U.S. Oil Rig Count Update – 4/21/21

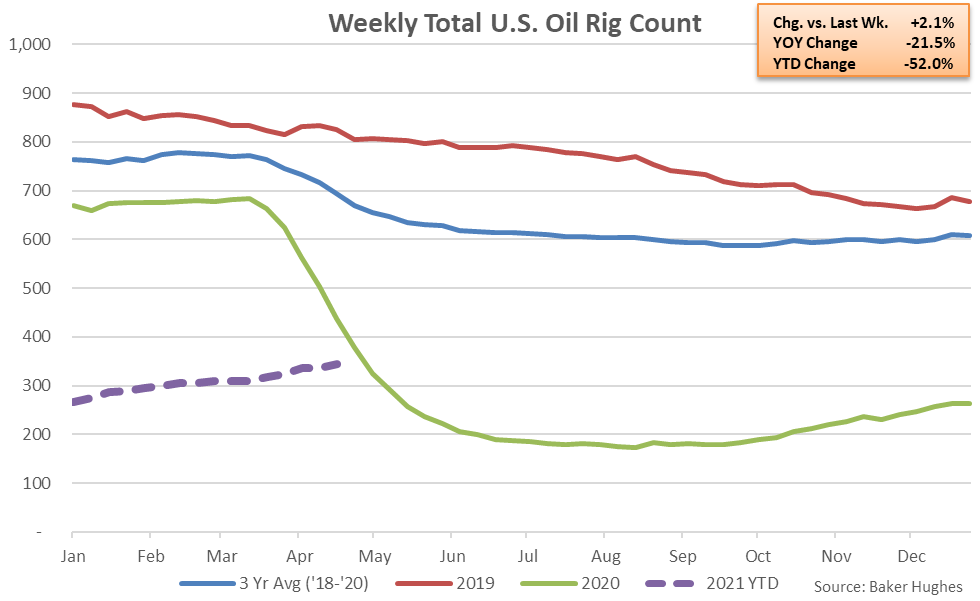

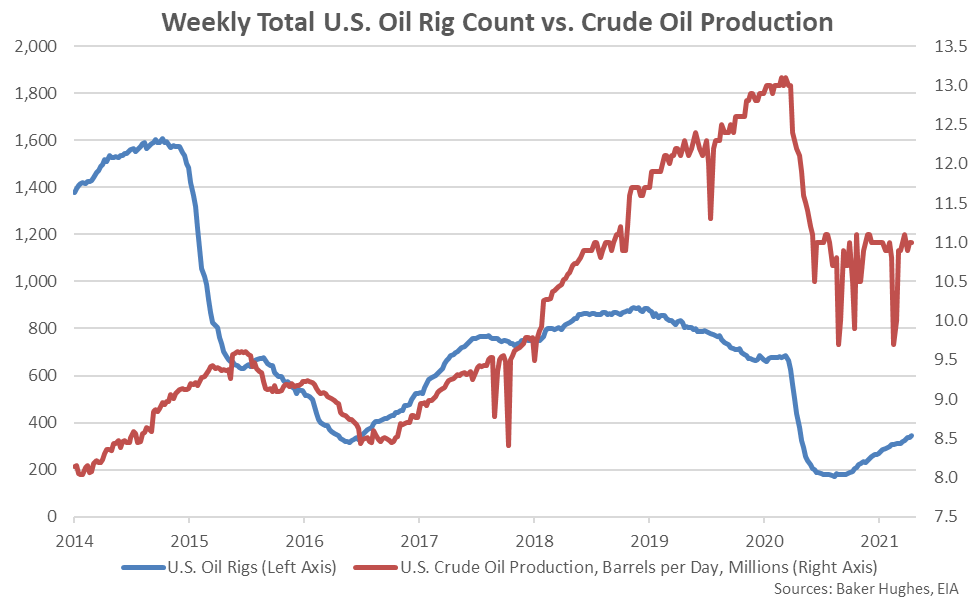

According to Baker Hughes, U.S. oil rig counts rebounded to an 11 month high level during the week ending Apr 16th but remained significantly lower on a YOY basis. Apr 16th week ending oil rig counts increased 2.1% from the previous week but remained 21.5% lower on a YOY basis and 61.3% below the three and a half year high levels experienced during November of 2018. Oil rig counts have increased over 26 of the past 30 weeks through the week ending Apr 16th. Oil rig counts had declined over 24 of 27 weeks through mid-September.

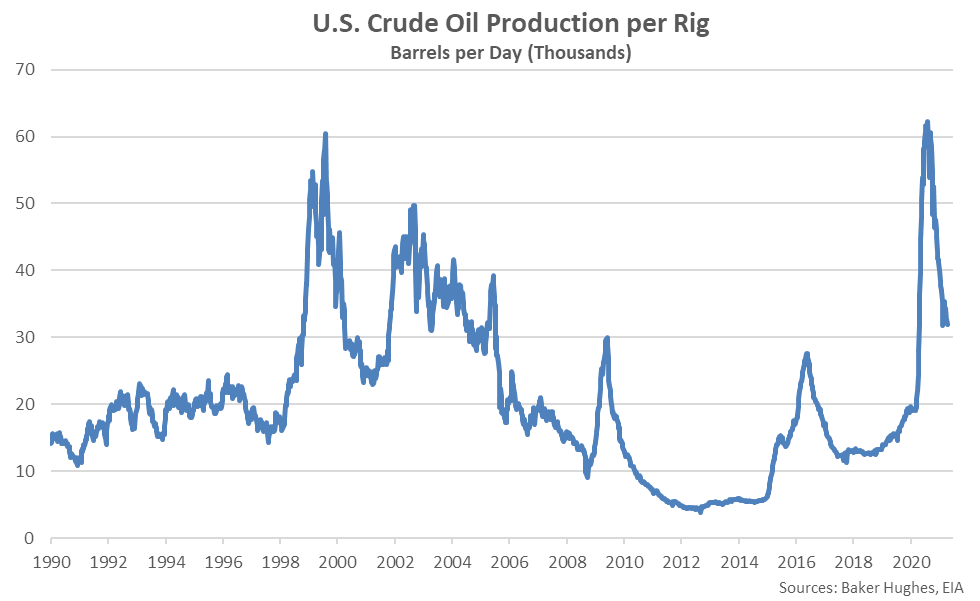

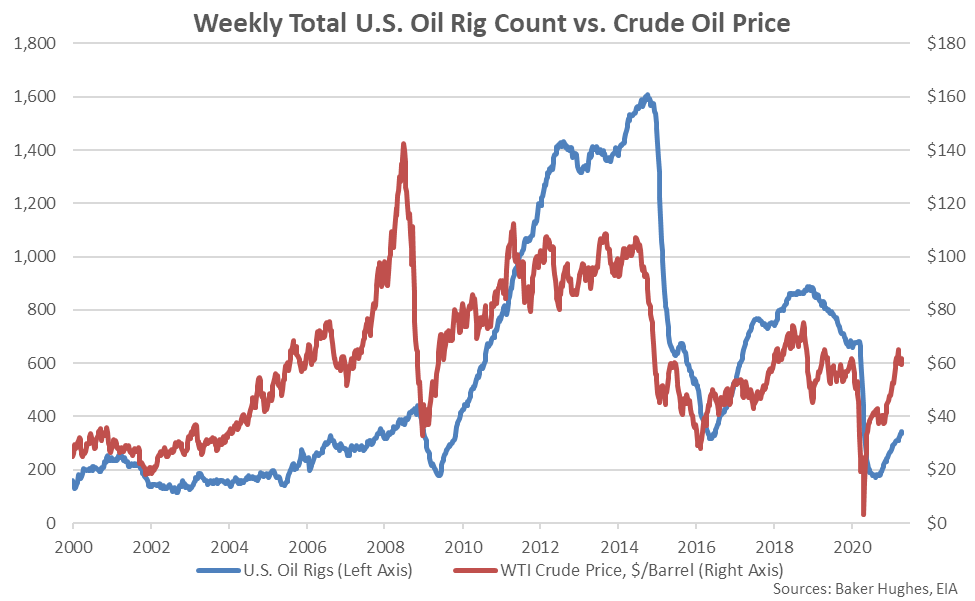

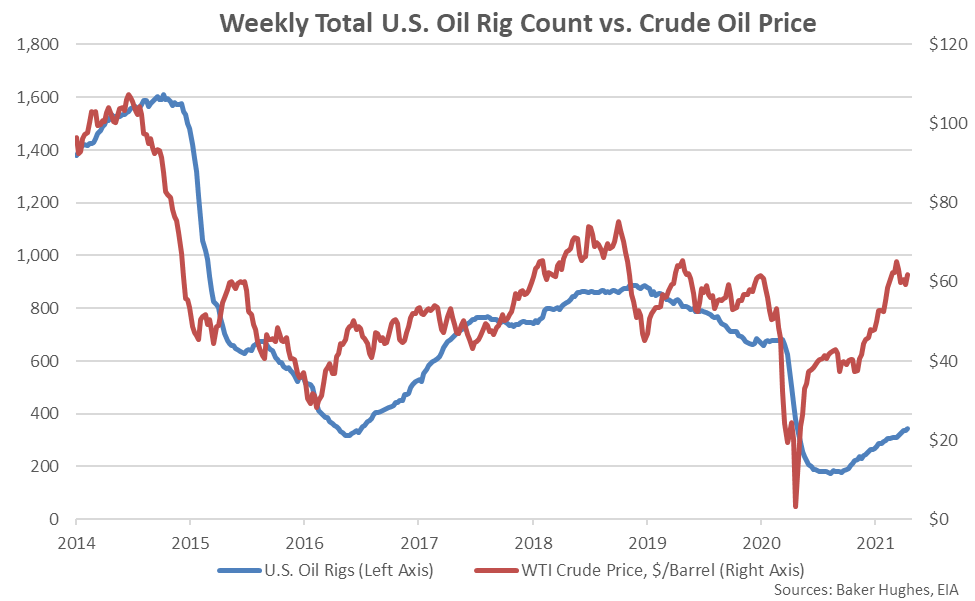

Oil rig counts have declined in response to lower WTI crude oil prices, which rebounded to a 28 month high level during early Mar ’21 but remained 18% below the Oct ’18 highs during the week ending Apr 16th. Crude oil production volumes have rebounded from the three year low levels associated with deep freeze related slowdowns but remained 16% below the Mar ’20 record high levels during the week ending Apr 16th. Oil production per rig remained historically high, finishing above recently experienced nine month low levels.

Oil Rig Counts Peaked in Late 2014, Prior to Declining Sharply in Early 2015

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

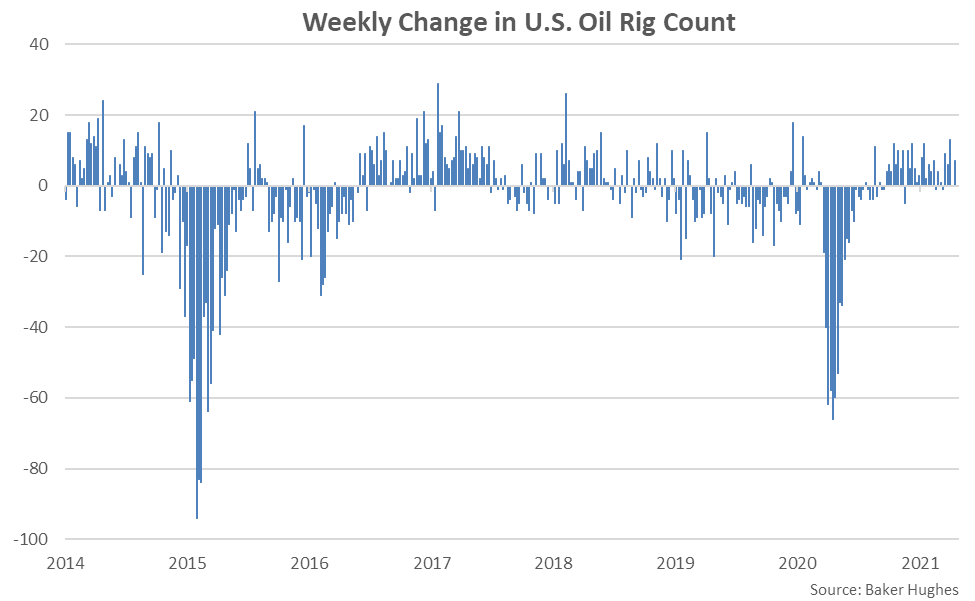

Apr 16th Oil Rig Counts Increased 2.1% Week-Over-Week but Remained 21.5% Lower YOY

Oil Rigs Have Increased Over 26 of the Past 30 Weeks Through the Week Ending Apr 16th

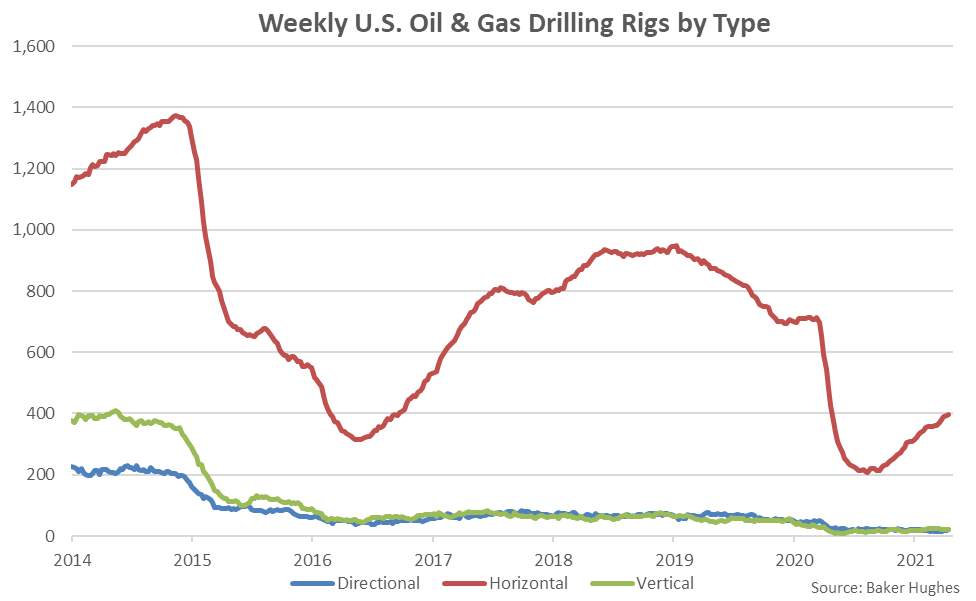

Horizontal Rigs Have Accounted for Over 97% of the Rebound in Total Rigs Since Mid-August

Apr 16th Crude Oil Production Remained 16% Below the Mar ’20 Record High Levels

Apr 16th Crude Oil Production per Rig Remained Above Recent Nine Month Lows