EIA Drilling Productivity Report Update – May ’20

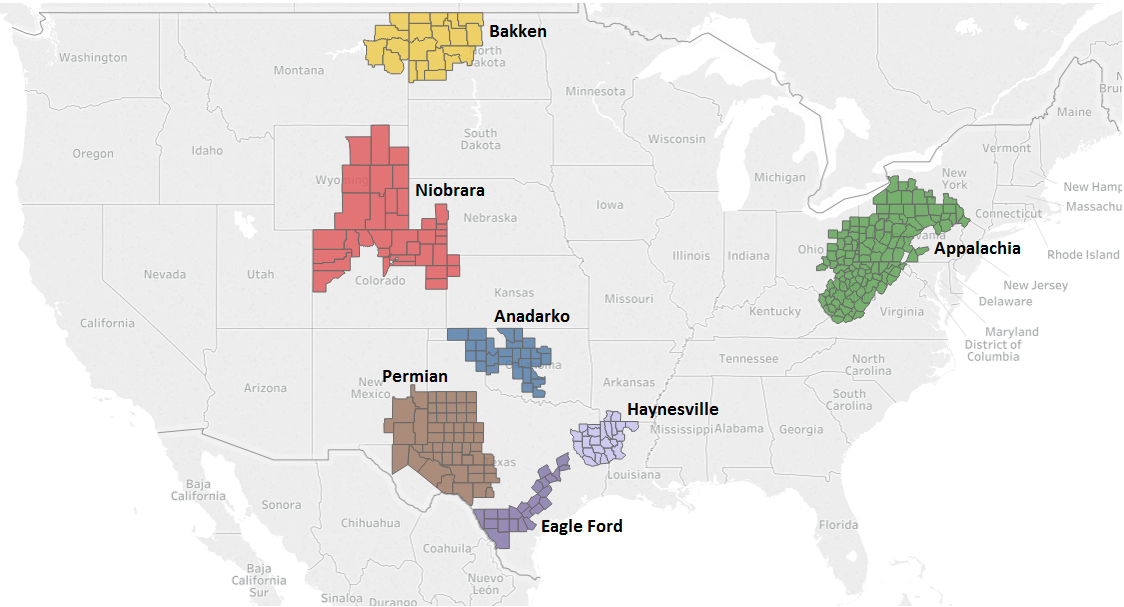

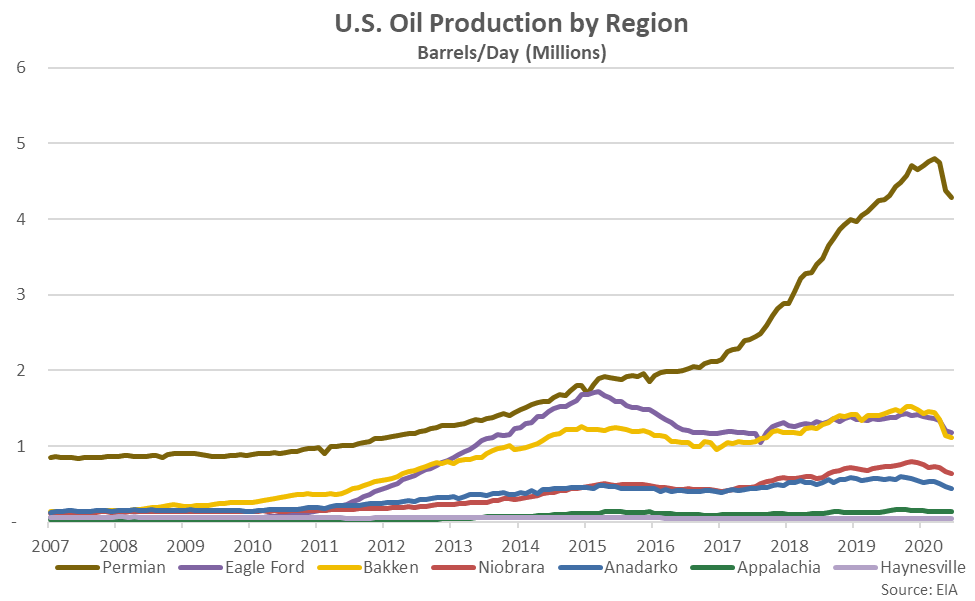

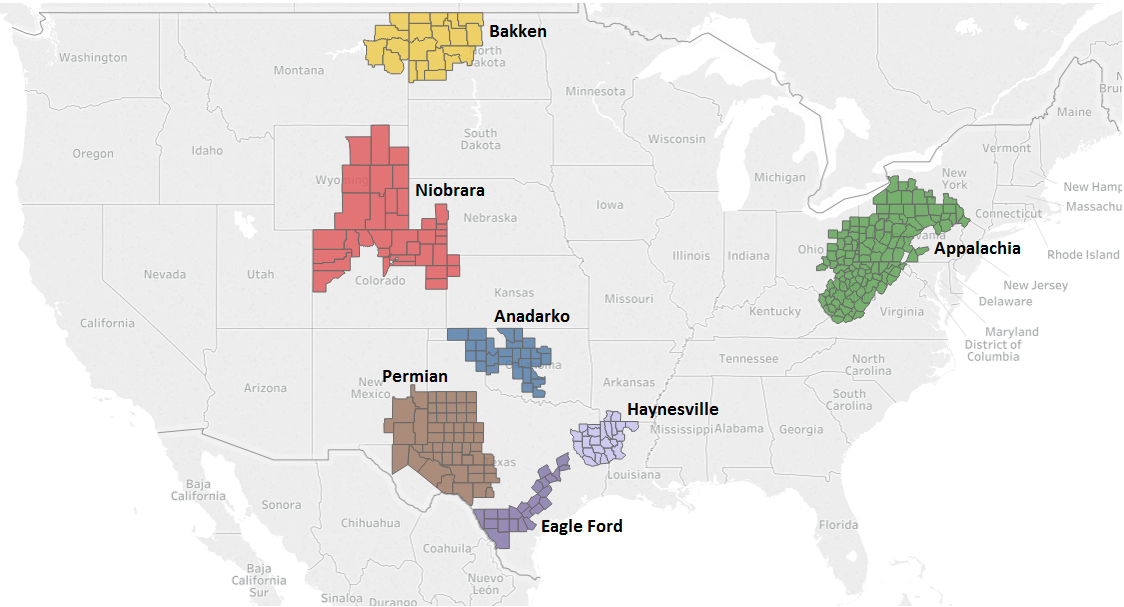

According to the EIA’s May Drilling Productivity Report, U.S. oil output is expected to decline to a 22 month low level throughout the month of June. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below.

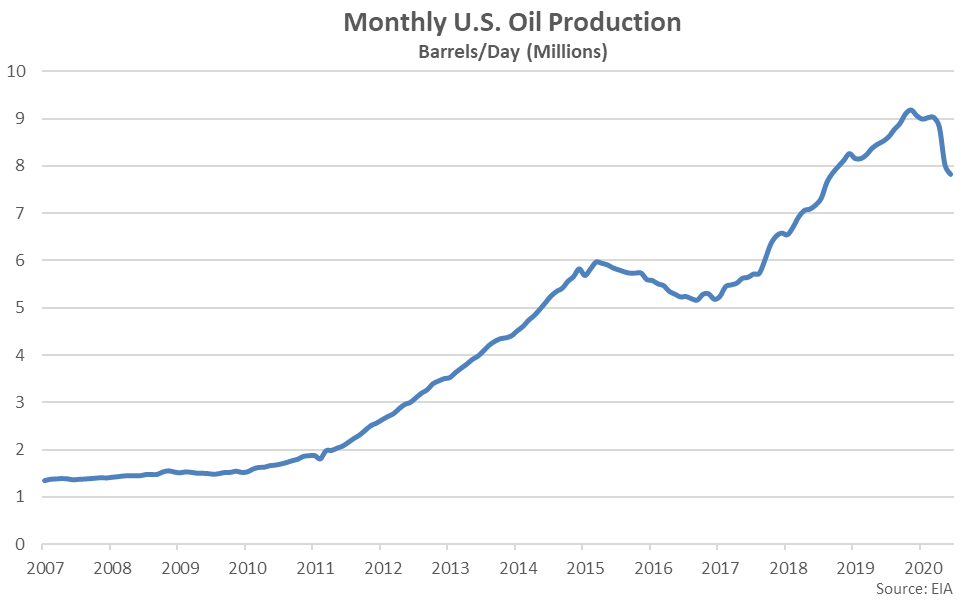

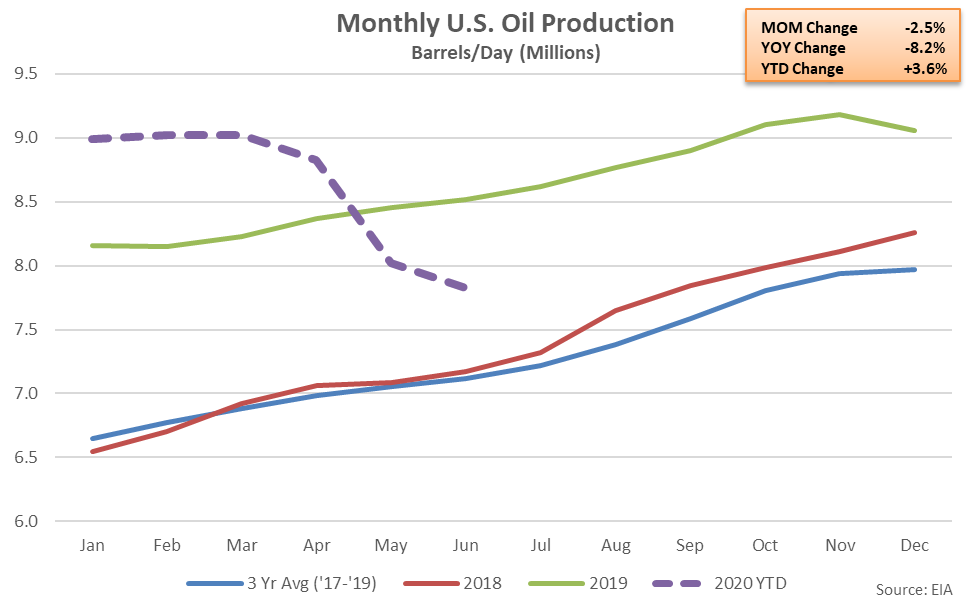

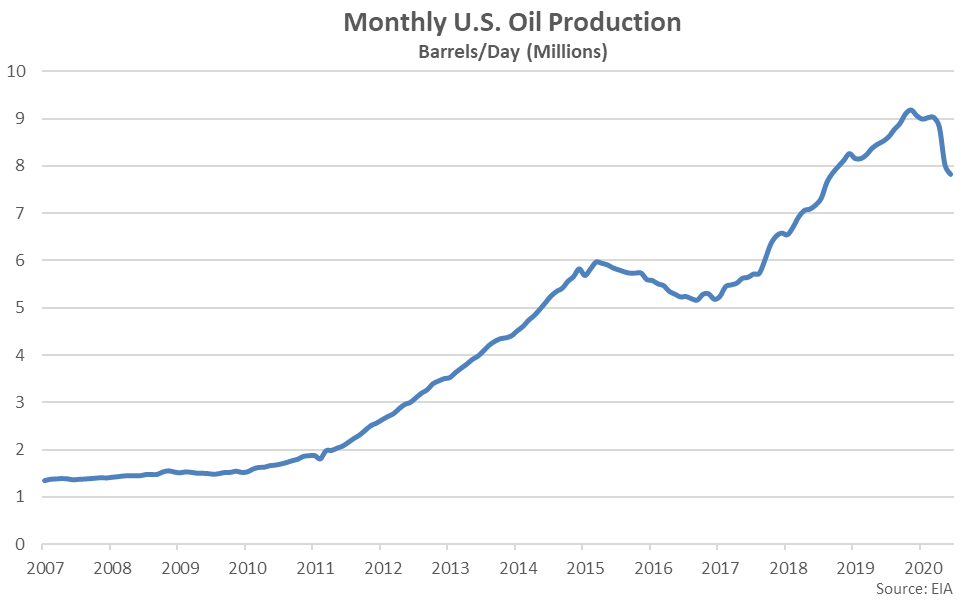

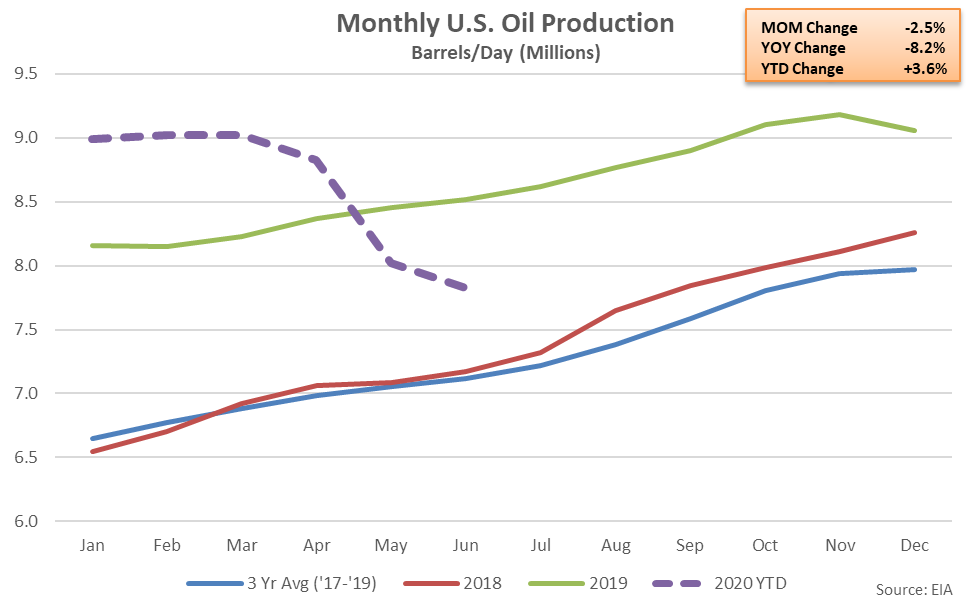

May ’20 production levels were revised 507,000 barrels per day (bpd), or 5.9%, below levels previously forecasted, finishing 805,000 bpd, or 9.1%, below Apr ’20 production levels. Jun ’20 production levels are expected to decline an additional 197,000 bpd, or 2.5%, from the May ’20 revised production levels to 7.82 million bpd, finishing at a 22 month low level.

May ’20 production levels were revised 507,000 barrels per day (bpd), or 5.9%, below levels previously forecasted, finishing 805,000 bpd, or 9.1%, below Apr ’20 production levels. Jun ’20 production levels are expected to decline an additional 197,000 bpd, or 2.5%, from the May ’20 revised production levels to 7.82 million bpd, finishing at a 22 month low level.

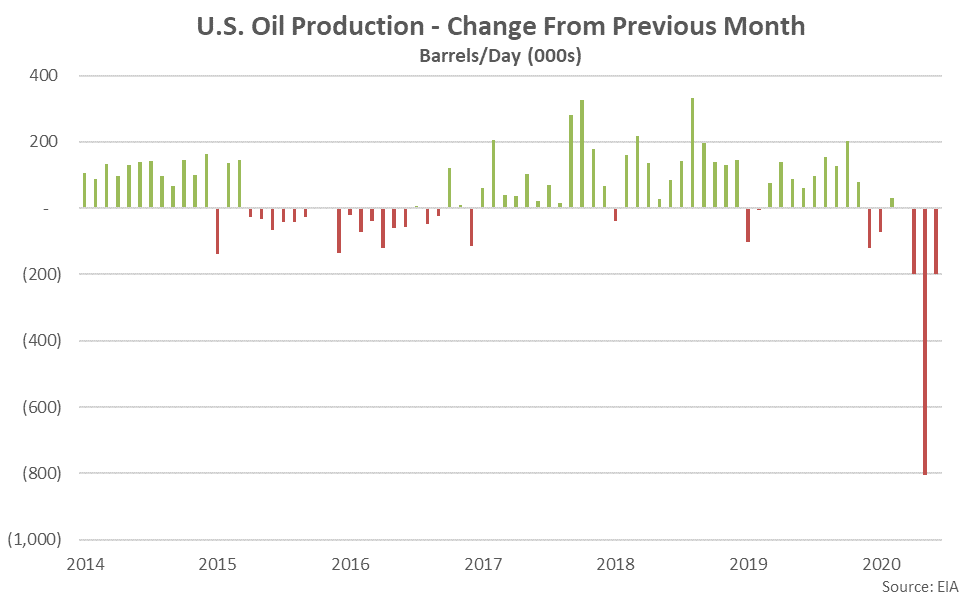

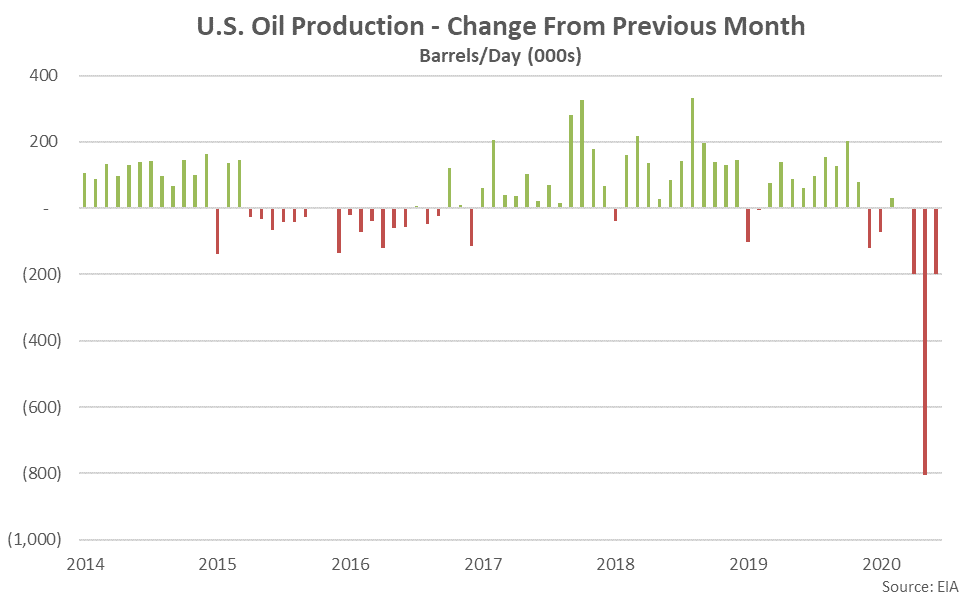

The Jun ’20 projected month-over-month decline in oil production would be the third experienced in a row but the smallest experienced throughout the three month period. The May ’20 month-over-month decline in crude oil production was by far the largest on record, exceeding the previous record high decline by over four times. EIA drilling productivity figures have been published since 2007.

The Jun ’20 projected month-over-month decline in oil production would be the third experienced in a row but the smallest experienced throughout the three month period. The May ’20 month-over-month decline in crude oil production was by far the largest on record, exceeding the previous record high decline by over four times. EIA drilling productivity figures have been published since 2007.

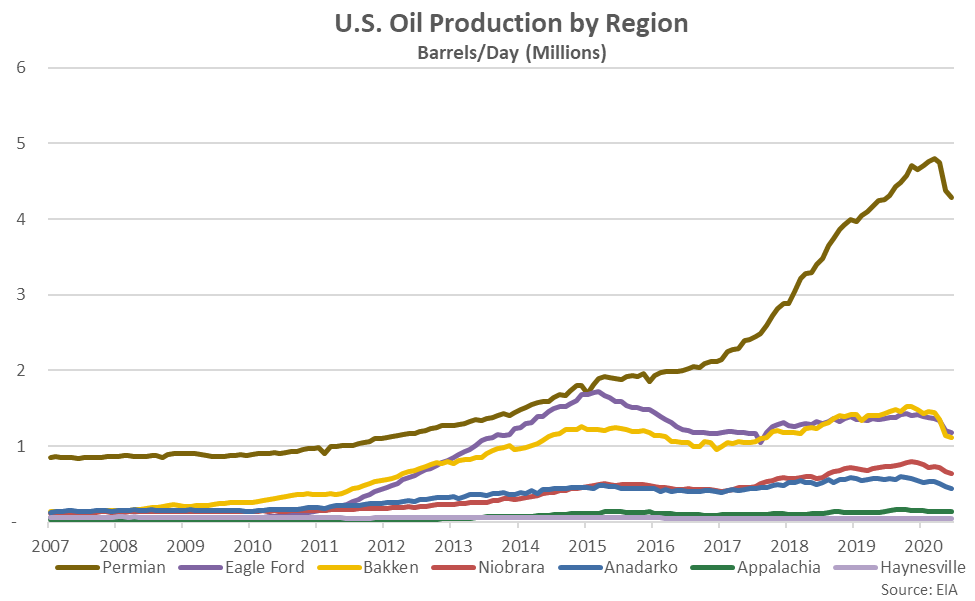

Oil production is expected to decline most significantly from the previous month within the Permian region (-87,000 bpd), followed by the Eagle Ford (-36,000 bpd) and Anadarko (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Oil production is expected to decline most significantly from the previous month within the Permian region (-87,000 bpd), followed by the Eagle Ford (-36,000 bpd) and Anadarko (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Jun ’20 oil production forecasts are expected to decline on a YOY basis for the second consecutive month, finishing 8.2% below previous year levels. The YOY decline in production would be the largest experienced throughout the past 45 months. Oil production had finished higher on a YOY basis over 38 consecutive months prior to finishing lower over the two most recent months of data.

Jun ’20 oil production forecasts are expected to decline on a YOY basis for the second consecutive month, finishing 8.2% below previous year levels. The YOY decline in production would be the largest experienced throughout the past 45 months. Oil production had finished higher on a YOY basis over 38 consecutive months prior to finishing lower over the two most recent months of data.

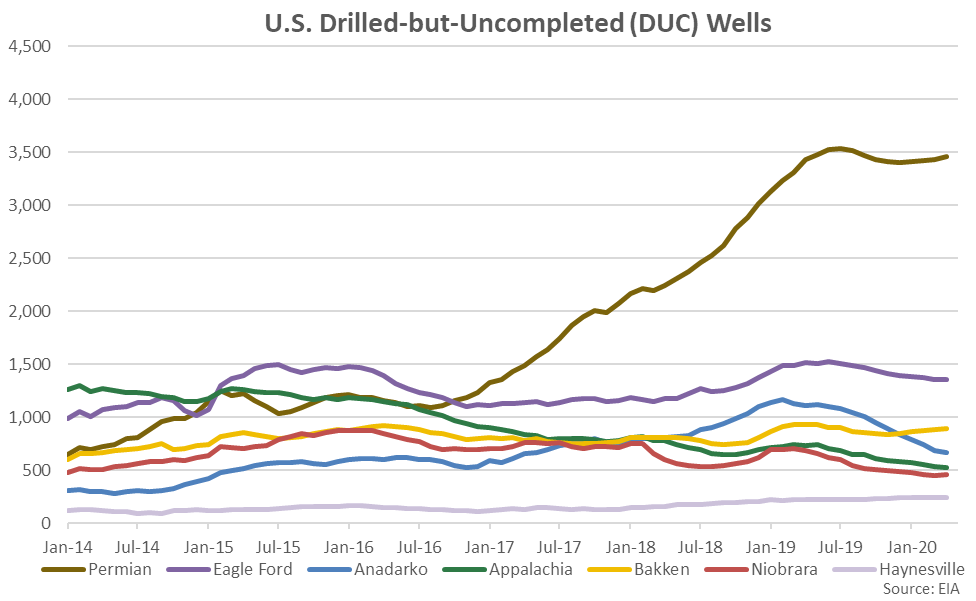

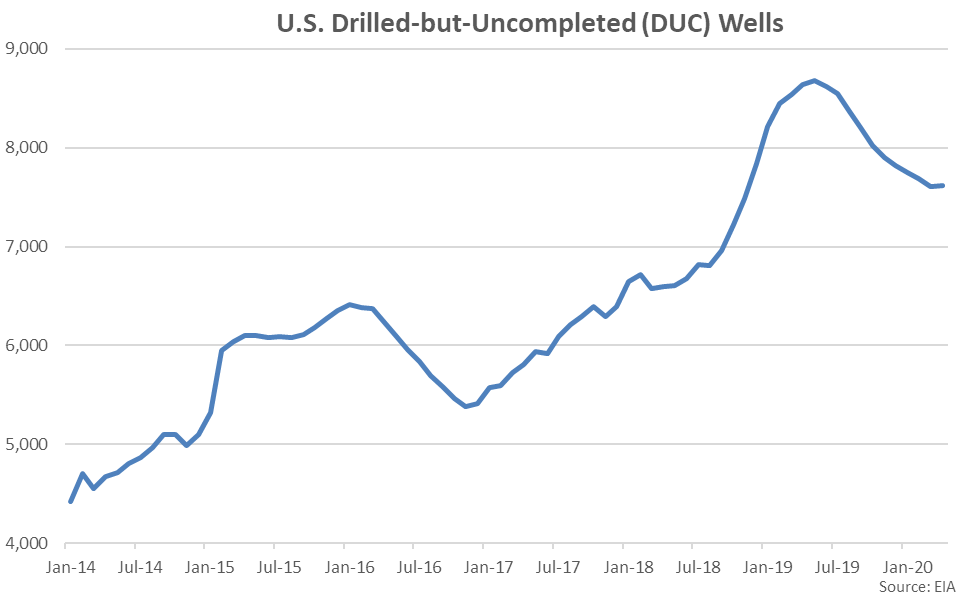

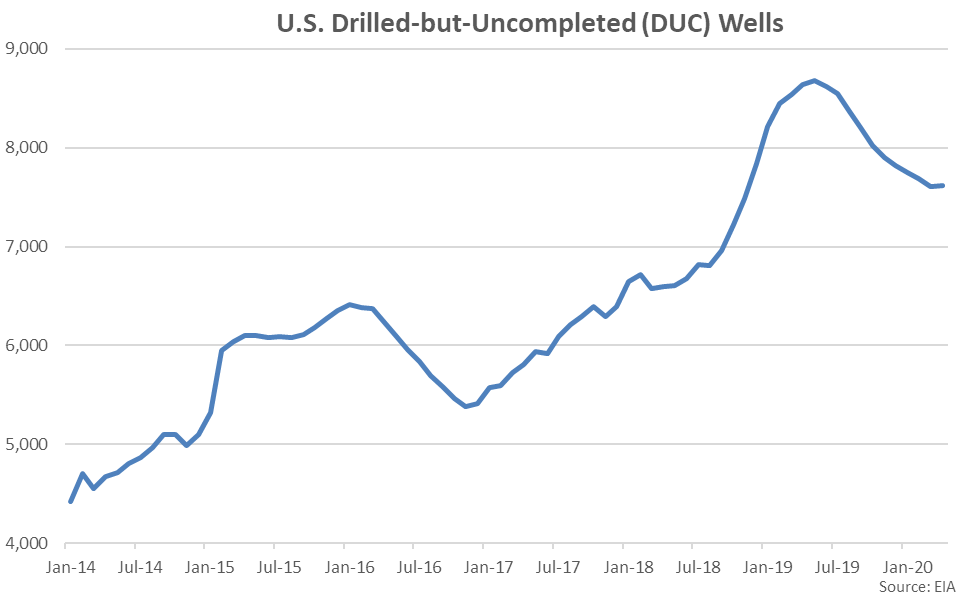

Apr ’20 U.S. drilled-but-uncompleted (DUC) wells rebounded slightly from the 16 month low level experienced throughout the previous month but remained significantly below the May ’19 record high levels. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Apr ’20 DUC wells figure of 7,616 finished 0.2% above the previous month, increasing for the first time in the past 11 months.

Apr ’20 U.S. drilled-but-uncompleted (DUC) wells rebounded slightly from the 16 month low level experienced throughout the previous month but remained significantly below the May ’19 record high levels. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Apr ’20 DUC wells figure of 7,616 finished 0.2% above the previous month, increasing for the first time in the past 11 months.

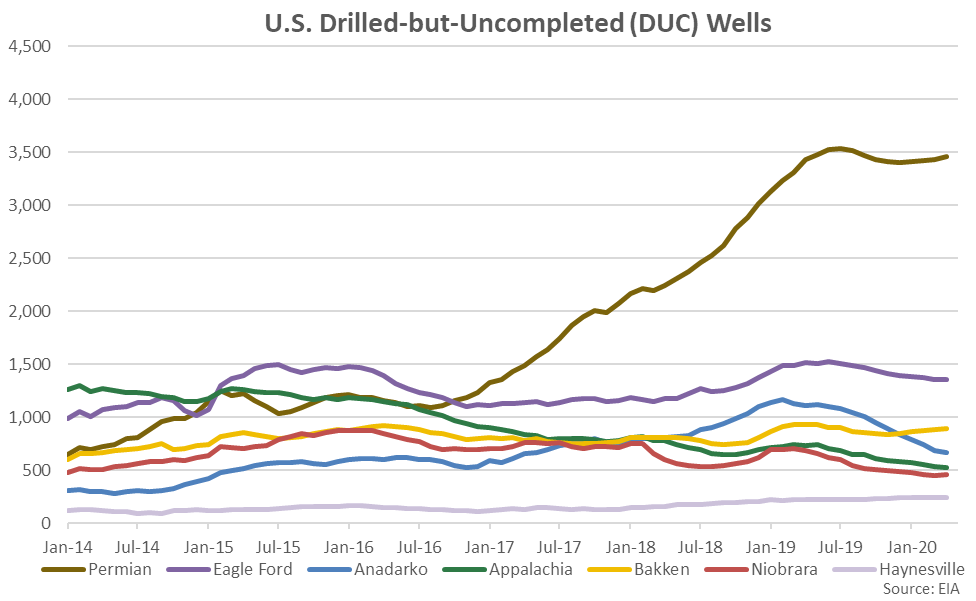

Permian DUC wells increased most significantly from the previous month throughout Apr ‘20, more than offsetting a combined decline in DUC wells experienced throughout the other six key production regions.

Permian DUC wells increased most significantly from the previous month throughout Apr ‘20, more than offsetting a combined decline in DUC wells experienced throughout the other six key production regions.

May ’20 production levels were revised 507,000 barrels per day (bpd), or 5.9%, below levels previously forecasted, finishing 805,000 bpd, or 9.1%, below Apr ’20 production levels. Jun ’20 production levels are expected to decline an additional 197,000 bpd, or 2.5%, from the May ’20 revised production levels to 7.82 million bpd, finishing at a 22 month low level.

May ’20 production levels were revised 507,000 barrels per day (bpd), or 5.9%, below levels previously forecasted, finishing 805,000 bpd, or 9.1%, below Apr ’20 production levels. Jun ’20 production levels are expected to decline an additional 197,000 bpd, or 2.5%, from the May ’20 revised production levels to 7.82 million bpd, finishing at a 22 month low level.

The Jun ’20 projected month-over-month decline in oil production would be the third experienced in a row but the smallest experienced throughout the three month period. The May ’20 month-over-month decline in crude oil production was by far the largest on record, exceeding the previous record high decline by over four times. EIA drilling productivity figures have been published since 2007.

The Jun ’20 projected month-over-month decline in oil production would be the third experienced in a row but the smallest experienced throughout the three month period. The May ’20 month-over-month decline in crude oil production was by far the largest on record, exceeding the previous record high decline by over four times. EIA drilling productivity figures have been published since 2007.

Oil production is expected to decline most significantly from the previous month within the Permian region (-87,000 bpd), followed by the Eagle Ford (-36,000 bpd) and Anadarko (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Oil production is expected to decline most significantly from the previous month within the Permian region (-87,000 bpd), followed by the Eagle Ford (-36,000 bpd) and Anadarko (-28,000 bpd) regions. The aforementioned regions combined to account for over three-quarters of the total month-over-month decline in production.

Jun ’20 oil production forecasts are expected to decline on a YOY basis for the second consecutive month, finishing 8.2% below previous year levels. The YOY decline in production would be the largest experienced throughout the past 45 months. Oil production had finished higher on a YOY basis over 38 consecutive months prior to finishing lower over the two most recent months of data.

Jun ’20 oil production forecasts are expected to decline on a YOY basis for the second consecutive month, finishing 8.2% below previous year levels. The YOY decline in production would be the largest experienced throughout the past 45 months. Oil production had finished higher on a YOY basis over 38 consecutive months prior to finishing lower over the two most recent months of data.

Apr ’20 U.S. drilled-but-uncompleted (DUC) wells rebounded slightly from the 16 month low level experienced throughout the previous month but remained significantly below the May ’19 record high levels. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Apr ’20 DUC wells figure of 7,616 finished 0.2% above the previous month, increasing for the first time in the past 11 months.

Apr ’20 U.S. drilled-but-uncompleted (DUC) wells rebounded slightly from the 16 month low level experienced throughout the previous month but remained significantly below the May ’19 record high levels. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The Apr ’20 DUC wells figure of 7,616 finished 0.2% above the previous month, increasing for the first time in the past 11 months.

Permian DUC wells increased most significantly from the previous month throughout Apr ‘20, more than offsetting a combined decline in DUC wells experienced throughout the other six key production regions.

Permian DUC wells increased most significantly from the previous month throughout Apr ‘20, more than offsetting a combined decline in DUC wells experienced throughout the other six key production regions.