Dairy WASDE Update – Jul ’20

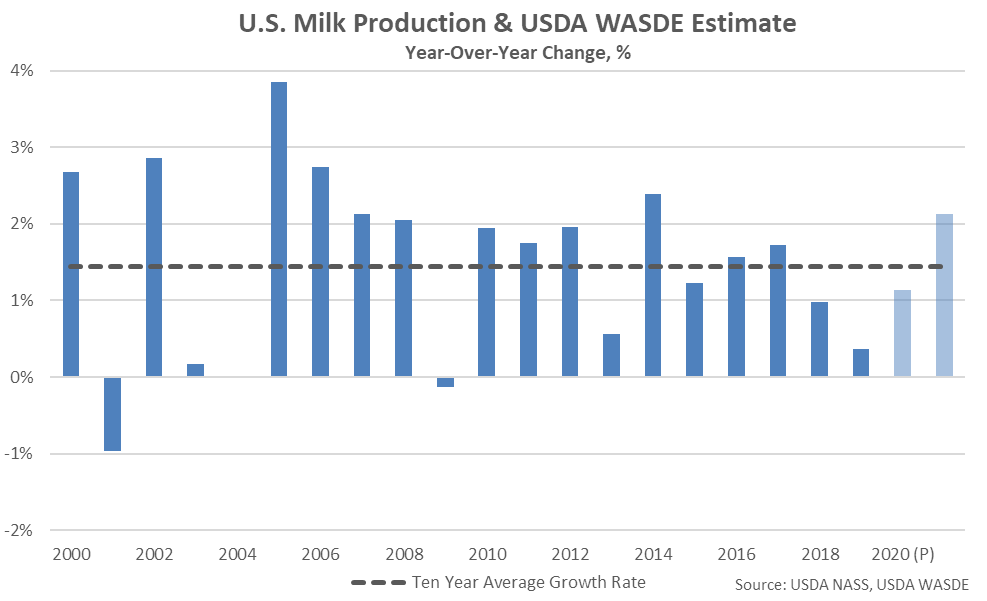

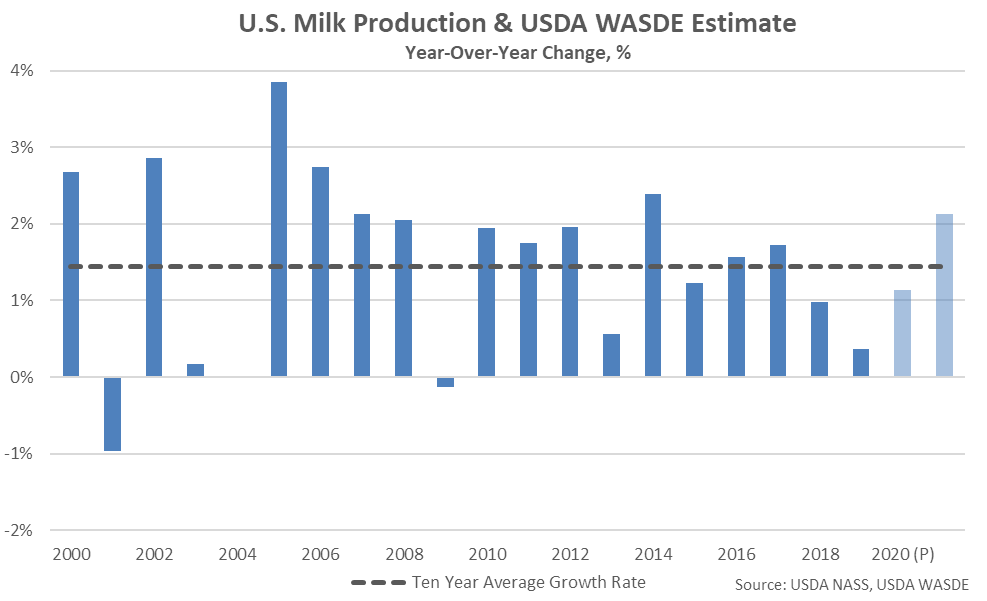

According to the July USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2020 U.S. milk production projection was reduced one billion pounds from the previous month on slower growth in milk per cow yields, reaching a ten month low projected level. 2020 projected milk production equates to a 1.1% YOY increase from 2019 production levels.

The 2021 milk production projection was raised 300 million pounds from the previous month, however, on expectations of dairy herd rebuilding and a recovery in growth in milk per cow yields. 2021 projected milk production equates to a 2.1% YOY increase from 2020 projected levels. The 2021 projected YOY increase in milk production volumes would be the largest experienced throughout the past seven years.

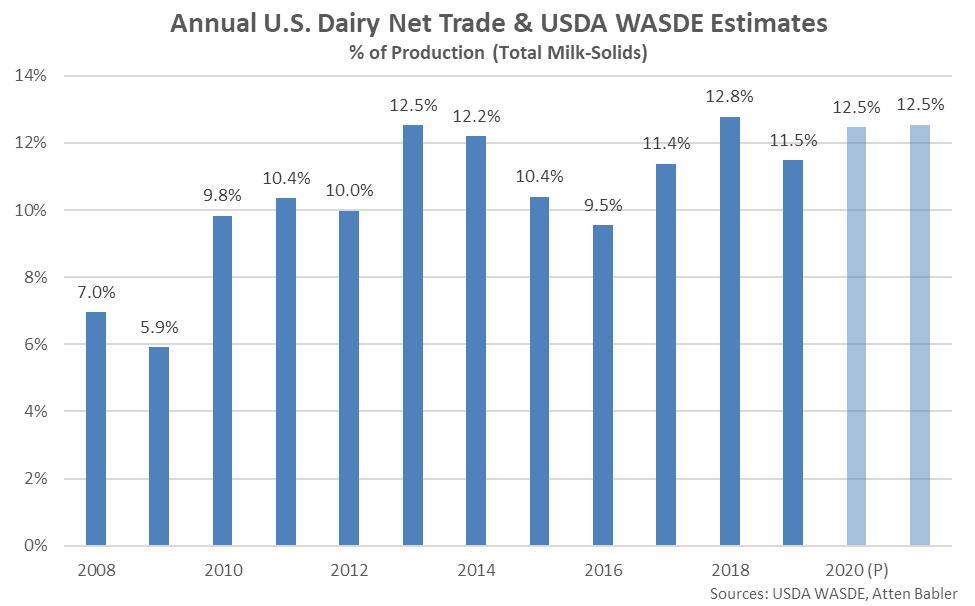

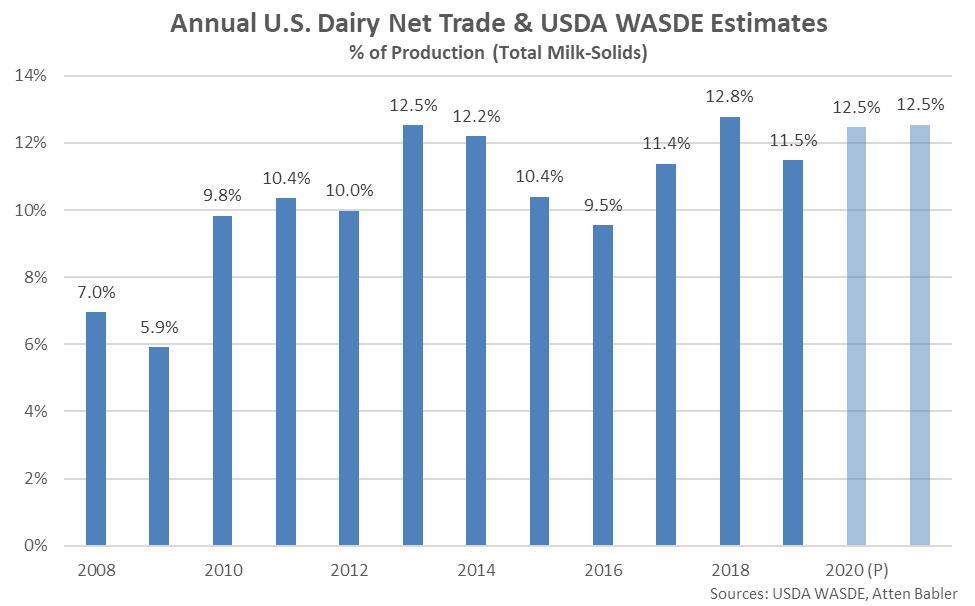

2020 dairy export forecasts were raised from the previous month on both a milk-fat and skim-solids basis on increased shipments of butterfat products, cheese, dry skim milk products and lactose. 2020 dairy import forecasts were raised slightly on a milk-fat basis on higher imports of butter but unchanged from the previous month on a skim-solids basis. 2021 dairy export forecasts were also raised from the previous month on both a milk-fat and skim-solids basis while 2021 import forecasts were raised on a milk-fat basis and unchanged on a skim-solids basis.

2020 projected dairy export volumes translated to 16.2% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2021 projected dairy export volumes also translated to 16.2% of total U.S. milk solids production, unchanged from the previous year projection, while import volumes were equivalent to 3.7% of total U.S. milk solids production, down slightly from the 2020 projection. 2021 net dairy trade is projected to rebound to a three year high level but remain below the 2018 record high level.

2020 dairy export forecasts were raised from the previous month on both a milk-fat and skim-solids basis on increased shipments of butterfat products, cheese, dry skim milk products and lactose. 2020 dairy import forecasts were raised slightly on a milk-fat basis on higher imports of butter but unchanged from the previous month on a skim-solids basis. 2021 dairy export forecasts were also raised from the previous month on both a milk-fat and skim-solids basis while 2021 import forecasts were raised on a milk-fat basis and unchanged on a skim-solids basis.

2020 projected dairy export volumes translated to 16.2% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2021 projected dairy export volumes also translated to 16.2% of total U.S. milk solids production, unchanged from the previous year projection, while import volumes were equivalent to 3.7% of total U.S. milk solids production, down slightly from the 2020 projection. 2021 net dairy trade is projected to rebound to a three year high level but remain below the 2018 record high level.

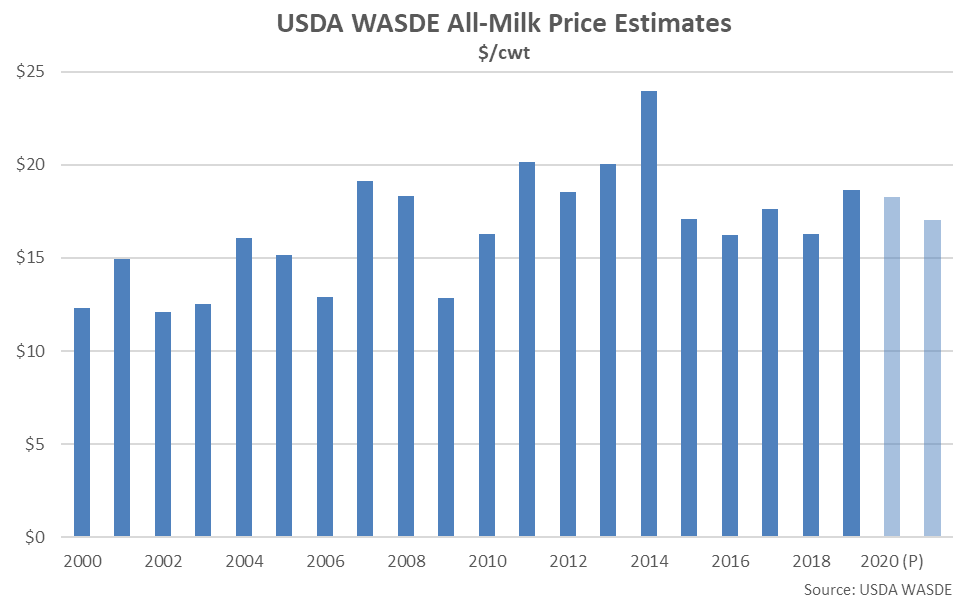

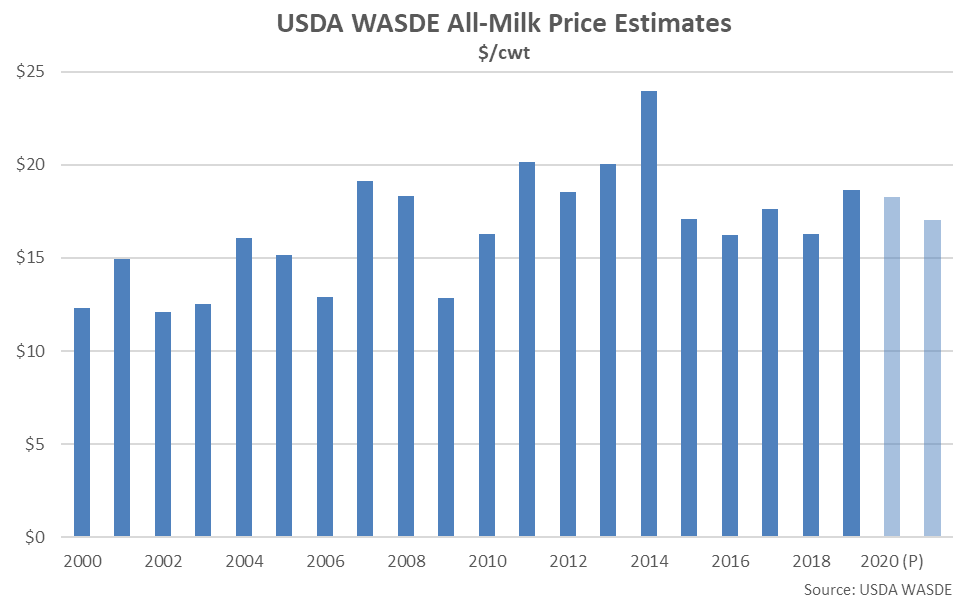

2020 butter, cheese and nonfat dry milk price forecasts were raised from the previous month on recent price strength and stronger anticipated demand however the 2020 dry whey price forecast was reduced from the previous month. The 2020 Class III milk price forecast of $18.00/cwt was raised $2.35/cwt from the previous forecast while the 2020 Class IV milk price forecast of $13.95/cwt was raised $0.40/cwt. The 2020 All-Milk price forecast of $18.25/cwt was raised $1.60/cwt from the previous forecast but remained 2.0% below 2019 price levels.

2021 butter, cheese and nonfat dry milk price forecasts were also raised from the previous month while the 2021 dry whey price forecast was unchanged. The 2021 Class III milk price forecast of $16.20/cwt was raised $1.10/cwt from the previous forecast but remained 10.0% below the 2020 projected level while the 2021 Class IV milk price forecast of $13.80/cwt was raised $0.45/cwt from the previous forecast but remained 1.1% below the 2020 projected level. The 2021 All-Milk price forecast of $17.05/cwt was raised $0.85/cwt from the previous forecast but is expected to remain 6.6% below 2020 projected levels, finishing at a three year low level.

2020 butter, cheese and nonfat dry milk price forecasts were raised from the previous month on recent price strength and stronger anticipated demand however the 2020 dry whey price forecast was reduced from the previous month. The 2020 Class III milk price forecast of $18.00/cwt was raised $2.35/cwt from the previous forecast while the 2020 Class IV milk price forecast of $13.95/cwt was raised $0.40/cwt. The 2020 All-Milk price forecast of $18.25/cwt was raised $1.60/cwt from the previous forecast but remained 2.0% below 2019 price levels.

2021 butter, cheese and nonfat dry milk price forecasts were also raised from the previous month while the 2021 dry whey price forecast was unchanged. The 2021 Class III milk price forecast of $16.20/cwt was raised $1.10/cwt from the previous forecast but remained 10.0% below the 2020 projected level while the 2021 Class IV milk price forecast of $13.80/cwt was raised $0.45/cwt from the previous forecast but remained 1.1% below the 2020 projected level. The 2021 All-Milk price forecast of $17.05/cwt was raised $0.85/cwt from the previous forecast but is expected to remain 6.6% below 2020 projected levels, finishing at a three year low level.

2020 dairy export forecasts were raised from the previous month on both a milk-fat and skim-solids basis on increased shipments of butterfat products, cheese, dry skim milk products and lactose. 2020 dairy import forecasts were raised slightly on a milk-fat basis on higher imports of butter but unchanged from the previous month on a skim-solids basis. 2021 dairy export forecasts were also raised from the previous month on both a milk-fat and skim-solids basis while 2021 import forecasts were raised on a milk-fat basis and unchanged on a skim-solids basis.

2020 projected dairy export volumes translated to 16.2% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2021 projected dairy export volumes also translated to 16.2% of total U.S. milk solids production, unchanged from the previous year projection, while import volumes were equivalent to 3.7% of total U.S. milk solids production, down slightly from the 2020 projection. 2021 net dairy trade is projected to rebound to a three year high level but remain below the 2018 record high level.

2020 dairy export forecasts were raised from the previous month on both a milk-fat and skim-solids basis on increased shipments of butterfat products, cheese, dry skim milk products and lactose. 2020 dairy import forecasts were raised slightly on a milk-fat basis on higher imports of butter but unchanged from the previous month on a skim-solids basis. 2021 dairy export forecasts were also raised from the previous month on both a milk-fat and skim-solids basis while 2021 import forecasts were raised on a milk-fat basis and unchanged on a skim-solids basis.

2020 projected dairy export volumes translated to 16.2% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2021 projected dairy export volumes also translated to 16.2% of total U.S. milk solids production, unchanged from the previous year projection, while import volumes were equivalent to 3.7% of total U.S. milk solids production, down slightly from the 2020 projection. 2021 net dairy trade is projected to rebound to a three year high level but remain below the 2018 record high level.

2020 butter, cheese and nonfat dry milk price forecasts were raised from the previous month on recent price strength and stronger anticipated demand however the 2020 dry whey price forecast was reduced from the previous month. The 2020 Class III milk price forecast of $18.00/cwt was raised $2.35/cwt from the previous forecast while the 2020 Class IV milk price forecast of $13.95/cwt was raised $0.40/cwt. The 2020 All-Milk price forecast of $18.25/cwt was raised $1.60/cwt from the previous forecast but remained 2.0% below 2019 price levels.

2021 butter, cheese and nonfat dry milk price forecasts were also raised from the previous month while the 2021 dry whey price forecast was unchanged. The 2021 Class III milk price forecast of $16.20/cwt was raised $1.10/cwt from the previous forecast but remained 10.0% below the 2020 projected level while the 2021 Class IV milk price forecast of $13.80/cwt was raised $0.45/cwt from the previous forecast but remained 1.1% below the 2020 projected level. The 2021 All-Milk price forecast of $17.05/cwt was raised $0.85/cwt from the previous forecast but is expected to remain 6.6% below 2020 projected levels, finishing at a three year low level.

2020 butter, cheese and nonfat dry milk price forecasts were raised from the previous month on recent price strength and stronger anticipated demand however the 2020 dry whey price forecast was reduced from the previous month. The 2020 Class III milk price forecast of $18.00/cwt was raised $2.35/cwt from the previous forecast while the 2020 Class IV milk price forecast of $13.95/cwt was raised $0.40/cwt. The 2020 All-Milk price forecast of $18.25/cwt was raised $1.60/cwt from the previous forecast but remained 2.0% below 2019 price levels.

2021 butter, cheese and nonfat dry milk price forecasts were also raised from the previous month while the 2021 dry whey price forecast was unchanged. The 2021 Class III milk price forecast of $16.20/cwt was raised $1.10/cwt from the previous forecast but remained 10.0% below the 2020 projected level while the 2021 Class IV milk price forecast of $13.80/cwt was raised $0.45/cwt from the previous forecast but remained 1.1% below the 2020 projected level. The 2021 All-Milk price forecast of $17.05/cwt was raised $0.85/cwt from the previous forecast but is expected to remain 6.6% below 2020 projected levels, finishing at a three year low level.