European Milk Production Update – Feb ’21

Executive Summary

EU-27+UK milk production figures provided by Eurostat were recently updated with values spanning through Dec ’20. Highlights from the updated report include:

- Dec ’20 EU-27+UK milk production is projected to have finished 0.5% higher on a YOY basis throughout Dec ’20, remaining at a record high seasonal level for the seventh consecutive month. The YOY increase in EU-27+UK milk production volumes was the 22nd experienced throughout the past 23 months.

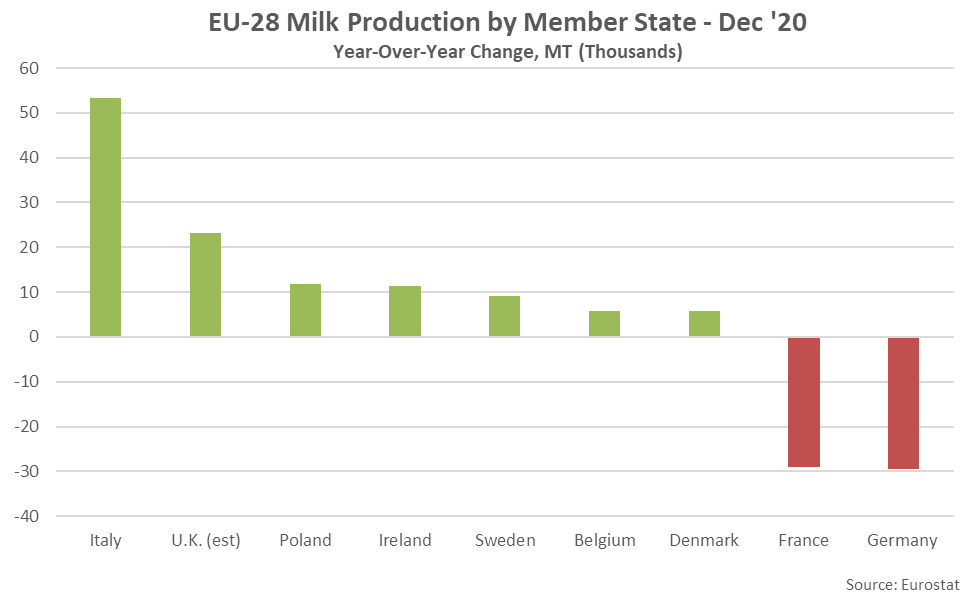

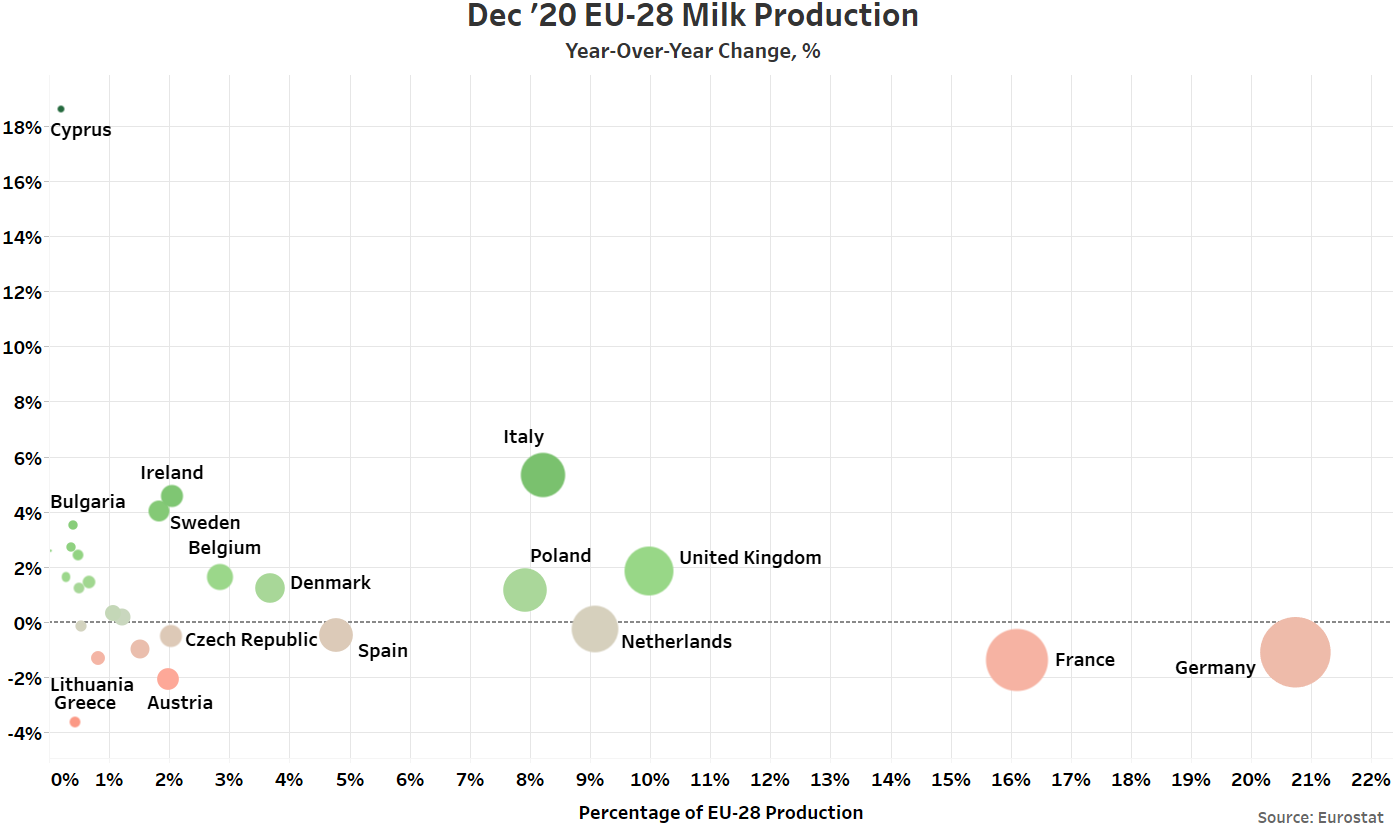

- Dec ’20 YOY increases in milk production were led by Italy, followed by the United Kingdom (estimated based on the previous month growth rate) and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by France. Overall, 18 of the 28 member states experienced YOY increases in milk production throughout the month.

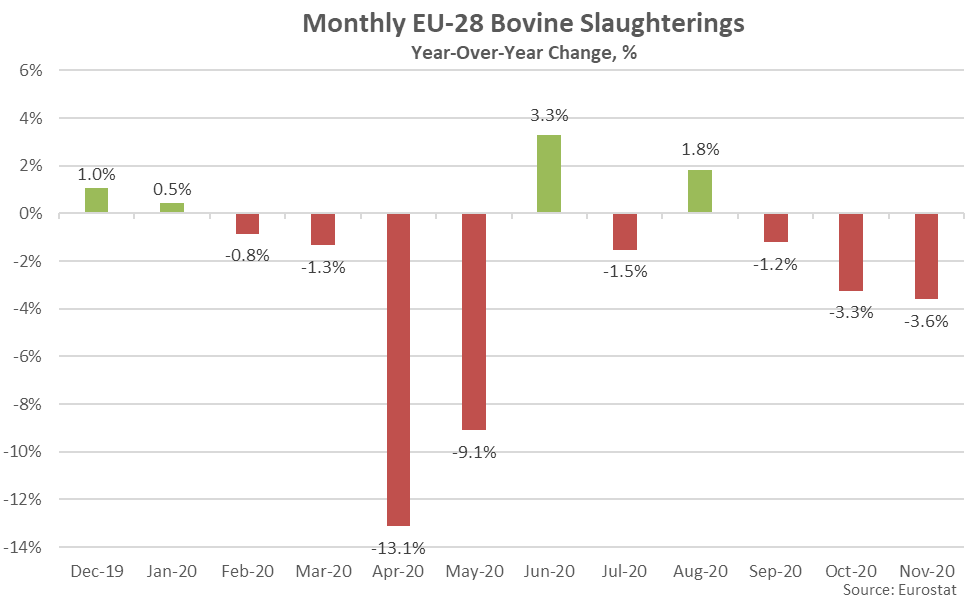

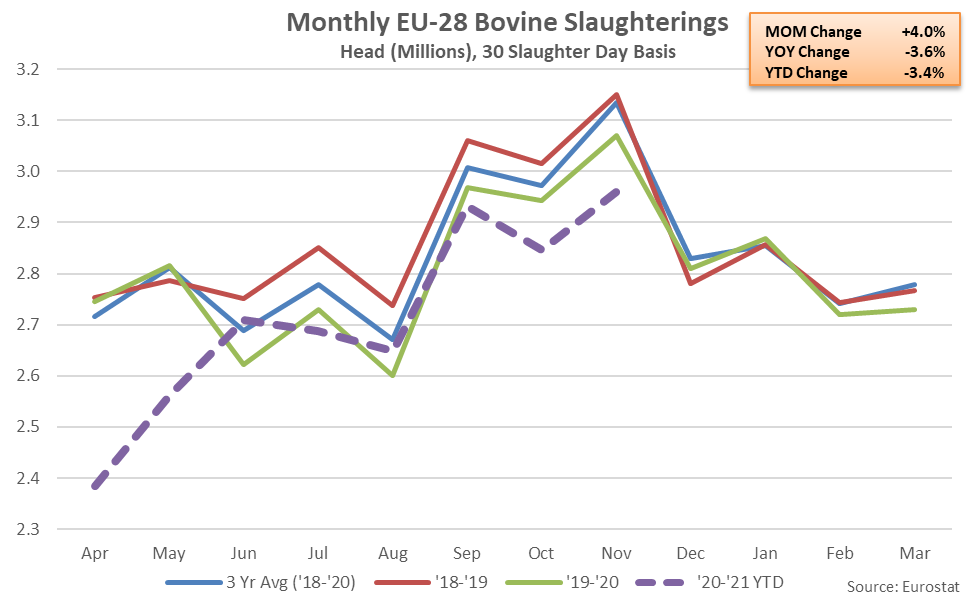

- EU-27+UK beef & dairy cow slaughter rates finished lower on a YOY basis for the eighth time in the past ten months during Nov ’20 when normalizing for slaughter days, declining by 3.6% and reaching a seven year low seasonal level.

Additional Report Details

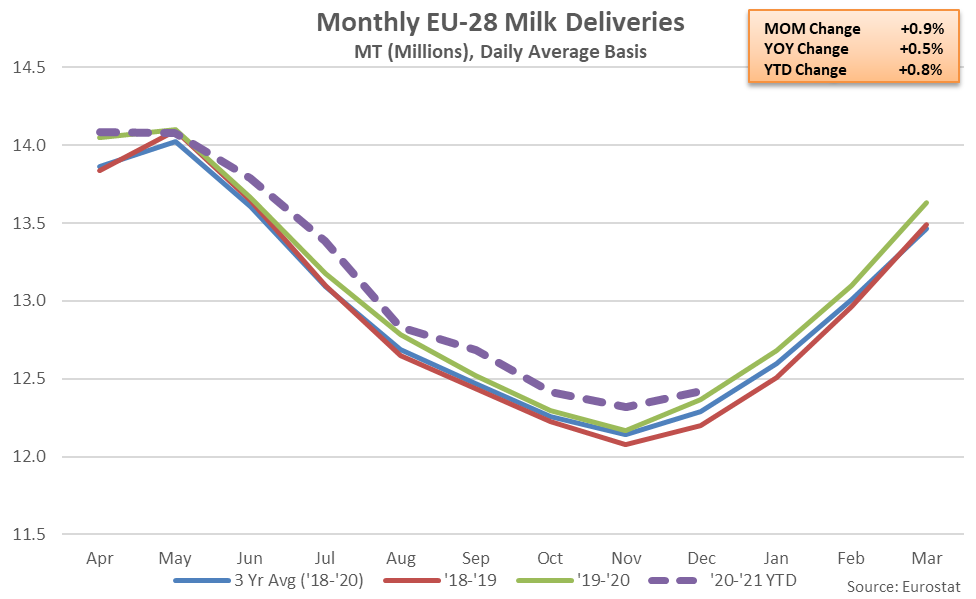

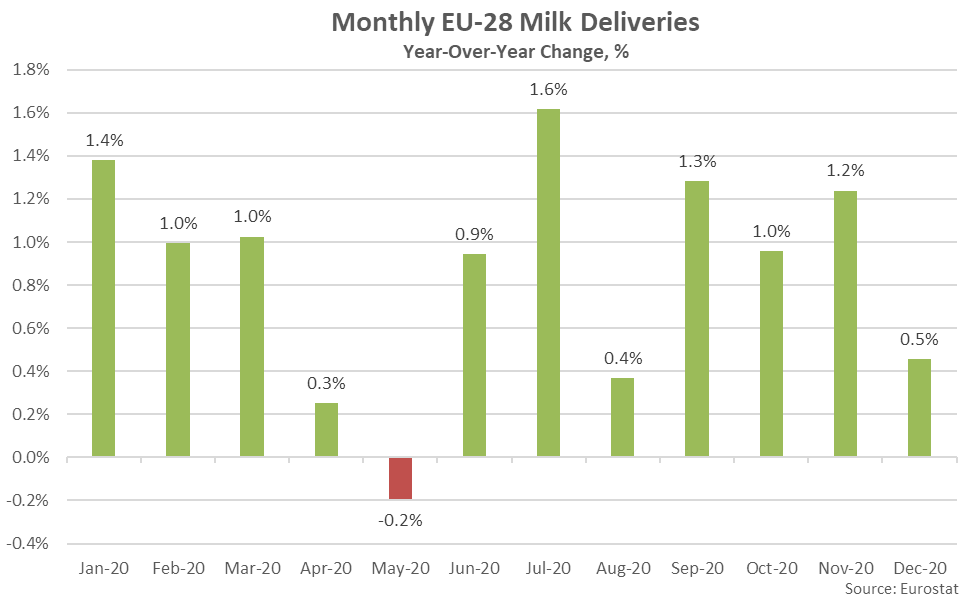

According to Eurostat, Dec ’20 EU-27+UK milk production volumes are projected to have increased seasonally by 0.9% from the previous month while finishing 0.5% higher on a YOY basis, reaching a record high seasonal level. EU-27+UK milk production volumes have finished at record high seasonal levels over seven consecutive months through Dec ’20. The November – December seasonal increase in production figures was smaller than the ten year average seasonal increase of 1.5%, however. Figures for the United Kingdom are not yet available and are based on the previous month YOY change in production. The United Kingdom has accounted for 9.6% of total EU-27+UK production volumes throughout the past 12 months.

’19-’20 annual EU-27+UK milk production volumes increased 0.8% on a YOY basis, reaching a record high level for the third consecutive year. ’20-’21 YTD milk production volumes have increased by an additional 0.8% YOY throughout the first three quarters of the production season.

The Dec ’20 YOY increase in EU-27+UK milk production volumes was the 22nd experienced throughout the past 23 months. EU-27+UK milk production volumes declined on a YOY basis for the first time in 16 months throughout May ’20 as warm and dry conditions adversely impacted pastures, particularly throughout Eastern Europe. Weather conditions have returned to more favorable levels for milk production over more recent months.

Dec ’20 YOY increases in production on an absolute basis were led by Italy, followed by the United Kingdom (estimated based on the previous month growth rate) and Poland, while YOY declines in production on an absolute basis were led by Germany, followed by France.

YOY increases in production on a percentage basis are expected to be led by Cyprus (+18.6%), followed by Italy (+5.3%) and Ireland (+4.6%), while declines in production on a percentage basis were led by Greece (-3.6%), followed by Austria (-2.1%) and France (-1.4%).

Six of the top ten milk producing member states experienced YOY increases in milk production during Dec ’20, resulting in production within the top ten milk producing member states increasing by a weighted average of 0.5% throughout the month. The top ten EU-27+UK milk producing member states accounted for over 85% of the total EU-27+UK milk production experienced throughout the month. Production outside of the top ten milk producing member states increased by 0.6% on a YOY basis. Overall, 18 of the 28 member states experienced YOY increases in production volumes during Dec ’20.

EU-27+UK beef & dairy cow slaughter finished lower on a YOY basis for the eighth time in the past ten months during Nov ’20 when normalizing for slaughter days, declining by 3.6% and reaching a seven year low seasonal level. YOY declines in beef & dairy cow slaughter were most significant throughout Germany, followed by Poland and the Netherlands.

’19-’20 annual EU-27+UK bovine slaughter declined on a YOY basis for the first time in the past six years, finishing down 1.8% and reaching a four year low level. USDA expects the EU-27+UK dairy cow herd to decline 1.2% throughout the 2020 calendar year, due to feed shortages stemming from the recent droughts but noted additional culling rates, coupled with improved genetics, are expected to have a positive impact on future per cow productivity as lower producing animals are culled. Significant declines in beef & dairy cow slaughter rates experienced throughout the months of April and May were likely amplified by dislocations in meat processing caused by COVID-19.