Soybean Complex Crushing & Stocks Update – Sep ’21

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Jul ’21. Highlights from the updated report include:

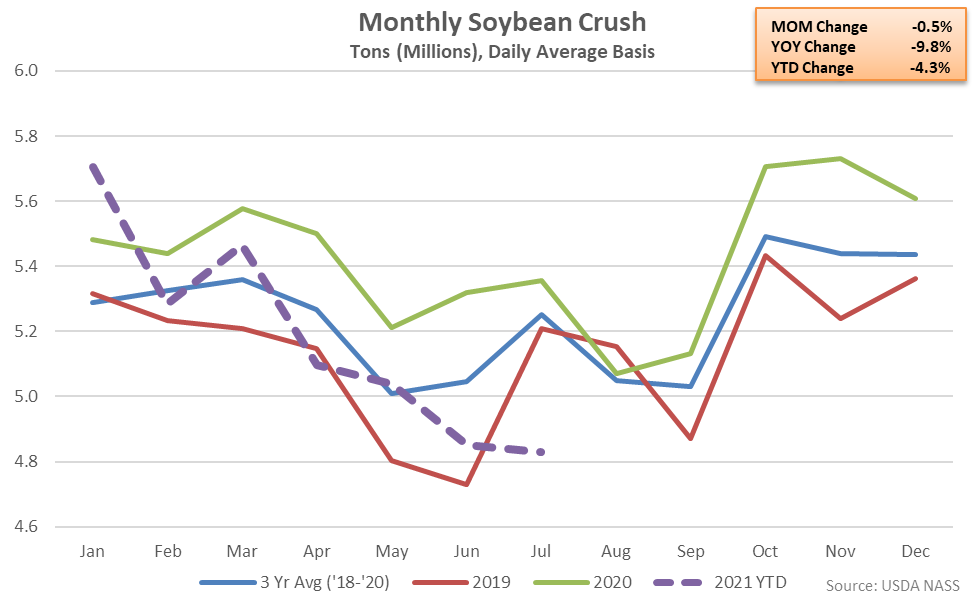

- U.S. soybean crushings declined 9.8% on a YOY basis throughout Jul ’21, finishing lower for the sixth consecutive month.

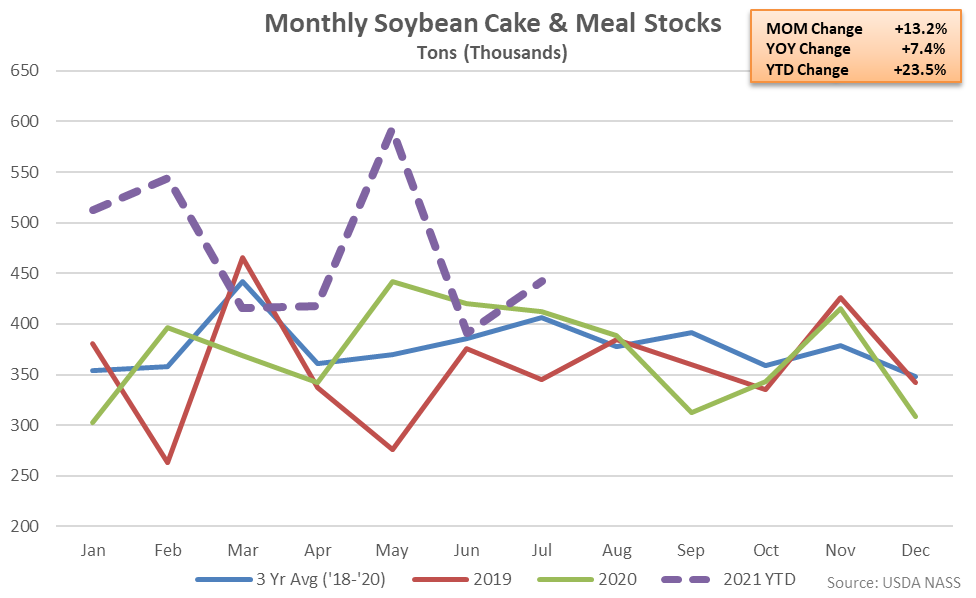

- Jul ’21 U.S. soybean cake & meal stocks remained higher on a YOY basis for the sixth time in the past seven months, finishing 7.4% above the previous year and reaching a three year high seasonal level.

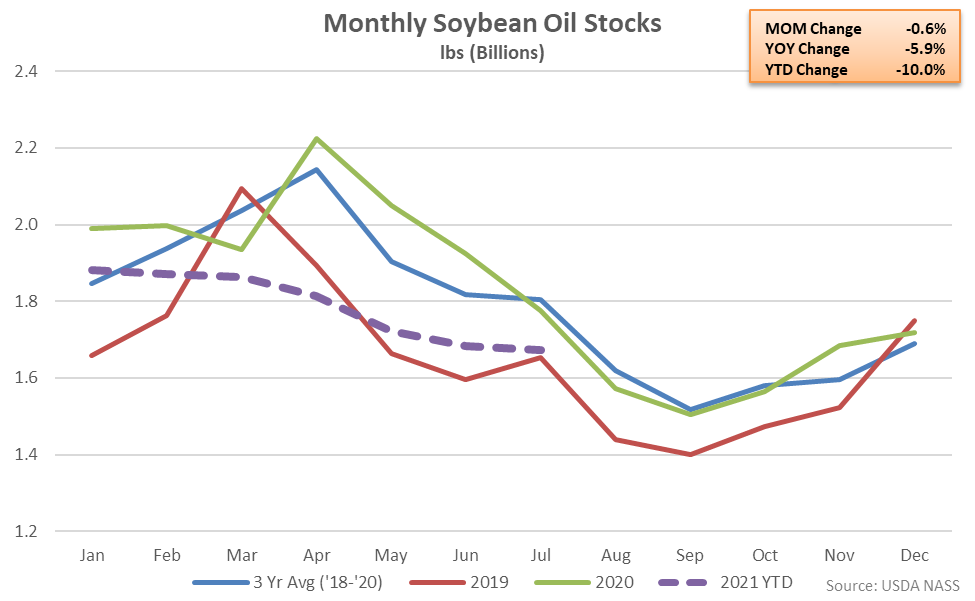

- Jul ’21 U.S. soybean oil stocks remained lower on a YOY basis for the eighth consecutive month, finishing 5.9% below previous year levels.

Additional Report Details

Soybean Crushing – Crush Declines YOY for the Sixth Consecutive Month, Finishes Down 9.8%

According to the USDA, Jul ’21 U.S. soybean crushings declined to a two year low level, finishing 9.8% below previous year levels. The YOY decline in soybean crushings was the sixth experienced in a row. Soybean crushings had reached record high seasonal levels over five consecutive months through Jan ’21, prior to declining on a YOY basis throughout the six most recent months of available data.

Jul ’21 YOY declines in soybean crushings were largest throughout the North & East states of Indiana, Kentucky, Maryland, Ohio, Pennsylvania and Virginia. The 0.5% month-over-month decline in soybean crushings was a slight contraseasonal move when compared to the five year average June – July seasonal increase of 2.2%. 2020 annual soybean crushings finished 5.6% higher on a YOY basis, reaching a record high annual level, however 2021 YTD crushings have declined by 4.3% throughout the first seven months of the calendar year.

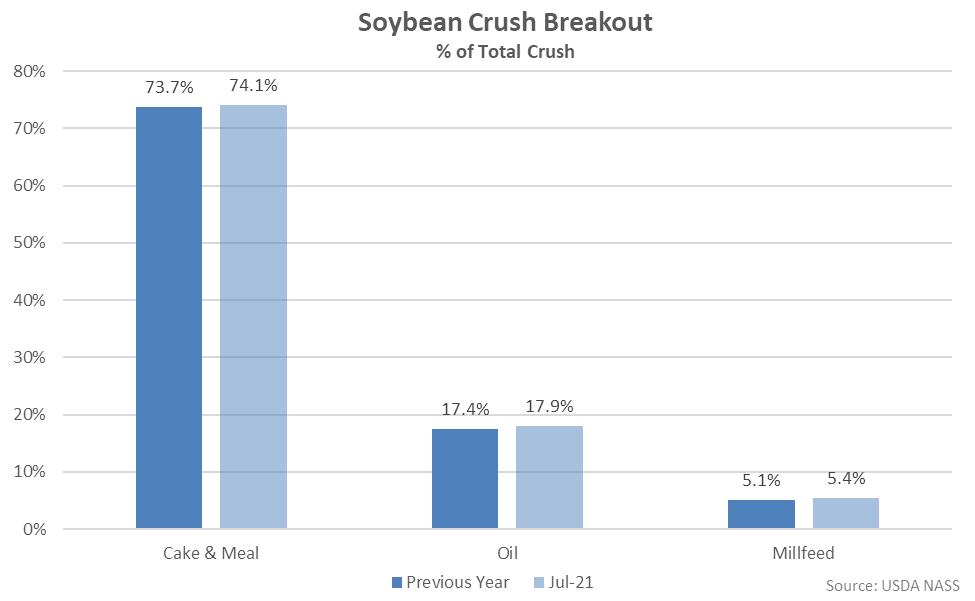

Cake & meal accounted for 74.1% of the total soybean crush throughout Jul ’21, up slightly from the previous year, while oil accounted for 17.9% of the total soybean crush, also up from the previous year.

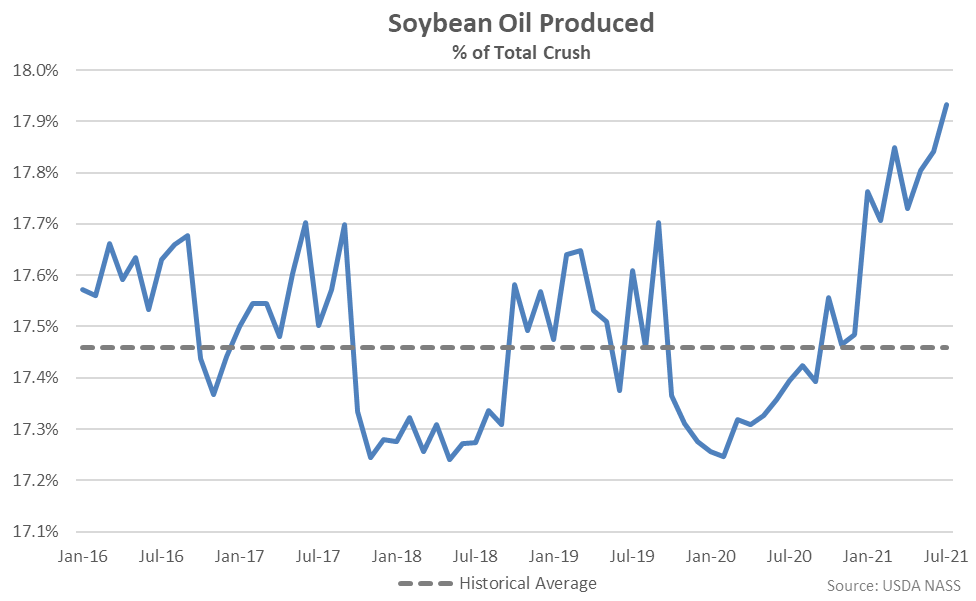

Jul ’21 soybean oil produced as a percentage of total crush remained above historical average figures for the tenth consecutive month, reaching a record high monthly level.

Soybean Cake & Meal Stocks – Stocks Finish Higher YOY for the Sixth Time in Seven Months, up 7.4%

Jul ’21 U.S. soybean cake & meal stocks rebounded from the previous month while finishing 7.4% above previous year levels, reaching a three year high seasonal level. The YOY increase in soybean cake & meal stocks was the sixth experienced throughout the past seven months. The month-over-month increase in soybean cake & meal stocks of 13.2% was smaller than the five year average June – July seasonal increase in stocks of 18.0%.

Soybean Oil Stocks – Stocks Remain Lower YOY for the Eighth Consecutive Month, Down 5.9%

U.S. soybean oil stocks declined seasonally to a nine month low level throughout Jul ’21 while finishing 5.9% below previous year levels. Soybean oil stocks have finished lower on a YOY basis over eight consecutive months through Jul ’21. The month-over-month decline in soybean oil stocks of 0.6% was smaller than the five year average June – July seasonal decline of 4.1%.