Atten Babler Corn & Soybeans FX Indices – Jul…

Corn FX Indices:

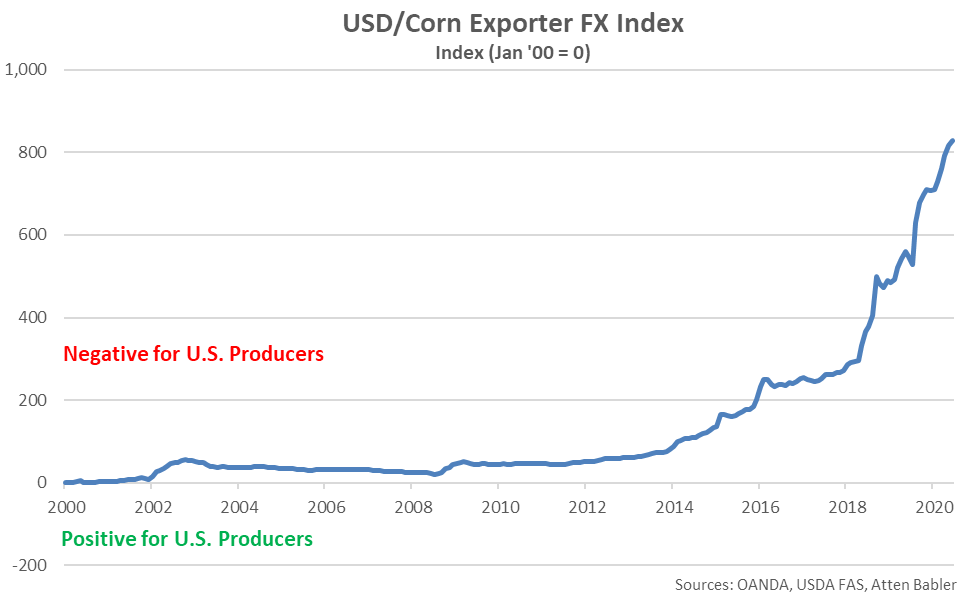

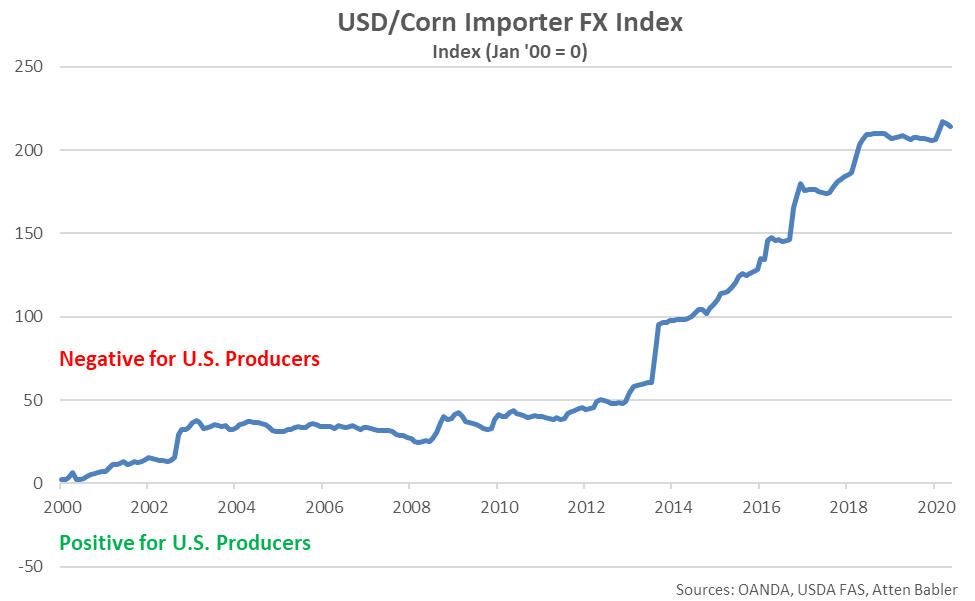

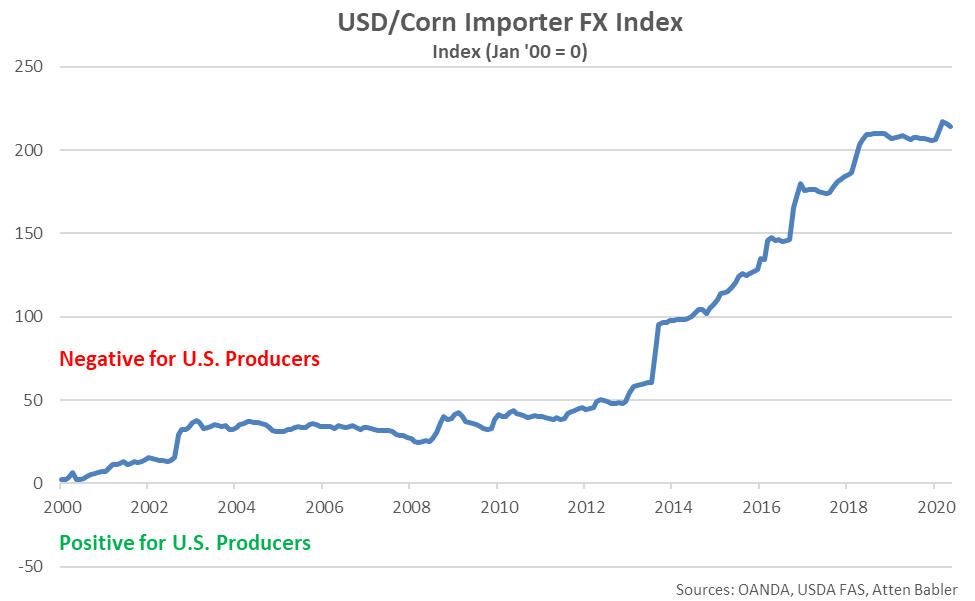

The Atten Babler Commodities Corn Foreign Exchange (FX) Indices were mixed throughout Jun ’20. The USD/Corn Exporter FX Index increased to a record high level however the USD/Corn Importer FX Index and USD/Domestic Corn Importer FX Index declined from the previous month. Despite declining from the previous month, the USD/Corn Importer FX Index and USD/Domestic Corn Importer FX Index each remained at the third highest levels on record.

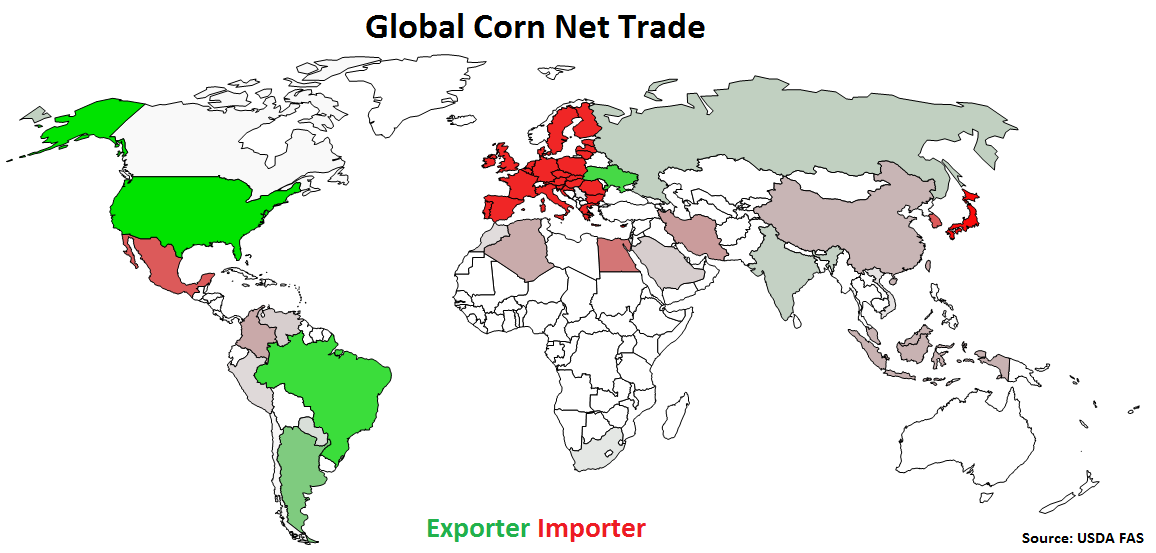

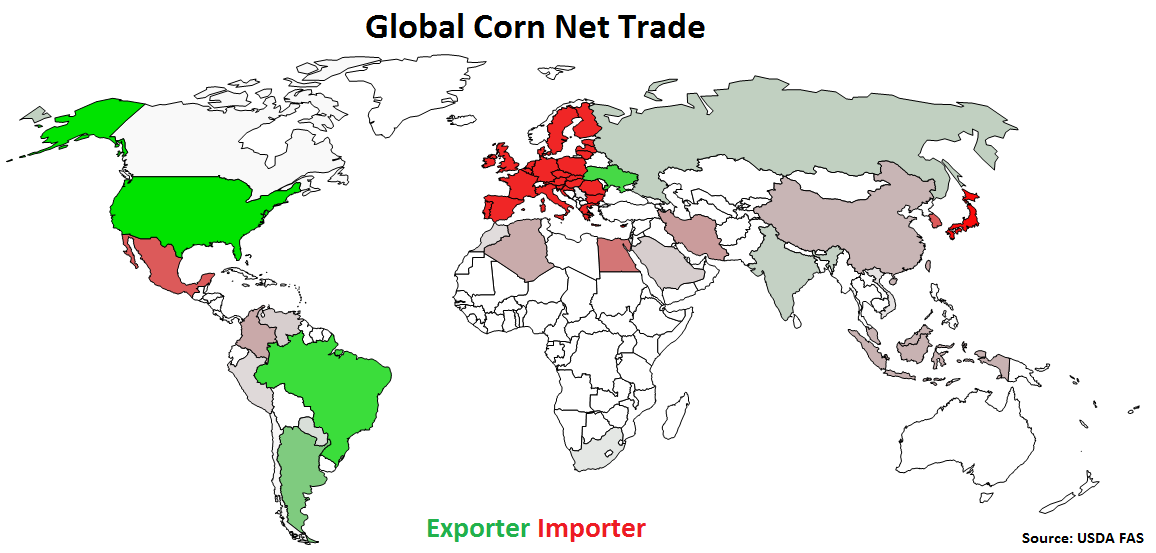

Global Corn Net Trade:

Major net corn exporters are led by the U.S., followed by Brazil, Ukraine, Argentina, Russia and India (represented in green in the chart below). Major net corn importers are led by the EU-28, followed by Japan, Mexico, South Korea, Egypt and Iran (represented in red in the chart below).

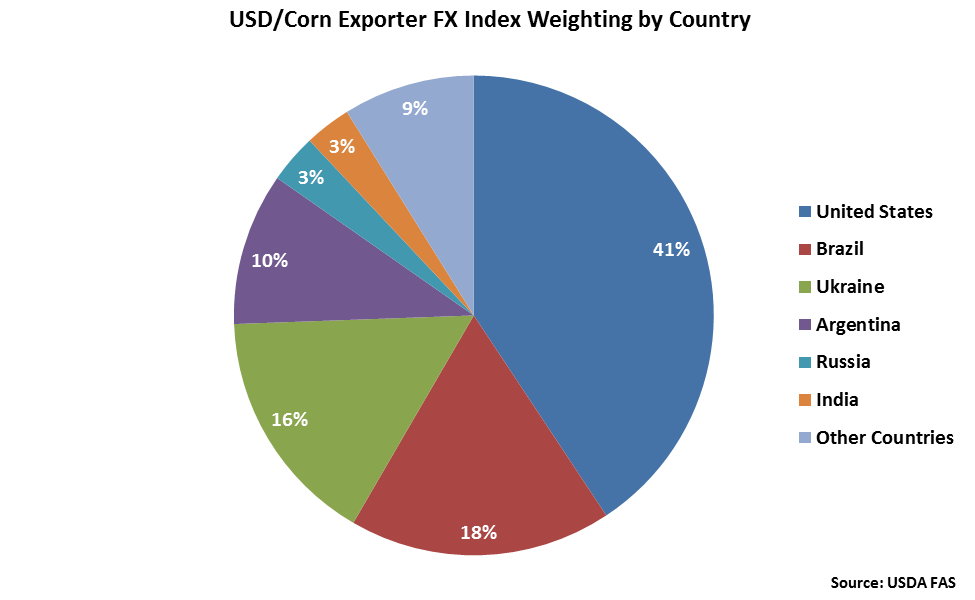

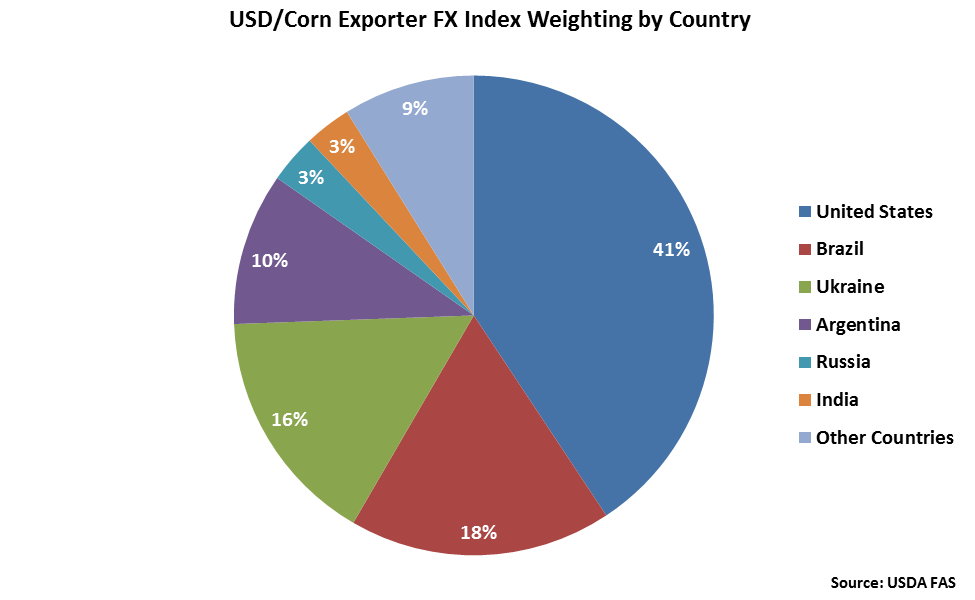

The United States accounts for over two fifths of the USD/Corn Exporter FX Index, followed by Brazil at 18%, Ukraine at 16% and Argentina at 10%.

The United States accounts for over two fifths of the USD/Corn Exporter FX Index, followed by Brazil at 18%, Ukraine at 16% and Argentina at 10%.

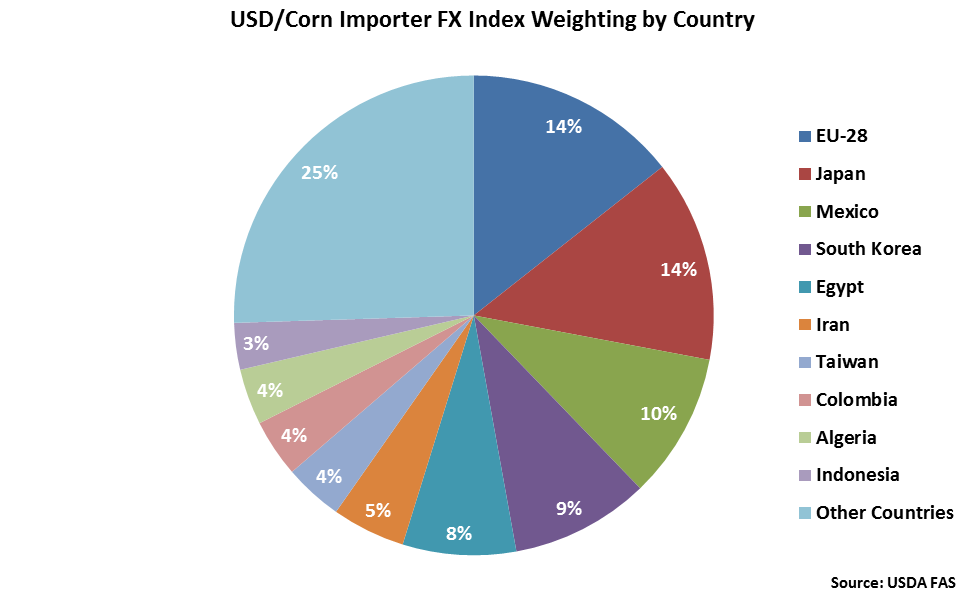

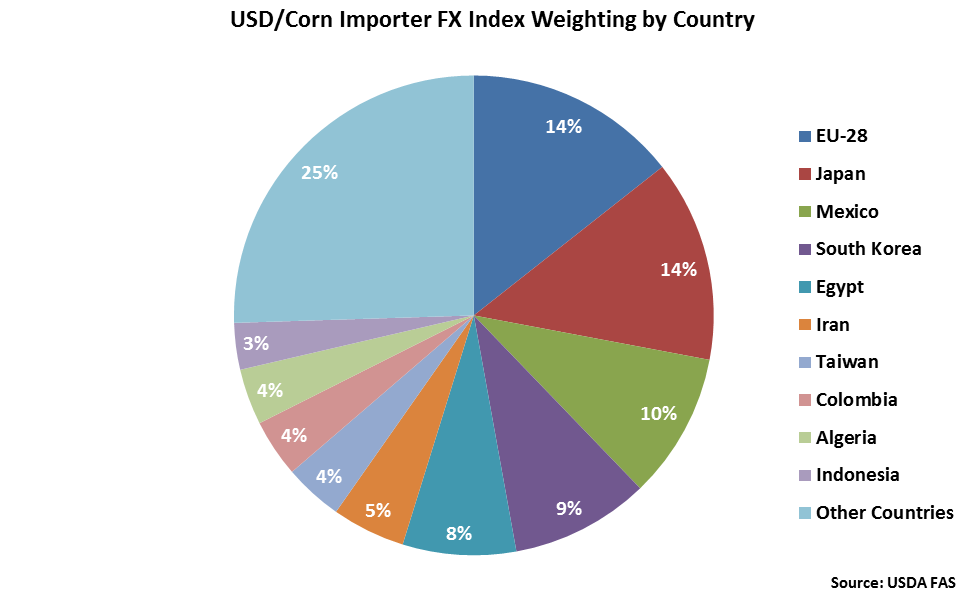

The EU-28 and Japan each account for 14% of the USD/Corn Importer FX Index. Mexico, South Korea, Egypt and Iran each account for between 5-10% of the index.

The EU-28 and Japan each account for 14% of the USD/Corn Importer FX Index. Mexico, South Korea, Egypt and Iran each account for between 5-10% of the index.

USD/Corn Exporter FX Index:

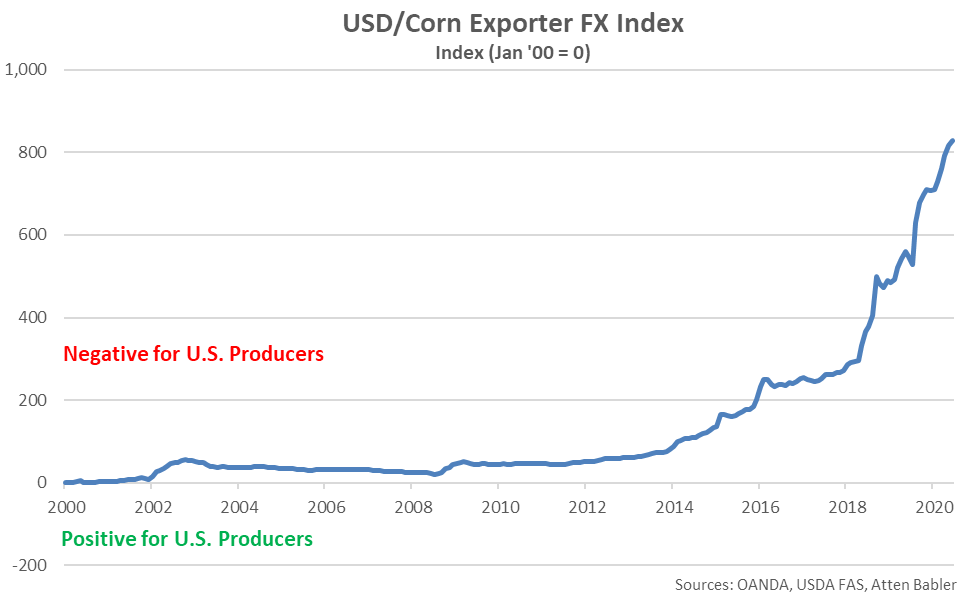

The USD/Corn Exporter FX Index increased 13.3 points during Jun ’20, finishing at a record high value of 829.0. The USD/Corn Exporter FX Index has increased 121.5 points throughout the past six months and 748.3 points since the beginning of 2014. A strong USD/Corn Exporter FX Index reduces the competitiveness of U.S. corn relative to other exporting regions (represented in green in the Global Corn Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Exporter FX Index:

The USD/Corn Exporter FX Index increased 13.3 points during Jun ’20, finishing at a record high value of 829.0. The USD/Corn Exporter FX Index has increased 121.5 points throughout the past six months and 748.3 points since the beginning of 2014. A strong USD/Corn Exporter FX Index reduces the competitiveness of U.S. corn relative to other exporting regions (represented in green in the Global Corn Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

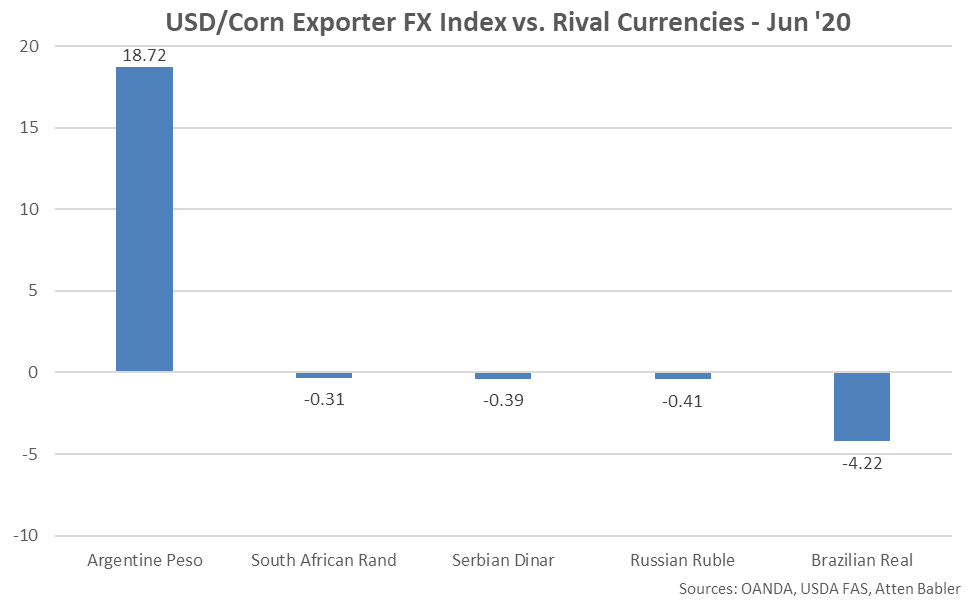

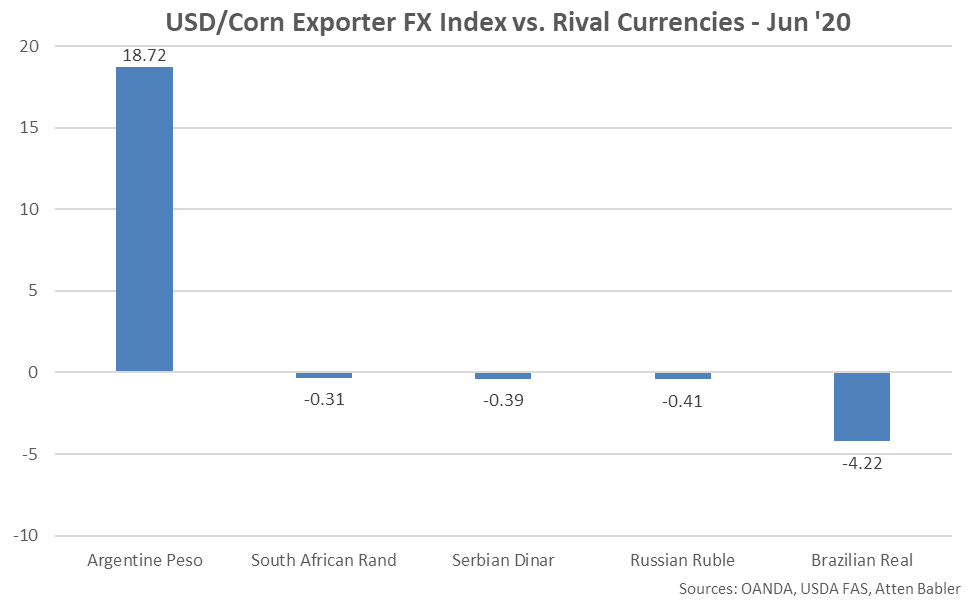

USD appreciation within the USD/Corn Exporter FX Index during Jun ’20 was led by gains against the Argentine peso. USD declines were exhibited against the Brazilian real, Russian ruble, Serbian dinar and South African rand.

USD appreciation within the USD/Corn Exporter FX Index during Jun ’20 was led by gains against the Argentine peso. USD declines were exhibited against the Brazilian real, Russian ruble, Serbian dinar and South African rand.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 214.1. Despite declining from the previous month, the USD/Corn Importer FX Index remained at the third highest level on record. The USD/Corn Importer FX Index has increased 7.5 points throughout the past six months and 117.4 points since the beginning of 2014. A strong USD/Corn Importer FX Index results in less purchasing power for major corn importing countries (represented in red in the Global Corn Net Trade chart), making U.S. corn more expensive to import. USD appreciation against the Iranian rial and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 214.1. Despite declining from the previous month, the USD/Corn Importer FX Index remained at the third highest level on record. The USD/Corn Importer FX Index has increased 7.5 points throughout the past six months and 117.4 points since the beginning of 2014. A strong USD/Corn Importer FX Index results in less purchasing power for major corn importing countries (represented in red in the Global Corn Net Trade chart), making U.S. corn more expensive to import. USD appreciation against the Iranian rial and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

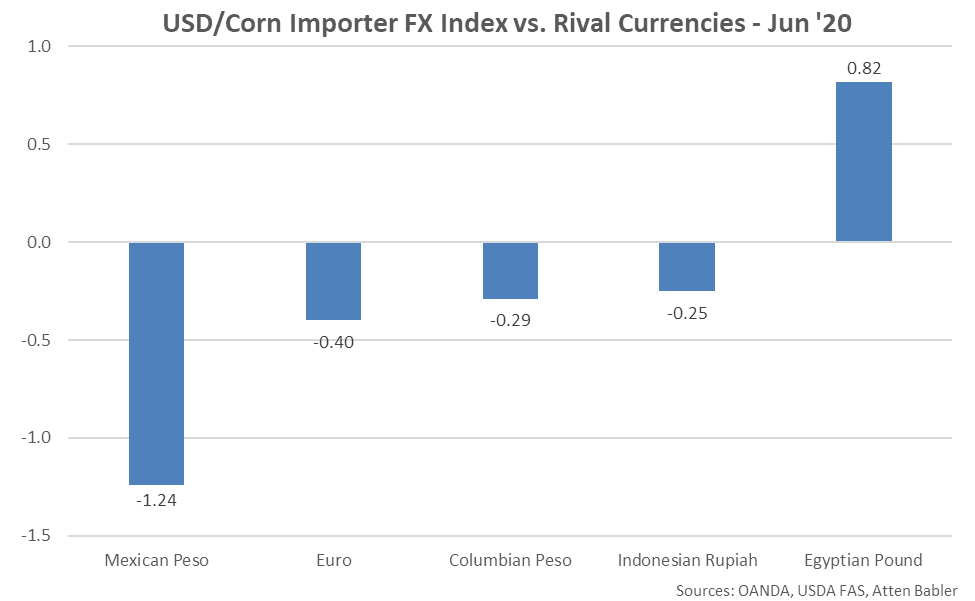

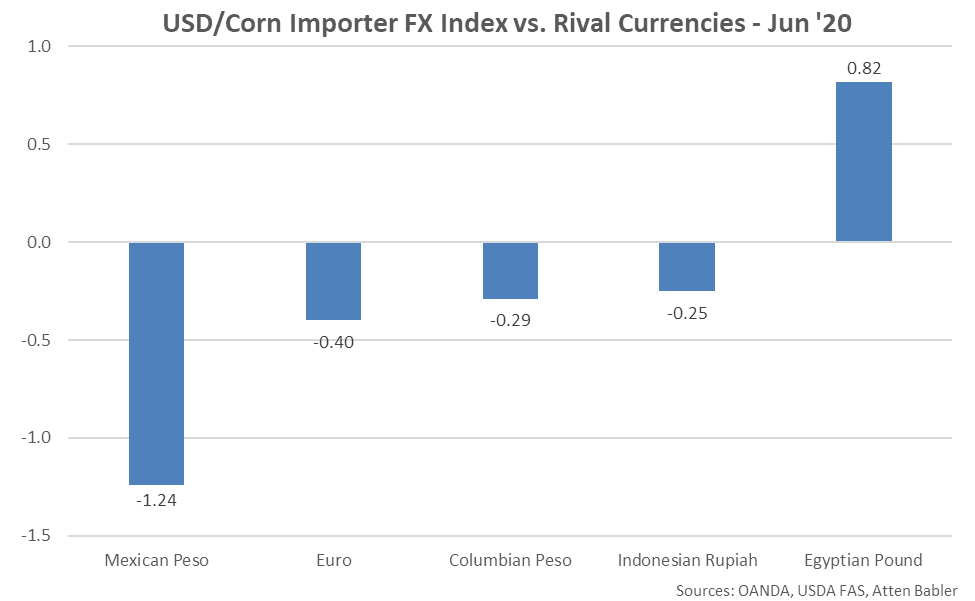

Appreciation against the USD within the USD/Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Columbian peso and Indonesian rupiah. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Columbian peso and Indonesian rupiah. USD gains were exhibited against the Egyptian pound.

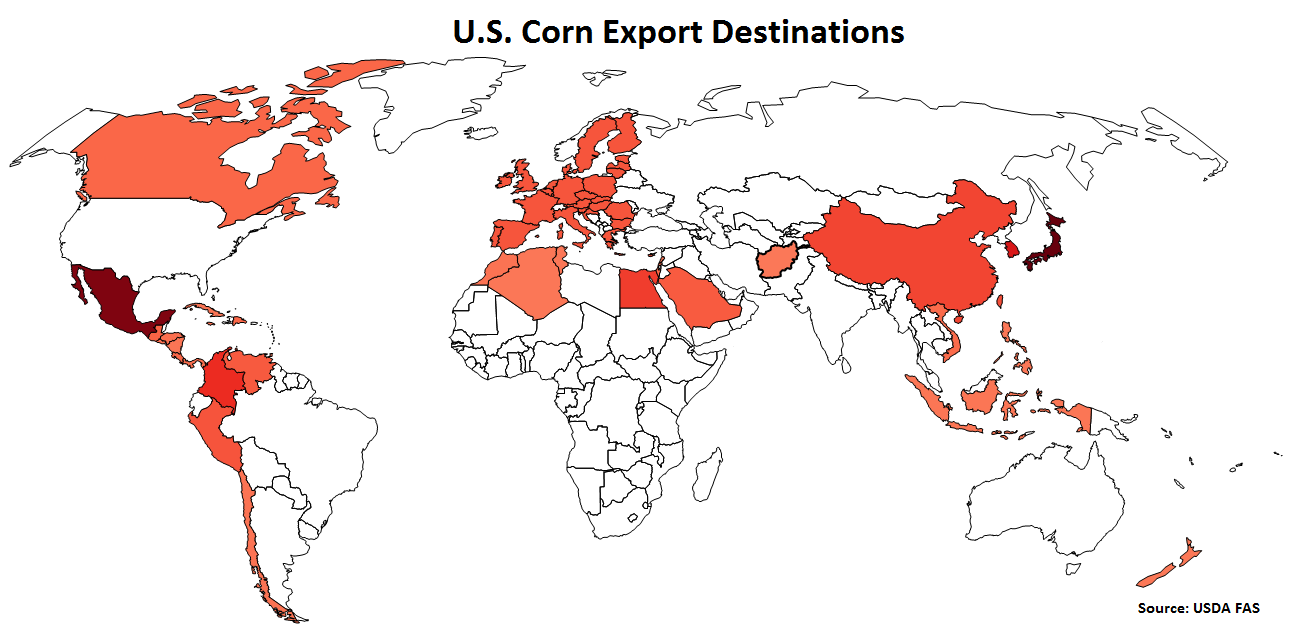

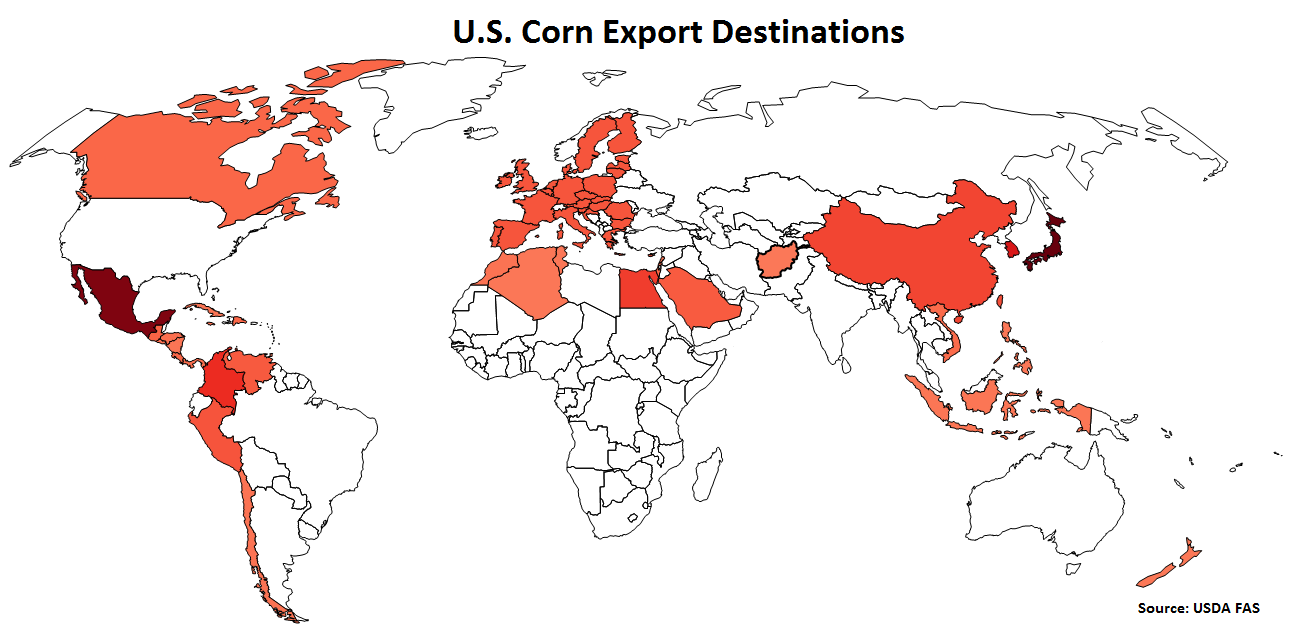

U.S. Corn Export Destinations:

Major destinations for U.S. corn are led by Japan, followed by Mexico, South Korea, Columbia, Egypt and China.

U.S. Corn Export Destinations:

Major destinations for U.S. corn are led by Japan, followed by Mexico, South Korea, Columbia, Egypt and China.

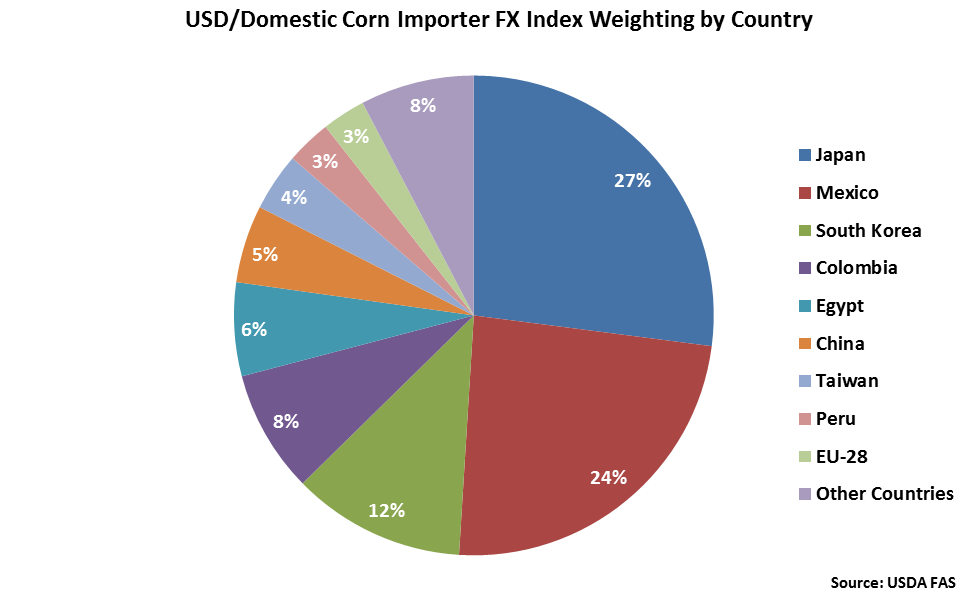

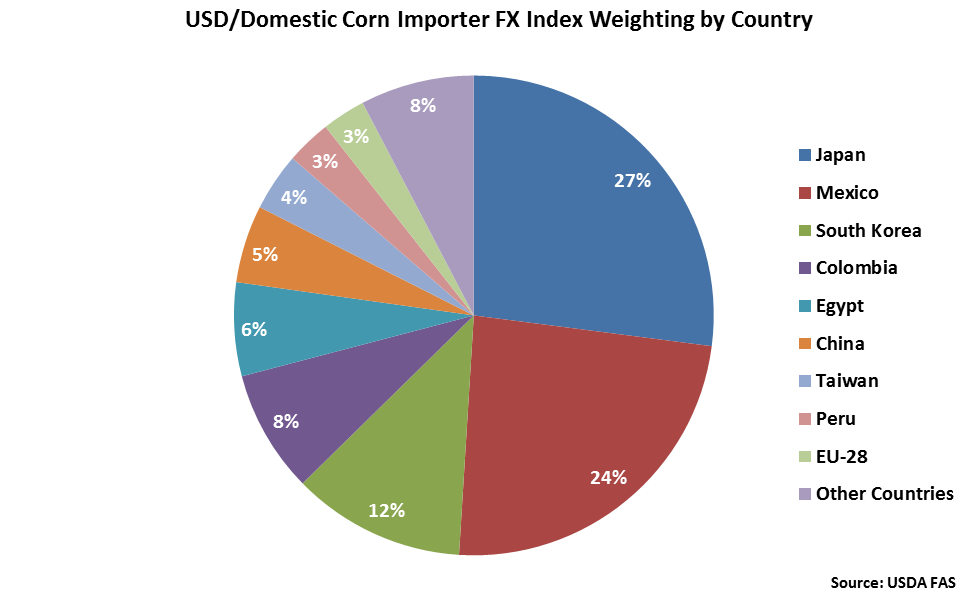

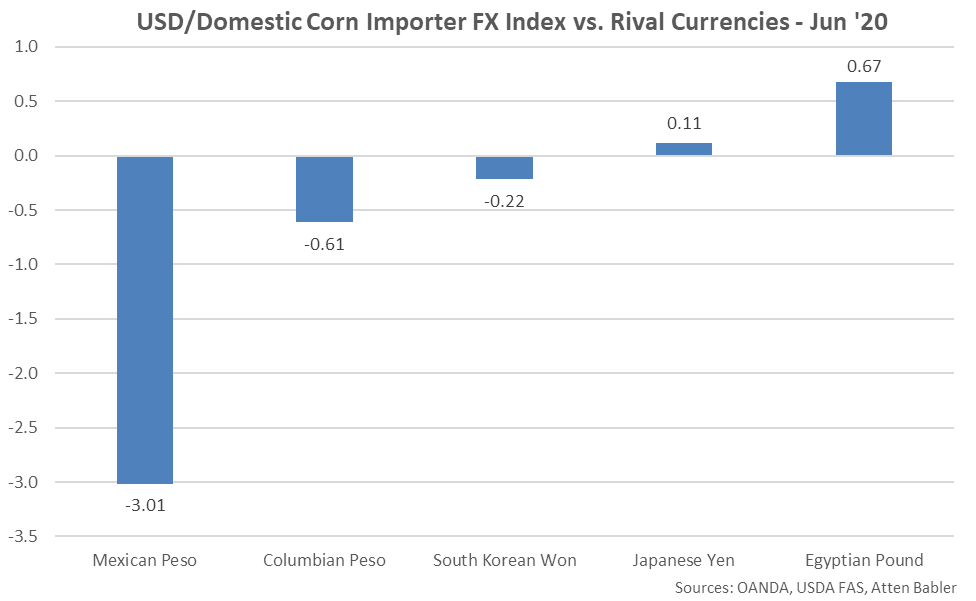

Japan accounts for 27% of the USD/Domestic Corn Importer FX Index, followed by Mexico at 24% and South Korea at 12%. Columbia, Egypt and China each account for between 5-10% of the index.

Japan accounts for 27% of the USD/Domestic Corn Importer FX Index, followed by Mexico at 24% and South Korea at 12%. Columbia, Egypt and China each account for between 5-10% of the index.

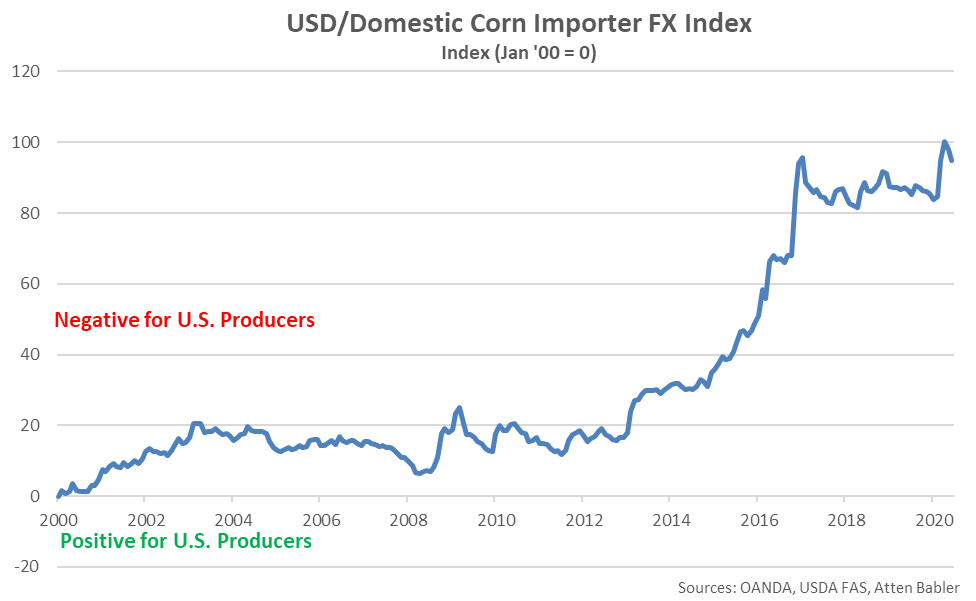

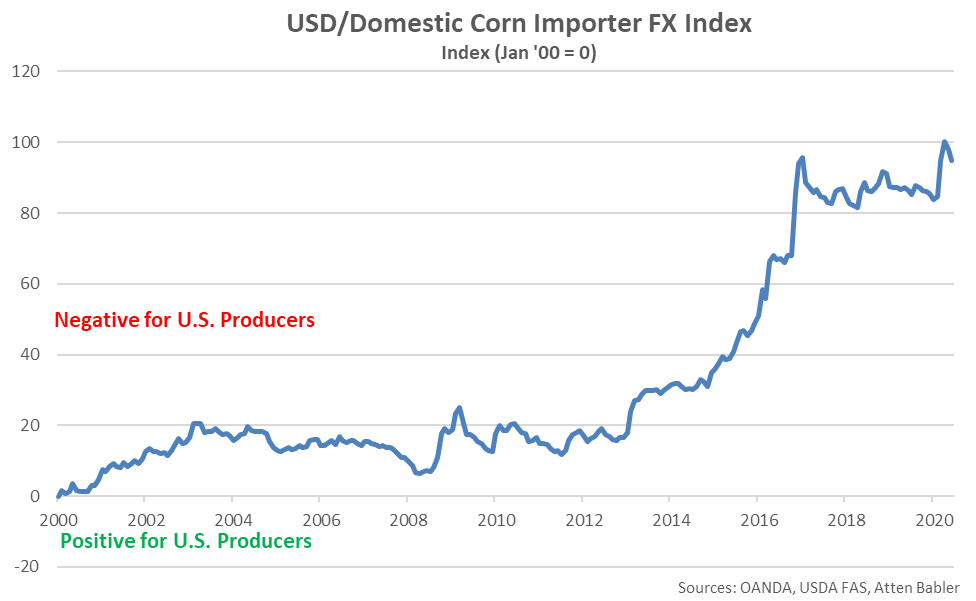

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index declined 3.1 points during Jun ’20, finishing at a value of 94.9. Despite declining from the previous month, the USD/Domestic Corn Importer FX Index remained at the third highest level on record. The USD/Domestic Corn Importer FX Index has increased 9.5 points throughout the past six months and 64.3 points since the beginning of 2014. A strong USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn (represented in red in the U.S. Corn Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index declined 3.1 points during Jun ’20, finishing at a value of 94.9. Despite declining from the previous month, the USD/Domestic Corn Importer FX Index remained at the third highest level on record. The USD/Domestic Corn Importer FX Index has increased 9.5 points throughout the past six months and 64.3 points since the beginning of 2014. A strong USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn (represented in red in the U.S. Corn Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

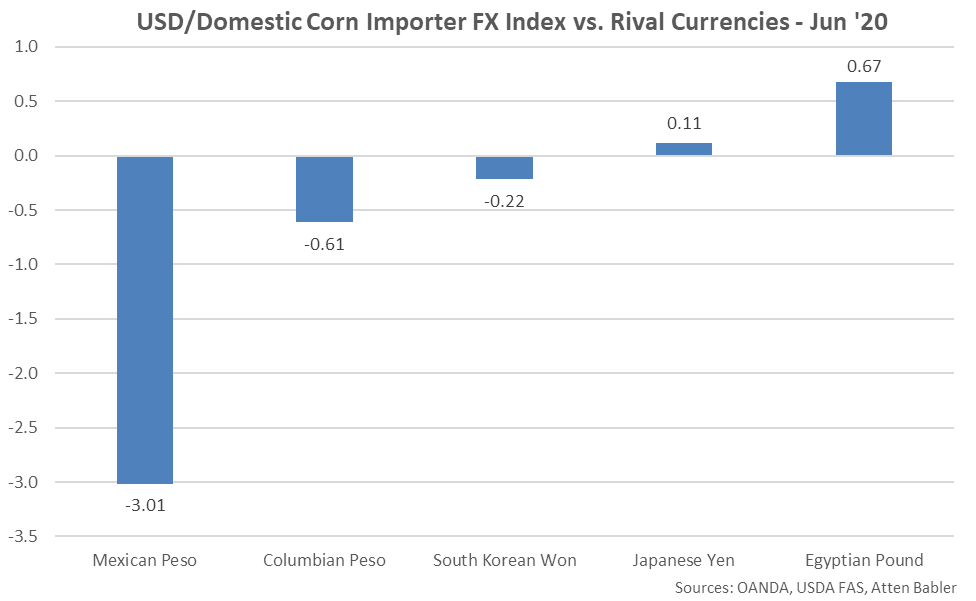

Appreciation against the USD within the USD/Domestic Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Columbian peso and South Korean won. USD gains were exhibited against the Egyptian pound and Japanese yen.

Appreciation against the USD within the USD/Domestic Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Columbian peso and South Korean won. USD gains were exhibited against the Egyptian pound and Japanese yen.

Soybeans FX Indices:

The Atten Babler Commodities Soybeans Foreign Exchange (FX) Indices were also mixed throughout Jun ’20. The USD/Soybeans Exporter FX Index increased to a record high level however the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index declined from the previous month. Despite declining from the previous month, the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index each remained at the third highest levels on record.

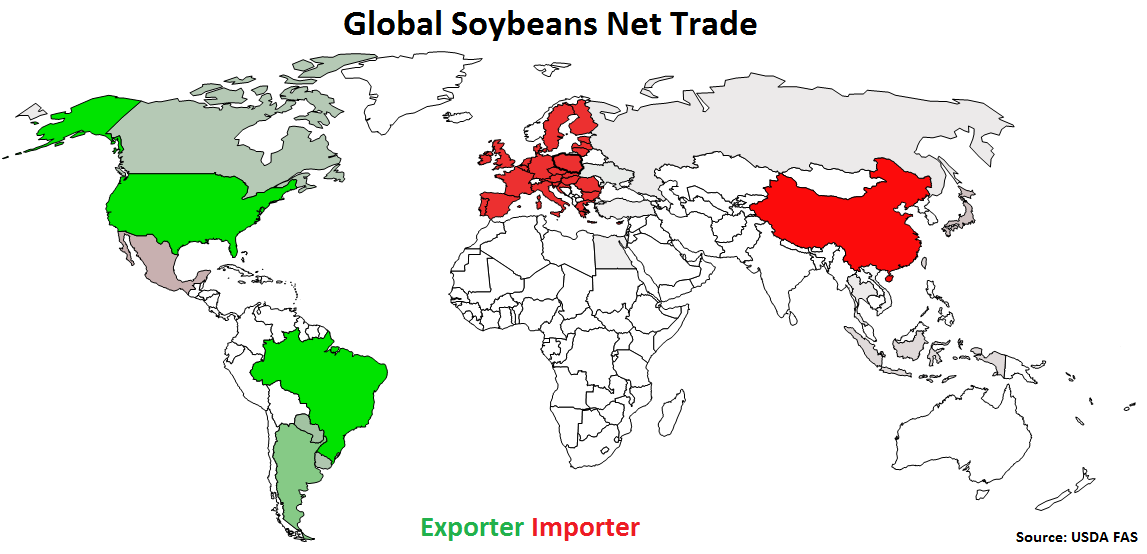

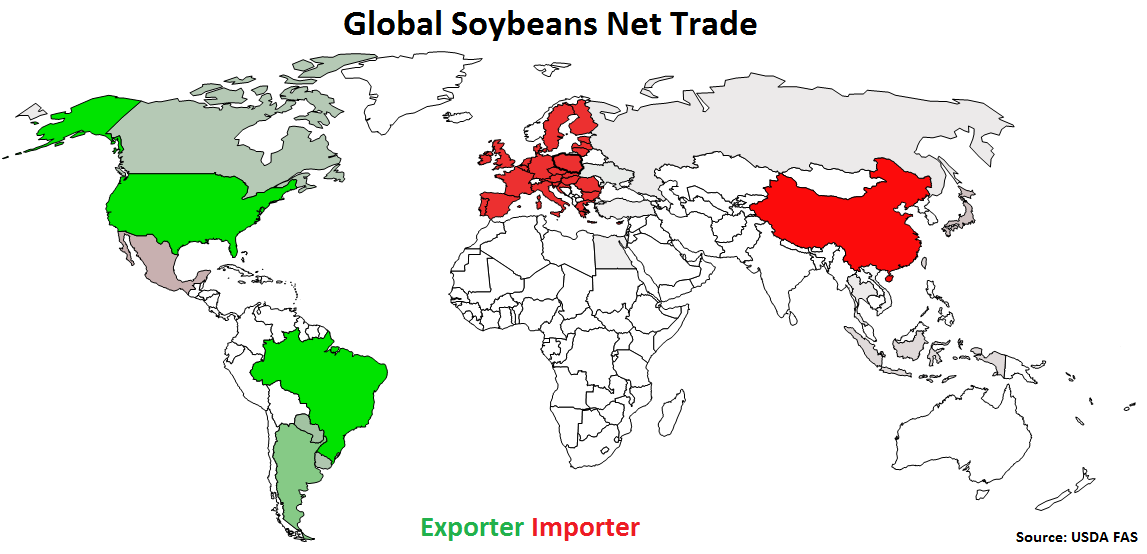

Global Soybeans Net Trade:

Major net soybeans exporters are led by Brazil, followed by the U.S., Argentina, Paraguay and Canada (represented in green in the chart below). Major net soybeans importers are led by China, followed by the EU-28, Mexico and Japan (represented in red in the chart below).

Soybeans FX Indices:

The Atten Babler Commodities Soybeans Foreign Exchange (FX) Indices were also mixed throughout Jun ’20. The USD/Soybeans Exporter FX Index increased to a record high level however the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index declined from the previous month. Despite declining from the previous month, the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index each remained at the third highest levels on record.

Global Soybeans Net Trade:

Major net soybeans exporters are led by Brazil, followed by the U.S., Argentina, Paraguay and Canada (represented in green in the chart below). Major net soybeans importers are led by China, followed by the EU-28, Mexico and Japan (represented in red in the chart below).

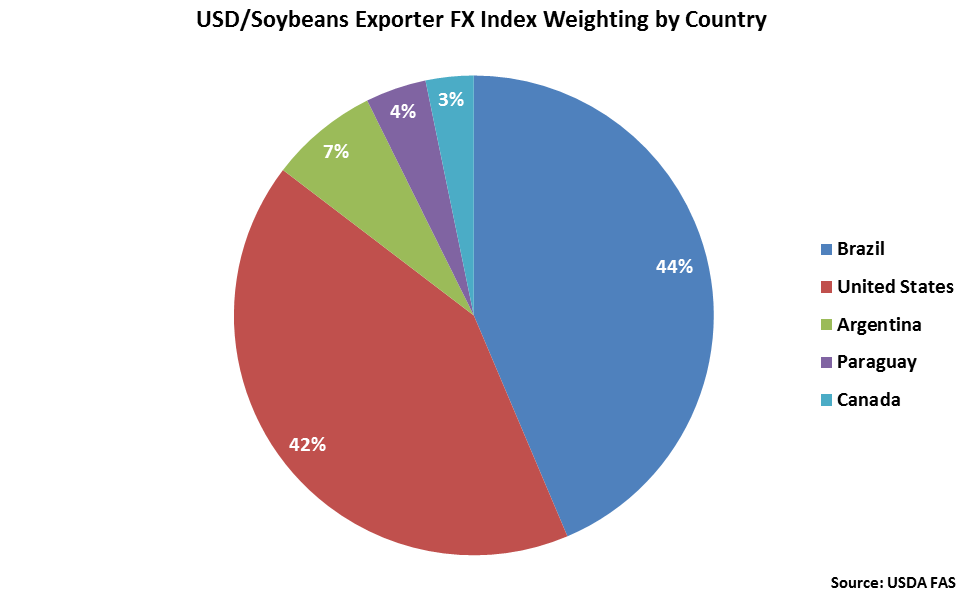

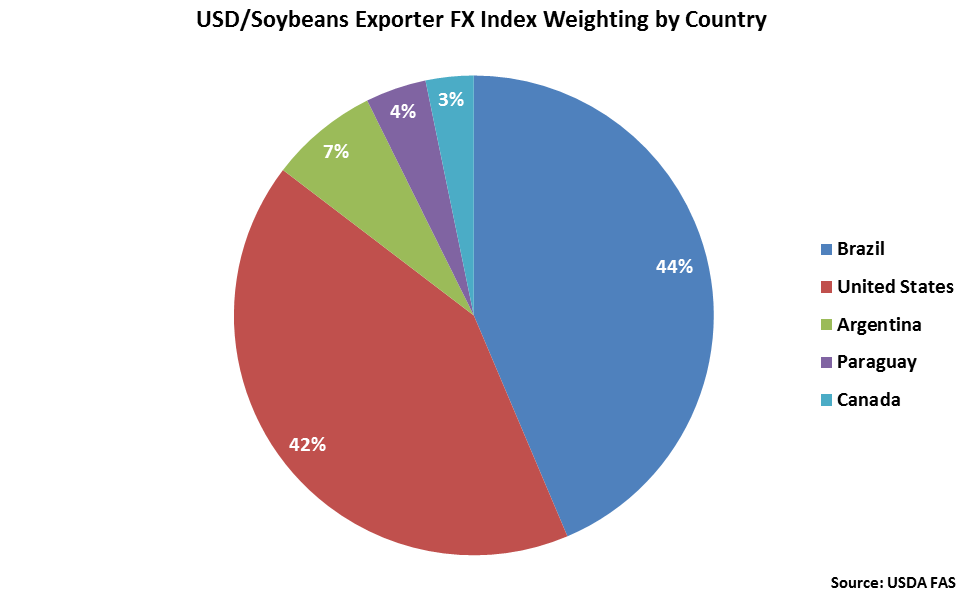

Brazil and the United States each account for over two fifths of the USD/Soybeans Exporter FX Index, followed by Argentina at 7%.

Brazil and the United States each account for over two fifths of the USD/Soybeans Exporter FX Index, followed by Argentina at 7%.

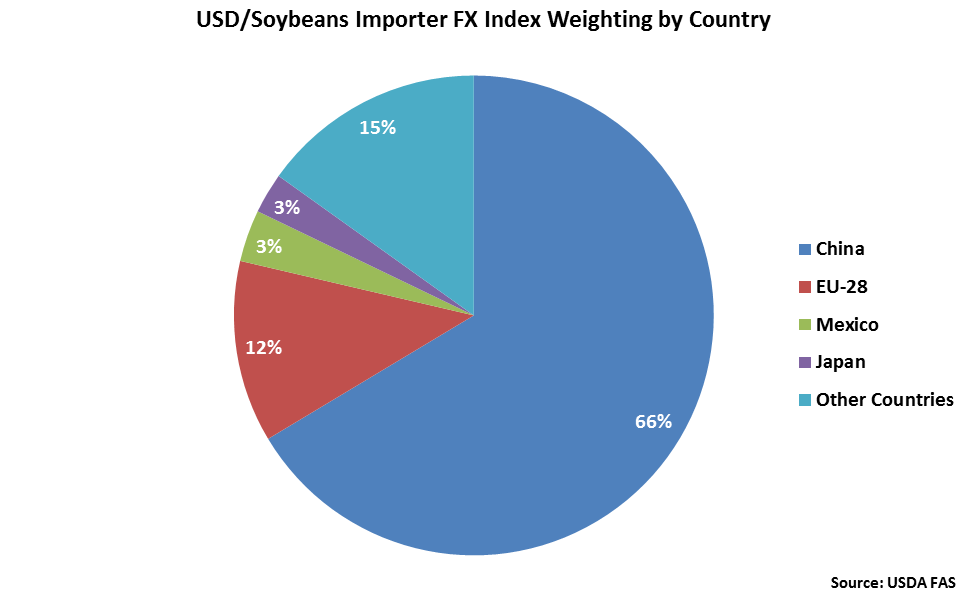

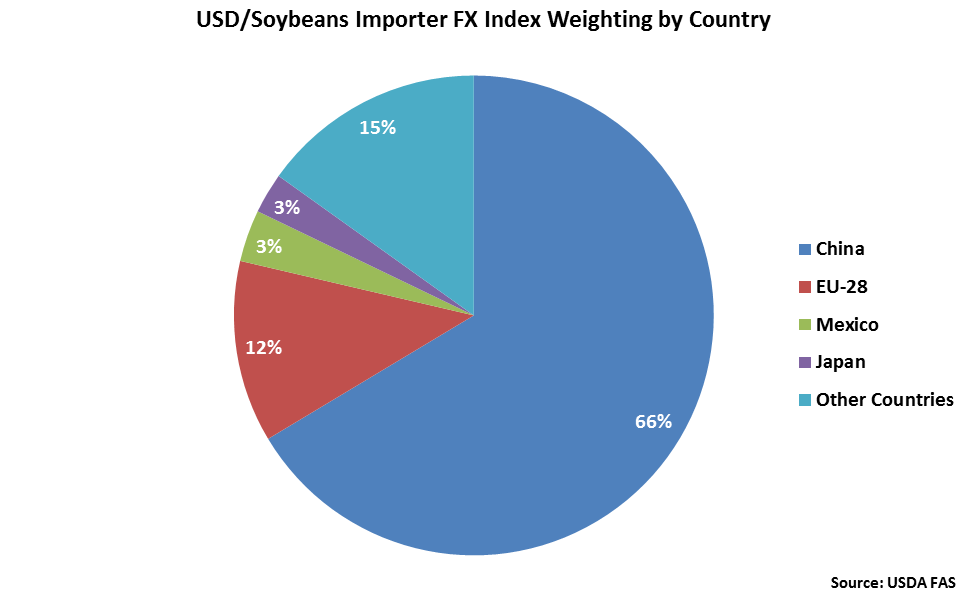

China accounts for nearly two thirds of the USD/Soybeans Importer FX Index, followed by the EU-28 at 12%.

China accounts for nearly two thirds of the USD/Soybeans Importer FX Index, followed by the EU-28 at 12%.

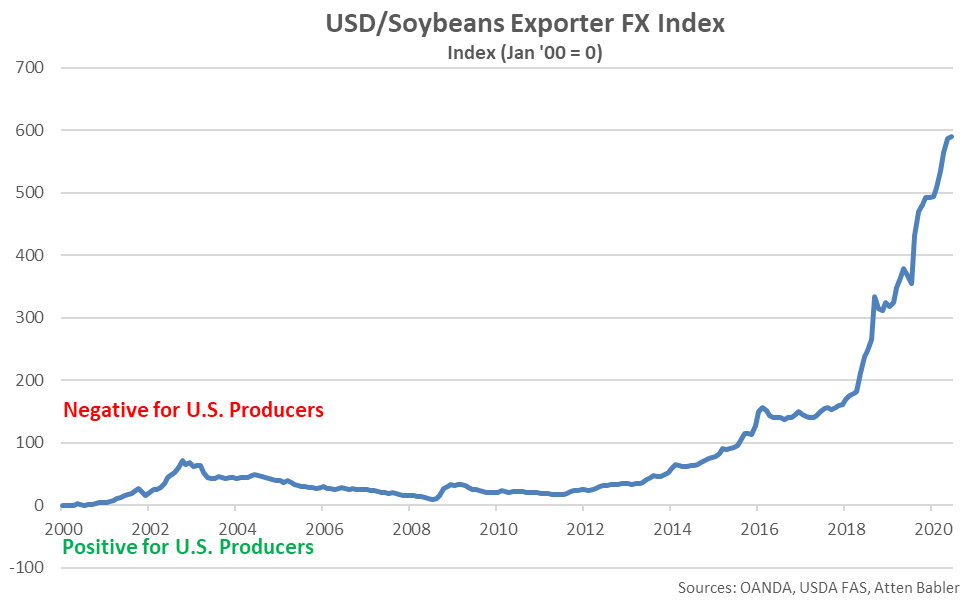

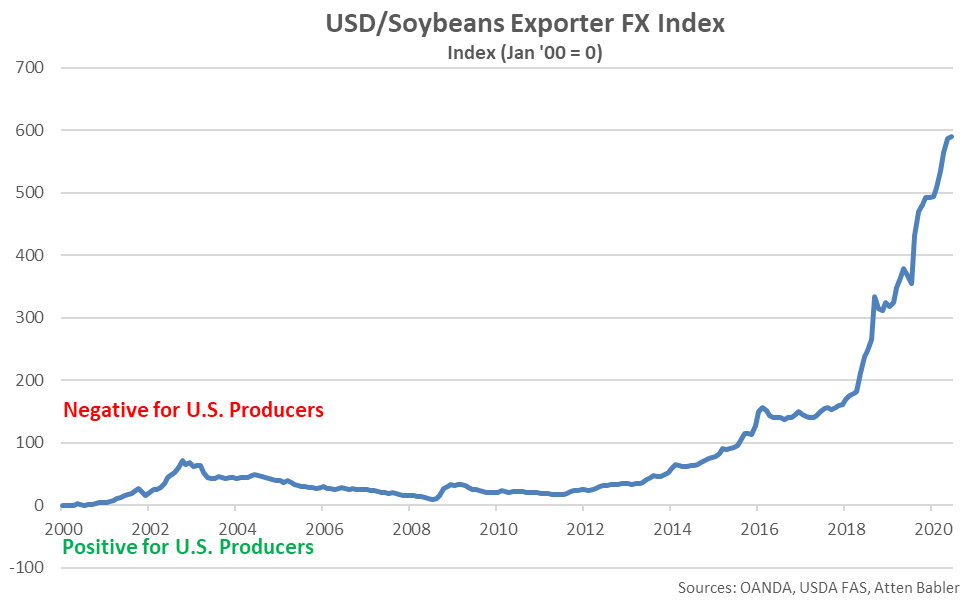

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 3.0 points during Jun ’20, finishing at a record high value of 589.3. The USD/Soybeans Exporter FX Index has increased 97.1 throughout the past six months and 536.7 points since the beginning of 2014. A strong USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions (represented in green in the Global Soybeans Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 3.0 points during Jun ’20, finishing at a record high value of 589.3. The USD/Soybeans Exporter FX Index has increased 97.1 throughout the past six months and 536.7 points since the beginning of 2014. A strong USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions (represented in green in the Global Soybeans Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

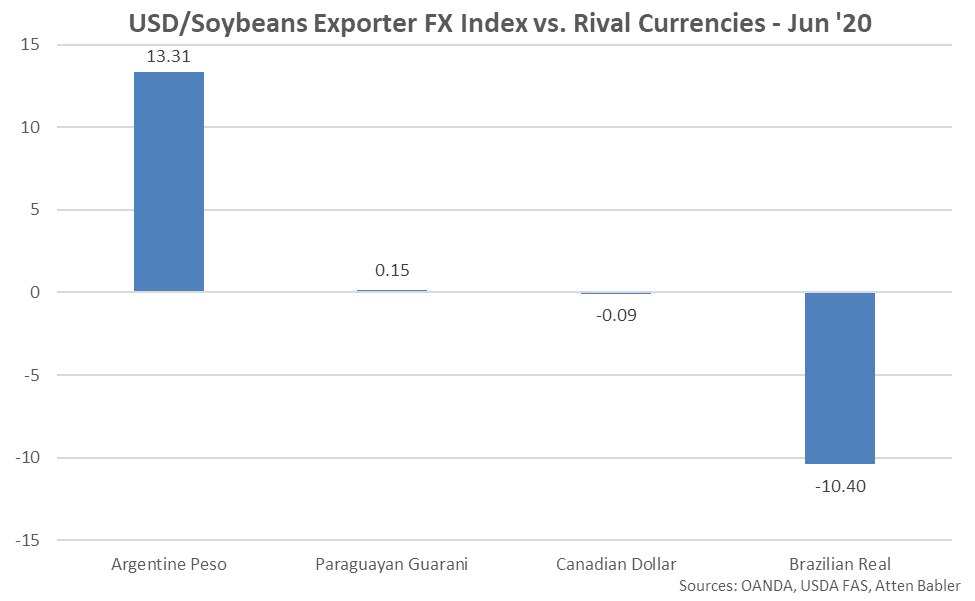

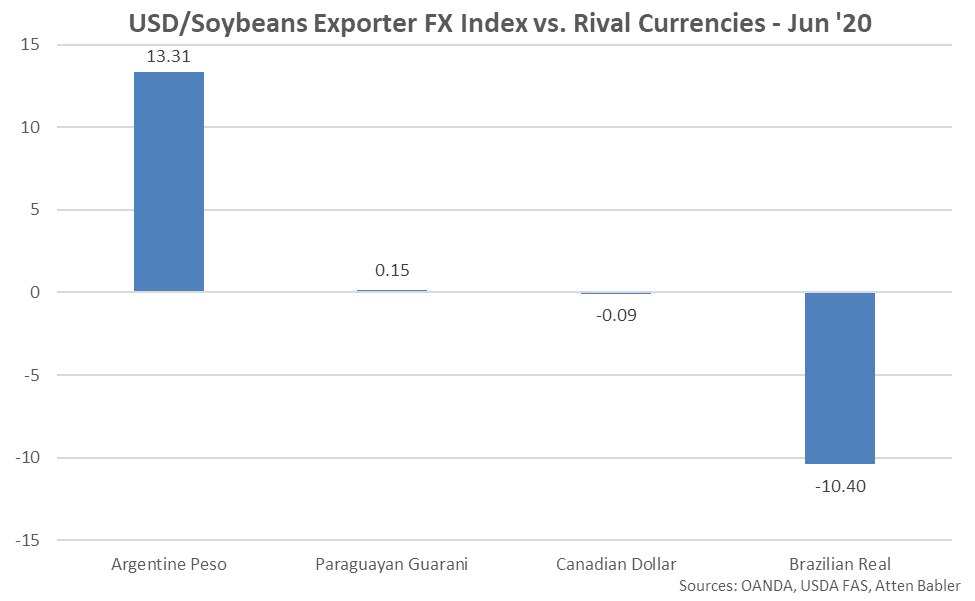

USD appreciation within the USD/Soybeans Exporter FX Index during Jun ’20 was led by gains against the Argentine peso, followed by gains against the Paraguayan guarani. USD declines were exhibited against the Brazilian real and Canadian dollar.

USD appreciation within the USD/Soybeans Exporter FX Index during Jun ’20 was led by gains against the Argentine peso, followed by gains against the Paraguayan guarani. USD declines were exhibited against the Brazilian real and Canadian dollar.

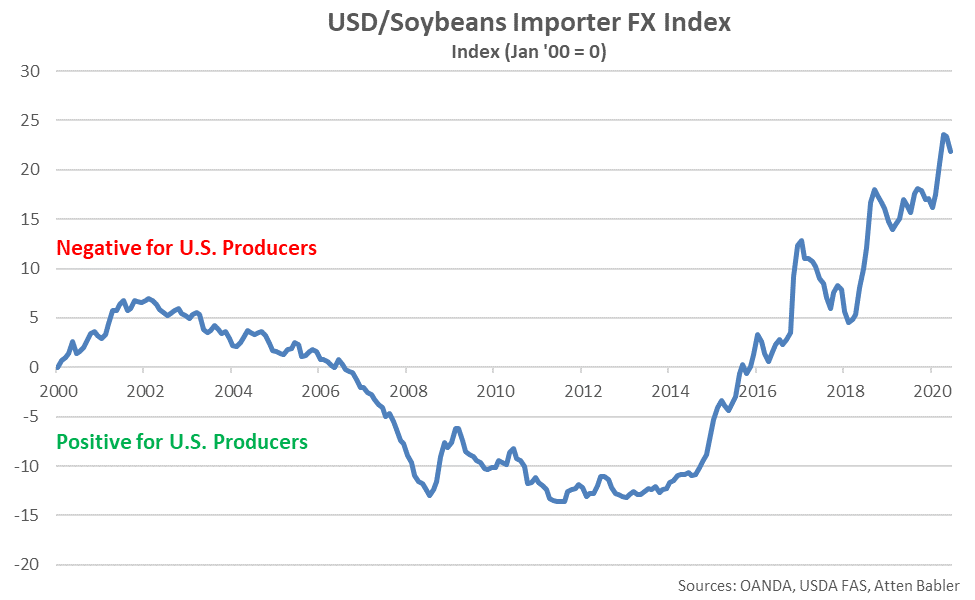

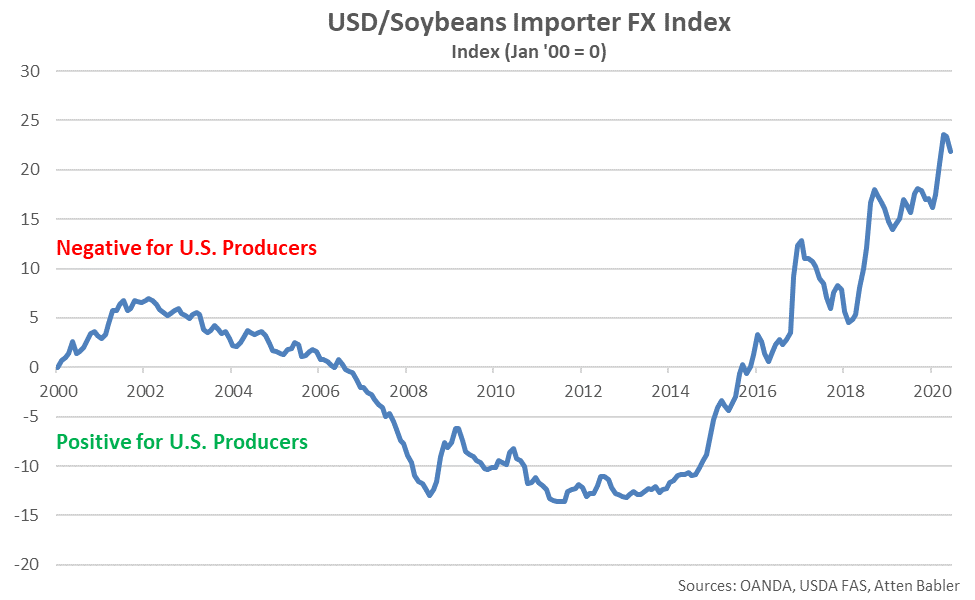

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index declined 1.5 points during Jun ’20, finishing at a value of 21.8. Despite declining from the previous month, the USD/Soybeans Importer FX Index remained at the third highest level on record. The USD/Soybeans Importer FX Index has increased 4.8 points throughout the past six months and 34.1 points since the beginning of 2014. A strong USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries (represented in red in the Global Soybeans Net Trade chart), making U.S. soybeans more expensive to import. USD appreciation against the Turkish lira and Chinese yuan renminbi has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index declined 1.5 points during Jun ’20, finishing at a value of 21.8. Despite declining from the previous month, the USD/Soybeans Importer FX Index remained at the third highest level on record. The USD/Soybeans Importer FX Index has increased 4.8 points throughout the past six months and 34.1 points since the beginning of 2014. A strong USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries (represented in red in the Global Soybeans Net Trade chart), making U.S. soybeans more expensive to import. USD appreciation against the Turkish lira and Chinese yuan renminbi has accounted for the majority of the gains since the beginning of 2014.

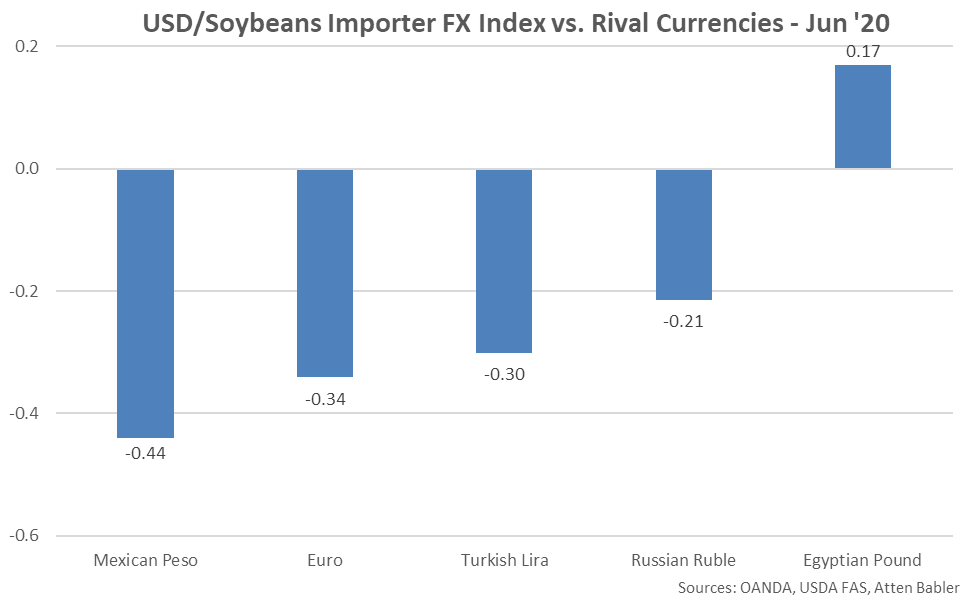

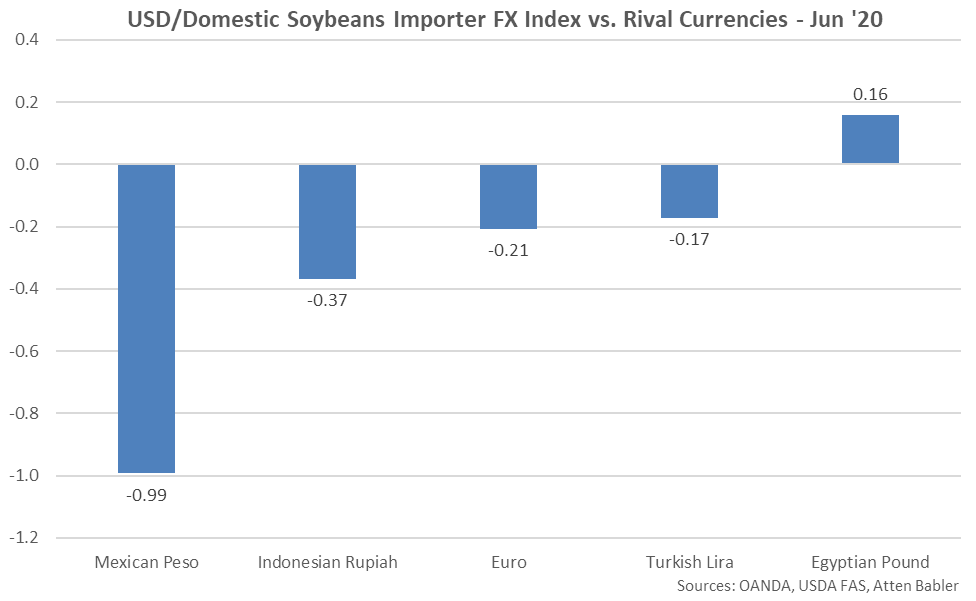

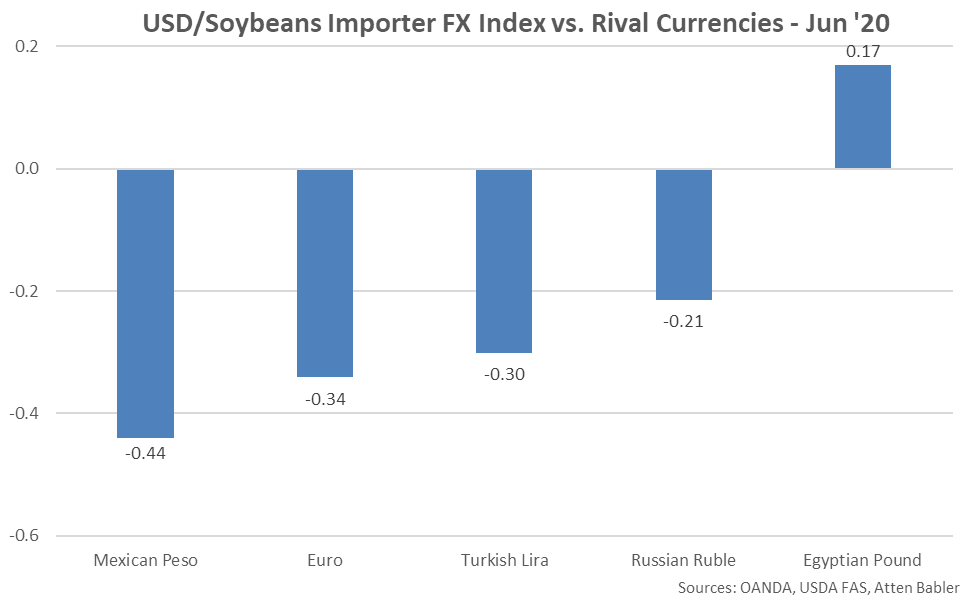

Appreciation against the USD within the USD/Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Turkish lira and Russian ruble. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Turkish lira and Russian ruble. USD gains were exhibited against the Egyptian pound.

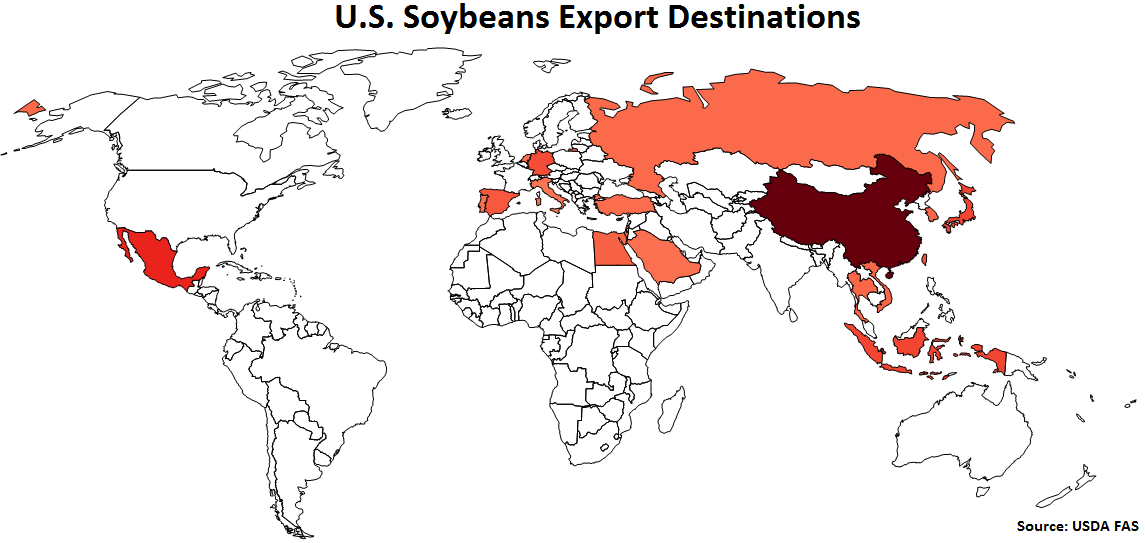

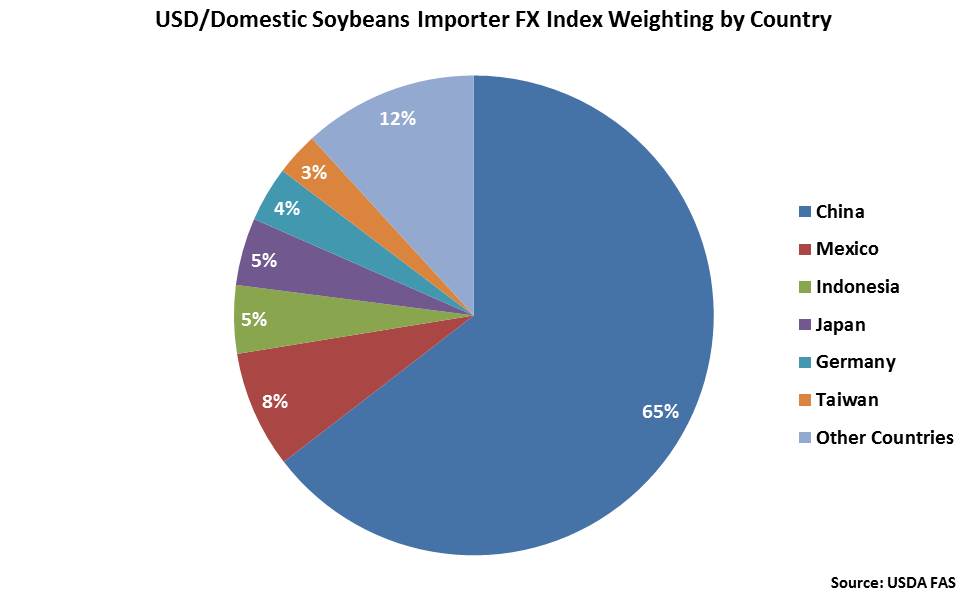

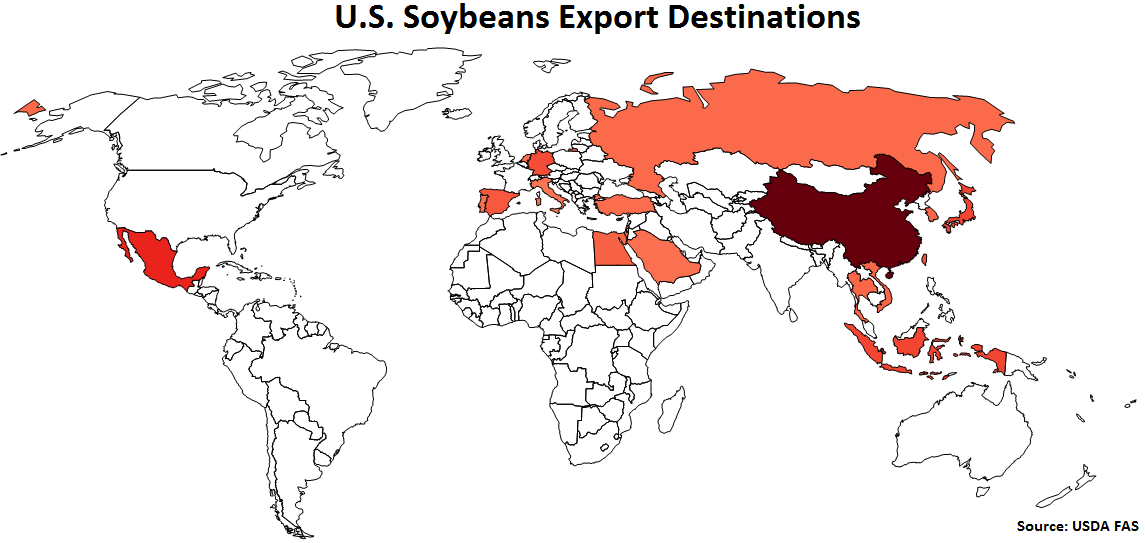

U.S. Soybeans Export Destinations:

Major destinations for U.S. soybeans are led by China, followed by Mexico, Indonesia and Japan.

U.S. Soybeans Export Destinations:

Major destinations for U.S. soybeans are led by China, followed by Mexico, Indonesia and Japan.

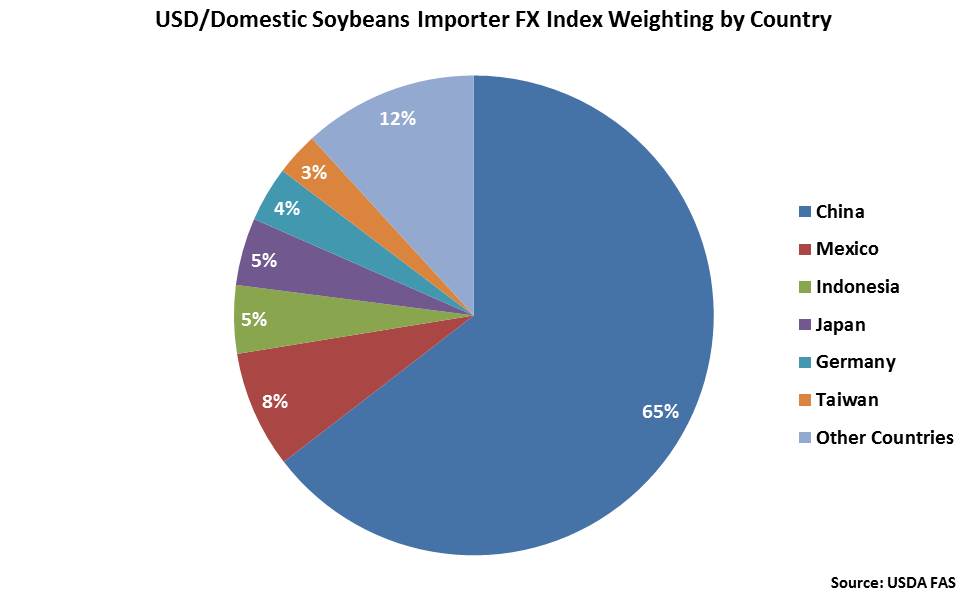

China accounts for nearly two thirds of the USD/Domestic Soybeans Importer FX Index. Mexico, Indonesia and Japan each account for between 5-10% of the index.

China accounts for nearly two thirds of the USD/Domestic Soybeans Importer FX Index. Mexico, Indonesia and Japan each account for between 5-10% of the index.

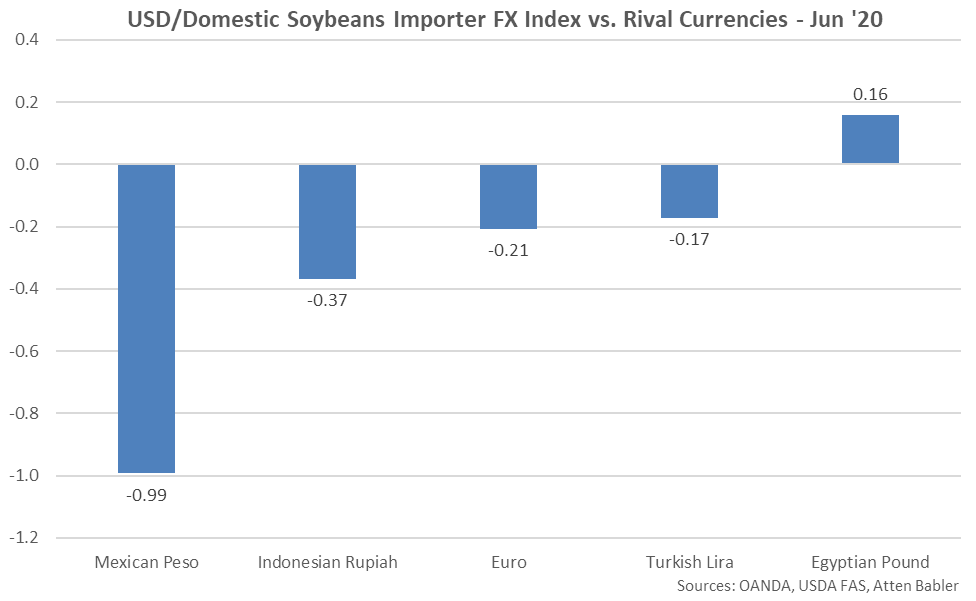

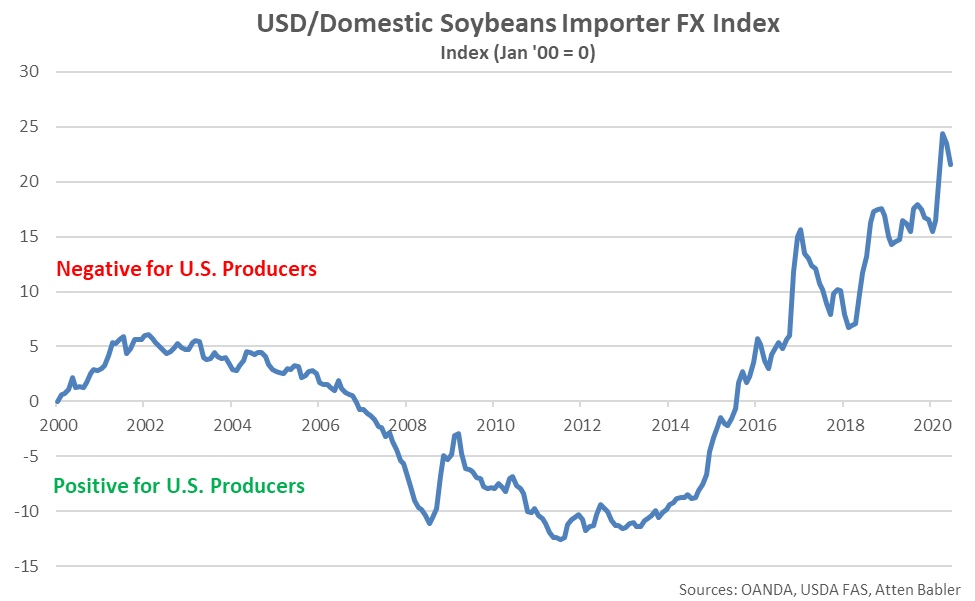

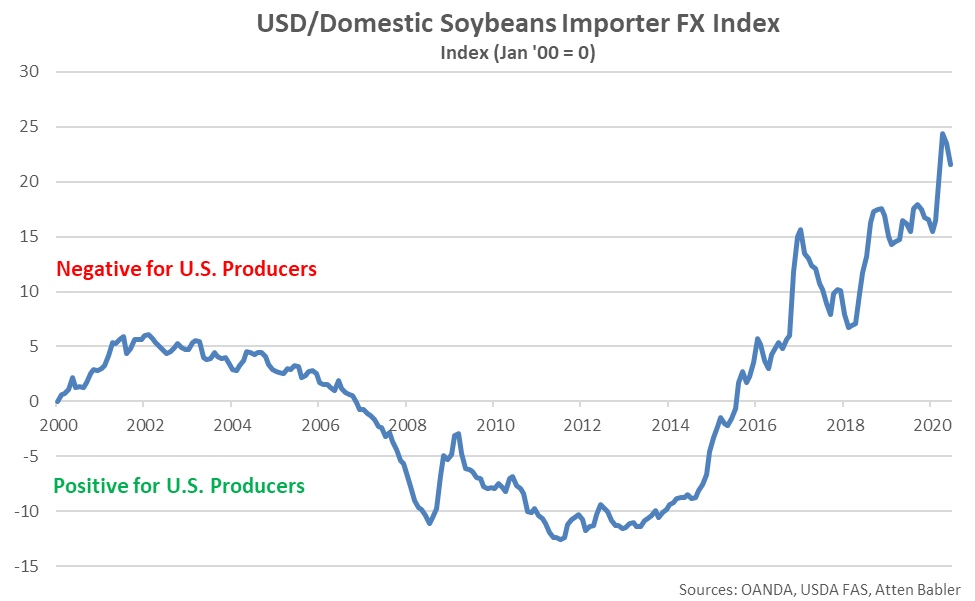

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 21.5. Despite declining from the previous month, the USD/Domestic Soybeans Importer FX Index remained at the third highest level on record. The USD/Domestic Soybeans Importer FX Index has increased 5.0 points throughout the past six months and 31.4 points since the beginning of 2014. A strong USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans (represented in red in the U.S. Soybeans Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Chinese yuan renminbi, Mexican peso and Turkish lira has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 21.5. Despite declining from the previous month, the USD/Domestic Soybeans Importer FX Index remained at the third highest level on record. The USD/Domestic Soybeans Importer FX Index has increased 5.0 points throughout the past six months and 31.4 points since the beginning of 2014. A strong USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans (represented in red in the U.S. Soybeans Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Chinese yuan renminbi, Mexican peso and Turkish lira has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Domestic Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Indonesian rupiah, euro and Turkish lira. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Domestic Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Indonesian rupiah, euro and Turkish lira. USD gains were exhibited against the Egyptian pound.

The United States accounts for over two fifths of the USD/Corn Exporter FX Index, followed by Brazil at 18%, Ukraine at 16% and Argentina at 10%.

The United States accounts for over two fifths of the USD/Corn Exporter FX Index, followed by Brazil at 18%, Ukraine at 16% and Argentina at 10%.

The EU-28 and Japan each account for 14% of the USD/Corn Importer FX Index. Mexico, South Korea, Egypt and Iran each account for between 5-10% of the index.

The EU-28 and Japan each account for 14% of the USD/Corn Importer FX Index. Mexico, South Korea, Egypt and Iran each account for between 5-10% of the index.

USD/Corn Exporter FX Index:

The USD/Corn Exporter FX Index increased 13.3 points during Jun ’20, finishing at a record high value of 829.0. The USD/Corn Exporter FX Index has increased 121.5 points throughout the past six months and 748.3 points since the beginning of 2014. A strong USD/Corn Exporter FX Index reduces the competitiveness of U.S. corn relative to other exporting regions (represented in green in the Global Corn Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Exporter FX Index:

The USD/Corn Exporter FX Index increased 13.3 points during Jun ’20, finishing at a record high value of 829.0. The USD/Corn Exporter FX Index has increased 121.5 points throughout the past six months and 748.3 points since the beginning of 2014. A strong USD/Corn Exporter FX Index reduces the competitiveness of U.S. corn relative to other exporting regions (represented in green in the Global Corn Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD appreciation within the USD/Corn Exporter FX Index during Jun ’20 was led by gains against the Argentine peso. USD declines were exhibited against the Brazilian real, Russian ruble, Serbian dinar and South African rand.

USD appreciation within the USD/Corn Exporter FX Index during Jun ’20 was led by gains against the Argentine peso. USD declines were exhibited against the Brazilian real, Russian ruble, Serbian dinar and South African rand.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 214.1. Despite declining from the previous month, the USD/Corn Importer FX Index remained at the third highest level on record. The USD/Corn Importer FX Index has increased 7.5 points throughout the past six months and 117.4 points since the beginning of 2014. A strong USD/Corn Importer FX Index results in less purchasing power for major corn importing countries (represented in red in the Global Corn Net Trade chart), making U.S. corn more expensive to import. USD appreciation against the Iranian rial and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

USD/Corn Importer FX Index:

The USD/Corn Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 214.1. Despite declining from the previous month, the USD/Corn Importer FX Index remained at the third highest level on record. The USD/Corn Importer FX Index has increased 7.5 points throughout the past six months and 117.4 points since the beginning of 2014. A strong USD/Corn Importer FX Index results in less purchasing power for major corn importing countries (represented in red in the Global Corn Net Trade chart), making U.S. corn more expensive to import. USD appreciation against the Iranian rial and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Columbian peso and Indonesian rupiah. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Columbian peso and Indonesian rupiah. USD gains were exhibited against the Egyptian pound.

U.S. Corn Export Destinations:

Major destinations for U.S. corn are led by Japan, followed by Mexico, South Korea, Columbia, Egypt and China.

U.S. Corn Export Destinations:

Major destinations for U.S. corn are led by Japan, followed by Mexico, South Korea, Columbia, Egypt and China.

Japan accounts for 27% of the USD/Domestic Corn Importer FX Index, followed by Mexico at 24% and South Korea at 12%. Columbia, Egypt and China each account for between 5-10% of the index.

Japan accounts for 27% of the USD/Domestic Corn Importer FX Index, followed by Mexico at 24% and South Korea at 12%. Columbia, Egypt and China each account for between 5-10% of the index.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index declined 3.1 points during Jun ’20, finishing at a value of 94.9. Despite declining from the previous month, the USD/Domestic Corn Importer FX Index remained at the third highest level on record. The USD/Domestic Corn Importer FX Index has increased 9.5 points throughout the past six months and 64.3 points since the beginning of 2014. A strong USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn (represented in red in the U.S. Corn Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Corn Importer FX Index:

The USD/Domestic Corn Importer FX Index declined 3.1 points during Jun ’20, finishing at a value of 94.9. Despite declining from the previous month, the USD/Domestic Corn Importer FX Index remained at the third highest level on record. The USD/Domestic Corn Importer FX Index has increased 9.5 points throughout the past six months and 64.3 points since the beginning of 2014. A strong USD/Domestic Corn Importer FX Index results in less purchasing power for the traditional buyers of U.S. corn (represented in red in the U.S. Corn Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Mexican peso and Egyptian pound has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Domestic Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Columbian peso and South Korean won. USD gains were exhibited against the Egyptian pound and Japanese yen.

Appreciation against the USD within the USD/Domestic Corn Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Columbian peso and South Korean won. USD gains were exhibited against the Egyptian pound and Japanese yen.

Soybeans FX Indices:

The Atten Babler Commodities Soybeans Foreign Exchange (FX) Indices were also mixed throughout Jun ’20. The USD/Soybeans Exporter FX Index increased to a record high level however the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index declined from the previous month. Despite declining from the previous month, the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index each remained at the third highest levels on record.

Global Soybeans Net Trade:

Major net soybeans exporters are led by Brazil, followed by the U.S., Argentina, Paraguay and Canada (represented in green in the chart below). Major net soybeans importers are led by China, followed by the EU-28, Mexico and Japan (represented in red in the chart below).

Soybeans FX Indices:

The Atten Babler Commodities Soybeans Foreign Exchange (FX) Indices were also mixed throughout Jun ’20. The USD/Soybeans Exporter FX Index increased to a record high level however the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index declined from the previous month. Despite declining from the previous month, the USD/Soybeans Importer FX Index and USD/Domestic Soybeans Importer FX Index each remained at the third highest levels on record.

Global Soybeans Net Trade:

Major net soybeans exporters are led by Brazil, followed by the U.S., Argentina, Paraguay and Canada (represented in green in the chart below). Major net soybeans importers are led by China, followed by the EU-28, Mexico and Japan (represented in red in the chart below).

Brazil and the United States each account for over two fifths of the USD/Soybeans Exporter FX Index, followed by Argentina at 7%.

Brazil and the United States each account for over two fifths of the USD/Soybeans Exporter FX Index, followed by Argentina at 7%.

China accounts for nearly two thirds of the USD/Soybeans Importer FX Index, followed by the EU-28 at 12%.

China accounts for nearly two thirds of the USD/Soybeans Importer FX Index, followed by the EU-28 at 12%.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 3.0 points during Jun ’20, finishing at a record high value of 589.3. The USD/Soybeans Exporter FX Index has increased 97.1 throughout the past six months and 536.7 points since the beginning of 2014. A strong USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions (represented in green in the Global Soybeans Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Exporter FX Index:

The USD/Soybeans Exporter FX Index increased 3.0 points during Jun ’20, finishing at a record high value of 589.3. The USD/Soybeans Exporter FX Index has increased 97.1 throughout the past six months and 536.7 points since the beginning of 2014. A strong USD/Soybeans Exporter FX Index reduces the competitiveness of U.S. soybeans relative to other exporting regions (represented in green in the Global Soybeans Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD appreciation within the USD/Soybeans Exporter FX Index during Jun ’20 was led by gains against the Argentine peso, followed by gains against the Paraguayan guarani. USD declines were exhibited against the Brazilian real and Canadian dollar.

USD appreciation within the USD/Soybeans Exporter FX Index during Jun ’20 was led by gains against the Argentine peso, followed by gains against the Paraguayan guarani. USD declines were exhibited against the Brazilian real and Canadian dollar.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index declined 1.5 points during Jun ’20, finishing at a value of 21.8. Despite declining from the previous month, the USD/Soybeans Importer FX Index remained at the third highest level on record. The USD/Soybeans Importer FX Index has increased 4.8 points throughout the past six months and 34.1 points since the beginning of 2014. A strong USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries (represented in red in the Global Soybeans Net Trade chart), making U.S. soybeans more expensive to import. USD appreciation against the Turkish lira and Chinese yuan renminbi has accounted for the majority of the gains since the beginning of 2014.

USD/Soybeans Importer FX Index:

The USD/Soybeans Importer FX Index declined 1.5 points during Jun ’20, finishing at a value of 21.8. Despite declining from the previous month, the USD/Soybeans Importer FX Index remained at the third highest level on record. The USD/Soybeans Importer FX Index has increased 4.8 points throughout the past six months and 34.1 points since the beginning of 2014. A strong USD/Soybeans Importer FX Index results in less purchasing power for major soybeans importing countries (represented in red in the Global Soybeans Net Trade chart), making U.S. soybeans more expensive to import. USD appreciation against the Turkish lira and Chinese yuan renminbi has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Turkish lira and Russian ruble. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the euro, Turkish lira and Russian ruble. USD gains were exhibited against the Egyptian pound.

U.S. Soybeans Export Destinations:

Major destinations for U.S. soybeans are led by China, followed by Mexico, Indonesia and Japan.

U.S. Soybeans Export Destinations:

Major destinations for U.S. soybeans are led by China, followed by Mexico, Indonesia and Japan.

China accounts for nearly two thirds of the USD/Domestic Soybeans Importer FX Index. Mexico, Indonesia and Japan each account for between 5-10% of the index.

China accounts for nearly two thirds of the USD/Domestic Soybeans Importer FX Index. Mexico, Indonesia and Japan each account for between 5-10% of the index.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 21.5. Despite declining from the previous month, the USD/Domestic Soybeans Importer FX Index remained at the third highest level on record. The USD/Domestic Soybeans Importer FX Index has increased 5.0 points throughout the past six months and 31.4 points since the beginning of 2014. A strong USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans (represented in red in the U.S. Soybeans Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Chinese yuan renminbi, Mexican peso and Turkish lira has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Soybeans Importer FX Index:

The USD/Domestic Soybeans Importer FX Index declined 1.9 points during Jun ’20, finishing at a value of 21.5. Despite declining from the previous month, the USD/Domestic Soybeans Importer FX Index remained at the third highest level on record. The USD/Domestic Soybeans Importer FX Index has increased 5.0 points throughout the past six months and 31.4 points since the beginning of 2014. A strong USD/Domestic Soybeans Importer FX Index results in less purchasing power for the traditional buyers of U.S. soybeans (represented in red in the U.S. Soybeans Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Chinese yuan renminbi, Mexican peso and Turkish lira has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Domestic Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Indonesian rupiah, euro and Turkish lira. USD gains were exhibited against the Egyptian pound.

Appreciation against the USD within the USD/Domestic Soybeans Importer FX Index during Jun ’20 was led by gains by the Mexican peso, followed by gains by the Indonesian rupiah, euro and Turkish lira. USD gains were exhibited against the Egyptian pound.