Dairy Margin Coverage Update – Aug ’20

The Dairy Margin Coverage (DMC) Program (previously known as Dairy Margin Protection Program, or MPP), provides dairy operations with risk management coverage that will pay producers when the difference between the national price of milk and the average cost of feed falls below a certain level selected by the program participant. Within DMC, producers can select margin coverage levels ranging from $4.00 to $9.50 per cwt, in $0.50 increments, on their first five million pounds of production (Tier I) and margin coverage levels ranging from $4.00 to $8.00 per cwt, in $0.50 increments, on additional production pounds (Tier II).

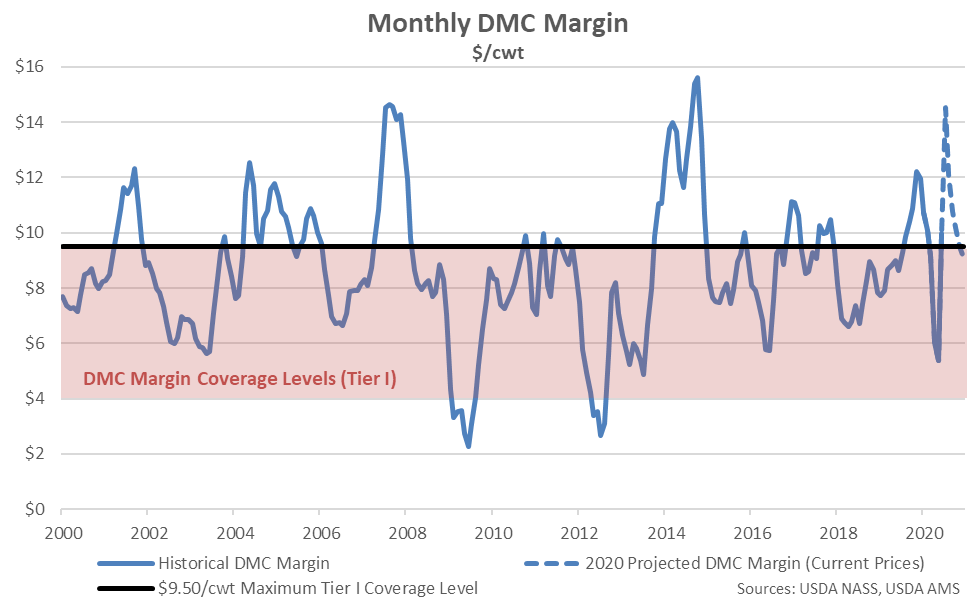

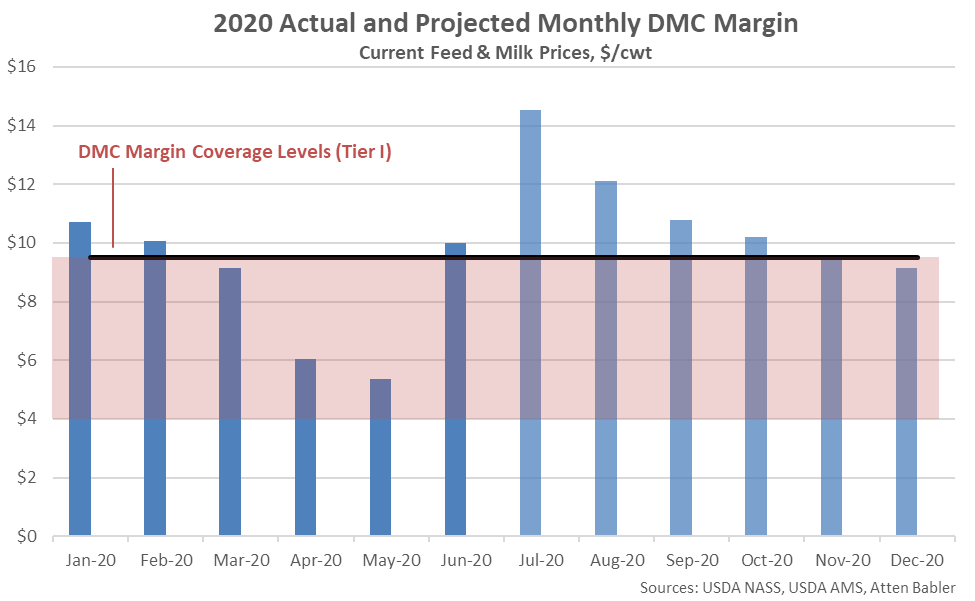

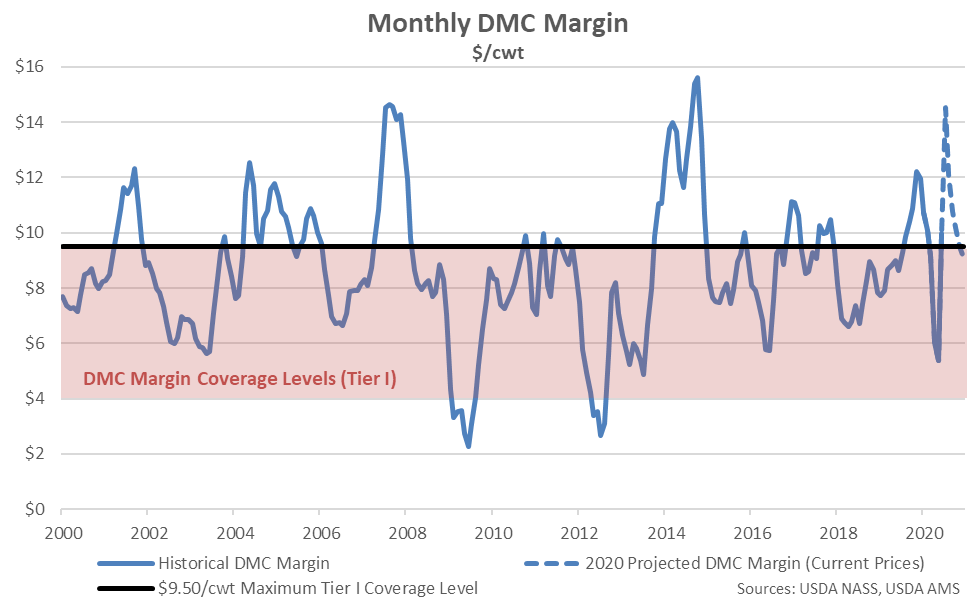

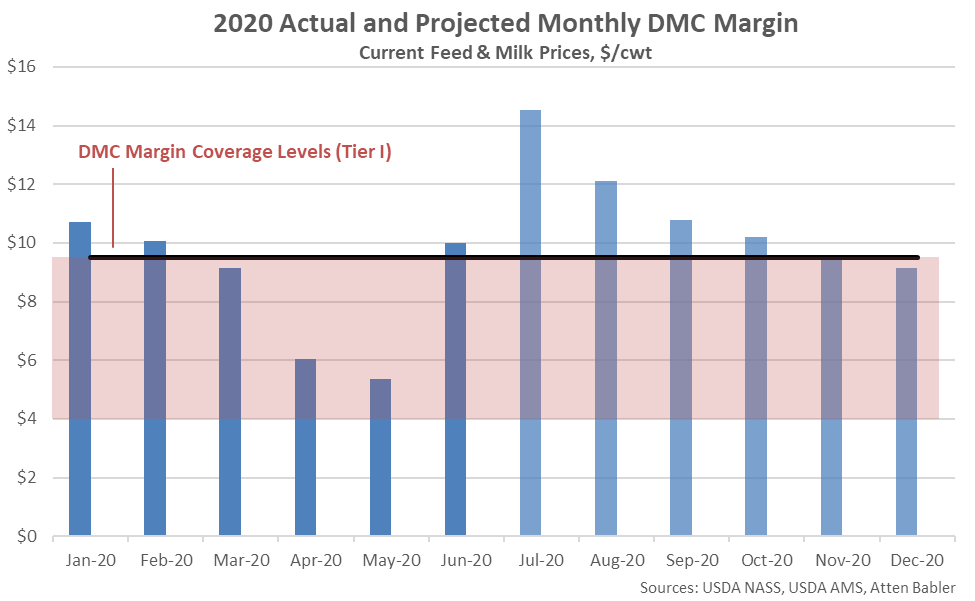

The DMC margin finished below the $9.50/cwt maximum Tier I margin coverage level throughout each of the first seven months of the 2019 calendar year, prior to rebounding to levels above the maximum margin coverage level over the months of August – December. The DMC margin remained above the $9.50/cwt maximum Tier I margin coverage level throughout the first two months of 2020 before finishing at levels of $9.15/cwt throughout March, $6.03/cwt throughout April, and $5.37/cwt throughout May. The May ’20 DMC margin was the lowest experienced throughout the past six and a half years, however margins rebounded throughout the month of June, finishing at a level of $9.99/cwt.

The DMC margin is expected to remain above the $9.50/cwt maximum Tier I margin coverage level throughout the months of July – November based on current futures prices and the historical relationship between the futures prices and the prices used within the DMC margin calculations. Projected DMC margins are expected to remain near the $9.50/cwt maximum Tier I margin coverage level throughout the month of December.

The DMC margin is expected to remain above the $9.50/cwt maximum Tier I margin coverage level throughout the months of July – November based on current futures prices and the historical relationship between the futures prices and the prices used within the DMC margin calculations. Projected DMC margins are expected to remain near the $9.50/cwt maximum Tier I margin coverage level throughout the month of December.

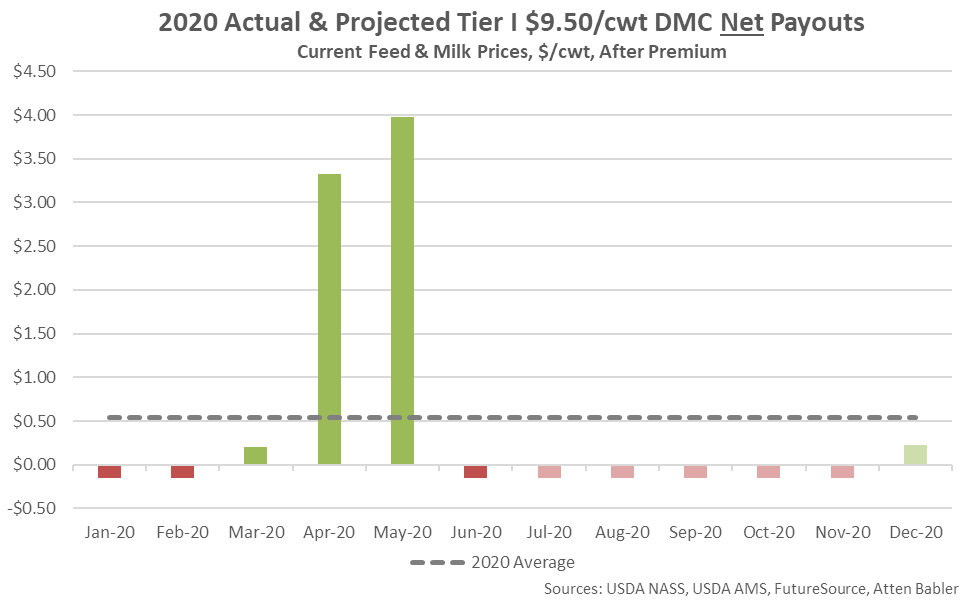

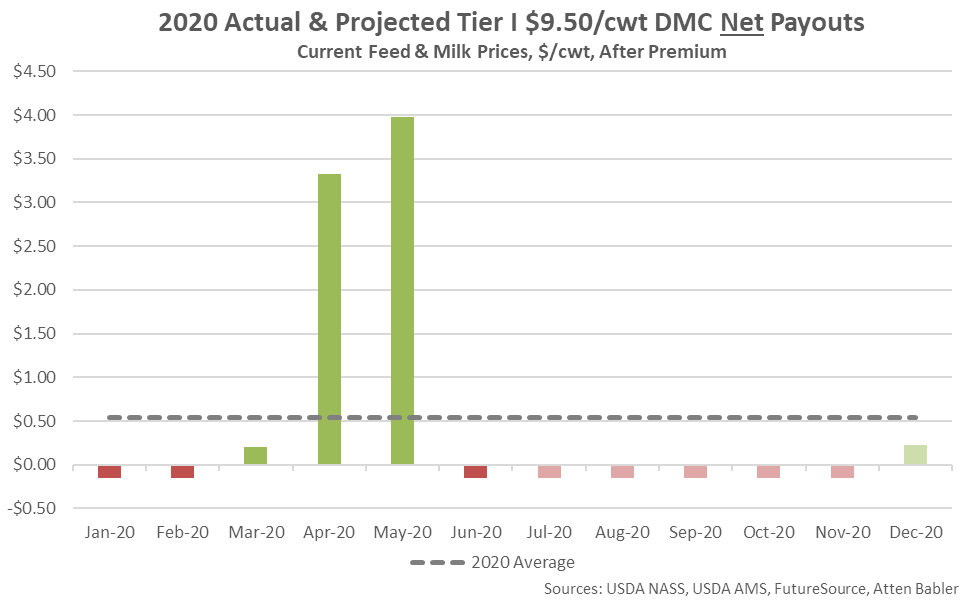

The 2020 average DMC gross margin at the $9.50/cwt Tier I margin coverage level is currently projected at $0.69/cwt based on current futures prices. When factoring in premium costs of $0.15/cwt on the $9.50/cwt Tier I coverage level, current futures prices are implying a net return of $0.54/cwt per hundredweight. A $7.30/cwt total net return throughout the months of April-May is expected to more than offset a negative $0.78/cwt total projected net return throughout the rest of the 2020 calendar year.

The 2020 average DMC gross margin at the $9.50/cwt Tier I margin coverage level is currently projected at $0.69/cwt based on current futures prices. When factoring in premium costs of $0.15/cwt on the $9.50/cwt Tier I coverage level, current futures prices are implying a net return of $0.54/cwt per hundredweight. A $7.30/cwt total net return throughout the months of April-May is expected to more than offset a negative $0.78/cwt total projected net return throughout the rest of the 2020 calendar year.

Current projected DMC margins would continue to result in no payouts on Tier II production volumes in excess of five million pounds at the $4.00/cwt – $5.00/cwt coverage levels. Due to the premium structure on Tier II production volumes, the vast majority of participants opted for $4.00/cwt – $5.00/cwt coverage.

Current projected DMC margins would continue to result in no payouts on Tier II production volumes in excess of five million pounds at the $4.00/cwt – $5.00/cwt coverage levels. Due to the premium structure on Tier II production volumes, the vast majority of participants opted for $4.00/cwt – $5.00/cwt coverage.

The DMC margin is expected to remain above the $9.50/cwt maximum Tier I margin coverage level throughout the months of July – November based on current futures prices and the historical relationship between the futures prices and the prices used within the DMC margin calculations. Projected DMC margins are expected to remain near the $9.50/cwt maximum Tier I margin coverage level throughout the month of December.

The DMC margin is expected to remain above the $9.50/cwt maximum Tier I margin coverage level throughout the months of July – November based on current futures prices and the historical relationship between the futures prices and the prices used within the DMC margin calculations. Projected DMC margins are expected to remain near the $9.50/cwt maximum Tier I margin coverage level throughout the month of December.

The 2020 average DMC gross margin at the $9.50/cwt Tier I margin coverage level is currently projected at $0.69/cwt based on current futures prices. When factoring in premium costs of $0.15/cwt on the $9.50/cwt Tier I coverage level, current futures prices are implying a net return of $0.54/cwt per hundredweight. A $7.30/cwt total net return throughout the months of April-May is expected to more than offset a negative $0.78/cwt total projected net return throughout the rest of the 2020 calendar year.

The 2020 average DMC gross margin at the $9.50/cwt Tier I margin coverage level is currently projected at $0.69/cwt based on current futures prices. When factoring in premium costs of $0.15/cwt on the $9.50/cwt Tier I coverage level, current futures prices are implying a net return of $0.54/cwt per hundredweight. A $7.30/cwt total net return throughout the months of April-May is expected to more than offset a negative $0.78/cwt total projected net return throughout the rest of the 2020 calendar year.

Current projected DMC margins would continue to result in no payouts on Tier II production volumes in excess of five million pounds at the $4.00/cwt – $5.00/cwt coverage levels. Due to the premium structure on Tier II production volumes, the vast majority of participants opted for $4.00/cwt – $5.00/cwt coverage.

Current projected DMC margins would continue to result in no payouts on Tier II production volumes in excess of five million pounds at the $4.00/cwt – $5.00/cwt coverage levels. Due to the premium structure on Tier II production volumes, the vast majority of participants opted for $4.00/cwt – $5.00/cwt coverage.