Global Dairy Trade Results Update – 9/15/20

Executive Summary

Dairy product prices strengthened during the GDT event held Sep 15th. Highlights from the most recent auction include:

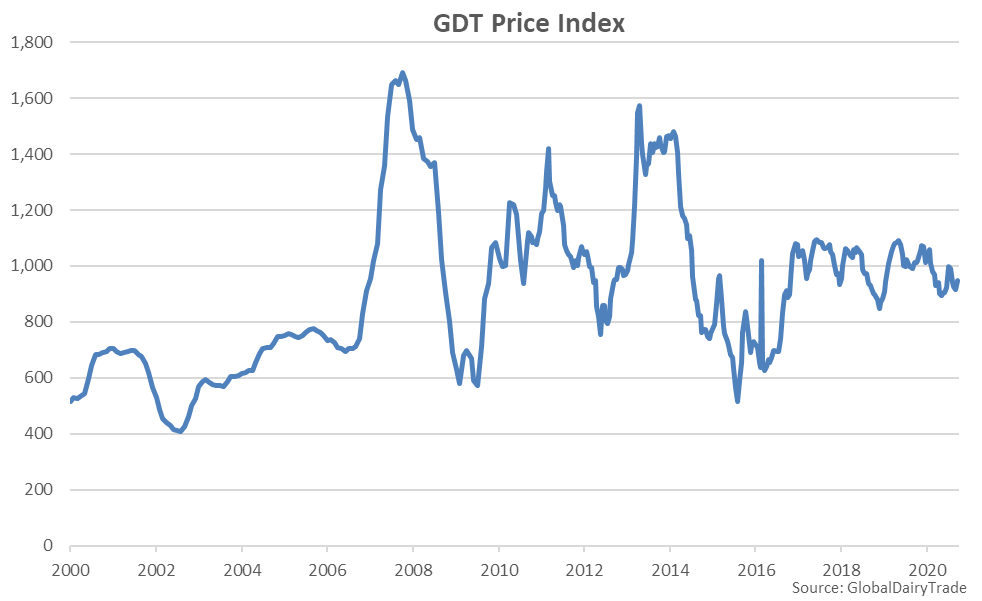

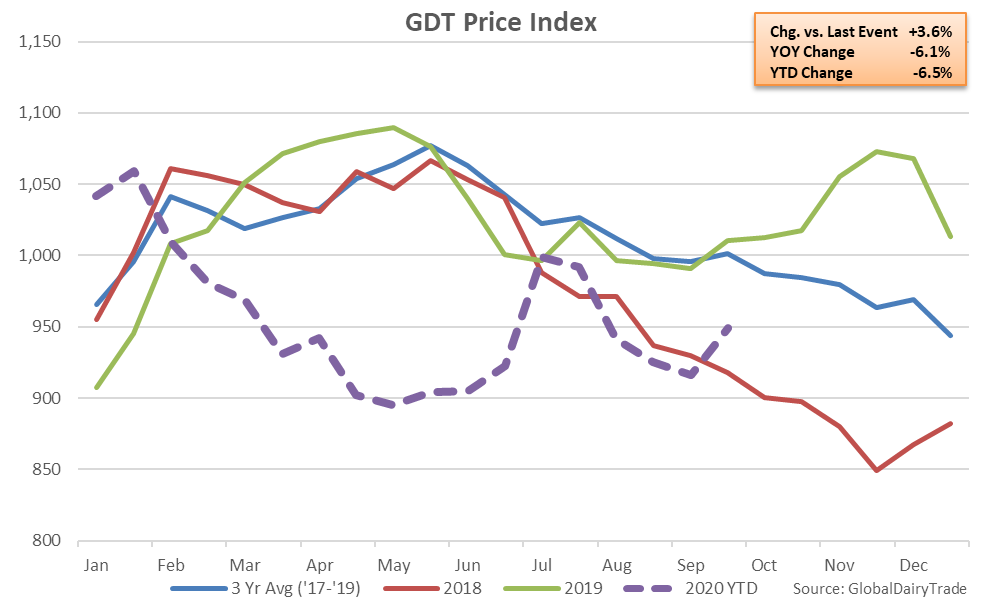

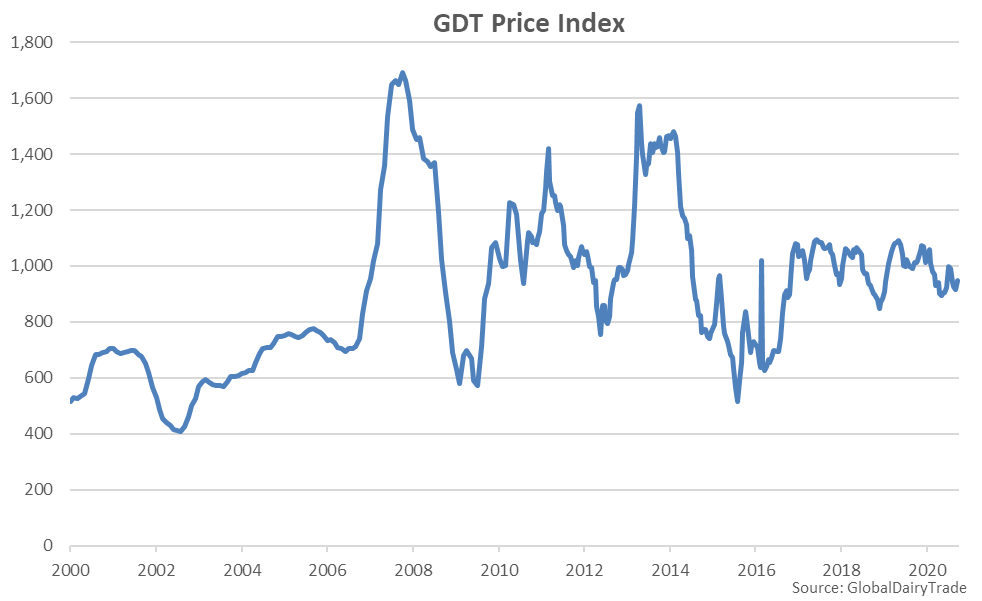

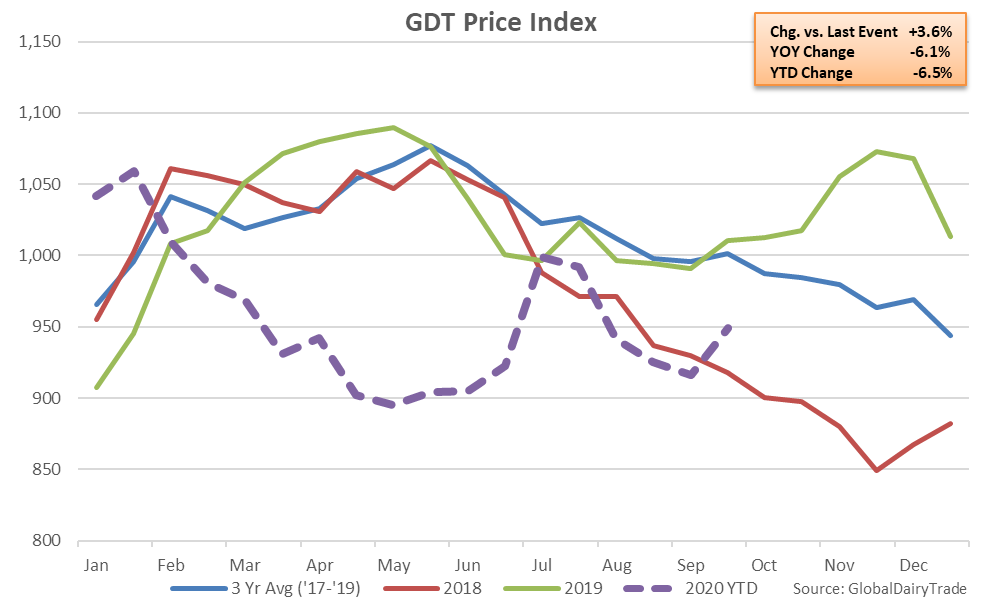

The GDT Price Index remained 6.1% below previous year price levels at the Sep 15th auction, declining on a YOY basis for the 14th time in the past 15 events. The GDT Price Index finished 5.2% below the three year average price for the second auction of September, finishing below three year average figures for the 16th consecutive event.

The GDT Price Index remained 6.1% below previous year price levels at the Sep 15th auction, declining on a YOY basis for the 14th time in the past 15 events. The GDT Price Index finished 5.2% below the three year average price for the second auction of September, finishing below three year average figures for the 16th consecutive event.

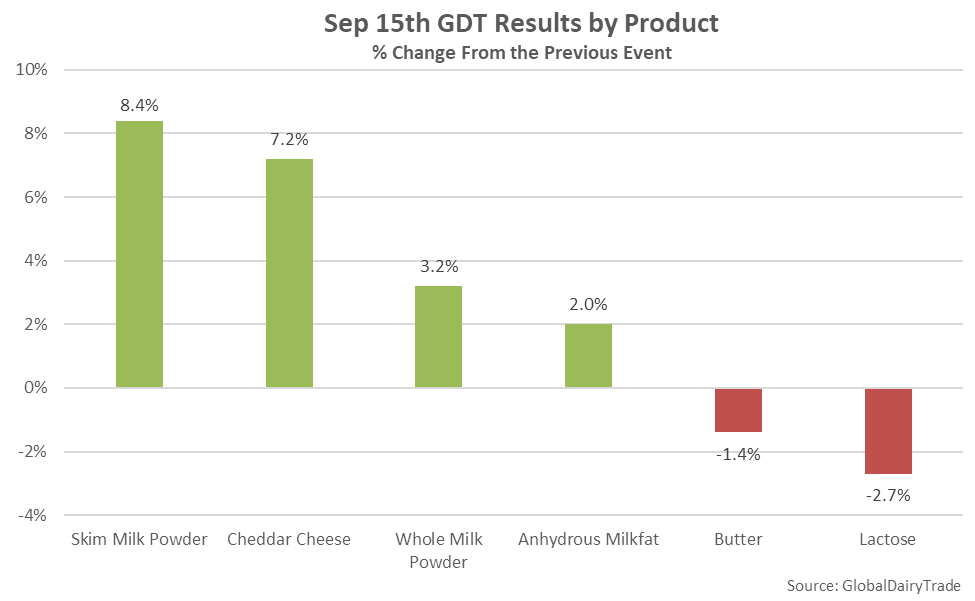

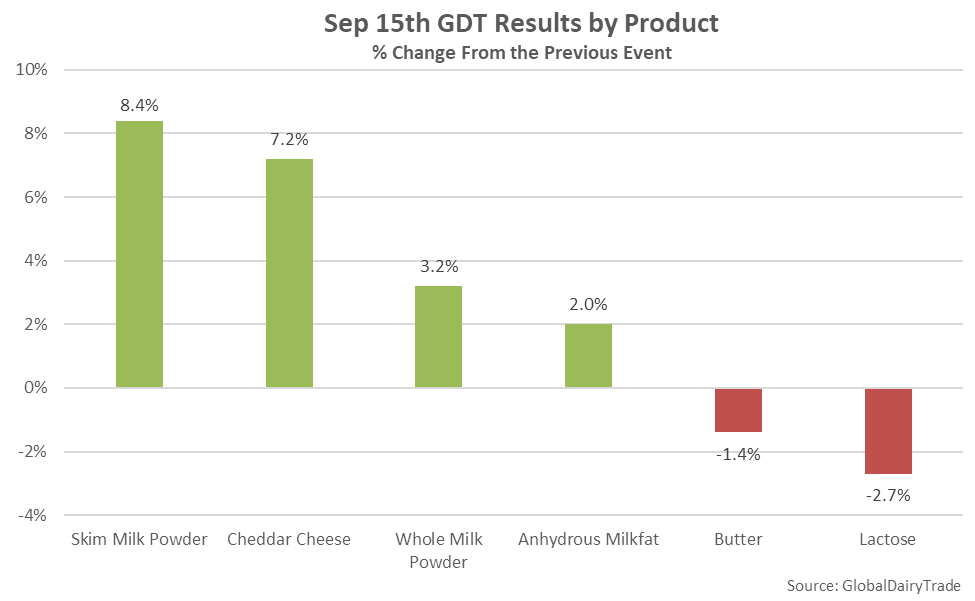

Within the latest auction, increases in prices were led by skim milk powder (+8.4%), followed by cheddar cheese (+7.2%), whole milk powder (+3.2%) and anhydrous milkfat (+2.0%). The increases more than offset declines in butter (-1.4%) and lactose (-2.7%) prices. Butter milk powder and sweet whey powder were not sold at the Sep 15th event.

Within the latest auction, increases in prices were led by skim milk powder (+8.4%), followed by cheddar cheese (+7.2%), whole milk powder (+3.2%) and anhydrous milkfat (+2.0%). The increases more than offset declines in butter (-1.4%) and lactose (-2.7%) prices. Butter milk powder and sweet whey powder were not sold at the Sep 15th event.

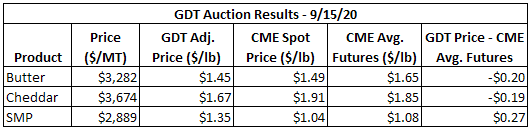

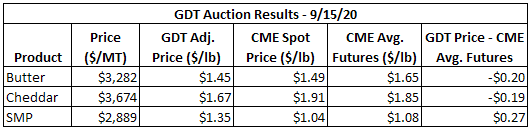

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Sep 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Sep 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

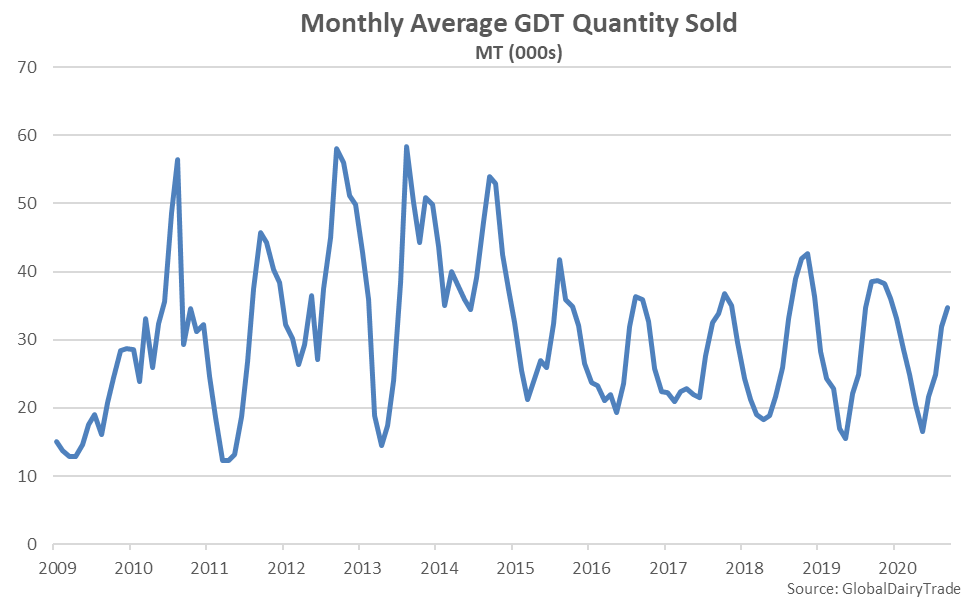

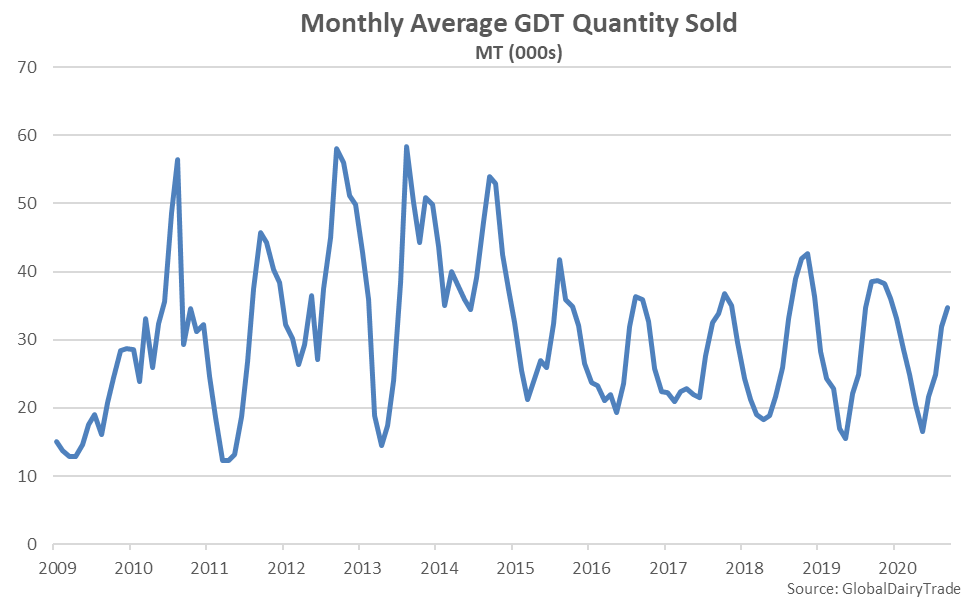

Total quantities sold for all products at the Sep 15th event declined 5.2% from the eight month high level experienced throughout the previous event while finishing 9.5% lower on a YOY basis. The YOY decline in total quantities sold was the fifth experienced in a row. Total quantities sold typically reach seasonal low levels throughout the months of April and May, prior to rebounding seasonally throughout the next several months.

Total quantities sold for all products at the Sep 15th event declined 5.2% from the eight month high level experienced throughout the previous event while finishing 9.5% lower on a YOY basis. The YOY decline in total quantities sold was the fifth experienced in a row. Total quantities sold typically reach seasonal low levels throughout the months of April and May, prior to rebounding seasonally throughout the next several months.

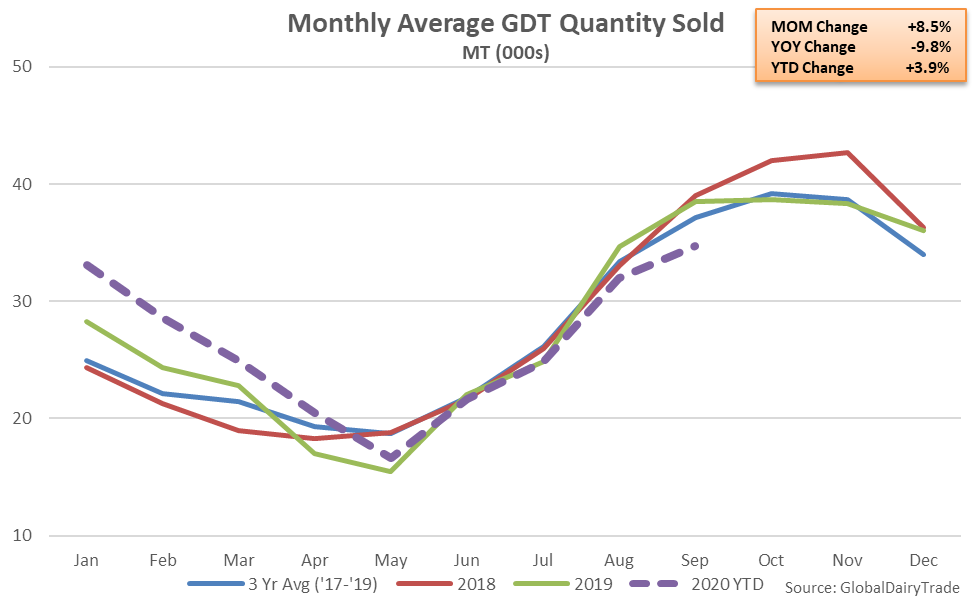

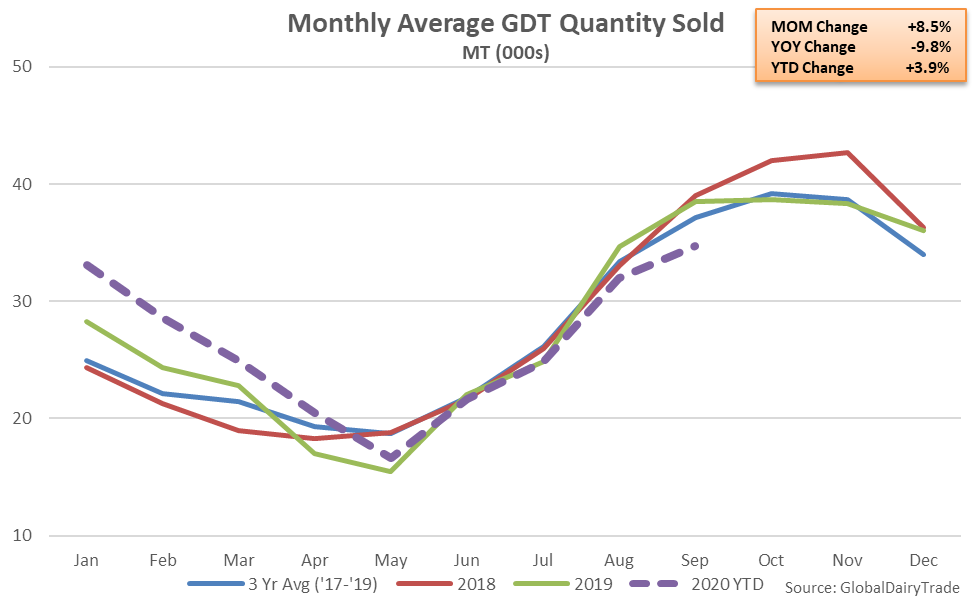

Volumes sold for all products within the September auctions increased 8.5% from average August volumes sold but remained 9.8% below last year’s average volumes sold for the month of September. Volumes sold for all products finished 6.4% below three year average seasonal figures, declining to a three year low seasonal level, overall.

Volumes sold for all products within the September auctions increased 8.5% from average August volumes sold but remained 9.8% below last year’s average volumes sold for the month of September. Volumes sold for all products finished 6.4% below three year average seasonal figures, declining to a three year low seasonal level, overall.

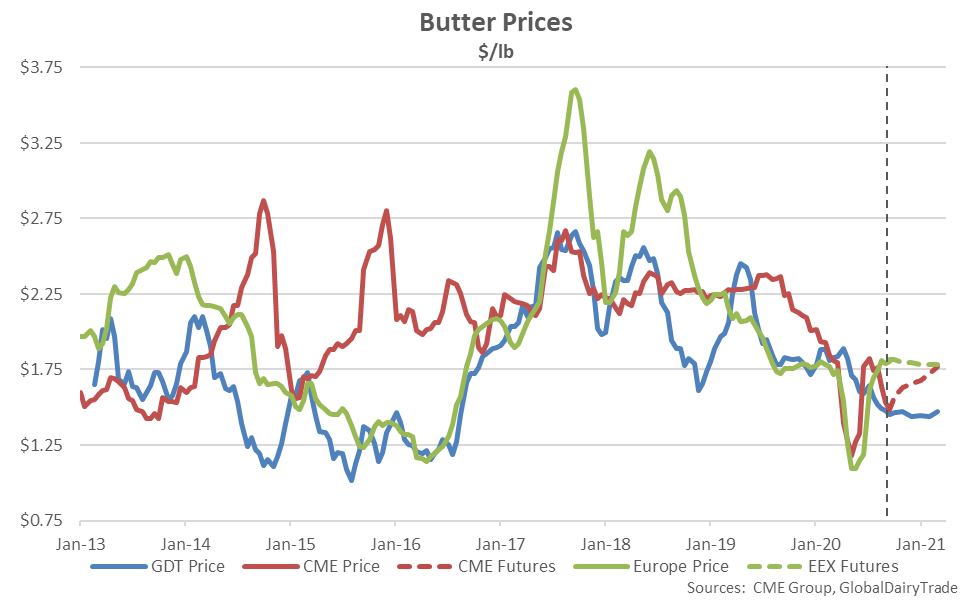

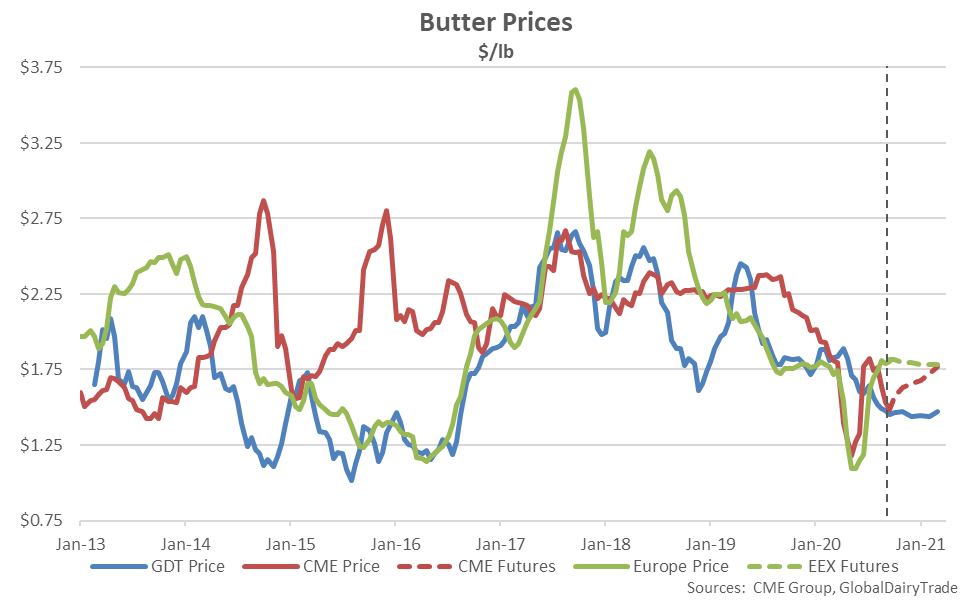

U.S. butter prices remained at a premium to GDT winning prices at the Sep 15th event, as GDT butter prices declined to a four year low level. U.S. spot butter prices are currently trading at a 2.6% premium to GDT prices while CME futures prices traded at a 14.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. butter prices remained at a premium to GDT winning prices at the Sep 15th event, as GDT butter prices declined to a four year low level. U.S. spot butter prices are currently trading at a 2.6% premium to GDT prices while CME futures prices traded at a 14.9% premium to GDT prices from Oct ’20 – Mar ’21.

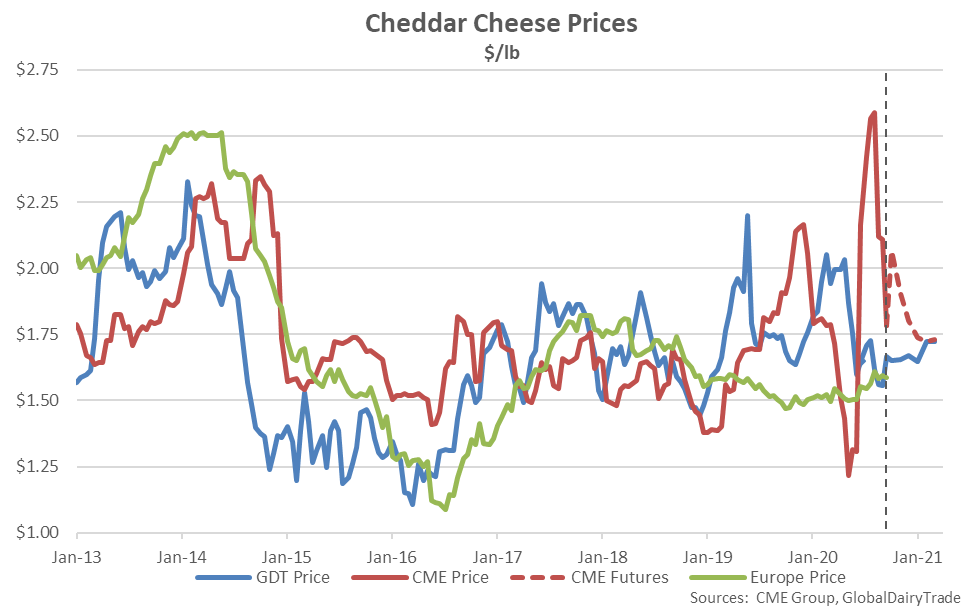

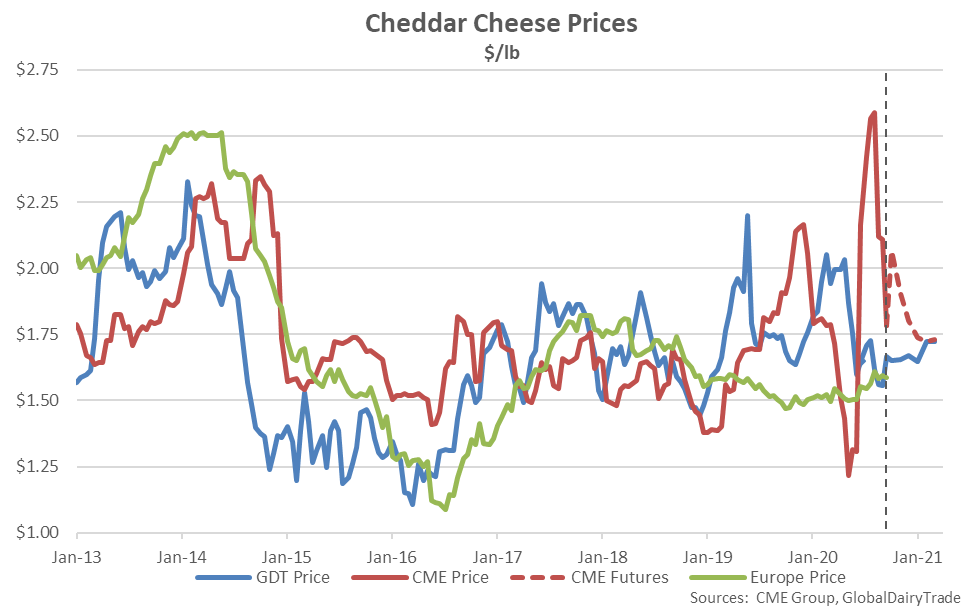

U.S. cheddar cheese prices also finished at a premium to GDT winning prices at the Sep 15th event, despite GDT cheddar cheese prices rebounding from the 20 month low level experienced throughout the previous auction. U.S. spot cheddar cheese prices are currently trading at a 14.5% premium to GDT prices while CME futures prices traded at an 8.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. cheddar cheese prices also finished at a premium to GDT winning prices at the Sep 15th event, despite GDT cheddar cheese prices rebounding from the 20 month low level experienced throughout the previous auction. U.S. spot cheddar cheese prices are currently trading at a 14.5% premium to GDT prices while CME futures prices traded at an 8.9% premium to GDT prices from Oct ’20 – Mar ’21.

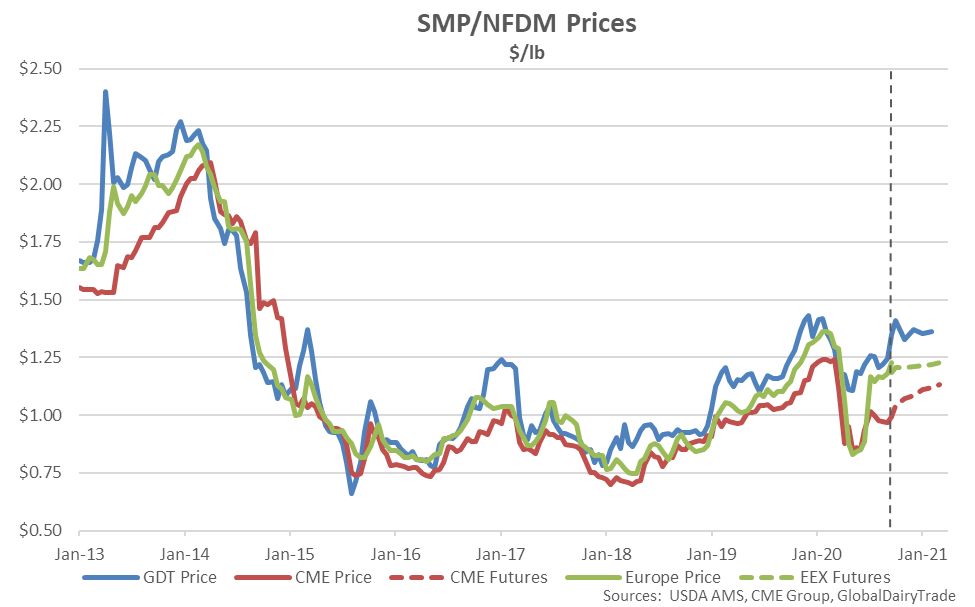

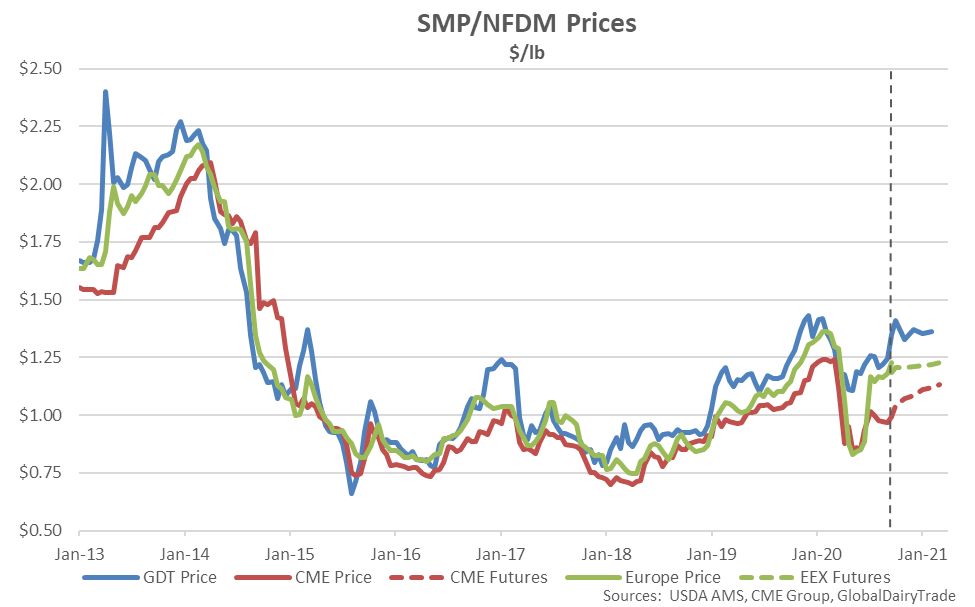

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Sep 15th event, as GDT SMP prices increased to a seven month high level. U.S. spot NFDM prices are currently trading at a 22.9% discount to GDT SMP prices while CME futures prices traded at a 20.4% discount to GDT SMP prices from Oct ’20 – Feb ’21. SMP was not sold at the GDT auction for Contract 6 (Mar ’21).

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Sep 15th event, as GDT SMP prices increased to a seven month high level. U.S. spot NFDM prices are currently trading at a 22.9% discount to GDT SMP prices while CME futures prices traded at a 20.4% discount to GDT SMP prices from Oct ’20 – Feb ’21. SMP was not sold at the GDT auction for Contract 6 (Mar ’21).

- The GDT Price Index increased 3.6% at the Sep 15th event, finishing higher for the first time in the past five auctions.

- Increases in prices within the Sep 15th event were led by skim milk powder, followed by cheddar cheese, whole milk powder and anhydrous milkfat. Skim milk powder prices increased to a seven month high level while cheddar cheese prices rebounded from the 20 month low level experienced throughout the previous event. Butter prices declined to a four year low level throughout the Sep 15th event.

- Total quantities sold for all products at the Sep 15th event remained lower on a YOY basis for the fifth consecutive auction, finishing down 9.5%.

The GDT Price Index remained 6.1% below previous year price levels at the Sep 15th auction, declining on a YOY basis for the 14th time in the past 15 events. The GDT Price Index finished 5.2% below the three year average price for the second auction of September, finishing below three year average figures for the 16th consecutive event.

The GDT Price Index remained 6.1% below previous year price levels at the Sep 15th auction, declining on a YOY basis for the 14th time in the past 15 events. The GDT Price Index finished 5.2% below the three year average price for the second auction of September, finishing below three year average figures for the 16th consecutive event.

Within the latest auction, increases in prices were led by skim milk powder (+8.4%), followed by cheddar cheese (+7.2%), whole milk powder (+3.2%) and anhydrous milkfat (+2.0%). The increases more than offset declines in butter (-1.4%) and lactose (-2.7%) prices. Butter milk powder and sweet whey powder were not sold at the Sep 15th event.

Within the latest auction, increases in prices were led by skim milk powder (+8.4%), followed by cheddar cheese (+7.2%), whole milk powder (+3.2%) and anhydrous milkfat (+2.0%). The increases more than offset declines in butter (-1.4%) and lactose (-2.7%) prices. Butter milk powder and sweet whey powder were not sold at the Sep 15th event.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Sep 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Sep 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

Total quantities sold for all products at the Sep 15th event declined 5.2% from the eight month high level experienced throughout the previous event while finishing 9.5% lower on a YOY basis. The YOY decline in total quantities sold was the fifth experienced in a row. Total quantities sold typically reach seasonal low levels throughout the months of April and May, prior to rebounding seasonally throughout the next several months.

Total quantities sold for all products at the Sep 15th event declined 5.2% from the eight month high level experienced throughout the previous event while finishing 9.5% lower on a YOY basis. The YOY decline in total quantities sold was the fifth experienced in a row. Total quantities sold typically reach seasonal low levels throughout the months of April and May, prior to rebounding seasonally throughout the next several months.

Volumes sold for all products within the September auctions increased 8.5% from average August volumes sold but remained 9.8% below last year’s average volumes sold for the month of September. Volumes sold for all products finished 6.4% below three year average seasonal figures, declining to a three year low seasonal level, overall.

Volumes sold for all products within the September auctions increased 8.5% from average August volumes sold but remained 9.8% below last year’s average volumes sold for the month of September. Volumes sold for all products finished 6.4% below three year average seasonal figures, declining to a three year low seasonal level, overall.

U.S. butter prices remained at a premium to GDT winning prices at the Sep 15th event, as GDT butter prices declined to a four year low level. U.S. spot butter prices are currently trading at a 2.6% premium to GDT prices while CME futures prices traded at a 14.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. butter prices remained at a premium to GDT winning prices at the Sep 15th event, as GDT butter prices declined to a four year low level. U.S. spot butter prices are currently trading at a 2.6% premium to GDT prices while CME futures prices traded at a 14.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. cheddar cheese prices also finished at a premium to GDT winning prices at the Sep 15th event, despite GDT cheddar cheese prices rebounding from the 20 month low level experienced throughout the previous auction. U.S. spot cheddar cheese prices are currently trading at a 14.5% premium to GDT prices while CME futures prices traded at an 8.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. cheddar cheese prices also finished at a premium to GDT winning prices at the Sep 15th event, despite GDT cheddar cheese prices rebounding from the 20 month low level experienced throughout the previous auction. U.S. spot cheddar cheese prices are currently trading at a 14.5% premium to GDT prices while CME futures prices traded at an 8.9% premium to GDT prices from Oct ’20 – Mar ’21.

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Sep 15th event, as GDT SMP prices increased to a seven month high level. U.S. spot NFDM prices are currently trading at a 22.9% discount to GDT SMP prices while CME futures prices traded at a 20.4% discount to GDT SMP prices from Oct ’20 – Feb ’21. SMP was not sold at the GDT auction for Contract 6 (Mar ’21).

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Sep 15th event, as GDT SMP prices increased to a seven month high level. U.S. spot NFDM prices are currently trading at a 22.9% discount to GDT SMP prices while CME futures prices traded at a 20.4% discount to GDT SMP prices from Oct ’20 – Feb ’21. SMP was not sold at the GDT auction for Contract 6 (Mar ’21).