a five year seasonal high level. Soybean cake & meal stocks increased contraseasonally throughout the month.

- Aug ’19 U.S. soybean oil stocks declined to a 21 month low level, finishing 21.9% below previous year volumes and reaching a five year seasonal low.

Cake & Meal accounted for 72.9% of the total soybean crush throughout Aug ’19, down slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, up slightly from the previous year.

Cake & Meal accounted for 72.9% of the total soybean crush throughout Aug ’19, down slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, up slightly from the previous year.

Aug ’19 soybean oil produced as a percentage of total crush declined from the previous month but remained above historical average figures for the tenth time in the past 11 months.

Aug ’19 soybean oil produced as a percentage of total crush declined from the previous month but remained above historical average figures for the tenth time in the past 11 months.

Soybean Cake & Meal Stocks – Stocks Increase 7.0% YOY, Reach a Five Year Seasonal High Level

Aug ’19 U.S. soybean cake & meal stocks increased 11.4% MOM and 7.0% YOY, finishing higher on a YOY basis for the second time in the past three months and reaching a five year seasonal high level. The seasonal increase in soybean cake & meal stocks of 11.4% was a contraseasonal move when compared to the three year July – August seasonal average decline of 29.2%.

Soybean Cake & Meal Stocks – Stocks Increase 7.0% YOY, Reach a Five Year Seasonal High Level

Aug ’19 U.S. soybean cake & meal stocks increased 11.4% MOM and 7.0% YOY, finishing higher on a YOY basis for the second time in the past three months and reaching a five year seasonal high level. The seasonal increase in soybean cake & meal stocks of 11.4% was a contraseasonal move when compared to the three year July – August seasonal average decline of 29.2%.

Soybean Oil Stocks – Stocks Decline to a 21 Month Low, Finish Down 21.9% YOY

Aug ’19 U.S. soybean oil stocks declined 12.9% MOM to a 21 month low level, finishing 21.9% below previous year volumes and reaching a five year seasonal low. The YOY decline in soybean oil stocks was the eighth experienced in a row and the largest experienced throughout the past four years on a percentage basis. The seasonal decline in soybean oil stocks of 12.9% was greater than the three year July – August seasonal average decline of 8.9%.

Soybean Oil Stocks – Stocks Decline to a 21 Month Low, Finish Down 21.9% YOY

Aug ’19 U.S. soybean oil stocks declined 12.9% MOM to a 21 month low level, finishing 21.9% below previous year volumes and reaching a five year seasonal low. The YOY decline in soybean oil stocks was the eighth experienced in a row and the largest experienced throughout the past four years on a percentage basis. The seasonal decline in soybean oil stocks of 12.9% was greater than the three year July – August seasonal average decline of 8.9%.