U.S. Dairy Dry Product Stocks Update – Sep ’20

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

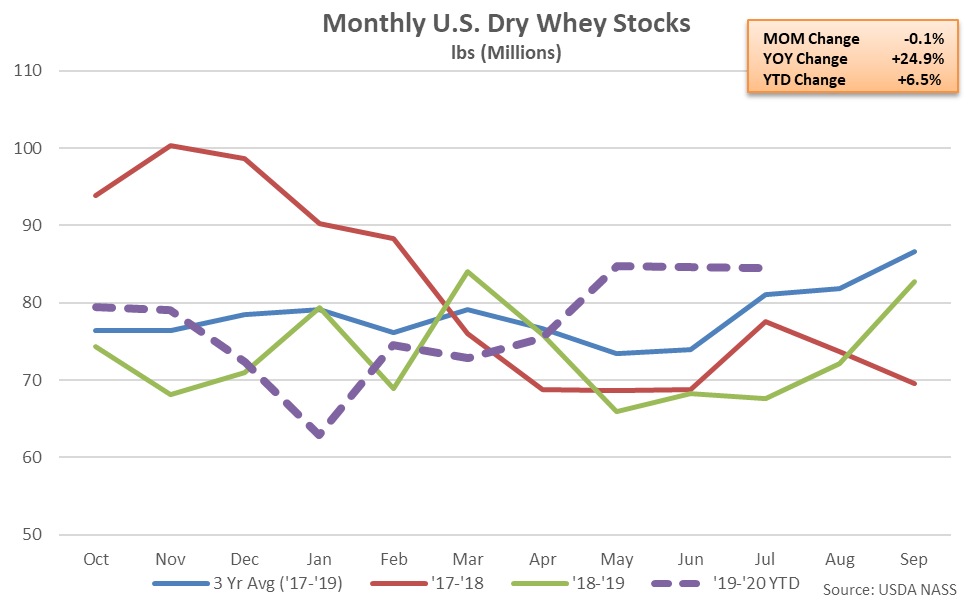

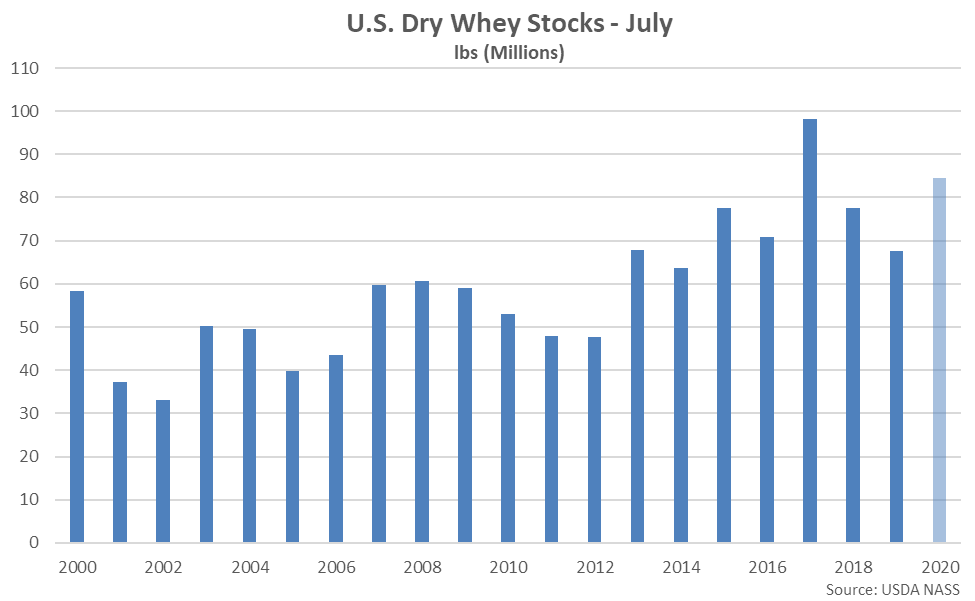

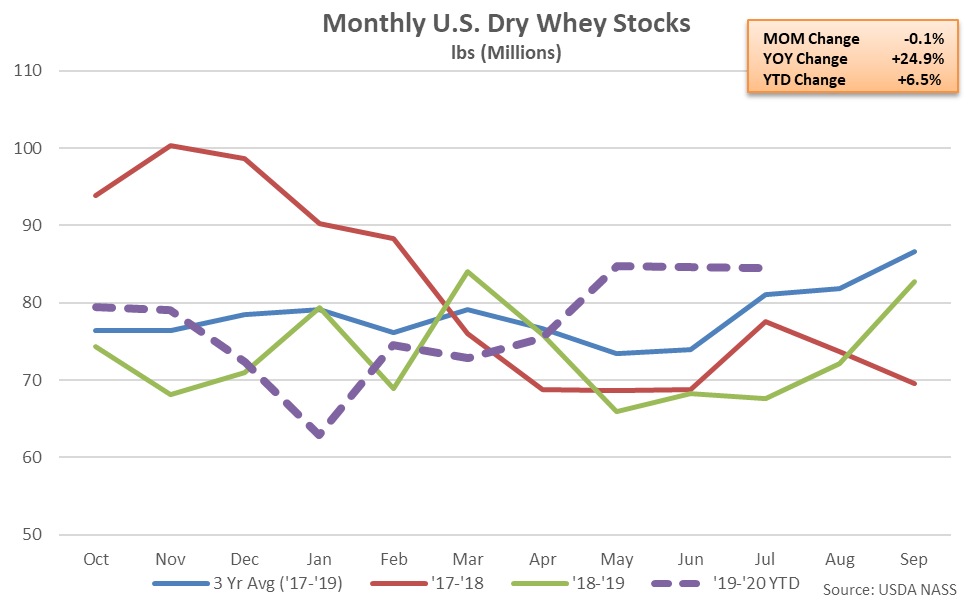

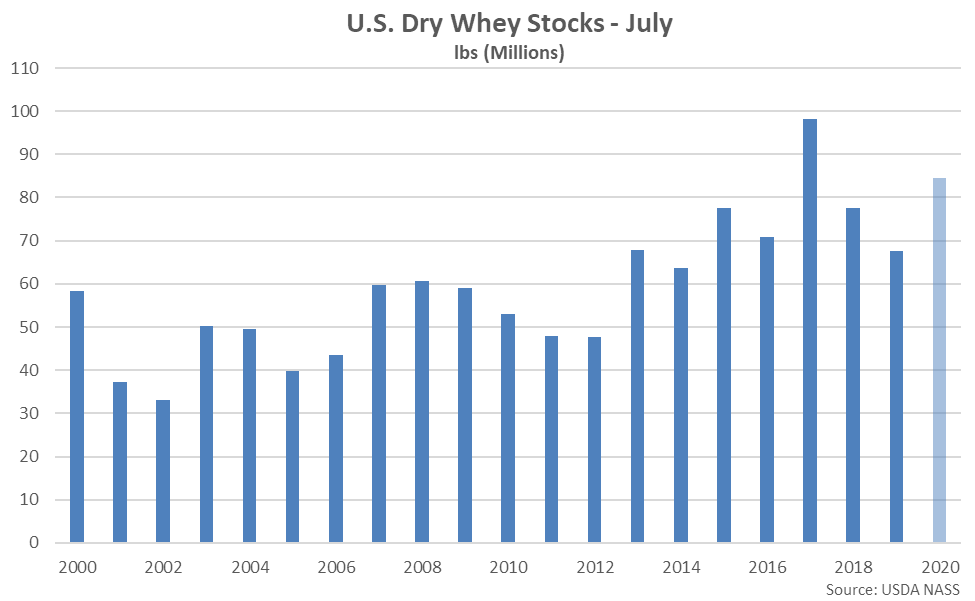

According to the USDA, Jul ’20 month-end dry whey stocks declined 0.1% from the previous month but remained 24.9% higher on a YOY basis, reaching a three year high seasonal level. The YOY increase in dry whey stocks was the third experienced in a row. The MOM decline in dry whey stocks of 0.1 million pounds, or 0.1%, was a contraseasonal move when compared to the ten year average June – July seasonal increase in dry whey stocks of 1.8 million pounds, or 2.2%, however. Dry whey production increased 2.0% on a YOY basis throughout Jul ’20, finishing higher for the 11th time in the past 12 months.

According to the USDA, Jul ’20 month-end dry whey stocks declined 0.1% from the previous month but remained 24.9% higher on a YOY basis, reaching a three year high seasonal level. The YOY increase in dry whey stocks was the third experienced in a row. The MOM decline in dry whey stocks of 0.1 million pounds, or 0.1%, was a contraseasonal move when compared to the ten year average June – July seasonal increase in dry whey stocks of 1.8 million pounds, or 2.2%, however. Dry whey production increased 2.0% on a YOY basis throughout Jul ’20, finishing higher for the 11th time in the past 12 months.

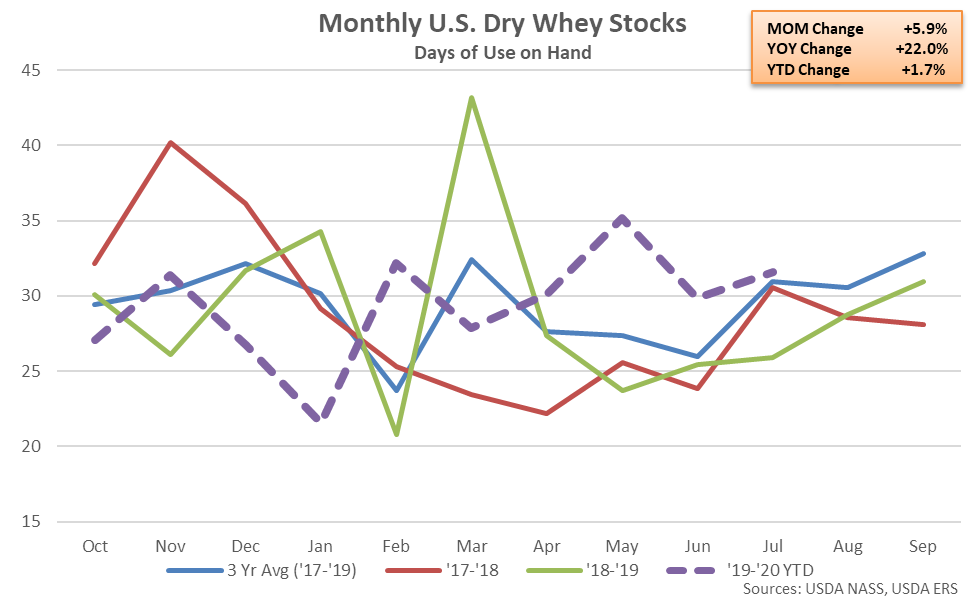

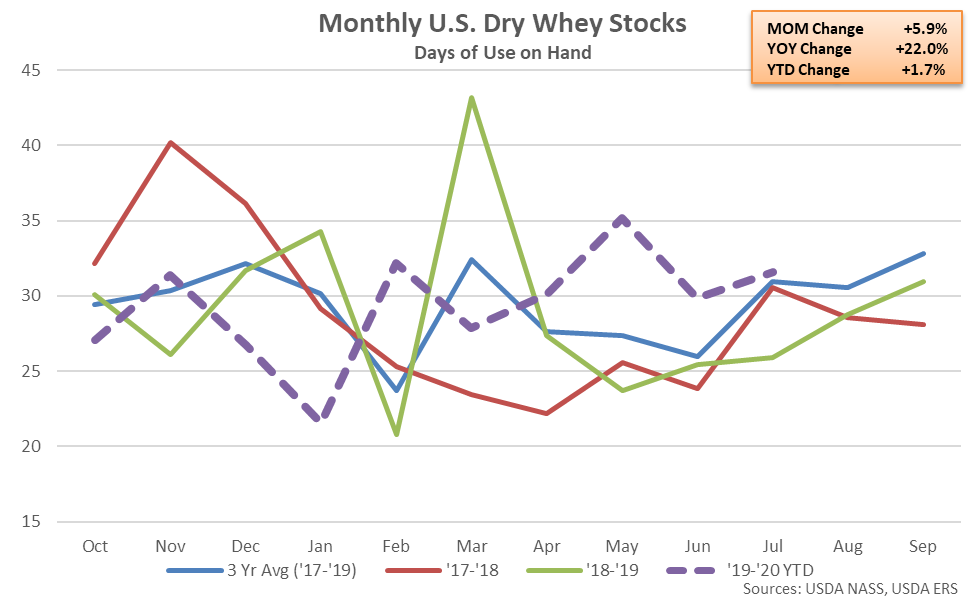

On a days of usage basis, Jul ’20 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished 22.0% higher YOY, increasing on a YOY basis for the fourth consecutive month.

On a days of usage basis, Jul ’20 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished 22.0% higher YOY, increasing on a YOY basis for the fourth consecutive month.

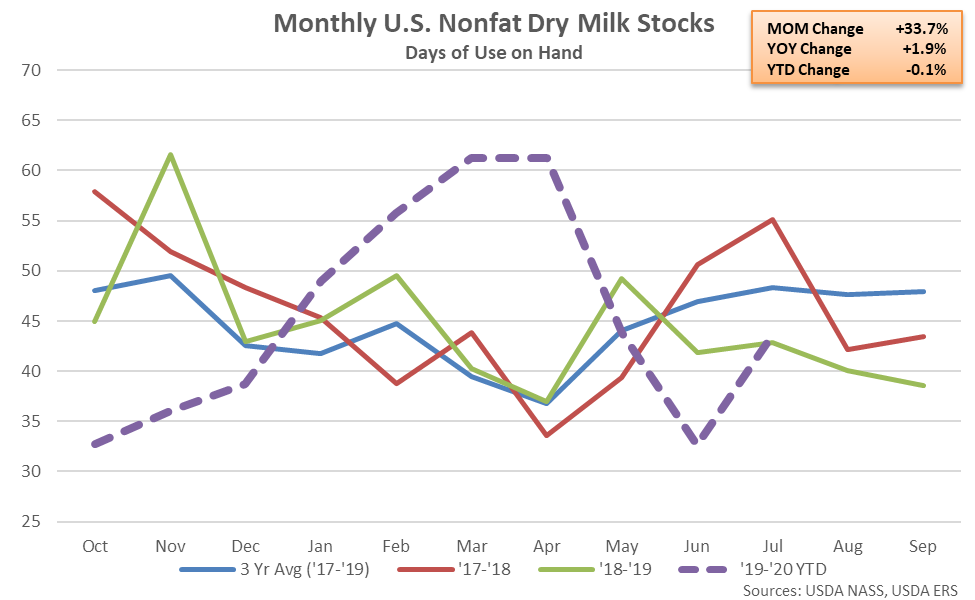

Nonfat Dry Milk – Stocks Increase YOY for the Fifth Time in the Past Six Months, Finish up 6.0%

Nonfat Dry Milk – Stocks Increase YOY for the Fifth Time in the Past Six Months, Finish up 6.0%

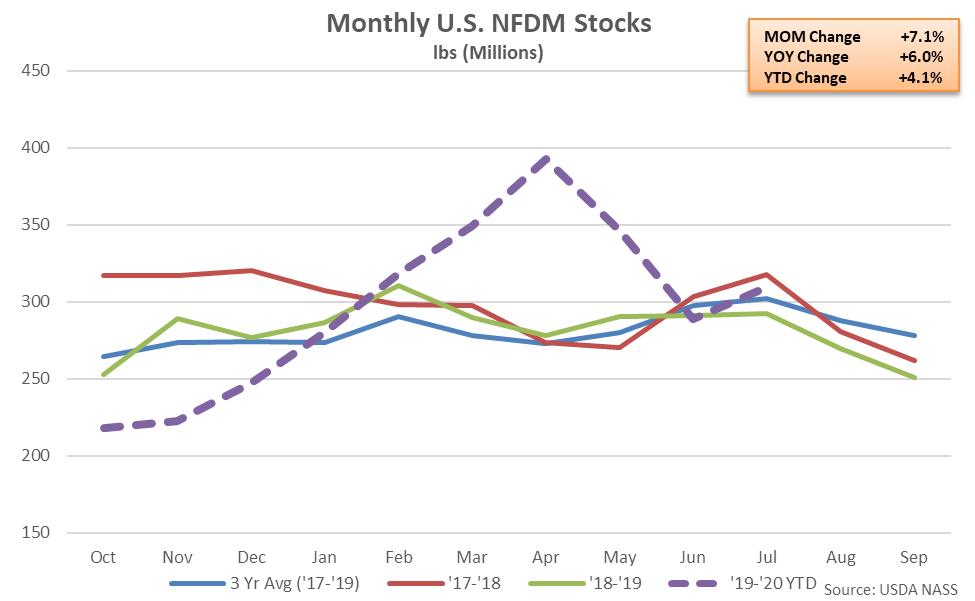

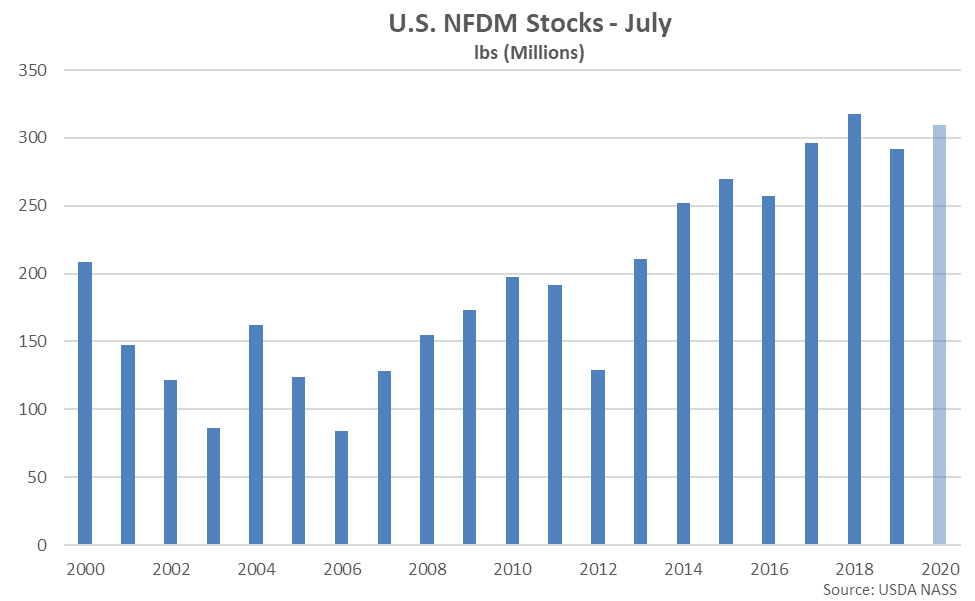

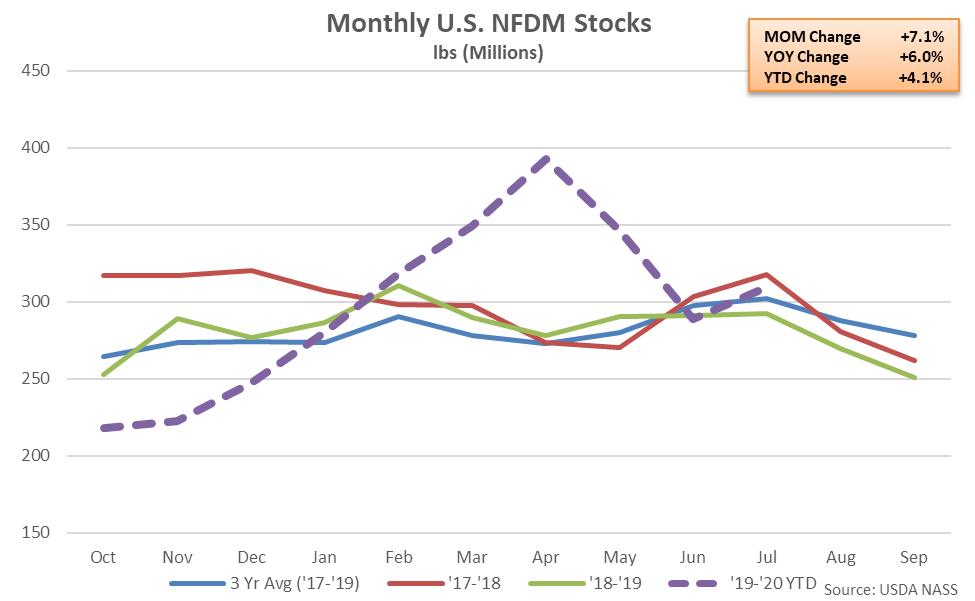

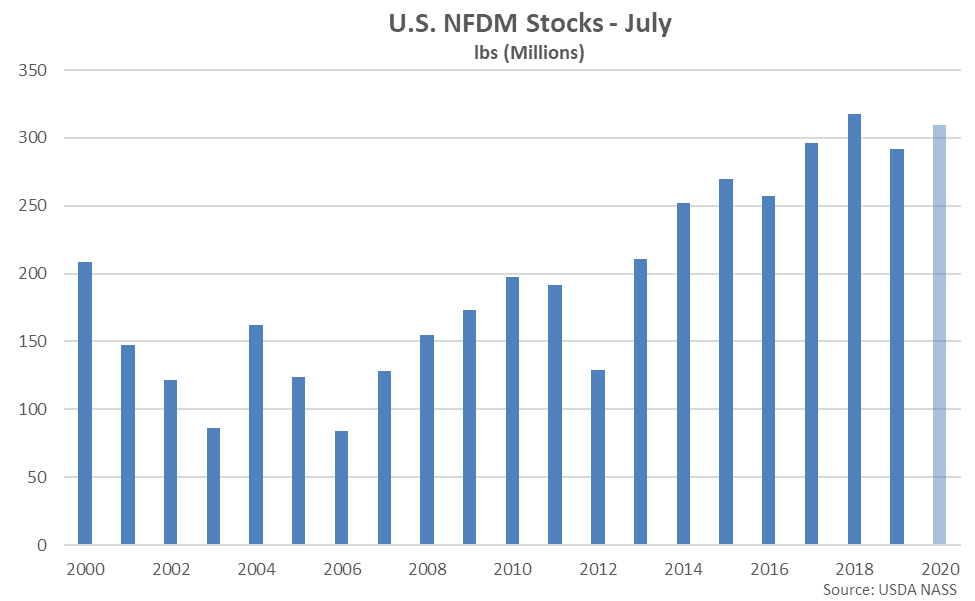

Jul ’20 month-end nonfat dry milk (NFDM) stocks increased 7.1% from the previous month while finishing 6.0% higher on a YOY basis. The YOY increase in NFDM stocks was the fifth experienced throughout the past six months. NFDM stocks reached the second highest seasonal level on record but remained 2.5% below the Jul ’18 seasonal high stock levels. The MOM increase in NFDM stocks of 20.6 million pounds, or 7.1%, was greater than the ten year average June – July seasonal build in stocks of 6.1 million pounds, or 2.4%. NFDM production declined 5.2% on a YOY basis throughout Jul ‘20.

Jul ’20 month-end nonfat dry milk (NFDM) stocks increased 7.1% from the previous month while finishing 6.0% higher on a YOY basis. The YOY increase in NFDM stocks was the fifth experienced throughout the past six months. NFDM stocks reached the second highest seasonal level on record but remained 2.5% below the Jul ’18 seasonal high stock levels. The MOM increase in NFDM stocks of 20.6 million pounds, or 7.1%, was greater than the ten year average June – July seasonal build in stocks of 6.1 million pounds, or 2.4%. NFDM production declined 5.2% on a YOY basis throughout Jul ‘20.

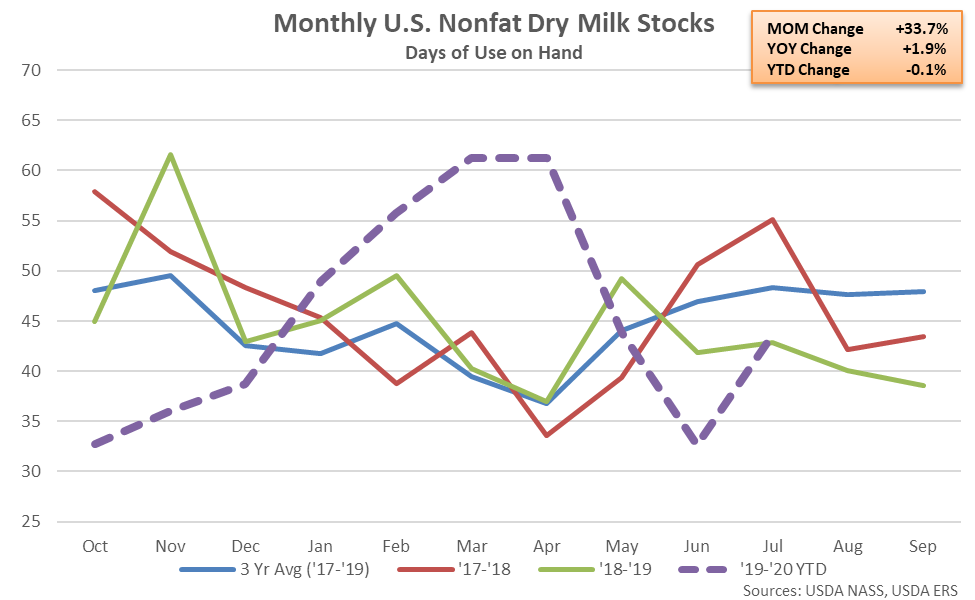

On a days of usage basis, Jul ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished 1.9% above previous year figures, increasing on a YOY basis for the first time in the past three months.

On a days of usage basis, Jul ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished 1.9% above previous year figures, increasing on a YOY basis for the first time in the past three months.

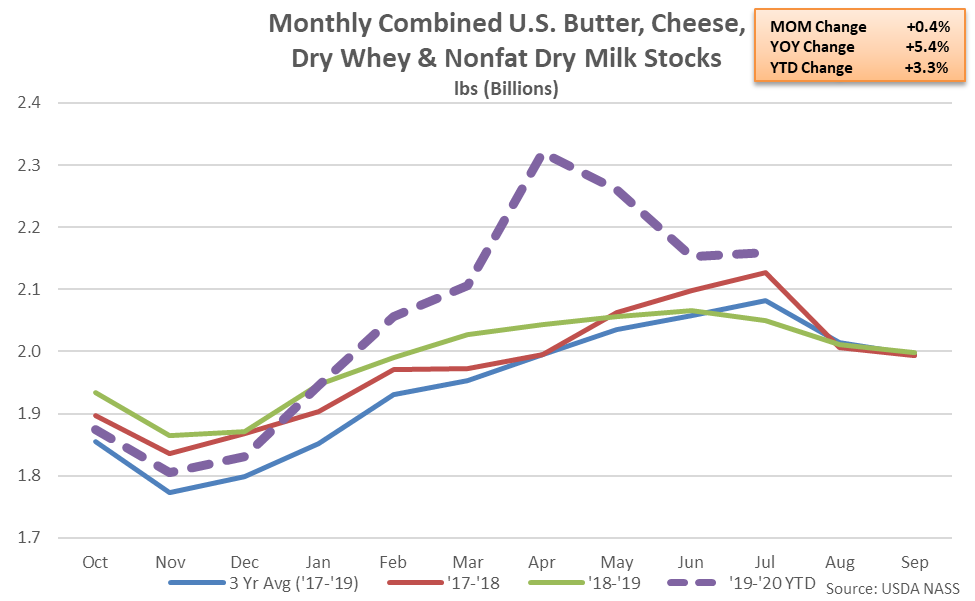

Combined Dairy Product Stocks – Stocks Remain at a Record High Seasonal Level, Finishing up 5.4%

Combined Dairy Product Stocks – Stocks Remain at a Record High Seasonal Level, Finishing up 5.4%

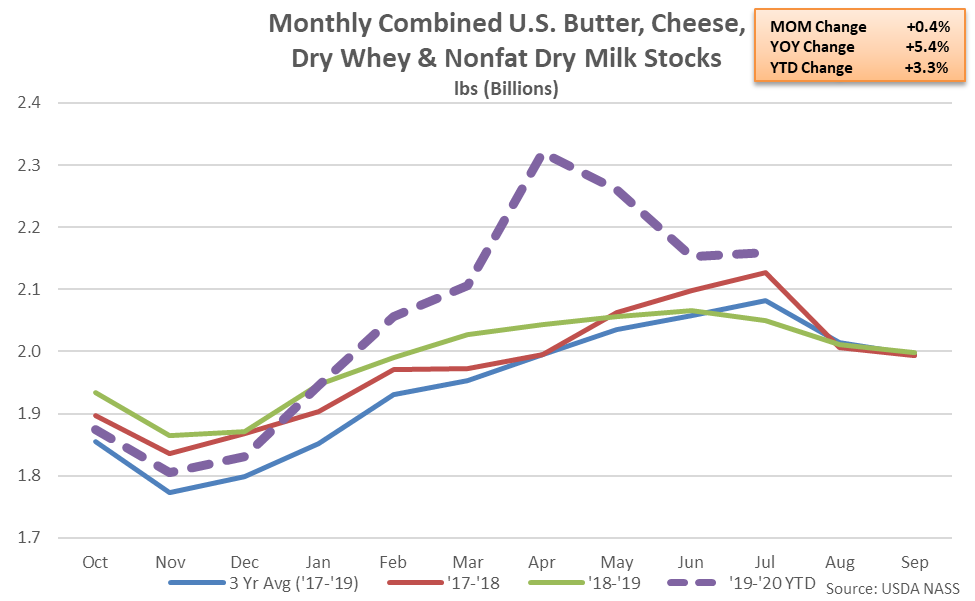

Jul ’20 combined stocks of butter, cheese, dry whey and NFDM increased slightly from the previous month while remaining 5.4% higher on a YOY basis, finishing at a record high seasonal level. The YOY increase in combined stocks was the sixth experienced in a row.

Jul ’20 combined stocks of butter, cheese, dry whey and NFDM increased slightly from the previous month while remaining 5.4% higher on a YOY basis, finishing at a record high seasonal level. The YOY increase in combined stocks was the sixth experienced in a row.

- U.S. dry whey stocks finished 24.9% higher on a YOY basis throughout Jul ’20, reaching a three year high seasonal level.

- U.S. nonfat dry milk stocks finished 6.1% higher on a YOY basis throughout Jul ’20, finishing higher for the fifth time in the past six months.

According to the USDA, Jul ’20 month-end dry whey stocks declined 0.1% from the previous month but remained 24.9% higher on a YOY basis, reaching a three year high seasonal level. The YOY increase in dry whey stocks was the third experienced in a row. The MOM decline in dry whey stocks of 0.1 million pounds, or 0.1%, was a contraseasonal move when compared to the ten year average June – July seasonal increase in dry whey stocks of 1.8 million pounds, or 2.2%, however. Dry whey production increased 2.0% on a YOY basis throughout Jul ’20, finishing higher for the 11th time in the past 12 months.

According to the USDA, Jul ’20 month-end dry whey stocks declined 0.1% from the previous month but remained 24.9% higher on a YOY basis, reaching a three year high seasonal level. The YOY increase in dry whey stocks was the third experienced in a row. The MOM decline in dry whey stocks of 0.1 million pounds, or 0.1%, was a contraseasonal move when compared to the ten year average June – July seasonal increase in dry whey stocks of 1.8 million pounds, or 2.2%, however. Dry whey production increased 2.0% on a YOY basis throughout Jul ’20, finishing higher for the 11th time in the past 12 months.

On a days of usage basis, Jul ’20 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished 22.0% higher YOY, increasing on a YOY basis for the fourth consecutive month.

On a days of usage basis, Jul ’20 U.S. dry whey stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished 22.0% higher YOY, increasing on a YOY basis for the fourth consecutive month.

Nonfat Dry Milk – Stocks Increase YOY for the Fifth Time in the Past Six Months, Finish up 6.0%

Nonfat Dry Milk – Stocks Increase YOY for the Fifth Time in the Past Six Months, Finish up 6.0%

Jul ’20 month-end nonfat dry milk (NFDM) stocks increased 7.1% from the previous month while finishing 6.0% higher on a YOY basis. The YOY increase in NFDM stocks was the fifth experienced throughout the past six months. NFDM stocks reached the second highest seasonal level on record but remained 2.5% below the Jul ’18 seasonal high stock levels. The MOM increase in NFDM stocks of 20.6 million pounds, or 7.1%, was greater than the ten year average June – July seasonal build in stocks of 6.1 million pounds, or 2.4%. NFDM production declined 5.2% on a YOY basis throughout Jul ‘20.

Jul ’20 month-end nonfat dry milk (NFDM) stocks increased 7.1% from the previous month while finishing 6.0% higher on a YOY basis. The YOY increase in NFDM stocks was the fifth experienced throughout the past six months. NFDM stocks reached the second highest seasonal level on record but remained 2.5% below the Jul ’18 seasonal high stock levels. The MOM increase in NFDM stocks of 20.6 million pounds, or 7.1%, was greater than the ten year average June – July seasonal build in stocks of 6.1 million pounds, or 2.4%. NFDM production declined 5.2% on a YOY basis throughout Jul ‘20.

On a days of usage basis, Jul ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished 1.9% above previous year figures, increasing on a YOY basis for the first time in the past three months.

On a days of usage basis, Jul ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished 1.9% above previous year figures, increasing on a YOY basis for the first time in the past three months.

Combined Dairy Product Stocks – Stocks Remain at a Record High Seasonal Level, Finishing up 5.4%

Combined Dairy Product Stocks – Stocks Remain at a Record High Seasonal Level, Finishing up 5.4%

Jul ’20 combined stocks of butter, cheese, dry whey and NFDM increased slightly from the previous month while remaining 5.4% higher on a YOY basis, finishing at a record high seasonal level. The YOY increase in combined stocks was the sixth experienced in a row.

Jul ’20 combined stocks of butter, cheese, dry whey and NFDM increased slightly from the previous month while remaining 5.4% higher on a YOY basis, finishing at a record high seasonal level. The YOY increase in combined stocks was the sixth experienced in a row.