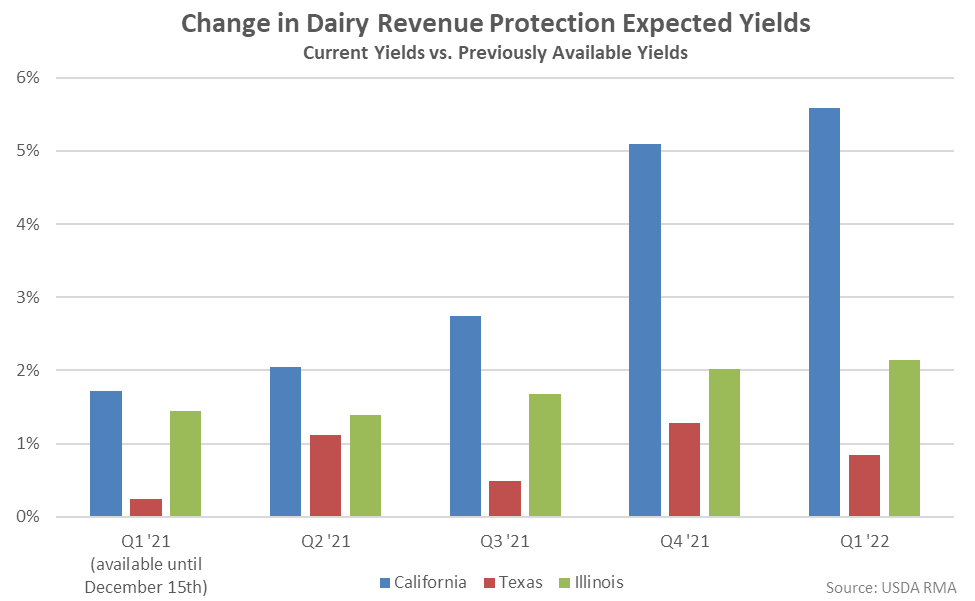

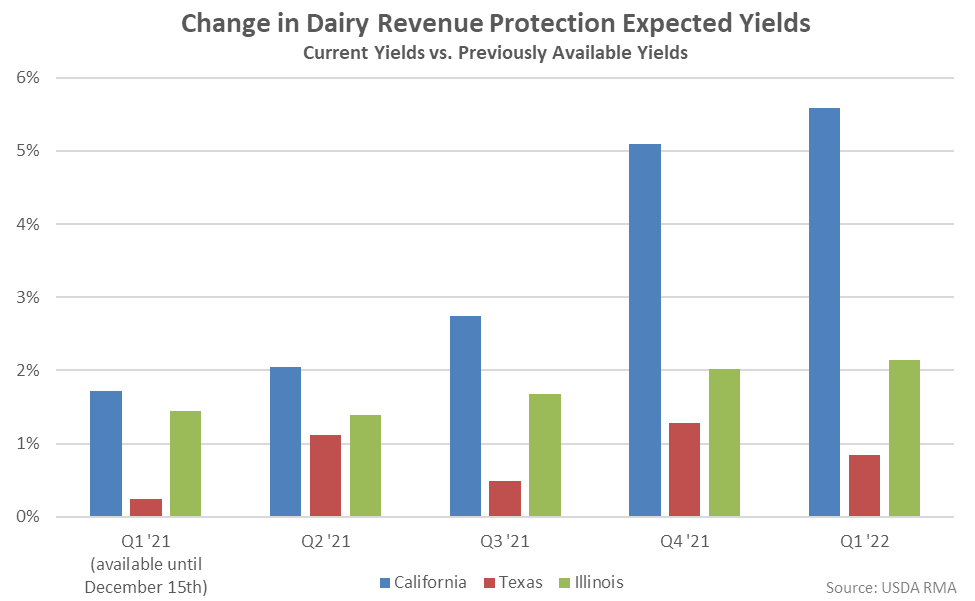

Dairy-RP Yield Adjustments – Dec ’20

The USDA Risk Management Agency (RMA) approved changes in Dairy Revenue Protection (Dairy-RP) estimated quarterly milk per cow yield calculations for the states of California, Texas and Illinois in late Nov ’20, resulting in a more financially attractive product for producers in those states.

California expected milk per cow yield calculations were revised most significantly higher, resulting in the most potential benefit for producers. California’s expected milk per cow yields have consistently underestimated the actual per cow productivity figures since the program began, resulting in reduced indemnity payments for producers. Within Dairy-RP, potential indemnities are reduced when actual milk per cow yields exceed expected figures when the endorsement was purchased.  Additional details on the updated yield forecast model can be found here: https://www.dairybusiness.com/updated-yield-forecasts-to-benefit-drp-in-california-two-other-states/

Additional details on the updated yield forecast model can be found here: https://www.dairybusiness.com/updated-yield-forecasts-to-benefit-drp-in-california-two-other-states/

Additional details on the updated yield forecast model can be found here: https://www.dairybusiness.com/updated-yield-forecasts-to-benefit-drp-in-california-two-other-states/

Additional details on the updated yield forecast model can be found here: https://www.dairybusiness.com/updated-yield-forecasts-to-benefit-drp-in-california-two-other-states/