U.S. Oil Rig Count Update – 8/5/20

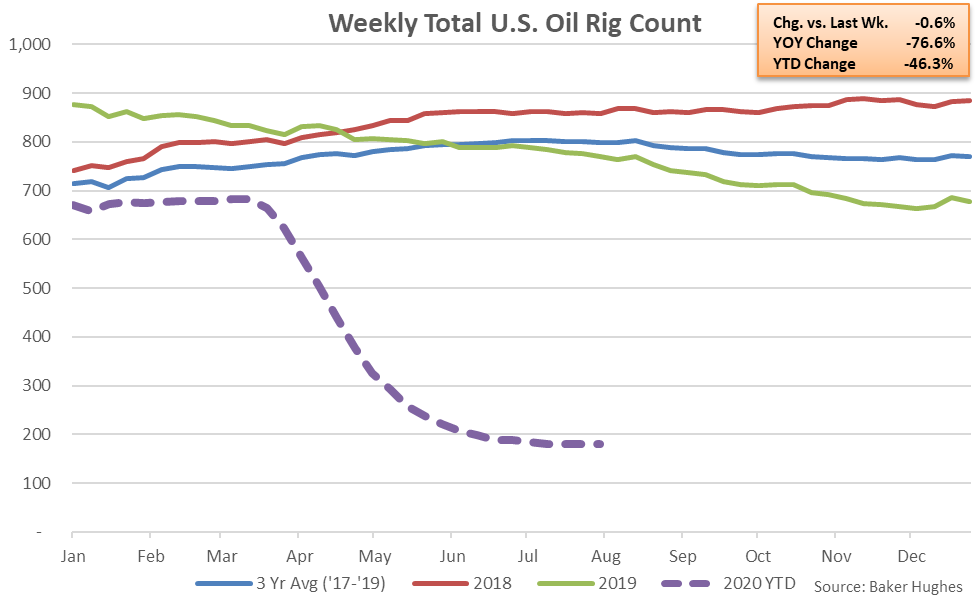

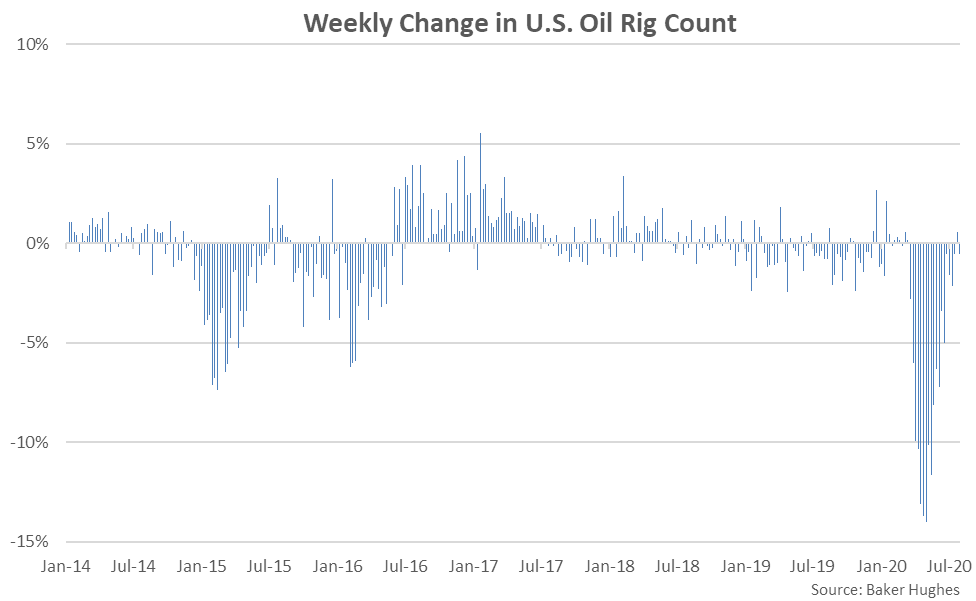

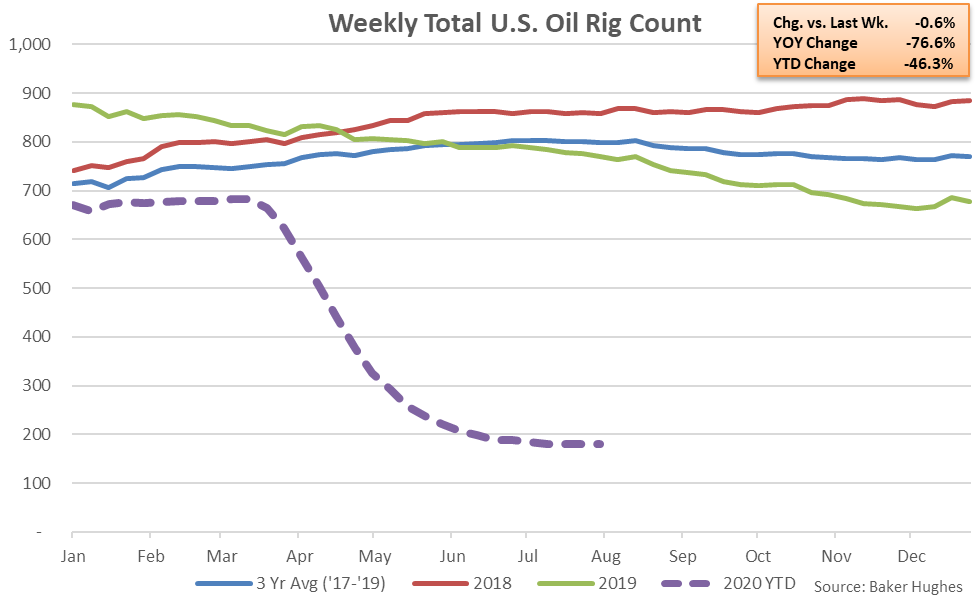

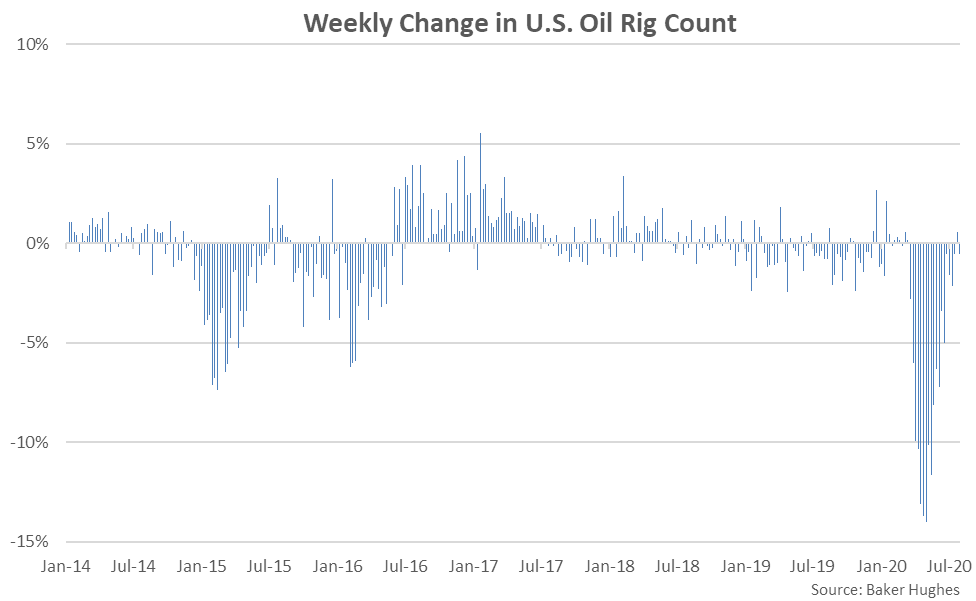

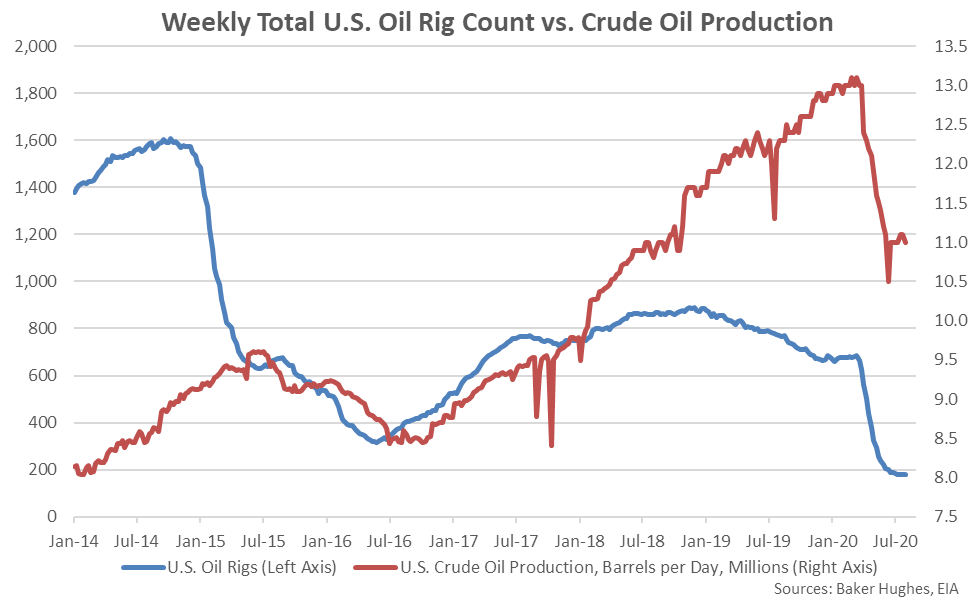

According to Baker Hughes, U.S. oil rig counts declined to an 11 year low level during the week ending Jul 31st. Jul 31st week ending oil rig counts declined 0.6% from the previous week while finishing 76.6% lower on a YOY basis and 79.7% below the three and a half year high levels experienced during November of 2018. Oil rig counts have declined over 19 of the past 20 weeks through the week ending Jul 31st however declines have decelerated over recent weeks.

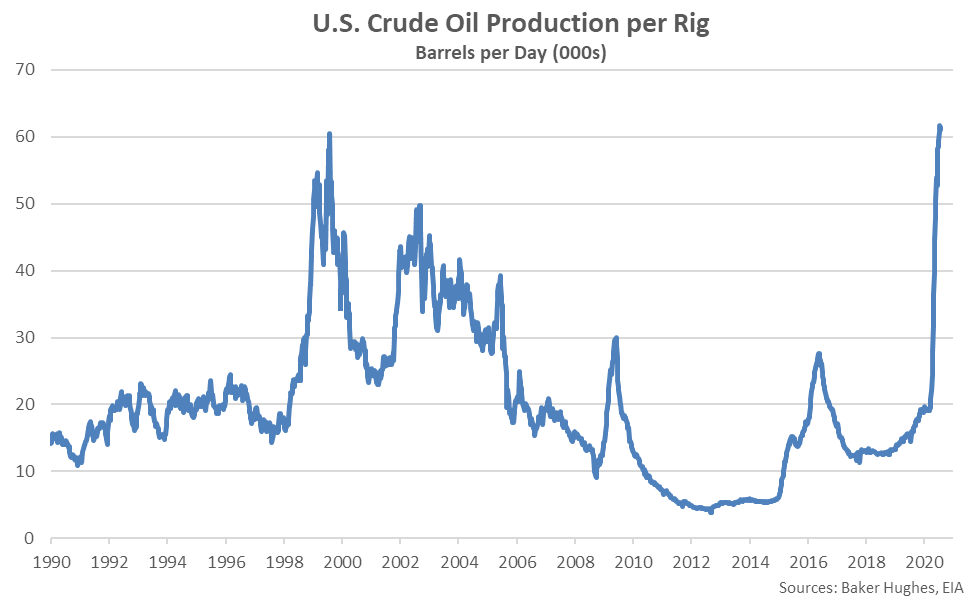

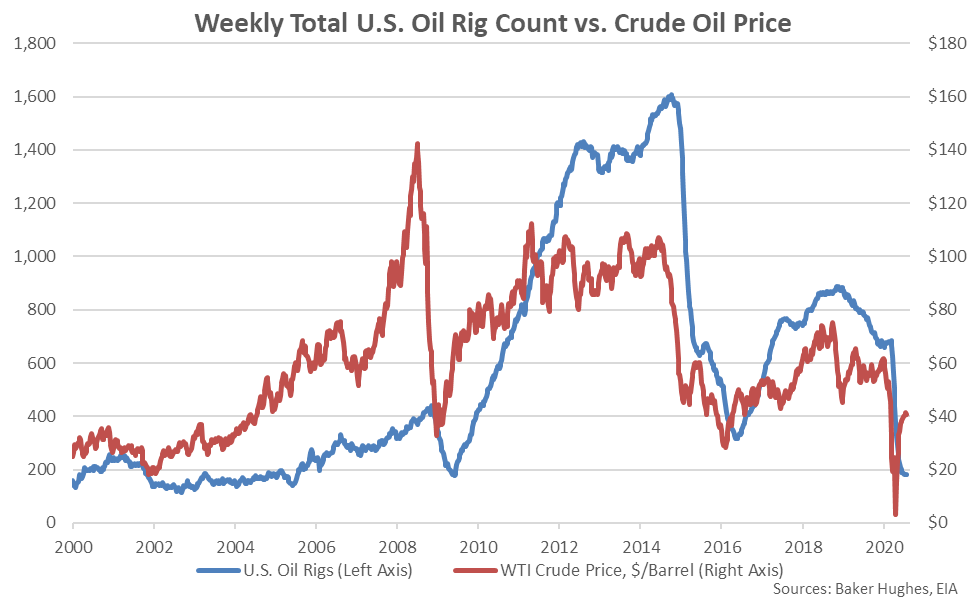

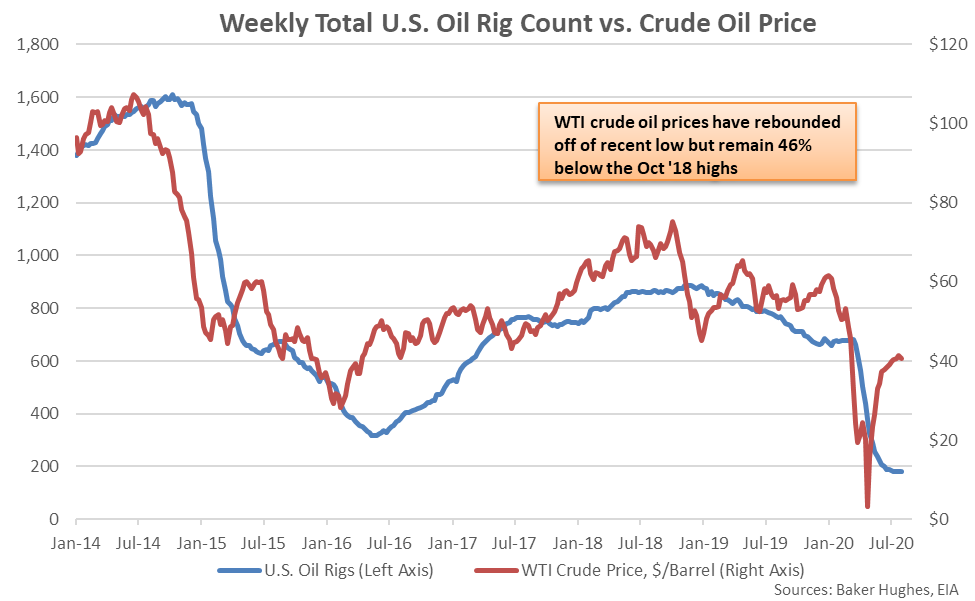

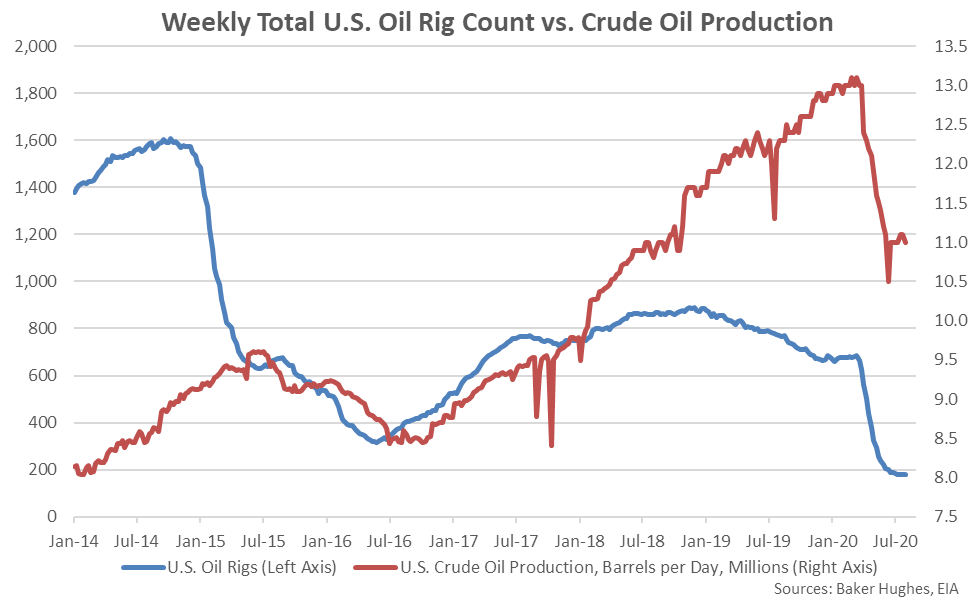

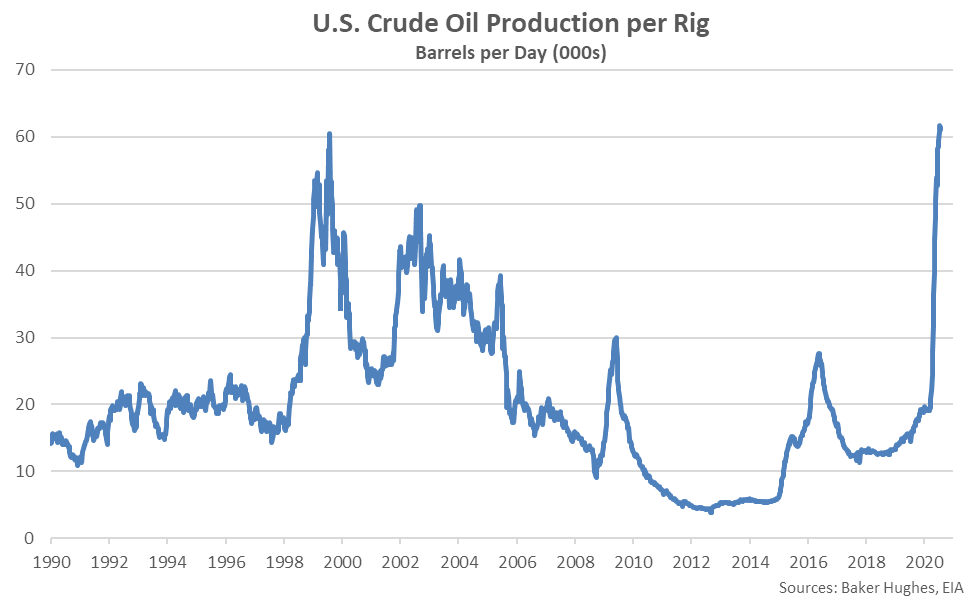

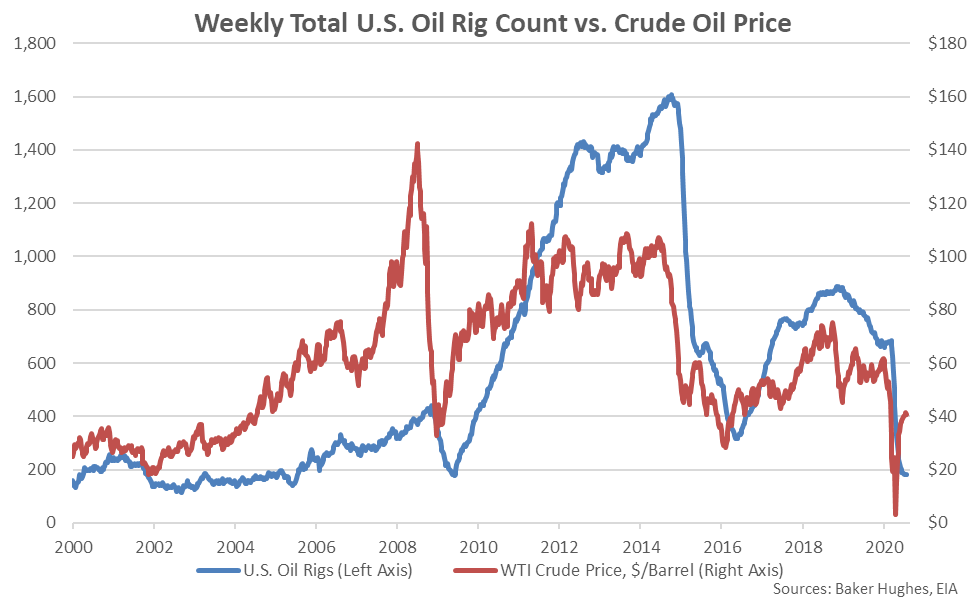

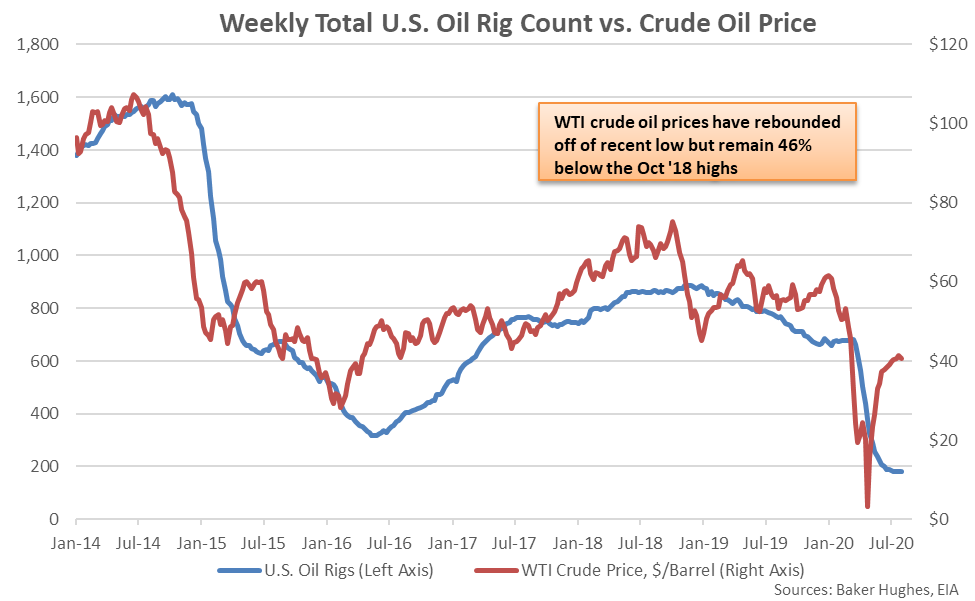

Oil rig counts have declined in response to lower WTI crude oil prices, which have rebounded off of recent lows but remain 46% below the Oct ’18 highs during the week ending Jul 31st. Crude oil production volumes have rebounded off of the 26 month low level experienced during mid-June but remain 16.0% below the record high level experienced during Mar ’20. Jul 31st week ending oil production per rig remained near the record high level experienced during mid-July. Crude oil production is expected to continue to slow throughout coming months according to drilling productivity estimates compiled throughout areas accounting for 95% of recent production gains.

Oil Rig Counts Peaked in Late 2014, Prior to Declining Sharply in Early 2015

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

Jul 31st Oil Rig Counts Declined 0.6% Week-Over-Week, Finishing 76.6% Lower YOY

Jul 31st Oil Rig Counts Declined 0.6% Week-Over-Week, Finishing 76.6% Lower YOY

Declines in Oil Rig Counts Have Decelerated Over Recent Weeks

Declines in Oil Rig Counts Have Decelerated Over Recent Weeks

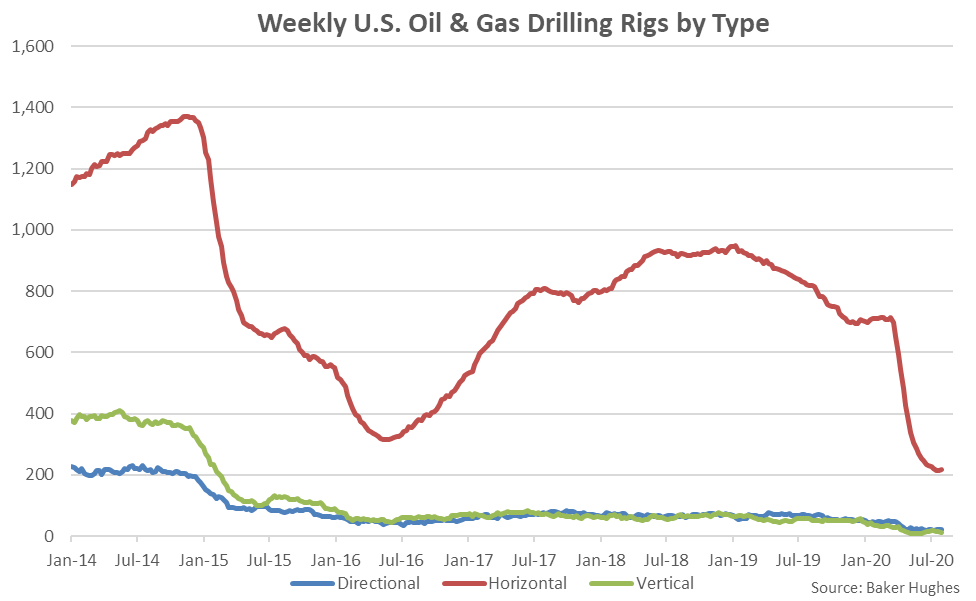

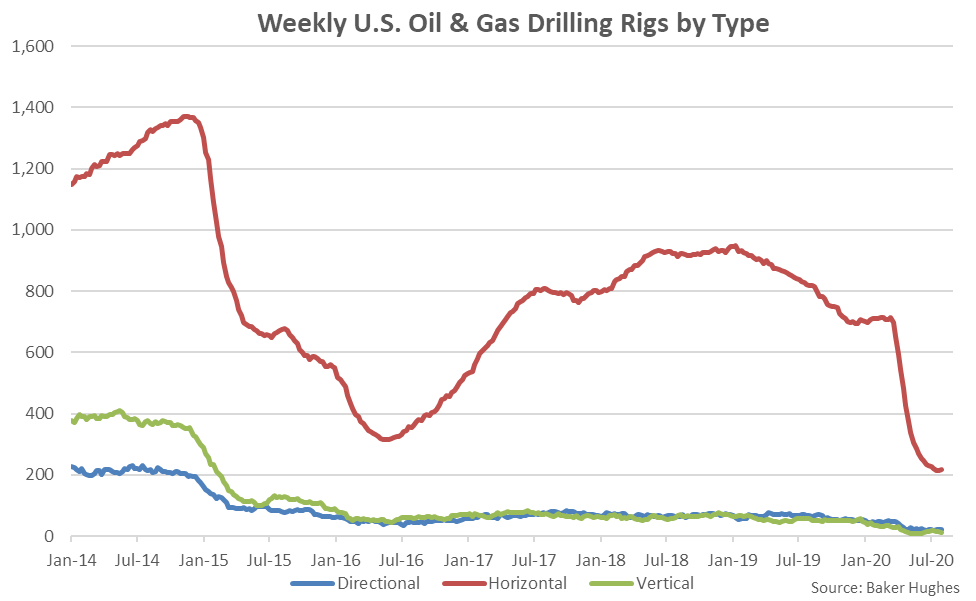

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Crude Oil Production Volumes Have Rebounded off of Recent 26 Month Low Levels

Crude Oil Production Volumes Have Rebounded off of Recent 26 Month Low Levels

Jul 31st Crude Oil Production per Rig Remained Near Recent Record High Levels

Jul 31st Crude Oil Production per Rig Remained Near Recent Record High Levels

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

Jul 31st Oil Rig Counts Declined 0.6% Week-Over-Week, Finishing 76.6% Lower YOY

Jul 31st Oil Rig Counts Declined 0.6% Week-Over-Week, Finishing 76.6% Lower YOY

Declines in Oil Rig Counts Have Decelerated Over Recent Weeks

Declines in Oil Rig Counts Have Decelerated Over Recent Weeks

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Crude Oil Production Volumes Have Rebounded off of Recent 26 Month Low Levels

Crude Oil Production Volumes Have Rebounded off of Recent 26 Month Low Levels

Jul 31st Crude Oil Production per Rig Remained Near Recent Record High Levels

Jul 31st Crude Oil Production per Rig Remained Near Recent Record High Levels