Soybean Complex Crushing & Stocks Update – Oct ’21

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Aug ’21. Highlights from the updated report include:

- U.S. soybean crushings declined 3.7% on a YOY basis throughout Aug ’21, finishing lower for the seventh consecutive month. Soybean oil produced as a percentage of total crush remained near recently experienced record high levels.

- Aug ’21 U.S. soybean cake & meal stocks declined to a four year low seasonal level, finishing 11.2% below the previous year.

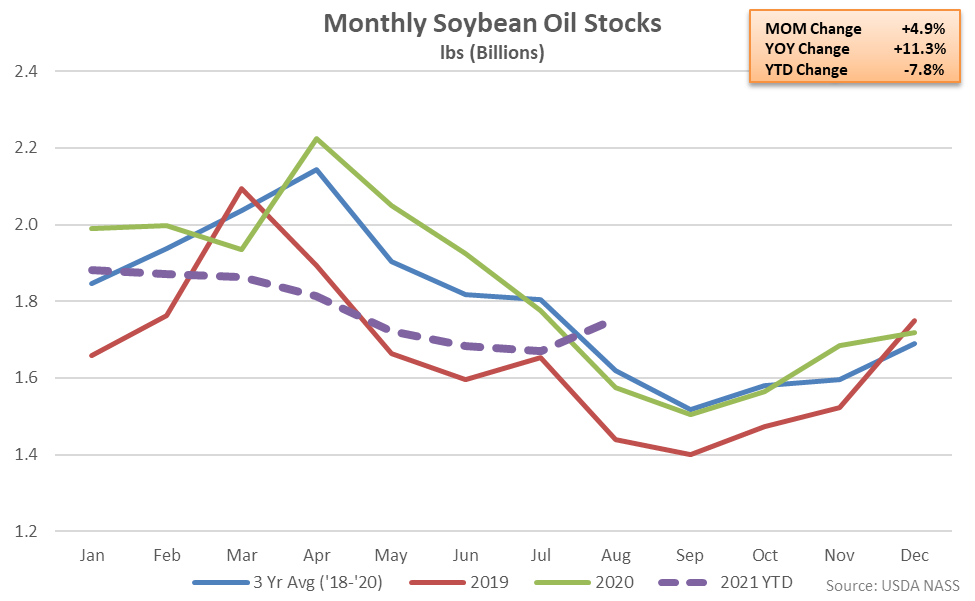

- U.S. soybean oil stocks increased contraseasonally from the previous month throughout Aug ’21 while finishing 11.3% above previous year levels. The YOY increase in soybean oil stocks was the first experienced throughout the past nine months.

Additional Report Details

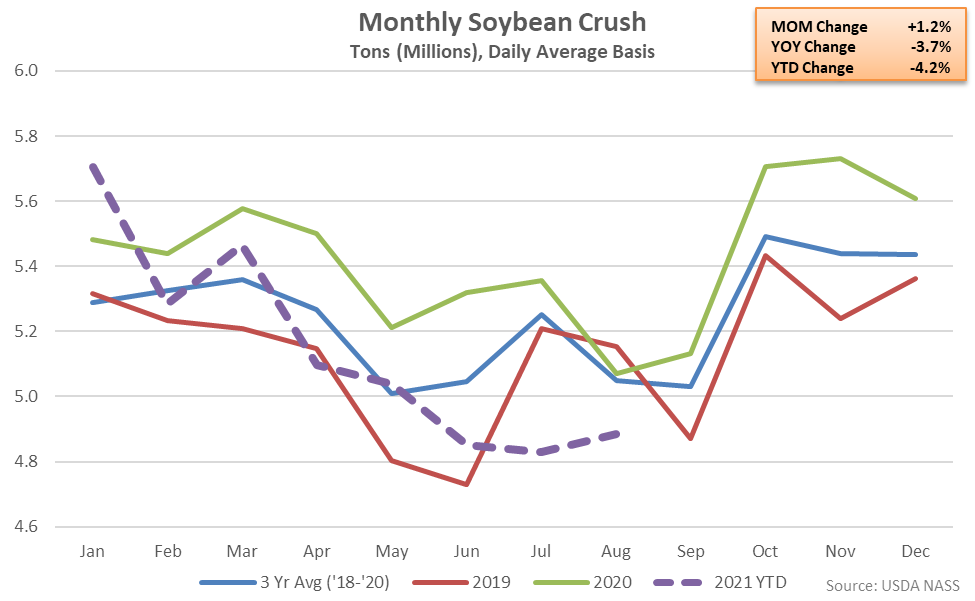

Soybean Crushing – Crush Declines YOY for the Seventh Consecutive Month, Down 3.7%

According to the USDA, Aug ’21 U.S. soybean crushings rebounded slightly from the two year low level experienced throughout the previous month but remained 3.7% below previous year levels. The YOY decline in soybean crushings was the seventh experienced in a row. Soybean crushings had reached record high seasonal levels over five consecutive months through Jan ’21, prior to declining on a YOY basis throughout the seven most recent months of available data.

Aug ’21 YOY declines in soybean crushings were largest throughout the West Central states of Kansas, Missouri and Nebraska. The 1.2% month-over-month increase in soybean crushings was a slight contraseasonal move when compared to the five year average July – August seasonal decline of 4.5%. 2020 annual soybean crushings finished 5.6% higher on a YOY basis, reaching a record high annual level, however 2021 YTD crushings have declined by 4.2% throughout the first two thirds of the calendar year.

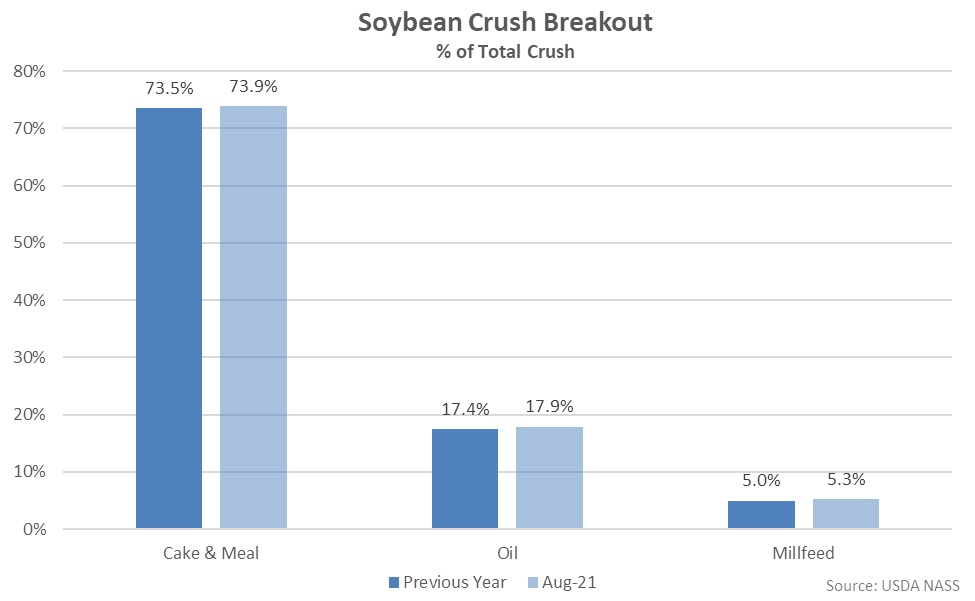

Cake & meal accounted for 73.9% of the total soybean crush throughout Aug ’21, up slightly from the previous year, while oil accounted for 17.9% of the total soybean crush, also up from the previous year.

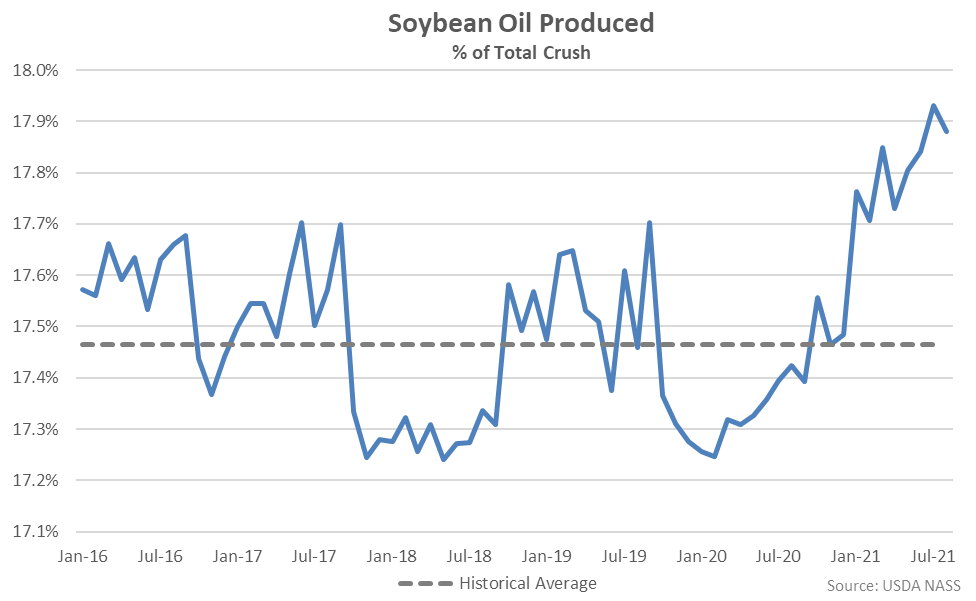

Aug ’21 soybean oil produced as a percentage of total crush declined slightly from the record high monthly level experienced throughout the previous month but remained above historical average figures for the 11th consecutive month.

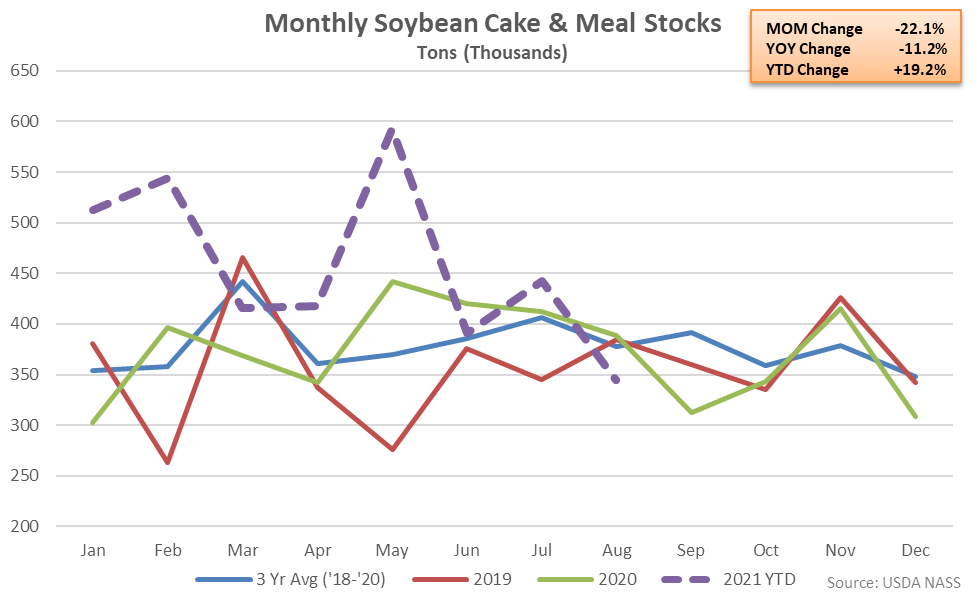

Soybean Cake & Meal Stocks – Stocks Decline to a Four Year Low Seasonal Level, Down 11.2%

Aug ’21 U.S. soybean cake & meal stocks declined to an eight month low level while finishing 11.2% below previous year levels, reaching a four year low seasonal level. The YOY decline in soybean cake & meal stocks was the second experienced throughout the past three months. The month-over-month decline in soybean cake & meal stocks of 22.1% was greater than the five year average July – August seasonal decline in stocks of 16.4%.

Soybean Oil Stocks – Stocks Increase Contraseasonally, Finish 11.3% Above Previous Year Levels

Aug ’21 U.S. soybean oil stocks increased contraseasonally from the nine month low level experienced throughout the previous month while finishing 11.3% above previous year levels. The YOY increase in soybean oil stocks was the first experienced throughout the past nine months. The month-over-month increase in soybean oil stocks of 4.9% was a contraseasonal move when compared to the five year average July – August seasonal decline of 10.2%.