Crop Progress Update – 8/31/20

According to the USDA, the current corn and soybean crops identified to be in good or excellent condition each continued to decline from the previous week but finished equal to or slightly above analyst expectations.

Corn:

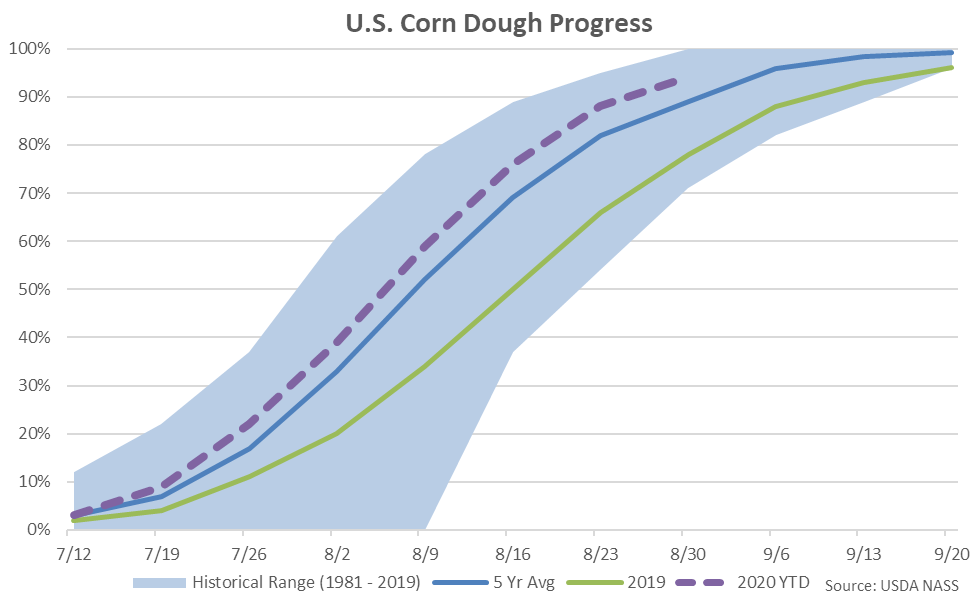

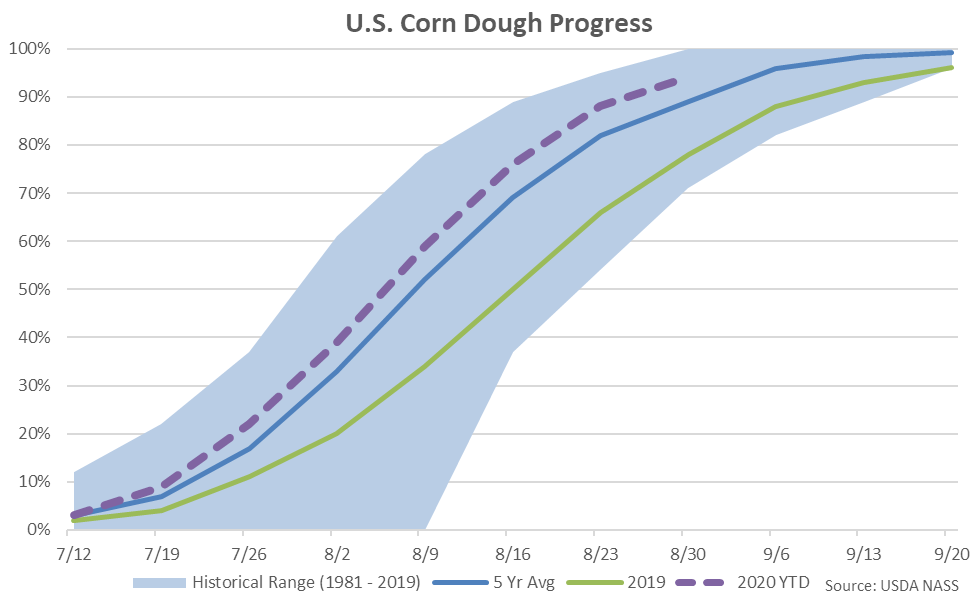

Corn dough as of the week ending Aug 30th was 94% completed, finishing ahead of last year’s pace of 78% completed and the five year average pace of 89% completed.

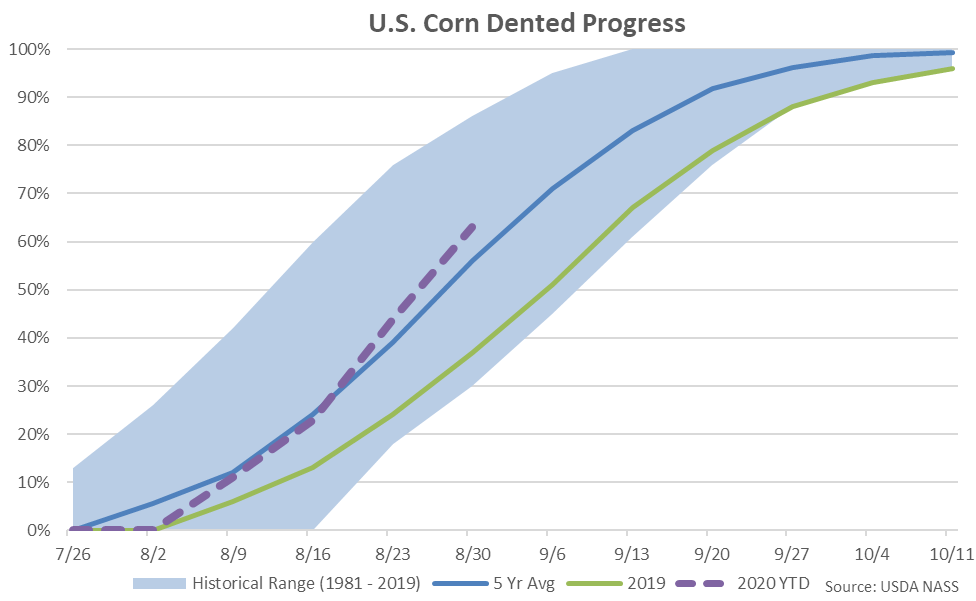

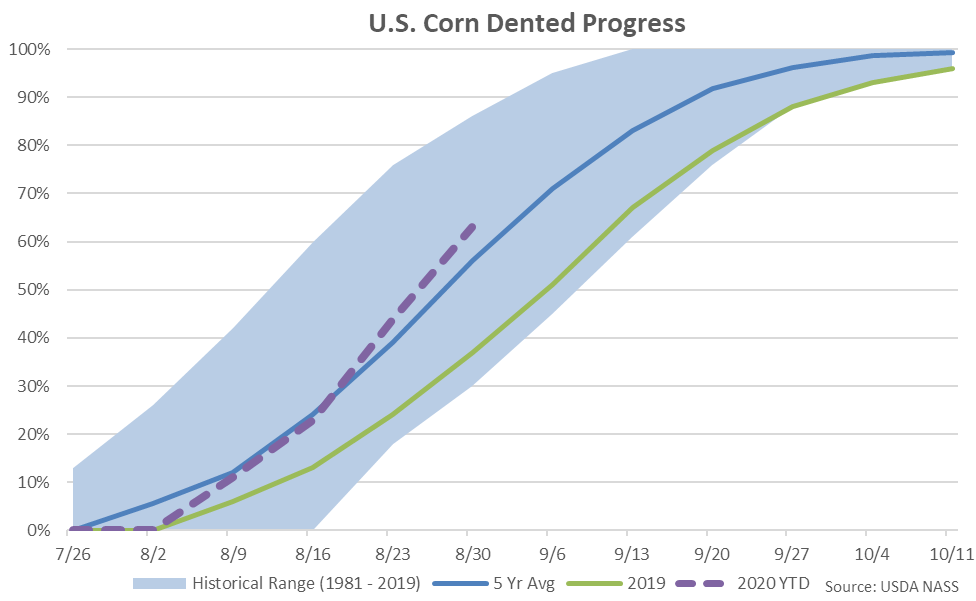

Corn dent as of the week ending Aug 30th was 63% completed, finishing ahead of last year’s pace of 37% completed and the five year average pace of 56% completed.

Corn dent as of the week ending Aug 30th was 63% completed, finishing ahead of last year’s pace of 37% completed and the five year average pace of 56% completed.

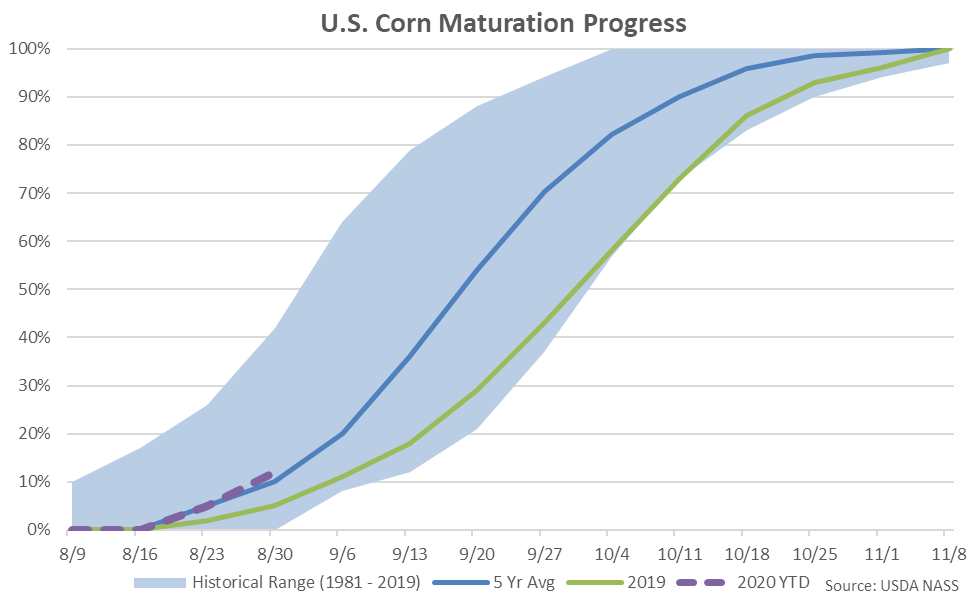

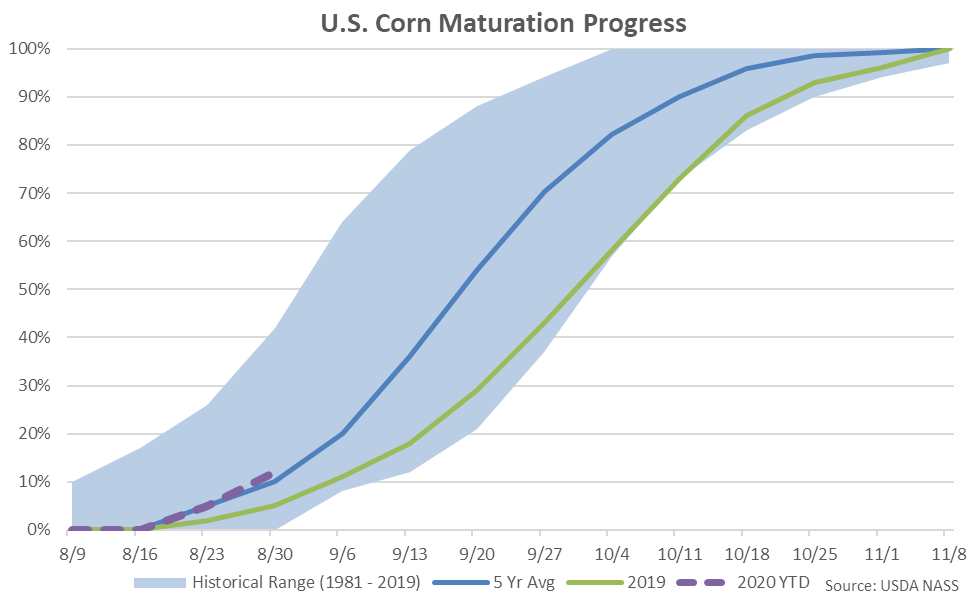

Corn maturation as of the week ending Aug 30th was 12% completed, finishing ahead of last year’s pace of five percent completed and the five year average pace of ten percent completed.

Corn maturation as of the week ending Aug 30th was 12% completed, finishing ahead of last year’s pace of five percent completed and the five year average pace of ten percent completed.

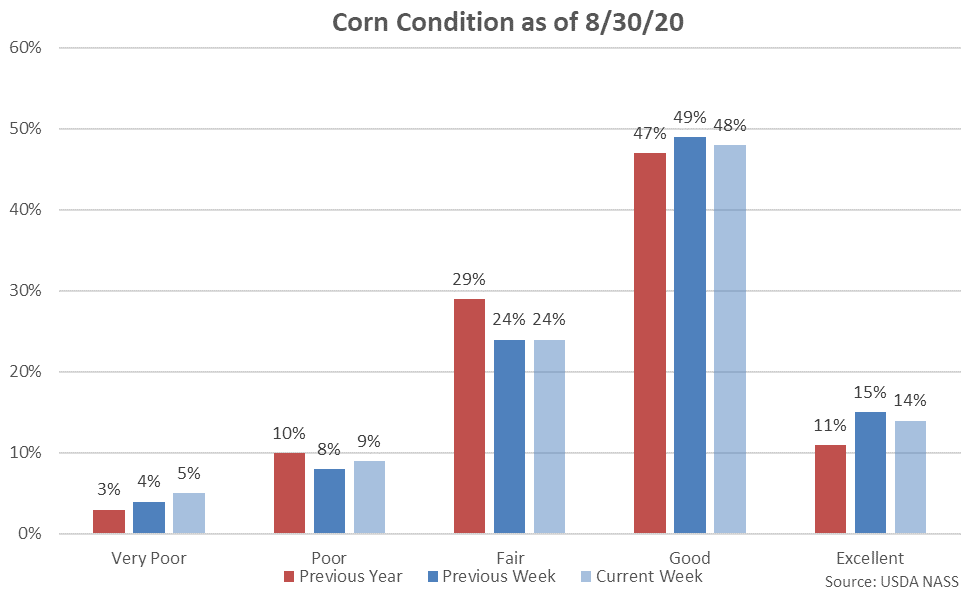

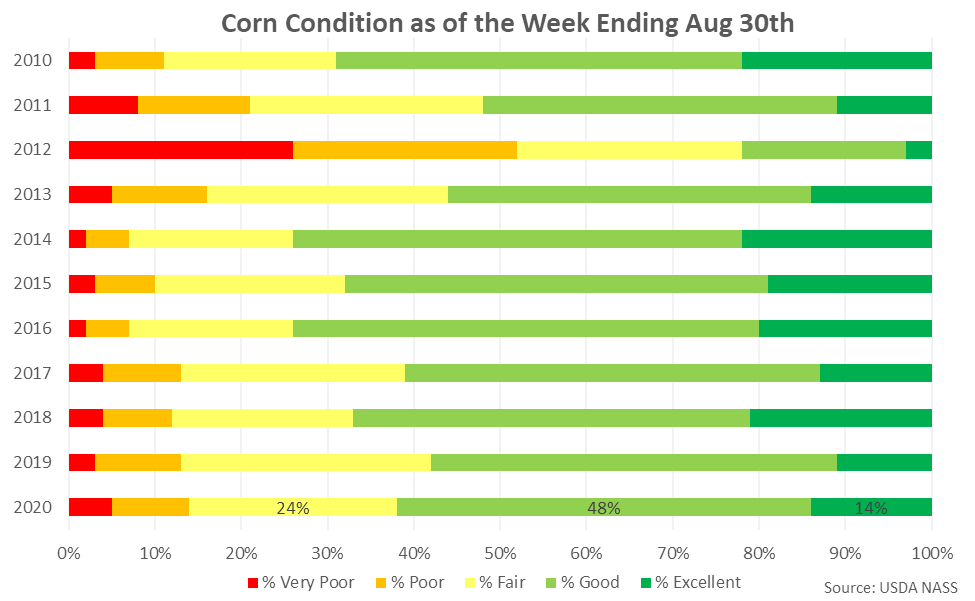

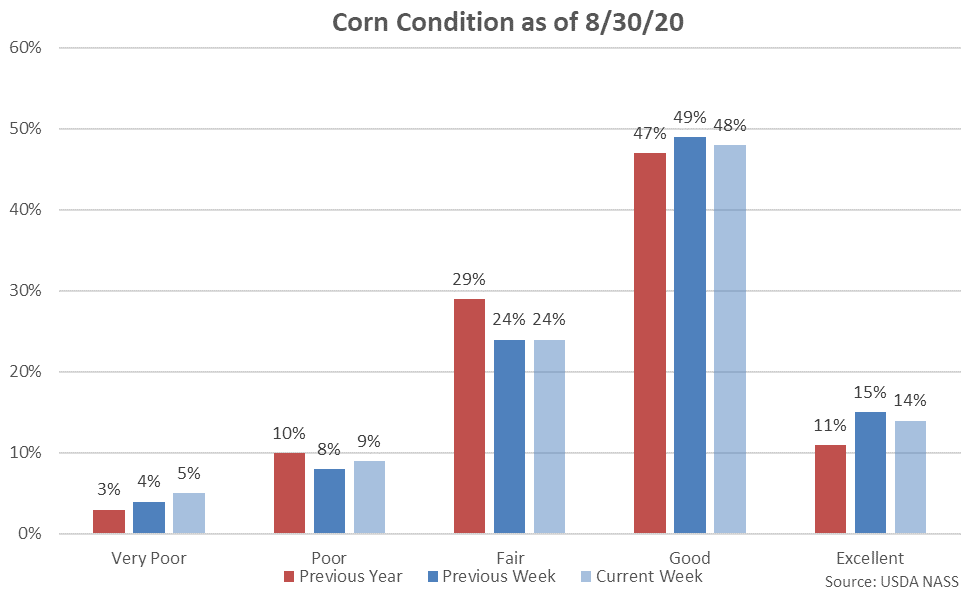

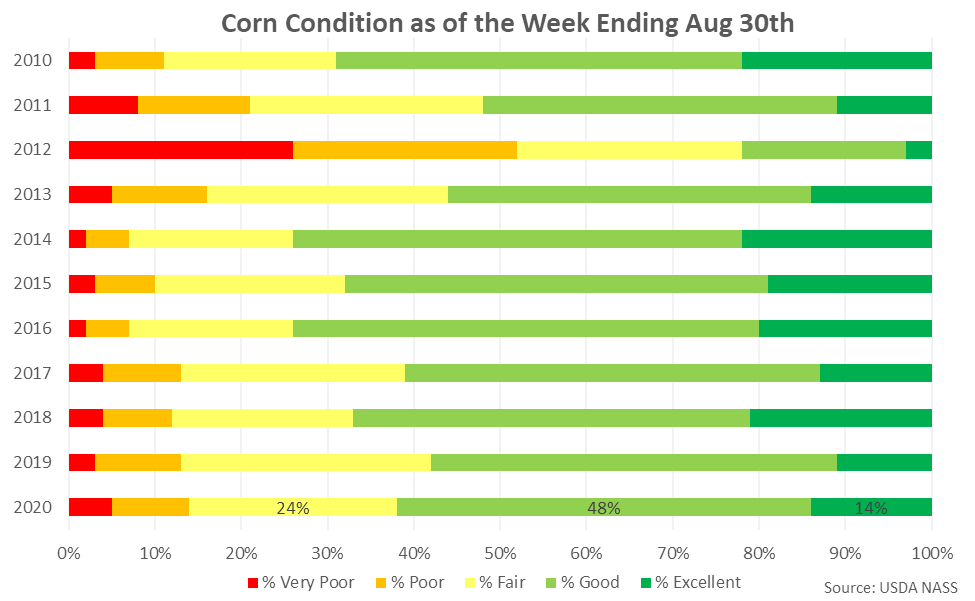

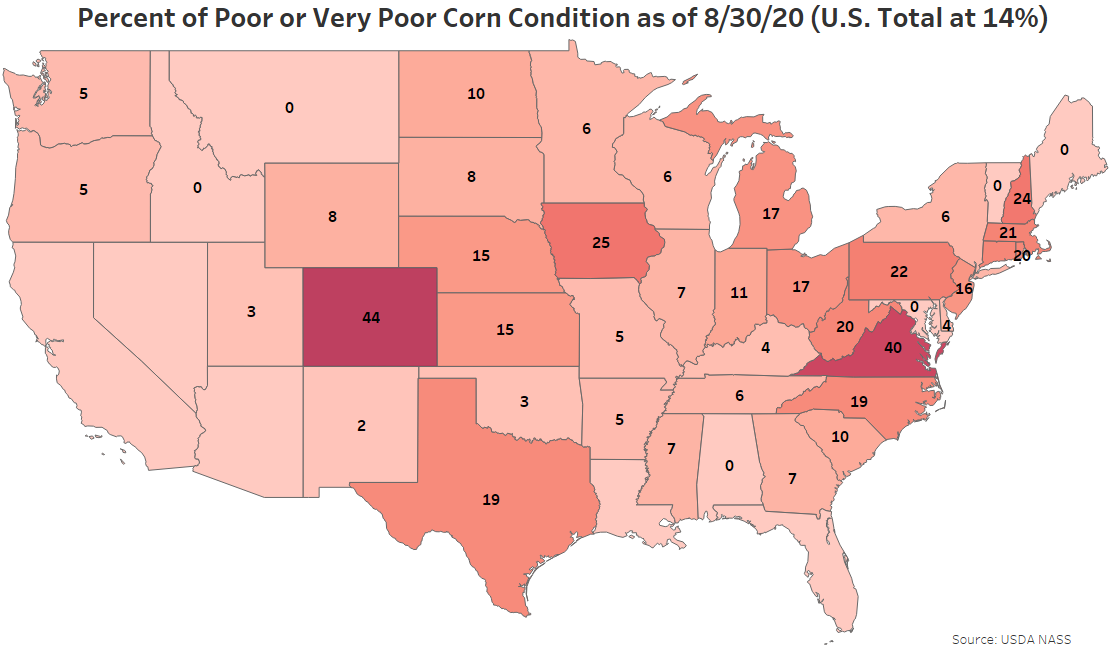

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 30th, down two percent from the previous week. The current corn crop identified to be in good or excellent condition finished significantly above analyst expectations of 61%, however. 14% of the current corn crop was identified as poor or very poor, up two percent from the previous week.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 30th, down two percent from the previous week. The current corn crop identified to be in good or excellent condition finished significantly above analyst expectations of 61%, however. 14% of the current corn crop was identified as poor or very poor, up two percent from the previous week.

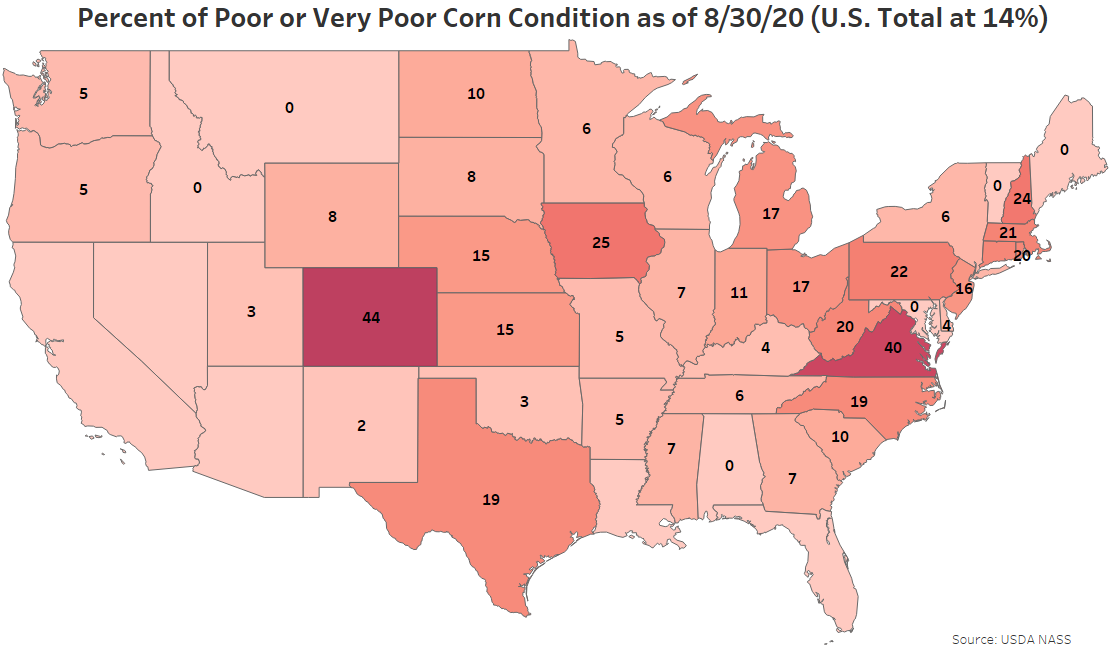

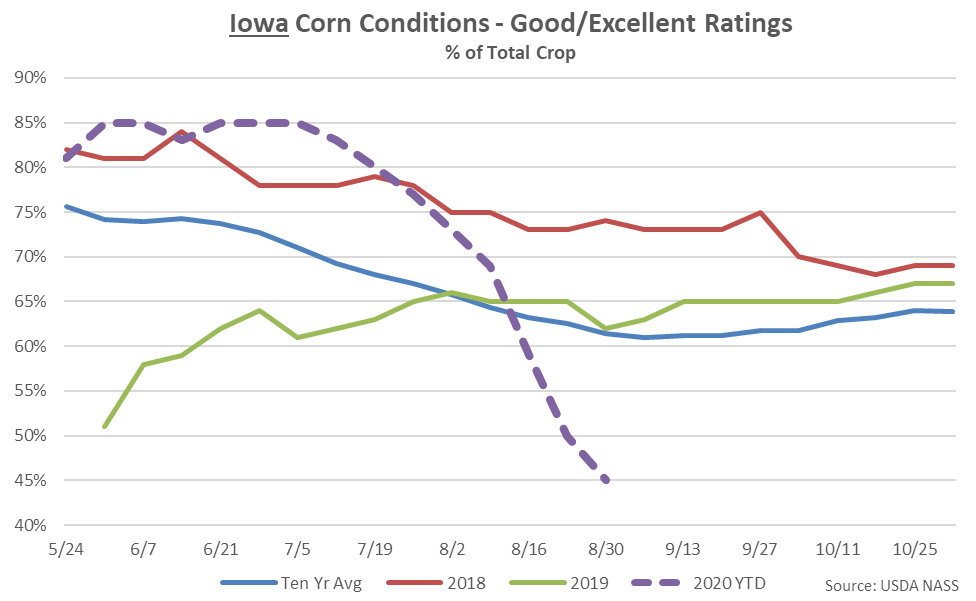

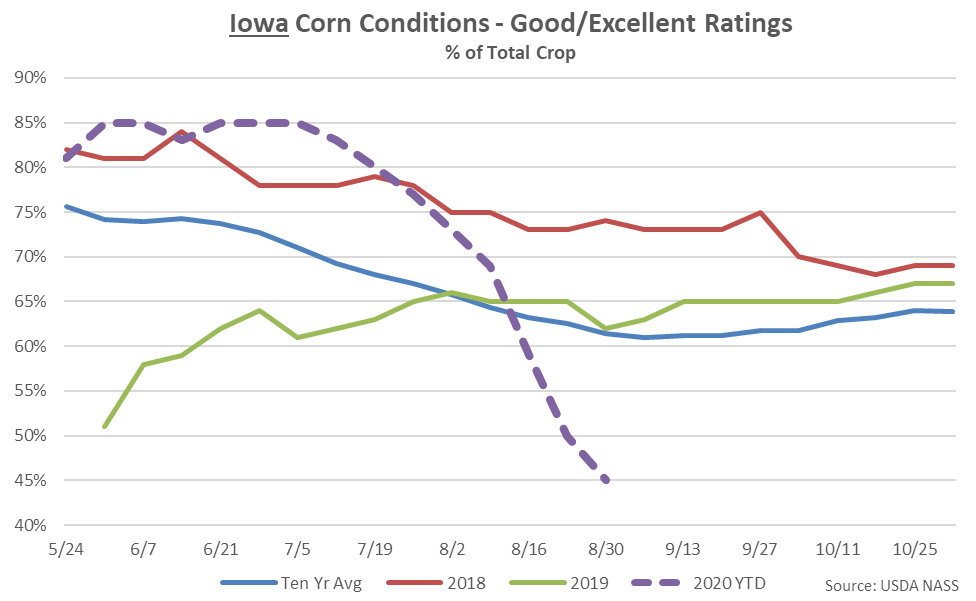

25% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up four percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the Aug 10th derecho. Just 45% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

25% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up four percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the Aug 10th derecho. Just 45% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

Soybeans:

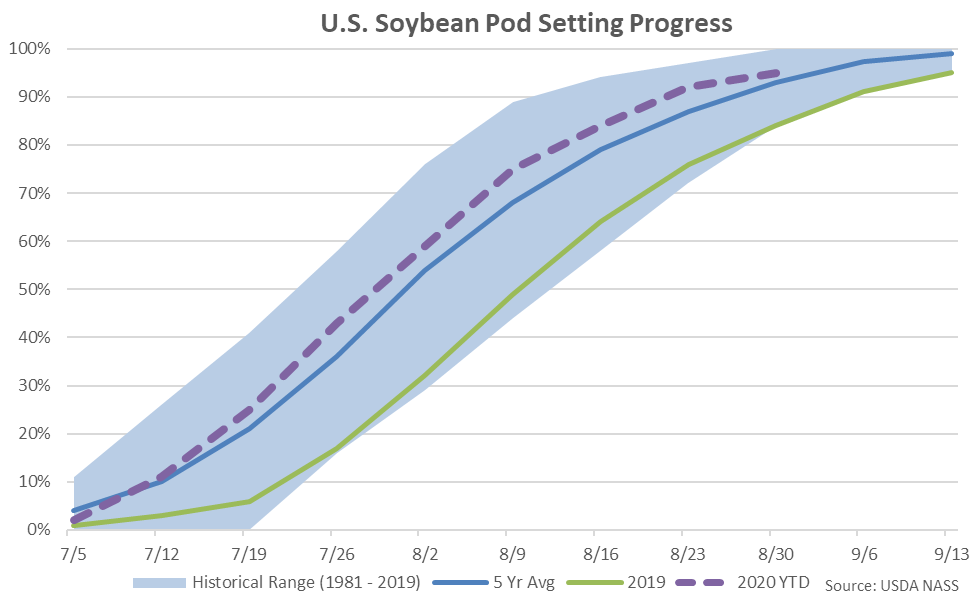

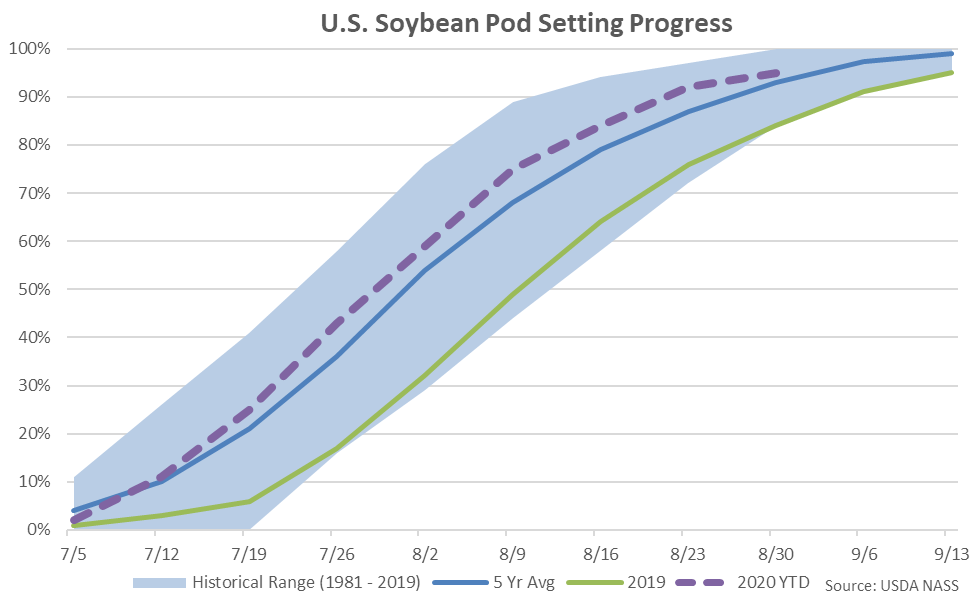

Soybean pod setting as of the week ending Aug 30th was 95% completed, finishing ahead of last year’s pace of 84% completed and the five year average pace of 93% completed.

Soybeans:

Soybean pod setting as of the week ending Aug 30th was 95% completed, finishing ahead of last year’s pace of 84% completed and the five year average pace of 93% completed.

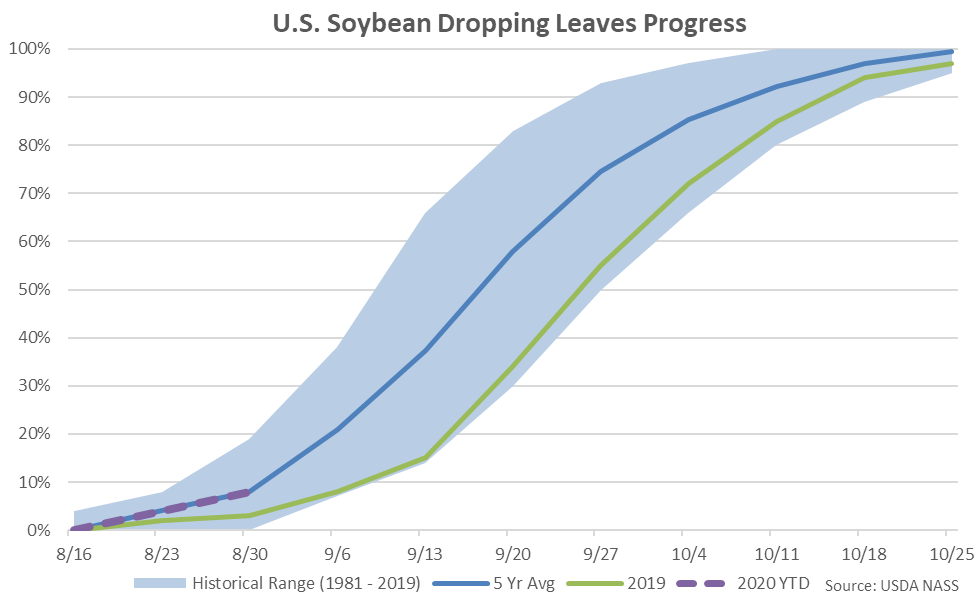

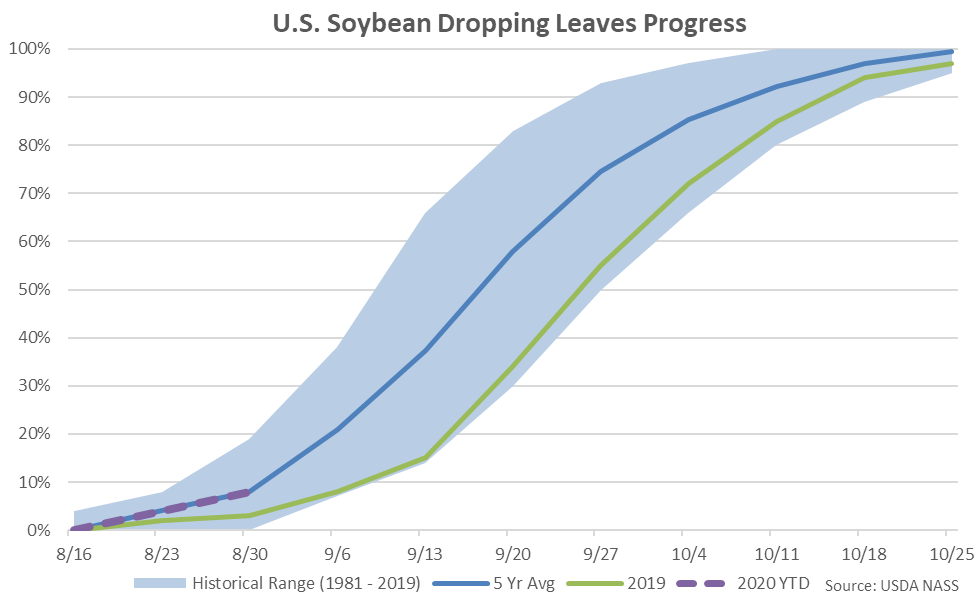

Soybean leaf dropping was eight percent completed as of the week ending Aug 30th, finishing ahead of last year’s pace of three percent completed and equal to the five year average pace of eight percent completed.

Soybean leaf dropping was eight percent completed as of the week ending Aug 30th, finishing ahead of last year’s pace of three percent completed and equal to the five year average pace of eight percent completed.

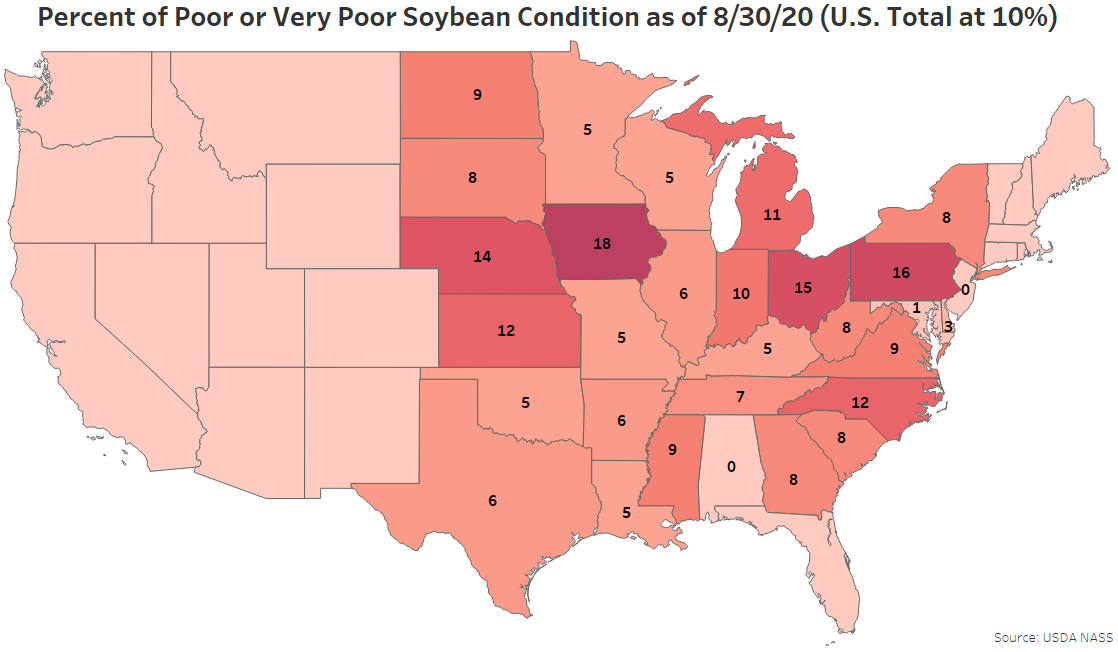

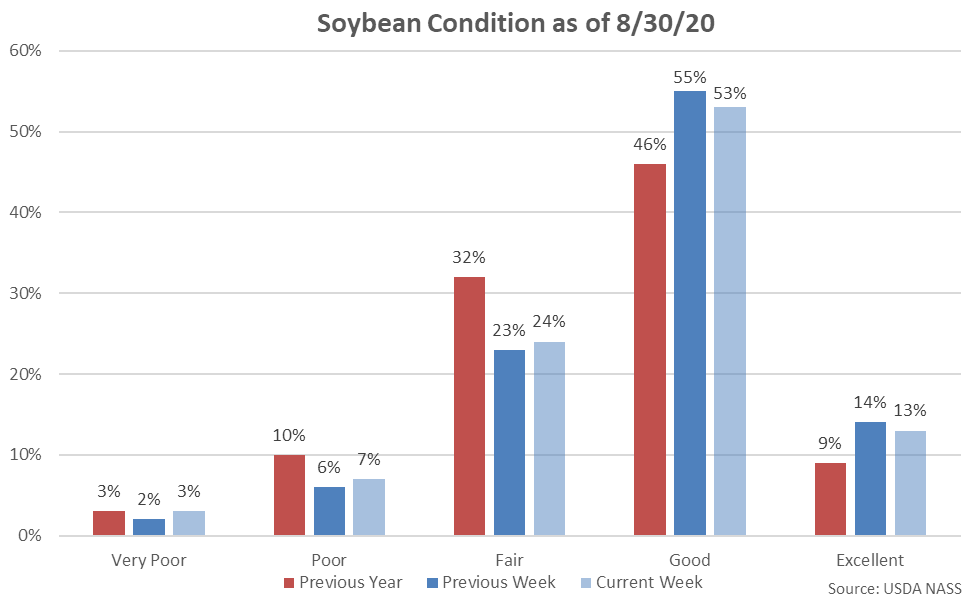

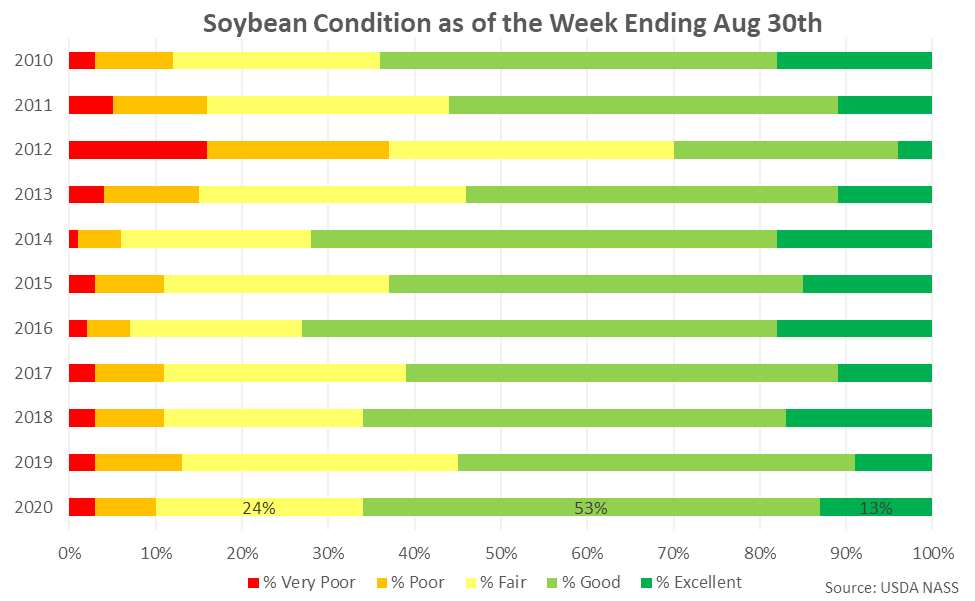

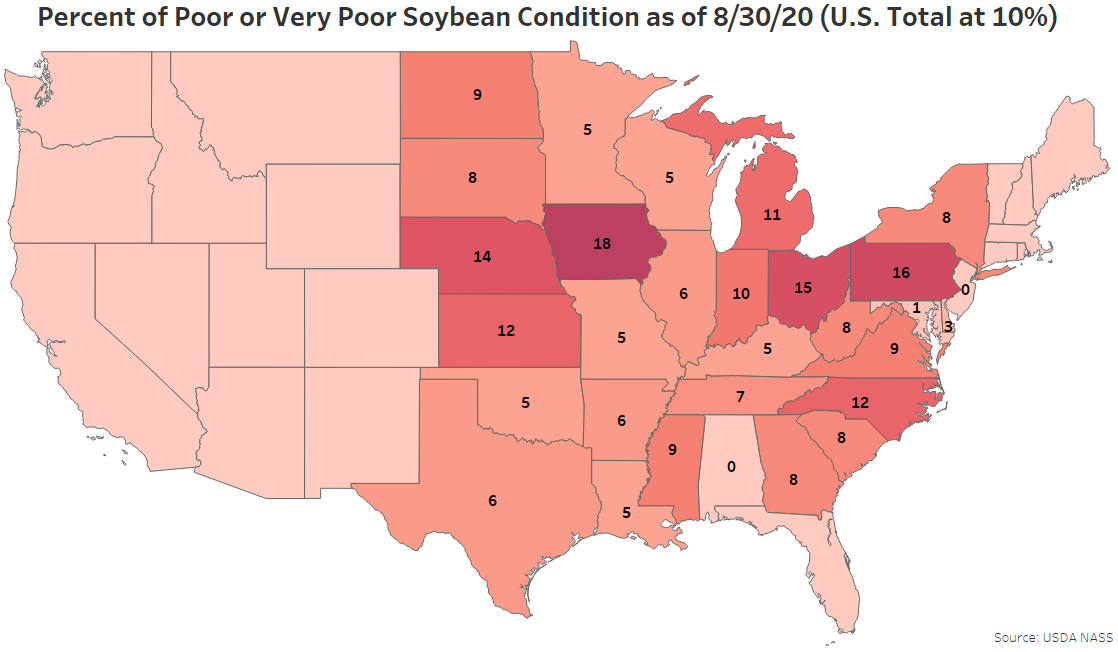

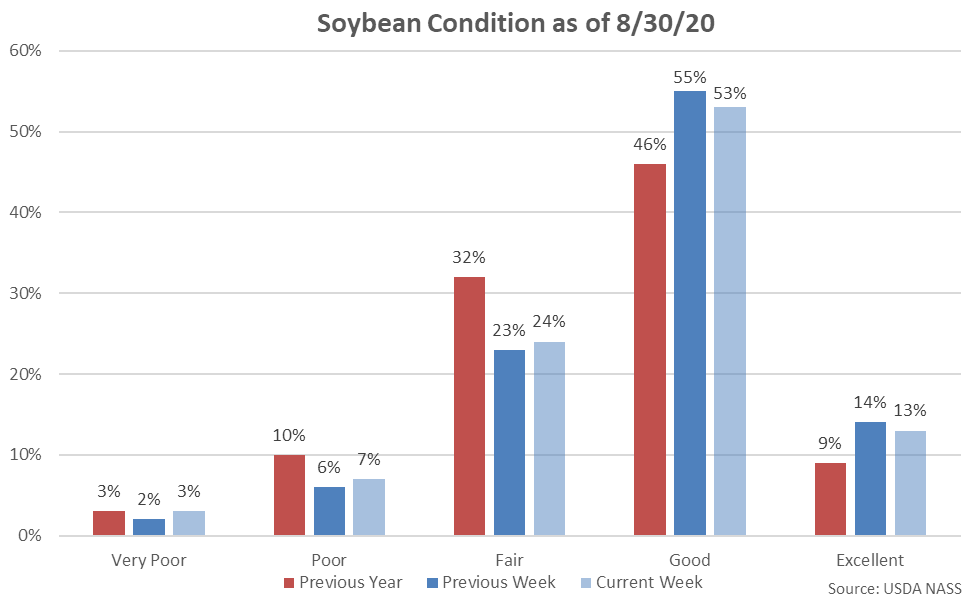

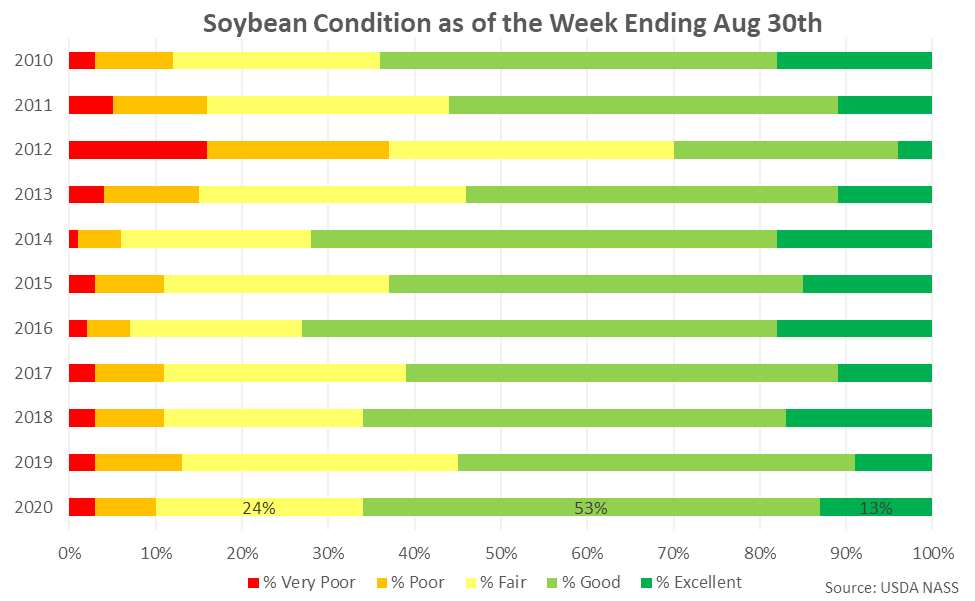

66% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 30th, down three percent from the previous week. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, up two percent from the previous week.

66% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 30th, down three percent from the previous week. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, up two percent from the previous week.

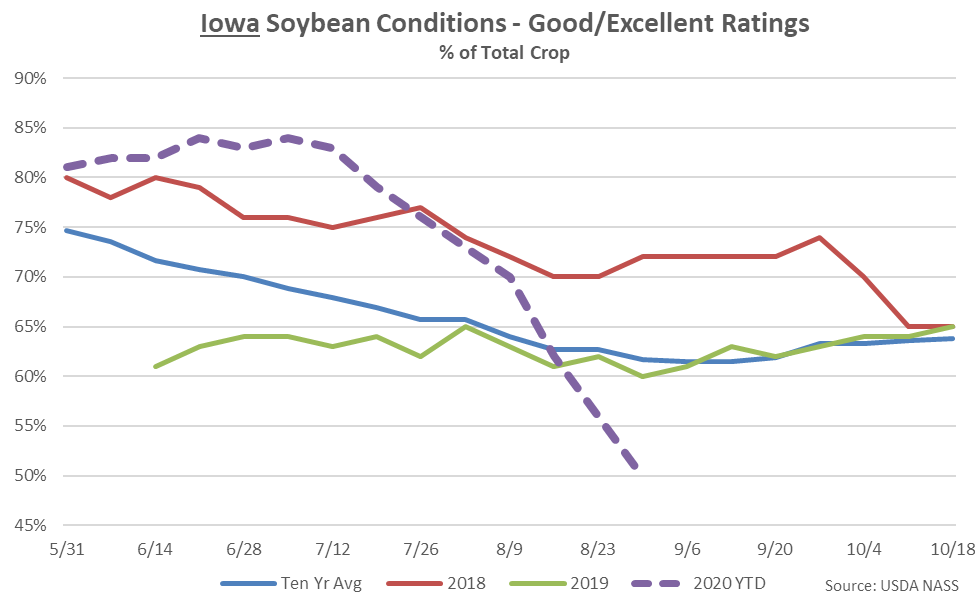

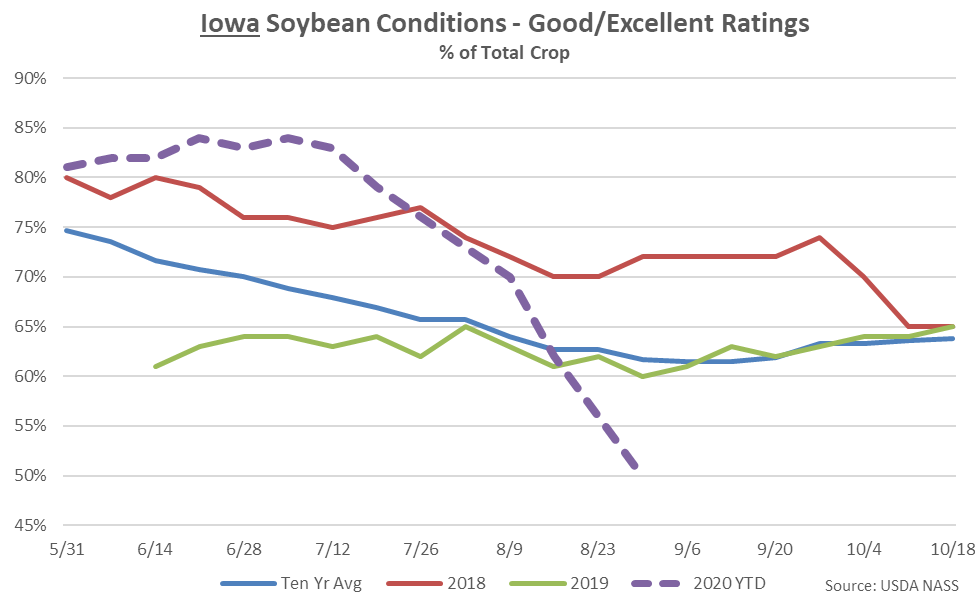

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up five percent from the previous week. Just 50% of the Iowa soybean crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up five percent from the previous week. Just 50% of the Iowa soybean crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

Corn dent as of the week ending Aug 30th was 63% completed, finishing ahead of last year’s pace of 37% completed and the five year average pace of 56% completed.

Corn dent as of the week ending Aug 30th was 63% completed, finishing ahead of last year’s pace of 37% completed and the five year average pace of 56% completed.

Corn maturation as of the week ending Aug 30th was 12% completed, finishing ahead of last year’s pace of five percent completed and the five year average pace of ten percent completed.

Corn maturation as of the week ending Aug 30th was 12% completed, finishing ahead of last year’s pace of five percent completed and the five year average pace of ten percent completed.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 30th, down two percent from the previous week. The current corn crop identified to be in good or excellent condition finished significantly above analyst expectations of 61%, however. 14% of the current corn crop was identified as poor or very poor, up two percent from the previous week.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 30th, down two percent from the previous week. The current corn crop identified to be in good or excellent condition finished significantly above analyst expectations of 61%, however. 14% of the current corn crop was identified as poor or very poor, up two percent from the previous week.

25% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up four percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the Aug 10th derecho. Just 45% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

25% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up four percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the Aug 10th derecho. Just 45% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

Soybeans:

Soybean pod setting as of the week ending Aug 30th was 95% completed, finishing ahead of last year’s pace of 84% completed and the five year average pace of 93% completed.

Soybeans:

Soybean pod setting as of the week ending Aug 30th was 95% completed, finishing ahead of last year’s pace of 84% completed and the five year average pace of 93% completed.

Soybean leaf dropping was eight percent completed as of the week ending Aug 30th, finishing ahead of last year’s pace of three percent completed and equal to the five year average pace of eight percent completed.

Soybean leaf dropping was eight percent completed as of the week ending Aug 30th, finishing ahead of last year’s pace of three percent completed and equal to the five year average pace of eight percent completed.

66% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 30th, down three percent from the previous week. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, up two percent from the previous week.

66% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 30th, down three percent from the previous week. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, up two percent from the previous week.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up five percent from the previous week. Just 50% of the Iowa soybean crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Aug 30th, up five percent from the previous week. Just 50% of the Iowa soybean crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.