Chinese Dairy Imports Update – Sep ’20

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Aug ’20. Highlights from the updated report include:

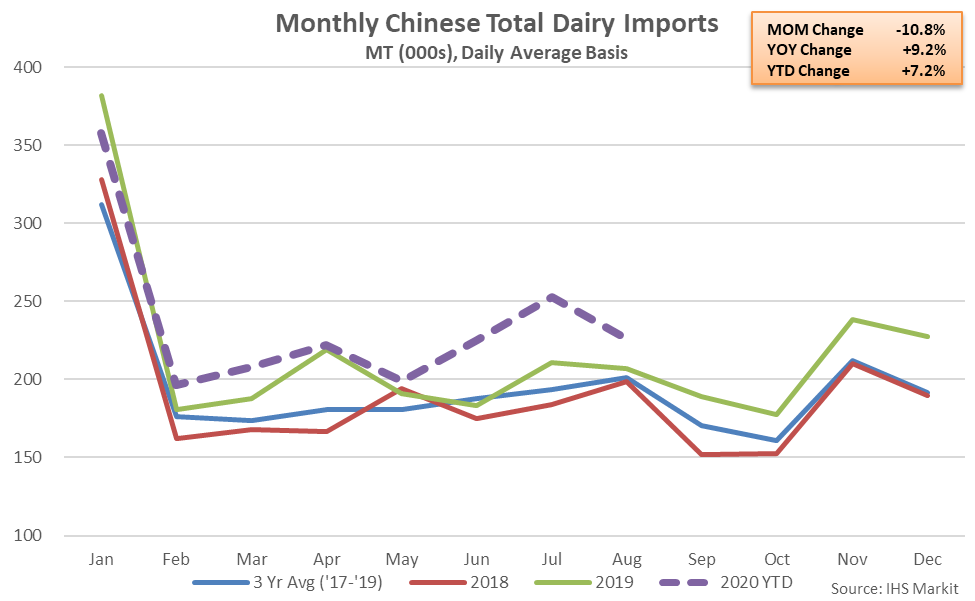

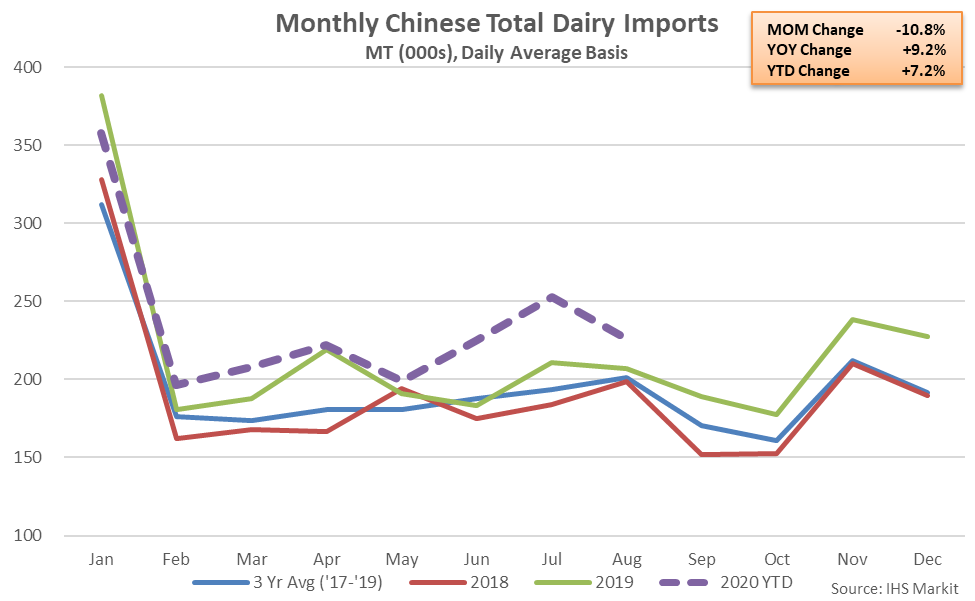

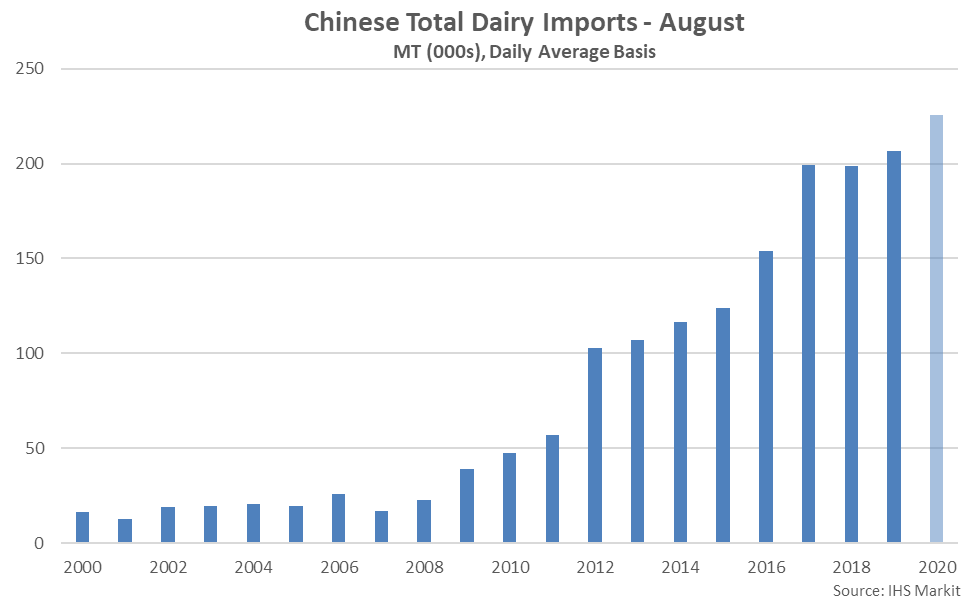

Aug ’20 Chinese Dairy Import Volumes Declined 10.8% MOM but Remained up 9.2% YOY

Aug ’20 Chinese Dairy Import Volumes Declined 10.8% MOM but Remained up 9.2% YOY

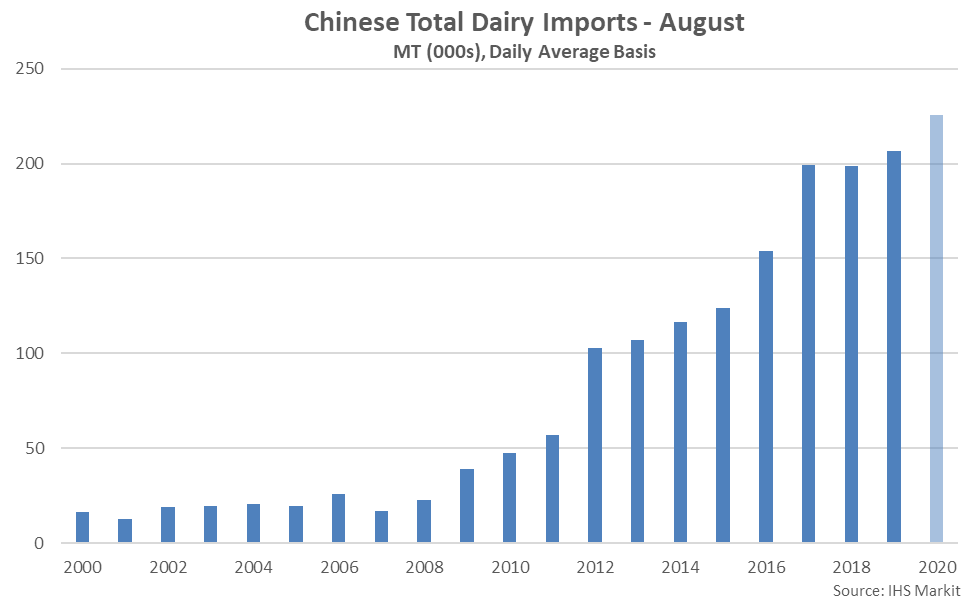

Aug ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

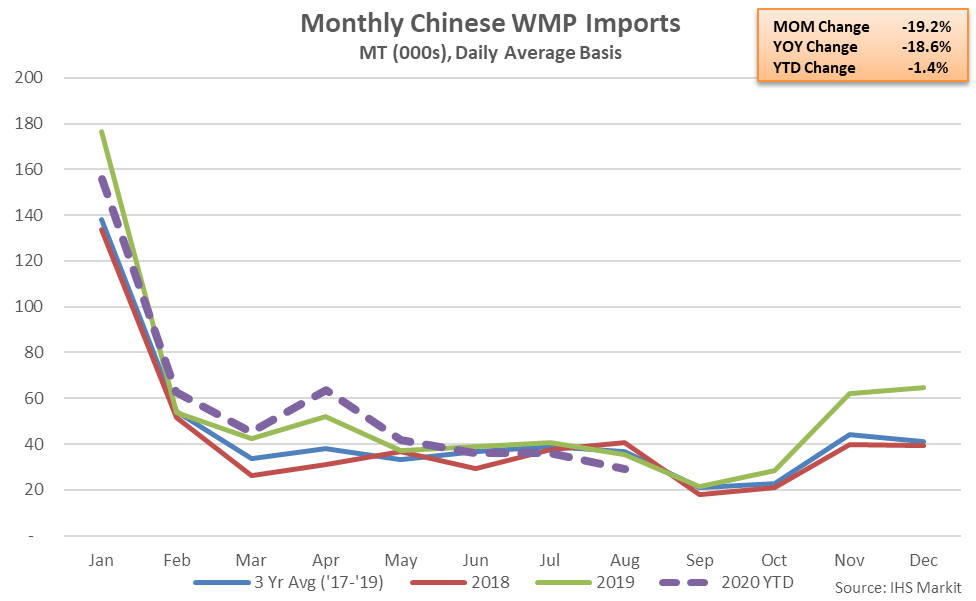

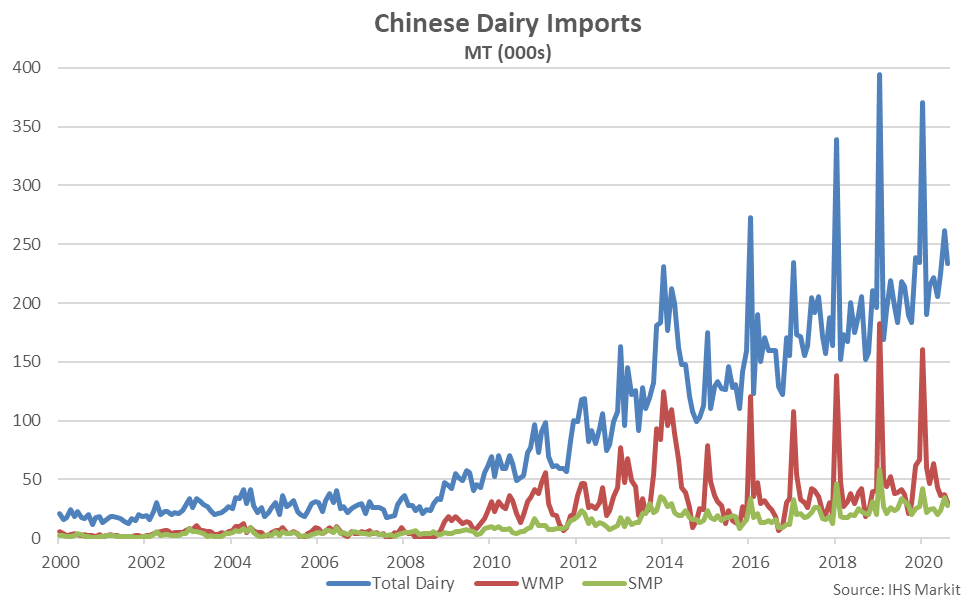

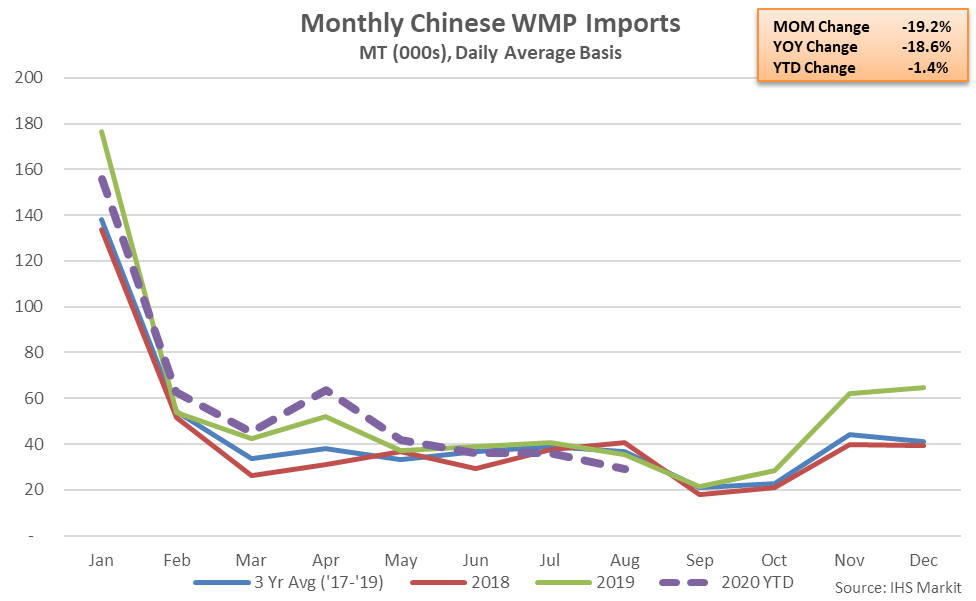

Aug ’20 Chinese WMP Import Volumes Declined 19.2% MOM and 18.6% YOY

Aug ’20 Chinese WMP Import Volumes Declined 19.2% MOM and 18.6% YOY

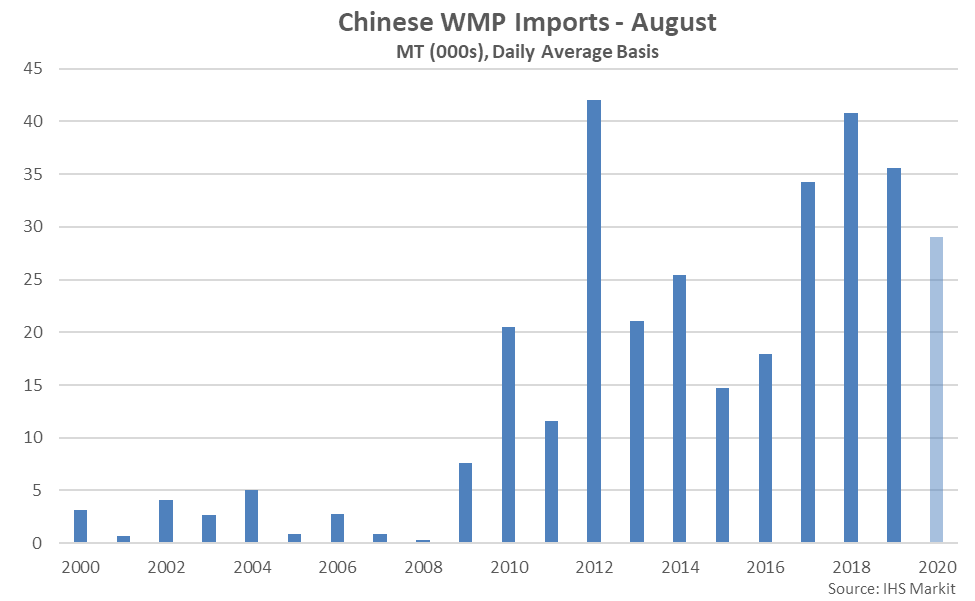

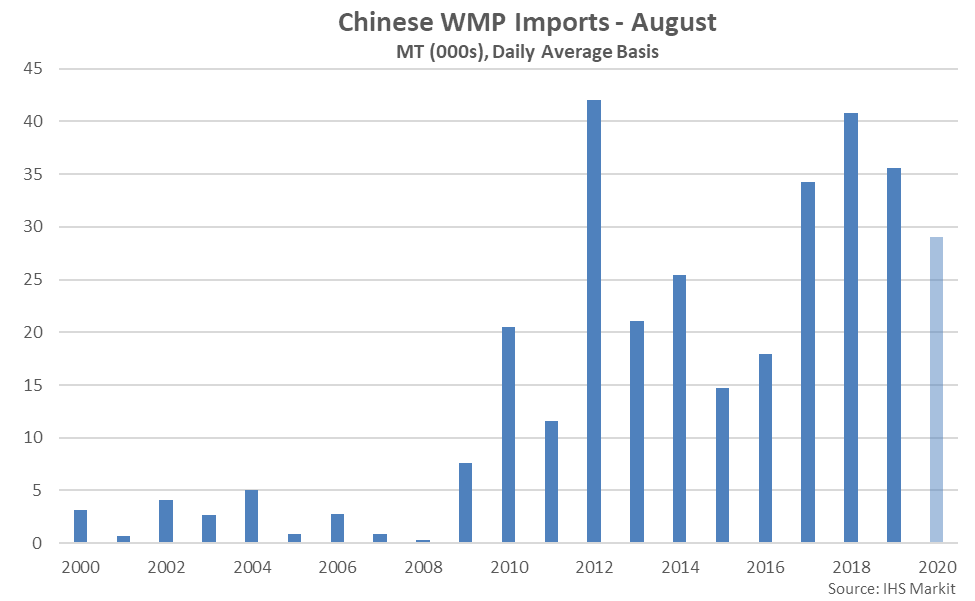

Aug ’20 Chinese WMP Imports Declined to a Four Year Seasonal Low Level

Aug ’20 Chinese WMP Imports Declined to a Four Year Seasonal Low Level

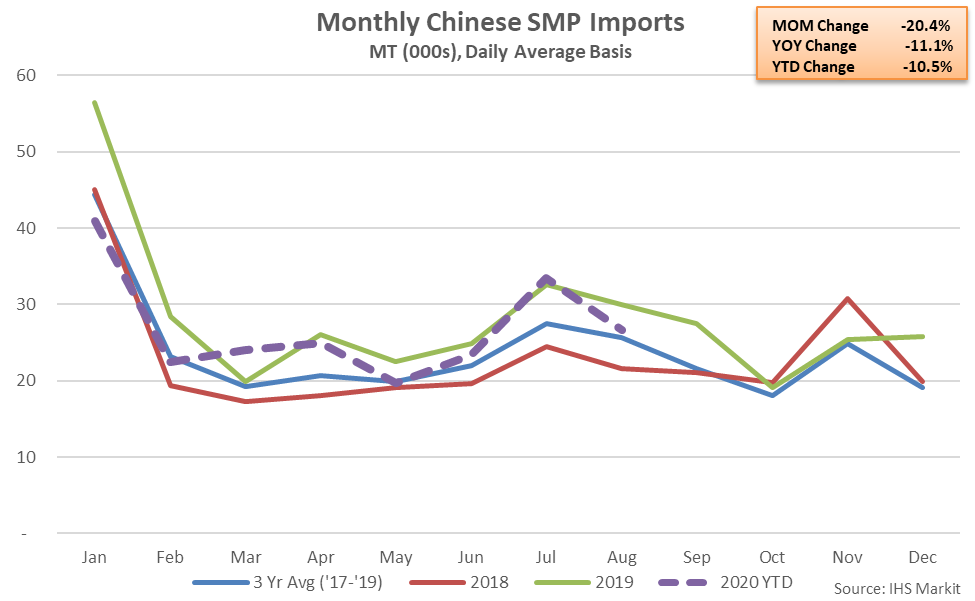

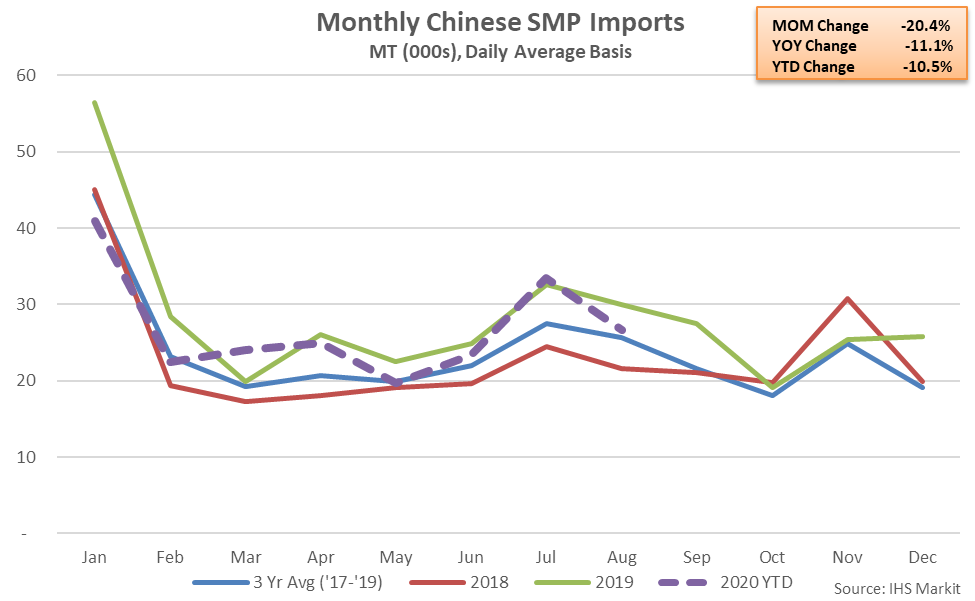

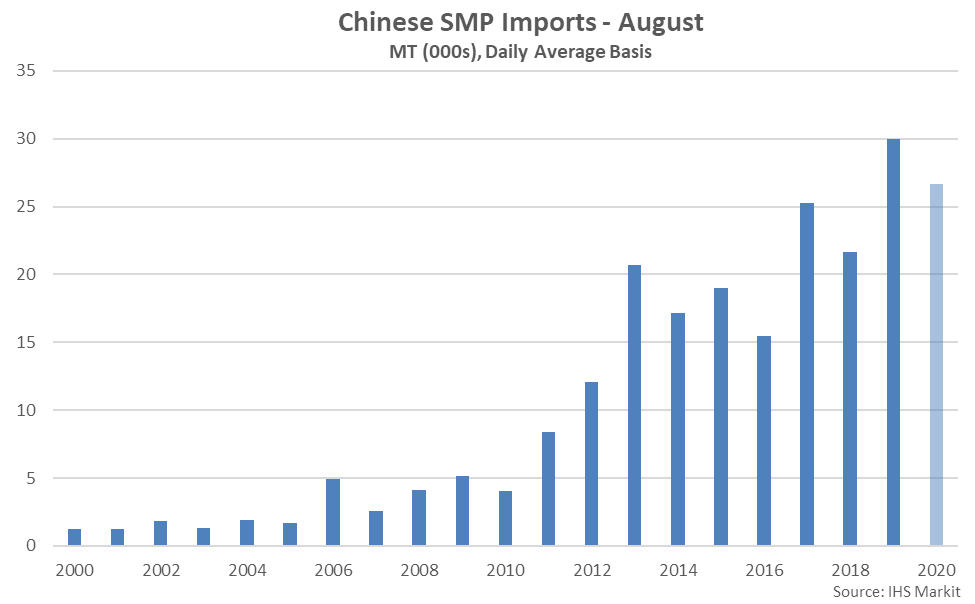

Aug ’20 Chinese SMP Import Volumes Declined 20.4% MOM and 11.1% YOY

Aug ’20 Chinese SMP Import Volumes Declined 20.4% MOM and 11.1% YOY

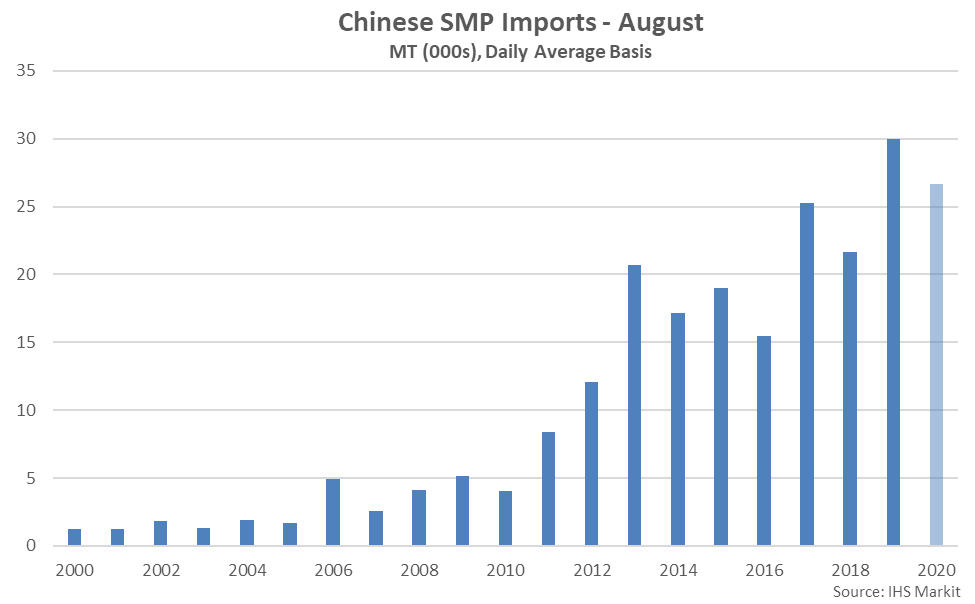

Aug ’20 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Aug ’20 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

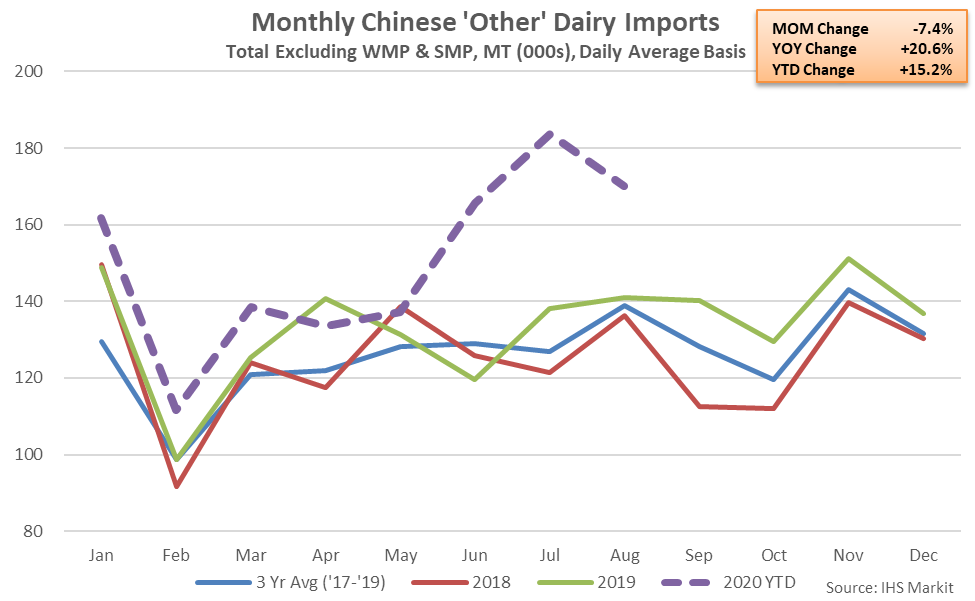

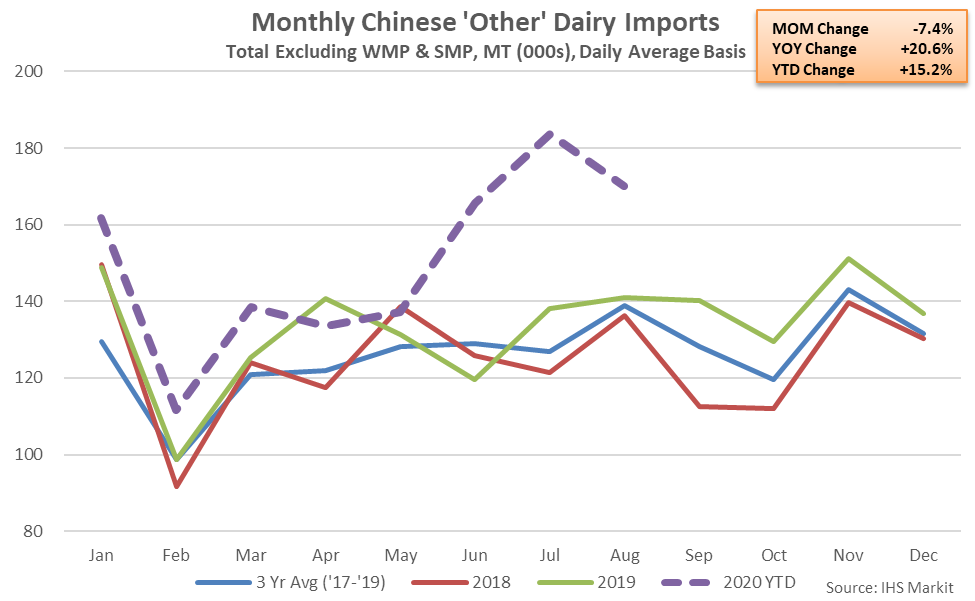

Aug ’20 Chinese Dairy Imports Excluding WMP & SMP Down 7.4% MOM but up 20.6% YOY

Aug ’20 Chinese Dairy Imports Excluding WMP & SMP Down 7.4% MOM but up 20.6% YOY

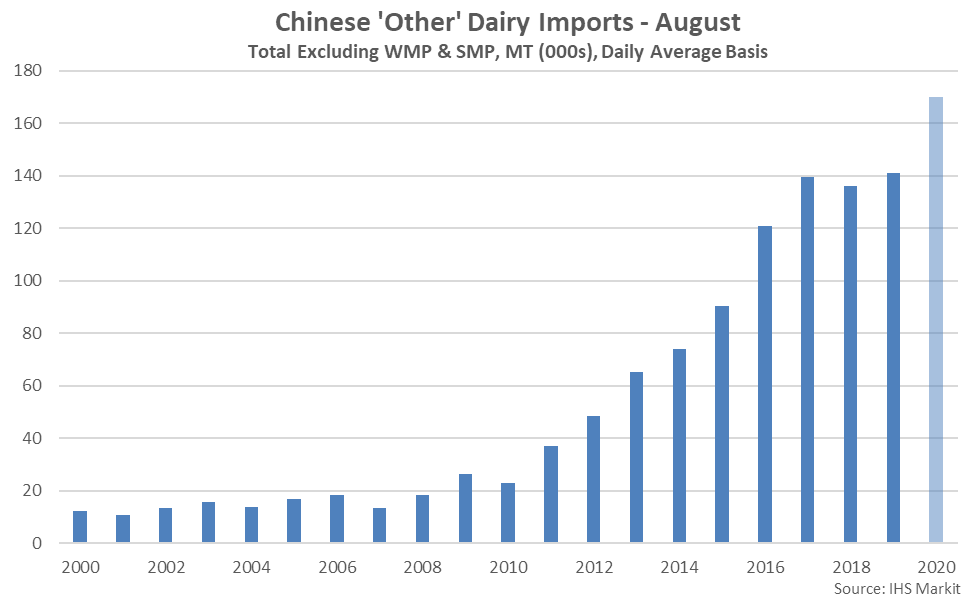

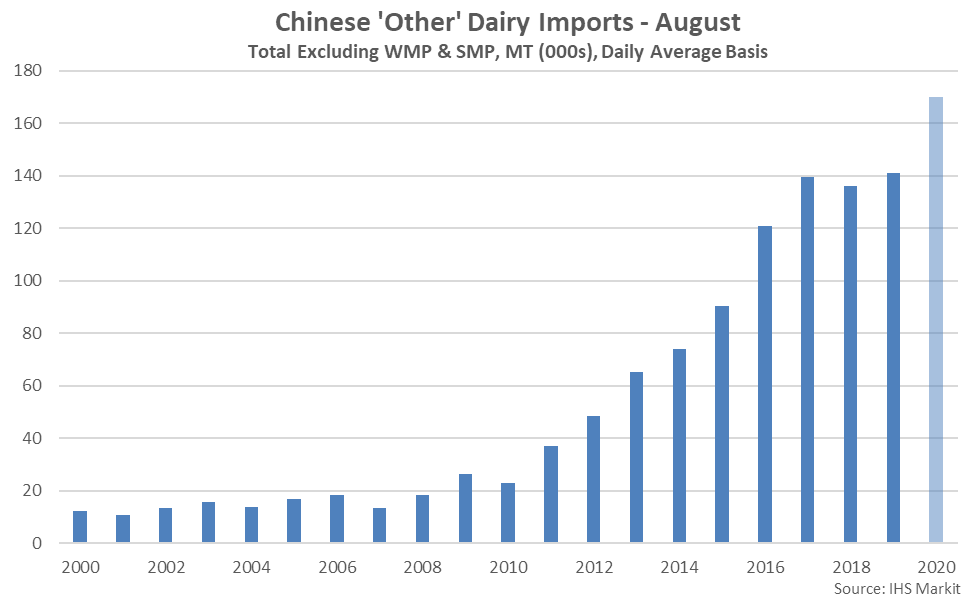

Aug ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Aug ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

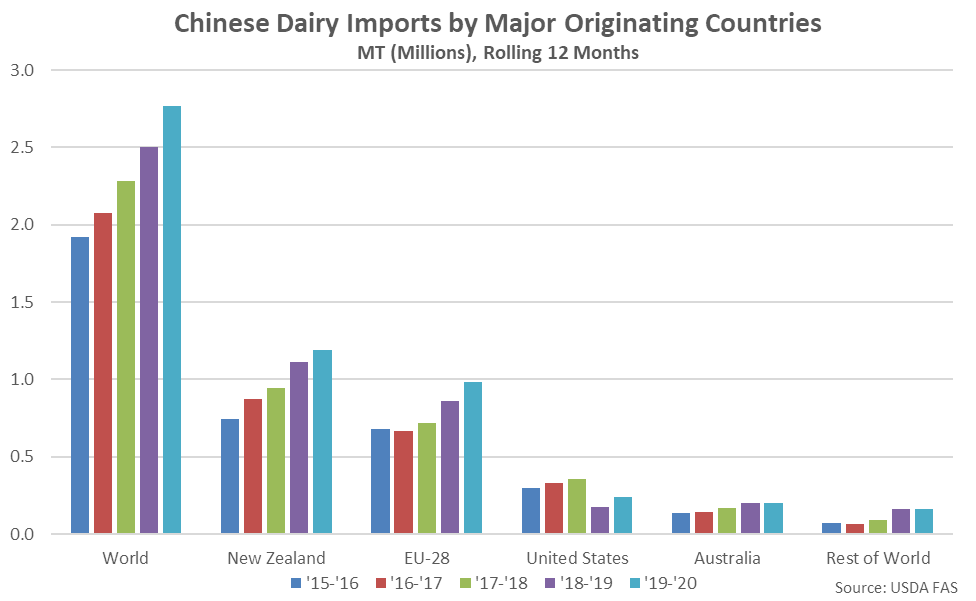

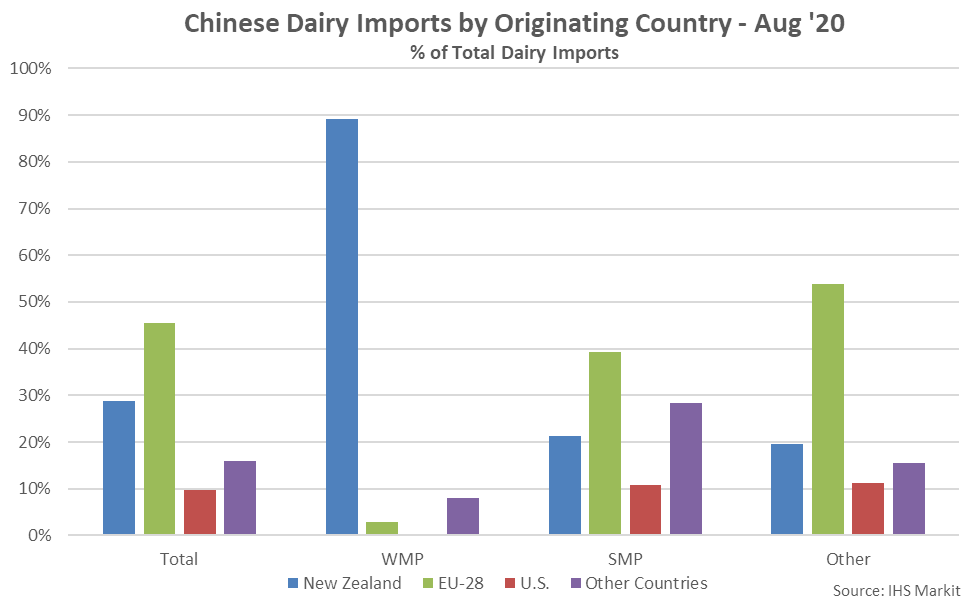

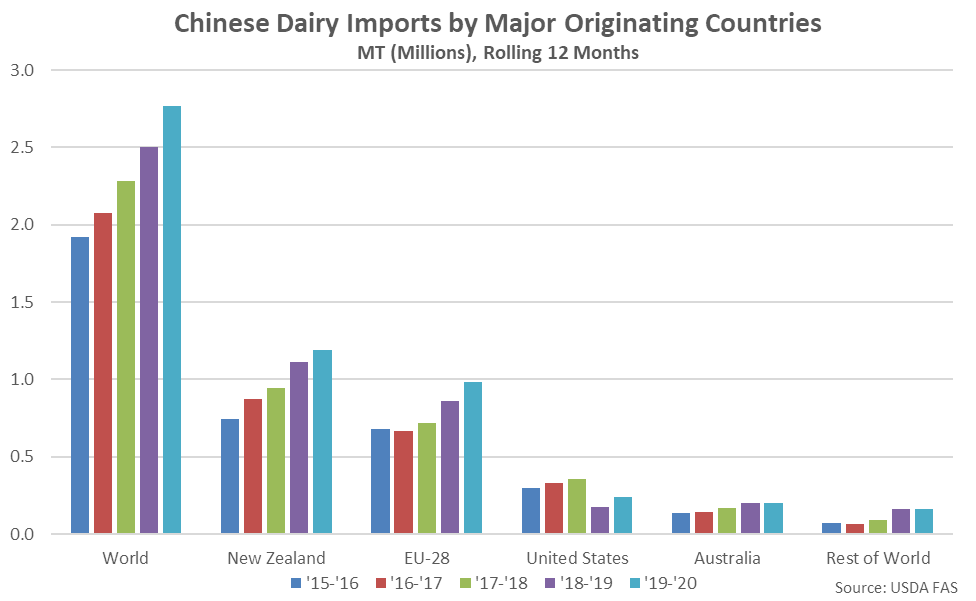

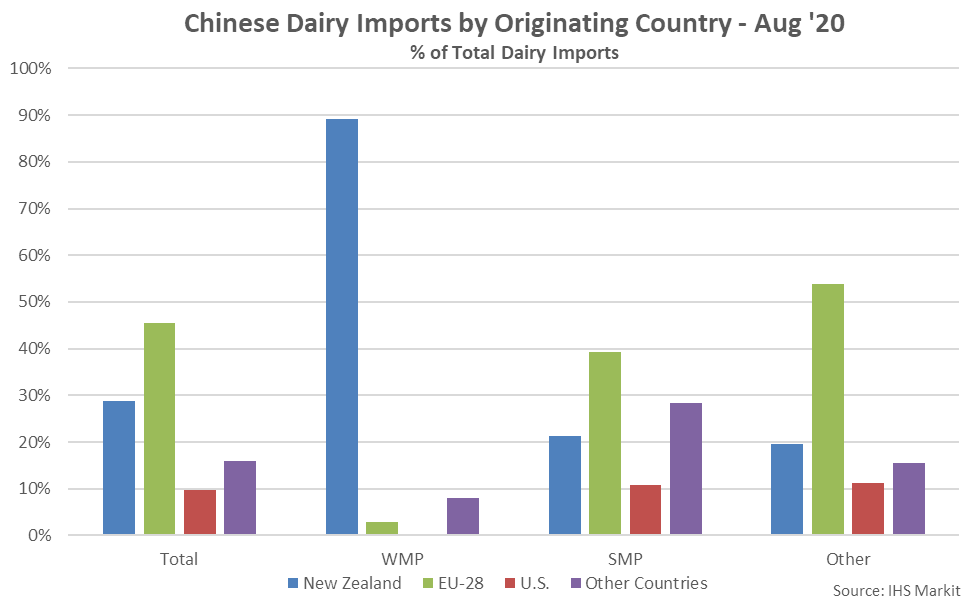

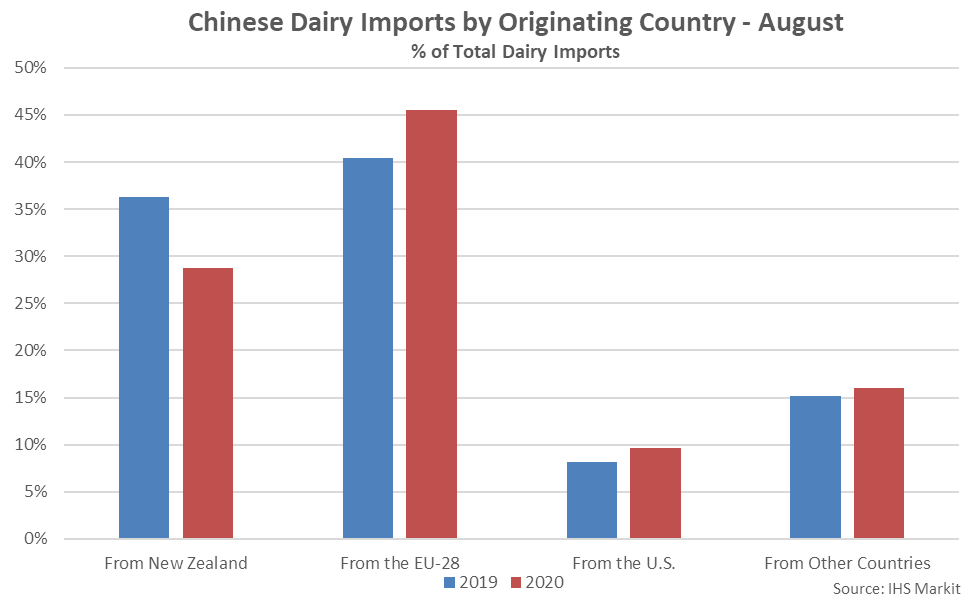

The EU-28 & NZ Combined to Account for 74% of All Aug ’20 Chinese Dairy Import Volumes

The EU-28 & NZ Combined to Account for 74% of All Aug ’20 Chinese Dairy Import Volumes

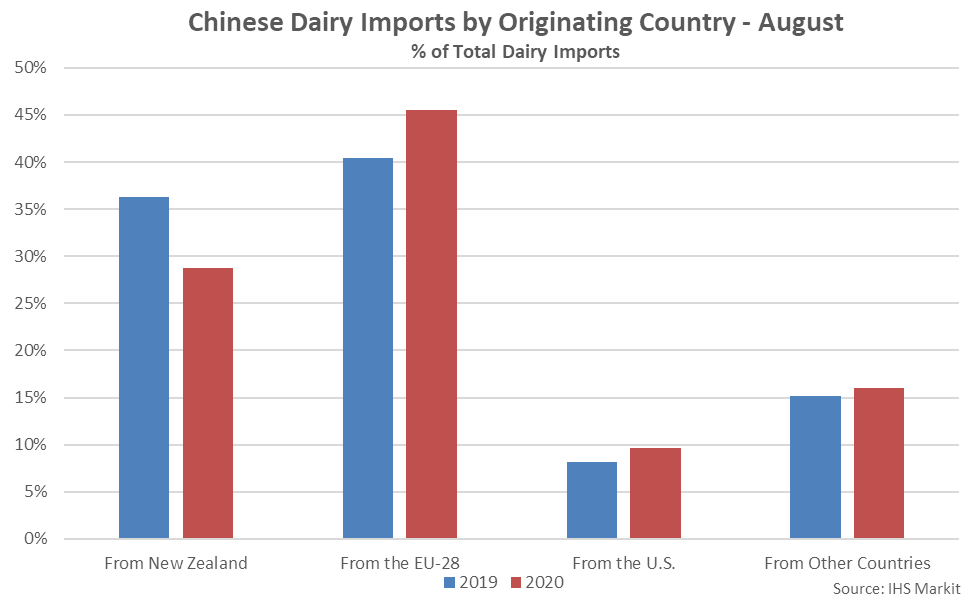

The Aug ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY

The Aug ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY

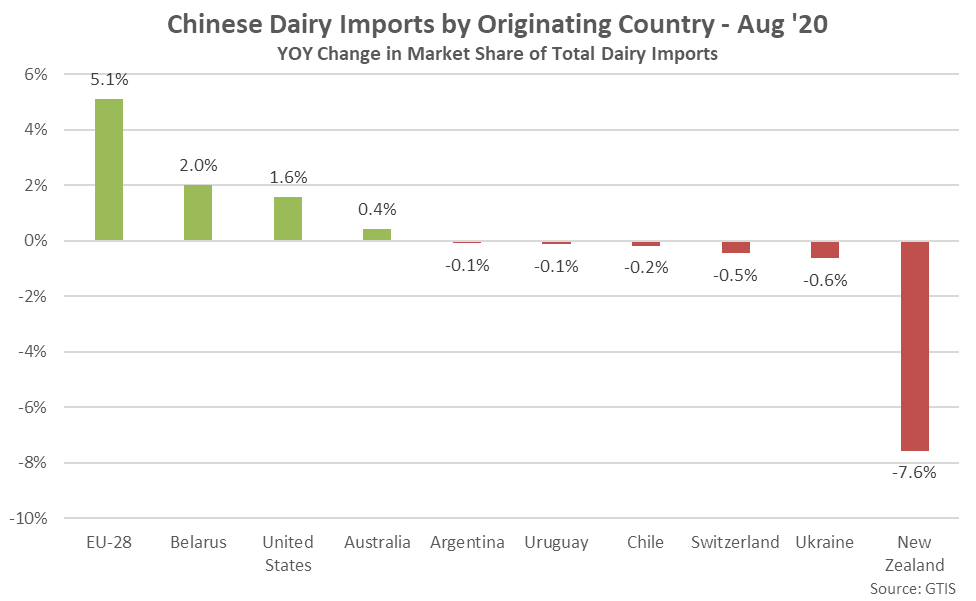

The Aug ’20 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

The Aug ’20 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months

Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months

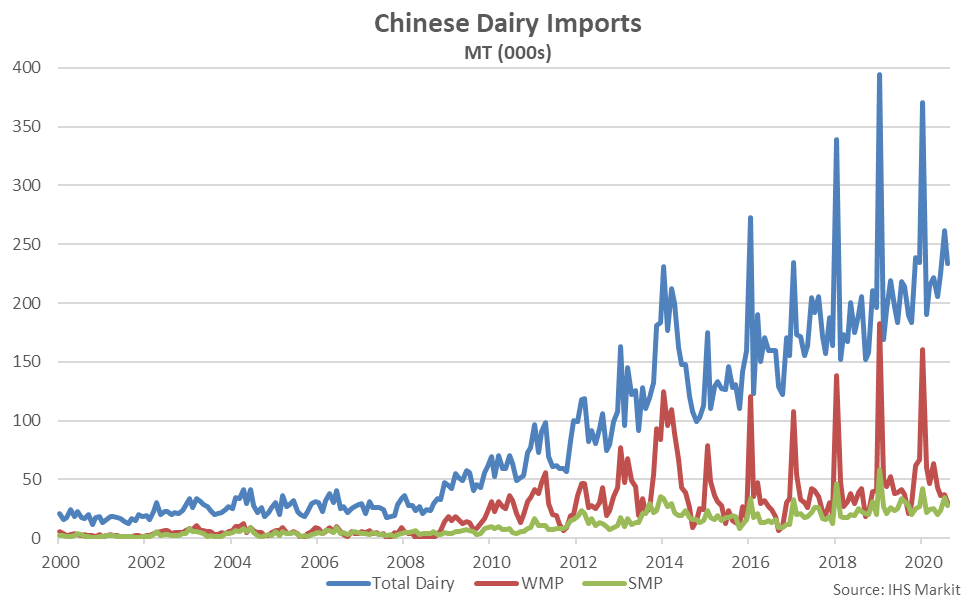

- Chinese dairy import volumes increased on a YOY basis for the 21st time in the past 23 months during Aug ’20, finishing up 9.2% and reaching a record high seasonal level.

- Chinese whole milk powder import volumes declined to a four year low seasonal level during Aug ’20 while Chinese skim milk powder import volumes also declined YOY but remained at the second highest seasonal level on record. Chinese dairy imports excluding SMP and WMP remained at a record high seasonal level for the third consecutive month, however.

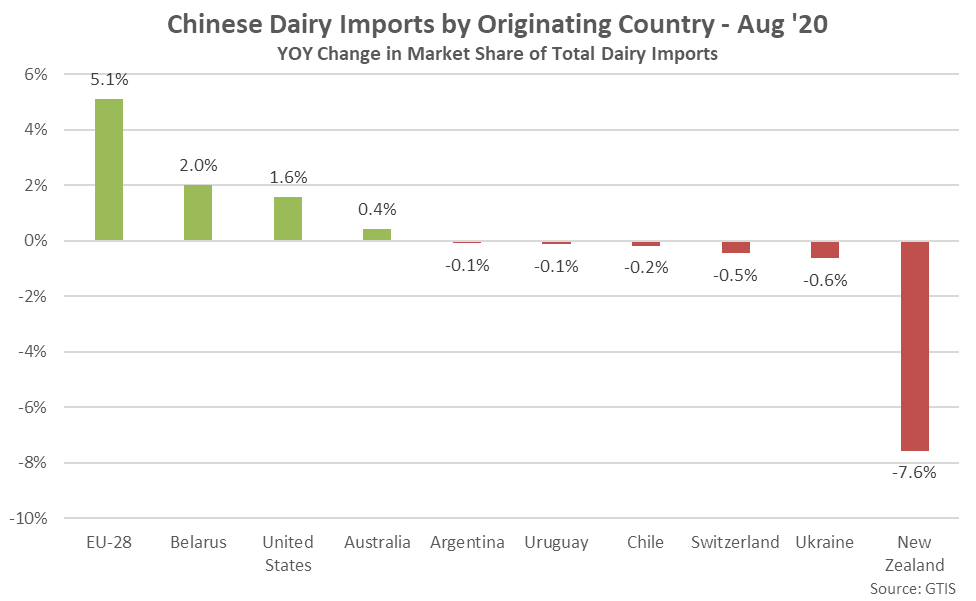

- The market share of Chinese dairy imports originating from within the EU-28 increased most significantly from the previous year throughout Aug ’20, while the market share of Chinese dairy imports originating from within New Zealand finished most significantly below previous year levels. The U.S. market share of Chinese dairy import volumes remained higher on a YOY basis for the tenth consecutive month.

Aug ’20 Chinese Dairy Import Volumes Declined 10.8% MOM but Remained up 9.2% YOY

Aug ’20 Chinese Dairy Import Volumes Declined 10.8% MOM but Remained up 9.2% YOY

Aug ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Aug ’20 Chinese WMP Import Volumes Declined 19.2% MOM and 18.6% YOY

Aug ’20 Chinese WMP Import Volumes Declined 19.2% MOM and 18.6% YOY

Aug ’20 Chinese WMP Imports Declined to a Four Year Seasonal Low Level

Aug ’20 Chinese WMP Imports Declined to a Four Year Seasonal Low Level

Aug ’20 Chinese SMP Import Volumes Declined 20.4% MOM and 11.1% YOY

Aug ’20 Chinese SMP Import Volumes Declined 20.4% MOM and 11.1% YOY

Aug ’20 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Aug ’20 Chinese SMP Imports Remained at the Second Highest Seasonal Level on Record

Aug ’20 Chinese Dairy Imports Excluding WMP & SMP Down 7.4% MOM but up 20.6% YOY

Aug ’20 Chinese Dairy Imports Excluding WMP & SMP Down 7.4% MOM but up 20.6% YOY

Aug ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Aug ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

The EU-28 & NZ Combined to Account for 74% of All Aug ’20 Chinese Dairy Import Volumes

The EU-28 & NZ Combined to Account for 74% of All Aug ’20 Chinese Dairy Import Volumes

The Aug ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY

The Aug ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY

The Aug ’20 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

The Aug ’20 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months

Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months