Soybean Complex Crushing & Stocks Update – Jan ’21

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Nov ’20. Highlights from the updated report include:

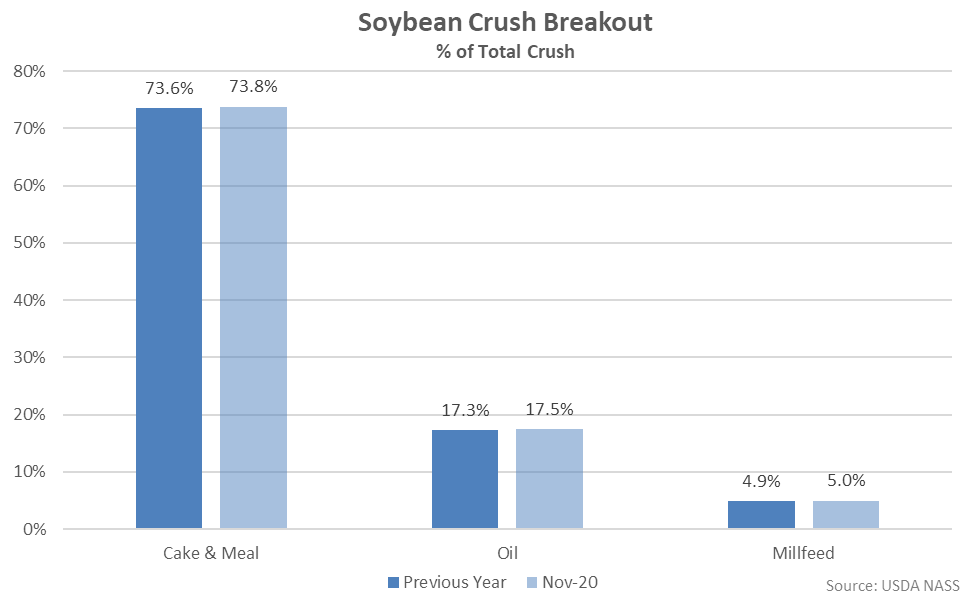

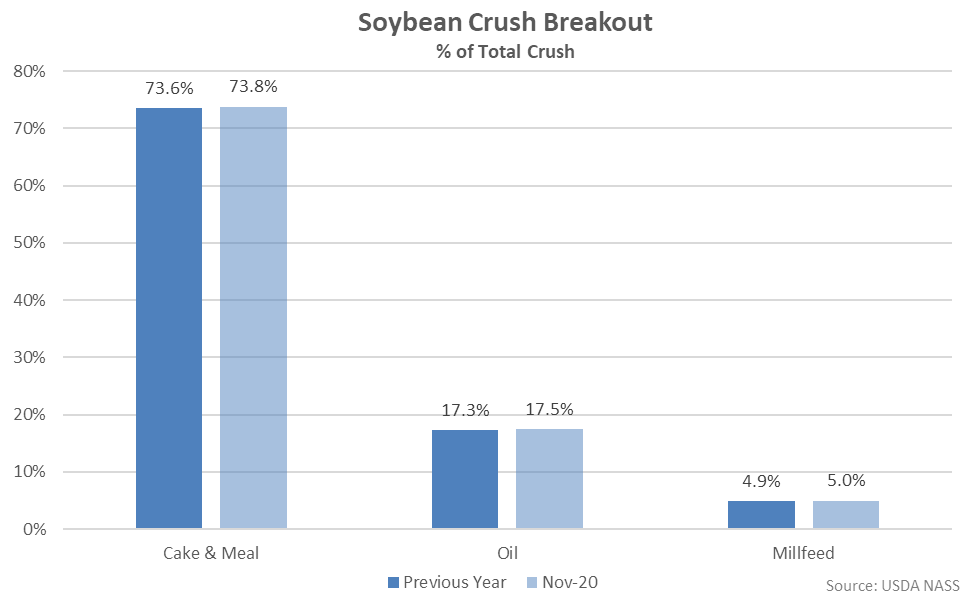

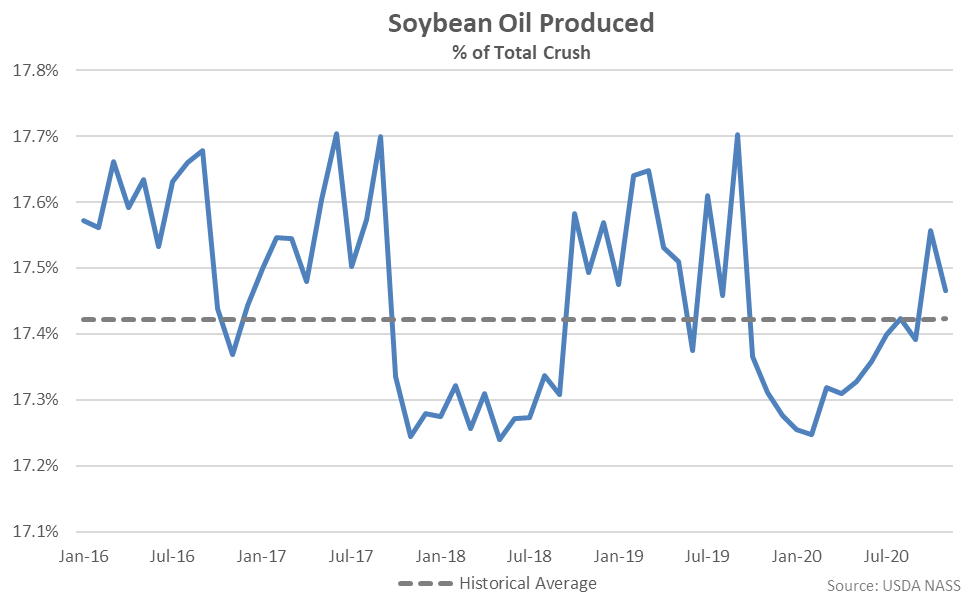

Cake & meal accounted for 73.8% of the total soybean crush throughout Nov ’20, up slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, also up slightly from the previous year.

Cake & meal accounted for 73.8% of the total soybean crush throughout Nov ’20, up slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, also up slightly from the previous year.

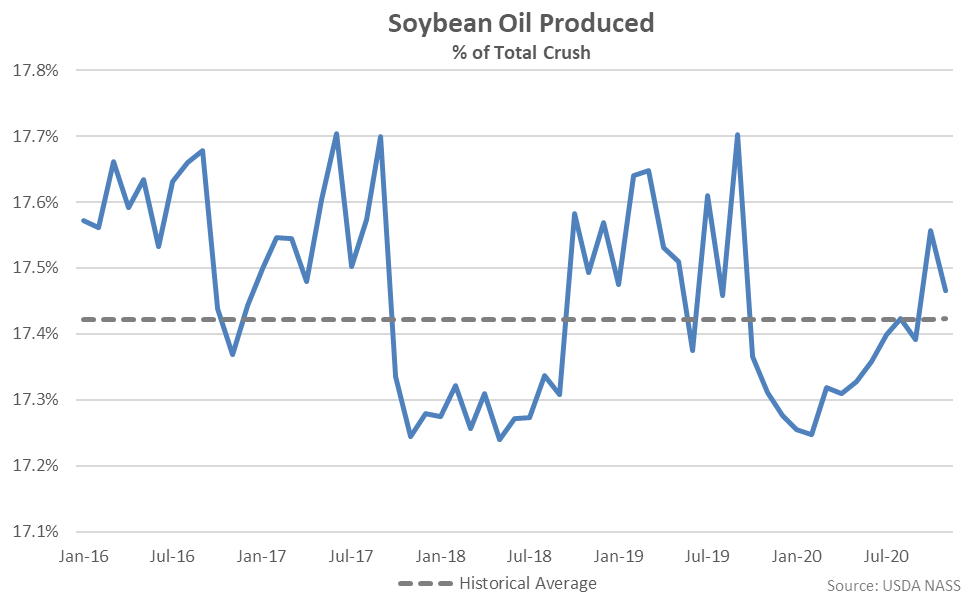

Nov ’20 soybean oil produced as a percentage of total crush declined from the 13 month high level experienced throughout the previous month but remained above historical average figures for the second consecutive month.

Nov ’20 soybean oil produced as a percentage of total crush declined from the 13 month high level experienced throughout the previous month but remained above historical average figures for the second consecutive month.

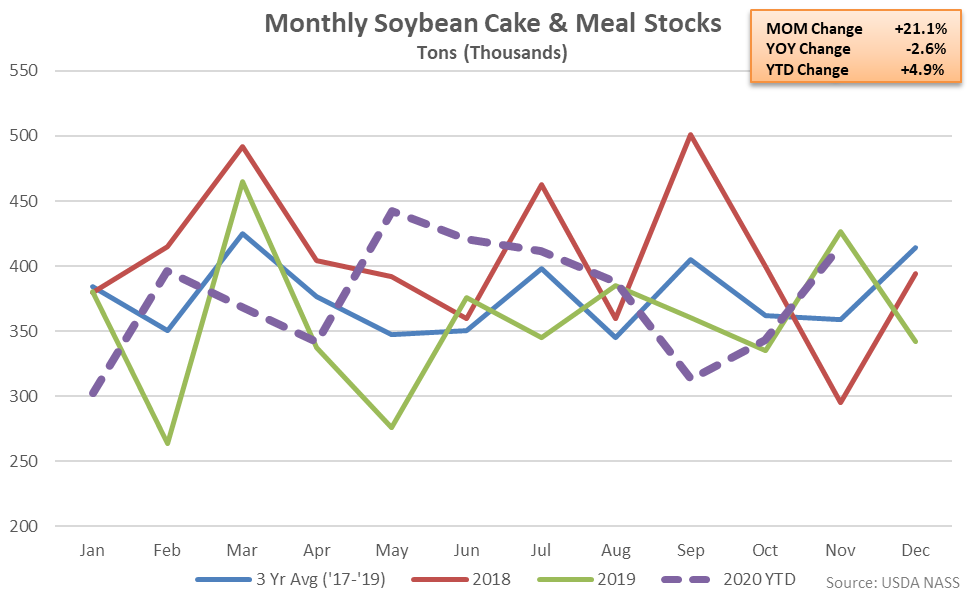

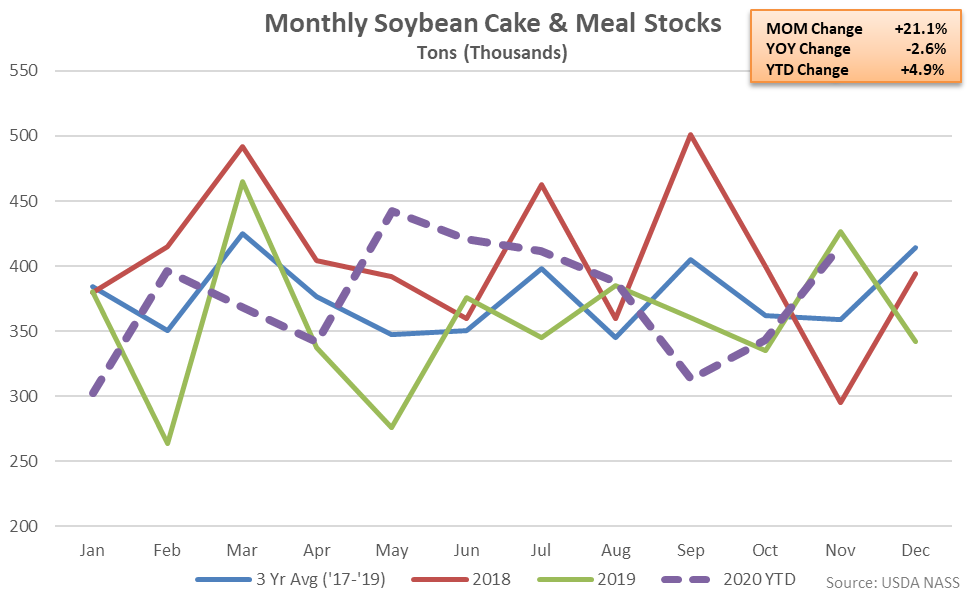

Soybean Cake & Meal Stocks – Stocks Finish Lower YOY but Remain Above Three Year Average Levels

Nov ’20 U.S. soybean cake & meal stocks increased to a five month high level but finished 2.6% lower on a YOY basis. The YOY decline in soybean cake & meal stocks was just the second experienced throughout the past eight months. The month-over-month increase in soybean cake & meal stocks of 21.1% was significantly larger than the three year average October – November seasonal increase in stocks of 0.7%. Despite finishing lower on a YOY basis, Nov ’20 soybean cake & meal stocks remained 15.7% above three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish Lower YOY but Remain Above Three Year Average Levels

Nov ’20 U.S. soybean cake & meal stocks increased to a five month high level but finished 2.6% lower on a YOY basis. The YOY decline in soybean cake & meal stocks was just the second experienced throughout the past eight months. The month-over-month increase in soybean cake & meal stocks of 21.1% was significantly larger than the three year average October – November seasonal increase in stocks of 0.7%. Despite finishing lower on a YOY basis, Nov ’20 soybean cake & meal stocks remained 15.7% above three year average seasonal levels.

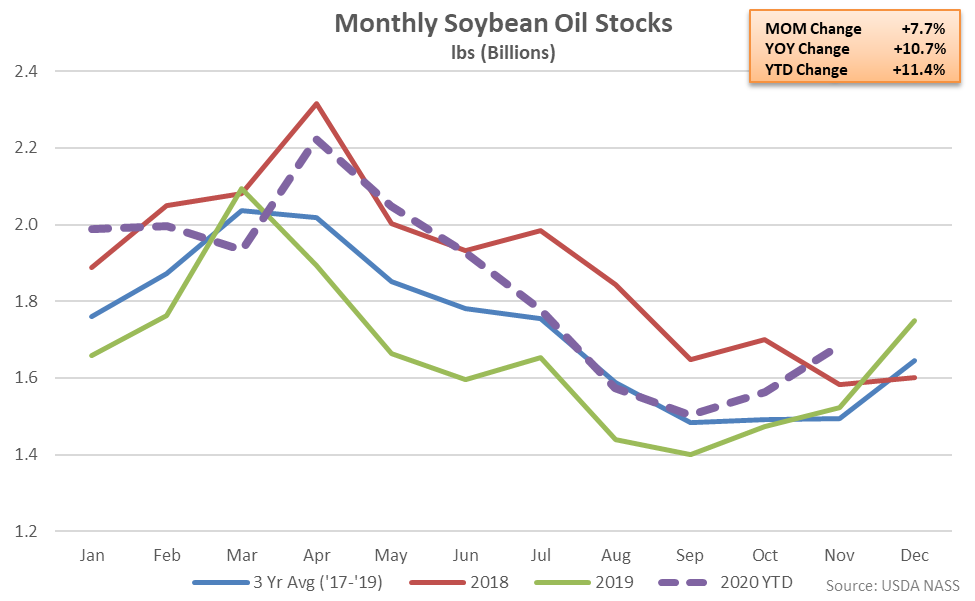

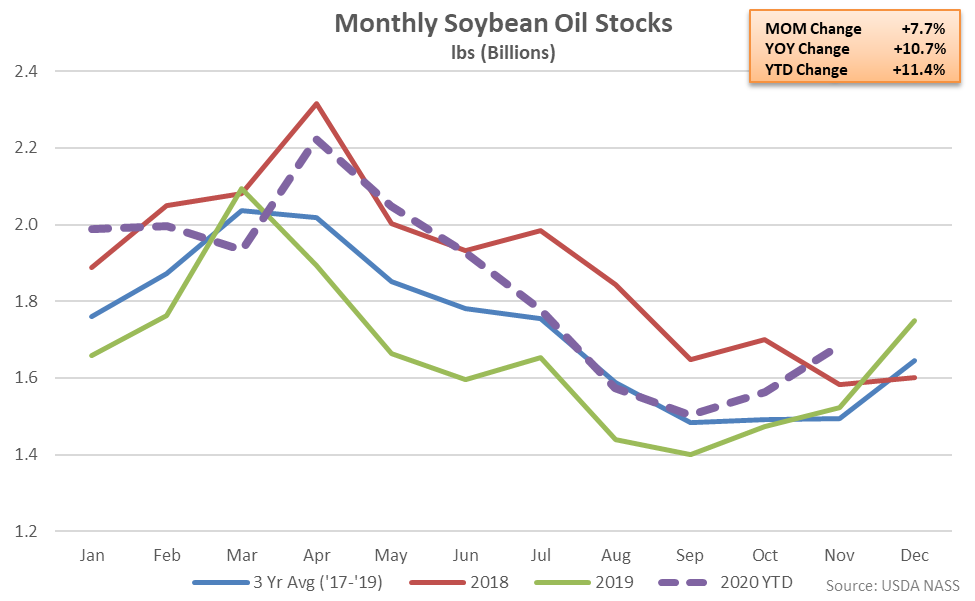

Soybean Oil Stocks – Stocks Remain Higher YOY for the 11th Time in 12 Months, up 10.7%

Nov ’20 U.S. soybean oil stocks rebounded seasonally to a four month high level while finishing 10.7% higher on a YOY basis. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout 11 of the past 12 months. The month-over-month increase in soybean oil stocks of 7.7% was significantly greater than the three year average October – November seasonal increase of 0.9%. Nov ’20 soybean oil stocks finished 12.7% above three year average seasonal levels, finishing higher for the 11th time in the past 12 months.

Soybean Oil Stocks – Stocks Remain Higher YOY for the 11th Time in 12 Months, up 10.7%

Nov ’20 U.S. soybean oil stocks rebounded seasonally to a four month high level while finishing 10.7% higher on a YOY basis. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout 11 of the past 12 months. The month-over-month increase in soybean oil stocks of 7.7% was significantly greater than the three year average October – November seasonal increase of 0.9%. Nov ’20 soybean oil stocks finished 12.7% above three year average seasonal levels, finishing higher for the 11th time in the past 12 months.

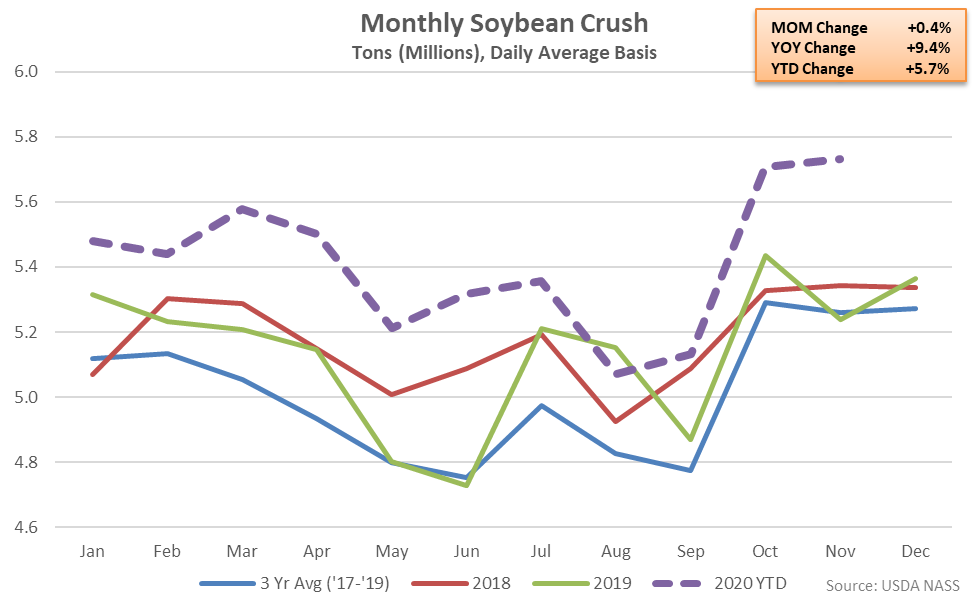

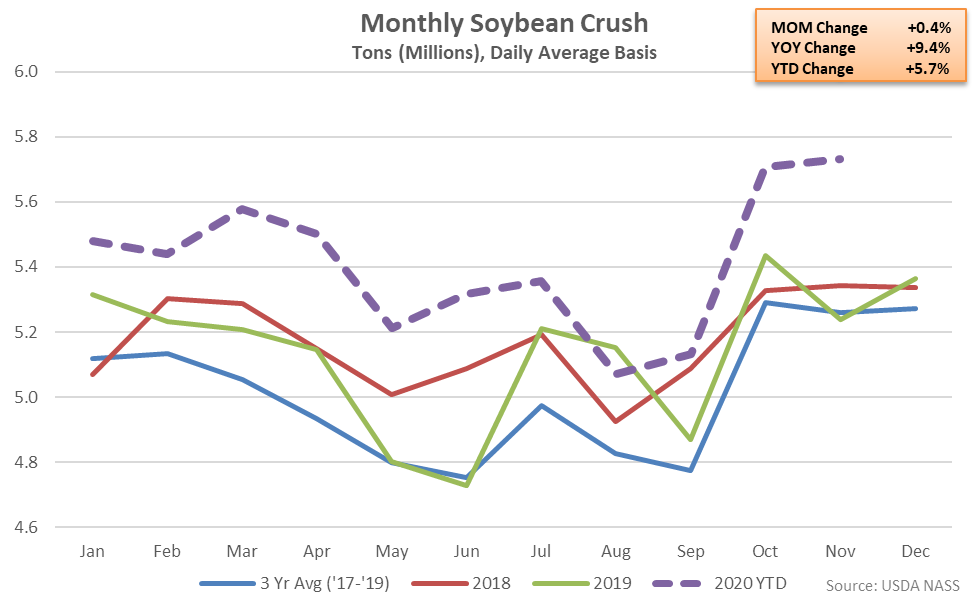

- U.S. soybean crushings increased 9.4% on a YOY basis during Nov ’20, finishing higher for the 11th time in the past 12 months.

- U.S. soybean cake & meal stocks declined on a YOY basis for just the second time in the past eight months during Nov ’20, finishing down 2.6%.

- U.S. soybean oil stocks remained higher on a YOY basis for the 11th time in the past 12 months, finishing up 10.7%.

Cake & meal accounted for 73.8% of the total soybean crush throughout Nov ’20, up slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, also up slightly from the previous year.

Cake & meal accounted for 73.8% of the total soybean crush throughout Nov ’20, up slightly from the previous year, while oil accounted for 17.5% of the total soybean crush, also up slightly from the previous year.

Nov ’20 soybean oil produced as a percentage of total crush declined from the 13 month high level experienced throughout the previous month but remained above historical average figures for the second consecutive month.

Nov ’20 soybean oil produced as a percentage of total crush declined from the 13 month high level experienced throughout the previous month but remained above historical average figures for the second consecutive month.

Soybean Cake & Meal Stocks – Stocks Finish Lower YOY but Remain Above Three Year Average Levels

Nov ’20 U.S. soybean cake & meal stocks increased to a five month high level but finished 2.6% lower on a YOY basis. The YOY decline in soybean cake & meal stocks was just the second experienced throughout the past eight months. The month-over-month increase in soybean cake & meal stocks of 21.1% was significantly larger than the three year average October – November seasonal increase in stocks of 0.7%. Despite finishing lower on a YOY basis, Nov ’20 soybean cake & meal stocks remained 15.7% above three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish Lower YOY but Remain Above Three Year Average Levels

Nov ’20 U.S. soybean cake & meal stocks increased to a five month high level but finished 2.6% lower on a YOY basis. The YOY decline in soybean cake & meal stocks was just the second experienced throughout the past eight months. The month-over-month increase in soybean cake & meal stocks of 21.1% was significantly larger than the three year average October – November seasonal increase in stocks of 0.7%. Despite finishing lower on a YOY basis, Nov ’20 soybean cake & meal stocks remained 15.7% above three year average seasonal levels.

Soybean Oil Stocks – Stocks Remain Higher YOY for the 11th Time in 12 Months, up 10.7%

Nov ’20 U.S. soybean oil stocks rebounded seasonally to a four month high level while finishing 10.7% higher on a YOY basis. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout 11 of the past 12 months. The month-over-month increase in soybean oil stocks of 7.7% was significantly greater than the three year average October – November seasonal increase of 0.9%. Nov ’20 soybean oil stocks finished 12.7% above three year average seasonal levels, finishing higher for the 11th time in the past 12 months.

Soybean Oil Stocks – Stocks Remain Higher YOY for the 11th Time in 12 Months, up 10.7%

Nov ’20 U.S. soybean oil stocks rebounded seasonally to a four month high level while finishing 10.7% higher on a YOY basis. Soybean oil stocks had finished lower on a YOY basis throughout eight consecutive months through Nov ’19 prior to finishing higher throughout 11 of the past 12 months. The month-over-month increase in soybean oil stocks of 7.7% was significantly greater than the three year average October – November seasonal increase of 0.9%. Nov ’20 soybean oil stocks finished 12.7% above three year average seasonal levels, finishing higher for the 11th time in the past 12 months.