Ethanol Rail Movements Update – Feb ’20

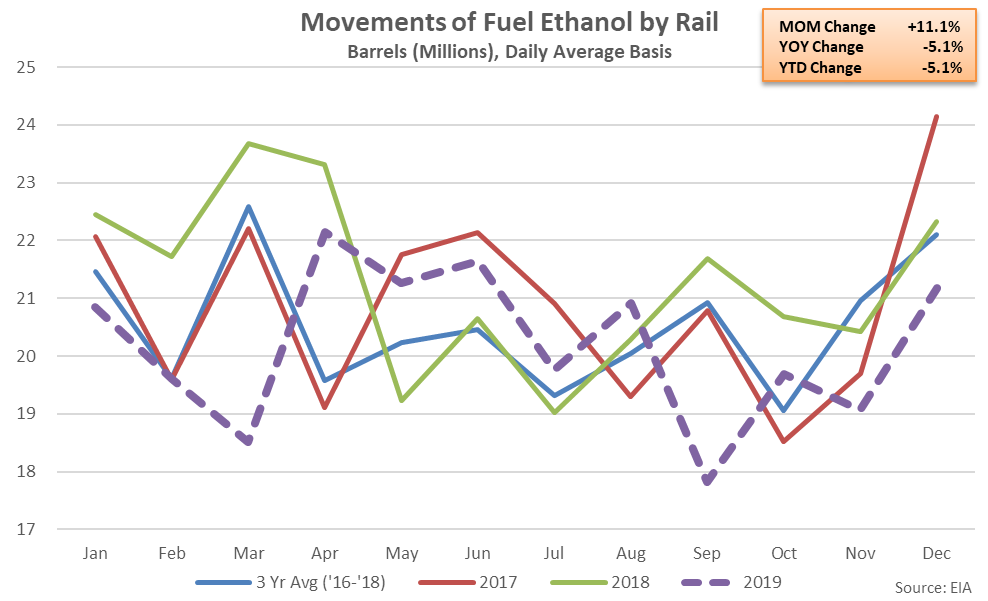

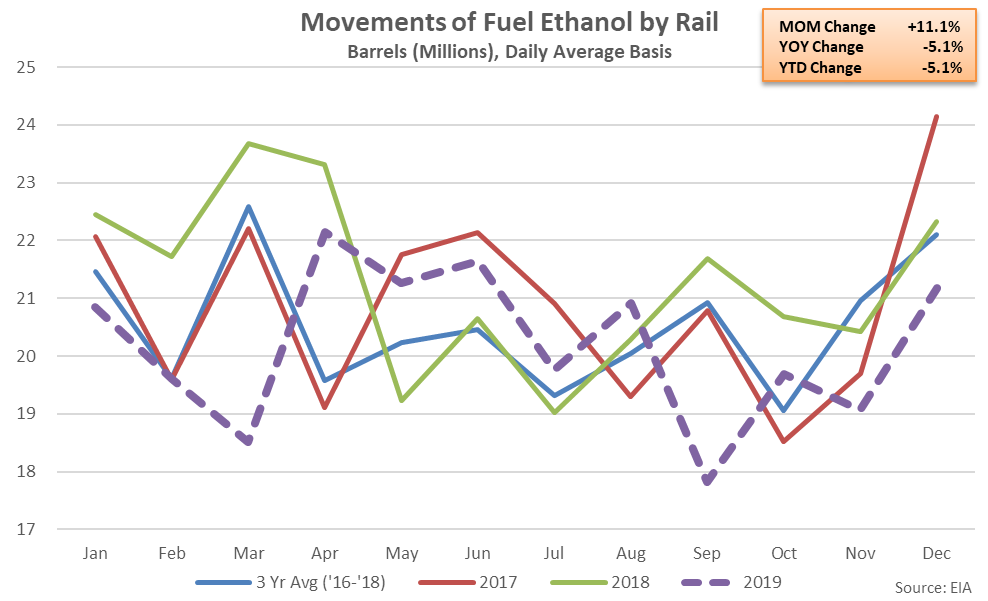

According to the EIA, Dec ’19 ethanol rail movements of 21.9 million barrels increased 11.1% MOM on a daily average basis to a six month high level but remained 5.1% below previous year levels, finishing lower on a YOY basis for the fourth consecutive month. 2019 annual ethanol rail movements declined 5.1% on a YOY basis, reaching a three year low level.

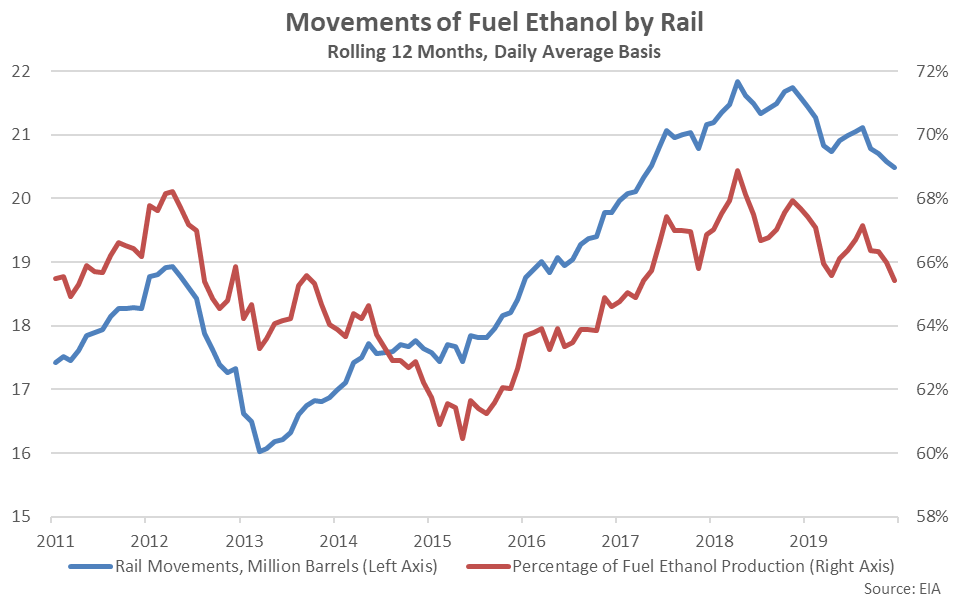

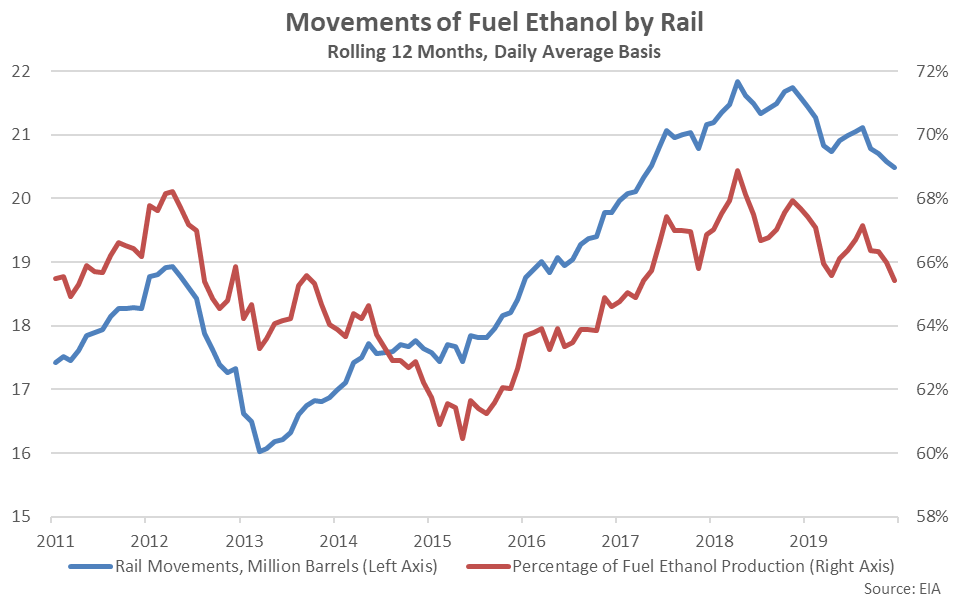

12 month rolling average ethanol rail movements have ranged from 60% – 69% of monthly ethanol production, historically. Dec ’19 ethanol rail movements accounted for 65.4% of monthly production on a 12 month rolling average basis, finishing at a 32 month low level.

12 month rolling average ethanol rail movements have ranged from 60% – 69% of monthly ethanol production, historically. Dec ’19 ethanol rail movements accounted for 65.4% of monthly production on a 12 month rolling average basis, finishing at a 32 month low level.

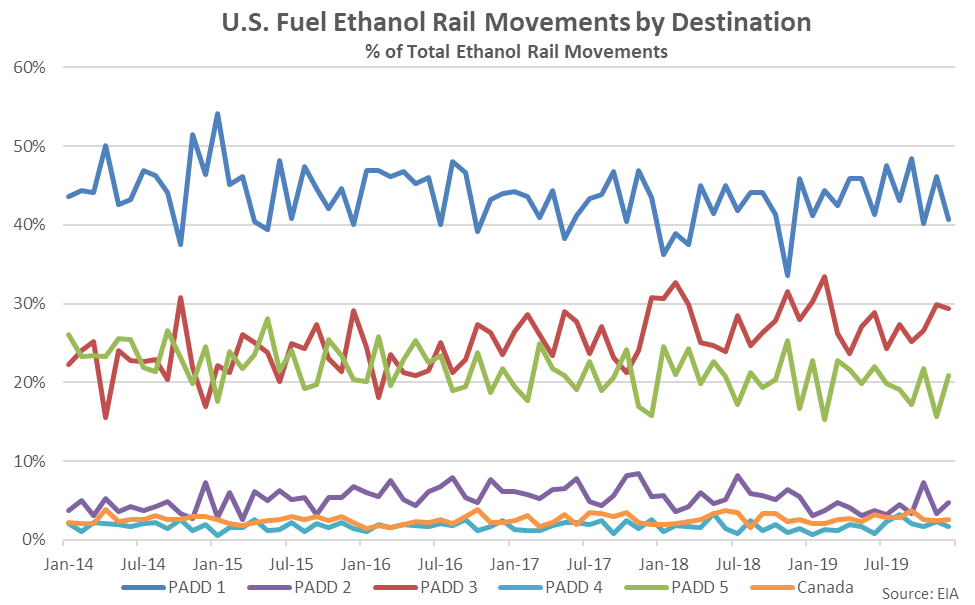

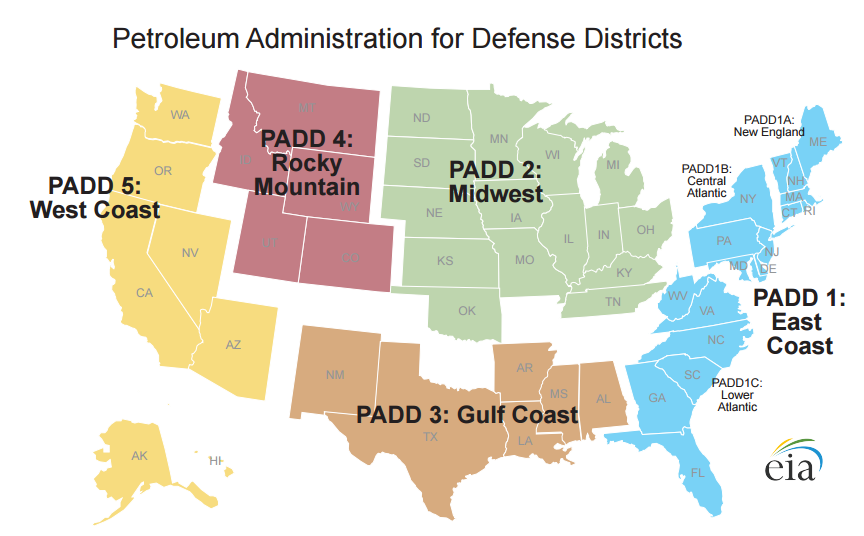

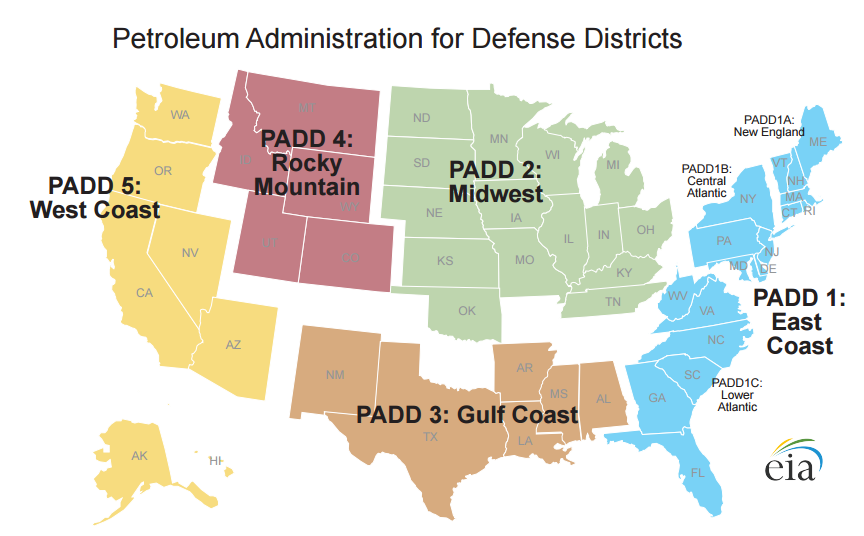

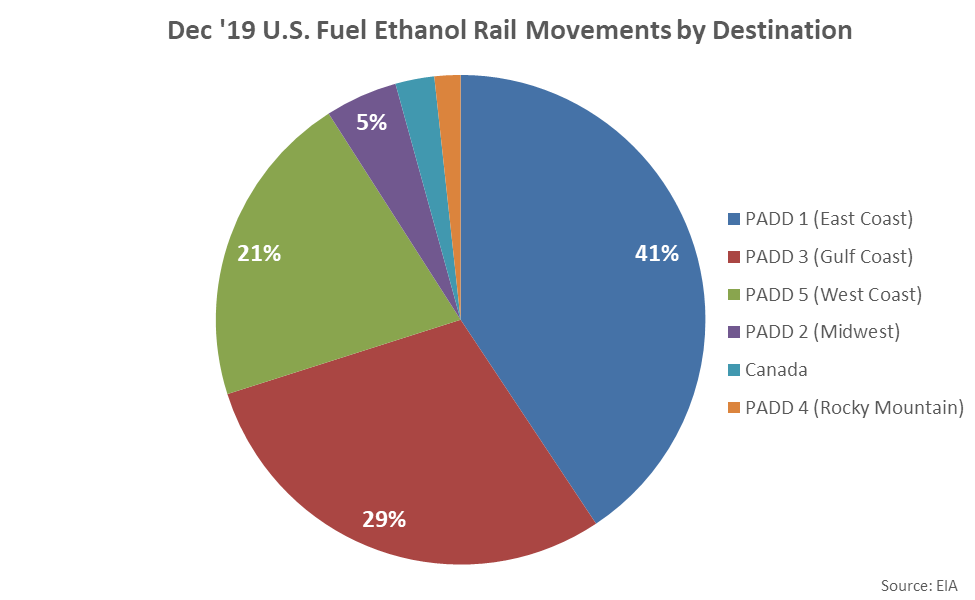

Ethanol rail movement figures are broken out by Petroleum Administration for Defense District (PADD) for both originating rail movements and destinations of shipments. The U.S. is regionally divided into five PADDs, which include the East Coast, Midwest, Gulf Coast, Rocky Mountain and West Coast.

Ethanol rail movement figures are broken out by Petroleum Administration for Defense District (PADD) for both originating rail movements and destinations of shipments. The U.S. is regionally divided into five PADDs, which include the East Coast, Midwest, Gulf Coast, Rocky Mountain and West Coast.

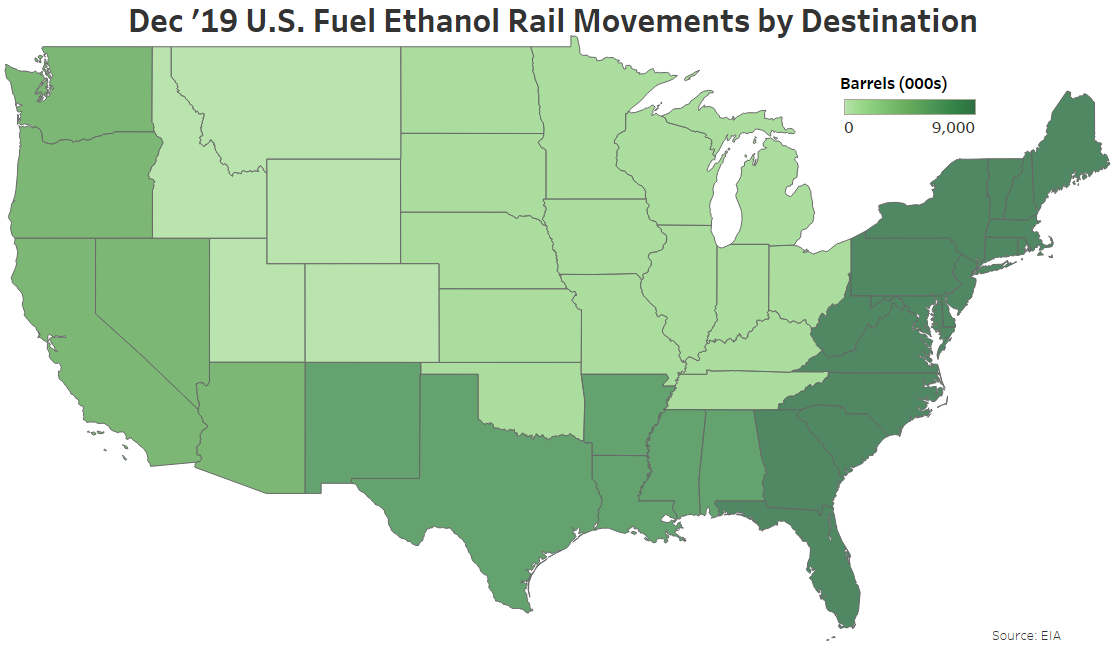

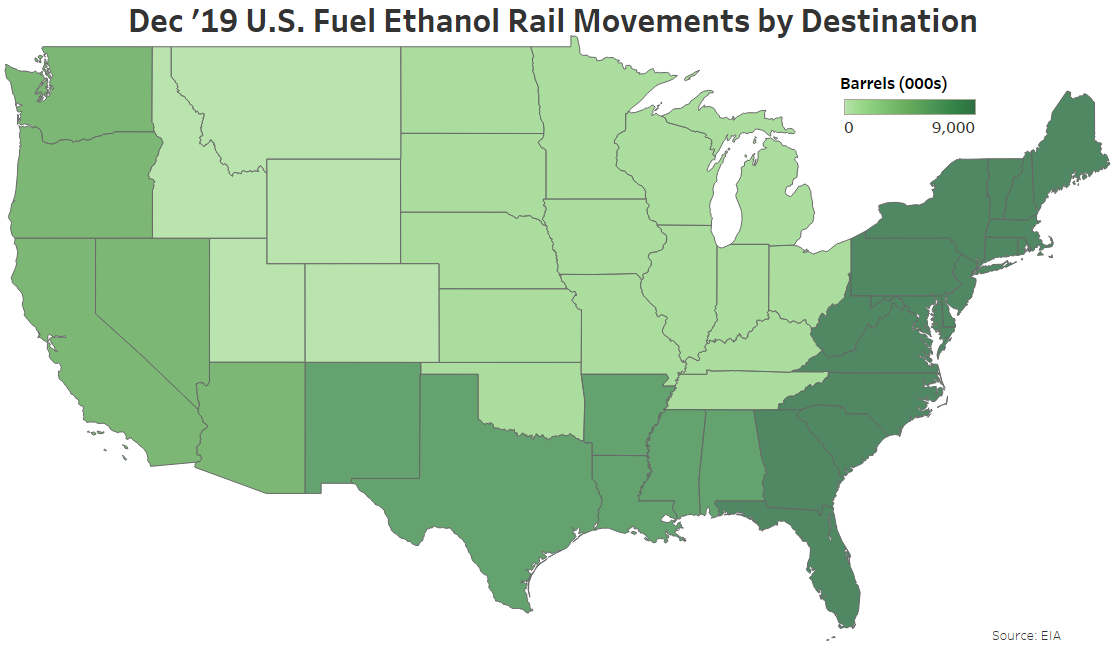

Over 97% of rail movements originated in PADD 2 (Midwest) during Dec ’19, with the remaining volumes originating in PADD 3 (Gulf Coast). Nearly 8.9 million barrels of ethanol rail movements were destined to PADD 1 (East Coast) during Dec ’19, leading all regional districts.

Over 97% of rail movements originated in PADD 2 (Midwest) during Dec ’19, with the remaining volumes originating in PADD 3 (Gulf Coast). Nearly 8.9 million barrels of ethanol rail movements were destined to PADD 1 (East Coast) during Dec ’19, leading all regional districts.

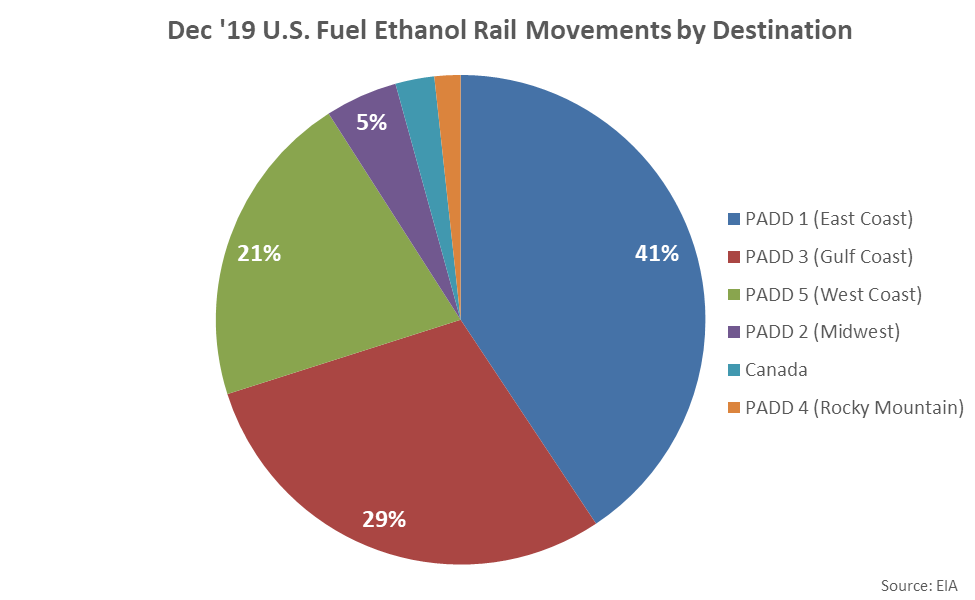

Ethanol rail movements destined to PADD 1 (East Coast) accounted for 41% of the total shipments during Dec ’19. Combined shipments to PADD 1 (East Coast), PADD 3 (Gulf Coast) and PADD 5 (West Coast) accounted for 91% of total ethanol rail movements, with minimal amounts being shipped to PADD 2 (Midwest), Canada and PADD 4 (Rocky Mountain).

Ethanol rail movements destined to PADD 1 (East Coast) accounted for 41% of the total shipments during Dec ’19. Combined shipments to PADD 1 (East Coast), PADD 3 (Gulf Coast) and PADD 5 (West Coast) accounted for 91% of total ethanol rail movements, with minimal amounts being shipped to PADD 2 (Midwest), Canada and PADD 4 (Rocky Mountain).

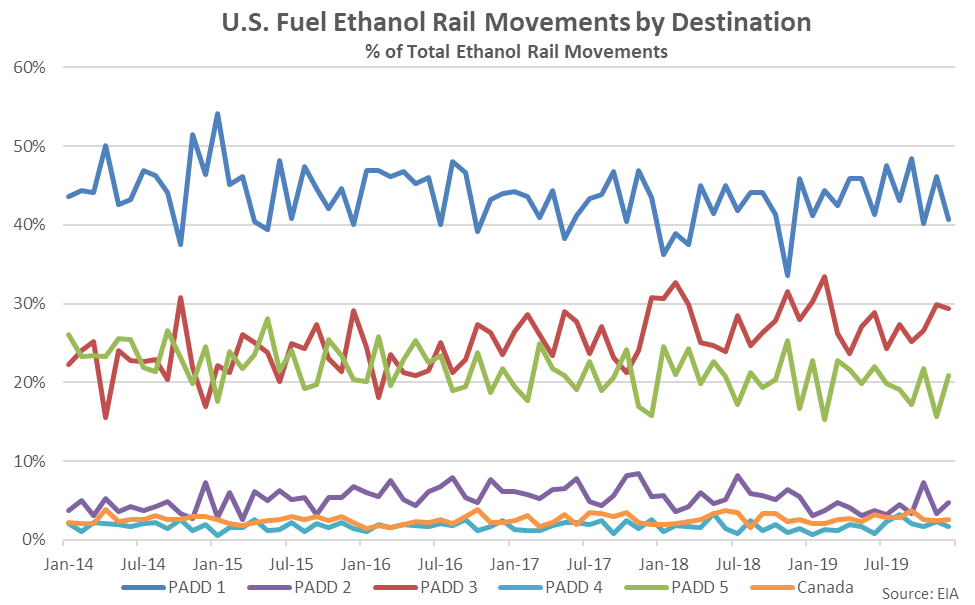

Ethanol rail movements destined to PADD 3 (Gulf Coast) finished most significantly above historical average figures throughout Dec ’19 while ethanol movements destined to PADD 1 (East Coast) finished most significantly below historical average figures.

Ethanol rail movements destined to PADD 3 (Gulf Coast) finished most significantly above historical average figures throughout Dec ’19 while ethanol movements destined to PADD 1 (East Coast) finished most significantly below historical average figures.

12 month rolling average ethanol rail movements have ranged from 60% – 69% of monthly ethanol production, historically. Dec ’19 ethanol rail movements accounted for 65.4% of monthly production on a 12 month rolling average basis, finishing at a 32 month low level.

12 month rolling average ethanol rail movements have ranged from 60% – 69% of monthly ethanol production, historically. Dec ’19 ethanol rail movements accounted for 65.4% of monthly production on a 12 month rolling average basis, finishing at a 32 month low level.

Ethanol rail movement figures are broken out by Petroleum Administration for Defense District (PADD) for both originating rail movements and destinations of shipments. The U.S. is regionally divided into five PADDs, which include the East Coast, Midwest, Gulf Coast, Rocky Mountain and West Coast.

Ethanol rail movement figures are broken out by Petroleum Administration for Defense District (PADD) for both originating rail movements and destinations of shipments. The U.S. is regionally divided into five PADDs, which include the East Coast, Midwest, Gulf Coast, Rocky Mountain and West Coast.

Over 97% of rail movements originated in PADD 2 (Midwest) during Dec ’19, with the remaining volumes originating in PADD 3 (Gulf Coast). Nearly 8.9 million barrels of ethanol rail movements were destined to PADD 1 (East Coast) during Dec ’19, leading all regional districts.

Over 97% of rail movements originated in PADD 2 (Midwest) during Dec ’19, with the remaining volumes originating in PADD 3 (Gulf Coast). Nearly 8.9 million barrels of ethanol rail movements were destined to PADD 1 (East Coast) during Dec ’19, leading all regional districts.

Ethanol rail movements destined to PADD 1 (East Coast) accounted for 41% of the total shipments during Dec ’19. Combined shipments to PADD 1 (East Coast), PADD 3 (Gulf Coast) and PADD 5 (West Coast) accounted for 91% of total ethanol rail movements, with minimal amounts being shipped to PADD 2 (Midwest), Canada and PADD 4 (Rocky Mountain).

Ethanol rail movements destined to PADD 1 (East Coast) accounted for 41% of the total shipments during Dec ’19. Combined shipments to PADD 1 (East Coast), PADD 3 (Gulf Coast) and PADD 5 (West Coast) accounted for 91% of total ethanol rail movements, with minimal amounts being shipped to PADD 2 (Midwest), Canada and PADD 4 (Rocky Mountain).

Ethanol rail movements destined to PADD 3 (Gulf Coast) finished most significantly above historical average figures throughout Dec ’19 while ethanol movements destined to PADD 1 (East Coast) finished most significantly below historical average figures.

Ethanol rail movements destined to PADD 3 (Gulf Coast) finished most significantly above historical average figures throughout Dec ’19 while ethanol movements destined to PADD 1 (East Coast) finished most significantly below historical average figures.