U.S. Oil Rig Count Update – 8/4/21

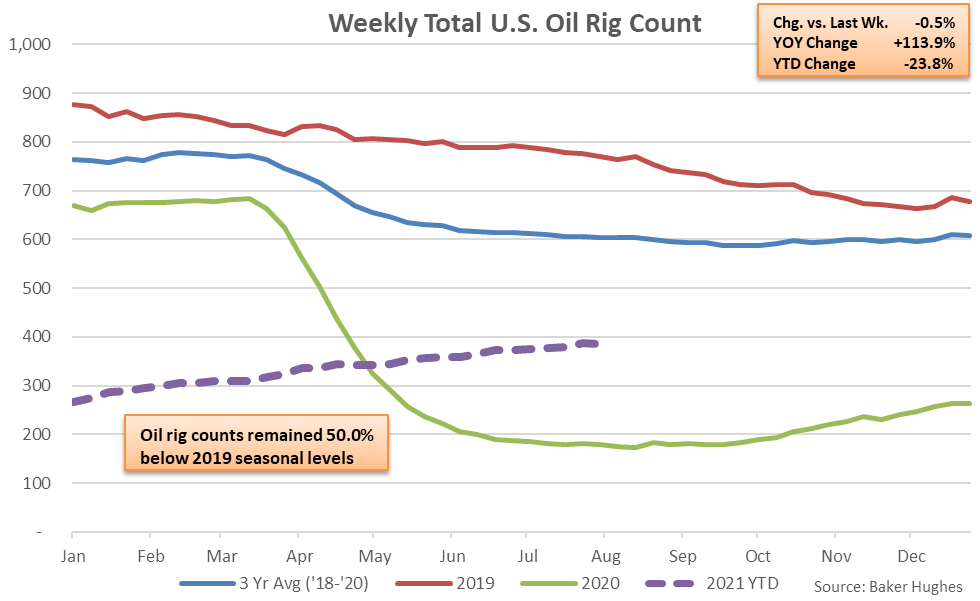

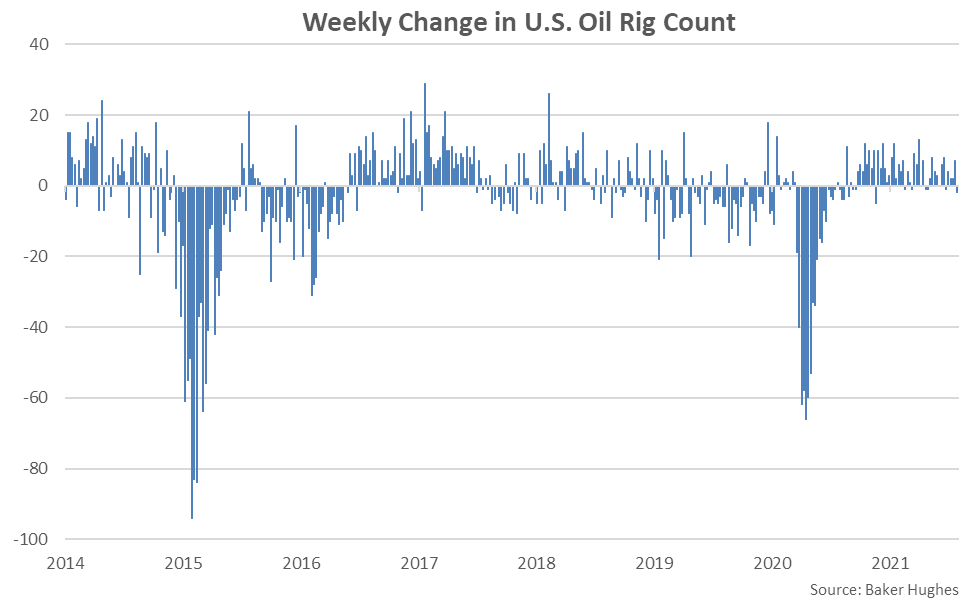

According to Baker Hughes, U.S. oil rig counts remained near recently experienced 15 month high levels during the week ending Jul 30th. Jul 30th week ending oil rig counts declined 0.5% from the previous week but finished 113.9% above previous year levels. Oil rig counts remained 56.6% below the three and a half year high levels experienced during November of 2018, however. Oil rig counts have increased over 36 of the past 45 weeks through the week ending Jul 30th, despite the most recent decline. Oil rig counts had declined over 24 of 27 weeks through mid-Sep ’20.

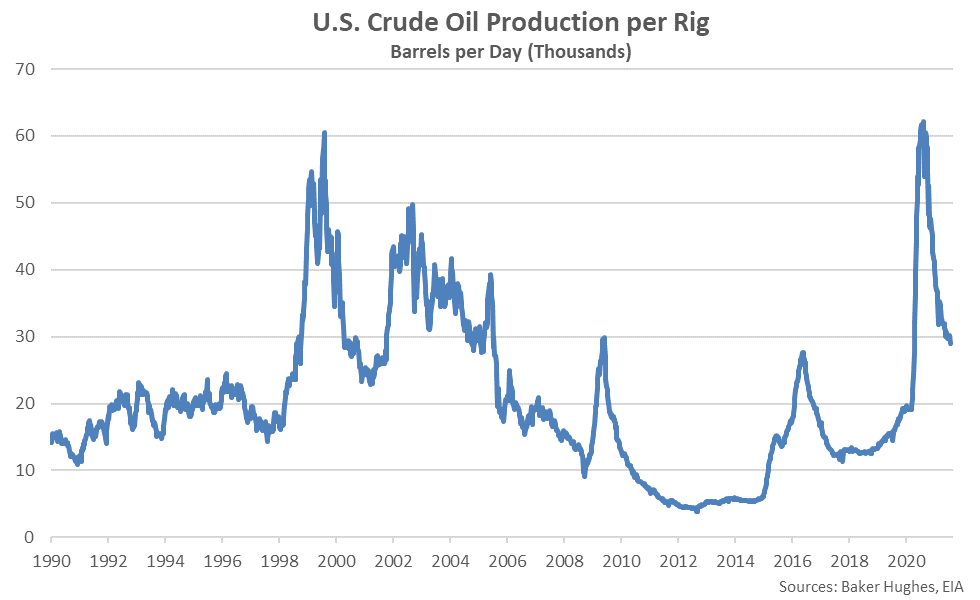

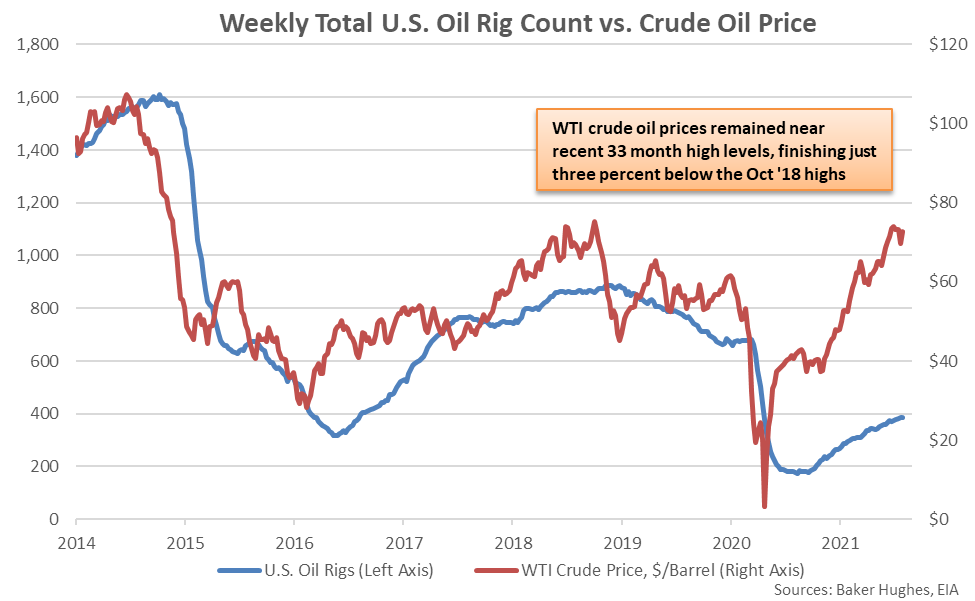

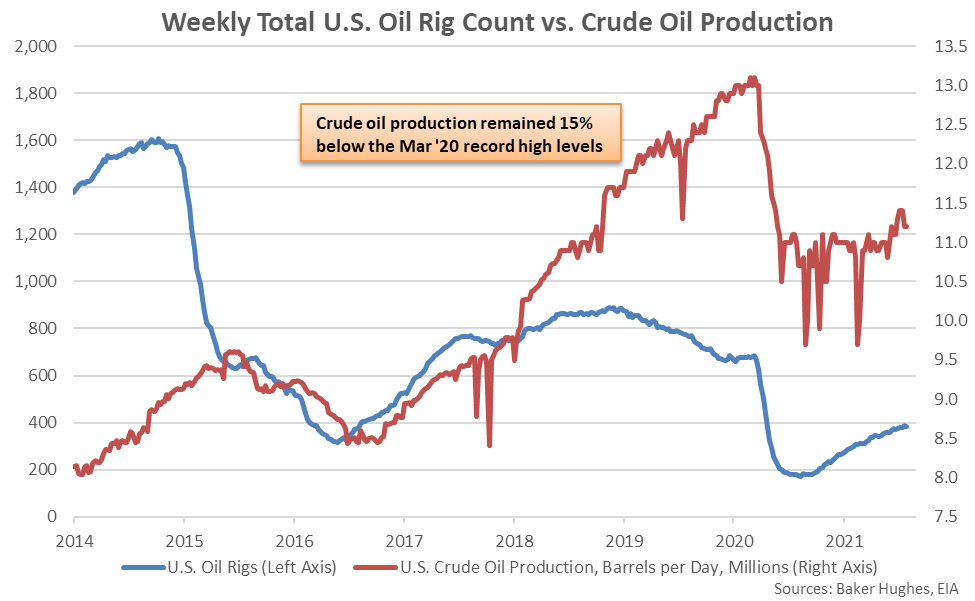

Oil rig counts declined throughout the first half of 2020 in response to lower WTI crude oil prices, which remained near recently experienced 33 month high levels and finished just three percent below the Oct ’18 highs during the week ending Jul 30th. Crude oil production volumes remained near recently experienced 13 month high levels during the week ending Jul 30th but finished 15% below the Mar ’20 record high levels. Oil production per rig remained near recently experienced 15 month low levels but remained historically high, overall.

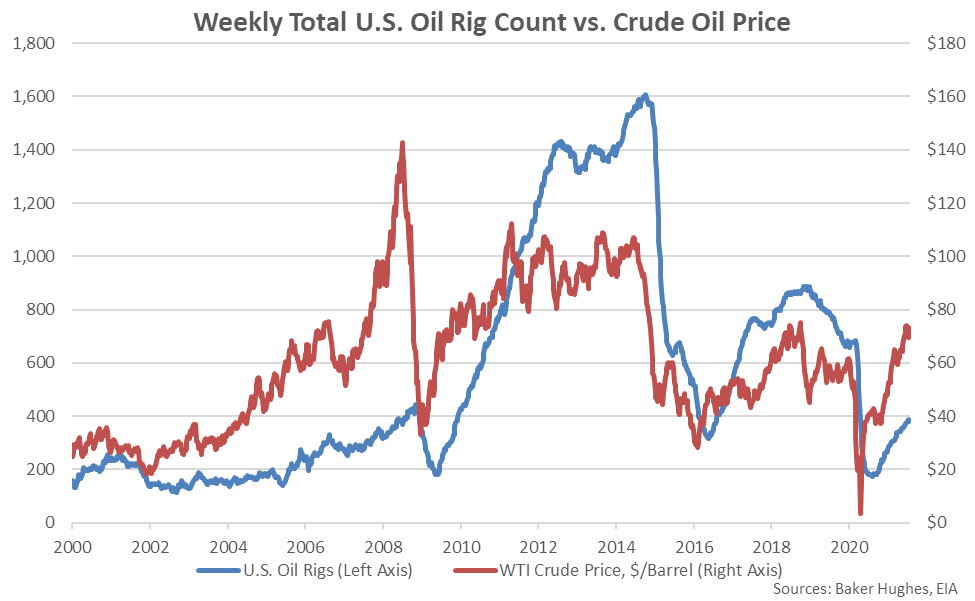

Oil Rig Counts Peaked in Late 2014, Prior to Declining Sharply in Early 2015

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2017-2018

Jul 30th Oil Rig Counts Declined 0.5% Week-Over-Week but Finished 113.9% Higher YOY

Oil Rigs Have Increased Over 36 of the Past 45 Weeks Through the Week Ending Jul 30th

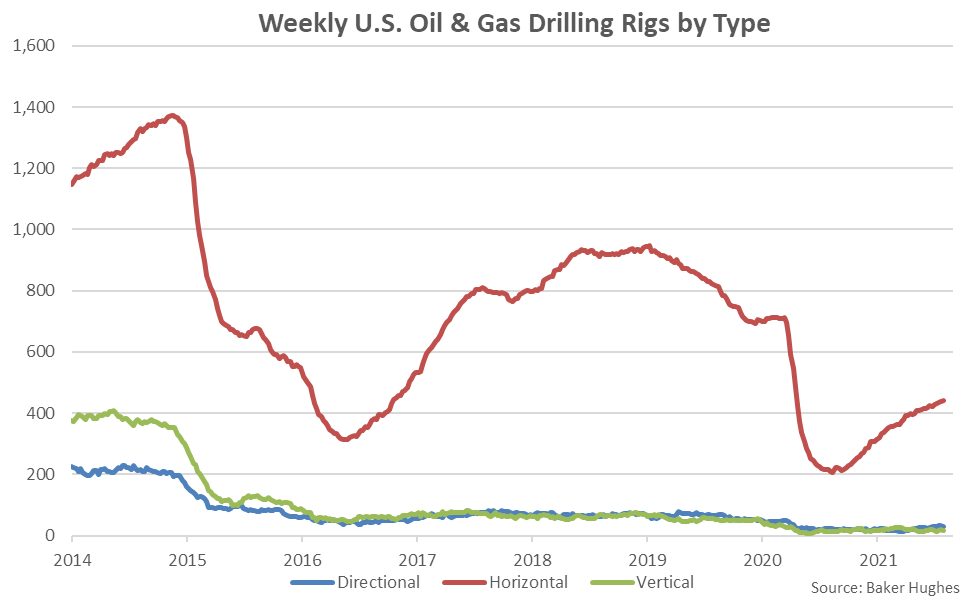

Horizontal Rigs Have Accounted for Over 96% of the Rebound in Total Rigs Since Mid-August

Jul 30th Crude Oil Production Finished Slightly Below Recent 13 Month High Levels

Jul 30th Crude Oil Production per Rig Remained Near Recent 15 Month Low Levels