EIA Drilling Productivity Report Update – Apr ’20

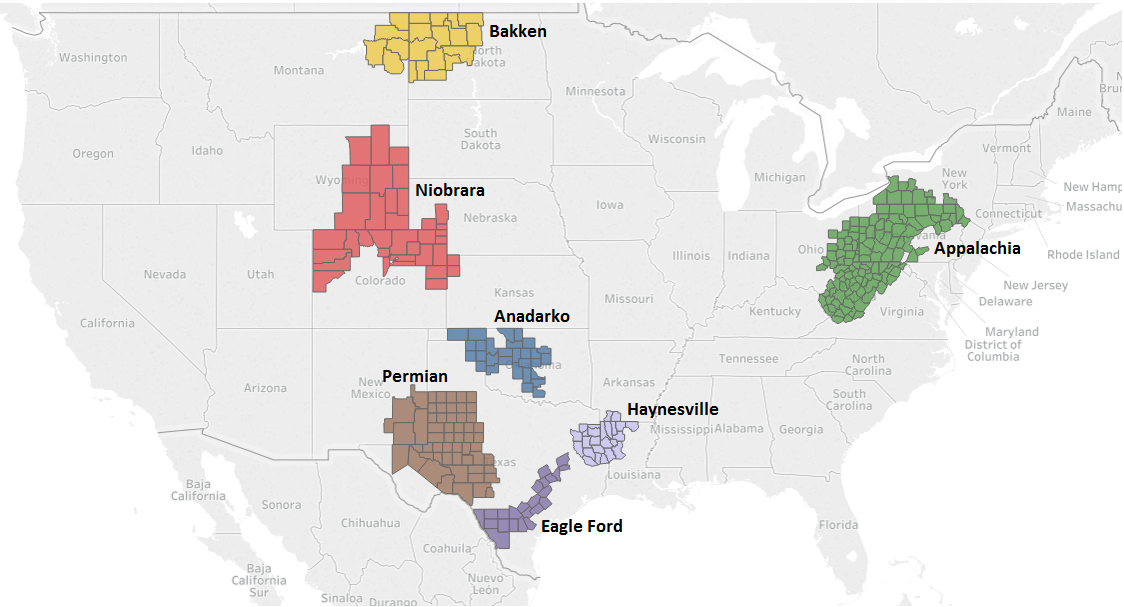

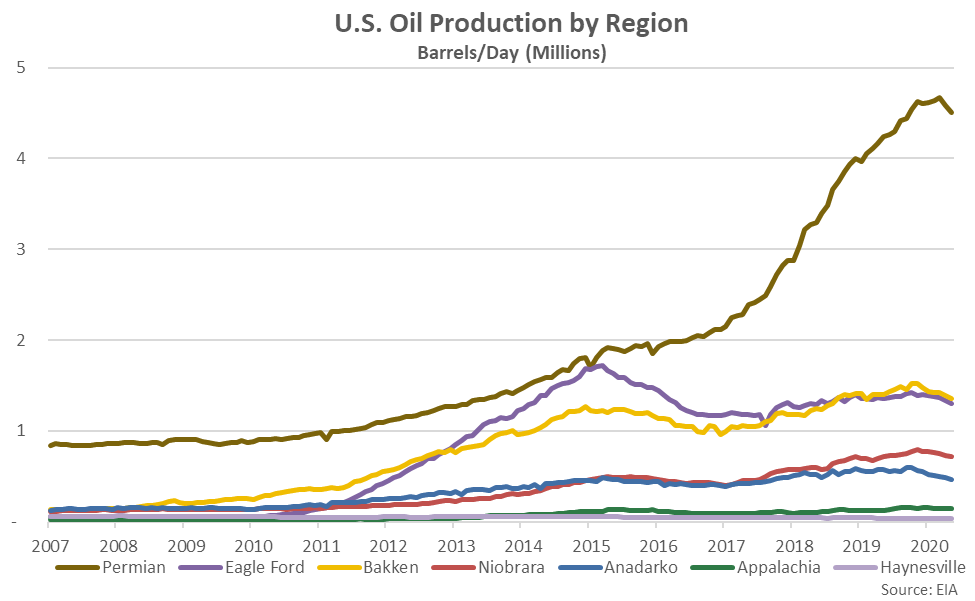

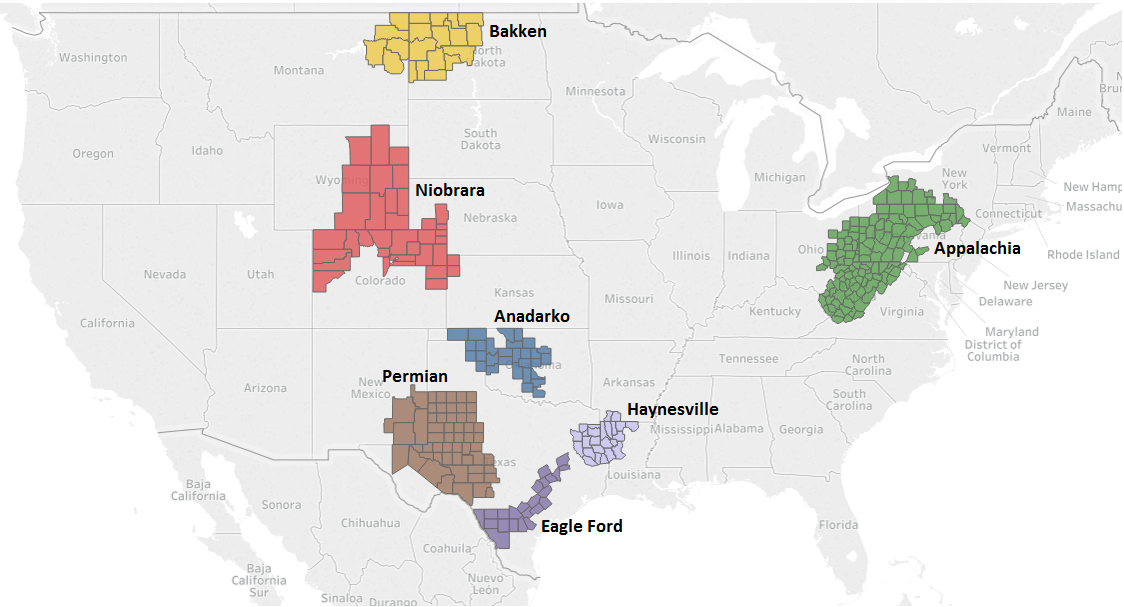

According to the EIA’s April Drilling Productivity Report, U.S. oil output is expected to decline to an 11 month low level throughout the month of May. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below.

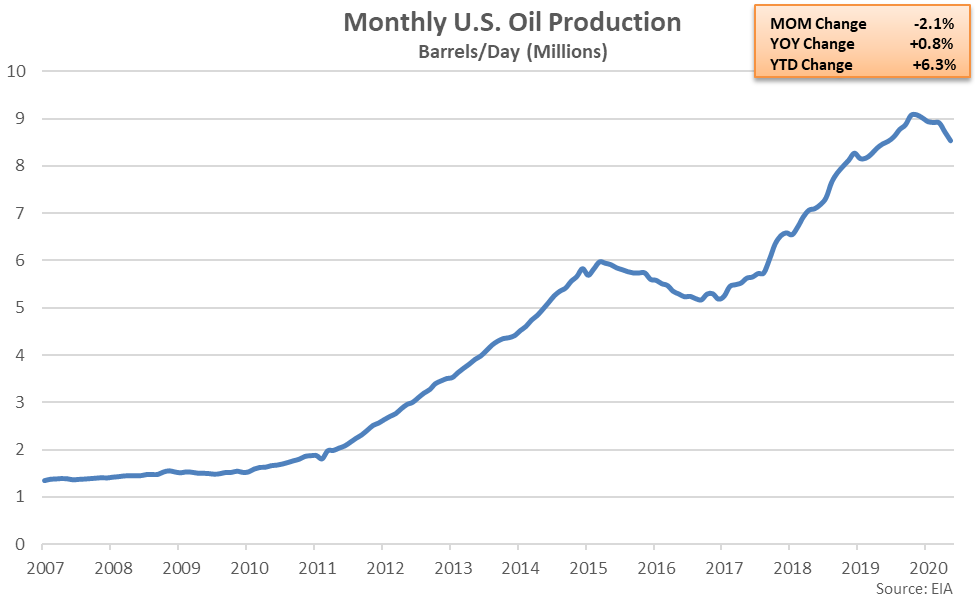

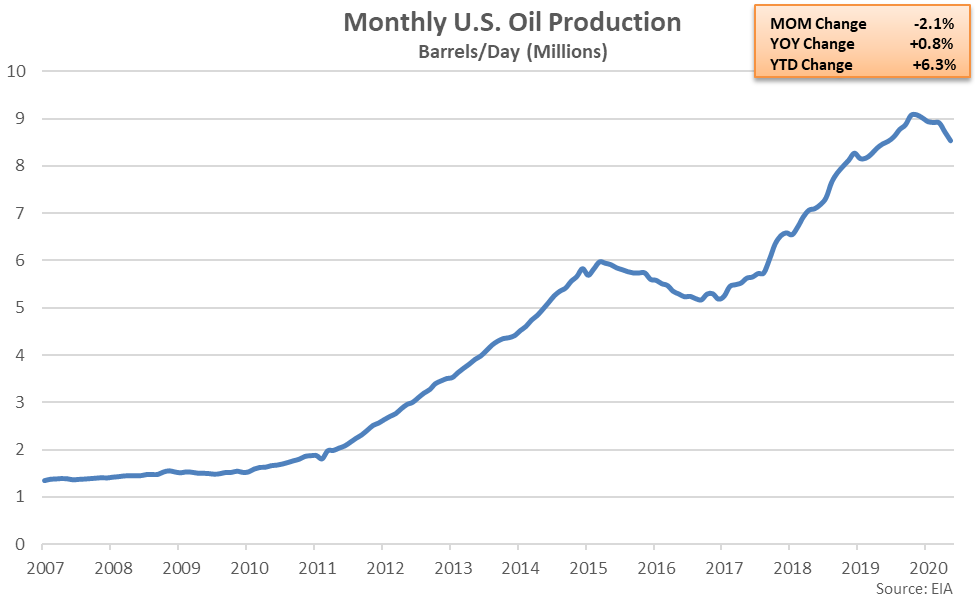

Apr ’20 production levels were revised 366,000 barrels per day (bpd), or 4.0%, below levels previously forecasted, finishing 194,000 bpd, or 2.2%, below Mar ’20 production levels. May ’20 production levels are expected to decline an additional 183,000 bpd, or 2.1%, from the Apr ’20 revised production levels to 8.53 million bpd, finishing at an 11 month low level. May ’20 production forecasts are expected to remain higher on a YOY basis for the 39th consecutive month, however, up 0.8% from the previous year levels.

Apr ’20 production levels were revised 366,000 barrels per day (bpd), or 4.0%, below levels previously forecasted, finishing 194,000 bpd, or 2.2%, below Mar ’20 production levels. May ’20 production levels are expected to decline an additional 183,000 bpd, or 2.1%, from the Apr ’20 revised production levels to 8.53 million bpd, finishing at an 11 month low level. May ’20 production forecasts are expected to remain higher on a YOY basis for the 39th consecutive month, however, up 0.8% from the previous year levels.

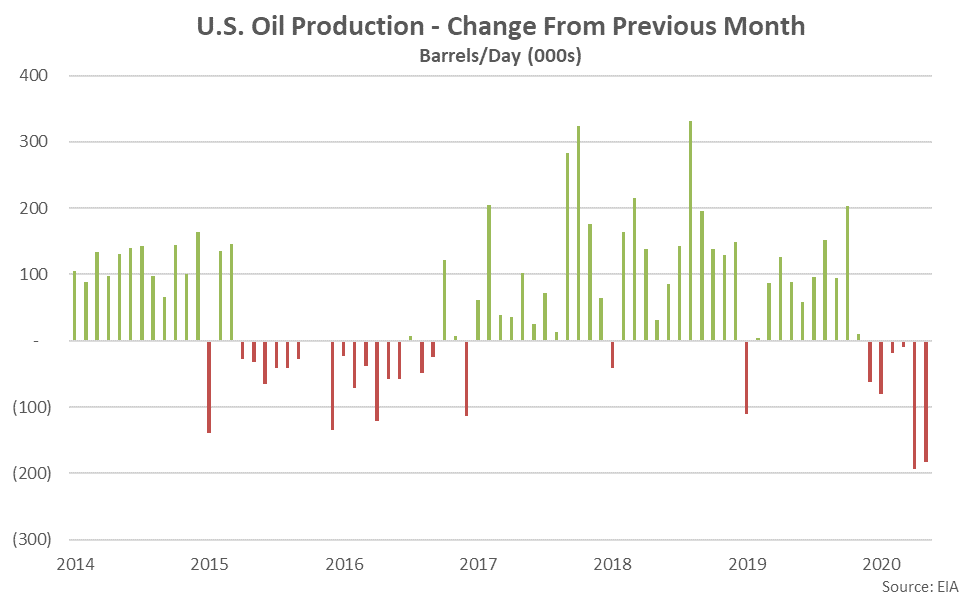

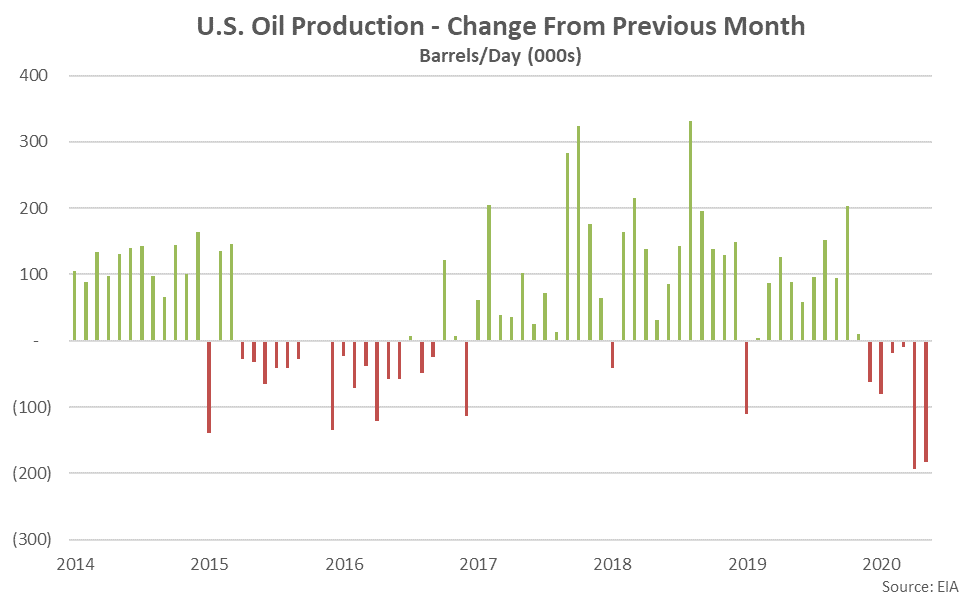

The May ’20 projected month-over-month decline in oil production would be the sixth experienced in a row and the second largest experienced on record, trailing only the previous month decline. EIA drilling productivity figures have been published since 2007.

The May ’20 projected month-over-month decline in oil production would be the sixth experienced in a row and the second largest experienced on record, trailing only the previous month decline. EIA drilling productivity figures have been published since 2007.

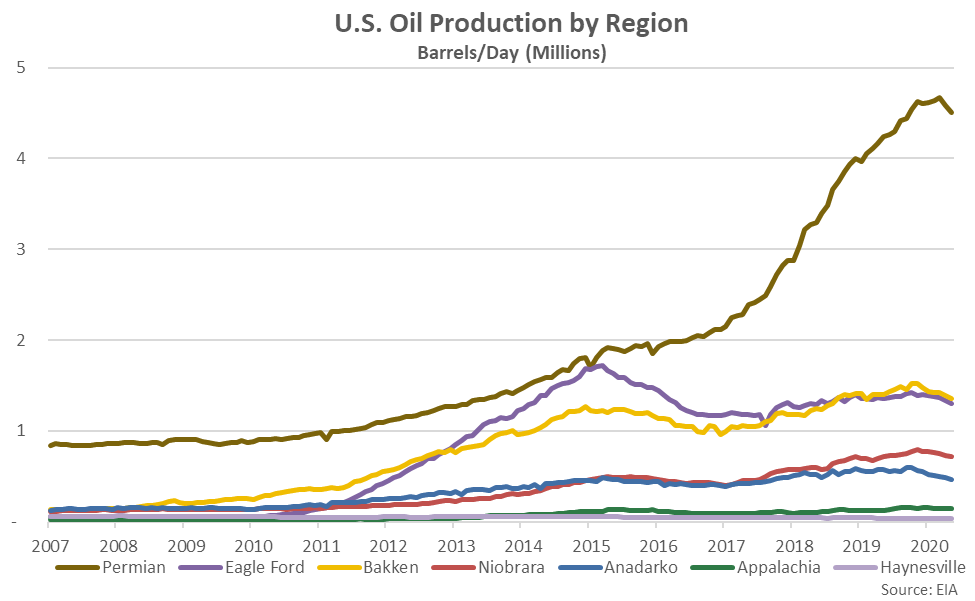

Oil production is expected to decline most significantly from the previous month within the Permian region (-76,000 bpd), followed by the Eagle Ford (-35,000 bpd) and Bakken (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Oil production is expected to decline most significantly from the previous month within the Permian region (-76,000 bpd), followed by the Eagle Ford (-35,000 bpd) and Bakken (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

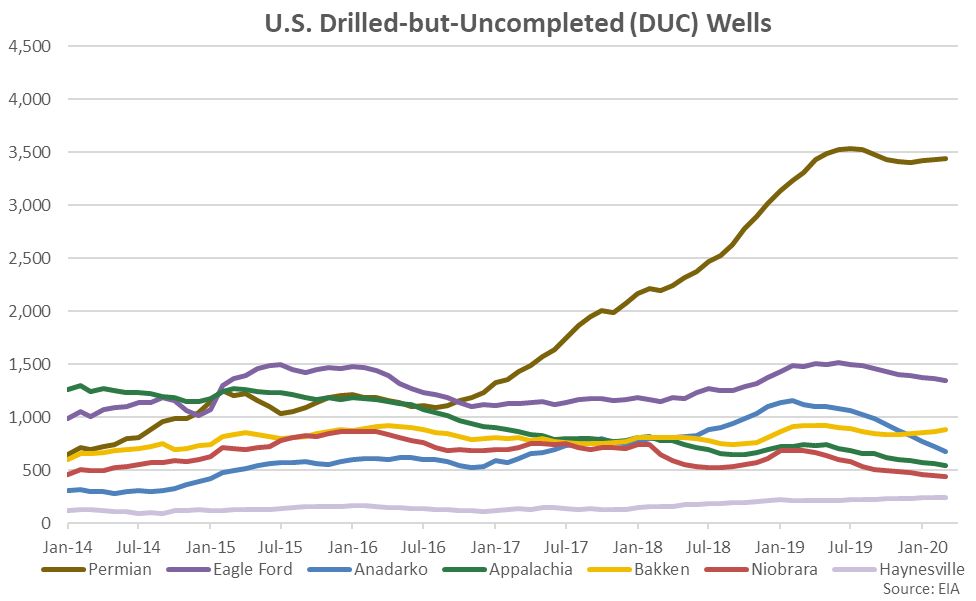

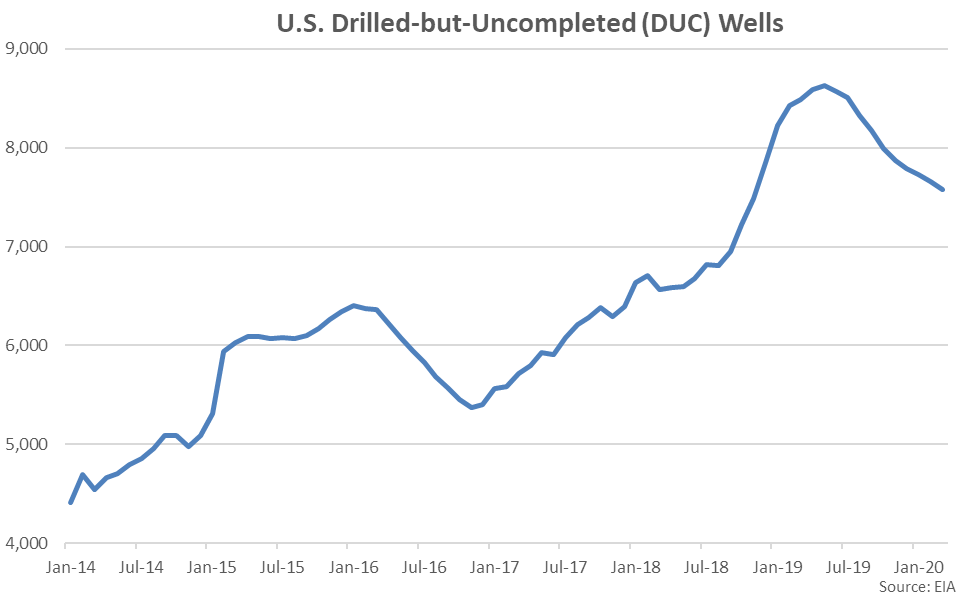

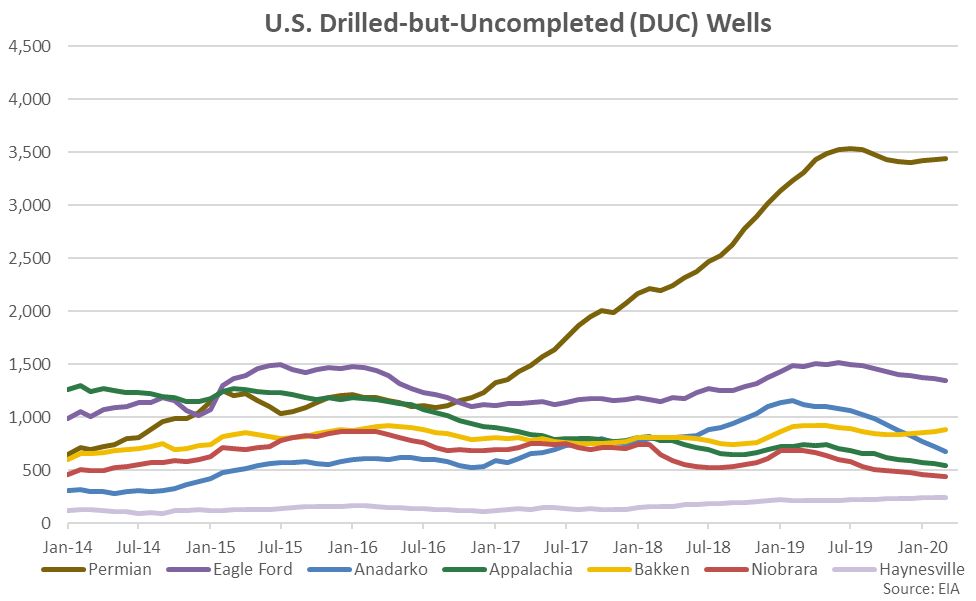

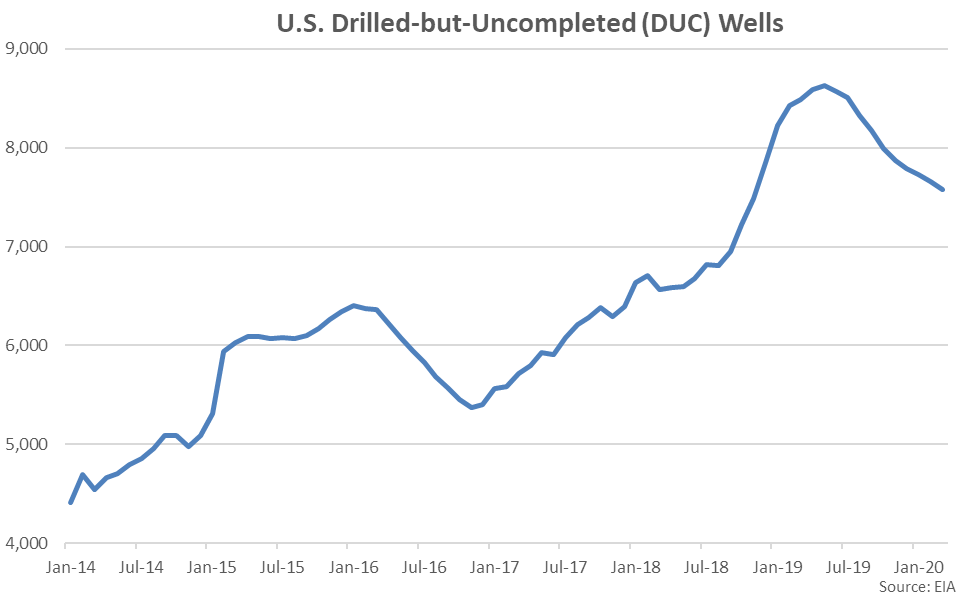

U.S. drilled-but-uncompleted (DUC) wells continued to decline from the May ’19 record highs, finishing lower for the tenth consecutive month. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Mar ’20 DUC wells figure of 7,575 finished 1.0% below the previous month, reaching a 16 month low level. The decline in DUC wells was the largest experienced throughout the past three months.

U.S. drilled-but-uncompleted (DUC) wells continued to decline from the May ’19 record highs, finishing lower for the tenth consecutive month. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Mar ’20 DUC wells figure of 7,575 finished 1.0% below the previous month, reaching a 16 month low level. The decline in DUC wells was the largest experienced throughout the past three months.

Anadarko DUC wells declined most significantly from the previous month, accounting for nearly two-thirds of the total month-over-month decline experienced throughout the seven production regions.

Anadarko DUC wells declined most significantly from the previous month, accounting for nearly two-thirds of the total month-over-month decline experienced throughout the seven production regions.

Apr ’20 production levels were revised 366,000 barrels per day (bpd), or 4.0%, below levels previously forecasted, finishing 194,000 bpd, or 2.2%, below Mar ’20 production levels. May ’20 production levels are expected to decline an additional 183,000 bpd, or 2.1%, from the Apr ’20 revised production levels to 8.53 million bpd, finishing at an 11 month low level. May ’20 production forecasts are expected to remain higher on a YOY basis for the 39th consecutive month, however, up 0.8% from the previous year levels.

Apr ’20 production levels were revised 366,000 barrels per day (bpd), or 4.0%, below levels previously forecasted, finishing 194,000 bpd, or 2.2%, below Mar ’20 production levels. May ’20 production levels are expected to decline an additional 183,000 bpd, or 2.1%, from the Apr ’20 revised production levels to 8.53 million bpd, finishing at an 11 month low level. May ’20 production forecasts are expected to remain higher on a YOY basis for the 39th consecutive month, however, up 0.8% from the previous year levels.

The May ’20 projected month-over-month decline in oil production would be the sixth experienced in a row and the second largest experienced on record, trailing only the previous month decline. EIA drilling productivity figures have been published since 2007.

The May ’20 projected month-over-month decline in oil production would be the sixth experienced in a row and the second largest experienced on record, trailing only the previous month decline. EIA drilling productivity figures have been published since 2007.

Oil production is expected to decline most significantly from the previous month within the Permian region (-76,000 bpd), followed by the Eagle Ford (-35,000 bpd) and Bakken (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Oil production is expected to decline most significantly from the previous month within the Permian region (-76,000 bpd), followed by the Eagle Ford (-35,000 bpd) and Bakken (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

U.S. drilled-but-uncompleted (DUC) wells continued to decline from the May ’19 record highs, finishing lower for the tenth consecutive month. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Mar ’20 DUC wells figure of 7,575 finished 1.0% below the previous month, reaching a 16 month low level. The decline in DUC wells was the largest experienced throughout the past three months.

U.S. drilled-but-uncompleted (DUC) wells continued to decline from the May ’19 record highs, finishing lower for the tenth consecutive month. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Mar ’20 DUC wells figure of 7,575 finished 1.0% below the previous month, reaching a 16 month low level. The decline in DUC wells was the largest experienced throughout the past three months.

Anadarko DUC wells declined most significantly from the previous month, accounting for nearly two-thirds of the total month-over-month decline experienced throughout the seven production regions.

Anadarko DUC wells declined most significantly from the previous month, accounting for nearly two-thirds of the total month-over-month decline experienced throughout the seven production regions.