Chinese Dairy Imports Update – Mar ’21

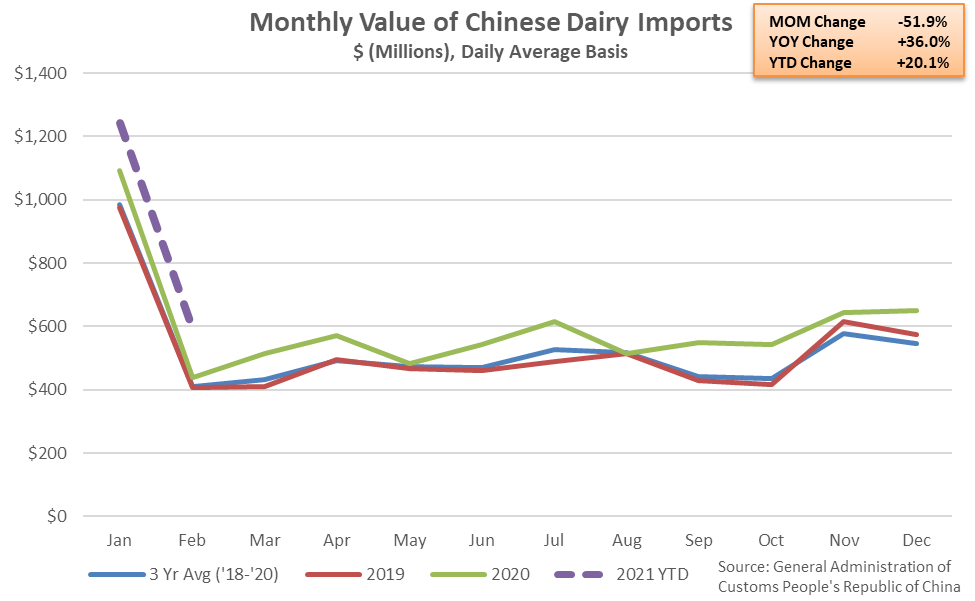

Feb ’21 Total Chinese Dairy Imports Declined Seasonally From the Jan ’21 Record Highs

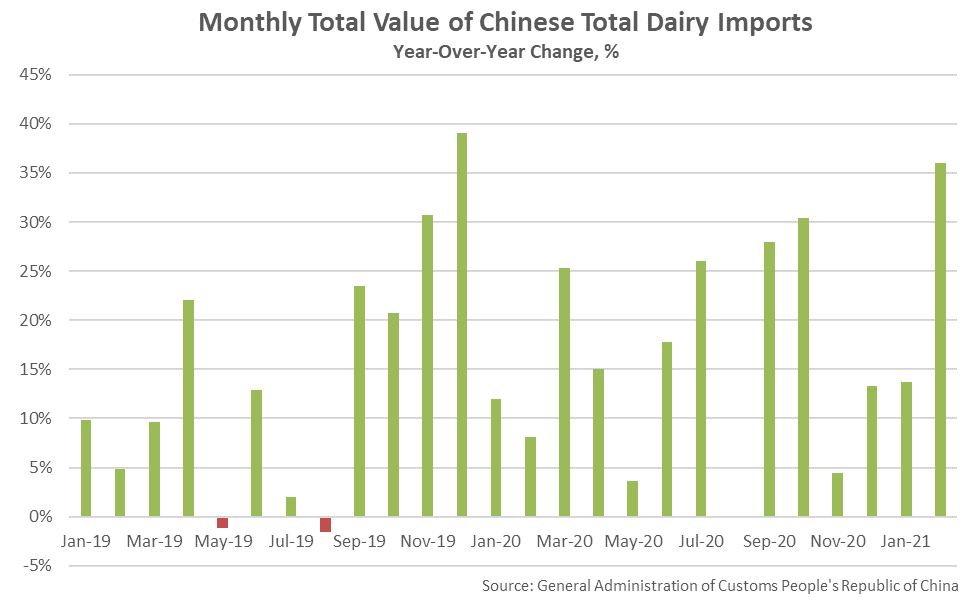

Feb ’21 Chinese Dairy Import Volumes Declined 51.9% MOM but Remained up 36.0% YOY

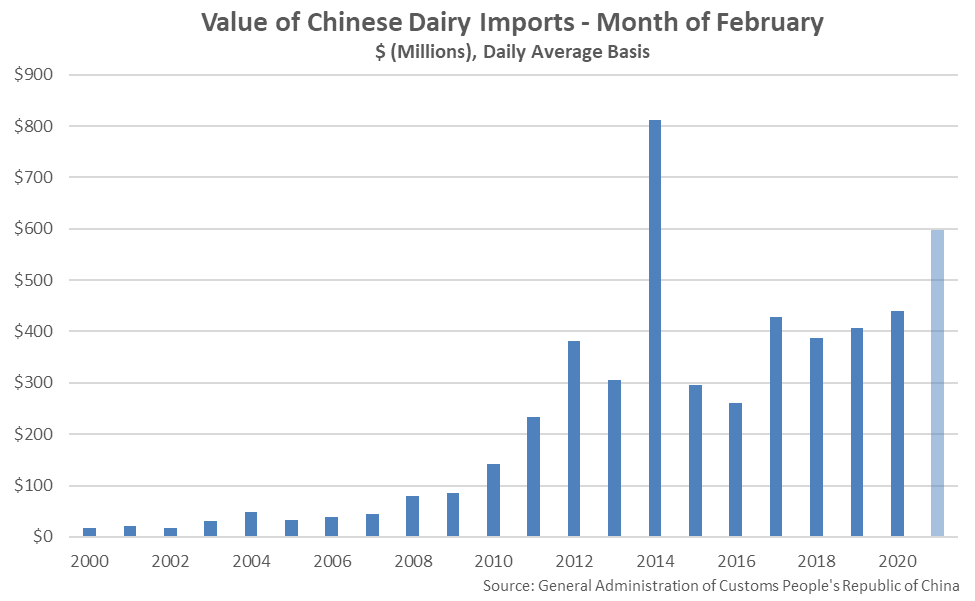

Feb ’21 Total Chinese Dairy Imports Reached a Seven Year High Seasonal Level

The Feb ’21 YOY Increase in Chinese Dairy Imports was the 18th Experienced in a Row

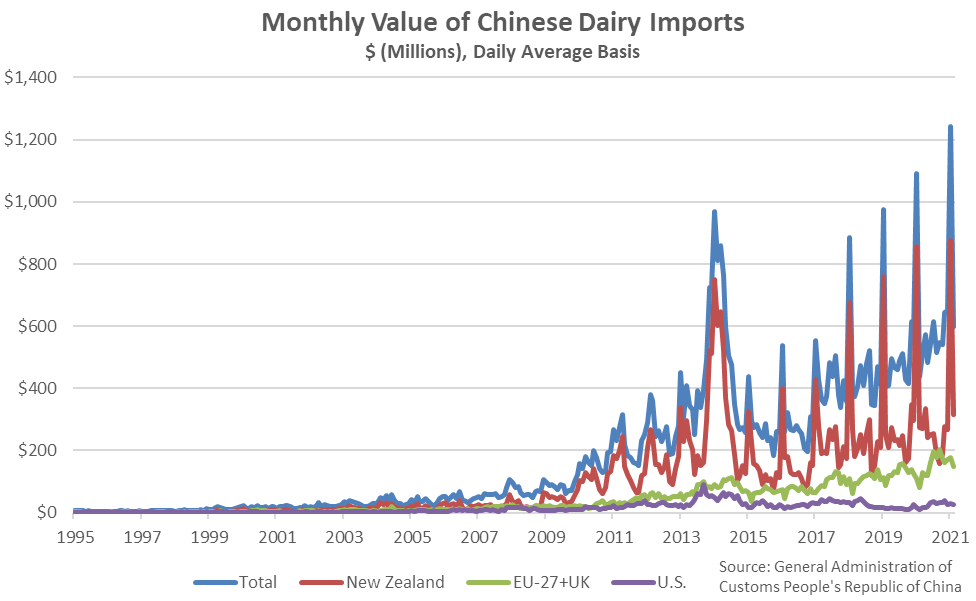

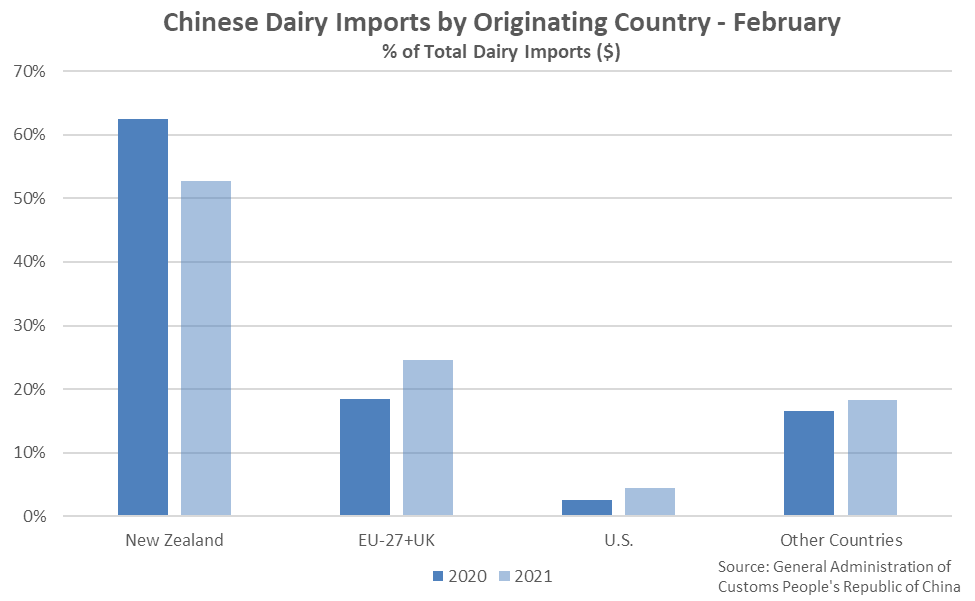

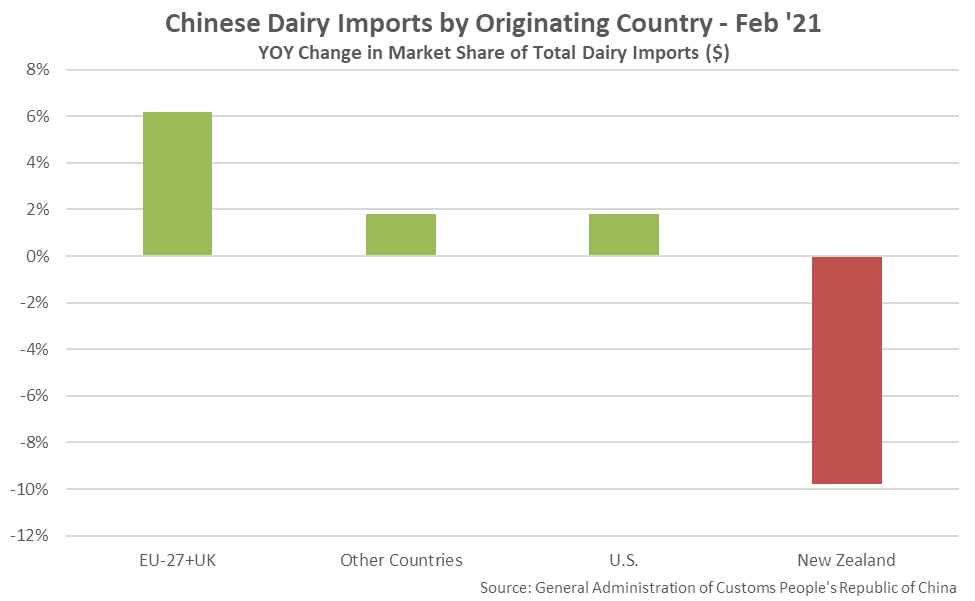

New Zealand & the EU-27+UK Accounted for 77% of Total Feb ’21 Chinese Dairy Imports

The Feb ’21 EU-27+UK Share of Total Chinese Dairy Imports Increased Most Significantly YOY

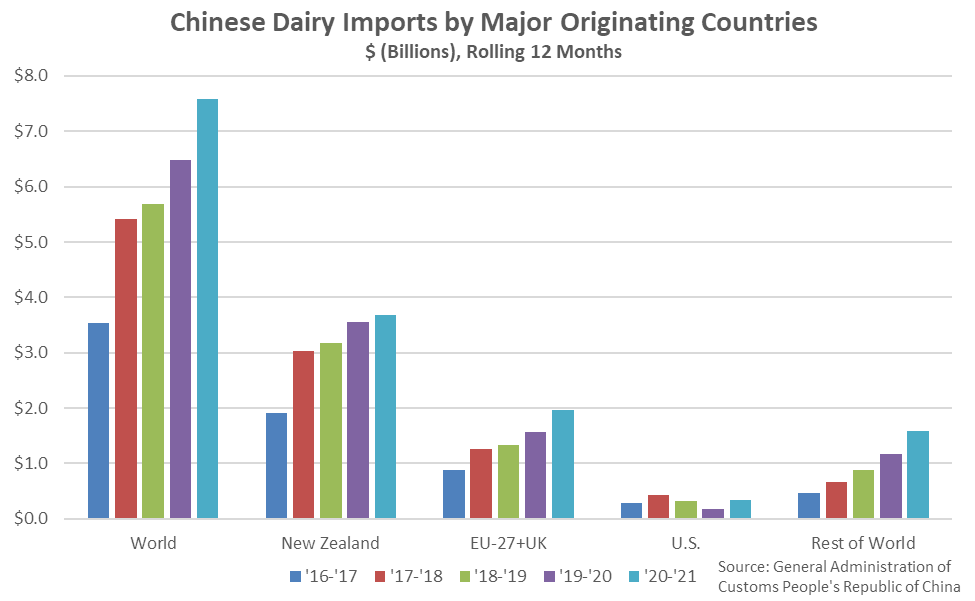

Chinese Dairy Imports From the EU-27+UK up the Most Over the Past 12 Months

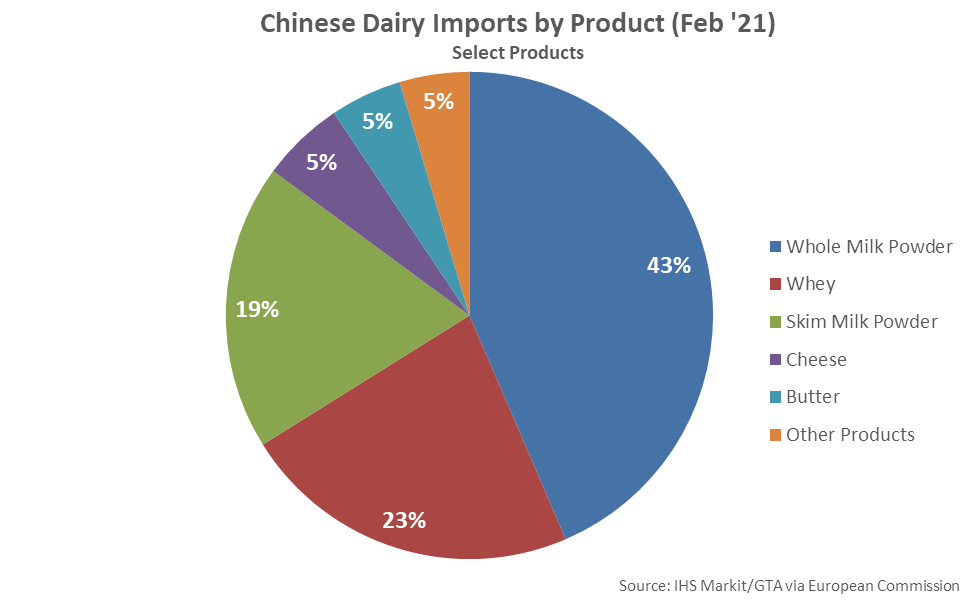

Whole Milk Powder Accounted for Nearly Half of All Feb ’21 Chinese Dairy Imports

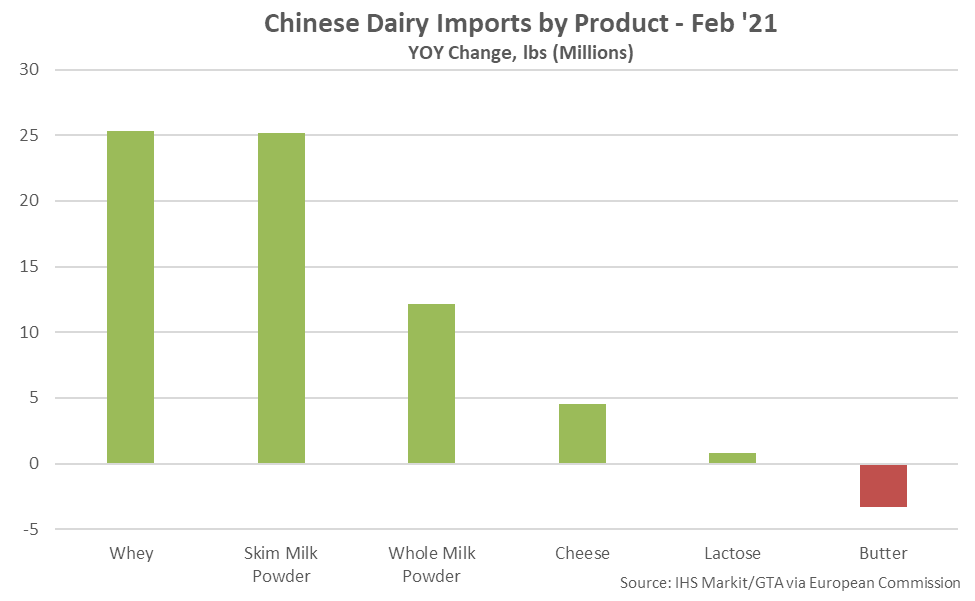

Feb ’21 YOY Increases in Chinese Dairy Imports led by Whey, Followed by SMP and WMP

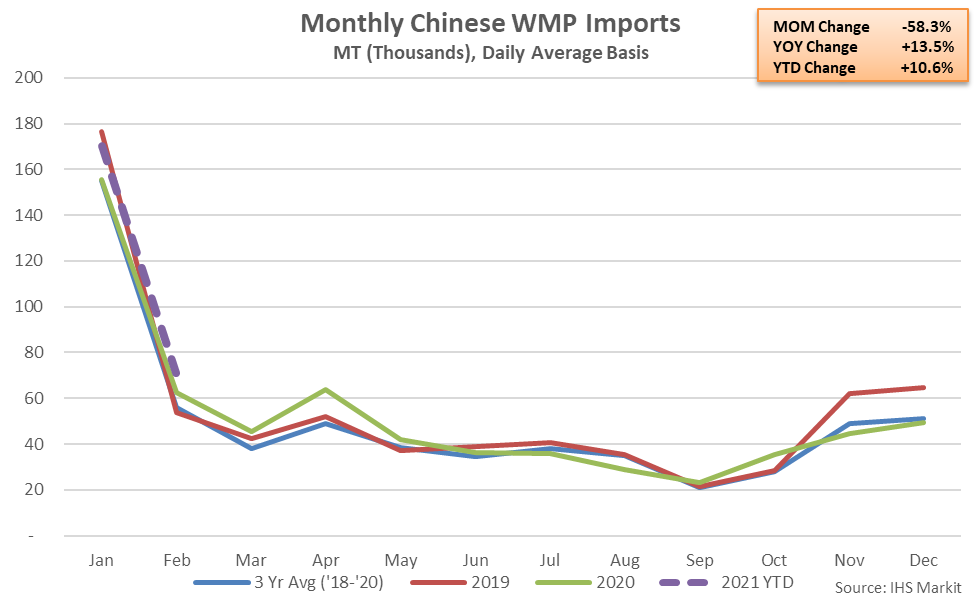

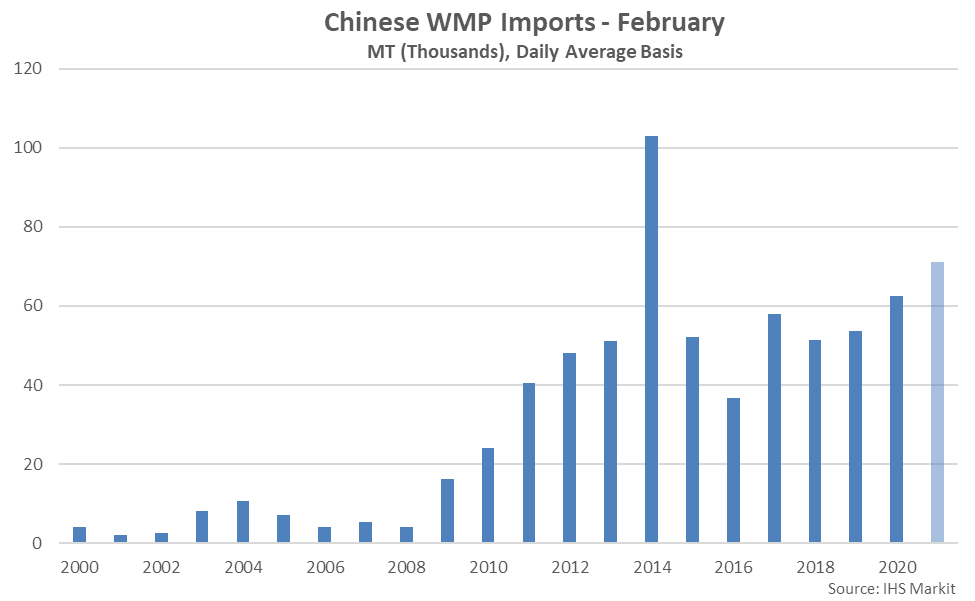

Feb ’21 Chinese WMP Import Volumes Declined 58.3% MOM but Remained up 13.5% YOY

Feb ’21 Chinese WMP Imports Reached the Second Highest Seasonal Level on Record

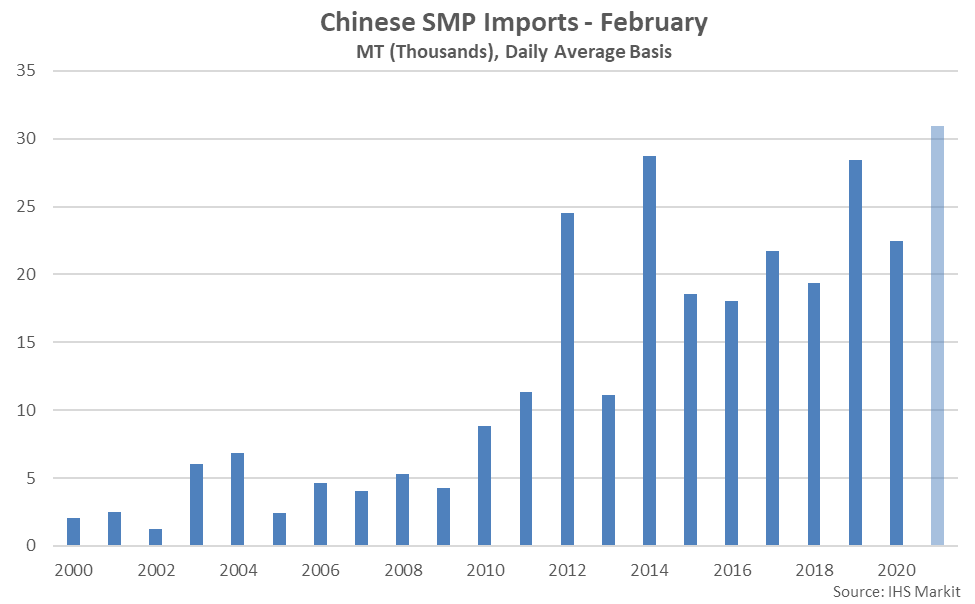

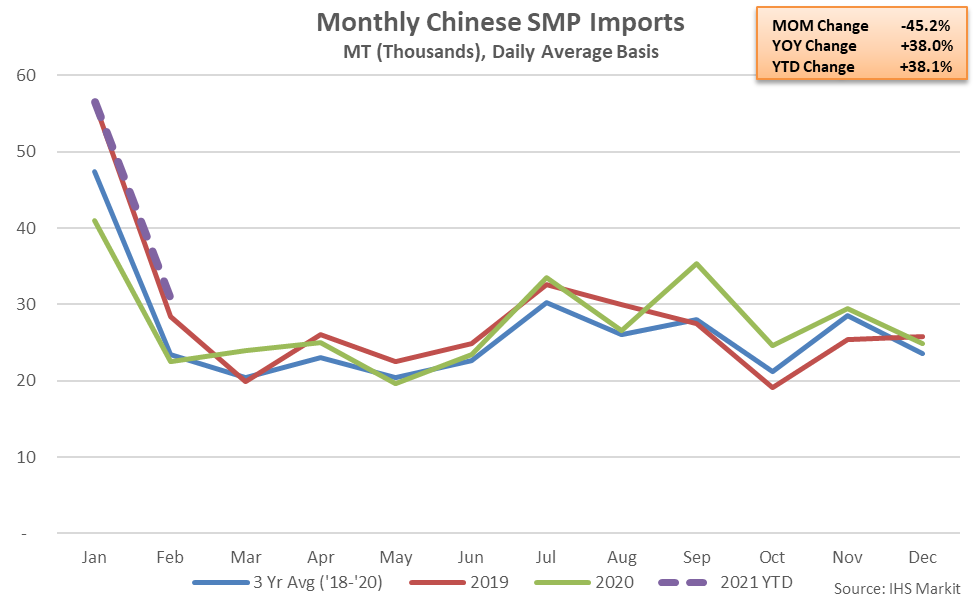

Feb ’21 Chinese SMP Import Volumes Declined 45.2% MOM but Remained up 38.0% YOY

Feb ’21 Chinese SMP Imports Reached a Record High Seasonal Level