Quarterly Grain Stocks Update – Mar ’21

Corn – Mar 1st Stocks Decline 3.2% From the Previous Year, Finish Below Expectations

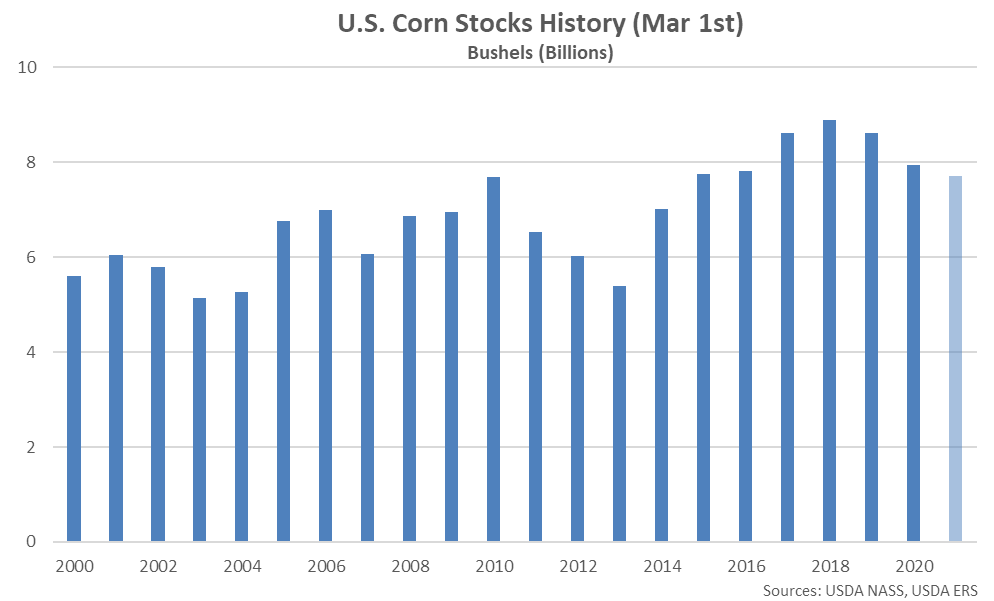

Corn stored in all positions as of March 1st, 2021 totaled 7.70 billion bushels, down 3.2% from the previous year and reaching a seven year low seasonal level. Corn stocks finished 0.9% below average analyst estimates of 7.77 billion bushels. Stocks indicated disappearance of 3.59 billion bushels from the previous quarter, 6.4% greater than the drawdown experienced during the same period last year.

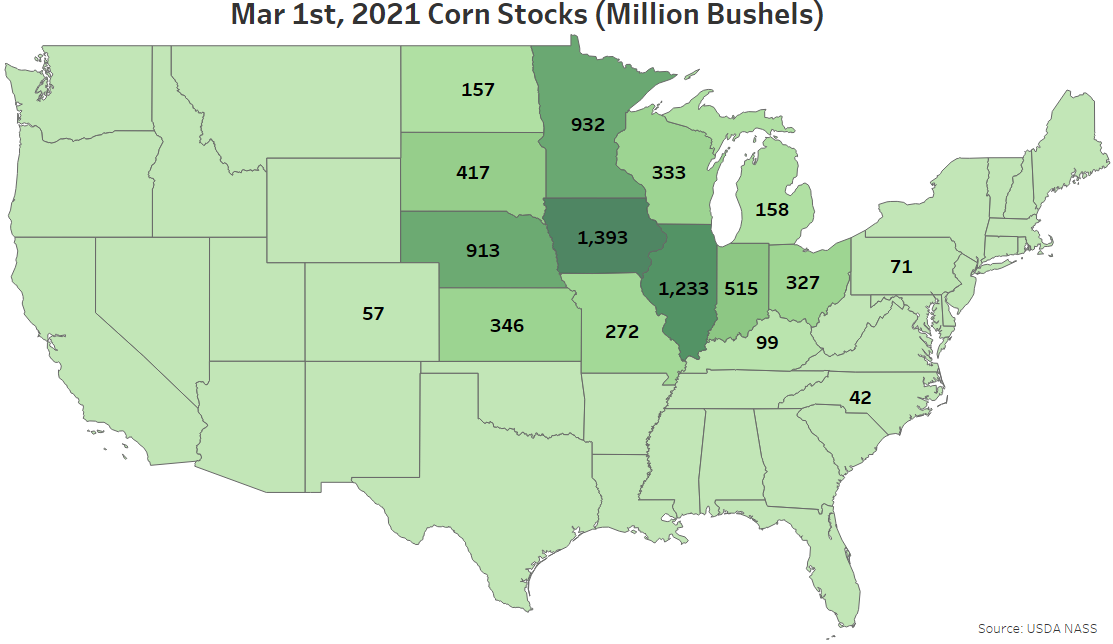

Mar 1st corn stocks were most significant within Iowa, followed by Illinois and Minnesota. The aforementioned states combined to account for nearly half of the total U.S. corn stocks.

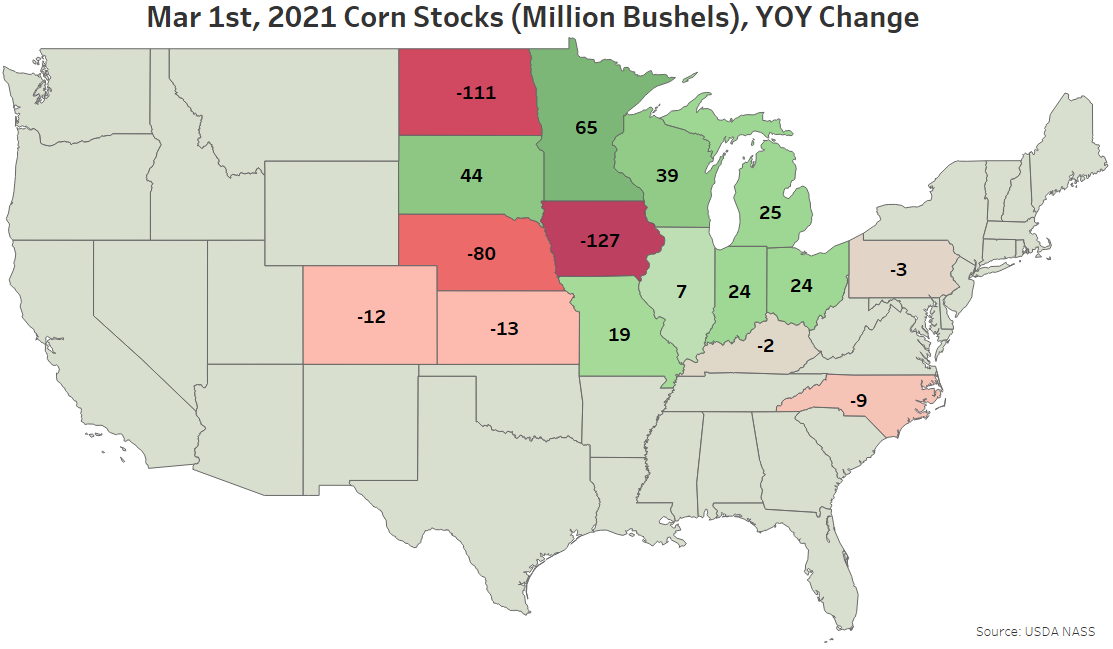

The most significant YOY declines in Mar 1st corn stocks were experienced throughout Iowa, followed by North Dakota and Nebraska. Minnesota experienced the largest YOY increase in corn stocks.

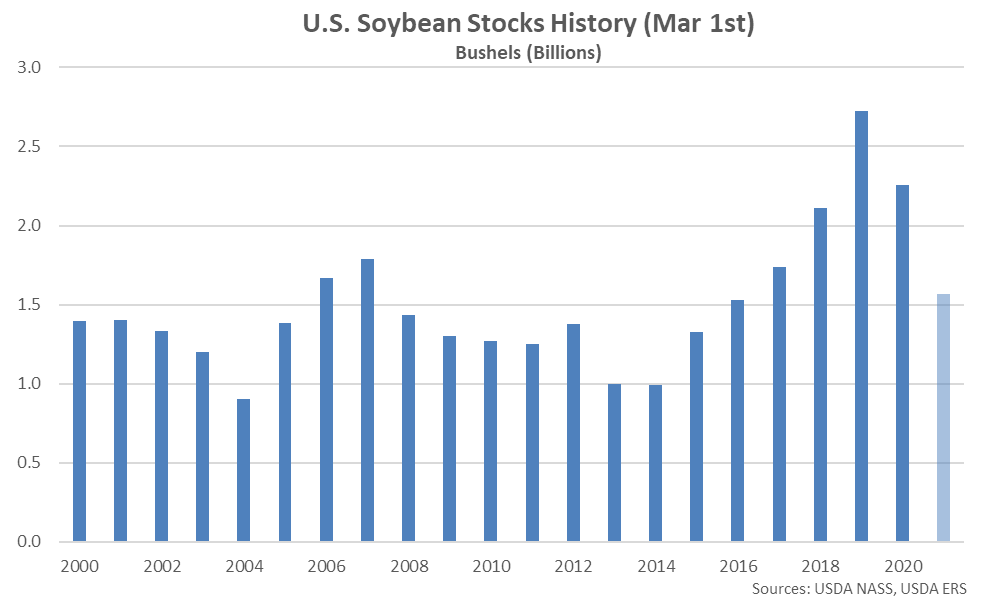

Soybeans – Mar 1st Stocks Decline 30.6% From the Previous Year but Finish Above Expectations

Soybeans stored in all positions as of March 1st, 2021 totaled 1.56 billion bushels, down 30.6% from the previous year and reaching a five year low seasonal level. Soybean stocks finished 1.4% above average analyst estimates of 1.54 million bushels, however. Stocks indicated disappearance of 1.38 billion bushels from the previous quarter, 38.6% greater than the drawdown experienced during the same period last year.

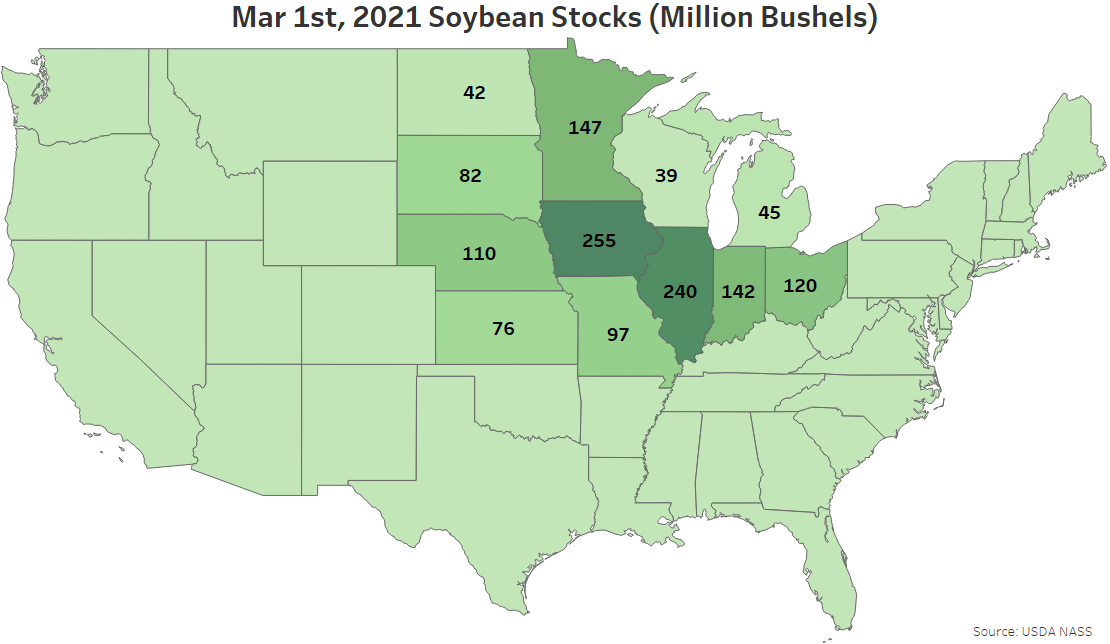

Mar 1st soybean stocks were most significant within Iowa, followed by Illinois and Minnesota. The aforementioned states combined to account for over 40% of the total U.S. soybean stocks.

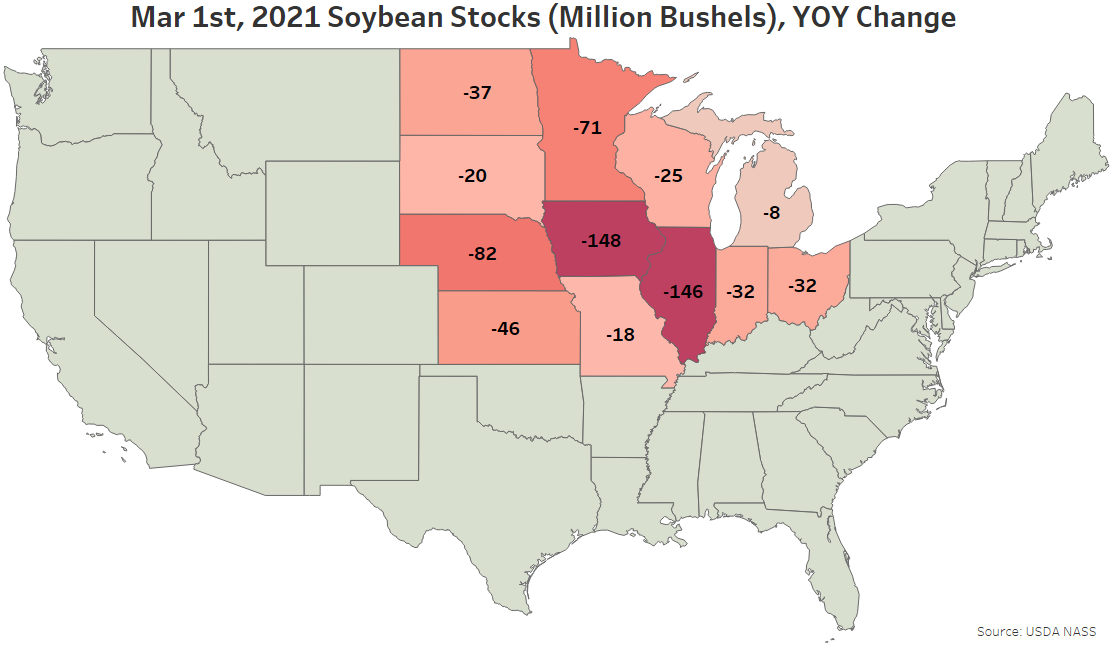

The most significant YOY declines in Mar 1st soybean stocks were experienced throughout Iowa, followed by Illinois and Nebraska. YOY declines in soybean stocks were widespread across states with provided data.

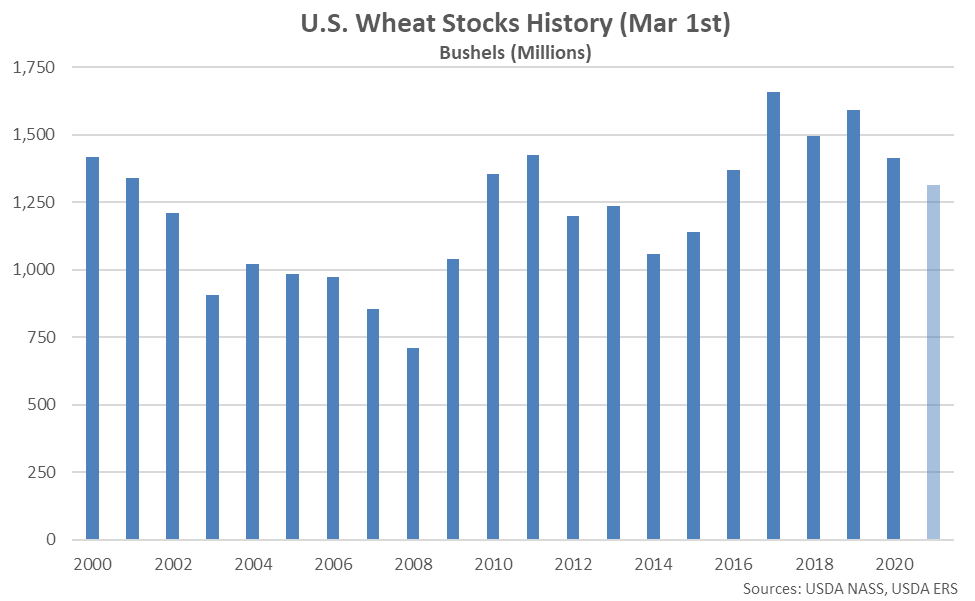

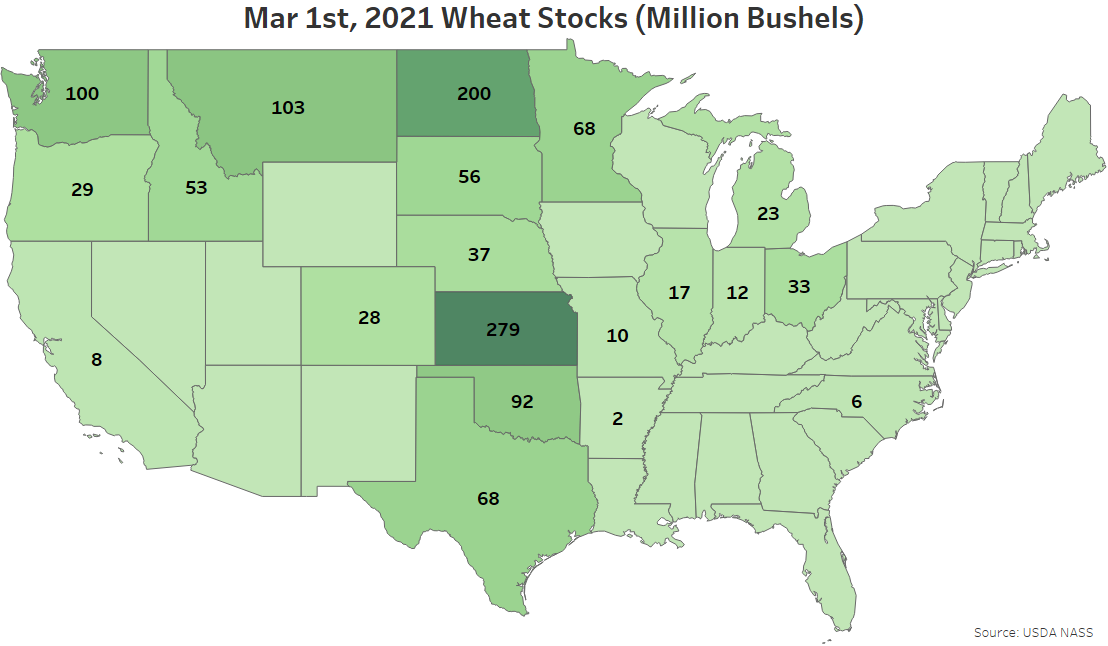

Wheat – Mar 1st Stocks Decline 7.1% From the Previous Year but Finish Above Expectations

Wheat stored in all positions as of March 1st, 2021 totaled 1.31 billion bushels, finishing 7.1% below the previous year and reaching a six year low seasonal level. Wheat stocks finished 3.3% above average analyst estimates of 1.27 billion bushels, however. Stocks indicated disappearance of 388 million bushels from the previous quarter, 8.7% below the drawdown experienced during the same period last year.

Mar 1st wheat stocks were most significant within Kansas, followed by North Dakota and Montana. The aforementioned states combined to account for over 40% of the total U.S. wheat stocks.

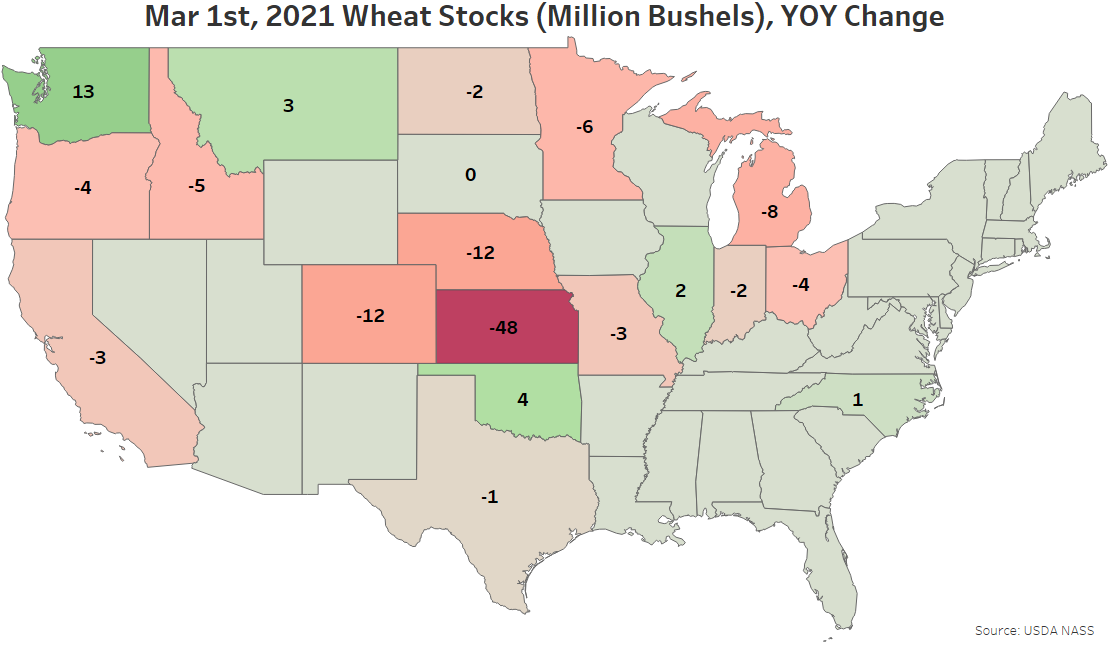

The most significant YOY declines in Mar 1st wheat stocks were experienced throughout Kansas, followed by Nebraska and Colorado. Washington experienced the largest YOY increase in wheat stocks.