Annual U.S. Prospective Plantings Update – Mar ’20

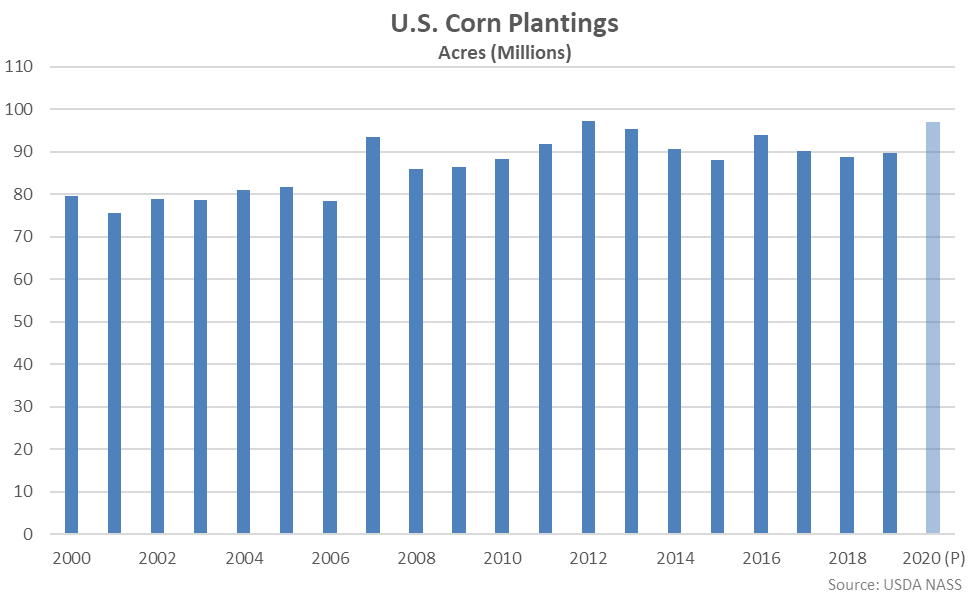

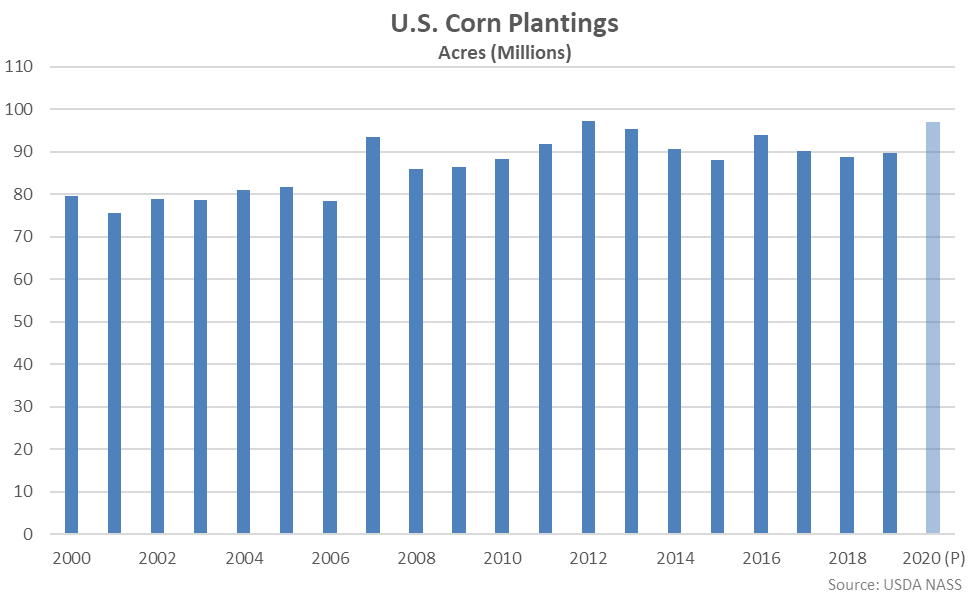

Corn – 2020 Prospective Plantings up 8.1% YOY, Finish Above Expectations

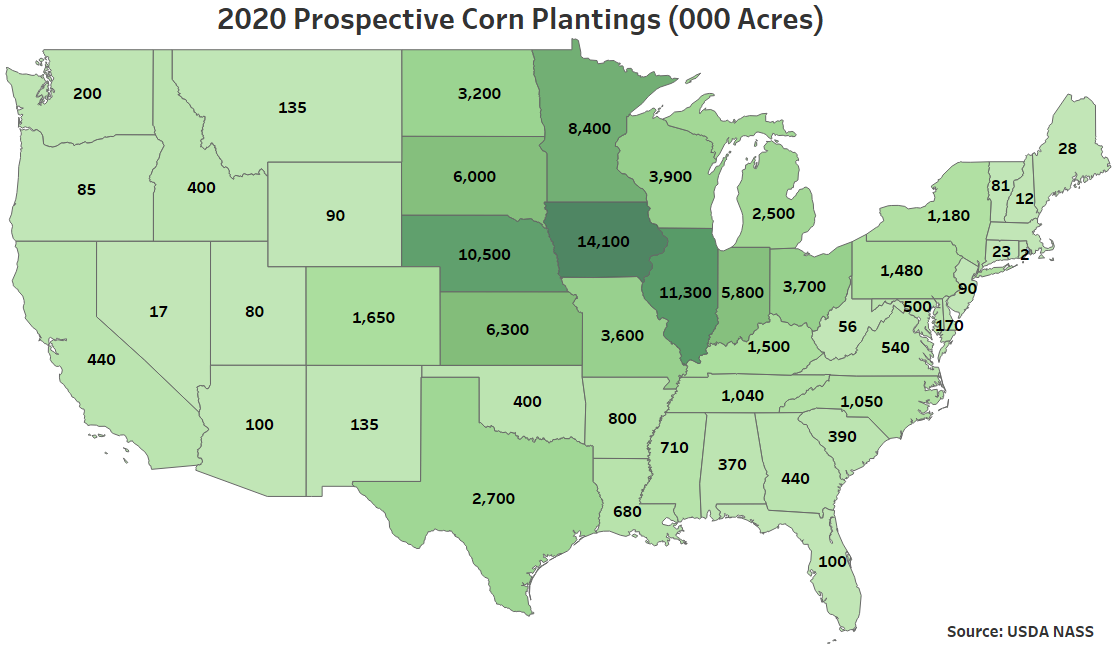

According to USDA’s annual prospective plantings report, 2020 corn plantings of 97.0 million acres finished 7.3 million acres, or 8.1%, above the previous year figure, reaching an eight year high level. Corn prospective plantings were 2.8% above average analyst estimates of 94.3 million acres.

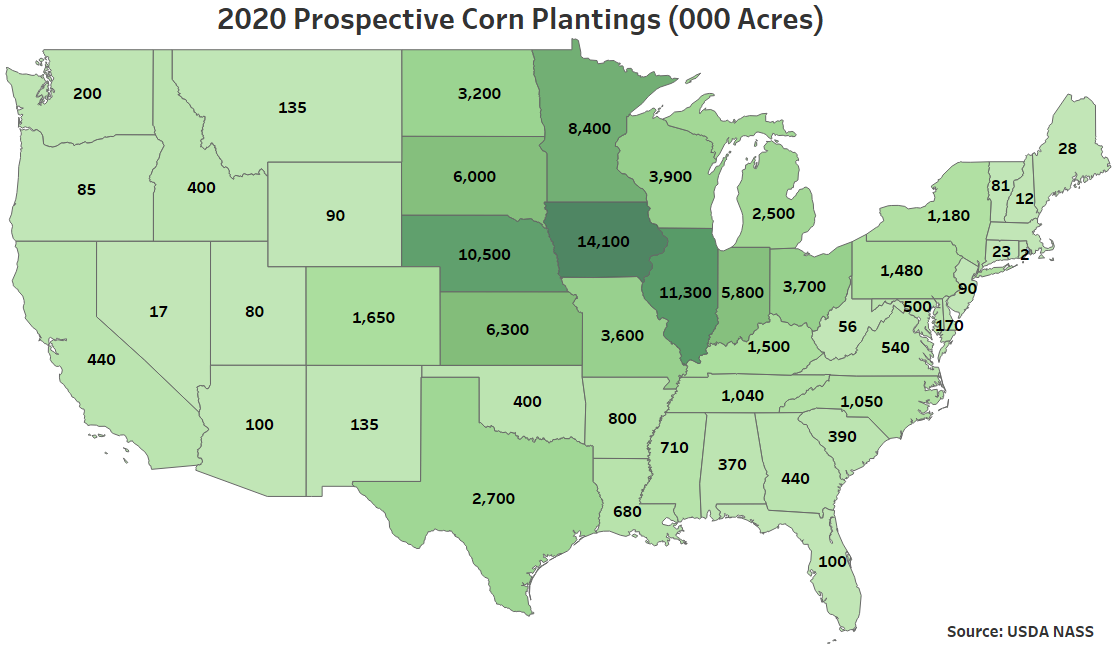

Prospective corn plantings for 2020 were led by Iowa (14.1 million acres), followed by Illinois (11.3 million acres) and Nebraska (10.5 million acres). The aforementioned states combined to account for over a third of the total U.S. prospective corn plantings.

Prospective corn plantings for 2020 were led by Iowa (14.1 million acres), followed by Illinois (11.3 million acres) and Nebraska (10.5 million acres). The aforementioned states combined to account for over a third of the total U.S. prospective corn plantings.

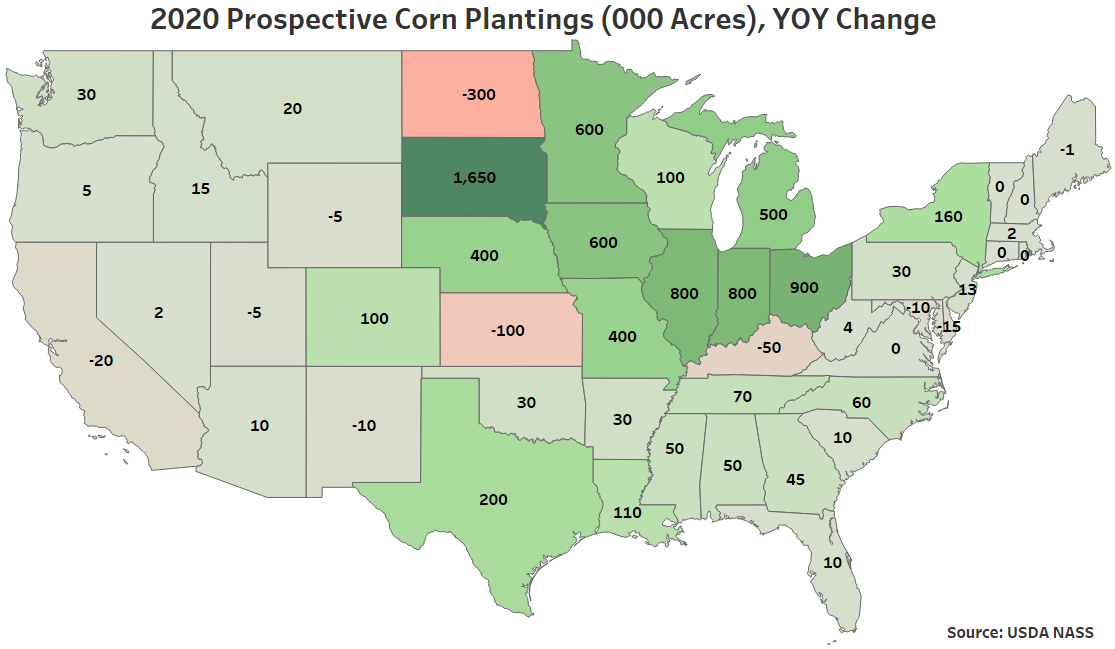

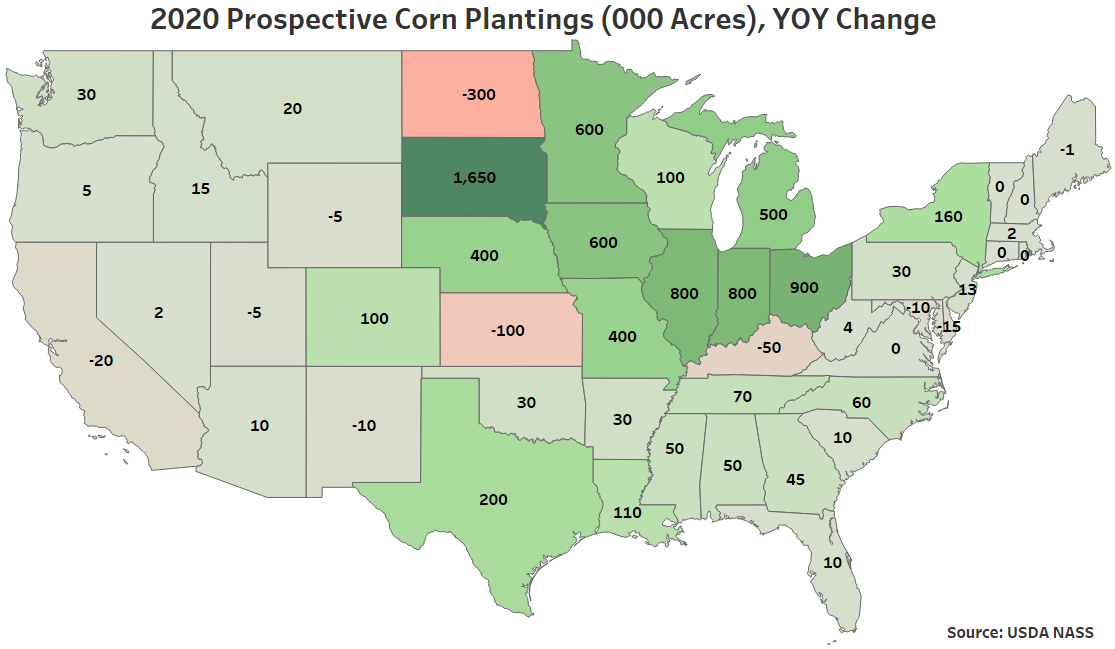

The largest YOY increases in prospective corn plantings were experienced throughout South Dakota (+1,650,000 acres), Ohio (+900,000 acres), Illinois (+800,000 acres) and Indiana (+800,000 acres). North Dakota (-300,000 acres) and Kansas (-100,000 acres) experienced the largest YOY declines in prospective corn plantings.

The largest YOY increases in prospective corn plantings were experienced throughout South Dakota (+1,650,000 acres), Ohio (+900,000 acres), Illinois (+800,000 acres) and Indiana (+800,000 acres). North Dakota (-300,000 acres) and Kansas (-100,000 acres) experienced the largest YOY declines in prospective corn plantings.

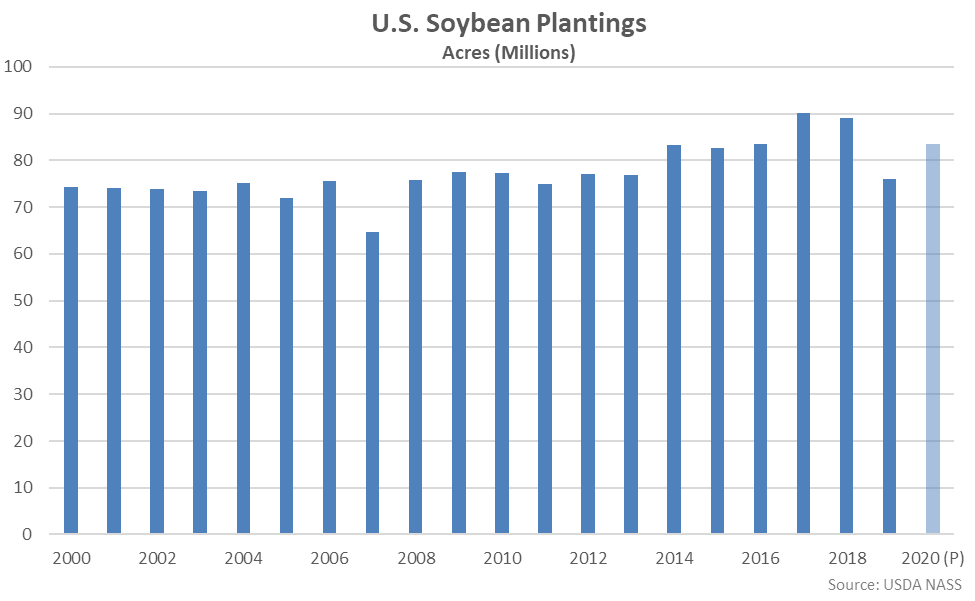

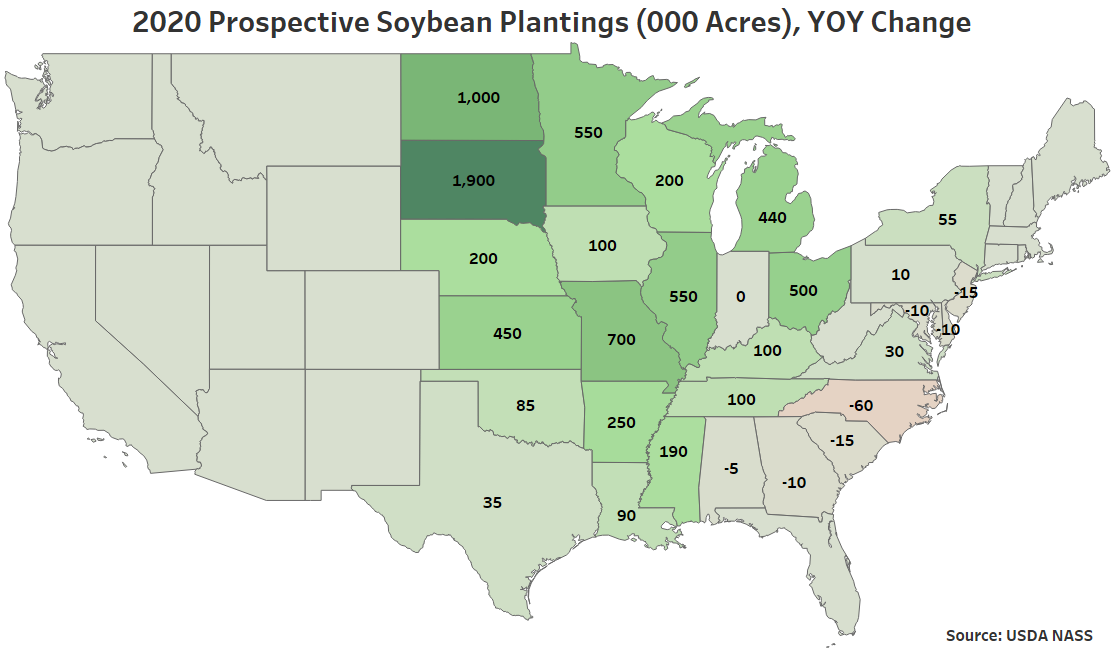

Soybeans – 2020 Prospective Plantings up 9.7% YOY but Finish Below Expectations

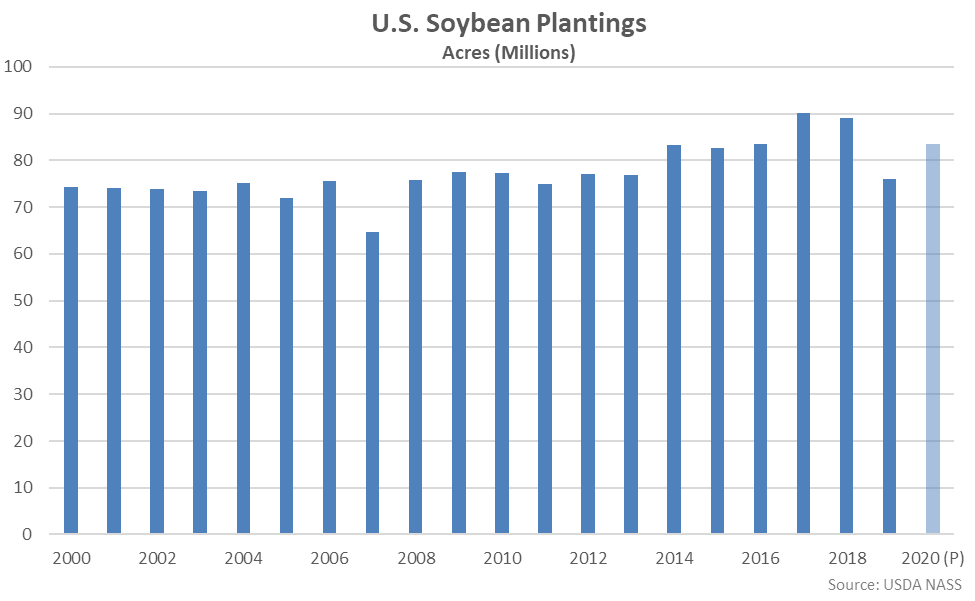

2020 soybean plantings of 83.5 million acres finished 7.4 million acres, or 9.7%, above the previous year figure but remained 1.9% below three year average figures. Soybean prospective plantings were 1.6% below average analyst estimates of 84.9 million acres.

Soybeans – 2020 Prospective Plantings up 9.7% YOY but Finish Below Expectations

2020 soybean plantings of 83.5 million acres finished 7.4 million acres, or 9.7%, above the previous year figure but remained 1.9% below three year average figures. Soybean prospective plantings were 1.6% below average analyst estimates of 84.9 million acres.

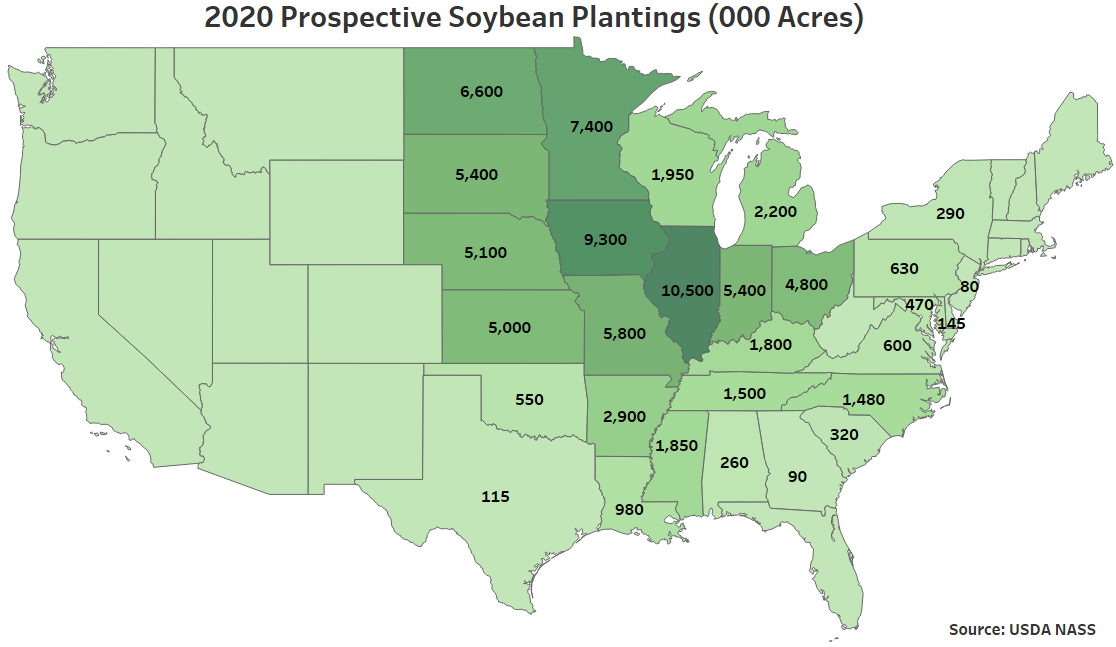

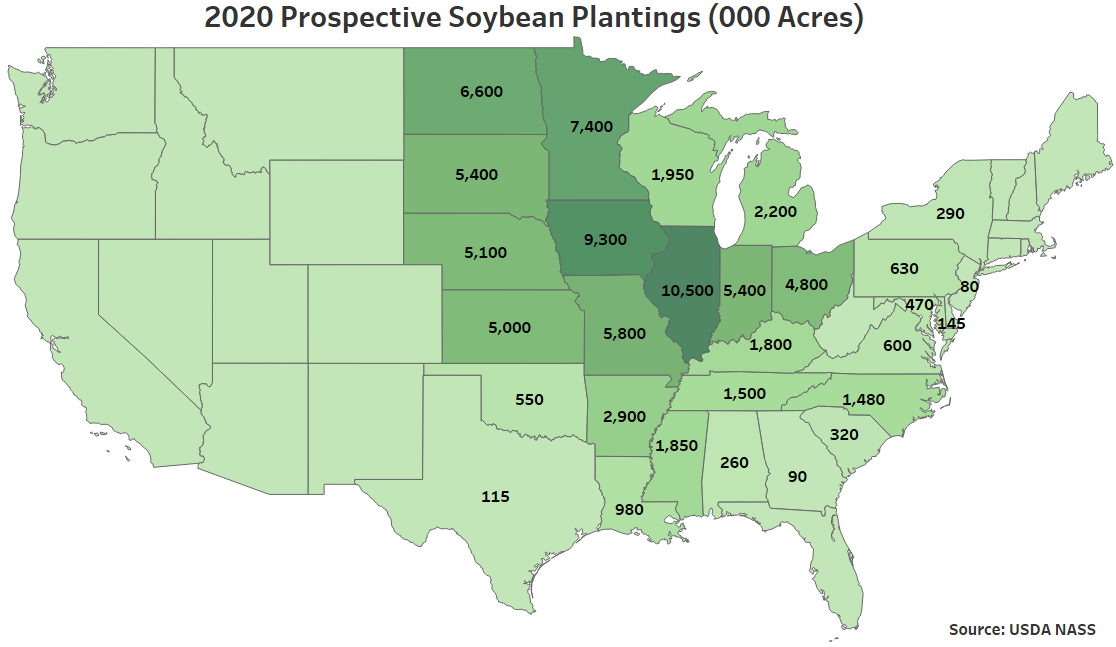

Prospective soybean plantings for 2020 were led by Illinois (10.5 million acres), followed by Iowa (9.3 million acres) and Minnesota (7.4 million acres). The aforementioned states combined to account for nearly a third of the total U.S. prospective soybean plantings.

Prospective soybean plantings for 2020 were led by Illinois (10.5 million acres), followed by Iowa (9.3 million acres) and Minnesota (7.4 million acres). The aforementioned states combined to account for nearly a third of the total U.S. prospective soybean plantings.

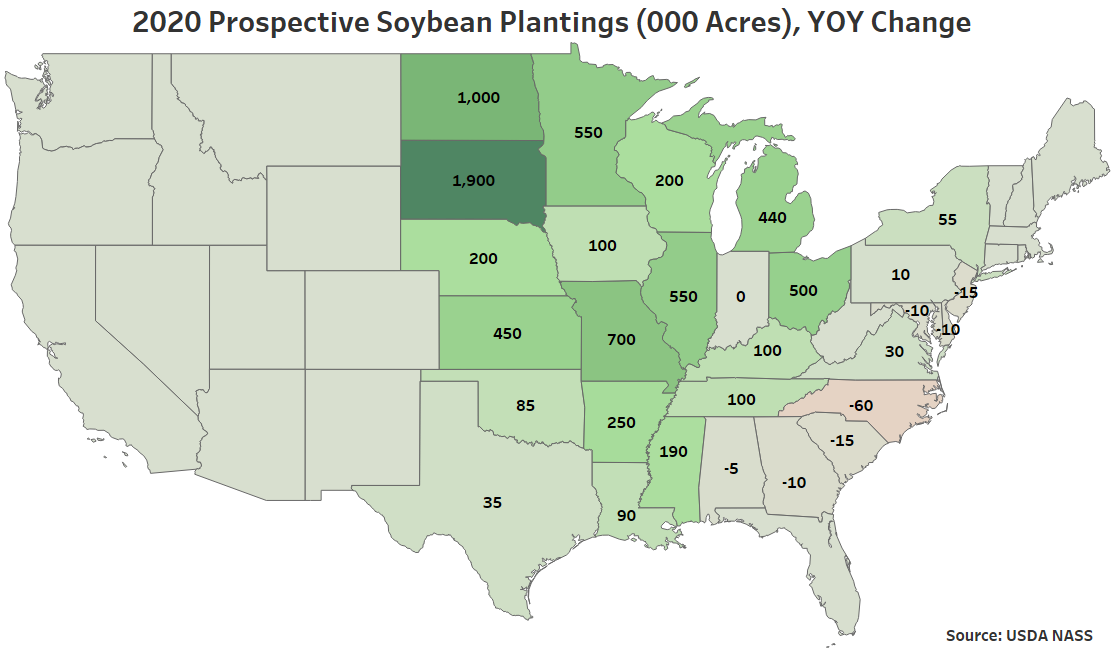

The largest YOY increases in prospective soybean plantings were experienced throughout South Dakota (+1,900,000 acres), North Dakota (+1,000,000 acres) and Missouri (+700,000 acres). North Carolina experienced the largest YOY decline in prospective soybean plantings (-60,000 acres).

The largest YOY increases in prospective soybean plantings were experienced throughout South Dakota (+1,900,000 acres), North Dakota (+1,000,000 acres) and Missouri (+700,000 acres). North Carolina experienced the largest YOY decline in prospective soybean plantings (-60,000 acres).

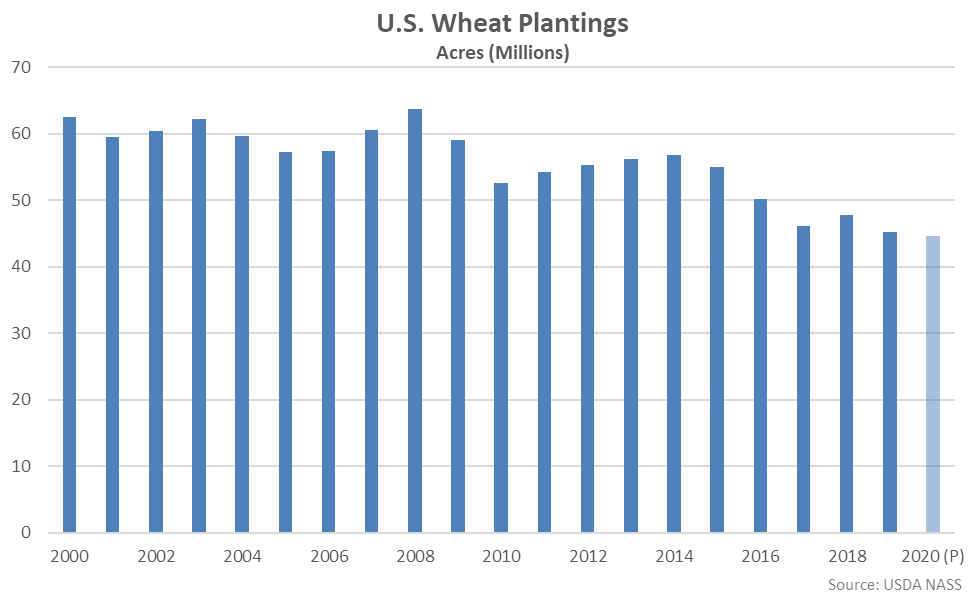

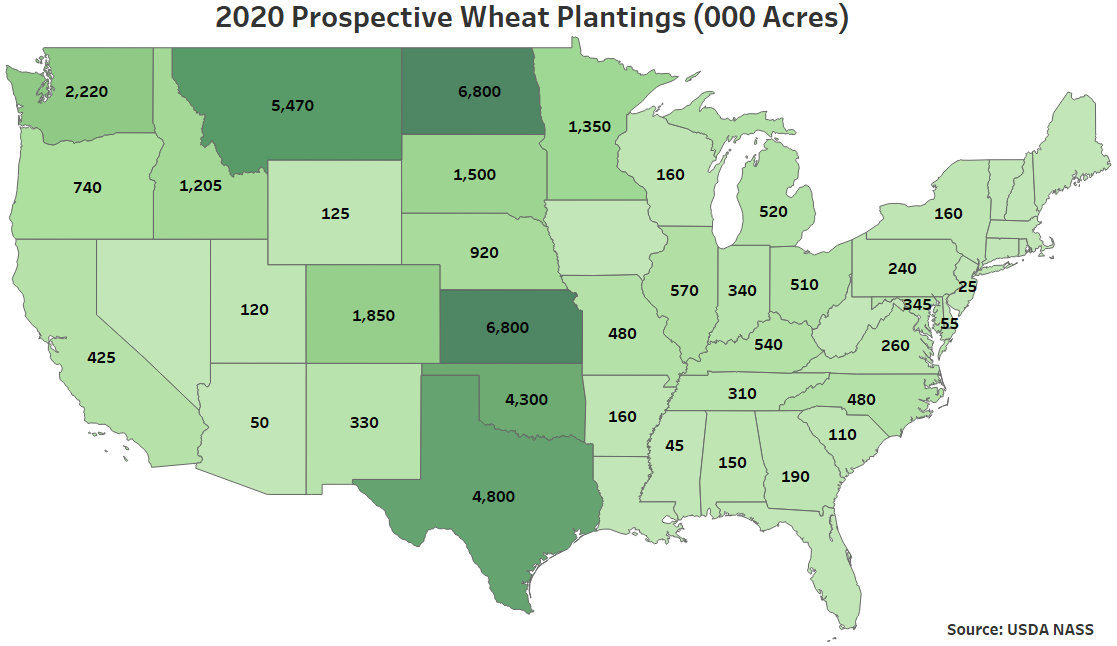

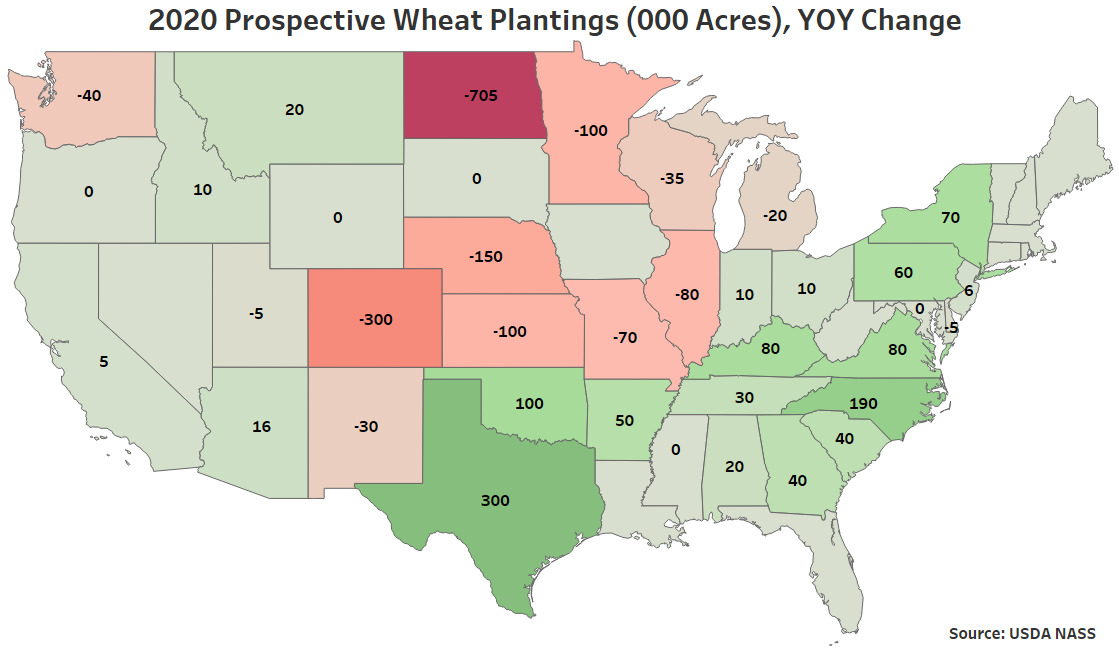

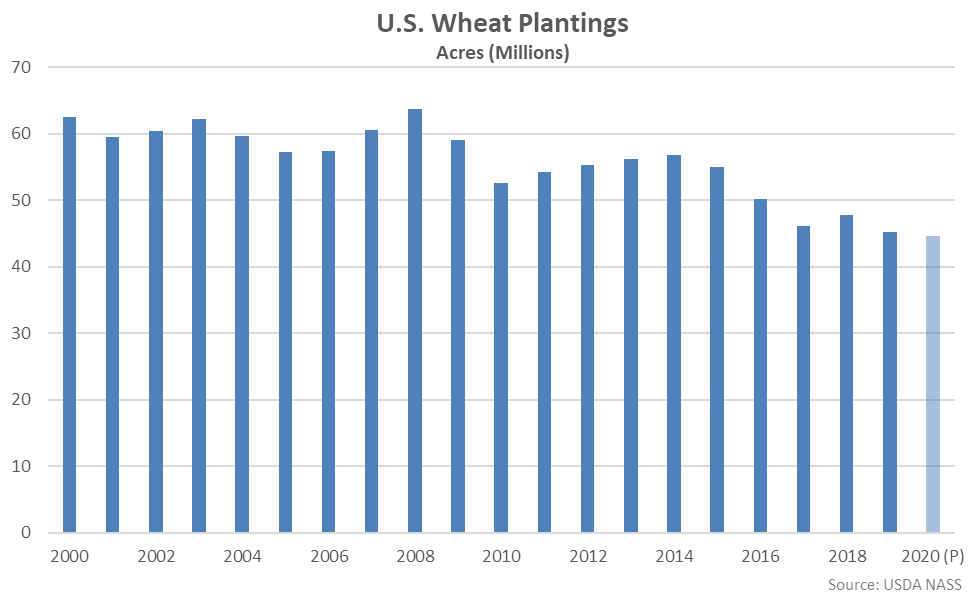

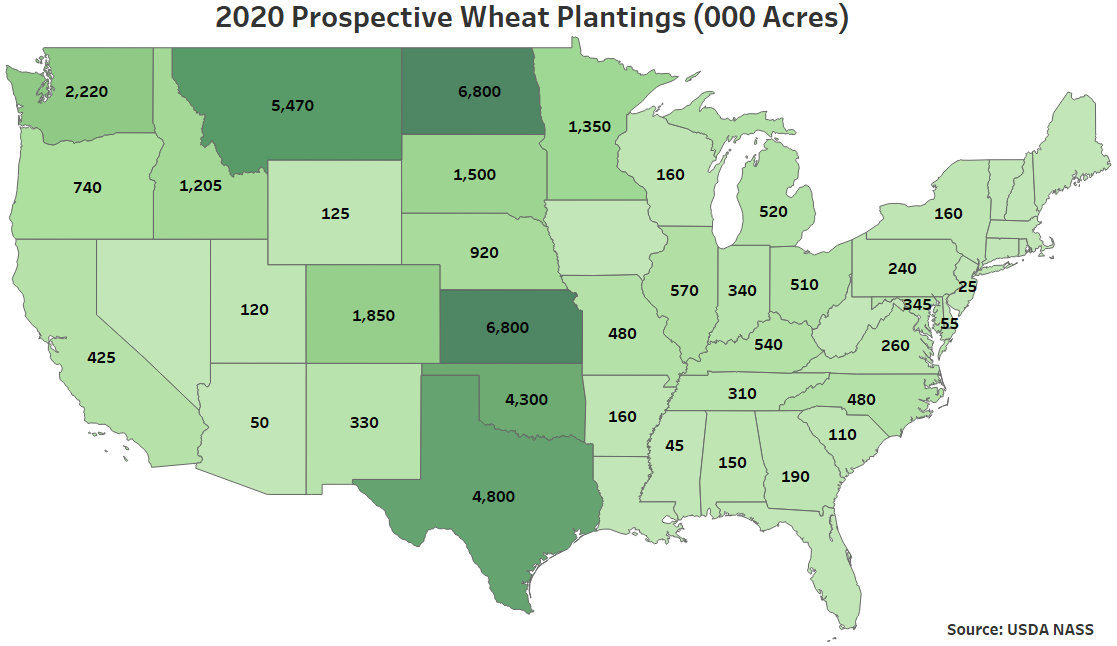

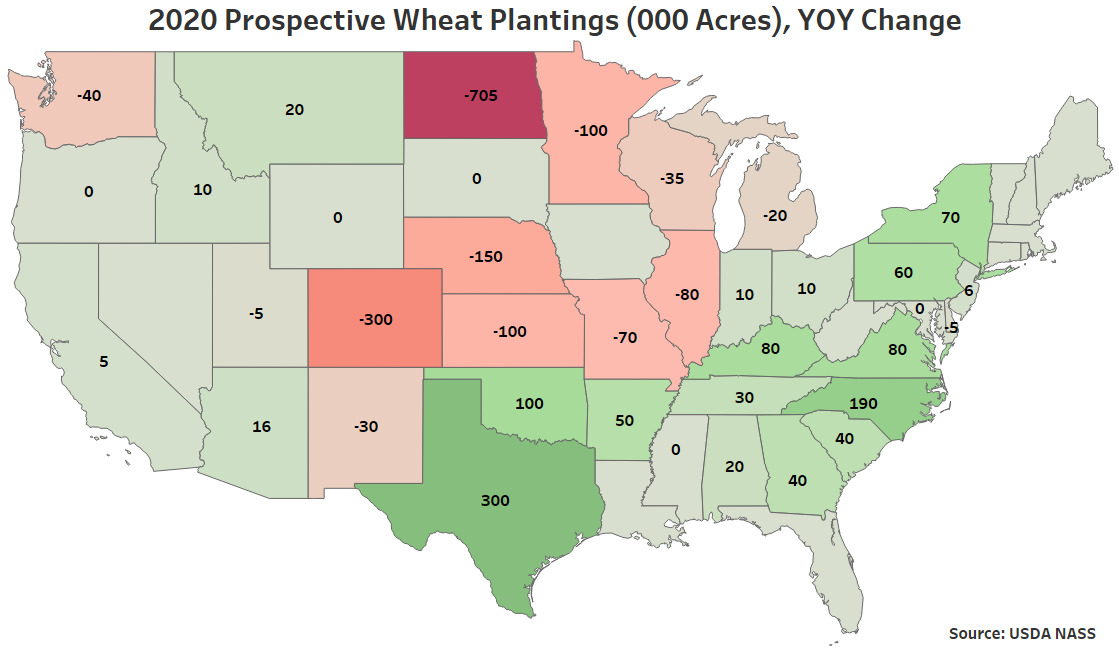

Wheat – 2020 Prospective Plantings Down 1.1% YOY to a Record Low, Finish Below Expectations

2020 wheat plantings of 44.7 million acres finished 0.5 million acres, or 1.1%, below the previous year figure, reaching a new record low level. Wheat prospective plantings were 0.7% below average analyst estimates of 45.0 million acres.

Wheat – 2020 Prospective Plantings Down 1.1% YOY to a Record Low, Finish Below Expectations

2020 wheat plantings of 44.7 million acres finished 0.5 million acres, or 1.1%, below the previous year figure, reaching a new record low level. Wheat prospective plantings were 0.7% below average analyst estimates of 45.0 million acres.

Prospective wheat plantings for 2020 were led by North Dakota (6.8 million acres) and Kansas (6.8 million acres), followed by Montana (5.47 million acres) and Texas (4.8 million acres). The aforementioned states combined to account for over half of the total U.S. prospective wheat plantings.

Prospective wheat plantings for 2020 were led by North Dakota (6.8 million acres) and Kansas (6.8 million acres), followed by Montana (5.47 million acres) and Texas (4.8 million acres). The aforementioned states combined to account for over half of the total U.S. prospective wheat plantings.

The largest YOY declines in prospective wheat plantings were experienced throughout North Dakota (-705,000 acres), Colorado (-300,000 acres) and Nebraska (-150,000 acres). Texas experienced the largest YOY increase in prospective wheat plantings (+300,000 acres).

The largest YOY declines in prospective wheat plantings were experienced throughout North Dakota (-705,000 acres), Colorado (-300,000 acres) and Nebraska (-150,000 acres). Texas experienced the largest YOY increase in prospective wheat plantings (+300,000 acres).

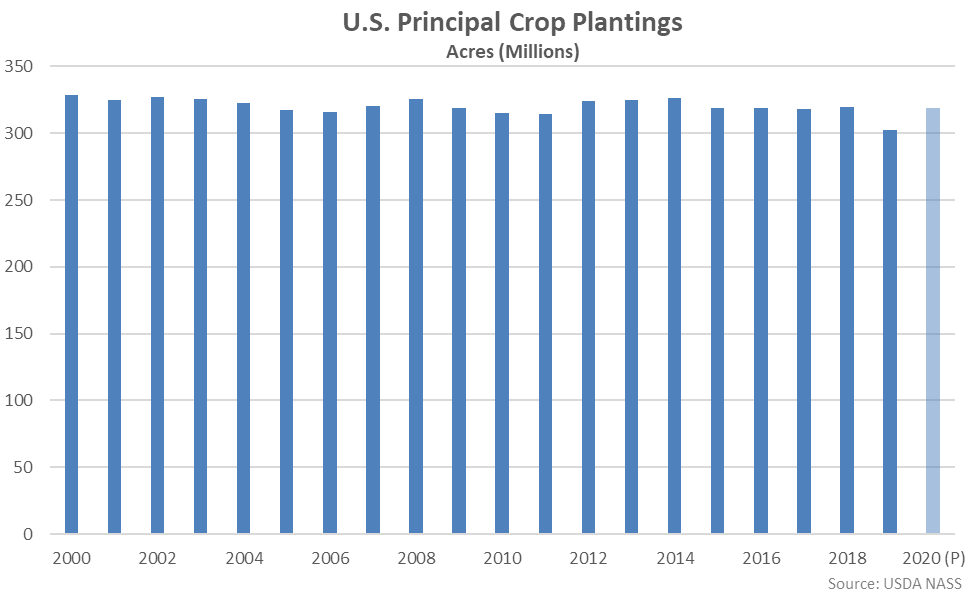

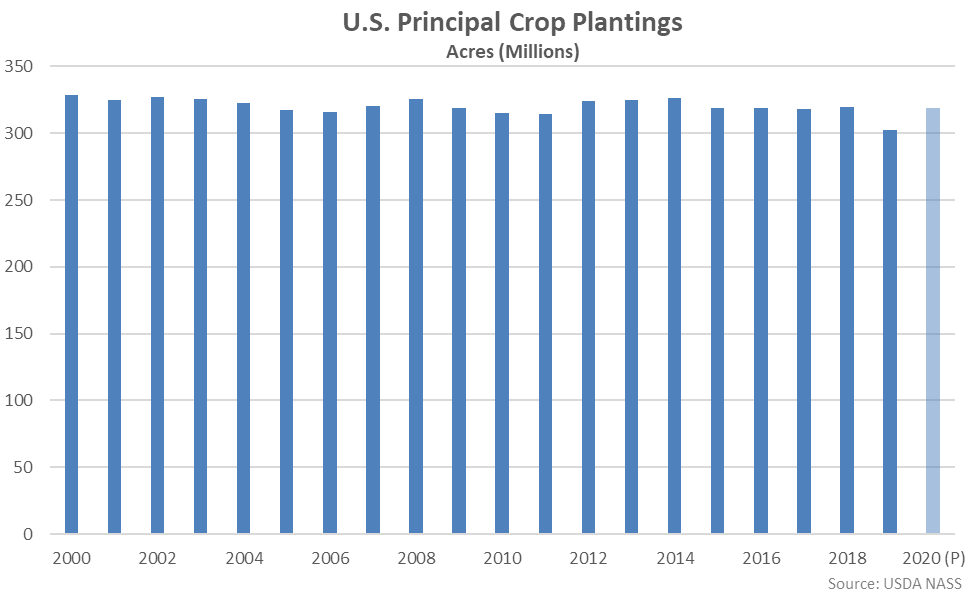

Total Principal Crops – 2020 Prospective Plantings up 5.4% YOY but Remain Slightly Below 2018 Levels

2020 total principal crop plantings of 319.1 million acres finished 16.5 million acres, or 5.4%, above the previous year figure but remained slightly below 2018 levels.

Crops included in the area planted are corn, soybeans, wheat, sorghum, oats, barley, rye, rice, peanuts, sunflower, cotton, dry edible beans, chickpeas, potatoes, sugarbeets, canola and proso millet. Harvested acreage is used for all hay, tobacco and sugarcane in computing total area planted. Values for 2020 were carried forward from 2019 for potatoes, proso millet, rye and sugarcane.

Total Principal Crops – 2020 Prospective Plantings up 5.4% YOY but Remain Slightly Below 2018 Levels

2020 total principal crop plantings of 319.1 million acres finished 16.5 million acres, or 5.4%, above the previous year figure but remained slightly below 2018 levels.

Crops included in the area planted are corn, soybeans, wheat, sorghum, oats, barley, rye, rice, peanuts, sunflower, cotton, dry edible beans, chickpeas, potatoes, sugarbeets, canola and proso millet. Harvested acreage is used for all hay, tobacco and sugarcane in computing total area planted. Values for 2020 were carried forward from 2019 for potatoes, proso millet, rye and sugarcane.

Prospective corn plantings for 2020 were led by Iowa (14.1 million acres), followed by Illinois (11.3 million acres) and Nebraska (10.5 million acres). The aforementioned states combined to account for over a third of the total U.S. prospective corn plantings.

Prospective corn plantings for 2020 were led by Iowa (14.1 million acres), followed by Illinois (11.3 million acres) and Nebraska (10.5 million acres). The aforementioned states combined to account for over a third of the total U.S. prospective corn plantings.

The largest YOY increases in prospective corn plantings were experienced throughout South Dakota (+1,650,000 acres), Ohio (+900,000 acres), Illinois (+800,000 acres) and Indiana (+800,000 acres). North Dakota (-300,000 acres) and Kansas (-100,000 acres) experienced the largest YOY declines in prospective corn plantings.

The largest YOY increases in prospective corn plantings were experienced throughout South Dakota (+1,650,000 acres), Ohio (+900,000 acres), Illinois (+800,000 acres) and Indiana (+800,000 acres). North Dakota (-300,000 acres) and Kansas (-100,000 acres) experienced the largest YOY declines in prospective corn plantings.

Soybeans – 2020 Prospective Plantings up 9.7% YOY but Finish Below Expectations

2020 soybean plantings of 83.5 million acres finished 7.4 million acres, or 9.7%, above the previous year figure but remained 1.9% below three year average figures. Soybean prospective plantings were 1.6% below average analyst estimates of 84.9 million acres.

Soybeans – 2020 Prospective Plantings up 9.7% YOY but Finish Below Expectations

2020 soybean plantings of 83.5 million acres finished 7.4 million acres, or 9.7%, above the previous year figure but remained 1.9% below three year average figures. Soybean prospective plantings were 1.6% below average analyst estimates of 84.9 million acres.

Prospective soybean plantings for 2020 were led by Illinois (10.5 million acres), followed by Iowa (9.3 million acres) and Minnesota (7.4 million acres). The aforementioned states combined to account for nearly a third of the total U.S. prospective soybean plantings.

Prospective soybean plantings for 2020 were led by Illinois (10.5 million acres), followed by Iowa (9.3 million acres) and Minnesota (7.4 million acres). The aforementioned states combined to account for nearly a third of the total U.S. prospective soybean plantings.

The largest YOY increases in prospective soybean plantings were experienced throughout South Dakota (+1,900,000 acres), North Dakota (+1,000,000 acres) and Missouri (+700,000 acres). North Carolina experienced the largest YOY decline in prospective soybean plantings (-60,000 acres).

The largest YOY increases in prospective soybean plantings were experienced throughout South Dakota (+1,900,000 acres), North Dakota (+1,000,000 acres) and Missouri (+700,000 acres). North Carolina experienced the largest YOY decline in prospective soybean plantings (-60,000 acres).

Wheat – 2020 Prospective Plantings Down 1.1% YOY to a Record Low, Finish Below Expectations

2020 wheat plantings of 44.7 million acres finished 0.5 million acres, or 1.1%, below the previous year figure, reaching a new record low level. Wheat prospective plantings were 0.7% below average analyst estimates of 45.0 million acres.

Wheat – 2020 Prospective Plantings Down 1.1% YOY to a Record Low, Finish Below Expectations

2020 wheat plantings of 44.7 million acres finished 0.5 million acres, or 1.1%, below the previous year figure, reaching a new record low level. Wheat prospective plantings were 0.7% below average analyst estimates of 45.0 million acres.

Prospective wheat plantings for 2020 were led by North Dakota (6.8 million acres) and Kansas (6.8 million acres), followed by Montana (5.47 million acres) and Texas (4.8 million acres). The aforementioned states combined to account for over half of the total U.S. prospective wheat plantings.

Prospective wheat plantings for 2020 were led by North Dakota (6.8 million acres) and Kansas (6.8 million acres), followed by Montana (5.47 million acres) and Texas (4.8 million acres). The aforementioned states combined to account for over half of the total U.S. prospective wheat plantings.

The largest YOY declines in prospective wheat plantings were experienced throughout North Dakota (-705,000 acres), Colorado (-300,000 acres) and Nebraska (-150,000 acres). Texas experienced the largest YOY increase in prospective wheat plantings (+300,000 acres).

The largest YOY declines in prospective wheat plantings were experienced throughout North Dakota (-705,000 acres), Colorado (-300,000 acres) and Nebraska (-150,000 acres). Texas experienced the largest YOY increase in prospective wheat plantings (+300,000 acres).

Total Principal Crops – 2020 Prospective Plantings up 5.4% YOY but Remain Slightly Below 2018 Levels

2020 total principal crop plantings of 319.1 million acres finished 16.5 million acres, or 5.4%, above the previous year figure but remained slightly below 2018 levels.

Crops included in the area planted are corn, soybeans, wheat, sorghum, oats, barley, rye, rice, peanuts, sunflower, cotton, dry edible beans, chickpeas, potatoes, sugarbeets, canola and proso millet. Harvested acreage is used for all hay, tobacco and sugarcane in computing total area planted. Values for 2020 were carried forward from 2019 for potatoes, proso millet, rye and sugarcane.

Total Principal Crops – 2020 Prospective Plantings up 5.4% YOY but Remain Slightly Below 2018 Levels

2020 total principal crop plantings of 319.1 million acres finished 16.5 million acres, or 5.4%, above the previous year figure but remained slightly below 2018 levels.

Crops included in the area planted are corn, soybeans, wheat, sorghum, oats, barley, rye, rice, peanuts, sunflower, cotton, dry edible beans, chickpeas, potatoes, sugarbeets, canola and proso millet. Harvested acreage is used for all hay, tobacco and sugarcane in computing total area planted. Values for 2020 were carried forward from 2019 for potatoes, proso millet, rye and sugarcane.