Dairy Pandemic Market Volatility Assistance Program Overview – Sep…

Program Overview

The U.S. Department of Agriculture recently announced details of the $350 million Pandemic Market Volatility Assistance Program (PMVAP) which will provide payments to dairy farmers who received a lower value for their products due to market abnormalities caused by the pandemic. Within PMVAP, qualified dairy farmers will receive payments for 80% of the revenue difference per month based on an annual production of up to five million pounds of milk marketed and on fluid milk sales from July through December of 2020. To be eligible for payments, a person or entity must have an average adjusted gross income of less than $900,000 for tax years 2016, 2017 and 2018, unless 75% or more of their income is derived from farming, ranching, or forestry-related activities. USDA will make payments through agreements with independent handlers and cooperatives.

Payment Rates

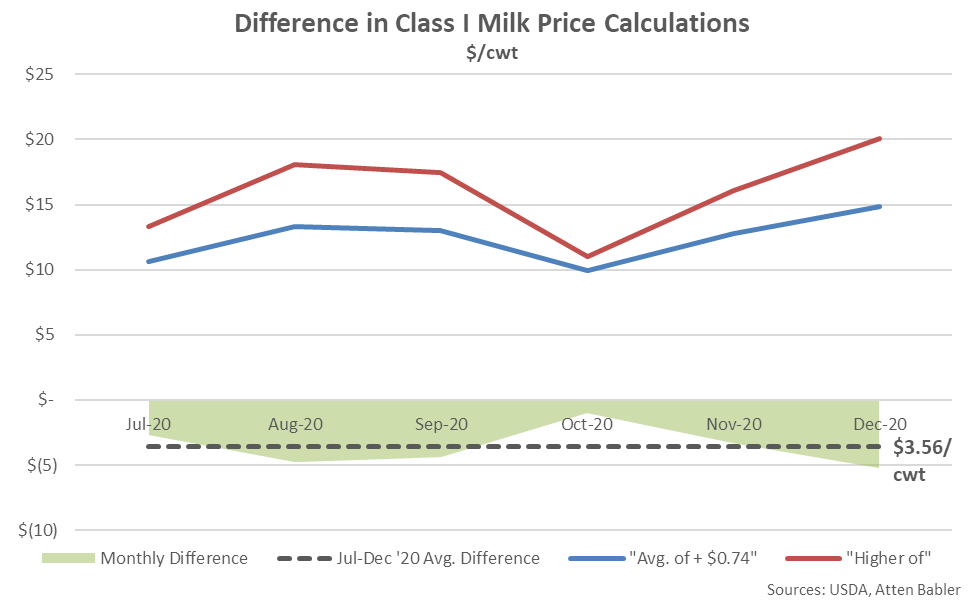

Payment rates will vary regionally based on the actual losses on pooled milk related to price volatility. PMVAP payments will compensate producers for 80% of the difference between Class I milk prices derived from the “higher of Class III and Class IV skim milk pricing factors” and the “average of Class III and Class IV skim milk pricing factors, plus $0.74”. Throughout the Jul – Dec ’20 period, the difference amounted to $3.56/cwt.

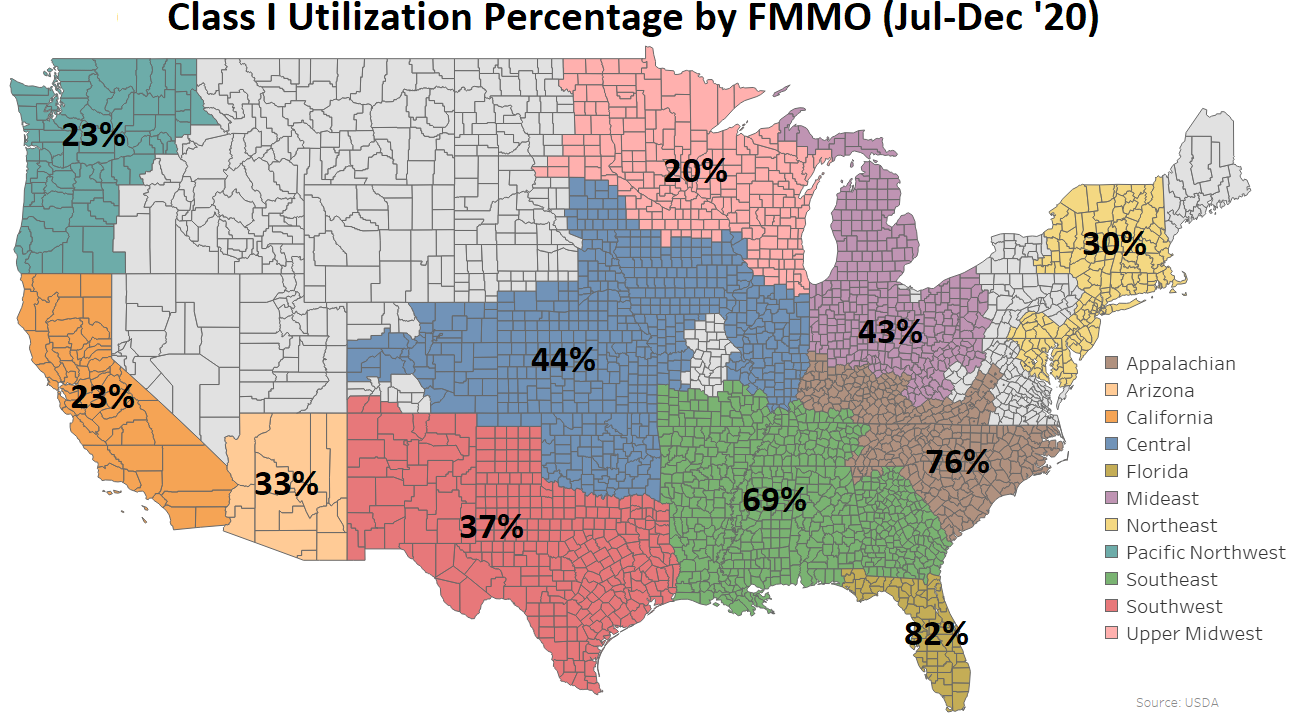

The $3.56/cwt difference between Class I milk prices, multiplied by the 80% compensation rate and the regional Class I utilization rate results in estimated potential payment rates. For producers with a 20% regional Class I utilization rate, the hypothetical potential PMVAP payment would work out to $0.57/cwt ($3.56/cwt * 80% * 20%). The Upper Midwest Federal Milk Marketing Order (FMMO), which includes the majority of the states of Wisconsin and Minnesota, exhibited a Class I utilization percentage of 20% throughout the Jul – Dec ’20 period. For comparison, the California FMMO exhibited a 23% Class I utilization percentage over the same period.

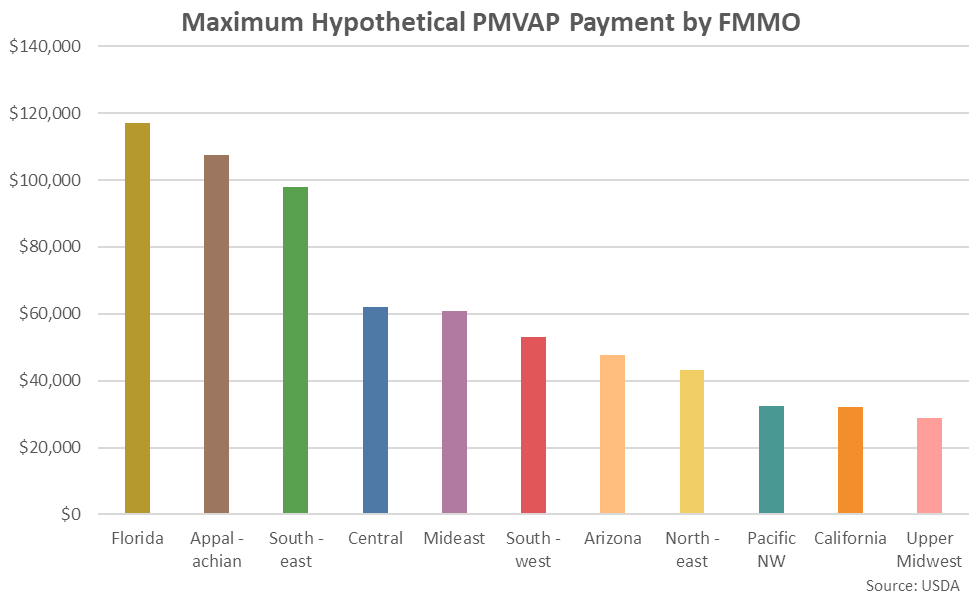

The five million pounds of annual production cap will significantly reduce potential PMVAP payments for relatively larger dairies. Assuming average daily milk per cow of 65 pounds, producers with herds greater than 210 cows will begin to max out their PMVAP payment allocation. Multiplying the $0.57/cwt hypothetical payment rate calculated above with the five million pound production cap results in a hypothetical total payment of approximately $28,500 per producer with a Class I utilization rate of 20%. Maximum hypothetical PMVAP payments scale considerably larger for producers in FMMOs with higher Class I utilization rates, as shown in the chart below.

Additional Pandemic Assistance

The PMVAP is the first part of an over $2 billion comprehensive package to help the dairy industry recover from the pandemic. In addition to the $350 million of PMVAP funds, a $400 million Dairy Donation Program (DPP) was announced in late August. DPP aims to facilitate timely dairy product donations while reducing food waste. According to the USDA, “dairy farmers, cooperatives, or processors that purchase fresh milk or bulk dairy products to process into retail-packaged dairy products and meet other requirements are eligible to participate.” Costs reimbursed through DPP include the cost of milk used to make the donated dairy products in addition to a portion of the manufacturing and transportation costs associated with the products. Reimbursements are retroactively eligible for donations made on or after January 1st, 2020.

Upcoming additional announcements will include $580 million for Supplemental Dairy Margin Coverage (DMC) for small to medium farms. Although outside of the pandemic assistance funding, the USDA will also make improvements to the DMC feed cost formula to better reflect the actual cost dairy farmers pay for high quality alfalfa. The adjustment to the DMC feed cost formula will be retroactive to Jan ’20 and is expected to provide additional retroactive payments of approximately $100 million for 2020 and 2021.