Grain & Oilseeds WASDE Update – Oct ’20

Corn – U.S. and Global Ending Stocks Above Private Estimates

Corn – U.S. and Global Ending Stocks Above Private Estimates

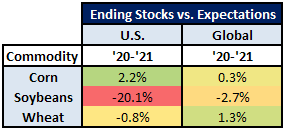

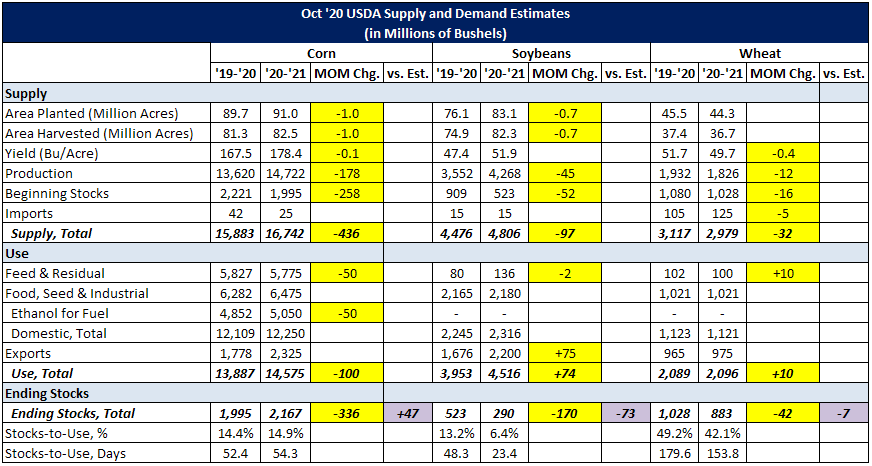

- ’20-’21 U.S. ending stocks of 2.167 billion bushels above expectations

- ’20-’21 global ending stocks of 300.5 million MT slightly above expectations

- ’20-’21 U.S. ending stocks of 290 million bushels significantly below expectations

- ’20-’21 global ending stocks of 88.7 million MT below expectations

- ’20-’21 U.S. ending stocks of 883 million bushels slightly below expectations

- ’20-’21 global ending stocks of 321.5 million MT above expectations